BITCOIN Is there enough time for another parabolic rally?Bitcoin (BTCUSD) is practically consolidating on the short-term, having just recently been rejected off its new All Time High (ATH). Despite the short-term volatility, the long-term outlook is still a very strong, structured uptrend, a Channel Up pattern that is now technically aiming for its next Higher High.

Incredibly enough, this Channel Up since the November 2022 market bottom, has been almost entirely within the Buy Zone (green) of the Fibonacci Channel Up going back all the way to April 2013!

As you can see during the previous two Cycles, every time BTC got above that Buy Zone, it started a parabolic rally. So far, we haven't got such rally on the current Cycle and with time running out (assuming the 4-year Cycle model continues to hold), do you think we will get one this time around?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTCUSD.P trade ideas

BTCUSD TRADES SIDEWAYS DUE TO A LACK OF DRIVING FACTORS

BTCUSD has been moving within sideways since the end of last week. This week there will be lack of news. The first significant will be FOMC minutes tomorrow, which will definitely affect the DXY index and bitcoin. So before that time I expect that the sideways dynamic of the asset will remain.

So, nothing to trade? Not really

We may consider entering long positions at a current price with a take profit nearby 0.786 Fibo and a stop loss just below the previous low:

🔼 a market buy order at 108078.50 with

❌a stop loss at 107389.50 and

🤑a take profit at 109176.65

After that I expect the price to rebound from the upper border of the triangle. Maybe will consider another long entry.

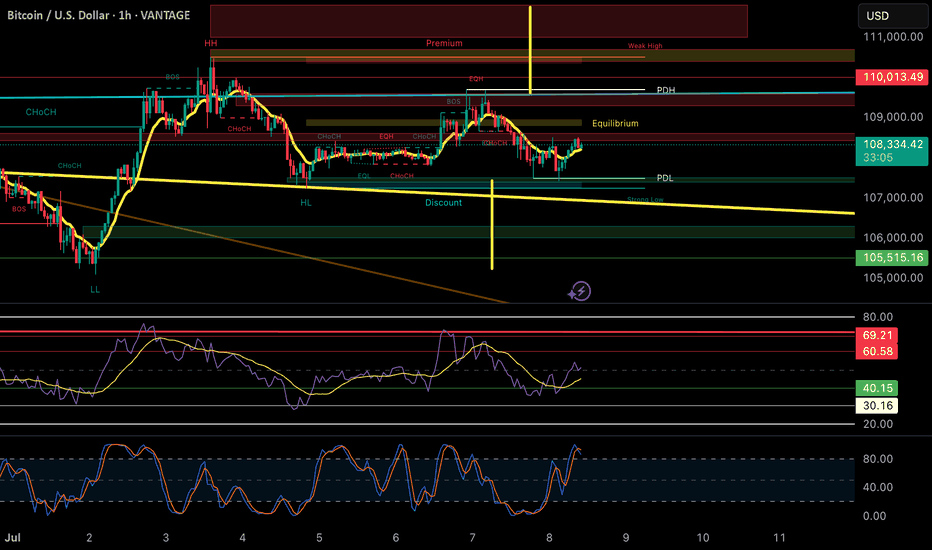

BTCUSD Structure Analysis : Bullish Zone From Support + Target🔍 Current Market Structure Overview:

Bitcoin is currently trading around $108,375, hovering just above a clearly respected rising support zone (shaded area). This dynamic support has held price multiple times and continues to act as a springboard for short-term bullish moves.

The chart illustrates a classic bullish continuation setup forming, with key structural levels marked as Minor BOS (Break of Structure) and Major BOS, indicating potential areas of trend validation and momentum acceleration.

🔹 Key Technical Elements:

✅ Support Zone:

The shaded diagonal support zone has acted as a bullish trendline base, holding up since late June.

BTC recently dipped into this area, found buyers, and is now attempting a reversal from this level.

This reinforces market interest and confirms the accumulation behavior in this zone.

⚠️ Break of Structure (BOS) Levels:

Minor BOS is marked near $109,800, signaling the first key intraday resistance.

A break above this level would signal bullish intent and open the way for price expansion.

Major BOS around $110,600–$110,800 is critical. A clean break here will likely validate a trend continuation toward the next objective.

🟩 Next Reversal Zone (Target Area):

Highlighted around $111,500–$112,000, this green zone represents a potential liquidity grab/reversal area where sellers could re-enter.

This zone aligns with previous price exhaustion levels and may trigger consolidation or a short-term pullback.

📈 Projected Price Path (Wave Schematic):

The chart outlines a wave structure projection, suggesting:

A possible retest of the minor BOS.

Follow-through into the major BOS area.

Final push into the reversal zone before potential rejection or sideways action.

🔧 Bias & Strategy:

Bias: Moderately Bullish as long as BTC respects the support zone.

Invalidation: A decisive breakdown below the trendline support and close under $107,500 would invalidate this bullish setup and shift bias to neutral/bearish short-term.

Trading Plan Ideas:

📥 Buy Opportunity: On minor dips within the support zone, targeting BOS levels.

📤 Sell Watch: Near reversal zone ($111.5K–$112K) if signs of exhaustion or bearish divergence appear.

📌 Final Notes:

BTC appears to be gearing up for a breakout from consolidation, and price action is coiling with higher lows. Market participants should watch closely how BTC reacts at the minor and major BOS zones, as they could define the next leg for either bullish continuation or rejection.

BTC/USD 15M CHART PATTERNHere’s a clear breakdown of your BTCUSD trading plan:

---

📈 Trade Setup (Buy Position)

Entry Price: 108,380

🎯 Take Profit Levels

1. TP1: 109,000

2. TP2: 109,300

3. TP3: 110,193

🛑 Stop Loss

SL: 107,337

---

🧮 Risk & Reward (Quick Overview)

Risk (SL): 1,043 points

Reward (TP1): 620 points

Reward (TP2): 920 points

Reward (TP3): 1,813 points

This gives you approximate Reward:Risk ratios:

TP1: ~0.59 : 1

TP2: ~0.88 : 1

TP3: ~1.74 : 1

---

✅ Notes

TP1 is conservative — may secure quick

BTCUSD: Whales Move 80,000 BTC, Shaking the MarketBTCUSD on Alert: Whales Move 80,000 BTC, Shaking the Market

By Ion Jauregui – Analyst at ActivTrades

The cryptocurrency market witnessed one of the year’s most puzzling moves this week. Over 80,000 Bitcoins—worth more than $8.6 billion—were transferred from wallets that had been inactive since the early years of the crypto ecosystem. These transfers, originating from addresses linked to 2010 and 2011, sparked a wave of reactions among investors, analysts, and crypto enthusiasts.

Fundamental Analysis: Mass Sell-Off or Simple Restructuring?

The market's initial response was uncertainty. It’s unusual for wallets from the so-called “Satoshi era” to become active again. However, research led by Arkham Intelligence and other on-chain analysis firms indicates that this was not an immediate sale. The BTC was not sent to exchanges, but to new addresses—possibly with enhanced security (SegWit or multisig technologies)—suggesting an internal reorganization rather than a liquidation.

On a macro level, the environment remains favorable for Bitcoin:

– Institutional inflows via ETFs have already surpassed $14 billion in 2025.

– Broader adoption is expected, driven by proposals such as the creation of a strategic Bitcoin reserve in the U.S. and clearer regulations in advanced economies.

– The market has shown resilience in the face of similar events in the past, reducing the risk of a structural correction.

Technical Analysis: Consolidation Zone with Key Resistance at $112,000

From a technical perspective, Bitcoin has maintained a strong bullish structure in recent weeks but is currently in a consolidation phase near its all-time highs:

• Key support: $103,477, located mid-range of the current consolidation zone. The lower bound sits at $98,209, where the price has reacted positively following the whale movements. The delta pressure zone is positioned at the upper part of the range, near current price levels.

• Immediate resistance: $111,978.21, a breakout of which could open the door to a move toward $112,000–$115,000.

• Daily RSI: Neutral bias with slight overbought conditions at 54.11%.

• Moving averages: The 50- and 100-day EMAs show clear compression—typically a precursor to a breakout—while the 200-day EMA remains well expanded, appearing to support the current consolidation.

Volume remains elevated but without speculative spikes, and funding rates in the derivatives market are still positive, suggesting sustained buying interest.

Conclusion: A Symbolic Shake-Up Rather Than a Threat

Although the whale movements have made headlines and stirred speculation about a possible sell-off, the signs point to a technical update rather than a shift in trend. The market has remained stable over the past 48 hours, with technical indicators and macro fundamentals supporting a short-term neutral-to-bullish outlook.

The key will be whether these funds remain dormant or begin to disperse in smaller transactions. For now, the crypto ecosystem has weathered the shake-up without major consequences, reinforcing the growing maturity of an increasingly institutional market.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success. Regulated status does not guarantee security.

SYMMETRYHey traders, hope you’re crushing it this week! 🚀 Quick note on our BTC/USD 4-hour ABC setup: the symmetry I’m talking about is purely price-based—AB and BC move roughly the same number of ticks, not the same amount of time.

So when we say “symmetry,” we mean:

A→B drop: ~3,670 ticks

B→C rally: ~3,427 ticks

That close price match gives us confidence in our PCZ at 107,600–107,300 (78.6%–100% retrace of B→C).

⚔️ Trade Plan Recap

Entry: Long between 107,300–107,600

Stop: Below 107,000 (keeps risk tight)

Targets:

Zone 1: 61.8–78.6% of B→C → 110,657–111,569

Zone 2: 127.2–161.8% extension of A→B → 114,206–116,084

Remember: look for that bullish pin-bar or engulfing candle down in our PCZ before pulling the trigger, and bail if we lose 107,000. No time-based symmetry here—just clean price alignment. Trade with structure, not emotion, and keep an eye on any macro or on-chain news for extra context. ✌️

Bitcoin Daily, Mixed Situation · Bitcoin vs Altcoins · Not MixedI came with the intention of doing an update on the weekly timeframe, the chart doesn't look great.

Here we are looking at Bitcoin daily and once more the situation is mixed to say the least. It is hard to predict with exactitude with such a chart. In this case, we have to look for clues in other places. The altcoins.

But before we go there let's consider a few of the actualities that are present on the Bitcoin chart.

Bitcoin price action

Mixed or not mixed, the action continues to happen at resistance against all odds; this is bullish.

Bitcoin is trading safely above $106-$107,000 daily, and this is also bullish.

Bitcoin is trading above all moving averages we track and nothing is more bullish than that. MA200 sits around $96,000. EMA55 at $104,700 and EMA13 at $107,700.

Bitcoin will be bullish regardless as long as it trades above these levels and at a such strong price. So the mixed part is only psychological. It is mixed because people are afraid of a drop or want to see it drop. It is bullish based on the actual numbers and the chart.

The altcoins market vs Bitcoin

Some altcoins are breaking up today two to three digits green. Those good old reputable projects. This wouldn't be happening preceding a major bearish wave. Such strong action on the altcoins tends to precede a major bull market. Last week there were other pairs breaking really strong, the previous week another group, this week a new group and so on. Slowly but surely the low prices are disappearing but this isn't still a marketwide occurrence, we can see/say that the market is in no hurry.

Another relationship between Bitcoin and the altcoins relates to how many are behaving; when Bitcoin is about to crash, the altcoins tend to crash really strong and fast. The altcoins don't wait and just go down and continue diving deep if Bitcoin is about to produce a major crash. But this isn't the case, many altcoins are already at bottom prices but not based on a crash but a very slow and drawn out retrace. From these lows they are recovering strong.

When Bitcoin is bullish, sideways with a strong price within a bull market, the altcoins tend to grow. It is the same signal looked at from a different perspective. These altcoins are telling us that behind the scenes Bitcoin is bullish and we know Bitcoin is bullish because it is trading above $107,000. A bullish continuation is the next logical step.

Thank you for reading.

Boost if you agree.

Namaste.

$BTC (BITCOIN) 4HPrice previously rallied strongly from a Fair Value Gap (FVG) at the bottom of the chart, forming a bullish market structure.

After a bullish displacement, BTC consolidated in a tight range (reaccumulation) and swept internal liquidity before breaking down.

Now, price has returned to a critical discount zone around 107800–107600

First Target: 109,229 — internal range high.

Main Objective: 112,000 — resting external liquidity above a clean high.

As long as BTC holds above 107600, we remain bullish. The current area is perfect for accumulation before a potential expansion phase toward external liquidity.

BTC moving higher, 140K not that crazyIf you're looking to short BTC around the 110K range thinking "oh yeah, this is the fourth or so time its been at 110, I'll make a quick buck".. don't. This is looking very different.

BTC has already broken out of its current resistance channel and its now acting as support. You can see its bounced off of support once and its hovering around there again.

All that BTC needs to do it do a small move up past its ATH and it's off to the races.

If the bull flag pattern holds true the move could go as high as $140k.

BTC Storm of Consolidation, New Money, and Macro-PoliticsBitcoin at the Precipice: A Perfect Storm of Consolidation, New Money, and Macro-Political Tailwinds

In the intricate and often tempestuous world of digital assets, there are moments of frantic volatility and periods of eerie calm. Bitcoin, the undisputed king of cryptocurrencies, currently finds itself in one of these fascinating lulls—a state of high-altitude consolidation that is anything but sleepy. Trading just a whisper away from its all-time high, the asset is coiling like a spring, absorbing immense selling pressure from early adopters while simultaneously drawing in a new, powerful wave of buyers. This delicate equilibrium, however, is set against a backdrop of explosive potential catalysts. From tightening technical indicators screaming of an imminent breakout to the looming deadline of US tariffs, the vocal endorsement of tech titans, and the unprecedented entry of Bitcoin into the mainstream political arena, the stage is being meticulously set. The question on every analyst's and investor's mind is no longer if Bitcoin will make its next major move, but when, and just how monumental it will be. This is not just another market cycle; it is a convergence of forces that could propel Bitcoin toward price horizons that were once the domain of only the most fervent optimists.

The Anatomy of a Healthy Consolidation: Whales Recede as a New Foundation is Built

At first glance, a market that stalls just below its peak might seem like a sign of weakness, an indication that the bullish momentum has been exhausted. However, a deeper look into the current structure of the Bitcoin market reveals a picture of profound strength and maturity. This period of consolidation is characterized by a crucial and healthy rotation of ownership. The so-called "whales"—early investors and large-scale holders who have accumulated vast quantities of Bitcoin at much lower prices—are beginning to ease their holdings. This is not the panic-selling seen during bear market capitulations. Rather, it is a strategic and logical process of taking profits, de-risking portfolios, and realizing life-changing gains after a historic run.

Every Bitcoin sold by a whale must be bought by someone else, and the identity of these new buyers is what makes the current phase so compellingly bullish. The supply being released onto the market is not causing a price crash; instead, it is being steadily absorbed by a fresh cohort of participants. This new wave includes a diverse mix of players: retail investors who are gaining confidence as Bitcoin solidifies its mainstream status, smaller institutional players who are now more comfortable entering the market, and, most significantly, corporations that are beginning to view Bitcoin as a legitimate treasury reserve asset. This process is akin to the changing of the guard. The early pioneers are passing the baton to a new generation of holders who are establishing a new, higher cost basis. This dynamic is incredibly constructive for long-term price stability. It builds a robust and formidable wall of support at these elevated price levels, transforming what was once a speculative peak into a solid foundation for the next leg up.

Further evidence of this underlying strength can be seen in Bitcoin's recent weekly performance. The asset has managed to set another record high weekly close. In the world of technical analysis, a weekly close is considered far more significant than a brief, volatile intraday spike. An intraday high can be the result of a short-lived speculative frenzy or a liquidation cascade, but a high weekly close demonstrates sustained buying pressure and conviction over a longer duration. It signifies that, for seven straight days, buyers successfully defended higher price levels against sellers, ultimately winning the battle as the candle closed. This repeated ability to secure high weekly closes indicates that the market is systematically accepting and validating these new price territories, creating a psychological and technical launchpad for a future assault on all-time highs. Traders are now intensely focused on this dynamic, attempting to pinpoint the new, higher bottoms of this consolidation range, recognizing that these levels are likely to serve as the bedrock for the next major bull run.

The Technical Cauldron: Bollinger Bands Signal an Imminent and Violent Breakout

While the fundamental picture is one of healthy rotation, the technical charts are sending an even more urgent message: prepare for a massive move. Among the myriad of indicators used by traders, the Bollinger Bands are currently painting a particularly dramatic picture. Bollinger Bands consist of three lines plotted over a price chart. The middle band is a simple moving average, while the upper and lower bands are positioned at a set number of standard deviations away from the middle band. In essence, they are a direct measure of market volatility. When the market is volatile, the bands widen. When the market is calm and consolidating, the bands contract, or "squeeze."

Bitcoin is currently in the midst of one of the most significant Bollinger Band squeezes seen in recent history. The upper and lower bands have drawn incredibly close to one another, indicating that volatility has been wrung out of the market to an extreme degree. Historically, such periods of low volatility are the calm before the storm. A Bollinger Band squeeze is almost always resolved by a period of explosive, high volatility—a powerful breakout. The longer and tighter the squeeze, the more violent the subsequent price move tends to be. The indicator itself does not predict the direction of the breakout, but in the current context, the directional bias is overwhelmingly clear. With Bitcoin consolidating just shy of its all-time high after a powerful uptrend, and with the fundamental backdrop being so strong, the path of least resistance is overwhelmingly to the upside.

This technical setup creates a powerful psychological feedback loop. As more traders and algorithms spot the tightening bands, they begin to position themselves for the inevitable breakout. This builds a massive amount of potential energy within the market. When the price finally does break through the upper band, it can trigger a cascade of buy orders—from traders entering new long positions, to short-sellers being forced to buy back to cover their losing bets. This rush of buying pressure is what can turn a simple breakout into a parabolic, face-ripping rally.

The anticipation surrounding this move has led to some audacious price targets being discussed. Analysts are now contemplating the possibility of a "false move" to as high as $105,000. The term "false move" in this context is intriguing. It could imply a rapid, almost wick-like surge to that level, driven by extreme speculation and leverage, which might then be followed by a sharp correction to shake out the "paper hands" before a more sustainable climb resumes. Alternatively, it could simply be a way of expressing disbelief at the sheer velocity of the potential move. Whether the target is $105,000 or another figure, the underlying message from the charts is unambiguous: Bitcoin is on the verge of a big move, and the technicals strongly suggest it will be a powerful breakout to the upside, potentially ushering in a new phase of price discovery.

The Confluence of Catalysts: Tariffs, Politics, and The Musk Effect

A primed technical setup is potent on its own, but when combined with powerful external catalysts, it creates the recipe for a perfect storm. Bitcoin's next potential move is not just being driven by its internal market dynamics; it is being pulled forward by a confluence of macroeconomic and political forces that are aligning in its favor.

One of the most significant near-term catalysts is the looming US tariff deadline. Historically, periods of geopolitical tension and economic uncertainty have been incredibly bullish for Bitcoin. Tariffs, trade wars, and protectionist policies create instability in global markets and can erode the value and trust in fiat currencies. As nations engage in economic conflict, savvy investors and even central banks begin to look for non-sovereign, censorship-resistant stores of value to hedge their wealth. Bitcoin, with its decentralized nature and fixed supply, is the ultimate hedge against such fiat currency debasement and geopolitical turmoil. The impending tariff deadline is forcing a global conversation about the stability of the current financial system, and Bitcoin stands to be a primary beneficiary as capital seeks a safe haven from the storm.

Adding fuel to this fire is the upcoming "Crypto Week," a period of heightened focus on the industry through conferences, major announcements, and media coverage. These events act as a gravitational force, pulling the attention of the financial world toward the digital asset space. This concentrated attention almost always leads to increased trading volume and volatility. It creates a self-fulfilling prophecy where the expectation of big news and market moves encourages traders to participate, thereby creating the very volatility they anticipated.

Perhaps the most electrifying and unpredictable catalyst, however, is the re-emergence of Elon Musk's "love" for Bitcoin and the asset's dramatic entrance onto the main stage of American politics. Musk, with his colossal social media following, has a proven and unparalleled ability to influence market sentiment with a single post. His recent teasing of a "Pro-Bitcoin America Party" has sent shockwaves far beyond the crypto community. This move, whether serious or satirical, has injected Bitcoin directly into the heart of the US political discourse. It reframes Bitcoin not just as a financial asset, but as a political symbol—a representation of innovation, decentralization, and freedom from government control.

This has been met with a reaction from other major political figures, including Donald Trump, creating a fascinating push-and-pull. The fact that leading presidential candidates and political influencers are now debating Bitcoin's merits and role in the nation's future is a monumental step in its journey toward mainstream legitimacy. It forces the public and policymakers to take it seriously. This political theater creates an environment where assets perceived as being aligned with pro-growth, pro-innovation, and pro-freedom ideologies can thrive. The emergence of a "BTC Bull Token" or similar concepts tied to this political momentum underscores the new reality: Bitcoin is no longer just a tech story; it is a powerful political and cultural movement, and this new dimension is likely to attract a wave of capital from those who align with its burgeoning ideology.

The Institutional Stamp of Approval: A Corporate Treasury Revolution

While retail excitement and political drama provide the fuel, the institutional adoption of Bitcoin provides the solid, unshakeable foundation for its long-term trajectory. The most powerful recent example of this trend is the announcement from Genius Group, a publicly traded education technology company, that it is increasing its Bitcoin treasury target to a staggering 10,000 BTC. This is not a speculative trade; it is a profound strategic shift in corporate treasury management.

This decision signifies that corporate boards and CFOs are beginning to understand and act upon Bitcoin's value proposition as a superior treasury reserve asset. In an era of persistent inflation and low-to-negative real yields on traditional assets like government bonds, holding large amounts of cash on a balance sheet is a guaranteed way to lose purchasing power. By allocating a portion of its treasury to Bitcoin, Genius Group is taking a proactive step to protect its shareholders' value from the ravages of monetary debasement. It is a declaration of confidence in Bitcoin's long-term potential as a reliable store of value.

The importance of such a move cannot be overstated. It provides a powerful stamp of approval and a case study for thousands of other corporations around the world. When one publicly traded company makes such a bold move and outlines its rationale, it normalizes the strategy. Other CFOs, who may have been hesitant, now have a blueprint to follow and a precedent to point to when presenting the idea to their own boards. This has the potential to unlock a veritable floodgate of corporate capital. Even a small, single-digit percentage allocation from the treasuries of the S&P 500 companies would represent hundreds of billions of dollars of new, sustained buying pressure for Bitcoin. The move by Genius Group is not an isolated event; it is the leading edge of a seismic shift in how the corporate world perceives and utilizes money.

Conclusion: The Dawn of a New Epoch

Bitcoin stands at a historic inflection point. The current period of quiet consolidation is deceptive; beneath the surface, a powerful confluence of forces is converging to launch the asset into its next major chapter. The market's internal structure has never been healthier, with the holdings of early whales being patiently absorbed by a new and committed class of buyers, building a formidable price floor far above previous highs. The technical charts are screaming of an imminent and powerful breakout, with the tightening Bollinger Bands signaling a massive release of energy that heavily favors the upside.

Layered on top of this potent technical and structural setup is a perfect storm of external catalysts. The specter of global economic instability driven by tariffs, the focused attention of a "Crypto Week," the unparalleled influence of figures like Elon Musk, and the shocking but legitimizing entry of Bitcoin into the partisan political arena are all acting as powerful tailwinds. This is all underpinned by the quiet but revolutionary trend of institutional and corporate adoption, which promises to bring waves of new capital into the asset for years to come.

The consolidation will soon end. The question is not about direction, but about magnitude. The forces at play are no longer just about market cycles; they are about a fundamental repricing of a global, non-sovereign asset in a world grappling with economic and political uncertainty. The stage is set for a breakout that could not only shatter previous all-time highs but could also permanently elevate Bitcoin's status, solidifying its role as a cornerstone of the 21st-century financial and political landscape.

BTCUSD What Next? BUY!

My dear subscribers,

My technical analysis for BTCUSD is below:

The price is coiling around a solid key level - 10750

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 10825

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTC — Weekend Pump Fades.. All Eyes on the Gartley Reversal ZoneBitcoin has been consolidating in a tight range between $110K and $105K over the past two weeks. This weekend’s attempted breakout stalled out quickly! BTC was rejected at the Point of Control (POC) of the previous range and came close to the 0.786 retracement of the recent drop.

🧠 Reminder: Weekend pumps are notorious for being unreliable, especially without strong volume.

Now, the charts point toward something much more structured — a potential Gartley harmonic pattern forming, with multiple levels of confluence suggesting the next key decision zone is just around the corner.

🧩 Gartley Completion Zone: $106,290–$106,400

This price zone is loaded with confluence:

✅ 0.786 Fib retracement of the XA leg sits at $106,290

✅ 1.0 trend-based Fib extension of the BC leg is at $106,370

✅ Anchored VWAP from all-time high aligns precisely at $106,370

✅ VAL (Value Area Low) sits at the same level

✅ Imbalance (Fair Value Gap) from earlier price inefficiency lies in this exact region

All of this stacks up into a high-probability reaction zone.

🎓 Educational Insight: How to Trade a Gartley Harmonic

The Gartley pattern is one of the most powerful harmonic setups — a structured form of retracement and extension that captures exhaustion before reversals. Here's how it works:

🔹 XA: Impulse leg

🔹 AB: Retracement of 61.8% of XA

🔹 BC: Retraces 38.2%–88.6% of AB

🔹 CD: Extends to 78.6% retracement of XA and aligns with a 1.0–1.272 Fib extension of BC

🟢 Point D is the entry zone — your reversal opportunity.

📉 Stop-loss sits just below invalidation (Point X).

💰 Targets usually lie at 0.382 and 0.618 of the CD leg.

🔎 Why It Works: It traps late traders and captures price exhaustion at natural Fibonacci ratios. Combined with other tools — like VWAP, liquidity zones, and order flow — it becomes a high-conviction strategy. These patterns are most effective on higher timeframes like 4H or daily.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

BITCOIN Short-term Target = $117kBitcoin (BTCUSD) is coming off a 4H Golden Cross, attempting to hold the 4H MA50 (blue trend-line) as its short-term Support. The early hours of the E.U. session today show that this might be a difficult task, however comparison with May's Bullish Leg, gives positive signs.

Almost the entire month of May sequence has been an uptrend, which looks very similar to today's. Almost identical rises from their bottoms (+13.60% against +12.60%) until the first top, with similar 4H RSI fractals also, we can expect the current uptrend to make a second top soon near the 1.5 Fibonacci extension at $117000.

Are you expecting such an outcome in the coming days? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇