BTCUPUSDT trade ideas

TradeCityPro | Bitcoin Daily Analysis #133👋 Welcome to TradeCity Pro!

Let's dive into the Bitcoin analysis and key crypto indexes. As usual, in this analysis, I’m going to review the triggers for the New York futures session.

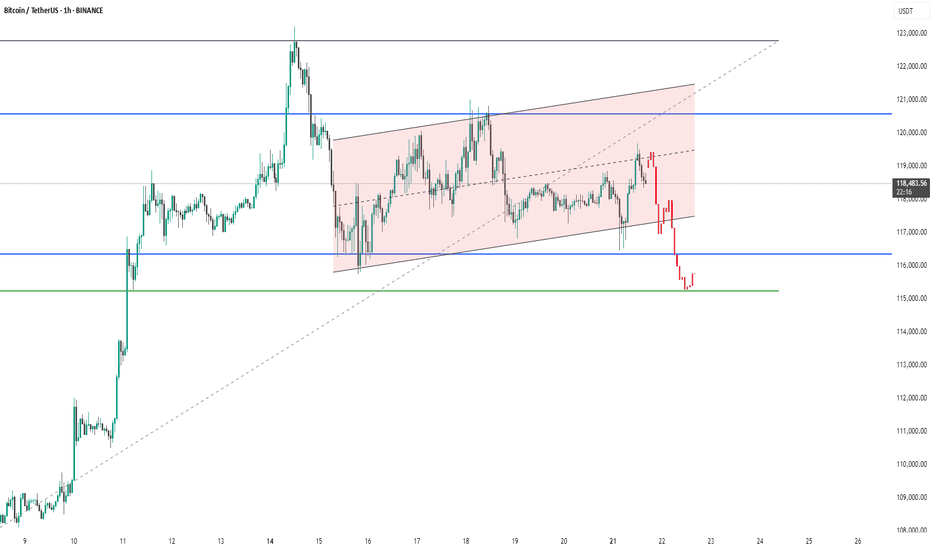

⏳ 1-Hour timeframe

On the 1-hour timeframe, Bitcoin has once again dropped to the support area at 116829 and reacted to it. Currently, it is fluctuating above this level.

✨ If 119395 is broken, the price could move toward the highs at 120594 and 122733.

📈 So for a long position, we can enter on the breakout of 119395. Pay attention to Bitcoin dominance, because if it’s in a downtrend, Bitcoin setups might not be ideal, and altcoins may offer better opportunities.

✔️ If the price stabilizes below 117647, it will enter the box between 116829 and 117647, and this time the likelihood of breaking the 116829 bottom and heading toward lower supports for deeper corrections becomes very high.

👑 BTC.D Analysis

Now let’s look at Bitcoin Dominance. BTC.D is still falling and after breaking the 61.45 level, it has reached 60.46.

⭐ If this level breaks, the next bearish leg may begin. The trend is strongly bearish with no visible weakness, and we’ll have to see how long this continues.

📅 Total2 Analysis

Let’s move to Total2. This index has broken the 1.5 resistance and is moving toward 1.62.

💫 At the moment, I don’t have a trigger for it, and we need to wait until its structure gives us the next setup.

📅 USDT.D Analysis

Now let’s look at Tether Dominance. This index has stabilized below the 4.22 level and is now moving downward after a pullback to this area.

🧩 The next support is at 4.08, and the index has room to fall to that level. I still see the USDT Dominance trend as bearish for now.

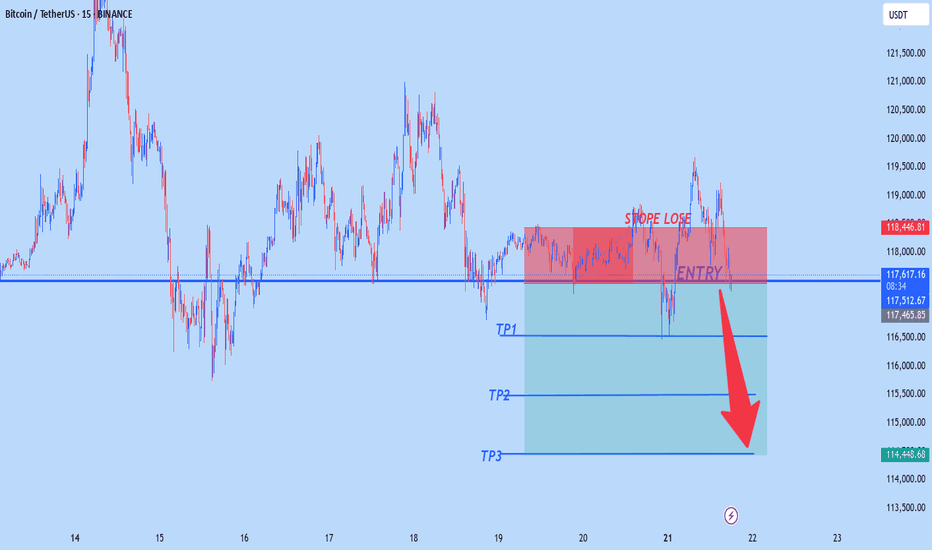

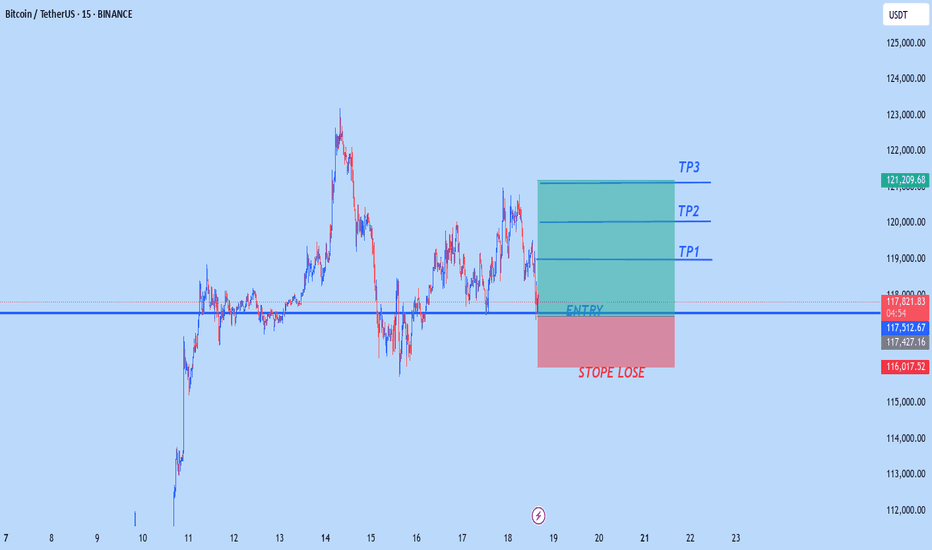

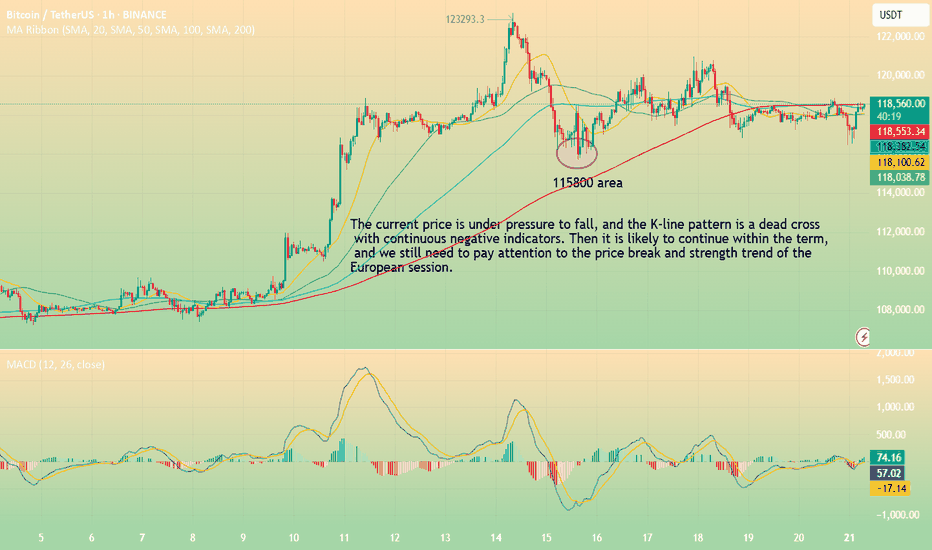

BTC-----Sell around 118300, target 116000 areaTechnical analysis of BTC contract on July 21:

Today, the large-cycle daily level closed with a small negative line yesterday, the K-line pattern continued to fall, the price was below the moving average, and the fast and slow lines of the attached indicator showed signs of a dead cross, and the overall trend has been in a sluggish state recently. The trend in the big trend also showed obvious signs of falling, so we have to pay attention to the strength and continuation of the retracement next; the short-cycle hourly chart price fell under pressure in the early morning, and the current K-line pattern continued to fall, the price was below the moving average, and the attached indicator was dead cross, so the price fell to the previous low of 115700 area. So you can sell after the pullback during the day, and pay attention to the breakout and strength and weakness trend of the European session.

Today's BTC short-term contract trading strategy:

Sell in the 118300 area, stop loss in the 118600 area, and target the 116000 area;

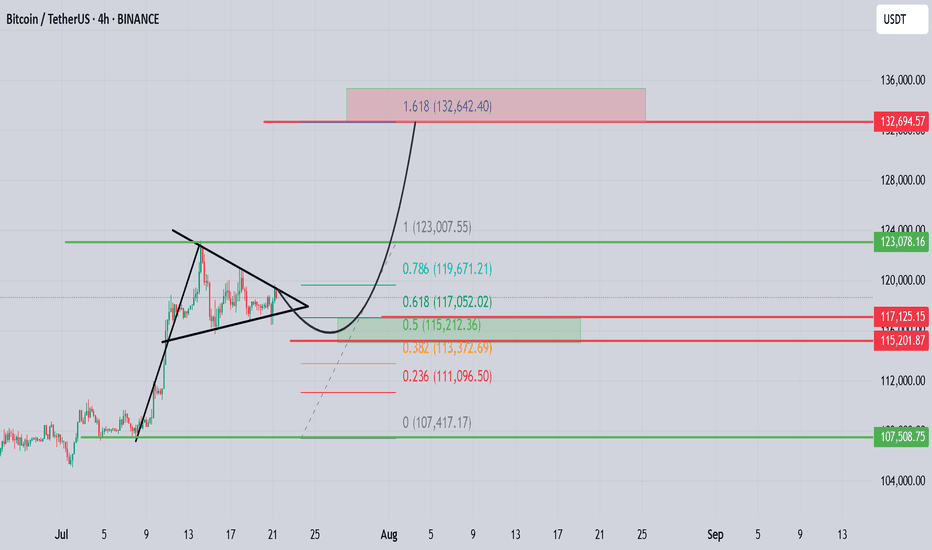

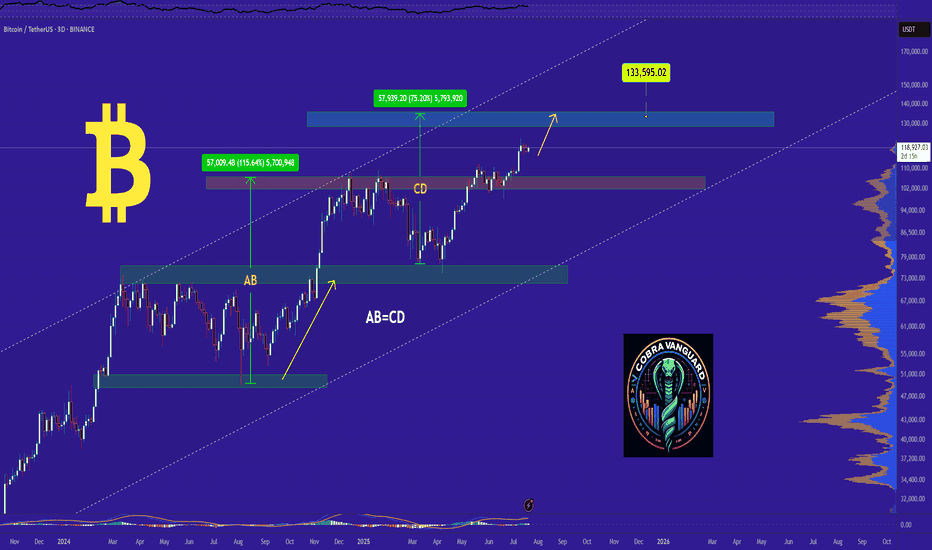

BTC Target Confluence Zone at \$130K–\$134K – Caution on Alts inHello everyone,

With U.S. stock indices at all-time highs, interest rate cuts on the horizon, and recent stablecoin-related news, Bitcoin is capitalizing on this period of mild euphoria.

Since June 27th, we've also finally seen the beginning of a mini altcoin bull run, with ETH leading the charge by gaining strength against both the USD and BTC.

After several false starts—what some might call mini alt seasons—it's important to remain cautious with altcoins, especially for latecomers who might be entering too late in the cycle.

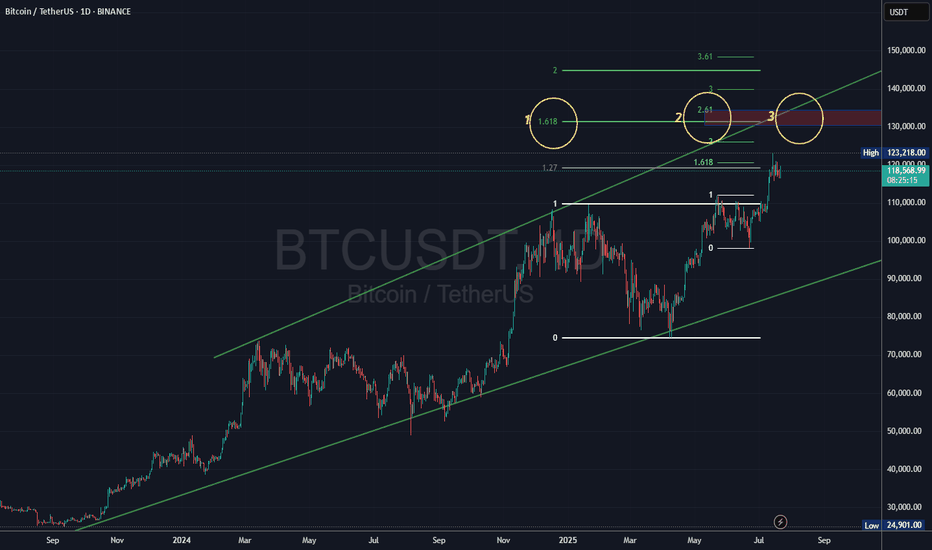

I’d like to highlight a realistic confluence zone of three technical targets in the \$130K to \$134K range for Bitcoin:

---

1 – Daily Target via 1.618 Fibonacci Extension**

This Fib is drawn from the January 21st, 2024 ATH (\$109.5K) to the April 9th, 2025 low (\$74.5K).

The 1.618 extension lands at **\$131.3K**.

Currently, we’re consolidating around the 1.27 Fib level, which validates this setup.

1 - H4 Target via 2.618 Fibonacci Extension**

This Fib is drawn from the May 23rd, 2025 high (\$111K) to the June 22nd, 2025 low (\$98.2K).

The 2.618 extension points to **\$134K**.

Price has been stalling at the 1.618 extension over the past couple of days, further confirming this Fib level.

3 – Daily Target at the Top of a Broadening Ascending Channel**

The upper resistance of this channel—currently above price—varies depending on the momentum of the next move. Interestingly, it aligns with the Fib extensions above, creating a strong confluence area.

These are, of course, theoretical targets. But during **price discovery**, Fibonacci extensions remain one of the few tools professionals and algorithms rely on to set take-profit levels.

Moonboys calling for a massive altseason might change their tune quickly if BTC gets violently rejected at this confluence zone. Without protection, alts could easily crater—**leaving some portfolios with a second hole**…

To cover all angles, I’ll state the obvious: on the daily and weekly charts, BTC has been steadily grinding within a bullish ascending channel—marked by long, frustrating retracements.

This has allowed the market to build solid strength for what could become a euphoric end to the cycle. BTC might even break out above the channel like it’s textbook.

However, upside breakouts from rising channels are often punished later with sharp reversals in the opposite direction—and that “opposite” could take us all the way back to **\$90K**. A move like that would likely erase the entirety of the altcoin rally in just a few candles.

(And maybe finally fill my forgotten buy orders in the basement 😉)

BTC will survive no matter what, but I’m more concerned about **collateral damage**—and having enough **dry powder** for lowball buy orders, if that fits your strategy.

**RSI**: Nothing to report. No bearish divergence on the D1 or H4.

This is a **short-term bullish outlook** with **realistic targets**, but it’s also a reminder: take some profits while you can—before the market takes them for you (again).

Have a great week

Please, like, dislike, comment and give your idea

Chart on BTC/USDT Spot on Binance 1day candle TF

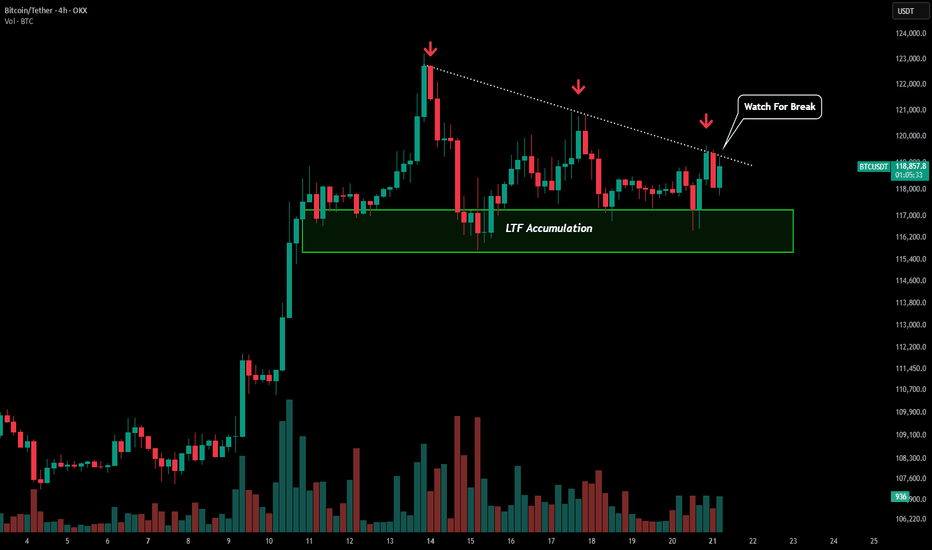

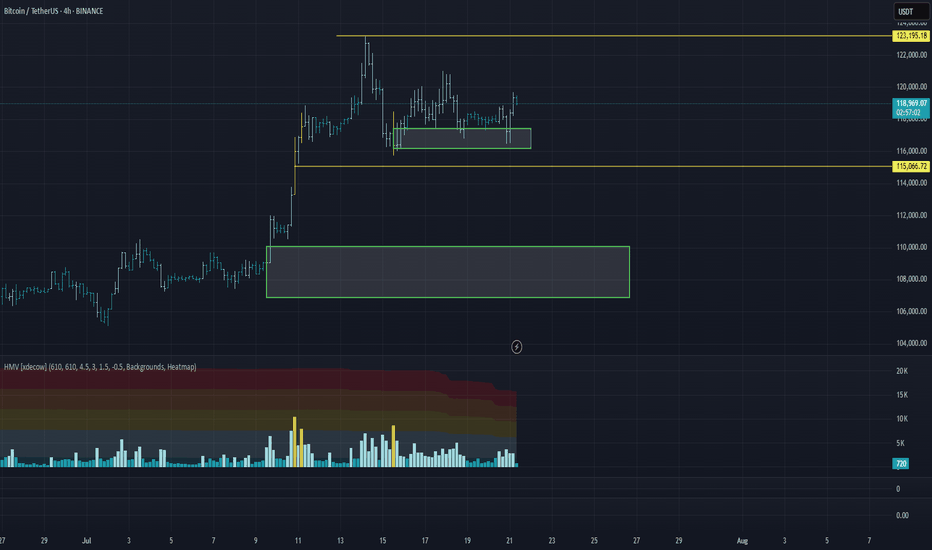

BTC - LTF Pattern IdentifiedIn our previous posts we were outlining the levels for a potential BTC pullback, but after some price development in this region it may be signaling a different story.

Since our high of $123k we have been forming a downwards sloping trendline of sell pressure (dotted white line). At the same time we have seen bulls continue to buy up the dips in our green box.

This has put price in some sort of symmetrical triangle that is currently testing the upper resistance level for a breakout.

If this breakout is successful then the first target would be $122.8k followed by a potential extended move up to around $130k.

If price fails to breakout and we drop below the LTF accumulation zone then the lower levels outline in the previous posts are still valid. For now monitor for a breakout to the upside.

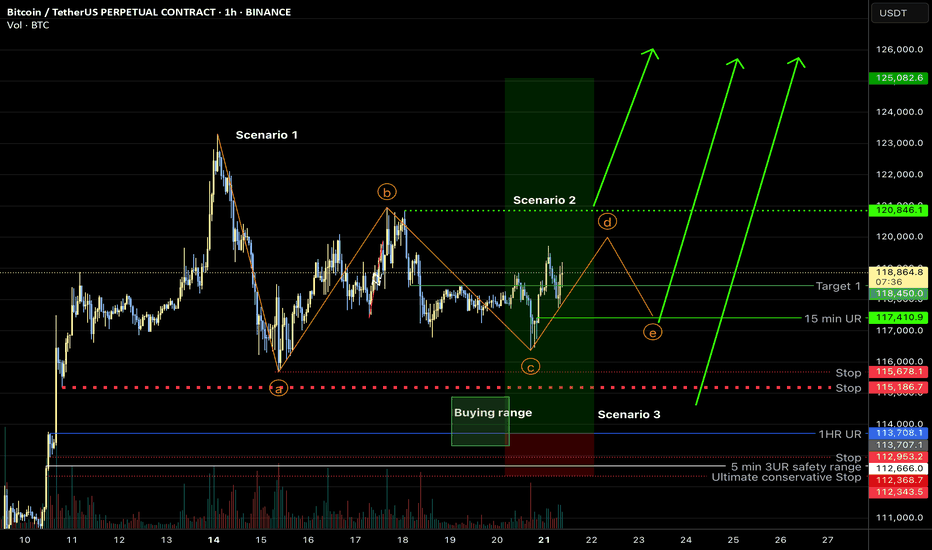

Bitcoin overall: sideways range, new ATH soonMy previous hypothesis of a sharp correction (scenario 3) looks to be incorrect. I believe the most likely corrective structure is a contracting triangle at this point (scenario 1), and the last leg should be bought for new ATH, however, it is also possible we had the last major low for this correction and new ATH are imminent (scenario 2)—which will be on the table if the indicated line gets taken out. In any case, new ATH should occur shortly!

BTC #Bitcoin (BTC/USDT)chart shows on a 1-hour timeframeThe chart shows Bitcoin (BTC/USDT) on a 1-hour timeframe experiencing a breakdown from an ascending channel (highlighted in pink). After reaching resistance near $120,800, price sharply declined, breaking below both the channel support and the key horizontal support around $117,000 (blue line). It is now testing the next support zone around $115,000 (green line). This suggests strong bearish momentum, and if $115K fails to hold, further downside could be expected.

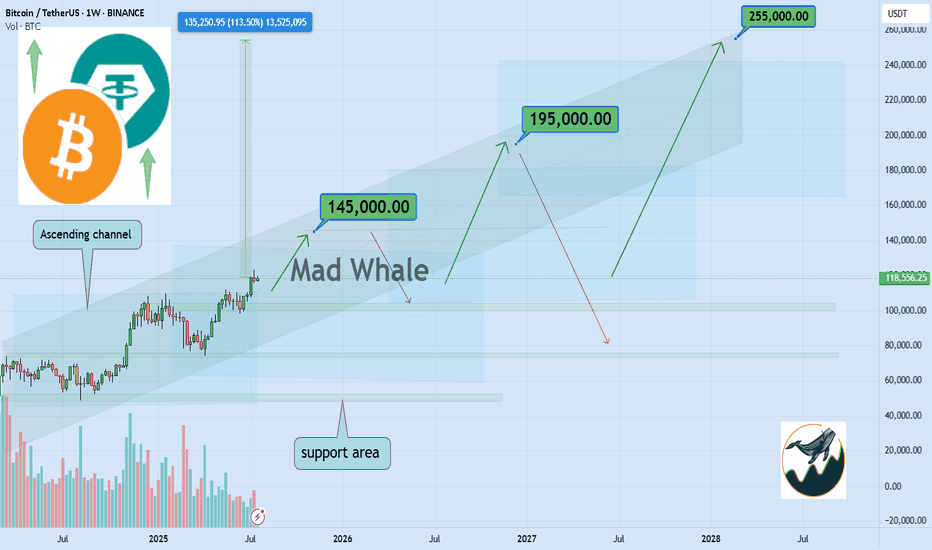

Bitcoin Eyes $145K, $195K, $255K in 2–6 YearsHello✌

Let’s analyze Bitcoin’s upcoming price potential 📈.

BINANCE:BTCUSDT , I expect a long-term upward bullish trend.

This analysis includes three main targets: $145,000, $195,000, and a final target of $255,000, which could potentially be reached within 2 to 6 years.

The price may form parallel channels at different stages, which are shown on the chart. I also expect the current upward bullish channel to remain valid and continue moving higher.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale🐋

🐋Many of the points and levels shown on the chart are based on personal experience, feeling, and over 7 years of research and daily study of crypto charts.

Some of the lines, channels, and price zones are drawn to make the chart easier to understand and to help imagine possible future price movements.

I’ve also included one very big drop in price even bigger than the others because in the crypto market, it’s common for prices to suddenly fall hard and push out small investors and traders with positions.

The targets on the chart are not guaranteed; they might be reached, or they might not.📚

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

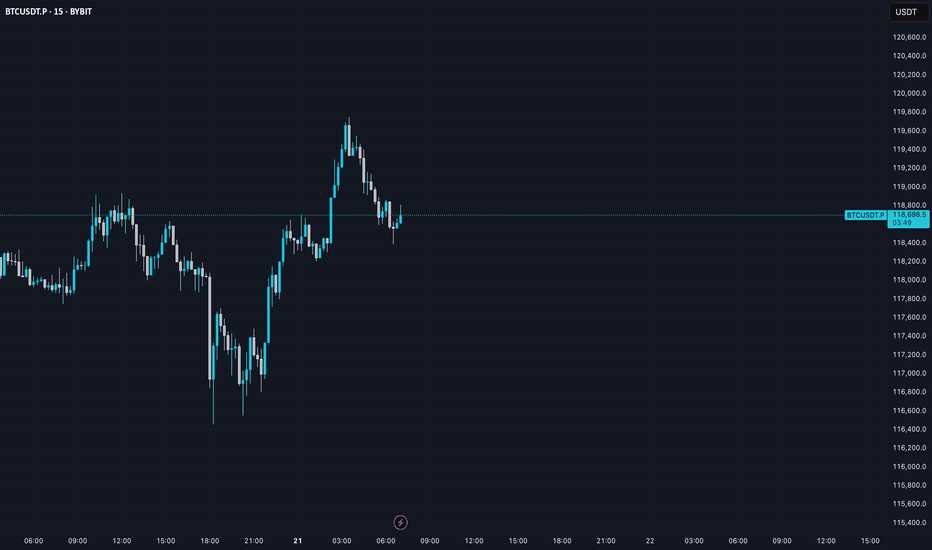

BTC AI Prediction Dashboard - 6h Price Path (21.07.25)

Prediction made using Crypticorn AI Prediction Dashboard

Link in bio

BTCUSDT Forecast:

Crypticorn AI Prediction Dashboard Projects 6h Price Path (Forward-Only)

Forecast timestamp: ~11:00 UTC

Timeframe: 15m

Prediction horizon: 6 hours

Model output:

Central estimate (blue line): -118,199

Represents the AI’s best estimate of BTC’s near-term price direction.

80% confidence band (light blue): 117,911 – 119,052

The light blue zone marks the 80% confidence range — the most likely area for price to close

40% confidence band (dark blue): 117,725 – 119,983

The dark blue zone shows the narrower 40% confidence range, where price is expected to stay with higher concentration

Volume on signal bar: 151.81

This chart shows a short-term Bitcoin price forecast using AI-generated confidence zones.

Candlesticks reflect actual BTC/USDT price action in 15-minute intervals.

This helps visualize expected volatility and potential price zones in the short term.

accumulate, continue to aim for new ATH💎 Update Plan BTC (July 21)

Notable news about BTC

CEO of Charles Schwab, Rick Wurster, said the company plans to deploy Bitcoin and Ethereum transactions for customers.

This company aims to compete with Coinbase, where customers buy BTC.

This development takes place after the progress of cryptocurrencies when President Donald Trump signs the Genius bill into law.

In an interview on Friday, the CEO of Charles Schwab, Rick Wurster, said the company plans to launch Bitcoin (BTC) and Ethereum (ETH) to compete with Coinbase cryptocurrencies. The move took place after President Donald Trump signed the Genius bill, officially confirming the first cryptocurrency law in the United States.

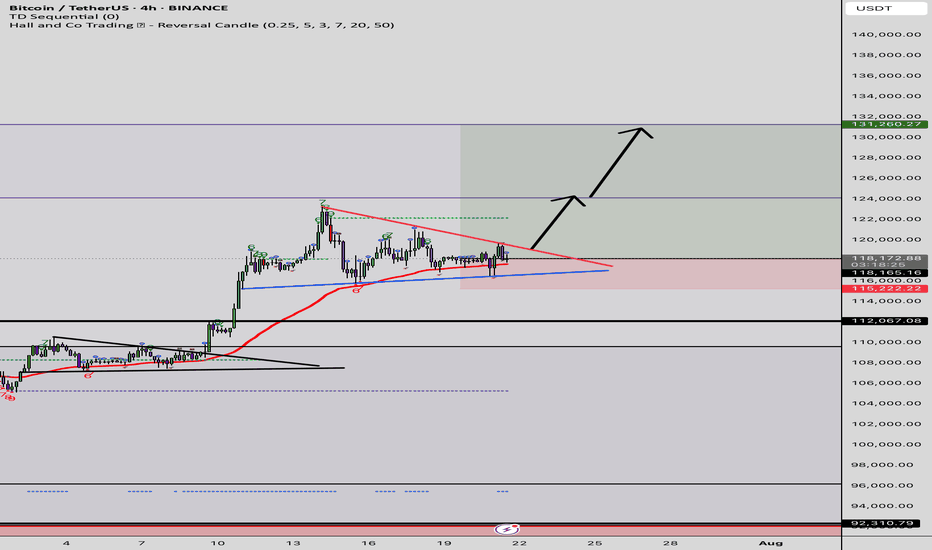

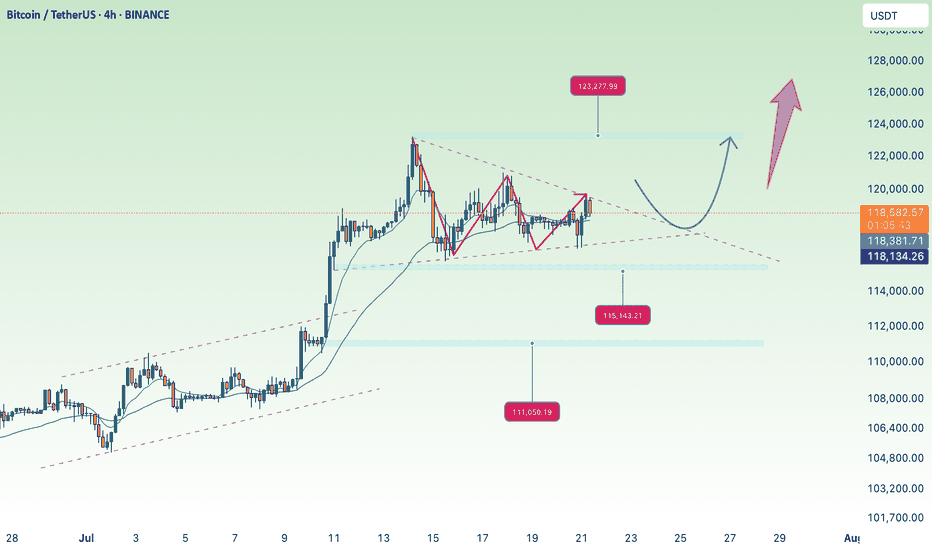

Technical analysis angle

🟠 Main trend:

BTC is sideway accumulated in the amplitude of 117,000 - 122,000 after a sharp increase.

The chart shows the descending triangular model - a potential sign for Breakout.

🔍 important areas:

Resist:

122,000 - 122,700: Strong resistance area, fibonacci mold 1.0.

130,600 - 131,100: The expected area if Breakout is successful (Fibonacci extension 1.618).

Support:

116,000: Support close, coincide with EMA 200.

111,100: The support area is stronger if the current support breaks.

✅ Scenario 1 - Rise:

If the price turns from supporting 116k → Test the resistance area of 122k.

If the 122K break is definitive, the next goal is 130k - 131k.

❌ Scenario 2 - Discount:

If the 116k area is lost, the possibility of falling will fall more deeply at 111k.

This is also the strong EMA area Fibo 0.382 of the previous wave.

Please follow the channel to receive the latest and continuous updates on XauUSD, currency and BTC

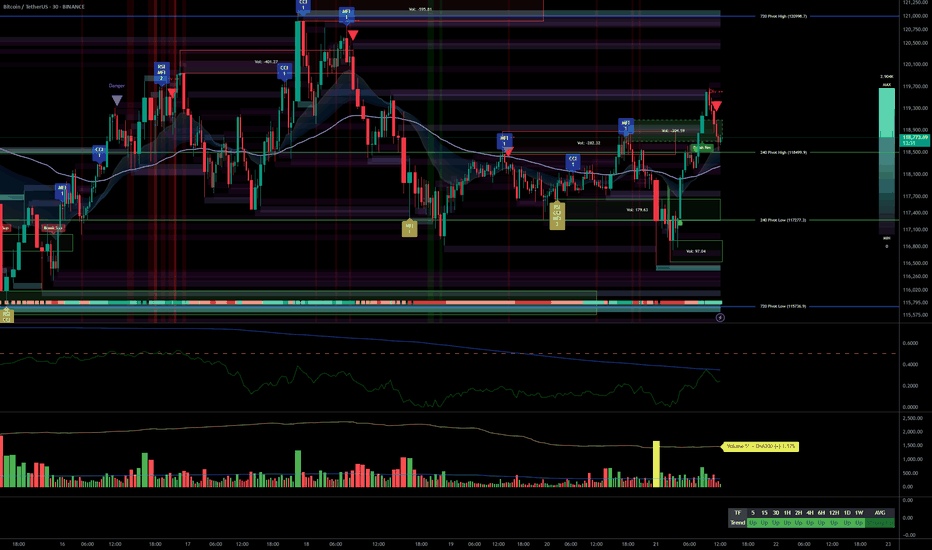

Bullish Multi-Timeframe Alignment, Macro Risks & Key Levels__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong bullish trend across all timeframes.

Major Supports: 115796/117277 (720/240 Pivot Low).

Key Resistances: 119000–123200 (240/D Pivot High), watch for potential extension or profit-taking.

Volume: Healthy participation, no marked anomalies.

Risk On / Risk Off Indicator: Strong sector momentum except 15min (neutral), risk appetite confirmed.

Multi-TF Behavior Synthesis: No "behavioral sell" warning, ISPD DIV neutral, no climax.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global Bias: Clearly bullish, all timeframes aligned, no notable technical divergences.

Opportunities: Buy on pullback (HTF support) or on breakout/consolidation above 123200 with increasing bullish volume.

Risk Zones: Drop below 115796 invalidates scenario; watch for “sell” behavioral signals (ISPD red/extreme volumes) or persistent sector divergence.

Macro Catalysts: Next Fed meeting (July 21st), ongoing geopolitical tensions.

Action Plan: Closely monitor supports/resistances, strict stops below 115796, dynamic adjustment to upcoming macro volatility.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Bullish breakout, leading tech/growth sector, stable volume.

12H: Bullish signal, price held above all key HTF pivots.

6H: Consolidation below key resistance 123218, no distribution, strength intact.

4H: Sideways just below resistance, controlled pause, possible push upwards.

2H: Stalling under resistance yet bullish momentum still present.

1H: Supports defended, rising volume on rebounds, no excess.

30min: Intraday momentum positive; no signs of reversal, strong indicator consensus.

15min: Testing pivots, slight momentum decline, neutral on Risk On / Risk Off Indicator.

__________________________________________________________________________________

Technical confluence: All timeframes aligned upward, strong sector momentum, controlled volumes, no behavioral excess. Watch for resolution near the 119000–123200 resistance zone (potential supply), and monitor for alert signals on behavioral/volume side. Macro: anticipate volatility around July 21 (Fed).

__________________________________________________________________________________

Macro & Decision Synthesis

__________________________________________________________________________________

News / Macro: Upcoming Fed meeting = caution period, expected volatility spike. Geopolitics: Middle East/Europe tensions, no Asian shock.

On-chain: BTC in price discovery, initial STH profit-taking, everyone in latent profit (interim top risk if overheated, reward up to $130k possible).

Actionable checklist:

Optimal entry: Pullback on 115796–117277 or strong breakout above 123200 with confirmed volume

Stop-loss: Below 115796 (major pivot); intraday swings below 117277

Imperative risk management, avoid leveraged trades ahead of macro event

__________________________________________________________________________________

Final Conclusion

__________________________________________________________________________________

Bitcoin is structurally bullish, supported by perfect multi-timeframe alignment, strong sector leadership (Risk On / Risk Off Indicator), and positive on-chain signals. However, proximity to historical resistances and looming volatility call for strict, active risk management. Targets: $123k/$130k; stops below 115796.

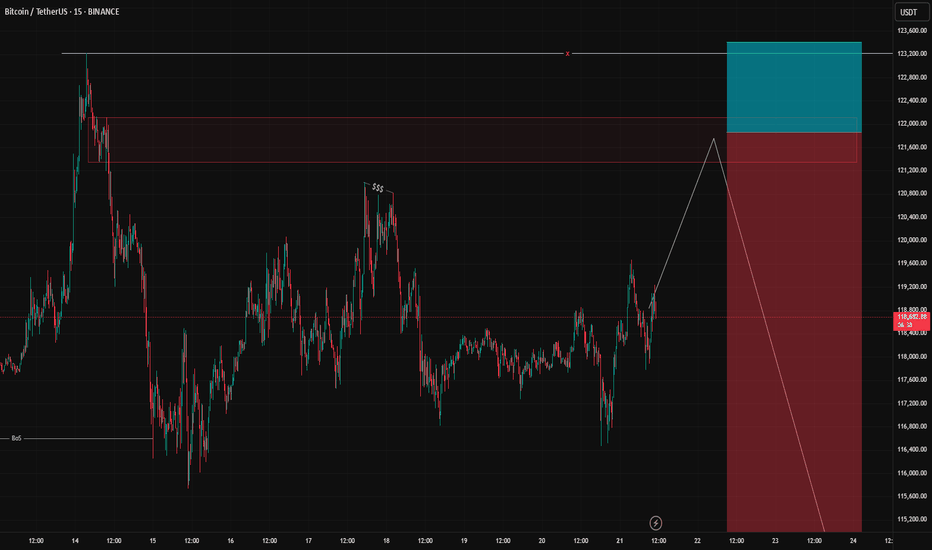

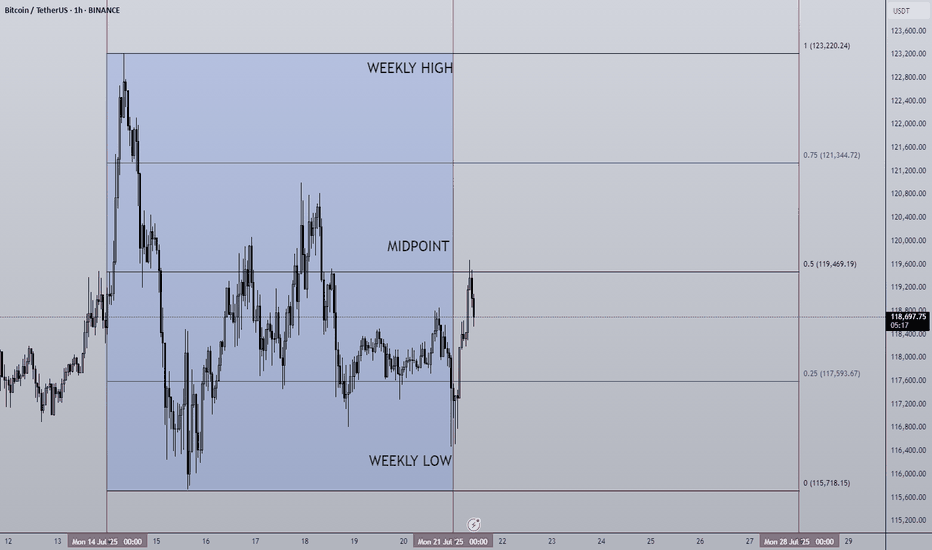

21/07/25 Weekly OutlookLast weeks high: $123,220.24

Last weeks low: $115,718.15

Midpoint: $119,469.19

New BTC ($123,220) & SPX ($6,315) ATH last week! We're really seeing progress being made on all fronts now, bitcoin saw its sixth week of net inflows into BTC ETFs ($2.39B).

The week began strong hitting the new ATH very early and then settled into a tight range to cool off. Altcoins however surged in relation to BTC to break out of HTF downtrends and begin to make up lost ground. One of the beneficiary's of this price movement has been ETH, breaking out from a multi year downtrend against BTC and hitting $3,800 in its USD pair.

For this week I do expect much of the same for BTC as momentum is with altcoins for now. However, as those altcoins reach HTF resistance levels it becomes very important for Bitcoins chop to be accumulation for the next leg up and not distribution for the way down. With so few pullbacks the threat of a sudden correction is present but the probability drops should BTC look to press higher with strong demand.

The ECB Interest rate decision takes place on Thursday but no changes to the 2.15% rate is forecast. In terms of news there are no planned upsets that I can see.

Good luck this week everybody!

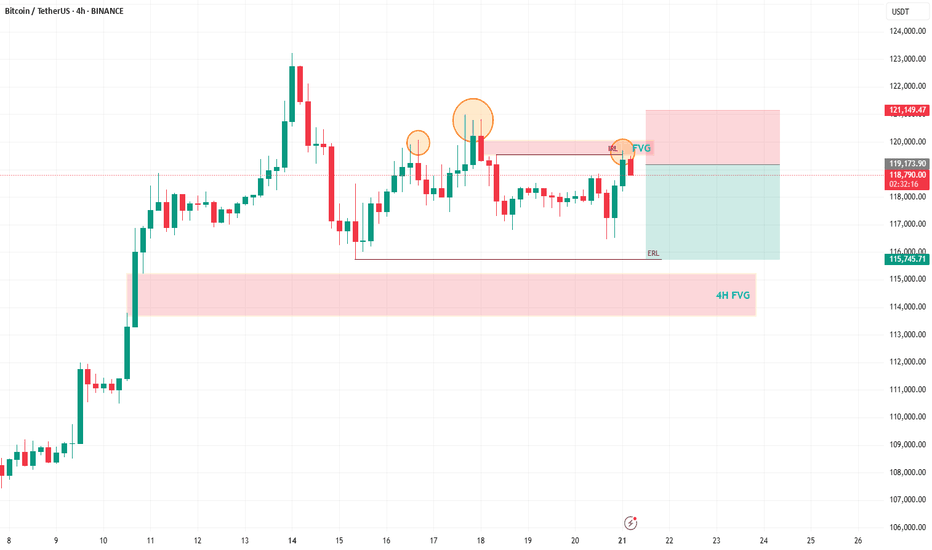

Bitcoin Trading Update: Consolidation, Patterns, and What's NextHey Fellow Traders! 👋

Bitcoin (BTC) has been on a wild ride after hitting its all-time high (ATH)! 📈 Since then, it’s been consolidating, generating liquidity, and setting the stage for the next big move. Meanwhile, altcoins are absolutely booming, stealing the spotlight! 💥 As we kick off the week, let’s dive into what’s happening with BTC and what to watch for.

📊 Technical Analysis Breakdown

Here’s what I’m seeing on the charts:

Head and Shoulders Pattern: A clear head and shoulders has formed on BTC, signaling a potential bearish move. 🐻

Daily Timeframe Order Blocks: These are in play, showing key levels of support and resistance.

Filled Fair Value Gap (FVG): A recent FVG on the daily chart has been filled, but there’s still a beautiful 4H FVG waiting to be tested below.

Liquidity Sweep: After the ATH, BTC needs to clear the liquidity from the past few days before it can push for new highs.

🔍 What’s Next for BTC?

I’m expecting a bearish reaction in the near term, with BTC targeting the sell-side liquidity around $115,800. This move should also fill the 4H FVG, setting the stage for a potential bounce and another shot at the ATH. 🚪 Keep an eye on these levels, as they’ll be critical for the next big move!

🔔 Stay in the Loop!

Let’s keep the conversation going! 💬 Follow for more updates, like if you found this helpful, and drop a comment with your thoughts or what you’re seeing in the markets. Are you trading BTC or riding the altcoin wave? Let’s hear it! 👇

Happy trading, and let’s make this week count! 💪

#Crypto #Bitcoin #Trading #TechnicalAnalysis

Market overview

WHAT HAPPENED?

Last week, after updating the historical maximum, bitcoin went into correction for the first time, after which it went sideways.

At the moment, the $117,300 – $116,300 zone has been retested (strong absorption of sales) and an active reaction from buyers has been received.

Within the current flat, the cumulative delta supports buyers, indicating the absorption of market sales. At the same time, the global wave structure on the 4H chart casts doubt on the last wave of buys, as we’ve rapidly adjusted back to its beginning.

💼 WHAT WILL HAPPEN: OR NOT?

We expect to exit the sideways at $116,000 – $121,000 in an upward direction from the current levels, either through capturing liquidity and testing the pushing volume zone at $115,000.

The target is the last ATH, which is $123,200. A re-correction is possible near $123,200, resulting in a wider flat range of $123,200 to $115,000. If there is a true breakout, we can expect the continuation of the global long trend.

Buy Zones:

~$115,000 (zone of initiating/pushing volumes)

$110,000–$107,000 (accumulated volume)

📰 IMPORTANT DATES

Macroeconomic events this week:

• Tuesday, July 22, 12:30 (UTC) — speech by Fed Chairman Jerome Powell;

• Wednesday, July 23, 14:00 (UTC) — publication of data on US second-hand housing sales for June;

• Thursday, July 24, 12:15 (UTC) — announcement of the deposit rate for July and the interest rate decision in the Eurozone;

• Thursday, July 24, 12:30 (UTC) — publication of the number of initial applications for unemployment benefits in the United States;

• Thursday, July 24, 12:45 (UTC) — press conference of the European Central Bank;

• Thursday, July 24, 13:45 (UTC) — publication of business activity indices (PMI) in the manufacturing and services sectors of the United States for July;

• Thursday, July 24, 14:00 (UTC) — publication of data on new home sales in the United States for June.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics

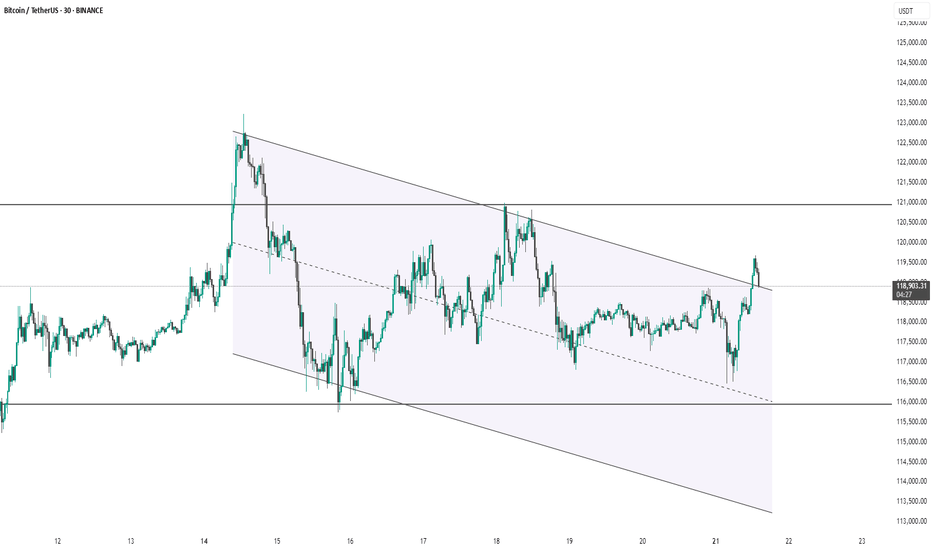

BTC #Bitcoin (BTC/USDT) 30-minute chartThis Bitcoin (BTC/USDT) 30-minute chart shows price action within a descending parallel channel. Recently, the price broke out above the channel's upper boundary, suggesting a potential bullish breakout. However, the price has slightly pulled back, now retesting the breakout zone near $119,000. Holding above this level may confirm the breakout and lead to further upside, while failure to hold could signal a false breakout and potential return into the channel. Key support and resistance levels are marked around $116,000 and $121,000 respectively.

thanking you

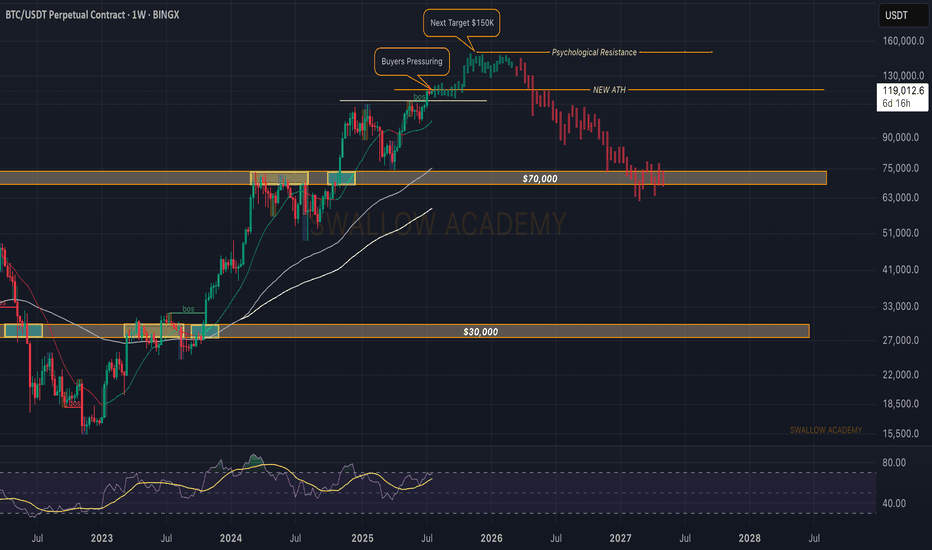

Bitcoin (BTC): Bullish Start of Week | Aiming For $150KChoppy weekends resulted in a bullish Monday. Once again, we are seeing strong buyside dominance at the start of the week, which is indicating a potential new ATH that we might be going for.

Now as the price is at the $119-120K zone, we are most likely going for a retest today of the current ATH, where we are going to look for some kind of breakout and upward movement.

Markets are on fire, so stay informed and do not FOMO—there will always be plenty of opportunities to gain something from markets, but to lose all it takes is just one stupid decision, so don't FOMO.

Swallow Academy

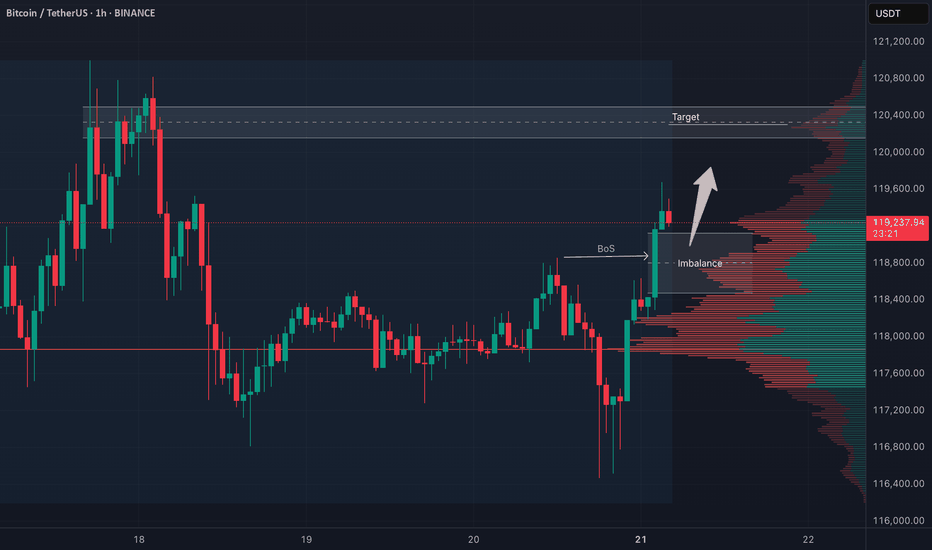

BTC 4H Structure Break – Long Bias with Conditions🚀 BTC (Bitcoin) has clearly broken bullish market structure on the 4-hour timeframe.

📈 My bias is to ride the momentum and look for a pullback to enter long.

✅ I follow a specific entry criteria — price must pull back into the imbalance, find support, and then form a bullish break of structure on a 15m chart to trigger an entry.

❌ If that setup doesn't play out, we simply abandon the idea.

⚠️ This is not financial advice.