Bitcoin - Will Bitcoin Go Up Again?!Bitcoin is trading below the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. The continuation of Bitcoin’s downward trend and its placement in the demand zone will provide us with the opportunity to buy it again.

As long as Bitcoin is above the drawn trend line, we can think about buying transactions. The continued rise of Bitcoin will also lead to testing of selling transactions from the supply zone. It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and observing capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand range.

In recent days, Bitcoin’s price has experienced a significant decline, reaching its lowest level in several weeks. This price drop coincides with growing concerns about a potential economic recession in the U.S. and the impact of Donald Trump’s recent statements on financial markets. As a result, many investors have shifted towards safer assets.

Analysts believe that Trump’s remarks have intensified market volatility, leading to increased selling pressure across financial markets. Consequently, riskier assets like Bitcoin have also seen a decline in price.

Given the uncertainty in the market and doubts surrounding the future of the U.S. economy, experts predict that Bitcoin’s price fluctuations will persist. While some investors see this drop as a buying opportunity, the lack of clarity on upcoming economic policies has heightened overall risk.

On March 14, Bitcoin broke its long-standing 12-year ascending support trend against gold (XAU). A well-known analyst, NorthStar, has warned that if Bitcoin remains below this level for a week or more, it could signal the end of its 12-year bullish trend.

This breakdown occurred as spot gold prices surged by 12.80% since the beginning of the year, reaching a new record high above $3,000 per ounce. In contrast, Bitcoin—often referred to as “digital gold”—has fallen 11% so far in 2025.

Arthur Hayes, co-founder of BitMEX, who previously predicted that Bitcoin would drop below $80K, now believes its decline will likely bottom out around $70K.

Meanwhile, reports indicate that Russia is increasingly using cryptocurrencies in its oil trade, which is valued at $192 billion. Digital assets are facilitating the conversion of yuan and rupees into rubles, streamlining transactions.

According to sources, Russian oil companies have been utilizing Tether, Bitcoin, and Ethereum in their trades.While digital assets currently represent a small portion of the oil trade, their adoption is growing rapidly.

BTCUSD.P trade ideas

Bitcoin under 40k? Possible, but is this also probable?In life, anything is possible , and when it comes to crypto, everything is possible .

But, as I mentioned in my educational post yesterday, there’s a big difference between what is possible and what is probable.

In this article, I want to analyze the possibility of Bitcoin dropping below $40,000 and more importantly, what would need to happen for this scenario to shift from just possible to truly probable.

________________________________________

BTC — From All-Time High to Distribution?

If we look at the Bitcoin chart, we notice that after the first all-time high very close to $100,000 at the end of November, the market began a consolidation phase.

Although we saw two more all-time highs — one around $108,000 in mid-December and another near $110,000 in January — the entire structure from late November to late February appears to be a distribution pattern rather than a healthy continuation.

Once Bitcoin broke below $90,000, we can consider this distribution phase complete, with a target for short positions around $75,000 — a level I’ve highlighted in my previous posts.

________________________________________

Long-Term Logarithmic Chart — Diminishing Returns and the Bigger Picture

Looking at the long-term logarithmic chart, we can see a clear pattern of diminishing returns:

• The first major leg up, starting in late 2011, was approximately 600x and lasted about two years, followed by a correction.

• The next leg was 100x, spanning four years, followed by another correction.

• Then, a 20x rally, which lasted just over a year.

• Finally, the most recent leg up has been around 7x.

What’s crucial here is that returns are decreasing and, even more importantly, the last leg up looks more like an ascending channel than a parabolic move like in previous cycles.

________________________________________

The Significance of the Ascending Channel

This ascending channel is not unusual — the market has matured, and big players are now involved, reducing volatility.

However, ascending channels on the long-term often signal potential reversals, rather than continuation.

________________________________________

What Would Make $40,000 Probable?

Now, let’s address the real question: What would need to happen for Bitcoin to drop to $40,000?

Zooming in on the logarithmic chart, it becomes evident that the $72,000 - $75,000 zone is a major support confluence.

If this area is broken — meaning a weekly candle closes below this level — the scenario of BTC dropping toward $40,000 becomes probable.

The target zone I’m watching in this case is $32,000 - $36,000, a strong historical support that is clearly visible on higher timeframes.

________________________________________

Conclusion — Watch the Key Levels, Not What you Hope

To conclude:

• Bitcoin dropping to those extreme levels is possible, but not yet probable.

• Probabilities will shift only if key support levels are broken — specifically $72k-$75k.

• The market has matured, cycles are changing, and returns are diminishing, so expecting a repeat of past parabolic runs may not be realistic.

• As traders and investors, we must focus on the charts and key levels, not on hopium and hype.

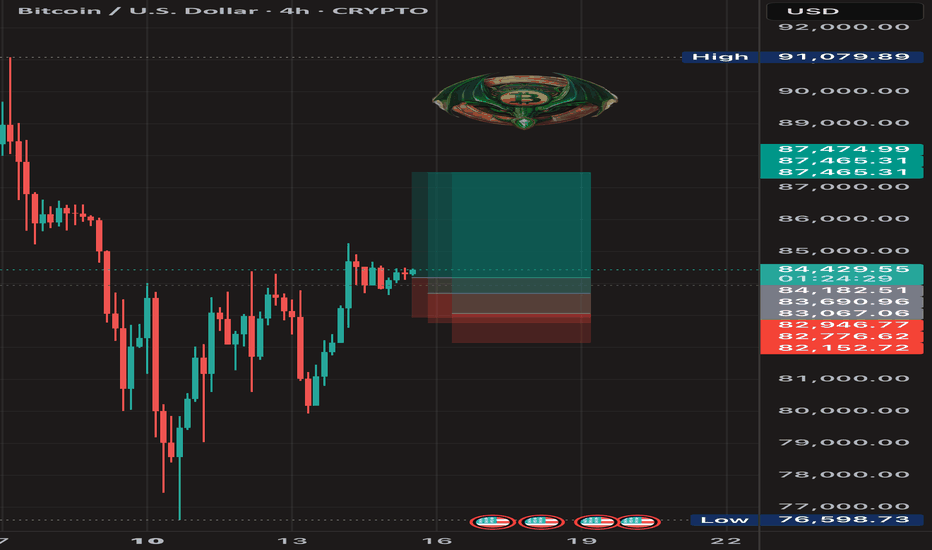

BTC Update: Price Rejected at ResistanceBTC Update: Price Rejected at Resistance

Key Developments:

- BTC price has been successfully rejected from the marked resistance zone.

- A deeper retracement (pullback) towards the lower marked $80k demand zone is now expected.

Market Outlook:

The rejection at resistance suggests a potential short-term bearish bias. Traders should monitor the $80k demand zone for a potential buying opportunity or further downside momentum.

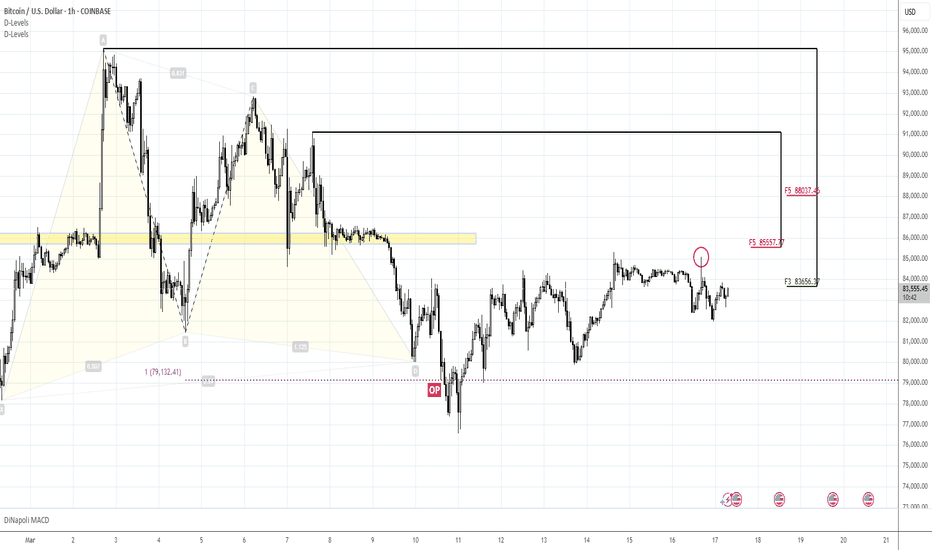

88K is not excluded but not granted as wellMorning folks,

So, we set for 85K sell and it worked. Downside reaction happened, but still, we call you to move stops to breakeven for some case.

The problem that we see is the market behavior. We see it not natural for normal bearish market. BTC stands stubbornly around K-resistance, not showing normal downside extension.

Our scenario of downside continuation from ~85K area is not broken yet, it is valid, and maybe everything will happen as we've suggested initially.

But we see the risk in the way of market behavior. It could lead to more extended upside bounce in the way of upside AB=CD pattern right to 88k resistance .

It means that if you already have bearish positions - move stops to breakeven. If you don't - do not take the new once for awhile. Or, at least, you could take but not more than 25-30% of your normal lot.

Our bearish scenario remains valid until market stands under 85.1K spike (because this is bearish reversal session on daily chart) and below 85.5K resistance in general. Upside breakout means an action to 88K.

Since we do not have the breakout it, I mark our update as "bearish", but we warned you... Take care.

Bitcoin: can it be the $90K?There has been a higher volatility on the crypto market during the previous week. The markets are still making shiny steps toward the upside, influenced by the macro sentiment and potential negative effects of the trade tariffs. Uncertainty is still strong on financial markets, where BTC also belongs as now part of mainstream markets. During the week, BTC was traded in a more bearish manner, with shy bullish moves. It still managed to finish the week with a weekly gain.

The lowest weekly level of BTC was at $77,5K at the beginning of the week. The uptrend was holding for the rest of the week, where BTC managed to get back toward the $85K resistance at the end of the week. The RSI reached a clear oversold market side, from where it started the reversal. Current RSI level stands at the level of 43, which is still not showing that the market clearly started its reversal toward the overbought market. The moving average of 50 days started its higher convergence toward the MA200, with still a distance between two lines.

Current charts are showing that the BTC is trying to make some recovery from previous week’s losses. But it seems that this is going to be a heavy task for BTC. Slow moves might continue also during the week ahead. As per current charts, there is a probability for the level of the $90K in the coming week or two. At this moment it is unclear whether the market will have the strength to pass this level. One warning signal coming from charts is that if the $90K is not branched toward the upside, then there would be a potential for a stronger move toward the downside. Still, these moves are for the longer time frame in the future. For the week ahead, it should be considered that the FOMC meeting is scheduled for March 19th, when certainly some volatility can be expected also on the crypto market.

BTC USD UpdateWe've seen massive news in the crypto space lately, yet the price absorbs buys and pushes lower week after week. The logical explanation is that they need to drive the price down to buy massive orders at a cheaper price. We don't close our spot trades; we remain overall bullish on these coins. So, we're in scalping mode, filling new spot orders as the price drops. We're confident it will go up sooner or later. Currently, we're in a bearish price range, and liquidity has built up heavily beneath the daily fractals. Therefore, we're focusing on scalps, trading in and out within the range. As of now, the range high is 95,128.88, and the low is 76,555.00. Let's see what happens.

BTCUSD UPWARD UPCOMING READ IN CAPTIONS (BULLISH) TREND SOONThe chart displays Bitcoin (BTC/USD) on a 1-hour timeframe, showing a concept of "Breaker Block" after a liquidity sweep. A breaker block is a failed order block formed when liquidity is swept. The chart highlights key points for identifying a breaker block:

1. Liquidity Sweep: A sweep of liquidity in the market before the price reversal.

2. Last Opposite Color Candle of Leg: The last candle of a different color before the reversal.

3. Failed Order Block: The block that fails to hold, indicating a reversal.

4. Market Structure Shift (ICT MSS): A shift in market structure, signifying a potential change in trend direction.

5. Inducement: A price move that induces traders to enter before a reversal.

The chart highlights areas marked SiBi (Swing In/Buy) and BiBi (Break In/Buy), which indicate possible zones where these events occur. The Resistance area is also shown as a key level for potential price rejection. Traders should look for confirmation of price action near these levels to assess the likelihood of further movement toward the Target around 84,000.

BTC Today's strategyThe support level for Bitcoin has started to move upwards. Currently, the market is still trading in the range of 80K to 85K. The consecutive short bets I have offered have also been profitable many times

If you are currently unsatisfied with the bitcoin trading results and are looking for daily accurate trading signals, you can follow my analysis for potential assistance.

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

BTC/USD 4HR // 17 March AnalysisBTC/USD is forming a downtrend on the 4HR timeframe.

We can wait and see if the price reached the trendline and how it reacts to it and the resistance zone marked.

We can look for potential sells if we get a good rejection from the area.

Long term target would be between the 72500 and 70000 area as previous strong level of support/resistance.

Bitcoin's left translated cycle - new lowsLet’s analyze both Cycle Market theories separately:

60-Day Cycle Status

Bitcoin printed a new cycle low on February 28. While many expected a rebound, it carved another low a week later, leading into a left-translated cycle (price trends downward for over half the cycle). We’re now on day 16, hovering just above the $78,000 low. Further downside is likely in coming weeks.

Multi-Timeframe Cycle Breakdown

2-Week Cycle: Will dip below 20 by Monday’s close, marking the start of accumulation (long-term oversold conditions).

1-Week Cycle: Broken below 20 and stuck there for two months – a reversal is imminent, signaling mid-term upside.

3-Day Cycle: Also below 20, confirming short-term bullish momentum.

1-Day Cycle: Topping above 80, hinting at a brief pullback soon.

Consensus : Both theories suggest a rally toward the 60-Day Cycle high (days 20-30), aligning with the 3-Day Cycle peak. However, we may see one final dip when the 3-Day Cycle resets to 20 before the bull run resumes.

BTC LONG TP:87,500 15-03-2025Bitcoin is showcasing a beautiful bullish structure, and we could finally be looking at levels of 87,000 or even 90,000. It remains to be seen whether it will break through these levels or if we will simply see a bounce that leads to a consolidation range.

This analysis is based on a 4-hour timeframe, so we should expect to see results within 2 to 3 days.

Make sure to follow me to achieve impressive results together!

BTC/USD 1 hour will be . market go up This chart is a Bitcoin (BTC/USD) 1-hour timeframe analysis from TradingView. Here’s a breakdown of what it represents:

1. Price Action:

The current Bitcoin price is $84,191.35.

The price has dropped by -149.18 (-0.18%).

2. Technical Analysis Features:

Resistance Zone (Marked with Green Box at the top): The price has struggled to break above this level.

Support Zone (Green Box at the bottom): The price has previously bounced off this level.

Falling Wedge Pattern (Blue lines on the left): This pattern typically signals a bullish reversal, which seems to have occurred.

Ascending Channel (Blue lines on the right): Suggests a short-term upward trend.

Sell and Buy Signals:

Sell Signal at $84,191.35 (Red box).

Buy Signal at $84,191.35 (Blue box).

3. Trade Setup:

Short Position Indicated (Red and Green Box on the right):

Stop-Loss at ~$87,021.76 (Red zone).

Take-Profit at ~$78,228.36 (Green zone).

The green downward arrow suggests a potential bearish move.

4. Macroeconomic Factors:

The bottom icons with U.S. flags indicate upcoming fundamental events that might impact BTC price.

Interpretation:

The analysis suggests a potential short opportunity, expecting BTC to drop towards $78,228.36 if it follows the trend.

If the price breaks above resistance, the bearish setup may become invalid.

It's not financial advice

BTC | USD - The Crypto Rodeo with PipGuardBTC | USD - The Crypto Rodeo with PipGuard

Hello, fellow financial misfits! Already regretting not closing your trade when you were in profit? Don’t worry, you’re in excellent company.

Before we dive in, let’s get one thing straight: if my analysis is saving you from ending up like FTX , then do yourself a favor— drop a boost, follow me, and leave a comment!

🚀 LET’S GO:

- Analysis to compare with the previous one that gave us a sweet 6K move, from 82K to 76K. Well done, colleagues! No Ferraris this time either, but at least you won’t have to sell your cat to cover your margin call. 🐱💸

CURRENT SITUATION: THE MARKET CIRCUS

Here we are, fresh update just for you, because I know that without my guidance, you’re staring at your charts like a confused goldfish. 🐟

Meanwhile, while Bitcoin figures out whether to go up, down, or just mess with us all, the real world keeps delivering its fair share of nonsense. Trump (a.k.a. the blond guy with a ramen wig) 🍜 is still keeping us entertained, while geopolitics is tangled up like a pair of earphones in your pocket.

And now, get this: Russia is using Bitcoin to trade oil with China and India.

🔹 Mother Russia’s Trick:

1. China and India pay for oil in yuan or rupees.

2. Everything gets converted into Bitcoin and other cryptos.

3. Russia cashes in and smirks while sipping vodka. 🍷😏

Meanwhile, we’re stuck dealing with KYC, banks blocking our withdrawals, and regulations changing every five minutes, while Putin is out here trading like a Wall Street shark. And us? Just trying not to get wrecked by the market.

TECHNICAL ANALYSIS - BITCOIN’S MAZE

📈 General trend: Still bullish, but with the emotional stability of a trader on 50x leverage in a pump & dump. 🎢

📌 Current price: 83K

📌 Key level: 84K, possible bearish rejection.

📌 Warning! It might push up to 87-86K to grab liquidity before pulling a textbook dump.

📌 Fun fact: If it closes above 87K on a higher timeframe, we could see a bullish reversal signal. Otherwise, grab your helmet, because we’re going down. 🪂

PRICE TARGETS

📉 Bearish targets:

1. 80.140K

2. 76.600K

3. 74.000K

4. 70.000K

5. 66.000K (if we hit this, light a candle for crypto) 🔥

📈 Bullish targets:

1. 86.700K

2. 89.000K

3. 92.000K

4. 95.000K

5. 102.000K (if we get there, big party and we all buy a Lambo… toy version) 🚗

If you enjoyed this analysis, support PipGuard , because financial information served with sarcasm and expertise is the only kind worth reading. Follow, boost, and comment, or I’ll send you a chart with invisible candles on a white background. 🎭

Until next time, may volatility be with you!

PipGuard 🚀

Those who buy BITCOIN without looking at anything should be careIn my view, history will repeat itself. BTC will reach 65000. Some Future matters is reducing the possibility of BITCOIN's upward movement. November 2021 is still expected. Those who buy BITCOIN without looking at anything should be careful. If you look at the BEARISH DIVERGECNE, you can see that the INTEREST of buyers is decreasing.

#202511 - priceactiontds - weekly update - bitcoin Good Evening and I hope you are well.

comment: Trading range week is behind us. Targets below are the same. 75k and maybe 70k. Bulls need to claim 95k again. I don’t have much to write about this right now. It’s a clear bear trend but it’s trying to bottom out above 75k. Next dip below 80k is the most important one. If bears fail again, we could try to 100k again.

current market cycle: bear trend

key levels: 70k - 94k

bull case: Bulls need anything above 91k to break above the bear trend line but giving this some room, even 94k could still not be enough for them to stop this bear trend. They are doing good at keeping the market above 80k and if they prevent the bears from testing the previous ath at 73.8k, that would be the third try and likely the last before many bears give up and bulls could test higher again.

Invalidation is below 70k.

bear case: Bears need to close the bull gap down to 73800, no ifs or buts.

Invalidation is above 94k.

short term: Neutral. Need strong selling momentum again for me to join this.

medium-long term - Update from 2025-02-23: 75000 is still my biggest target for 2025. It’s happening. 70k/75k and then I expect a bigger bounce first. Then we will see if we can go lower or not. For now it’s very low probability that the big bull trend line from 2023-10 breaks anytime soon.

current swing trade: None

chart update: Nothing

Bitcoin: 80K For Higher Low Long This Week.Bitcoin has retraced off the of the 76K to 78K AREA and established a double bottom formation (see arrows). I specifically mentioned this in my previous article and talked about it further during my most recent stream. While a bear flag formation IS now present, which implies weakness on the horizon, I anticipate a higher low support around the 80K area this week (see illustration). If it breaks, then 76K should be watched for another double bottom or failed low formation which offers attractive price points for swing trade long opportunities.

This is a wild environment because we have tons of unexpected news constantly affecting the market while at the same time the highest seasonal volume (compared to August). This means moves will be BIG on both sides of the market, people will OVER react AND opinions will be more costly than usual. The first step to navigating such an environment effectively as a swing trader is to FOCUS on LEVELS and NOT news. No matter what the news is, either a level is going to be respected or its not. By focusing on what the herd is not, you can gain an advantage on the market, even if its brief.

Along with that, if you understand how to use dollar cost averaging effectively in this environment, you can start a position slightly earlier while waiting for confirmation before you add. An example of this is while watching for test of 80K, you buy a small position which you can take pain on, which means a much wider than usual stop. IF confirmation appears, you add. While it is possible that after the add the market goes against you, the PROBABILITY of the location and formation FAVORS a positive outcome more. In cases like this it is worth the risk. If 80K breaks without any confirmation, you are still small and you lose less than you normally would because of the adjusted size.

When market sentiment reaches extremes, THIS is when you want to pay CLOSE attention, especially during BEARISH extremes. In order for a market to reach attractive prices, mews typically needs to be negative. During such times, traders tend to avoid the market because the market looks "bad" yet, these same traders buy aggressively at the WORST prices, typically the highs when everything looks "great". One of my long time followers during my stream mentioned he was interested in buying, but only taking small bites because things looked so bearish. My response was that I usually suggest small bites at highs, and right now we are no where near the highs, so slightly greater risk can be justified at these prices for swing trades and investing.

Assuming risk requires confidence. What gives me such confidence is being able to gauge potential risk through analyzing price structure and levels. Wave counts are very helpful in this regard and help me shape reasonable expectations. In this context, Bitcoin at 76K MAY be the Wave 4 bottom. As long as 65K is not touched, a Wave 4 bottom can otherwise be established somewhere between 76K and 66K if 76K breaks. This will go against ALL of the bearish sentiment required to push prices to such levels. Navigating this effectively means you will have to put your contrarian hat on. Pay attention to the levels and confirmations, not what people are saying.

Thank you for considering my analysis and perspective.

BRIEFING Week #11 : Are we done ? (nope)Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BITCOIN → Short-squeeze 86-89K before falling further to 75KBINANCE:BTCUSD continues to form a downtrend after breaking the bullish structure on the weekly timeframe. There is no bullish driver yet, and technically, the price is heading to the global imbalance zone of 75-73K

The past crypto summit and any other talk of cryptovalt support cannot support the market. Such events end with further market decline.

Technically, the market continues to form a downtrend (global counter-trend), based on this alone, we can say that the price is now going against the crowd and this is generally logical behavior. Globally, the zone of interest is located in the following zones - 75K, 73K and order block 69-66K

Locally, I would emphasize the nearest liquidity zones, located at the top, which can be tested before the further fall: 86697, 89.397

Resistance levels: 85135, 86678, 89397

Support levels: 79987, 78173, 73512

After the false break of 78K support there is no strong reaction, the market is forming a struggle for 84-85K zone, which generally indicates buying weakness. Before the further fall there may be a short-squeeze relative to the above mentioned zones of liquidity, which may lead to a further fall

Regards R. Linda!