BTCUSD.P trade ideas

BTCUSD Hourly market AnalysisBITSTAMP:BTCUSD On the H1 time frame, if we consider the trend line going from top to bottom, which indicates a bearish trend, on the other hand, the RSI is currently at 47.98, indicating a decline below the midline. In the past, it has been moving sideways for a few days, which turned upward. Where there is liquidity on the upside, this also shows that Bitcoin is showing a bearish trend, we will consider selling.

Support and Resistance

Strong Support Zone : 76,660

Strong Resistance Zone : 92,700

Resistance Zone: 84,950

BTCUSD Sell Entry: 83,200

TP: 81,400

TP: 79,400

TP: 76,600

SL: 84,950

BTCUSD - A fresh look on the current supportIf you understand the mechanics of the Medianlines aka Pitchfork, then you understand the projected movement of the markets.

Whatever you measure with them, the same principal applies.

In the prior analysis, the framework of the Medianlines pointed us in the right direction.

Now it's time to reassess this product.

The 0 to 5 Count:

It's often a good indication when the last sprint happens. After P5, the count starts again from 0, up to 5 again. Here we see that the P5 was reached and we get the bounce, down to the Center-Line aka Medianline, where it finds support.

Could it move upward again? Absolutely, even if it where just for a pullback and the a further continuation to the downside. In fact, I even expect it to bounce up to the red resistance zone.

This would mark P2 before a harder drop down to P3, cracking the Centerline.

Most often after the Centerline is breached, we see a test/retest to it. (P3-P4), an exhaustion of the buyers and then the final hit on the head with a target at P5. In between P4 and P5, there's also the 1/4 line, where we often see a sudo-support. But it's not often that price starts to turn again and negating P5. It's mostly just a try, before the last drop to P5.

So there you have my coffee-ground reading.

Always remember, that even with such an accurate TA-Framework, we only shall trade what we see.

Many thanks to the loyal followers and all likes and sharing. I always love your feedback and constructive criticism. §8-)

Hellena | BITCOIN (4H): LONG to resistance level of 90,000.Colleagues, after drawing the waves I realized that bitcoin is in a major wave “IV” correction and I believe that this correction is either over or about to be over.

Either way I believe that long positions should be prioritized.

I expect that the price will either immediately start an upward movement and reach the psychological resistance level of 90,000, or will update the low in the area of 75,866 a little more and then start moving towards the target.

In the second case, I advise using pending limit orders.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

CHECK BTCUSD ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(BTCUSD) trading signals technical analysis satup👇🏼

I think now (BTCUSD) ready for( BUY )trade ( BTCUSD) BUY zone

( TRADE SATUP) 👇🏼

ENTRY POINT (82300) to (82100) 📊

FIRST TP (82800)📊

2ND TARGET (83700)📊

LAST TARGET (84400) 📊

STOP LOOS (81200)❌

Tachincal analysis satup

Fallow risk management

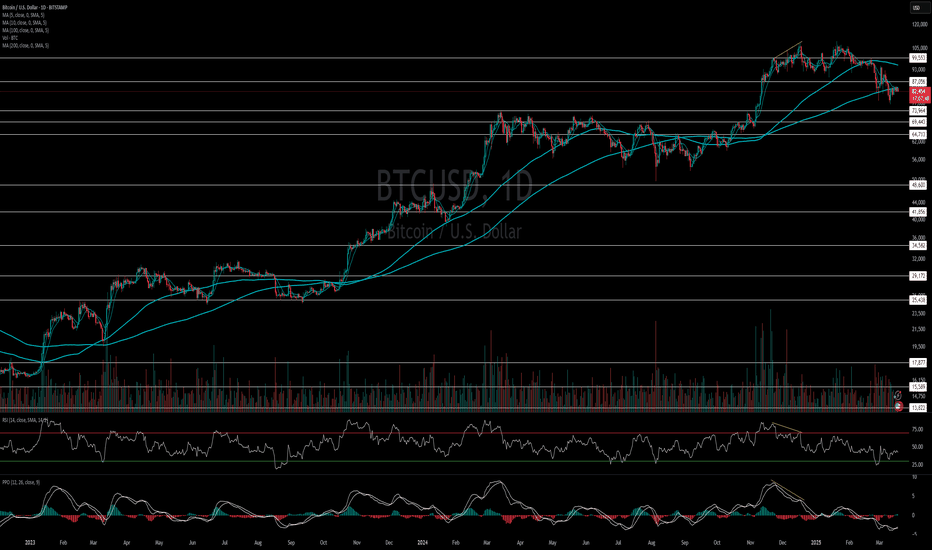

Bitcoin Market Update: Price Consolidation at Key Moving AverageThe cryptocurrency market is seeing significant regulatory and institutional developments that could shape the future of Bitcoin:

U.S. Establishes Strategic Bitcoin Reserve: The U.S. government has announced the creation of a Strategic Bitcoin Reserve, a move aimed at positioning Bitcoin as a hedge against fiat currency risks and enhancing national financial stability. This marks a pivotal step in Bitcoin’s integration into mainstream financial infrastructure.

Trump Administration Expands Crypto Influence: President Trump has appointed David Sacks as a key advisor for AI and cryptocurrency initiatives, underscoring the growing recognition of Bitcoin’s role in the financial system.

These policy shifts suggest increasing institutional involvement and regulatory clarity, factors that could drive future Bitcoin adoption.

Market Dynamics and Price Movements

Bitcoin’s price has experienced volatility, with key market trends unfolding:

Price Near Key Moving Averages:

Bitcoin is currently sitting around the 200-day moving average, with the 100-day moving average above as a key resistance level. This positioning suggests a critical juncture for the asset, where the next move could dictate broader market sentiment.

Resistance and Support Zones:

Resistance: Bitcoin faces resistance at $87,000 and the psychological barrier of $100,000. A break above these levels could fuel a new leg of the bull run.

Support: Bitcoin has key support at $74,000 and $69,000. If these levels hold, they could provide a foundation for the next bullish push.

Open Interest Reset: A significant reduction in open interest, wiping out $12 billion in positions, suggests a market reset that could remove excessive leverage and allow for healthier price action.

Security Concerns and Scams

Despite Bitcoin’s growing institutional recognition, security risks persist:

Fraudulent Activities: In Australia, a recent fraud case involved a woman laundering over $500,000 through Bitcoin transactions, highlighting the ongoing vulnerabilities in crypto-related financial crimes.

Technical Analysis

Bitcoin’s chart structure suggests potential near-term moves:

Moving Averages: The 200-day moving average is acting as a critical support level, while the 100-day moving average sits above, posing a significant resistance zone.

Relative Strength Index (RSI): RSI is hovering in neutral territory, indicating that Bitcoin is neither overbought nor oversold, leaving room for movement in either direction.

PPO Indicator: Bitcoin remains in a bearish momentum phase, but any upward break from the 200-day MA could shift the trend.

Conclusion

Bitcoin is at a pivotal level, consolidating around the 200-day moving average with significant resistance ahead at GETTEX:87K and $100K and key support at $74K and $69K. Institutional adoption and regulatory clarity are adding legitimacy to the asset, but price action in the coming days will determine the next big move.

CHECK BTCUSD ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(BTCUSD) trading signals technical analysis satup👇🏼

I think now (BTCUSD) ready for( BUY )trade ( BTCUSD) BUY zone

( TRADE SATUP) 👇🏼

ENTRY POINT (83600) to (83400) 📊

FIRST TP (84300)📊

2ND TARGET (82200)📊

LAST TARGET (86200) 📊

STOP LOOS (82000)❌

Tachincal analysis satup

Fallow risk management

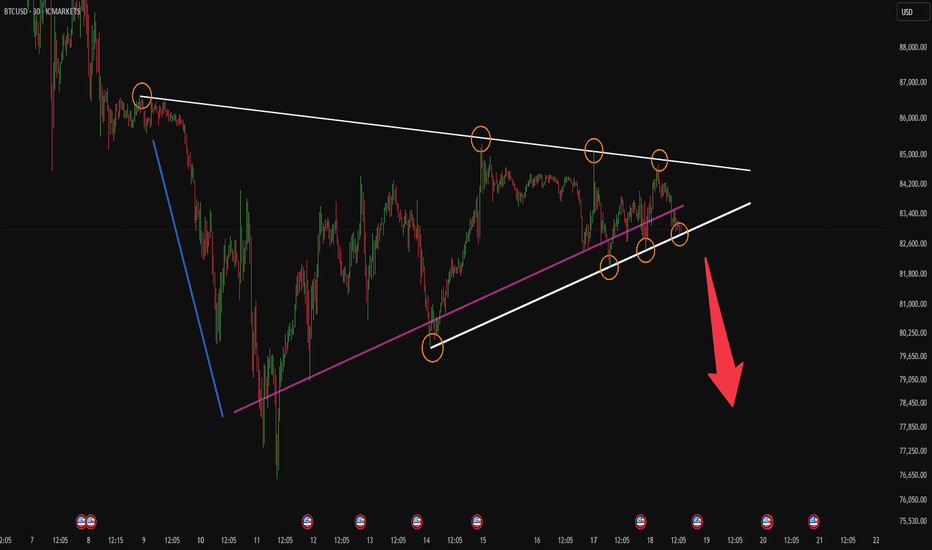

BTC in triangle formation, likely a price drop soonHey traders,

- As you can see, the price recovery from March 11 to March 18 ( blue line ) has experienced a challenging rally, taking significantly longer than expected and still failing to fully recoup the losses from the price drop between March 9 and 11 ( purple line ).

- During this period, there were minor rallies, but the bears consistently clawed back most of the gains.

- Once the price breaks out of this triangle formation (white), I believe there's a strong likelihood that the bears will grow even more confident.

BTC LONG TP:87,500 16-03-2025After the manipulation that caused us to exit at break-even, we can now look to enter a long position in the range of 87,000 to 88,000, with a potential profit and a risk-reward ratio of over 6.

This analysis is based on a 2-hour timeframe, so we expect this to unfold within 24 hours.

Make sure to follow me to keep trading together and stay updated on the latest developments!

LONGS GETTING READY AGAINOne more spike up is brewing again on the 1hr tf lets see if this time bulls are able to break above and hold above the $85500 to make the base for the last 4hrs tf break out that will take place around the 22nd (if not sooner) but bulls are NOT showing muscle and TIME is running out. On the 4hrs tf there are two scenarios and both will end marking the next leg down but the higher the leg down starts (ideally above the $90k line) the less likely it will be for bears to print a lower low but make NO mistake that after the last bounce takes place price will quickly retrace to go and test at least the $80k line. Buckle up ladies and gentlemen we are heading for another wild ride.

The current BTC chart, incorporating my 'flash-crash' thesisThis chart illustrates the current Bitcoin pattern, with my 'April flash crash thesis.'

I believe we will see another thrust lower into the green box ranges before a spring into the fifth wave. However, the fifth wave will be a "false breakout," as a flash crash in mid to late April is likely to occur, intentionally designed to sweep liquidity by liquidating overleveraged positions and triggering stop losses—driving price past the previous low set in the green box, only for the market to recover shortly thereafter and continue its breakout to the upside. This breakout will likely push beyond the pattern, taking out the all-time high, and setting a new high somewhere in the 20K to 25K range.

There could be some opportunities in the next 4 to 6 weeks, but with opportunity comes risk. Always use a proper risk management strategy suited to your skill level and wallet size.

Good luck, and always use a stop loss!

BTC Today's strategyThe support level of Bitcoin has begun to move upward. Currently, the market is still trading in the range of $80,000 to $85,000. The short-selling strategies I continuously provided have also made profits many times.

This week's BTC trading range could be broken at any time. We just need to wait for the market to show a new direction and then adjust our strategy

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

Weekly Analysis for Week 12 2025!Hello fellow traders , my regular and new friends!

How was your trading this week? Managed to catch the Eurjpy or GbpCad and EurCad movements as mentioned last week?

Which pairs or instruments should we keep a look out for?

This coming week is packed with interest rate decision, how?What to do?

Do check out my recorded video for more insights!

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

BTC Fibonacci Time Zone Inflection - Sun, 2/9 to Mon, 2/10Practicing here & publishing for prosperity in case this voodoo fib time series actually works. Confluence, directional, range, yadda, yadda.

Fib time zone marks potential reversals or major inflections using fib time series. Using the drop from 108k to 89k marked with yellow circles, the fib time zone predicts another major inflection on Sunday, Feb 9th on the Daily chart and Monday, Feb 10th on the Weekly chart.

4HOUR BTCUSD currently consolidating near support will be go up

Entry Price: The level at which the trade is initiated ( $84,454).

Target Price: The anticipated profit-taking level (, $92,000).

Stop Loss: The predefined price level to exit the trade if the market moves against the position (e.g., $79,138).

Risk-Reward Ratio: The relationship between potential risk and reward, ideally above 1:1 for a favorable trade setup.

Why Take a Long Position?

✔️ Bullish Market Sentiment – If technical indicators and fundamentals support an upward trend.

✔️ Breakout from Resistance – When Bitcoin breaks above key resistance levels, confirming buying momentum.

✔️ Support Holding Strong – A long entry can be placed near a strong support level with minimal downside risk.

Risk Management Considerations

Position Sizing: Ensure proper allocation based on risk tolerance.

Trailing Stop Loss: Adjust stop loss as price moves in favor.

Market Monitoring: Stay updated on news, economic events, and technical levels.

will be market go up we will waiting for that.its not financial advise

Tue 18th Mar 2025 BTC/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Buy. Enjoy the day all. Cheers. Jim

$BTCUSDT: Fictitious Fractal 136KSo. I see we are having a relatively difficult time.

My expectations are in this range for the next appx. 125 days - 365 days.

Downside: 68.6k-69.9k

Topside: 100k to 136k (round to 150k)

I drew this fractal by hand and I want to watch it closely.

I expect in the next few weeks we hit 100k and then do a nice rug to 69k range.

This is probably wrong.

I pretty much extrapolated the red brush circle into a weeks long fractal.

I am longing all the dips to 68k.

Enjoy.

Mr. Storm.

BITCOIN When unsure, look at the bigger pictureSimple, yet highly informative especially in times of high uncertainty like the current one.

Bitcoin / BTCUSD has a Full Cycle of 4 years.

1 year of Bear and 3 years of Bull.

Right now we have entered the final year of the 3 year Bull Cycle, so we have a few more months left until the end of the year.

Come October, we can start considering a top for BTC.

Until then.. Buy the dip.

Follow us, like the idea and leave a comment below!!