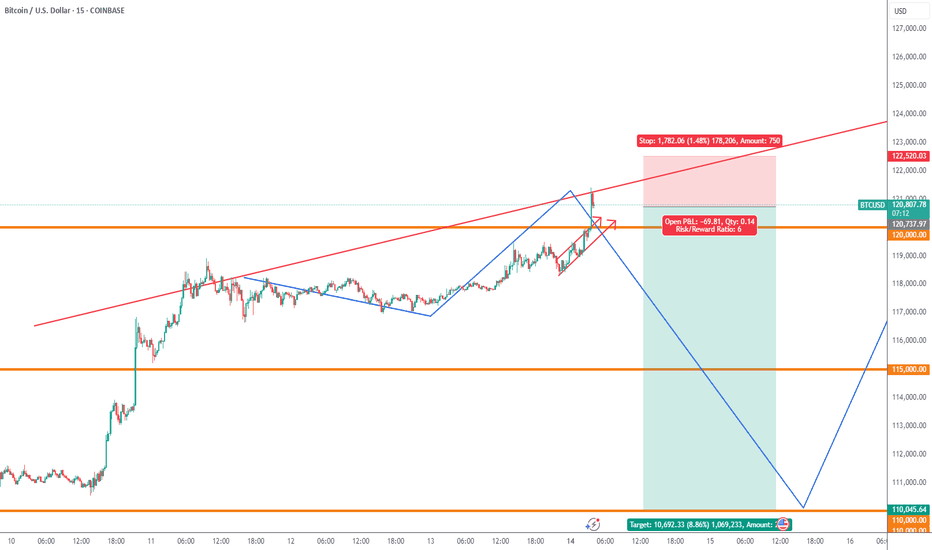

symmetrical triangle in progressBitcoin has been consolidating at this level for several weeks, easing some of the pressure in order to push above 120K. As of today, we have a clear formation—a large symmetrical triangle—which confirms the continuation of the upward trend and rules out any possibility of returning to lower levels.

BTCUSD.P trade ideas

BTC/USDT HIDDEN PATTERN! SM, FIB AND MORE COMFIRMED!Price Resilience Amid Geopolitical Stress

Bitcoin demonstrated remarkable strength during the Israel-Iran conflict, briefly dipping to ~$98K but swiftly rebounding above $105K. This aligns with historical patterns where BTC initially sells off on geopolitical shocks but recovers aggressively within weeks, outperforming gold and equities by 15-60% post-crisis. There is a $96K-$94K "footprint" that coincided with institutional accumulation, evidenced by $1.37B in spot ETF inflows during the conflict week, led by BlackRock's IBIT ($240M single-day inflow) according to official information. This institutional backstop and many others might single-handedly prevented a deeper correction for now, remember that smart money psychology is to create cause out of thin air and buy during selling and indecisive times.

Critical Levels to Watch

Immediate Support: $108k area is vital. A sustained hold here maintains short-term bullish momentum. The 50-day SMA near $102.8K (tested during June 13 conflict sell-off) remains a macro support floor.

Resistance & Targets: The $112K ATH is the near-term ceiling. Breaking this requires stronger spot demand—currently, net exchange inflows are negative, indicating weak retail participation or traders that are backing off for now.There's a $120K target (0.618 Fib) aligned with Standard Chartered’s $150K year-end model if ETF inflows persist.

Risk Zones: A close below $108.3K risks a slide to $105K. Failure here opens path to $96K and a further break of this 92k to 96k zone could lead directly to 70k area or even lower if economical and social activities are not favorable in the near to medium future.Dominance above 55% (currently 65%) delays alt season, but a break below 60% could ignite alts in a positive way.

Macro Catalysts & Market Sentiment

Policy Tailwinds: Trump’s "One Big Beautiful Bill" (proposing $5T debt ceiling hike and U.S. strategic BTC reserves) could weaken the USD, boosting BTC’s "digital gold" narrative. DXY’s -9% YTD drop already correlates with BTC’s 54% post-election rally.

Fed Influence: Pressure to cut rates (amid cooling employment data) may accelerate institutional rotation into BTC. ETF inflows hit $2.75B in late June, signaling renewed institutional FOMO.

Geopolitical Cooling: Iran-Israel ceasefire talks reduced immediate panic, but residual volatility risk remains. Traders note BTC often rallies 20-40% within 60 days of conflict events.

Structural Challenges

Liquidity Fragility: Whale moves (for example: 10K BTC sell orders) now impact prices more due to ETF-driven liquidity concentration. Recent $98K flash crash exemplified this.

Regulatory Overhang: MiCA compliance costs in the EU and U.S. security-reclassification proposals could pressure smaller tokens, though BTC’s status appears secure 28.

Seasonal Slump: July historically sees 6.1% of annual crypto volume—low volatility may delay breakouts until August 4.

Strategic Outlook

A July breakout above $112K could ignite the next leg to $120K, but a retest of $107K-$105K is likely first. Altcoins remain subdued until BTC dominance breaks <55%—select projects with institutional backing (for example, ETF candidates) or real-world utility for asymmetric opportunities.

Conclusion: BTC’s resilience amid chaos confirms its institutional maturity. Trade the $108.3K-$112K range aggressively, with a break above ATH targeting $120K by September. Always hedge tail risks (escalations, regulatory shocks) in this volatility-rich asset class. While this great surge in institutional inflow is good for BTC it also indicates a reduction or slower pace of other crypto currencies.

This is my analysis for BTC, let me know what you think and I hope you like it!

Weekly Close Watch: Bitcoin’s Key Level Could Shift the ChartsGood morning, Guys

There's only 1 day and 13 hours left until the weekly Bitcoin candle closes.

It's crucial that this candle closes above the 112,331 level with strong volume. Anyone experienced in economics and technical analysis knows just how significant this is.

If we get that close above the level, I’ll share a powerful analysis with a clear target.

I want to sincerely thank everyone who’s been supporting my analyses with likes—your support is

my biggest source of motivation when it comes to sharing content.

Much love to you all—we’re more than just a community, we’re a family. 💛

BTC Massive SetupConsolidation for months between 91k and 106k

- Classic Wyckoff setup as an accumulation/distribution

- Price targets of: 121.878 (122k is the popular target) to the upside with 75,827 on the down

- Saylor today put out news to be raising another $2 billion to buy BTC. Either he is going to be able to hold the floor or get washed out

- Trade can be taken with confirmation of breakout on either side pretty easily as momentum will be so strong that being on the wrong side will most likely be an immediate stop out

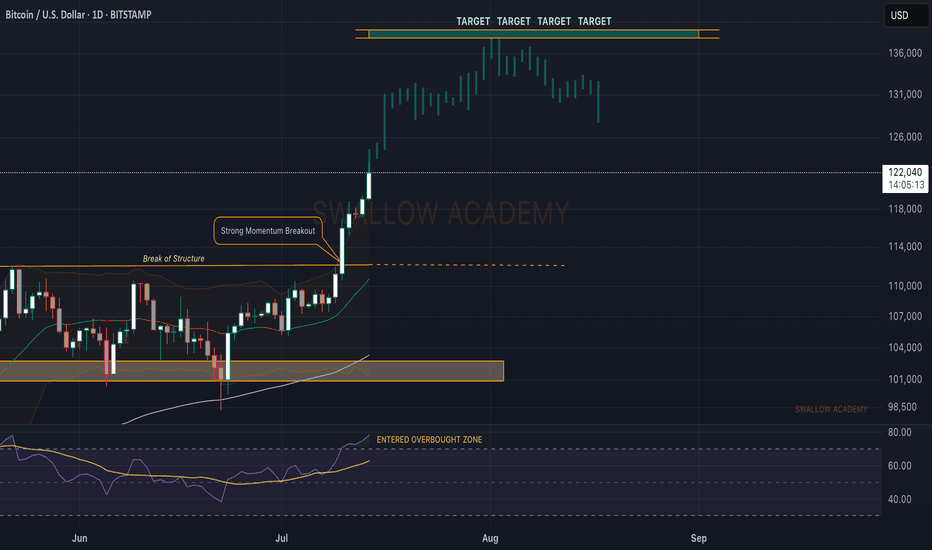

Bitcoin (BTC): Targeting $140K | Our ATH for This Bullish Cycle$120K was broken too easily, and we are now setting our new ATH to $140K, which will be our last target and local top before entering into a bearish market.

Now, as we recently had a strong break of structure that was not retested properly (meaning buyers have not secured this area), combined with the RSI being in the overbought zone, we might see some pullback happening anytime from here so keep an eye out for it.

About RSI, our yellow line is still in the neutral area, and we see the demand and buyside volume growing, so we are going to look for that line to also enter into overbought zones before looking for potential selloffs.

Swallow Academy

Bitcoin Update – Textbook Patterns Playing OutIn last week’s Bitcoin idea, I highlighted a key technical setup: price retested the neckline of a massive inverted Head & Shoulders pattern and launched a strong move upward. Let’s dive into what’s unfolding on the daily chart.

We’re seeing classic Wyckoff consolidation behavior—appearing right before the breakout and again after the neckline retest. Multiple smaller Head & Shoulders patterns have also formed and hit their targets cleanly.

The Volunacci pattern came alive after a precise bounce from the Golden Zone, adding more fuel to the bullish narrative.

Next major level in focus: $120K. Will Bitcoin reach it? Let the market decide.

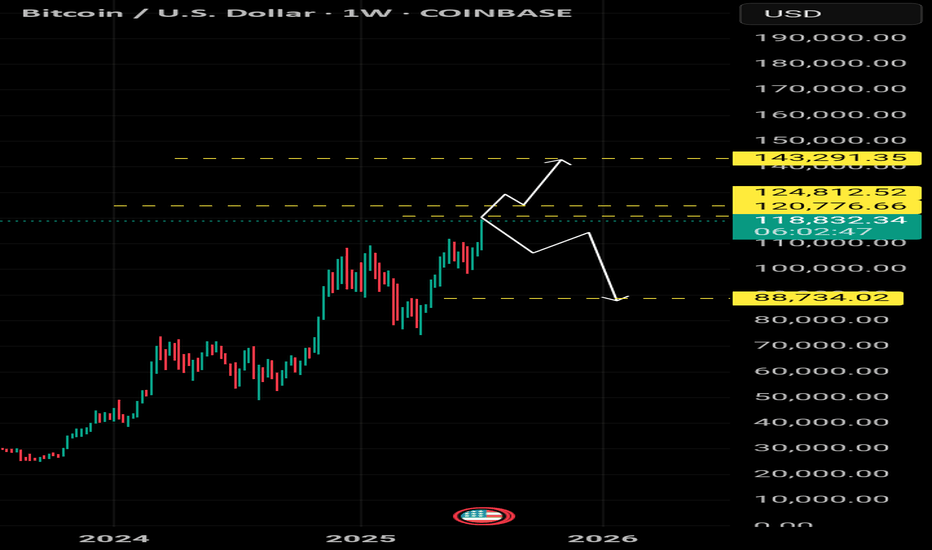

End in sight, Bull run near complete, don't be fooled. Bitcoin has experienced an incredible surge, rising from $15,000 to over $111,000 in this bull cycle so far. I expect the market peak to be around $114,000 to $115,000, with historical trends indicating strong resistance at these levels. As a long-term Bitcoin bull who has navigated through multiple cycles, I see several indicators suggesting we might be nearing a market top.

Firstly, this bull run has lasted 623 days, with only 462 days remaining until the predicted next cycle bottom. This could lead to a significant correction in the short term, potentially dropping prices by at least 50% down to below $40,000. Additionally, trading volume is declining; although exchange volume is decreasing, the number of trades per day is also dwindling. This means there’s less buying and selling pressure in the market. If this trend shifts to more selling pressure amidst such low volume, we could see a rapid decline. This scenario seems to align with what market whales may be anticipating.

MicroStrategy (MSTR) is certainly supporting the market, along with new institutional investors. However, we have yet to fully assess the impact of tariffs and other economic factors, which could result in fewer people willing to invest, especially in high-risk markets.

The Net Unrealized Profit/Loss (NUPL) has been high, remaining above 66 since March 2024, which also suggests that a correction is due, as many holders are currently in profit. Although institutional investment has been steadily increasing, we are now observing a plateau in the Accumulation/Ddistribution chart. The number of BTC long positions is decreasing, while shorts remain very low, indicating a lack of confidence that Bitcoin will rise significantly higher. This low interest in both longs and shorts suggests that market pressure could shift soon.

ETF inflows have remained stable, but profit-taking is likely to occur as investors seek to increase their positions in the bear market. While we all love Bitcoin and want the rally to continue, it's crucial to remember that a bear market will eventually happen, along with the next halving—it's just a matter of timing.

Looking at the charts, if anything signifies a market top more than “Laser Eyes,” it could very well be Trump coin. We might see another upward push, but history has shown that if everyone expects a massive rally in September or the fourth quarter, the opposite usually occurs; we end up buying the rumor and selling the news.

Safe trading, everyone! I remain a staunch Bitcoin bull, but I recognize that all good things must eventually come to an end and the next cycle will be so exciting, so make sure youe have the reserves to invest in the bear!

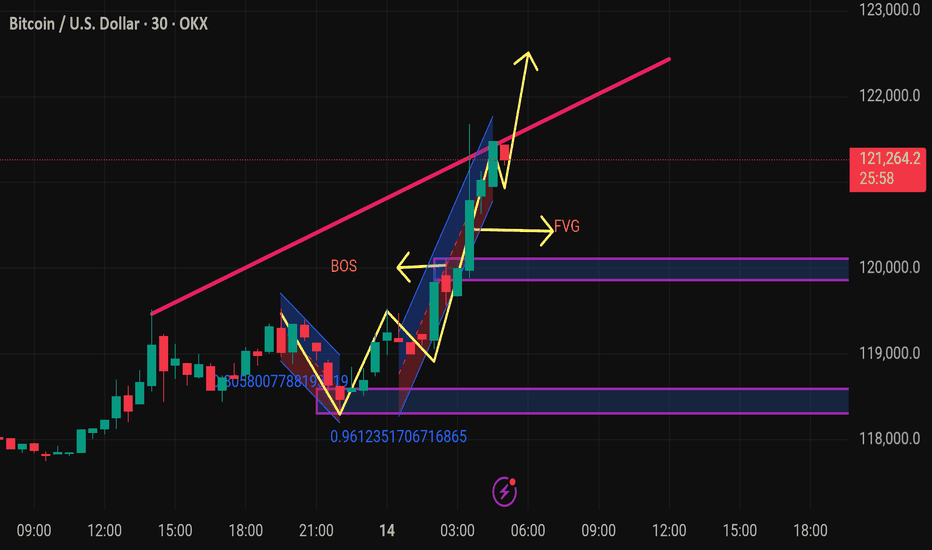

Btcusd techinical analysis.This Bitcoin (BTC/USD) 30-minute chart shows several key technical indicators and annotations, pointing to a bullish outlook. Here's a breakdown of the chart elements:

Key Elements:

1. Price Level:

Current price: $121,315.1

Change: +$2,178.0 (+1.83%)

2. Break of Structure (BOS):

Marked in yellow — indicates a shift in market structure from bearish to bullish.

It suggests a bullish trend continuation after this key resistance was broken.

3. FVG (Fair Value Gap):

The yellow "FVG" arrow points to an imbalance or gap between candle wicks that the market might return to for liquidity.

Often used as a potential entry point or pullback target.

4. Trendline:

The pink upward trendline shows current bullish momentum.

Price is currently testing or has broken above this trendline.

5. Bullish Flag/Channel:

Blue diagonal channel indicates a bullish flag or continuation pattern.

Price broke out upward from this flag — typically a bullish sign.

6. Fibonacci or Ratio Markers:

Numbers like 0.9612351706716865 and 0.305800778819... may

Ascending Inverse H&S on the BTC weekly chartThe longer it takes to break above this neckline the higher the breakout target will be. I have arbitrarily placed the measured move line at July 18th 2025. If the breakout were to happen on that day the measured move target is around 208k, which could take quite awhile to reach or if we entered a truly hyperparabolic blow off top we could reach such a target way quicker than when the dotted measured move line reaches it. *not financial advice*

BTC bullish scenario - short term bearishMapping out BTC sideways consolidation that could wreak havoc on ALTS.

Looking at the daily chart, this consolidation is still bullish as BTC price action is still likely respecting this ascending channel.

However, each move down on BTC could mean a significant dump on alt coins.

IMO, based on how the chart looks, BTC price still needs to come and test the bottom and coincidentally there is a huge FVG left when BTC rose impulsively. In all likelihood, I am expecting at the very least for a quick wick down to fill the gap before BTC can then start some bullish price action.

BTC/USD Heist Mode: Buy Low, Escape Rich🔓 BTC/USD Crypto Vault Breach: Thief Strategy for Long Entry Robbery (Swing/Day Setup) 🔓

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰💸✈️

🚨 Welcome to our next Thief Trading-style breakout mission — this time targeting the mighty BTC/USD vault. Using a fusion of technical precision and macro-level insight, we're charting a long entry blueprint for a profitable heist.

🔑 Entry Plan

"The vault is open!" 💥

Buy at current price or set Buy Limit near swing lows (15–30min timeframe pullback entries). We're timing the entry with stealth—precision over panic.

🛑 Stop Loss Setup

SL set near recent swing low (4H TF reference: ~104.000).

Adjust based on position sizing, risk appetite & multi-order tactics.

🎯 Take Profit Target

Targeting 115.000—or exit earlier if price action stalls. Get in, get out. Efficiency is the code.

👀 Scalpers' Notice

Only work the Long side. If your bag’s heavy, strike instantly. If light, ride with swing robbers. Use trailing SLs to protect your bag.

📈 Why We’re Bullish

Market momentum favors the bulls:

Overbought zones acting as lures

Bearish traps ready to flip

Key confluences from sentiment, COT, on-chain & macro analysis

➡️ Full supporting breakdown available 👉👉🔗🔗.

📢 Risk Note – Stay Sharp

Major news events = increased volatility ⚠️

Avoid entries during news. Trail stops to protect running profit. Rob smart.

💖 Boost the Crew

If this blueprint aligns with your mission, hit that Boost button. It fuels the team, and together, we profit like pros. One heist at a time. 💪🎉

🧠 Stay ready—next plan drops soon. Until then, rob safe, rob smart. 🐱👤

$BTC Ready to Explode – Targeting $125K+ Soon! Bitcoin has finaCRYPTOCAP:BTC Ready to Explode – Targeting $125K+ Soon!

Bitcoin has finally broken out of the previous resistance range (~$110K–$111K), where it was rejected multiple times in June. Now it's consolidating in a tight box, setting up for a big move.

🔸 Support $110k–$113k

This area was previous resistance and is now acting as strong support. Holding above this confirms bullish strength.

🔸 Upside Target: $125k

If BTC holds within the current range and breaks above, the next leg could push price toward $125K. A clean breakout could even extend toward $140K.

🔸 Short-Term Take Profits:

✅ TP1: $120,000

✅ TP2: $122,000

✅ TP3: $125,000

🔸 Risk Level at $110,000:

Break below this level would invalidate the bullish setup and increase downside risk.

BTCUSD: Bearish Continuation

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the BTCUSD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bitcoin Long: Expects New High; Target 124,632Over in this video, I update on the Elliott Wave counts for Bitcoin and explain why I think that Bitcoin is going higher for a wave 5 of 3 of 5.

The stop loss will be below the wave 4 and given some leeway, will be around 115,900. There are 2 Take profit targets:

1. 119,251, and

2. 124,632

I made it known that my personal preference is $124,632 but note that once a new high is made, this wave counts will already be validated even if it then drops to our stop.

I talk about the possibility of trailing the stop once a new high is reached but commented that every trader must trade based on their own style and risk preference.

Finally, Good luck in your trading!

[UPD] Trend analysis: BTC / ETH / SOL / XRP and other Just recorded a new video overview of the crypto market and the current trend developments in major coins: CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , CRYPTOCAP:LINK , GETTEX:HYPE , BSE:SUPER , $FLOKI.

Among the new assets on my radar I shared my view on the trend structure of $RENDER.

In my personal investment planning, I continue to treat any potential corrections into key support zones as opportunities to add or open new positions.

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉).