BTCUPUSDT trade ideas

How to Capture Reversals/Breakouts with MAD IndicatorBTC/USDT 15M – Market Anomaly Detector (MAD) Captures Reversals & Breakouts

⸻

Description:

On this BTC/USDT 15-minute chart, the Market Anomaly Detector (MAD) is actively highlighting high-probability market turning points and anomaly zones.

Key Observations from the Chart:

1. Green & Red Zones = Expected Price Range

• Green Line (Upper Band): Expected top of the range.

• Red Line (Lower Band): Expected bottom of the range.

• Price usually travels green → red → green, forming a natural oscillation.

2. Buy/Sell Signals = Breakout + Reversal Detection

• Buy Signal: Triggered when price closes above the green line or recovers from below the red line.

• Sell Signal: Triggered when price closes below the red line or rejects from the green line.

• This reverse psychology logic helps catch false breakouts and stop-loss hunts.

3. Performance on This Chart:

• Signals aligned with key reversals during the sideways-to-downtrend transition.

• The strong downtrend in the second half of the chart shows multiple accurate sell signals, confirming trend continuation.

• Sideways movements had minimal false signals due to cooldown + volume filter.

4. Unique Advantage (USP):

• Statistical approach using Z-Score & Standard Deviation.

• Multi-filter confirmation with RSI, volume, and higher timeframe trend.

• Visually clear anomaly zones:

• Green background = Bullish anomaly

• Red background = Bearish anomaly

• Gray background = Neutral range

Takeaway:

MAD helps traders anticipate anomalies rather than react late, offering high-probability trade entries and reversals in trending and volatile conditions.

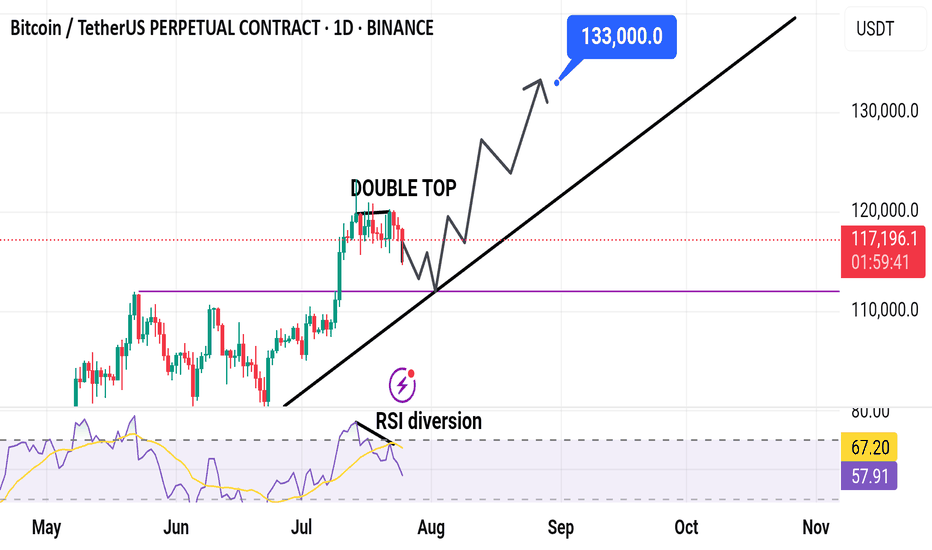

BTCUSDT 1D – Retesting Key Support, Will Bulls Hold the Line?Bitcoin is retesting a crucial structural support level around $112K after its recent local top near $120K. This zone previously acted as resistance and is now being tested as support — a textbook bullish continuation signal if it holds.

Historically, these flips (from resistance to support) have triggered strong upside momentum, as seen after the $78K breakout earlier this cycle. However, failure to hold this level could open the door for a deeper correction toward $100K or even the $90K region.

This chart outlines the major structural zones:

Long-term accumulation base near $70–78K

Resistance flip zone at $110–112K

Local resistance near $120K

📌 If bulls defend this zone and reclaim momentum, we could see another push toward cycle highs. If not, patience is key — the next high-conviction entry may come lower.

How are you positioning around this zone? Let me know in the comments 👇

$BTC Daily OutlookDaily Chart

Today’s close printed a small bearish doji; visually bearish but still another inside-day that keeps BTC boxed between the High-Volume Node / v-Level cluster at $116 860-$123 300.

Holding $116 860 remains critical; lose it on a daily close and price can easily slide to the weekly breakout shelf near $111 960. We are now 16 days inside this balance. Per Auction-Market-Theory rule #5, the longer price churns at the edge, the more resting liquidity is absorbed, eventually a decisive push will follow. If buyers defend $116 860 again, the path opens toward range high $123 300 and the prior ATH; if they fail, expect a fast flush to the weekly V-Level.

Footprint Read

Value Area High and Low span the full candle, with the POC parked mid-range, classic two-sided trade. Delta finished negative and the heaviest prints sit at session lows: sellers hit the bid hard, yet could not follow through. That absorption leaves shorts vulnerable to a squeeze if new selling momentum doesn’t appear quickly.

Fundamental Pulse – Week Ahead

ETF Flows: Spot-Bitcoin ETFs booked three consecutive inflow days to close last week (+$180 M net). Sustained demand under the range supports the bullish case.

Macro Data: U.S. FOMC & Federal Fund Rates prints for this week; expect more volatility starting from tomorrow.

Game Plan

Primary bias stays long while daily candles close above $116 860; upside trigger is a clean for now or shorts squeeze toward $123 300.

If $116 860 breaks with volume, prepare for a quick liquidity hunt into the weekly shelf at $111 960, where we reassess for swing longs.

Intraday: I’ll monitor the Intraday Chart on tomorrow's High impact events and look for best opportunities across the board. Alt window: a fresh downtick in BTC Dominance could spark rotation; watch high-Open Interest majors if BTC ranges.

Bitcoin & Altcoins: Technical Analysis and Market OutlookBitcoin (BTC) Analysis

Bitcoin is currently forming a short-term bullish pennant within a larger long-term pattern, projecting a potential target around $135K.

Key Levels: BTC is consolidating between the lower zone at $117.3K and the upper zone at $119.7K.

Breakout Potential: A break above this pattern could propel BTC toward a new all-time high (ATH), surpassing the current ATH at $123K.

Macro Events This Week:

Wednesday: The Federal Reserve will announce its interest rate decision, with no changes expected.

Wednesday: ADP Employment Report, providing insights into potential future rate cuts.

Friday: Non-Farm Payrolls (NFP) data release, which could further influence market sentiment.

Ethereum (ETH) Breakout

Ethereum has decisively broken through its 4-year historical resistance around $3,725, closing the week above this level. This breakout signals a strong bullish outlook for ETH, with potential for further upside.

Altcoin Highlights

BNB: Has shattered its previous all-time highs, showcasing significant bullish momentum.

XRP: Reached approximately $3.64, reflecting strong gains and market interest.

Market Context

The crypto market is showing robust activity, with altcoins following Bitcoin and Ethereum's lead. Key macroeconomic events this week could introduce volatility, so traders should stay vigilant.

Disclaimer: This is not financial advice. Every trader is responsible for their own strategy and risk management.

Happy trading and good profits! 🚀

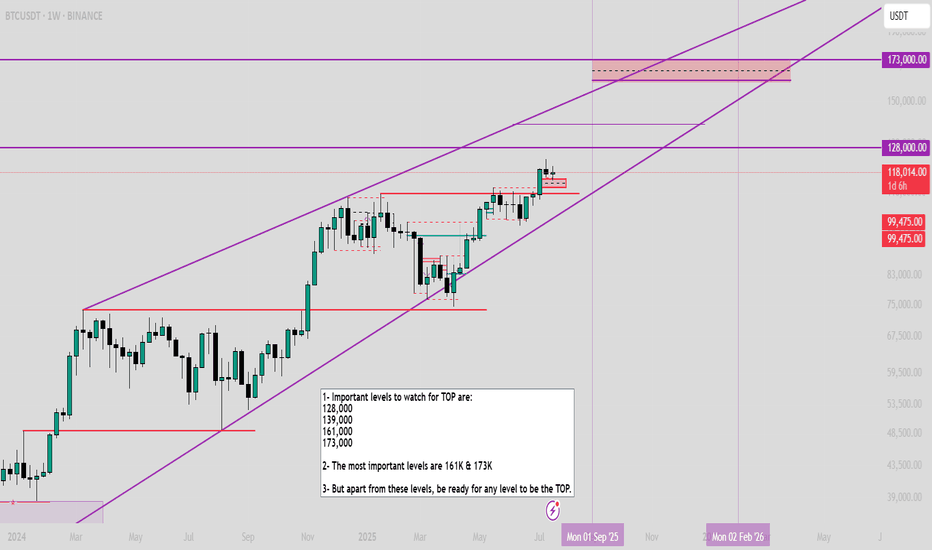

$BTC Important levels to watch1- Important levels to watch for TOP are:

128,000

139,000

161,000

173,000

2- The most important levels are 161K & 173K

3- But apart from these levels, be ready for any level to be the TOP.

(and again, Bull market is not over, watch my previous analysis BTC/XAG on the last post)

BTC Consolidates Below 119,300 Over the Weekend💎 BTC WEEKEND PLAN UPDATE (26/07)

NOTABLE BTC NEWS

The cryptocurrency market is attempting to stabilize after a wave of sell-offs during Friday’s Asian session, when Bitcoin (BTC) dropped to an intraday low of $114,723. A recovery trend is gradually strengthening, with BTC trading at $115,868 at the time of writing, indicating that buying interest at lower levels may increase in upcoming sessions.

TECHNICAL ANALYSIS PERSPECTIVE

Symmetrical Triangle Pattern

BTC is currently fluctuating within a symmetrical triangle pattern, with converging upper and lower trendlines. This pattern typically signals a strong consolidation phase before a decisive breakout.

Scenario unfolded as planned:

• The price failed to break the resistance zone around $120,000 (previously forecasted as a likely failed breakout zone).

• BTC then dropped sharply to the support zone around $115,000, touching the lower trendline and the potential breakout zone.

• At this level, the price rebounded as expected, indicating strong buying pressure at support.

MA lines supporting the trend:

• The price is currently moving around the 200-day MA (red line), showing that the dynamic support is working effectively.

• The 50-day MA (yellow line) is acting as short-term resistance. If broken, it could support the recovery momentum.

Two potential upcoming scenarios:

🔼 If BTC breaks above the $119,500 – $120,000 zone with strong volume, it may continue to test higher levels around $123,000 – $125,000.

🔽 Conversely, if it faces strong rejection around $119K and turns downward, BTC may retest the support zone at $114,000 – $115,000 once again.

Stay tuned to the channel for the latest and continuous updates on XAUUSD, CURRENCIES, and BTC.

BTC | Swing Plan UpdatePrice failed to break out above 1D supply and sharply rejected, losing key 4H demand at $117,300.

HTF demand at $109,000 (1D FVG + BOS + S/R) is the next major area of interest—this is where I’ll look for fresh swing setups if the market flushes further.

No need to rush new positions until a clean setup prints or levels are reclaimed.

Plan:

Wait for price to test $109,000 zone before considering a swing long.

Only consider LTF scalp longs if we reclaim the 4H BOS at $118,300.

Stay flat until high-probability entry, let the market show its hand.

HOW TO Spot Liquidity-Driven Reversals & Market TrapsAdaptive Liquidity Pulse

🎯 Spot Liquidity-Driven Reversals & Market Traps

The Adaptive Liquidity Pulse is designed to help traders detect high-volume rejections and absorptions, revealing where big players are likely defending or accumulating positions. This indicator is especially useful for spotting market traps, liquidity sweeps, and swing reversals.

⸻

🧠 How It Works

1. Dynamic Liquidity Zones

• Red Band (High EMA) → Potential supply/rejection zone

• Blue Band (Mid EMA) → Equilibrium / magnet zone

• Green Band (Low EMA) → Potential demand/absorption zone

2. Signal Labels

• 🔴 Rejection → Price spikes into high liquidity with volume → Bearish bias

• 🟢 Absorption → Price flushes into low liquidity with volume → Bullish bias

3. Volume-Weighted Detection

• Only triggers signals when volume exceeds a configurable threshold

• Filters out weak moves, highlighting true liquidity events

⸻

📊 Best Use Cases

• Scalping & Intraday Trading: Identify early reversal points

• Swing Trading: Track absorption/rejection cycles to time entries/exits

• Liquidity Sweep Detection: Spot where false breakouts occur with volume confirmation

⸻

⚡ Trading Tips

• Use Rejection (Red) for short entries or take-profits near highs

• Use Absorption (Green) for long entries or short exits near lows

• Combine with support/resistance zones or trend structure for higher accuracy

• Midline (Blue) often acts as a mean-reversion magnet in ranging markets

⸻

📢 Alerts

• 🔴 Rejection Alert → Strong selling pressure at liquidity zone

• 🟢 Absorption Alert → Heavy buying at demand zone

⸻

🧠 Why Traders Love It

• ✅ Visualizes hidden liquidity interactions

• ✅ Highlights trap zones before reversals occur

• ✅ Works across crypto, indices, forex, and commodities

• ✅ Designed for confluence with other strategies

⸻

This script gives you a real-time pulse of liquidity shifts, allowing you to trade like institutions and avoid falling into retail traps.

⸻

BTC/USDT Analysis – Bullish Pennant Holds Key to $150,000 TargetBINANCE:BTCUSDT is holding just above $115,000, recovering from a 2.4% dip in the last 24 hours, with one technical setup dominating the conversation: a bullish pennant on the 3-day chart.

The pattern formed after a sharp 25% rally earlier this month, creating a classic pole-and-pennant structure. Multiple breakout attempts have failed so far, with long wicks signaling heavy volatility, but the pattern remains valid as long as the BINANCE:BTCUSDT price stays above the $114,000 support zone.

A confirmed 3-day candle close above $119,700—the top of recent failed breakouts—would likely trigger the next leg higher. A measured move from the pole projects an upside target near $150,000, aligning with long-term bullish expectations.

Supporting this setup, the Fund Flow Ratio has been making lower highs, suggesting fewer coins are heading to exchanges and potential sell pressure is easing. At the same time, Chaikin Money Flow (CMF) on the 3-day chart is forming higher highs, signaling quiet accumulation despite recent price dips.

Until either level breaks, BINANCE:BTCUSDT trades in a pivotal range. Bulls want a clean breakout above $119,700, while a drop below $114,000 would invalidate the pattern and open the door to further downside.

The Curtain Falls on the Script: Why I Believe It's Time to StopHello everyone, this is EC.

From late June through July, we experienced a full-fledged primary uptrend in crypto, driven by a weakening U.S. Dollar. From the script preview to the execution of the plan, every step has been clearly documented.

However, today, I want to share a different, more cautious perspective: I believe this script may be nearing its end.

I. Reviewing the Script and the "Bubble's" Manifestation

After our call on July 4th that the "main bull wave" was starting, the market perfectly delivered on our expectations. What was more interesting was the clear internal divergence we saw, which precisely confirms our thesis about the "bubble phase" from my June 20th article, "The Restlessness Before the Storm."

When the market's sentiment "balloon" is inflated to its limit, capital flows from the leader (BTC) to assets with higher elasticity (ETH).

The data shows that from July 11th until now, ETH took the baton and rallied approximately 35%, while BTC gained only around 6% in the same period. When BTC is already showing signs of fatigue while ETH is still in a solo rally, that in itself is a major signal that the bubble is nearing its end.

II. A Shift in the Winds: The Hand Inflating the Balloon is Loosening

I've chosen to end this script at this moment based on signal changes on two levels:

The "External Factor" Shift: The Potential Strengthening of the USD

As I pointed out in my July 28th analysis, "The Market's Rebalancing," the market has entered a phase of "strength-weakness divergence." This trend is now becoming more evident: the U.S. Dollar, cushioned by the extreme weakness of currencies like the Japanese Yen, has begun to show signs of a broad strengthening. Concurrently, U.S. and European stock markets are pulling back in sync, and global risk appetite is cooling.

The external environment that fueled the bubble (a weak USD) is beginning to falter.

The "Internal Factor" Signal: The Needle Point Inside the Balloon

The crypto market itself is also showing warning signs of resistance (see attached ETH daily chart). When the leading asset, ETH, begins to show signs of stagnation and distribution at its highs, it's like the balloon meeting the needle point. The exhaustion of internal momentum is a more direct warning than changes in the external environment.

III. Conclusion: Don't Be Greedy for the Last Dessert

When the core logic driving the rally (a weak USD) begins to waver, and the market simultaneously shows internal signs of exhaustion, my choice is to end this script and take profits off the table.

This doesn't mean I think crypto will crash immediately. But "no longer suitable to hold" implies that, in my view, the risk/reward ratio at the current level is no longer attractive. A grand feast is coming to an end, and being greedy for the last dessert is not a wise move. Shifting from "buying the dip" to "cautious observation" is the rational choice.

Thank you for your attention and for following along this past month.

#Crypto #BTC #ETH #TradingView #MarketAnalysis #RiskManagement

BTC/USDT Analysis — Hidden Buyer

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin continued its move toward the local low and formed a false breakout.

Throughout the decline, we observed a positive delta, which may indicate gradual accumulation of long positions. At the same time, the descending trendline has not yet been broken, and there was strong absorption of market buys around ~$118,400 and ~$118,800 — which makes entering long positions very risky at the moment.

Our main expectations are based on further rotation within the range marked in yesterday’s analysis. In the short term, we are watching for a test of two local zones to assess the reaction from sellers. If the reaction is weak, a test of the upper boundary of the new sideways range is quite possible.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

Sell zones:

~$118,400 and ~$118,800 (local resistances)

This publication is not financial advice.

BTC/USDT Analysis — Potential Sideways Range

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin experienced a local reversal. At this point, two zones previously marked by us have been worked out:

Buy zone — $118,300–$117,300

Sell zone — $119,500–$119,000

We now expect continued rotation within the $117,400–$119,800 range, with potential expansion in both directions. The overall context remains positive, so a full breakout to the upside could occur in the near future.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

This publication is not financial advice.

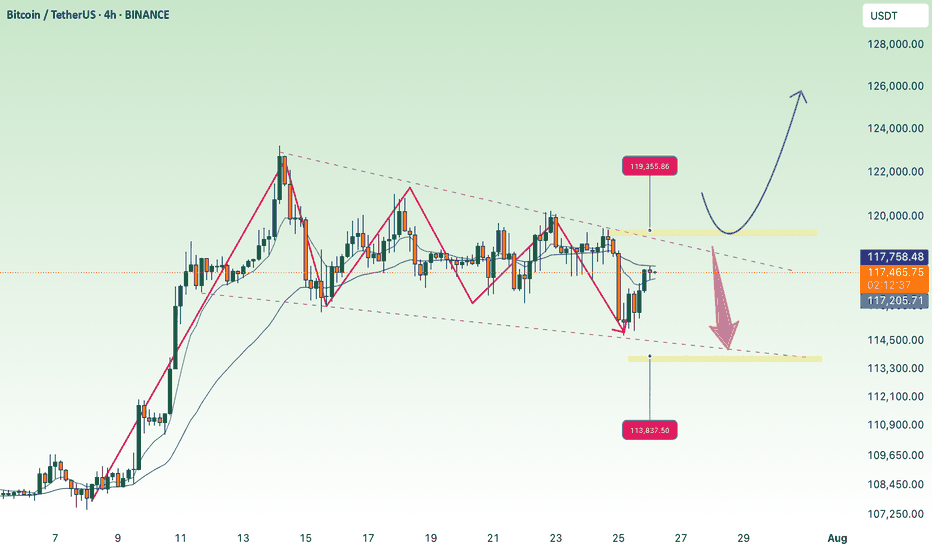

Hunting for liquidity. Retest resistance before a fallBitcoin is still in correction, but is rebounding from the local low of 117.4, formed during the pullback, and is heading back up towards the zone of interest at 119.8-120.1, which it did not reach during the main upward movement. I see no fundamental or technical reasons for the correction to end and for growth beyond 121K. I expect a rebound from the resistance zone towards 115-114K. However, in the medium term, I expect the market to attempt to close half or all of the gap between 112K and 114.8K, thereby expanding the key trading range.

Resistance levels: 119.77, 120.1K, 120.8K

Support levels: 117.4, 116.37, 115.68

Technically, a false breakout (liquidity capture) of key resistance and price consolidation in the selling zone could trigger bearish pressure on the market, which in turn would lead to a correction.

#BTC Update #11 – July 29, 2025#BTC Update #11 – July 29, 2025

Bitcoin continues to move within the channel and has completed several corrections of its last impulsive move. It is currently undergoing a correction within a correction. There was a liquidation zone around the $117,000 level, which was mostly filled, triggering a reaction.

From what we can observe now, Bitcoin is facing rejection from the upper boundary of the channel. If it manages to break out of the channel and continue its climb, I believe it will target the high liquidity zone near $122,000.

At this stage, Bitcoin is not in a suitable position for either long or short trades.

BTC setup projection🚨 BTCUSD Trade Setup – 5M Chart

📉 Entry Zone: 118,950–119,000

🎯 Target 1: 120,280

🎯 Target 2: 120,779

🎯 Final TP: 123,221

🛡️ SL Zone: Below 118,447

✅Confidence level 7.5/10

Bias: Bullish 📈 – anticipating a reversal from the demand zone with clean upside liquidity targets.

Stay patient, wait for confirmation before entry. Let the setup come to you.

As always, manage risk. Risk what you’re okay to lose. 💼

BTCUSDT Range-Bound Market: Short-Term Bearish MoveBTCUSDT

has failed to break through the descending resistance near 120,000 and is now forming a lower high within the broader resistance zone. The price action follows an impulsive leg up and is currently tracing a potential reversal pattern under key structural resistance. As long as the market remains capped below 120,000, continuation toward 117,500 is likely. The downward bias is supported by weakening momentum after the bull trap and resistance rejection.

📉 Key Levels

Sell trigger: Breakdown below 119,000

Sell zone: 119,400 – 120,000

Target: 117,500

Invalidation: Break and close above 120,500