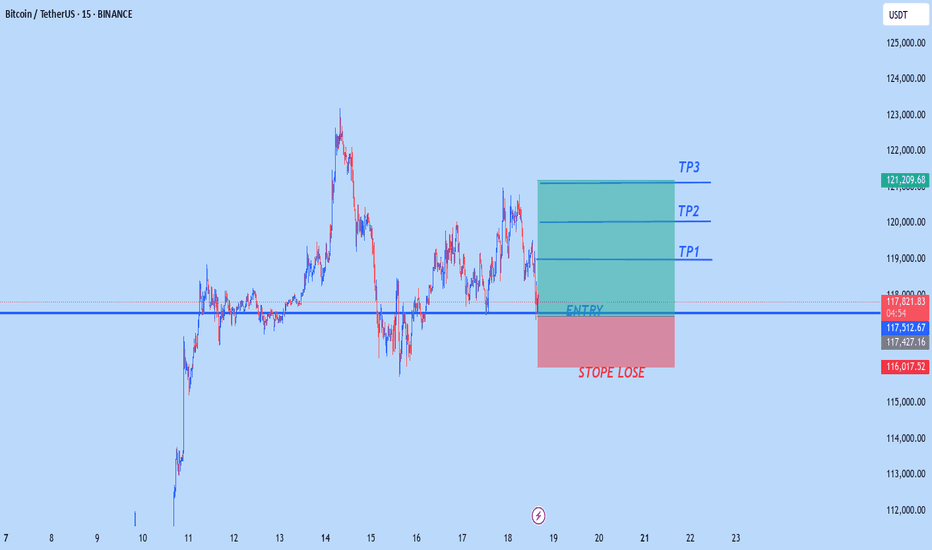

BTCUSDT - UniverseMetta - Signal#BTCUSDT - UniverseMetta - Signal

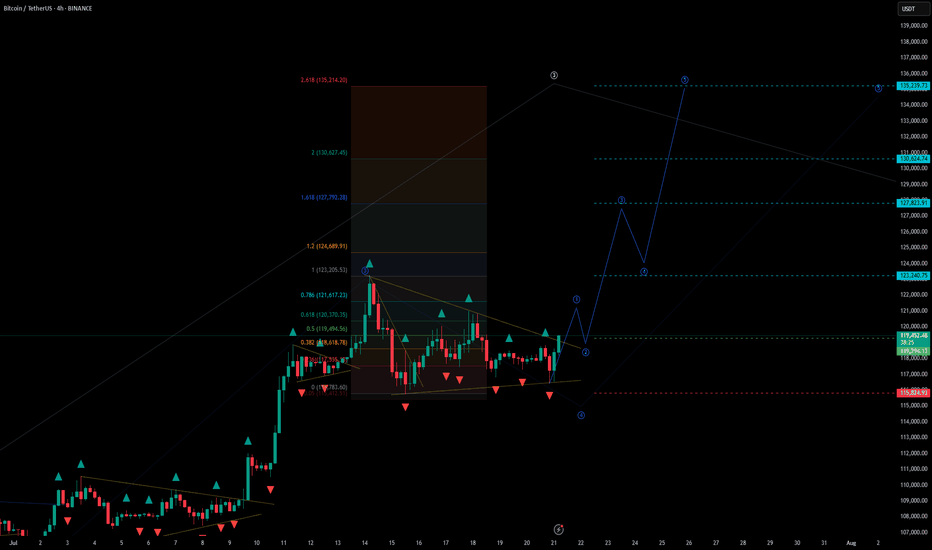

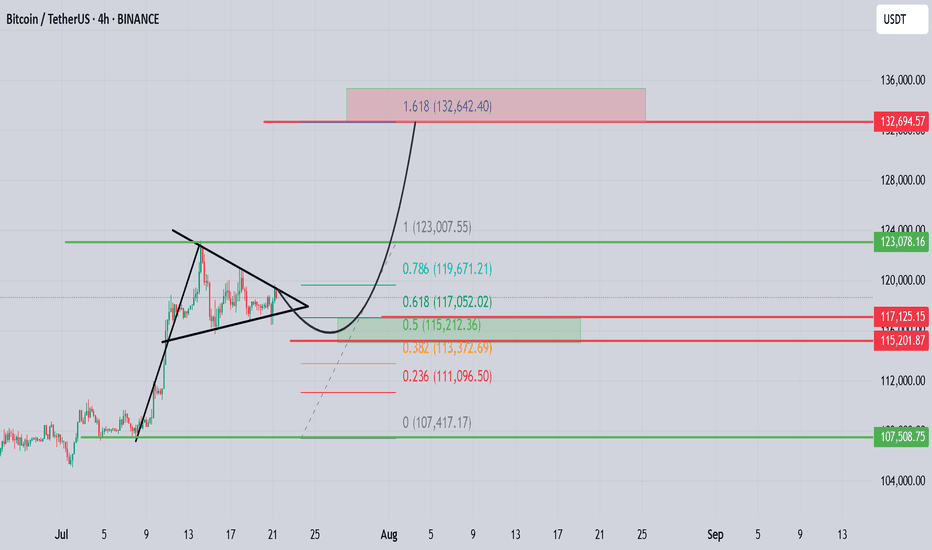

H4 - Formation of a triangular formation in continuation of the trend, for a more confident entry you can wait for a retest and formation of the 3rd wave. Stop behind the minimum of the 1st wave.

Entry: 119294.13

TP: 123240.75 - 127823.91 - 130624.74 - 135239.73

Stop: 115824.93

BTCUPUSDT trade ideas

The 3-Step Rocket Booster Strategy Bitcoin Edition🚀 3 Key Features of Bitcoin

Decentralized Network – No central authority like a bank or government controls Bitcoin.

Limited Supply – Only 21 million bitcoins will ever exist, making it scarce and valuable.

Borderless Transactions – Send or receive money globally without needing permission or intermediaries.

✅ 3 Benefits of Using Bitcoin

Freedom from Inflation – Bitcoin resists inflation because of its fixed supply.

Fast & Low-Cost Transfers – Especially useful for international payments.

Financial Inclusion – You don’t need a bank to own or use Bitcoin—just a smartphone and internet.

⚠️ 3 Problems with Bitcoin

Price Volatility – The price can change rapidly in short timeframes.

Scams & Fraud – Many fake crypto projects use Bitcoin’s name to deceive people.

Technical Learning Curve – Beginners may find it hard to understand wallets, keys, and security.

🤔 3 Common Objections

“Bitcoin is too volatile—I might lose money!”

“It’s too complicated for me to use.”

“Governments will ban it eventually.”

💡 3 Ways to Overcome Objections

Use only what you can afford to lose. Start small and grow with knowledge and confidence.

Use beginner-friendly apps like Binance, Trust Wallet, or Paxful. These platforms make Bitcoin easier than ever.

Bitcoin is legal in most countries, and major companies are adopting it—its use is expanding, not shrinking.

🛒 Take Action Now!

Don’t wait for the price to explode again. Learn, test with small amounts, and start your Bitcoin journey today.

👉 Buy Bitcoin now and take control of your financial future!

🚀 The 3-Step Rocket Booster Strategy

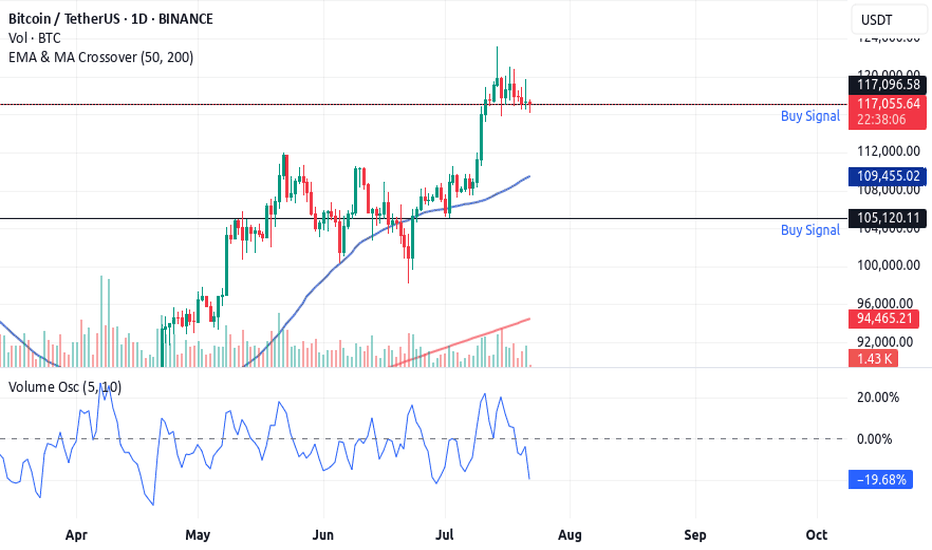

🔍 Step 1: Price Above the 50 EMA

What it means: The price is trending upward in the short-to-medium term.

Why it matters: This shows strength and upward momentum—price is above its recent average.

🔍 Step 2: Price Above the 200 EMA

What it means: The long-term trend is also bullish.

Why it matters: This confirms that the overall market direction is up, reducing the risk of fakeouts.

🔍 Step 3: Volume Oscillator Surge (Volume "Booster")

What it means: There is a spike in volume (measured using a volume oscillator).

Why it matters: Volume confirms that big players are involved. Price moves backed by high volume are more reliable and likely to continue.

✅ Optional Extra Filter: Check if the price has gapped up or if there's a bullish candlestick pattern (e.g. Marubozu, Engulfing, Morning Star) to increase confidence.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please use a simulation trading account before you trade with real money.Also learn risk management and profit taking strategies.

BITCOIN FINAL WARNING BEFORE HUGE MOVE!!! (urgent) Yello Paradisers! I am Sharing with you my idea about #Bitcoin of what's going on with Bitcoin right now: be very careful because the Fear and Greed Index, a special one, is at "Greed". We are seeing funding rates, the accumulated funding rates, as extremely positive. We are seeing bearish patterns forming.

In this video, I'm describing the confirmations we are waiting for that will confirm that Bitcoin is about to make a huge movement. Make sure that you are trading with professional trading strategies and that you are waiting for confirmations before any trade execution. Also, make sure that you have tight risk management because only the best, most professional traders will win long-term in this game.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

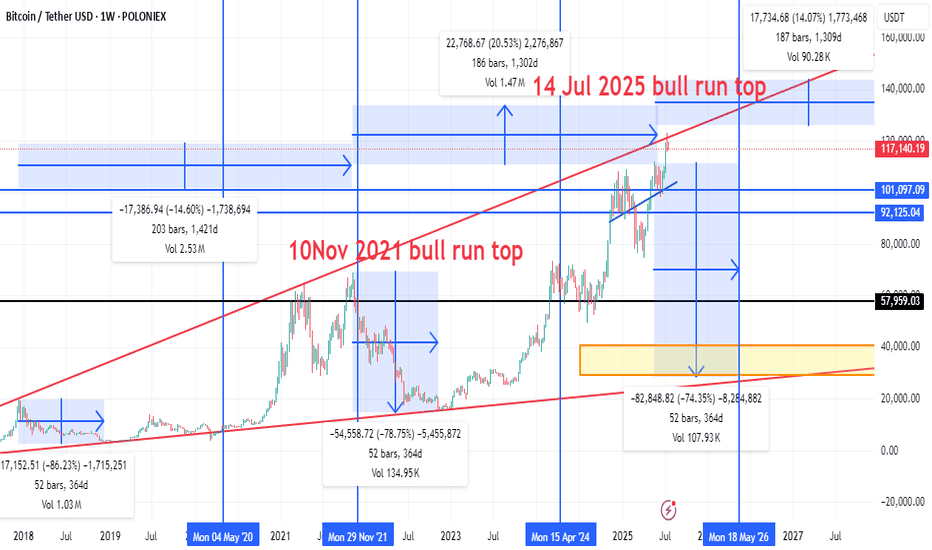

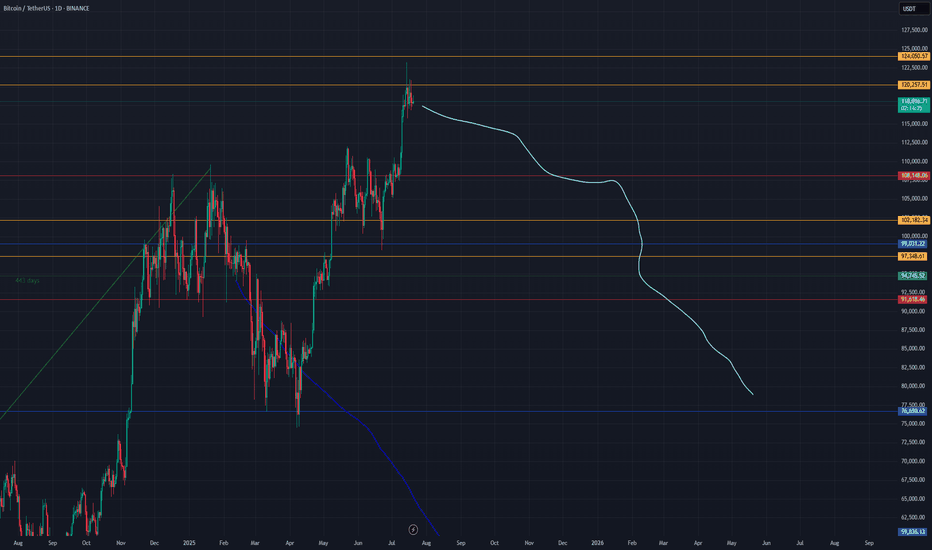

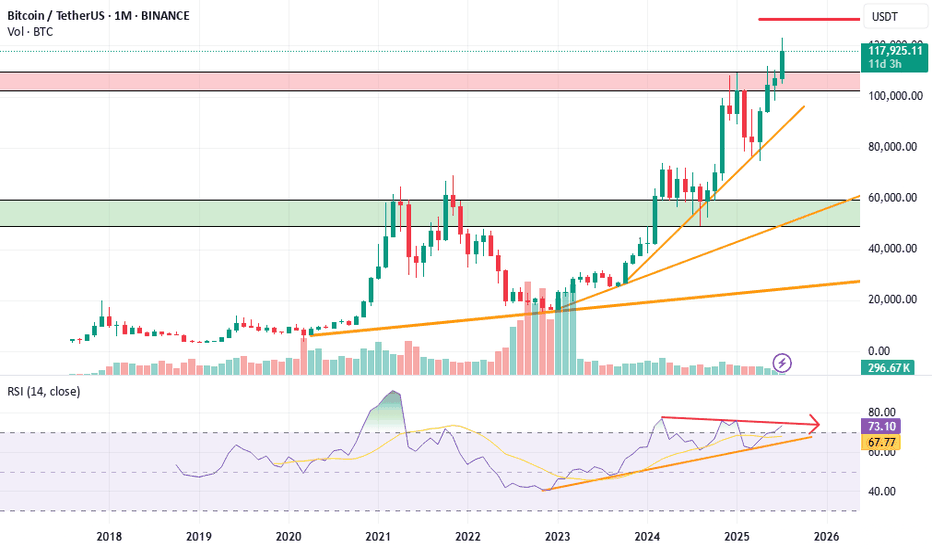

Bitcoin’s “four‑year” halving‑cycle rhythm by overlaying three c🔍 Key Highlights from the Chart

🟢 Bull Market Peaks

10 Nov 2021: Previous cycle top around ~$69,000.

14 Jul 2025 (Projected): Potential new bull market top (approx. $120K–$125K zone based on red trend line projection).

🔴 Bear Market Drops

2021–2022 Crash:

Drop of -78.75% from the 2021 top.

Lasted 52 bars (364 days).

Next Projected Bear Market:

Projected from July 2025 to May 2026.

Expected drawdown: -74.35%, possibly taking BTC down to the $30K–$40K range (orange box support zone).

📉 Correction Zones

Mid-cycle corrections like the one from Apr 2024, showing smaller drops (~20%).

📈 Trend Channel

Red diagonal lines form an ascending channel for bull market tops.

Current price (~$117,872) is nearing upper resistance of this long-term trend channel.

📊 Support/Resistance Levels

$120K & $125K: Horizontal resistance zones.

$57,959: Major historical support (former resistance).

$30K–$40K: Bear market bottom zone based on history and trendline confluence.

⏳ Cycle Timing

Historical cycles span about 4 years:

Peak → bottom → new peak = ~1,300–1,400 days.

This cycle’s timing aligns almost perfectly:

Nov 2021 → Jul 2025 = 1,300+ days (same as past cycles).

Suggests potential top is in or near.

📌 Summary & Outlook

Phase Estimate

Current Price ~$117,872

Projected Top ~$120K–$125K (likely topped 14 Jul 2025)

Next Major Drop -70% to -75% (target: $30K–$40K)

Next Cycle Low Mid 2026 (May–July 2026)

Strong Support Zone $30K–$40K (orange box)

🧭 Strategic Notes

If this chart pattern holds, major profit-taking should already be done or initiated.

Watch for weekly close rejections at trend channel top for confirmation of top formation.

Reentry in mid-2026 would historically offer a high reward/risk zone.

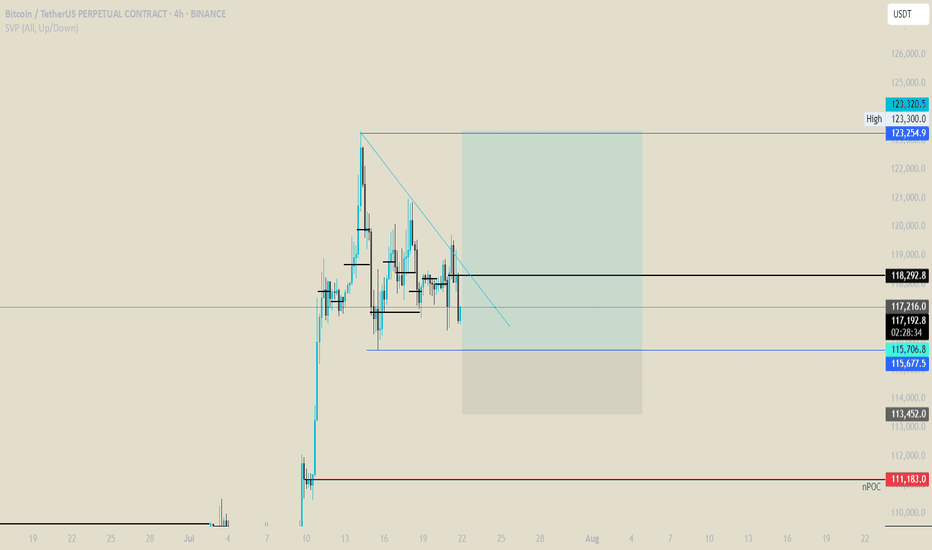

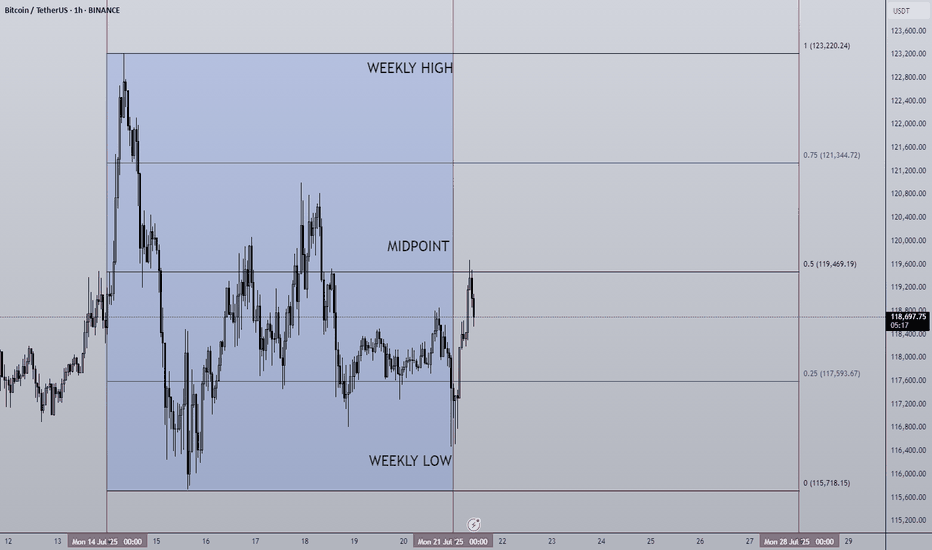

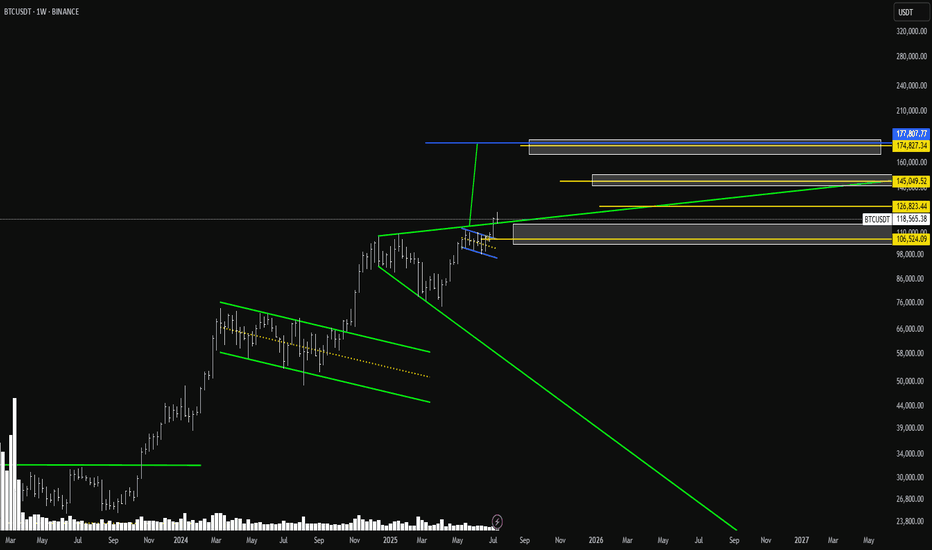

21/07/25 Weekly OutlookLast weeks high: $123,220.24

Last weeks low: $115,718.15

Midpoint: $119,469.19

New BTC ($123,220) & SPX ($6,315) ATH last week! We're really seeing progress being made on all fronts now, bitcoin saw its sixth week of net inflows into BTC ETFs ($2.39B).

The week began strong hitting the new ATH very early and then settled into a tight range to cool off. Altcoins however surged in relation to BTC to break out of HTF downtrends and begin to make up lost ground. One of the beneficiary's of this price movement has been ETH, breaking out from a multi year downtrend against BTC and hitting $3,800 in its USD pair.

For this week I do expect much of the same for BTC as momentum is with altcoins for now. However, as those altcoins reach HTF resistance levels it becomes very important for Bitcoins chop to be accumulation for the next leg up and not distribution for the way down. With so few pullbacks the threat of a sudden correction is present but the probability drops should BTC look to press higher with strong demand.

The ECB Interest rate decision takes place on Thursday but no changes to the 2.15% rate is forecast. In terms of news there are no planned upsets that I can see.

Good luck this week everybody!

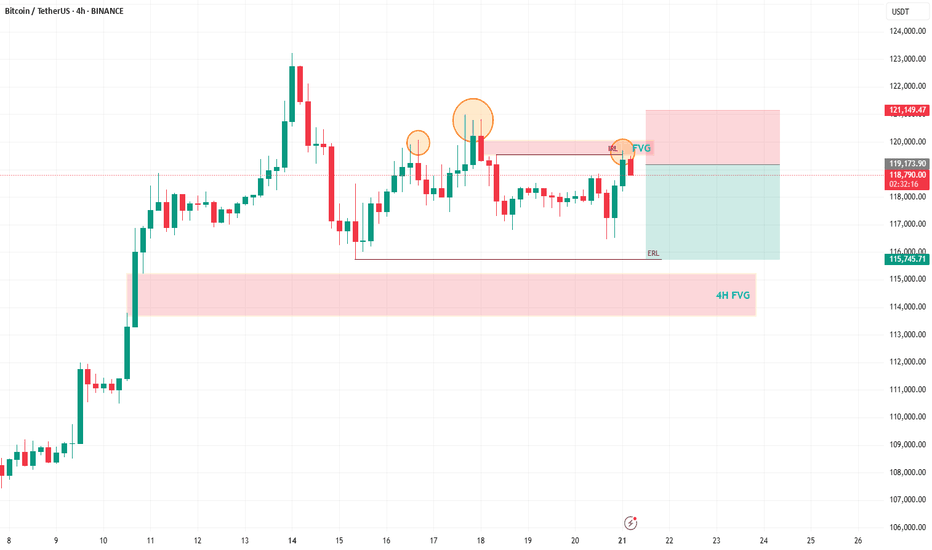

Bitcoin Trading Update: Consolidation, Patterns, and What's NextHey Fellow Traders! 👋

Bitcoin (BTC) has been on a wild ride after hitting its all-time high (ATH)! 📈 Since then, it’s been consolidating, generating liquidity, and setting the stage for the next big move. Meanwhile, altcoins are absolutely booming, stealing the spotlight! 💥 As we kick off the week, let’s dive into what’s happening with BTC and what to watch for.

📊 Technical Analysis Breakdown

Here’s what I’m seeing on the charts:

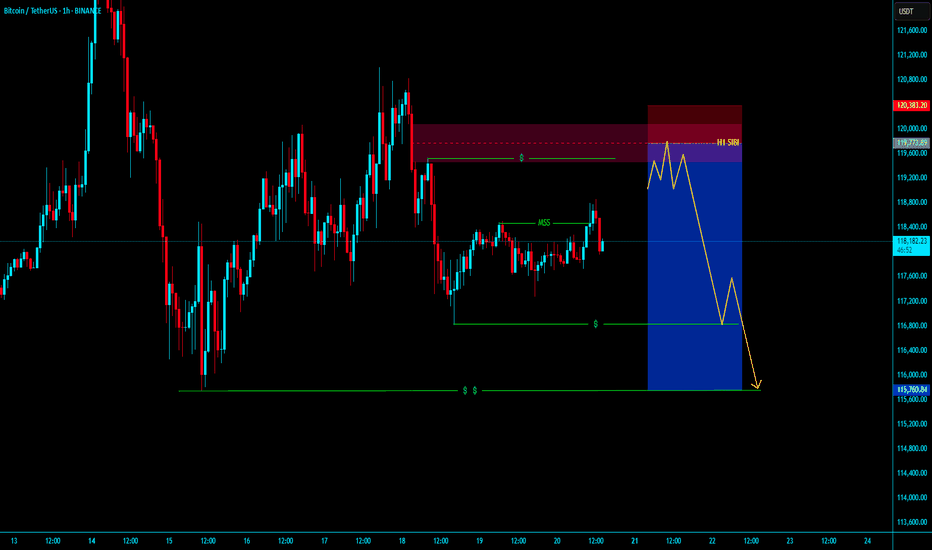

Head and Shoulders Pattern: A clear head and shoulders has formed on BTC, signaling a potential bearish move. 🐻

Daily Timeframe Order Blocks: These are in play, showing key levels of support and resistance.

Filled Fair Value Gap (FVG): A recent FVG on the daily chart has been filled, but there’s still a beautiful 4H FVG waiting to be tested below.

Liquidity Sweep: After the ATH, BTC needs to clear the liquidity from the past few days before it can push for new highs.

🔍 What’s Next for BTC?

I’m expecting a bearish reaction in the near term, with BTC targeting the sell-side liquidity around $115,800. This move should also fill the 4H FVG, setting the stage for a potential bounce and another shot at the ATH. 🚪 Keep an eye on these levels, as they’ll be critical for the next big move!

🔔 Stay in the Loop!

Let’s keep the conversation going! 💬 Follow for more updates, like if you found this helpful, and drop a comment with your thoughts or what you’re seeing in the markets. Are you trading BTC or riding the altcoin wave? Let’s hear it! 👇

Happy trading, and let’s make this week count! 💪

#Crypto #Bitcoin #Trading #TechnicalAnalysis

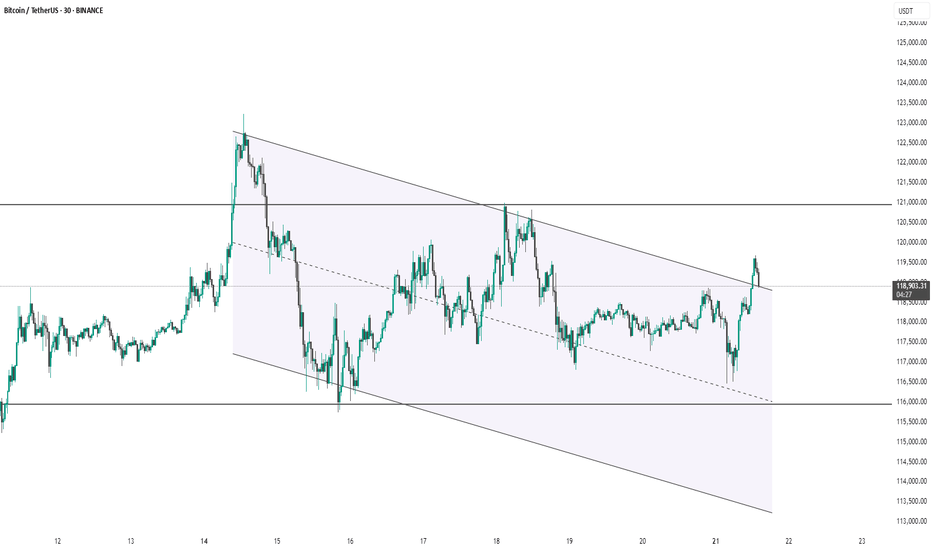

BTC #Bitcoin (BTC/USDT) 30-minute chartThis Bitcoin (BTC/USDT) 30-minute chart shows price action within a descending parallel channel. Recently, the price broke out above the channel's upper boundary, suggesting a potential bullish breakout. However, the price has slightly pulled back, now retesting the breakout zone near $119,000. Holding above this level may confirm the breakout and lead to further upside, while failure to hold could signal a false breakout and potential return into the channel. Key support and resistance levels are marked around $116,000 and $121,000 respectively.

thanking you

BTC Weekly Recap & Outlook 20/07/2025📈 BTC Weekly Recap & Outlook

Market Context:

Price continued its bullish momentum, fueled by institutional demand and supportive U.S. policy outlook.

We captured solid profits by following the game plan I shared earlier (see linked chart below).

🔍 Technical Analysis

✅ BTC made a strong bullish move, breaking into new all-time highs.

📊 The daily RSI entered overbought territory, which signaled the potential for a short-term retracement or consolidation.

Currently, price is ranging, and RSI is cooling off. That tells me the market is likely building energy for the next leg up — but not before a significant liquidity run.

🎯 Game Plan

I'm watching for one of two potential setups:

1️⃣ Liquidity Sweep to the Downside

- A run of the daily swing low

- Into the most discounted range (0.75 Fib zone)

OR

2️⃣ Tap into the Weekly FVG Zone (marked with the purple line)

Either move would create the liquidity and energy needed to fuel a breakout above the equal highs (EQHs) marked by the black line.

🚀 Target

First Target: EQHs (Black Line)

Second Target: Price Discovery (new ATHs)

💬 Let me know your thoughts or drop your own chart ideas below!

📌 Follow for Weekly Recaps & Game Plans

If you found this useful, make sure to follow for weekly BTC updates, market outlooks, and detailed trade plans based on structure and liquidity.

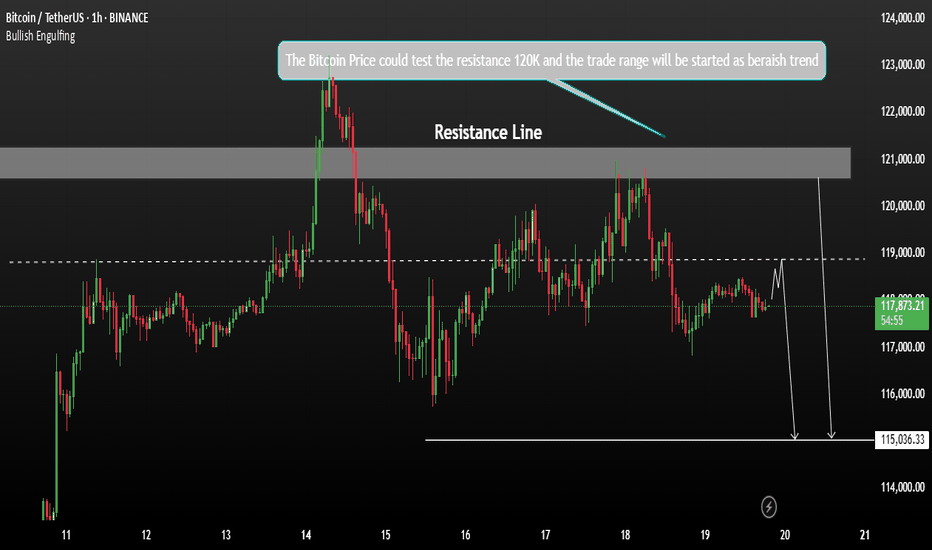

Bitcoin Price Could test resistance 120K After DeclineBitcoin is consolidating within a range — not showing strong directional momentum yet — and is testing the resistance zone between 120K and 121K.

This is a critical supply zone, where buyers were previously liquidated. It’s a psychological level and might trigger profit-taking or heavy resistance from sellers. If BTC fails to break and hold above the 121K zone, there’s a high probability of a pullback toward the 116.2K–117K area to grab liquidity before a new move.

Former President Donald Trump signing new crypto laws could introduce market-moving fundamentals. However, the impact on price will depend on the content of those regulations:

You may find more details in the chart Ps Support with like and comments for better work.

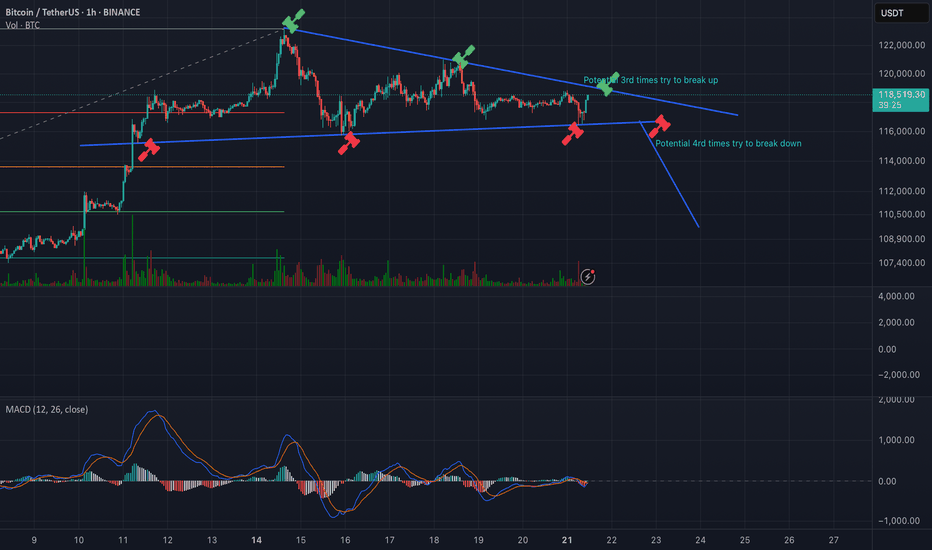

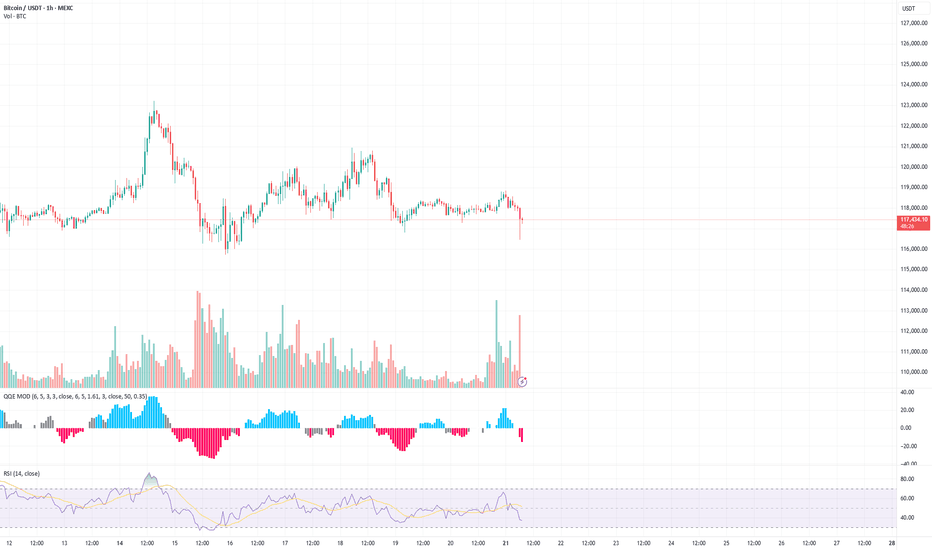

Local Top Confirmed, Short-Term Bearish Pressure BuildingBTC/USDT 1H – Local Top Confirmed, Short-Term Bearish Pressure Building

📍 Timeframe: 1 Hour

📍 Exchange: MEXC

📍 Pair: BTC/USDT

📍 Bias: Short-term bearish, watching for support re-test near 116k

Market Context:

BTC broke out aggressively earlier in the week, pushing above the 120k psychological level before forming a local top near 122k. Since then, we’ve seen:

A strong rejection wick at the top

Lower highs forming

A bearish engulfing candle marking the shift in momentum

Technical Observations:

Bearish Signs:

MACD histogram rolling over, showing fading bullish momentum

QQE MOD flipping red, indicating a shift toward bearish control

RSI crossing below 50 and trending downward — loss of bullish strength

A clean rejection off recent highs, creating a double top feel

Volume on the recent sell candle is higher than average, suggesting strength in the move down

Support Zones to Watch:

116.5k: Prior breakout zone and most recent demand zone

114.8k – 115.2k: Volume consolidation area; if broken, may invite sharper downside

112k: Key structure zone from previous sideways range

Potential Scenarios:

Bearish Continuation (more likely short term):

Break below 116.5k could lead to fast drop to 114.8k support

RSI and MACD momentum align with this move

Look for breakdown confirmation with volume spike + close under structure

Bullish Reversal (less likely unless invalidation):

Hold above 116.5k + reclaim of 118.2k with strength

RSI must turn up above 50 and MACD histogram flip blue

Could target re-test of 120k–121k if bullish momentum returns

Trading Approach:

Short-term traders may look for pullbacks to short under 118k with 116.5k as the first target

Swing traders should be cautious and wait for confirmation at 116k–115k zone before considering long re-entries

Avoid chasing breakouts — let the market confirm direction first

Conclusion:

BTC on the 1H chart shows signs of exhaustion after a strong run. The market is leaning toward a correction phase. Watch the key support levels — they will dictate whether this is a short-term dip or the start of a deeper move.

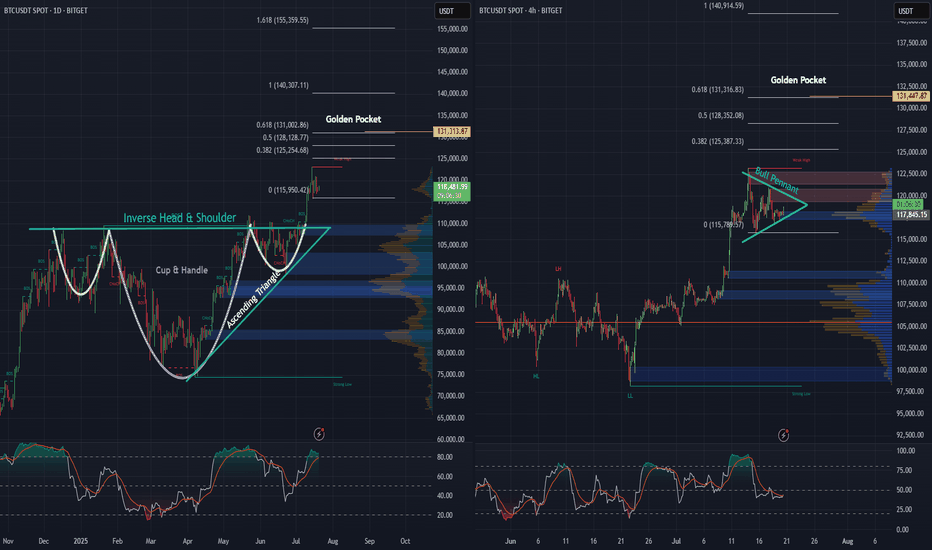

BTC daily, and 4 hr. Bullish Patterns Stack Up!Looking at the Daily and 4-hour charts for BTC, we can see multiple bullish formations unfolding.

An inverse head and shoulders - daily

A cup and handle - daily

An ascending triangle - daily

Price action looks strong, as we’ve begun the breakout from the neckline on the inverse H&S, as well as the cup and handle and ascending triangle simultaneously, and momentum is building fast.

Also, on the 4-hour chart, there’s a pretty substantial bull pennant taking shape. A breakout here could be the next leg up, and the push needed to keep momentum alive.

Zooming out, when we apply the trend-based Fibonacci extension, it reveals a $131,000 golden pocket, on both the the daily as well as the 4 hr. And that could be a major upside target if these bullish structures hold.

Stay tuned to see if BTC continues its move and sets a new all-time high.

**BTC/USDT Monthly Analysis: Navigating Key Resistance****Overview:**

On the monthly timeframe, Bitcoin (BTC) is exhibiting significant strength as it approaches a pivotal historical resistance zone. This multi-year resistance, ranging approximately from **$115,000 to $120,000**, represents a critical inflection point for the asset.

**Key Observations:**

1. **Historical Resistance Test:** The current price action sees BTC challenging a formidable resistance level that has previously acted as a major ceiling. A decisive breakout above this zone, supported by strong volume, would signal a continuation of the bullish trend towards new all-time highs.

2. **RSI Bearish Divergence:** A notable observation on the Monthly Relative Strength Index (RSI) is the presence of **bearish divergence**. While price has made higher highs, the RSI has printed lower highs, indicating a potential weakening in bullish momentum. This divergence suggests that the current upward move might be losing steam and could precede a healthy price correction or consolidation phase. This is a crucial cautionary signal for long-term holders and potential new entrants.

**Outlook:**

The bullish macro trend for Bitcoin remains intact, yet the confluence of strong historical resistance and a developing bearish divergence on the monthly RSI warrants caution. Traders should closely monitor for a clear break and sustained close above the $120,000 level to confirm further upside. Conversely, a rejection from this resistance zone could lead to a significant retracement to key support levels.

**Disclaimer:** This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research and manage your risk appropriately.

**M. Kiani**

```ش

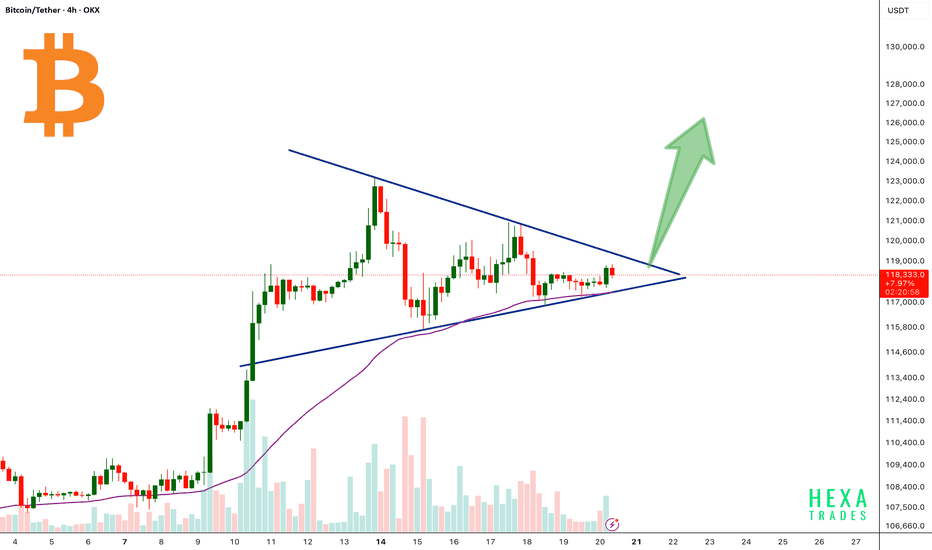

BTC Forming Bullish Triangle!Bitcoin is currently consolidating inside a symmetrical triangle pattern after a strong bullish rally. The price is approaching the apex of the triangle, signaling a potential breakout soon.

The 50 EMA is acting as dynamic support, perfectly aligned with the triangle’s lower trendline, reinforcing the bullish structure.

A confirmed breakout above the triangle resistance could trigger a strong upward move, with a potential target near the $125,000–$130,000 zone.

Cheers

Hexa

BINANCE:BTCUSDT CRYPTOCAP:BTC

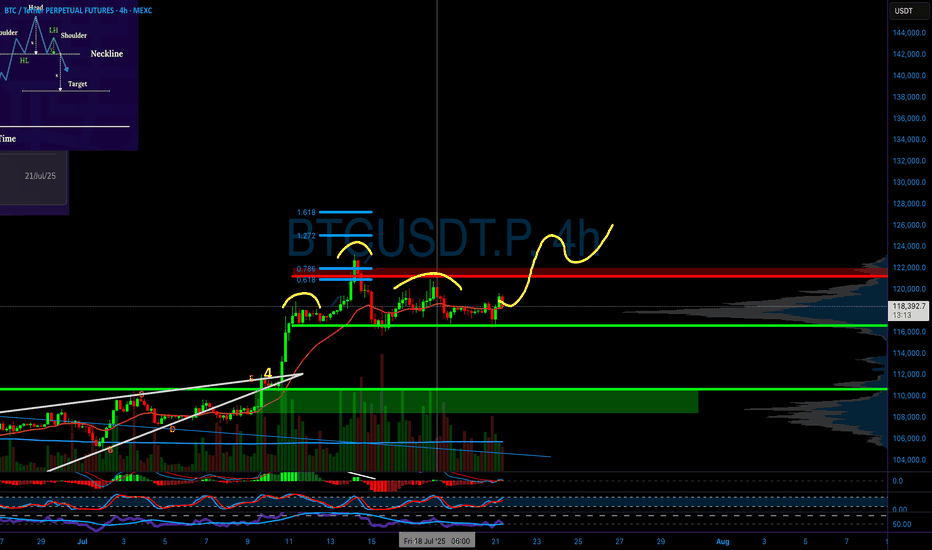

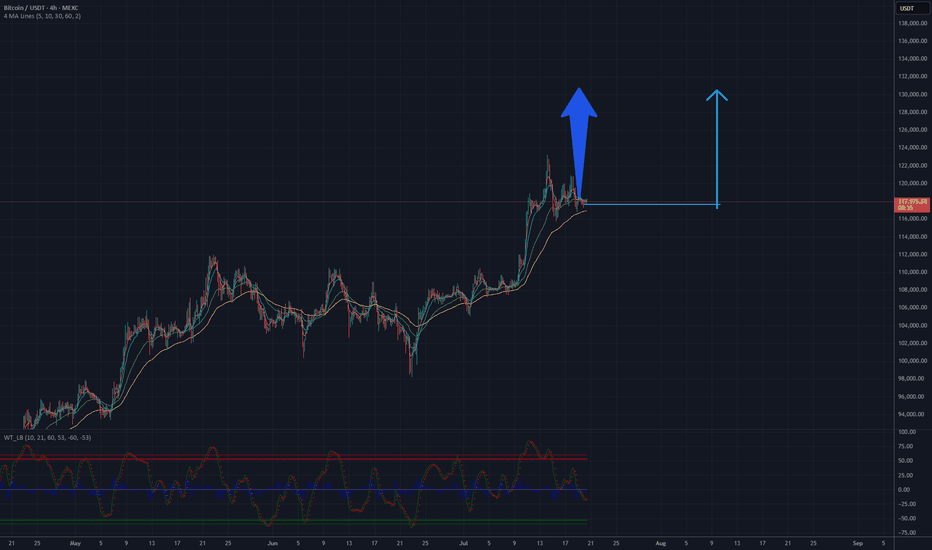

BTC will be 130 K USD? Potential target 130 000 USDAnalysis of the Bitcoin (BTC/USDT) chart on the MEXC platform indicates a positive upward trend. The price is currently hovering around $117,823, with clear support at approximately $100,000, as confirmed by the lower channel line. Moving averages (MA) suggest a sustained upward trend, and the trend line drawn from the lows points to potential for further growth. The current resistance is in the $120,000-$125,000 range, but if momentum holds and this level is breached, the price could head toward $130,000 in the short to medium term. It is recommended to monitor volume and key support and resistance levels to confirm further upward movement.

Potential TP: 130 000 $

BTC Price Prediction and Elliott Wave AnalysisHello friends,

>> Thank you for joining me in my analysis. We finished the pink Y wave as wxy in purple counting. Now we are moving into creating a confirmation for starting the Big Yellow C wave.

>> our confirmations:

* 4Hr TF: I need to close above the 113420 level.

* 1D TF: I will prefer to close below 113297 and above its opening 112550, and the next double days break today's high.

Keep liking and supporting me to continue. See you soon!

Thanks, Bros