BTCUSD.P trade ideas

BTC Today's strategyIndustry News: Japanese listed company Metaplanet increased its holdings of 162 BTC, which to some extent reflects institutional optimism towards Bitcoin, and may have a positive impact on market sentiment, attracting more investors to pay attention and buy. However, Bitcoin's real-world application is still relatively limited, and its fundamentals are still relatively weak, which may limit the price of Bitcoin in the long run.

From the supply side, after bitcoin hit its highest price in history, short-term holders (STH) increased their holdings, while long-term holders (LTH) decreased their holdings. This change in supply pattern reflects the growing speculative atmosphere in the market, and short-term traders are more sensitive to price fluctuations, which may lead to increased volatility in bitcoin prices. From the demand side, despite the continued increase in bitcoin holdings by institutional buyers and ETFs, actual spot demand continues to decline. If demand does not recover, bitcoin's continued rally may be difficult to maintain.

Overall, the price of Bitcoin on March 14, 2025 is currently showing a certain upward trend, but the overall trend is still facing many uncertainties. A variety of factors such as the macroeconomic environment, the Federal Reserve's monetary policy, industry dynamics, and market supply and demand are all having an impact on the trend of Bitcoin.

buy:77K-79K

tp:83K-85k

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

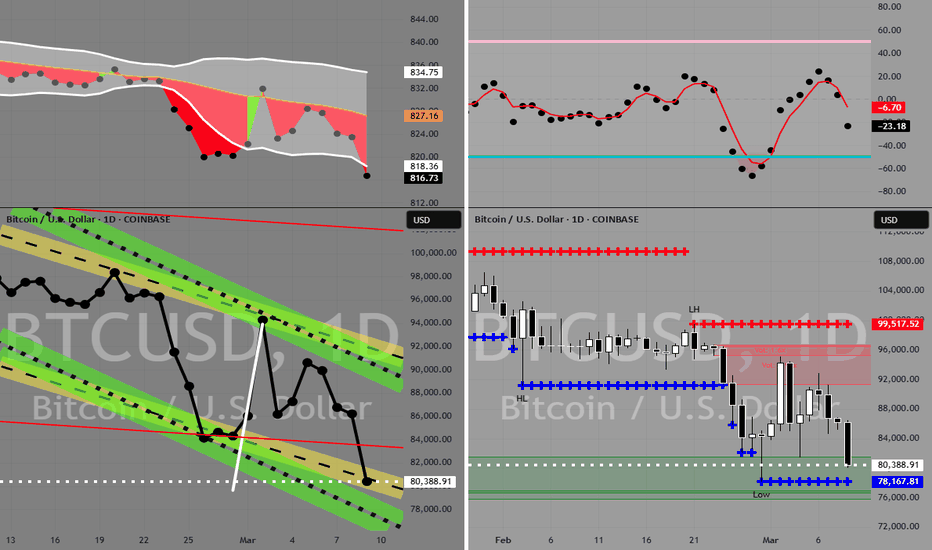

BTCUSD DOWN TARGET SUCCESSFUL DONE READ IN CAPTIONSBitcoin (BTC/USD)* on a 1-hour time frame, showing price action, a channel formation, and key support and resistance levels.

Key Observations:

1. Price Movement in a Channel:

The chart clearly displays Bitcoin's price moving within a descending channel, indicated by the blue lines. This suggests a bearish trend, where the price is making lower highs and lower lows. The price has recently approached the support level and is testing it once again.

2. Resistance Zone:

The resistance zone is marked in red, highlighting the upper boundary of the channel, around 81,800 to 82,000. This is the region where Bitcoin has struggled to break above, making it a critical point to watch for potential reversals or a breakout.

3. Support Zone:

The support zone is indicated by the red box on the lower part of the chart, around 80,200. This is where Bitcoin’s price has consistently bounced in the past, making it a potential area to consider for entering buy positions.

4. Target Completion:

The target price for the current move has already been hit at80,200, as shown by the “TARGET COMPLETE” label. This suggests that the market has reached the projected support level, completing the move to the downside.

Trading Strategy:

- Sell Setup: If Bitcoin fails to break above the resistance at 82,000, there could be a potential continuation of the bearish trend towards the support at 80,200.

- Buy Setup: If the price holds at the support zone of 80,200 and shows signs of reversal, traders might look for a buying opportunity targeting the resistance at 81,800 - 82,000.

- Stop Loss: To protect against potential reversals, a stop loss could be placed just above the resistance level around 82,500.

Conclusion:

This chart shows Bitcoin's price movement within a descending channel, with a target price at 80,200 already hit. Traders should pay attention to the resistance at 82,000 and support at $80,200 for potential trade opportunities. The market could continue to consolidate within this range or break out in either direction, depending on the price action.

Downturn in traditional markets will suck liquidity from Crypto.For what feels like the longest time I have had my eye on the CME gaps down at approx 11k and 9.5k.

I still feel like a retrace to these levels is possible should a significant enough downturn in traditional markets occur.

I would look at placing buy orders at these levels (as well as on the way down to there) in anticipation of there being a rapid cascade of liquidated longs.

Such a retrace would not be uncommon for Bitcoin, and targeting these levels would be a great way to load up on shockingly cheap coin while weak hands and excess leverage are shaken out of the market.

Obviously, altcoins would be affected also.

I would not trust any stable coin that has market exposure as part of their stabilizing mechanism.

XAU and PAXG are probably the "safest" places to keep un-allocated capital.

Thoughts and insights are welcome.

BTC - Short-Term Short Position.BTC on the Daily for the thesis: general idea is a continuation of the overall bearish trend, but in context of the monthly & weekly TF, where we have an FVA residing at the FWB:73K level, meaning that could be our low before a potential reversal to a new ATH, in line with Monthly market structure.

If we dont come lower from here, expect higher prices, but, my money is on 73-75K levels being tapped before any reversal higher.

Learn To Invest: Global Liquidity Index & BitcoinGlobal Liquidity Index & BitCoin:

🚀 Positive Vibes for Your Financial Journey! 🚀

BITSTAMP:BTCUSD

Look at this chart! It's the Global Liquidity Index , a measure of how much extra money is flowing through the world's financial systems.

Why is this important? Because when this index is high, it often means good things for investments like #Bitcoin! 📈

Think of it like this: when there's more money flowing, people are often more willing to take risks and invest in things like Bitcoin.

See those "BullRun" boxes? That means things are looking bright! It's showing that money is flowing, and that's often a good sign for potential Bitcoin growth. 🌟

Even if you're not a pro, it's easy to see the good news here. Understanding these trends can help you make smarter decisions.

Let's all aim for growth and success! 💪

Bitcoin (BTCUSD) Rejection – Bearish Move Incoming?📉 Key Observations:

Resistance Zone (Purple Box): Price has tested this area and faced rejection.

Bearish Projection (Gray Box & Arrow): The chart anticipates a drop towards the $76,800 - $77,000 range.

Liquidity Grab? Price might consolidate before a sharp decline.

⚠️ Possible Scenarios:

Rejection Confirmation 🔻: If BTC fails to reclaim $84,470, selling pressure could increase.

Breakout Fakeout? 🤔: A deviation above resistance followed by a dump remains a risk.

🎯 Levels to Watch:

Resistance: $84,470 - $85,078

Support: $80,000 and $76,825

🔥 Final Take: If BTC struggles below resistance, a short setup could play out. Confirmation is key!

bitcoin 2025btc and time

Ladies and gentlemen, let me tell you something. Bitcoin, digital currencies, it's the future. No doubt about it. The world is changing. We’re moving into the 21st century faster than ever before. And folks, the only way to keep up—truly keep up—is to embrace this technology. We have to adapt, we have to move forward, or we’ll get left behind. Believe me.

Now, some people, they’ll tell you that Bitcoin is too volatile, that it’s too risky. Well, let me tell you something. Nothing worth doing is ever easy, okay? There are always going to be risks. But Bitcoin, digital money, it’s the future. It’s the future of finance. And let me tell you, it’s already happening. We have the biggest companies, the smartest people, they’re all talking about it. Tesla, MicroStrategy, you name it. They’re already in. So why aren’t we? Why aren’t we moving faster? That’s the question. We have to be smart. We have to get ahead of the game.

Look, I’ve seen it all—the stock market, the banks, the big banks. They don’t get it. They don’t understand how fast things are changing. But Bitcoin and digital currencies—they understand change. They understand innovation. And that’s what we need. We need innovation, folks. We need to update our systems, we need to update our country. We need to update the way we think about money.

Some people say it’s just a trend, just a bubble. I’ve heard it all before. You know what? They said the same thing about the internet. They said the same thing about smartphones. And look at us now. We don’t want to be the last ones to figure it out. We want to be the first. We want to lead. And that’s what we’re going to do.

So I say to you, the future is bright. We’re talking about an economy that moves faster, more efficiently. It’s the future, folks. We need to make sure we’re part of it. Digital money is coming whether we like it or not, so we’d better make sure we’re on top of it.

And let me tell you, it’s going to be big. The biggest. The world is looking to us. They want us to lead, and I believe we will. We’re going to make sure America is at the forefront of digital finance. We’re going to make sure we’re ahead of the curve. And we’re going to win. We’re going to win big. Thank you, God bless you, and God bless America!

BTCUSD Analysis Today: Technical and On-Chain !In this video, I will share my BTCUSD analysis by providing my complete technical and on-chain insights, so you can watch it to improve your crypto trading skillset. The video is structured in 4 parts, first I will be performing my complete technical analysis, then I will be moving to the on-chain data analysis, then I will be moving to the liquidation maps analysis and lastly, I will be putting together these 3 different types of analysis.

I BELIEVE BTC WILL DROP SINCE THE MARKET VOLUME IS LOW AT TIME A bearish trend is unfolding in the Bitcoin market, presenting a potential short opportunity. The recent price action has been characterized by a lack of upward momentum, and the market's overall sentiment has shifted towards the downside.

Technical Analysis

- Bearish Trend Line Resistance: The chart is showing a clear bearish trend line resistance, indicating a potential reversal.

- Low Market Volume: The current market volume is low, suggesting a lack of buying interest and increasing the likelihood of a downward move.

- RSI Oversold: The Relative Strength Index (RSI) is not oversold, but the price action suggests that the market is due for a correction.

- MACD Bearish Crossover: The Moving Average Convergence Divergence (MACD) is showing a bearish crossover, indicating a potential trend reversal.Trade Rationale

This trade is based on a combination of technical and market sentiment analysis. The bearish trend line resistance, low market volume, and MACD bearish crossover all suggest that the market is due for a correction. The RSI is not oversold, but the price action suggests that the market is due for a pullback. its not financial advise

Bitcoin Weekly LINEAR chart shows possible re run of 2021 2X ATHI was just looking at this Linear chart and spotted a couple of things.

So many people Use LOGARITHMIC charts.

In summery, A logarithmic chart is a graphical representation that uses a logarithmic scale, which differs from the conventional linear scale. In a logarithmic scale, the distance between values is not constant but increases by a factor, making it useful for datasets with a wide range of values. This approach helps in presenting numerical information more efficiently and allows for a better visualization of rates of change or percentages rather than absolute values.

A LINEAR chart however, shows you the REAL rate of change.

And on This Linear chart, I have noticed that PA is creating a very Similar Top to the MARCH ATH of 2021

I do not think we will follow it perfectly, as that drop in 2021 was over 50% and that would take us down to 52K, which I think is not a real possibility. But, being open to ALL possibilities, that trend line that was used by PA to bounce to the Nov ATH currently sits around 65K But the longer we wait, it heads higher, towards the 1 Fib ext around the Old 2021 ATH near 70K ( 69300)

Also note, how once PA had Dropped in March 2021, it levelled out and slide sideways for around 7 weeks.

So if we come over to Today, we have just dropped around 30% and seem to have found a Floor around 76K

We HAD to drop out of that Upper range box - It would have been December before we found support on the rising Trend line that has been the trigger for moves higher since 2023

And so, we have dropped to a Lower Range Box ( hopefully ) and this box hits the Rising trend line around June.

This has confluence with a number of other charts

And if we do range sideways, around this level, it is similar to that Range after the drop in 2021.

In 2021, after that range, PA rose by around 122%

I am not to sure we would see that but................

So now we wait to see if we stay in this range or not, with a top around 90K

We could See wicks out of this Range, down to the 70K mark maybe, with swift recovery.....

We may also see further Drop....

there is abcolutly NO guarentee that we will even head higher again.....

We have to wait and see and have plans and stick to them..for both BULl and BEAR

BEARISH AND BULLISH SCENARIOI'll use harmonics for both bearish and bullish case. ASSUMING that the top is in, ABCD bearish scenario is in play. Congratulations to those who have shorted :) For the bullish case scenario, I'm seeing a Cypher pattern, which directs us to the 40k region and I think this will be the accumulation of whales in preparation for the next cycle. In connection to my previous post using my crude representation of the waves, 40k area is the legendary trading zone and it might be tested as a support that will take us to 200k+ next cycle. Just my two cents. Good luck trading.

BTC Double Bottom Formation Likely - Strong SupportEntering another BRC Long at the current level of support. Appears we have a lot stronger potential for a bounce here. Looking at RSI we see oversold conditions with larger time frames holding bull divergences.

Looking at this to be a low risk trade with lots of potential. Loading in now.

Have fun and as always protect that capital.

BTC Buy at this Level - NFP News This Week (Volatility Risk!)Short term Buy idea on Bitcoin. This is a riskier idea because:

A) BTC is showing signs of Weakness (so we are counter trend trading)

B) This idea is based on NFP news timing

I may wait until Monday to get clarity (unless you also trade on the weekend)

Overall Idea for this is:

- W1/M candles have big rejection wicks to the downside, retesting the previous Week's wick, hinting at some Buyside potential

- We see divergence with ETH.

- The LTF H4 shows a Break of Structure, momentum move to the upside.

- We've already had a retracement down after, and it validated the gap in price (blue zone), reacting off it, hinting that it will hold.

- Now I'm waiting for the next best price to enter.

Again, NFP volatility can create bigger than usual spikes, so keeping that in mind.

If NFP takes it higher without coming to a better price, so be it - the train will leave without me. Will wait for further PA.

Price will be giving the validation to enter.

BTC on weekly chart ( cup and handle )CRYPTO:BTCUSD BINANCE:BTCUSD

As an overview of Bitcoin on the weekly chart.

We have a cup and handle targeting the area at 131,000 and I think this price is the target of this cycle.

We also have the neckline zone at the price of 73k and we see that the price is still trading above it until now, so in the event of any other decline, I think the neckline area is the lowest price that will be reached and represents the retest point to start for the new highs.

We also note that the price is still above the averages: 50-100-200 and we notice its rebound when it touched the average of 50

Conclusion: Since we are above the 70-73 thousand zone, there is no need to worry because this indicates that the chart is moving in the right direction, but in the event of a break in the 70k zone, this will be the first sign of the beginning of the negative.

UPDATE SOON ....

Bitcoin’s Wild Ride: Up or Down, I’m Watching!Hey there, trading family—just chilling and watching Bitcoin like it’s my buddy on a rollercoaster. It’s hanging out near that FWB:83K spot, and I’m like, “Dude, if you bust through, I can see you tearing up to $120K-$130K—time for a high-five and a snack!” But if you start slipping with those lower lows, no biggie. You might drop to $79,600, then maybe $78,700, $77,000, or even $73,500. I’m just kicking back, enjoying the show—up or down, it’s all good vibes! If you liked this, comment below, boost, or follow—let’s keep the trading love going!

Kris/ Mindbloome Exchange

Trade Smarter Live Better

BTC in Buy ZoneMy trading plan is very simple.

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom of channels

Stochastic Momentum Index (SMI) at oversold level

Money flow momentum is spiked negative and under bottom of Bollinger Band

Entry around $80K

Target is upper channel around $90K

Gaussian Channel may indicate break down or next pumpI have analyzed the last two bull markets to assess how the Gaussian channel could predict the initiation of a bear market. Additionally, I examined the typical duration of the bullish phase—from exiting the bear market to breaking into the Gaussian channel—as an indicator of the bull market’s completion.

Historically, right-translated cycles have exhibited approximately 840 days of bullish price action. If this pattern holds, the current bull market should conclude by November this year, unless we have already reached the peak.

A key factor for the bull market to continue is staying above the Gaussian channel. Dropping into the channel would signal the start of a bear market. Currently, this critical level is at $73K.

Wishing us all luck, as the altcoin market has already suffered significant losses.