BTCUPUSDT trade ideas

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

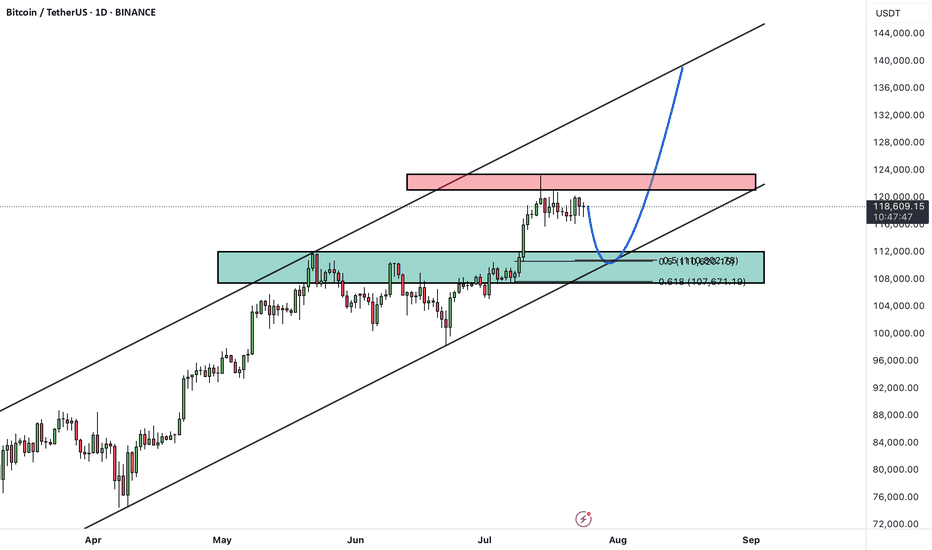

After setting a new all-time high, Bitcoin remains in a corrective phase, marked by sideways price action and choppy movements.

There's a notable gap around the $114,000 level, which may act as a magnet for price during this correction.

The ongoing pullback is likely to extend toward the key support zone, which aligns with the previous breakout level and the bottom of the ascending channel.

Once this support holds, we could see a bullish reversal, targeting the upper boundary of the channel once again.

As long as Bitcoin remains above the marked support zone, the overall structure stays bullish and this correction may present a buy-the-dip opportunity.

Will Bitcoin fill the gap and bounce back toward new highs? Let us know your thoughts! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

BTC Unfolds in Complex Way After Hitting 123KBTC Unfolds in Complex Way After Hitting 123K

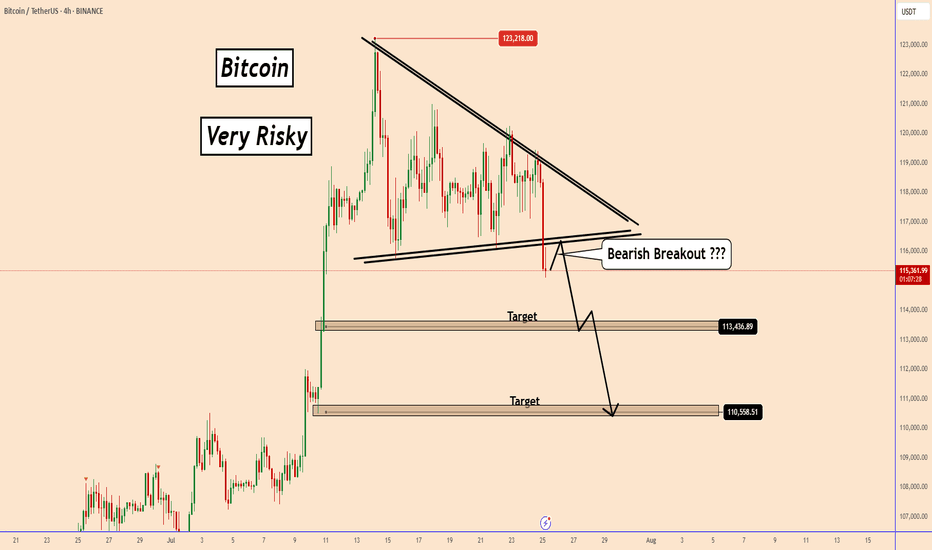

Bitcoin recently reached a historic all-time high near 123,200, marking a strong bullish run. Over the past two weeks, BTC has been consolidating, showing signs of a potential upward movement.

However, today's price action disrupted that bullish setup and introduced bearish momentum.

At this moment, two scenarios are possible:

1️⃣ Continued Bullish Momentum: The prevailing trend remains strongly bullish. Selling BTC now is risky, as there's a high chance it could resume its aggressive rise again.

False Bearish Breakout: The recent bearish signal may be misleading. BTC may be forming a broader accumulation structure, paving the way for another upward move.

2️⃣ Profit-Taking Phase: This bearish shift might be valid, suggesting that Bitcoin is entering a profit-taking cycle after an extended rally. If this scenario unfolds, a deeper correction may follow, aligning with the current technical pattern.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

BTC poised to rise further! Market volume remains the problemBTC poised to rise further! Market volume remains the problem

From our chart we can see that BTC likes to make big corrections before moving higher. Over the weekend, BTC transformed from a bearish picture to a clear bullish triangle with a bullish breakout.

The prevailing trend should push BTC higher as shown in the chart, but again the problem is with the volume.

Suppose BTC has not accumulated enough volume during the development of the pattern. In that case, it is very likely that it will fall even further to develop an even larger pattern like the previous one that we can see at the end of the wave.

However, at the moment, BTC has a bullish pattern and the scenario could develop in the way shown in the chart. We cannot assume further transformations at the moment.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Deep Dive Into Bollinger Bands 🗓This article explores the Bollinger Bands indicator—a powerful volatility tool used by traders worldwide. You'll learn how it works, how to calculate it, and how to use it to detect potential breakouts, trend reversals, and overbought or oversold conditions in the market.

📚 Introduction to Bollinger Bands

In the fast-paced world of trading, understanding market volatility is key to making informed decisions. Bollinger Bands, developed by John Bollinger in the 1980s, offer a visual and statistical method to measure this volatility. Unlike simple moving averages, which only tell you the trend, Bollinger Bands expand and contract based on recent price action, helping traders spot overbought, oversold, or consolidation phases.

These bands dynamically adjust to market conditions, making them one of the most popular indicators for trend-following, mean-reversion, and breakout strategies. Whether you’re trading crypto, stocks, or forex, Bollinger Bands can help you identify high-probability setups by combining trend direction with volatility.

📚 How Bollinger Bands Are Calculated

Bollinger Bands consist of three lines:

Middle Band – This is a simple moving average (SMA) of the price, typically over 20 periods.

Upper Band – The middle band plus two standard deviations.

Lower Band – The middle band minus two standard deviations.

Middle Band = SMA(n)

Upper Band = SMA(n) + (k × σₙ)

Lower Band = SMA(n) - (k × σₙ)

Where σₙ is the standard deviation of the price for n periods and k is the multiplier, typically set to 2, which captures ~95% of price action under normal distribution. The middle band shows the average price over the last 20 candles. The upper and lower bands adjust based on how volatile the price has been — expanding in high volatility and contracting in low volatility.

🤖 For those traders who want to implement Bollinger Bands into algorithmic strategy we provide formula it's calculation in Pine Script:

basis = ta.sma(src, length) // Middle Band (SMA)

dev = mult * ta.stdev(src, length) // Standard Deviation × Multiplier

upper = basis + dev // Upper Band

lower = basis - dev // Lower Band

📚 How to Use MACD in Trading Strategies

⚡️Bollinger Band Squeeze (Volatility Contraction and Expansion)

The idea is pretty simple, а squeeze indicates low volatility and often precedes a breakout. The squeeze is the situation when the Upper Band and Lower Band contract, and BB width is at a local minimum. In this case you shall be prepared for the high volatility after the period of low volatility. This strategy doesn’t predict direction — it prepares you for volatility.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open long trade when candle shows a breakout and closes above the Upper Band.

Set a trailing stop-loss at the Middle Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open short trade when candle shows a breakdown and closes below the Lower Band.

Set a trailing stop-loss at the Middle Band

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open long trade when candle closes above the Upper Band.

4. Close trade when price touched the Middle Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open short trade when candle closes below the Lower Band.

4. Close trade when price touched the Middle Band.

⚡️Mean Reversion (Rebound from the Bands)

This is the most common approach to use Bollinger Bands. The idea is also very simple, we just want to open long if price touches Lower Band and short if price reaches Upper Band. Price tends to revert to the mean (Middle Band), especially in range-bound markets. It's very important to trade in the direction of the major trend to reduce the probability of the large move against you.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Open long trade when price touches the Lower Band.

Set the initial stop-loss at the fixed percentage below entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Upper Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Open short trade when price touches the Upper Band.

Set the initial stop-loss at the fixed percentage above entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Lower Band.

🧪 Important: the most common approach to close trades is the Middle Band touch, this is classic mean reversion. We experimented multiple times with different approached and revealed that usually it's better to take profit at the Upper/Lower band for long/short trades and use Middle Band only for setting stop-loss at breakeven. This approach provides better risk to reward ratio.

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open long trade the Lower Band.

3. Put Initial stop-loss 2% below the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close long trade at the Upper Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open short trade the Upper Band.

3. Put Initial stop-loss 2% above the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close short trade at the Lower Band.

🧪 Important tip: notice that initial stop-loss is needed only to avoid disaster in case of price moves strongly against you. This percentage shall give enough space to avoid its reaching too often. Mean reversion strategy provides fast trades with the small average gain, so you shall maintain the high win rate (perfectly above 70%). You have to choose stop-loss based on particular asset volatility.

⚡️Combined Approach: Mean Reversion + Trend Following

Skyrexio made multiple researches about Bollinger Bands strategies and we found that we can receive better gains in combination of different approaches. Mean reversion gives you great entry with discount but you don't need to exit that early. Use the trading stop and allow to gain profit while market is moving in your direction.

This approach you can find in our advanced strategy Bollinger Bands Enhanced Strategy which we shared in 2024. Click on the link to read about it and understand how you can combine best features of this popular indicator.

📚 Conclusion

Bollinger Bands are more than just a volatility indicator — they provide a flexible framework for understanding price dynamics and market conditions. By visualizing the relationship between price and standard deviation around a moving average, traders can gain valuable insights into whether an asset is consolidating, trending, or preparing for a breakout.

The real strength of Bollinger Bands lies in their versatility. They can adapt to different trading styles — whether you’re a short-term scalper, a swing trader, or a long-term position holder. From identifying squeeze setups to riding strong trends or capturing mean reversion moves, BBs offer a strategic edge when used correctly.

However, Bollinger Bands should never be used in isolation. Like any technical tool, they work best when combined with momentum indicators like RSI or MACD, volume analysis, and price action signals. Context is key: a signal that works well in a ranging market may fail during high momentum trends.

Ultimately, Bollinger Bands help traders make more informed, disciplined decisions by clarifying where price stands relative to recent history. When paired with sound risk management and broader market awareness, they become a powerful ally in navigating market uncertainty.

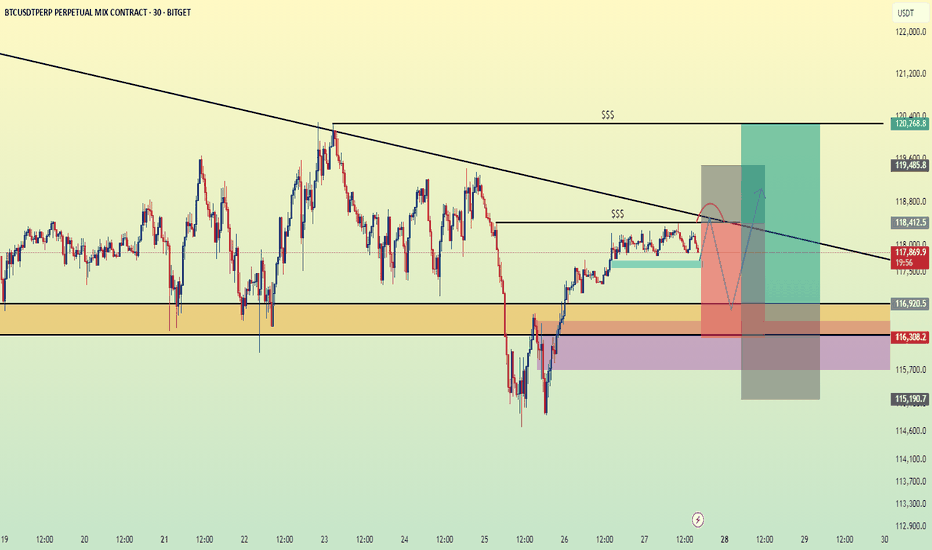

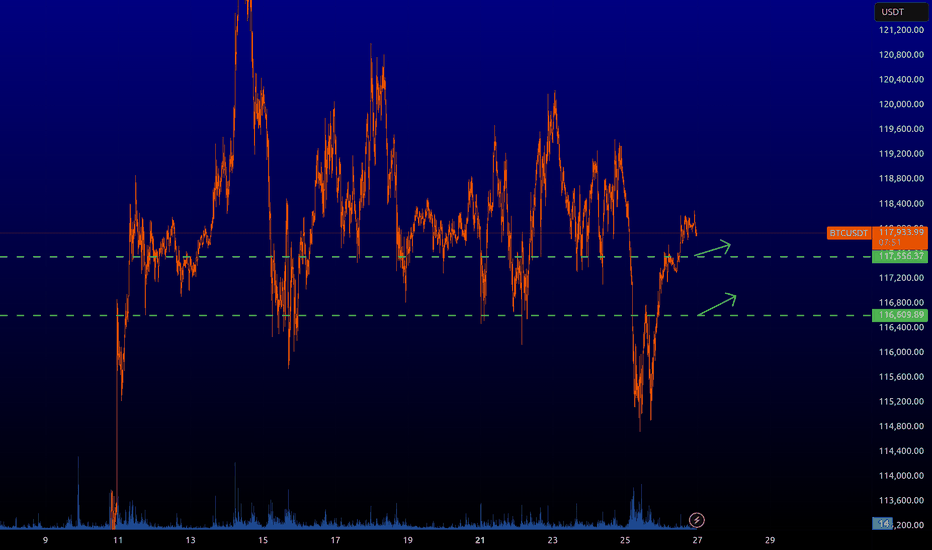

Bitcoin in 15minCaption important🛑🛑🛑

Hello to all traders. 😎😎

I hope all your deals will hit their targets. 🎉🎉

I’m opening a short position on Bitcoin from the current level, targeting $118,200 as the first take-profit, and $117,600 as the second target.

⚠️ This is a high-risk trade, so make sure to apply proper risk management.

What Do You Think?

Which scenario do you think is more likely to happen? **Share your thoughts!** ⬇️

Don't forget that this is just an analysis to give you an idea and trade with your own strategy. And don't forget the stop loss🛑🛑🛑

❤️❤️❤️The only friend you have in financial markets is your stop loss❤️❤️❤️

Please support me with your ✅' like'✅ and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me 🙏😊

Be Happy , Ali Jamali

Bitcoin BTC price analysis by the end of 2025🕯 July is coming to an end, with 3 weeks of OKX:BTCUSDT consolidation between $117k–121k.

Tomorrow begins the last month of summer — and it promises to be "hot" as, according to our earlier published calendar Trump's administration plans to send letters with new, increased tariffs to "all countries" on 01.08.

💰 Also, take a look at Bitcoin Monthly Returns. In our view, 2025 resembles 2020 the most.

What do you think?

👉 According to this dynamic, the real "hot" may come not in summer, but late autumn.

💰 We've also tried to find a price fractal for #BTCUSD that fits the current structure — and for now, it looks plausible:

◆ In the coming days, CRYPTOCAP:BTC should not rise above $121k.

◆ A low of correction might hit mid-September around $93k.

◆ A cycle top for #BTC could arrive to the end of 2025, near $147k.

📄 Now that you've seen our version — share your forecasts on future #BTCUSDC price action in the comments 👇

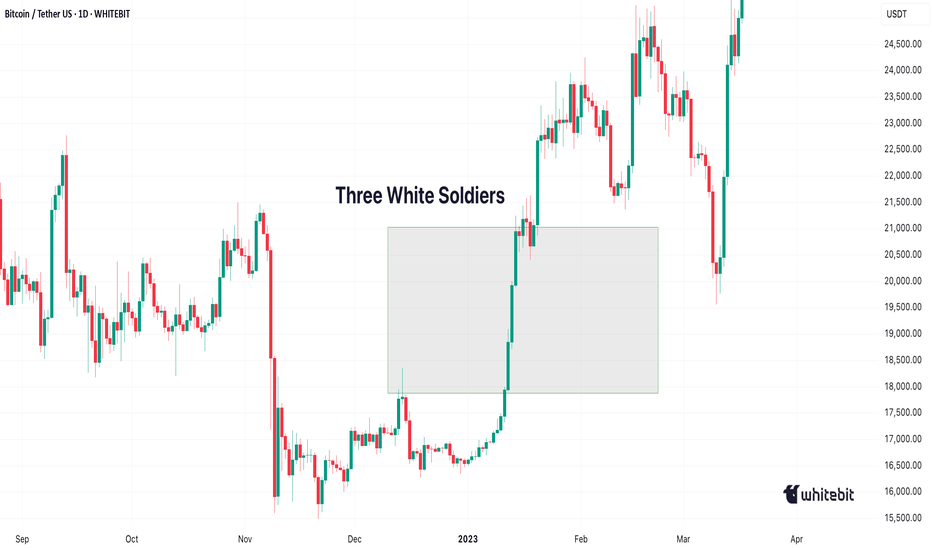

Three White Soldiers & Three Black CrowsHello, Traders! 😎

In technical analysis, not all candlestick patterns are created equal. While some merely hint at indecision or short-term corrections, others shout with conviction: "Trend reversal is coming…" Two of the most powerful momentum candlestick formations are the Three White Soldiers and the Three Black Crows. When they appear, traders PAY ATTENTION. In this article, we’ll dive deep into: What do these patterns look like? Why do they form? What do they tell us about market psychology? How to trade them?+ Their limitations 👇🏻

What Are Three White Soldiers and Three Black Crows?

These Are Multi-Candle Reversal Patterns That Suggest A Strong Shift In Market Sentiment:

Three White Soldiers. A 🐂bullish reversal pattern that occurs after a downtrend. It consists of three consecutive long-bodied green (or white) candles, each closing higher than the last, and ideally opening within the previous candle’s real body.

Three Black Crows. A 🐻bearish reversal pattern that shows up after an uptrend. It’s made of three consecutive long-bodied red (or black) candles, each closing lower than the last and opening within the previous candle’s real body. They signal not just a change in price, but a shift in power, from sellers to buyers (or vice versa).

Candles With a Message

Unlike most one-candle signals or minor patterns, these sequences tell a real story. They show that one side has taken clear control over the market — not for an hour, not for a single day, but for multiple sessions. And that kind of shift, especially on higher timeframes like daily or weekly charts, is something seasoned traders pay close attention to.

Let’s get into the psychology for a second. Imagine you’re a trader who just watched BTC drop for two weeks. Then out of nowhere, three strong green candles appear, each more bullish than the last. You’re seeing buyers push through resistance levels like they don’t even exist. That’s not just a bounce, that’s confidence. That’s the kind of thing that makes people FOMO back in, or finally close out their shorts. Same with the Black Crows. If the price has been climbing and suddenly sellers start hammering it for three days straight? That’s not retail panic. That’s big money exiting.

Now, How do Traders Trade Them?

Well, a lot of people jump in right after the third candle closes. If you’re going long on the Three White Soldiers, you’re betting that the breakout has legs. Same for shorting the Black Crows.

But, and here’s the trap, not all of these patterns play out. Sometimes, that third candle is the climax, not the beginning. So confirmation matters. Volume should increase. The move should break a recent key level. Indicators like RSI or MACD should support the shift. Otherwise, you might just be catching the end of a move, not the start of one.

Another mistake? Ignoring context. These patterns mean nothing if they’re forming in the middle of chop or during low-volume holiday trading. They work best when they signal the end of exhaustion.

And let’s be honest. Even if the pattern is clean, you still need a plan. Stops should go below the first green candle (for bullish setups) or above the first red one (for bearish setups). If price moves against you, it means momentum never really shifted. That’s your cue to get out fast.

Final Thoughts

Three White Soldiers and Three Black Crows are powerful tools in the hands of a patient trader. Of course, these patterns aren’t perfect. They don’t account for time, so a 3-day move might seem powerful, but if it happens slowly over 12-hour candles, it’s not as strong as the same pattern on a daily chart with volume.

The takeaway? These are patterns worth knowing, not because they’re magic, but because they reflect a real shift in market behavior. When Three White Soldiers or Three Black Crows show up in the right place, at the right time, with the right confirmation… that’s when charts stop being random and start making sense. But remember. They are indicators, not guarantees. The best traders use them in conjunction with other tools and a clear trading plan.

One last Correction till breakoutWith the most recent SFP printed on the higher timeframe and BTC still failing to break a significant high, all signs point toward one final dip – a move to shake weak hands and reload for the breakout that’s been brewing in silence.

⚡ If the orange level holds, consider it a highly bullish signal – supercycle potential unlocked?

Naturally, the Wizard plays both sides of the board:

📉 Short ideas would activate around the blue Order Block / green correction level.

📈 But should we bounce strong from orange… well, let’s just say you’ll want a seat for what comes next.

🟥 Bullish invalidation rests at the red line.

Let’s see how the game unfolds.

BTCUSD long setup: Targeting the next bull move.Hello IGT FOLLOWERS

Here is my BTCUSD overview, Bitcoin is showing bullish momentum after holding strong support near $112,000. A breakout above the $115000 resistance suggests buyers are regaining control. RSI is turning upward, and volume is increasing on green candles signaling demand. As long as price holds above $113,000, bulls may push toward the $117,500 target.

Key points :

Entry point : 113500

1st Target : 115000

2nd Target : 117500

Follow me for more latest updates and signals

What Nobody Taught You About Risk Management. Part 1

Numerous authors and communicators have addressed the importance of risk management, more or less comprehensively, but I have not come across any who present what I intend to share with you today. Once my presentation is complete, I will share some useful resources with which you can complement what you learn here, as I will only cover an important but small part of the topic: execution.

What is risk management?

Risk management is the planning an investor undertakes to protect capital and maximize profits. It encompasses factors surrounding the creation of a profitable system or method, the allocation of our capital, and the execution of our trades.

Some key concepts:

Risk-Reward Ratio

The risk-reward ratio is a metric used in trading and investing to assess the relationship between the risk taken in a trade and the expected potential profit. It is expressed as a ratio, for example, 1:1, 1:2, 2:1, etc.

Stop Loss (SL)

The SL, or stop-loss, is an automatic order placed in a trading operation to close your position at a specific price, with the aim of limiting losses if the market moves against you.

Take Profit (TP)

The TP, or take-profit, is an automatic order placed in a trading operation to close your position at a specific price to secure profits when the market reaches a favorable level. It is the point where you decide to "take" your profits and exit the trade.

Margin

In trading, margin is the amount of money a trader must deposit or maintain in their account to open and sustain a position.

Volatility

Volatility, in the context of trading and financial markets, measures the magnitude and frequency of changes in an asset's price.

Leverage

Leverage in trading is a tool that allows investors to control a larger market position using only a fraction of their own capital. It acts as a "loan" provided by the trading platform, amplifying both potential profits and potential losses.

Risk Management and Trade Execution:

The most common problem among other investors, beyond psychological factors or lack of experience, is the absence of total control over their trades. They use random leverage, take entries with risk-reward ratios below 1:1, and some don’t even know what percentage of profits or losses they will have at the end of the trade.

For an investor to execute a successful trade, they must meet the following criteria:

1. Ensure minimum risk-reward ratios of 1:1.

2. Properly allocate their investment capital, adhering to strict rules to avoid undermining their statistical performance.

3. Adapt to volatility and know how to adjust their leverage accordingly.

4. Set a fixed stop-loss (SL) price and determine what percentage of losses they are willing to accept per trade.

5. Set a fixed price for taking profits from the trade and know what percentage of profits they will achieve.

Failing to meet these parameters will not only destroy traders’ profitability but also make it impossible for them to develop reliable investment systems and methods.

Incorrect Execution:

For example, if I see an entry opportunity in BTC/USDT, it would be a mistake to choose random leverage and plan to manually close when I think I’ve gained or lost enough. The volatility of the price chart itself may or may not require leverage, and that leverage must be adjusted to our risk management strategy. Trading in the manner described above is a recipe for failure, which is why it’s a lucrative business to allow inexperienced investors to access markets through online platforms.

Correct Execution:

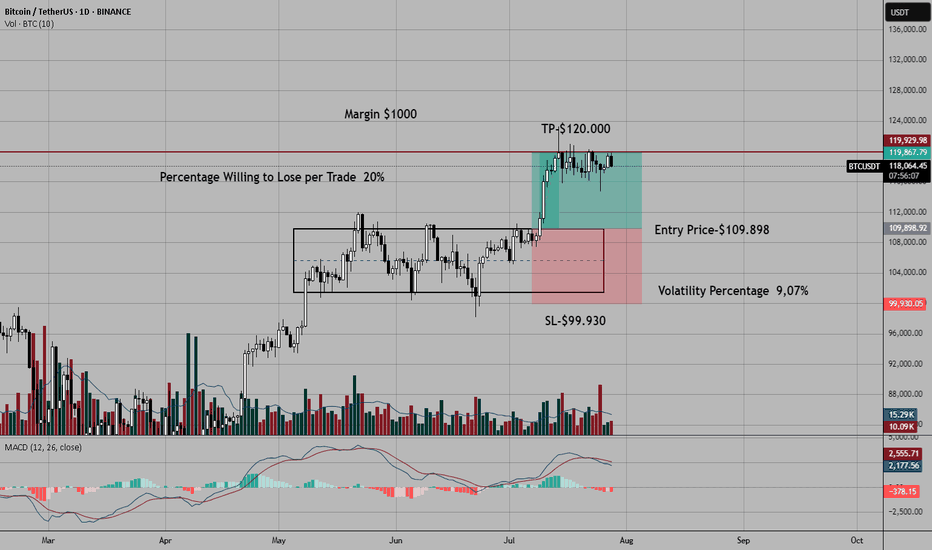

Before explaining a practical case, let’s assume I use a $1,000 amount per trade and am willing to risk a 20% stop-loss (SL). These parameters are non-negotiable to avoid undermining my statistical performance.

A few days ago, I took the trade shown in the chart. To enter this long position in BTC/USDT, the first thing I did was identify the entry point and the exit points for my trade (SL and TP). The trade met a minimum risk-reward ratio of 1:1, so I considered whether leverage was necessary. A volatility of 9.07% from the entry point to my SL price offered low profit expectations relative to what I was willing to risk from my margin per trade (20% of $1,000). I needed leverage.

In the toolbar on the left, once you have a price chart open in TradingView, you can use the ruler to easily measure the percentage of volatility.

How can I ensure that 20% of the margin I’m investing is triggered when the price reaches my SL zone using leverage?

To calculate the exact leverage, we divide the SL percentage we’re willing to risk (20%) by the volatility percentage from the entry point to the SL price (9.07%).

For example, my entry point in BTC was $109,898, and the exit point or SL was $99,930. I measured the volatility between the entry price ($109,898) and the exit price ($99,930), resulting in 9.07%. Since the volatility was somewhat low and I wanted to risk 20% of my margin per trade when the price hit my SL, I calculated the required leverage. To do this, I divided 20% (the percentage I was willing to lose per SL) by 9.07% (the volatility percentage from the entry price to the SL price). The result was approximately 2x leverage when rounded.

In summary: At 2x leverage, we would lose approximately 20% of our capital if the price reached $99,930. Since I had a 1:1 risk-reward ratio before entering the trade, I assumed I would gain approximately 20% of the invested margin when the price reached $120,000.

The trade was a winner, reaching the TP price without issues and generating a 20% profit on the margin I invested ($1,000).

Use investment platforms that allow you to manually adjust leverage, such as 1x, 2x, 3x, 4x… 38x, 39x, 40x, and avoid platforms where leverage is set to default values like 1x, 5x, 10x, 20x, 50x… This seemingly minor detail for most small investors allows platforms to pocket large fortunes from failed trades.

Conclusions and Recommendations:

Risk management is the backbone of investors, and knowing how to execute entries with precision is rare among retail traders. Even so, I’ve only covered a small part of this topic. To complement this knowledge, I recommend searching on YouTube for the video by investor and educator Yuri Rabassa titled “The Secrets of Good Money Management.” This video will help you develop basic statistical skills that are vital for creating a trading system. Additionally, in the book *Forex Price Action Scalping* by renowned author Bob Volman, you’ll find a very insightful chapter titled “The Principle of Probability.”

Final Note:

If you’d like to take a look at my analysis log, you can find my profile in Spanish, where I transparently share well-defined market entries. Send your good vibes if you enjoyed this article, and may God bless you all.

Bitcoin projection for the rest of the year. Bullish.We are in a retracement phase , i think btc will retrace deep enough to convince people that bull run is over . Once that happens it will flip to the upside and leave everyone shocked.

A retrace towards 108k-104k is possible.

Once they get tapped btc will start a new run towards a new all time high where everything will get to an end and a new besr market will start. Until then lets enjoy the rest of the year.

$BTC Daily OutlookBINANCE:BTCUSDT.P

Weekly Chart:

Bitcoin has now printed three consecutive weekly closes above the former higher-high threshold at $111 960. That series is enough to confirm a clean breakout of the prior HH-HL range and keeps the long-term bias pointed firmly higher.

That said, a near-term pullback is still on the table:

• First support — the breakout shelf at $111 960 (re-test of structure).

• Deeper support — the next V-level around $98 115.

Why the caution?

Last week’s candle left a small Failed Auction just above the new high, and Footprint data shows a cluster of aggressive buy-delta trapped in that wick. Those buyers may need to get washed out before the trend resumes.

Big picture: weekly structure is bullish; any dip into the levels above is a potential reload zone while the breakout holds.

Daily Chart:

Price action remains firmly bullish: multiple Failed-Auction rejections at the $116 860 higher-low vLevel keeps supply thin and reinforce the up-trend toward the prior ATH.

That said, remember Auction Market Theory rule #5: “When time or volume builds at the edge of balance, price often pushes through.”

• Each failed auction is absorbing resting bids.

• If sellers lean in again with size, the level can flip from support to resistance very quickly.

In practice that means:

•Base case – continuation to the highs while the Daily structure holds.

•Risk scenario – a clean break of $116 860 would open room for a deeper weekly pullback toward $107456.0

For now we treat the current weekly pullback as a fresh opportunity: scouting intraday longs as price reacts to the 1-Hourly zone.

From the footprint read-out, today’s bar finished with a neutral delta, but note where the profile is stacked: both the Value Area Low and the POC sit right at the bottom of the candle. That tells us the bulk of volume printed down at the session lows and it skewed negative, sellers were leaning hard, trying to extend the move lower.