BTCUSD | 1W Time Frame | BITSTAMP ExchangeI have been using curve analysis for Bitcoin on the weekly time frame for a long time, employing two indicators: My BTC Log Curve and Bitcoin Logarithmic Growth Curves, of course, with my own custom settings to achieve maximum harmony with price movements. I recommend that to gain a precise understanding of Bitcoin curve analysis, you search for and study it, and make use of the two free indicators mentioned above.

Bitcoin finally managed to break free from the curve floor in the second week of September 2023, initiating a logical and gradual upward trend. Currently, it is supported by a significant level around $84,000 (keeping in mind that this rate will gradually increase due to the market's floating nature). However, the most critical price ceiling for Bitcoin in the current bullish market trend is approximately $154,000. Given the acceptable momentum of the current upward trend, reaching this price target seems reasonable. Nevertheless, we should anticipate a corrective reaction from the market, considering the historical behavior in this price range.

In summary, it can be stated that for mid-term holders, the price target of $154,000 appears to be a realistic and attainable goal, while the price floor of $84,000 serves as a very suitable level for buying and re-accumulating.

BTCUSD.PM trade ideas

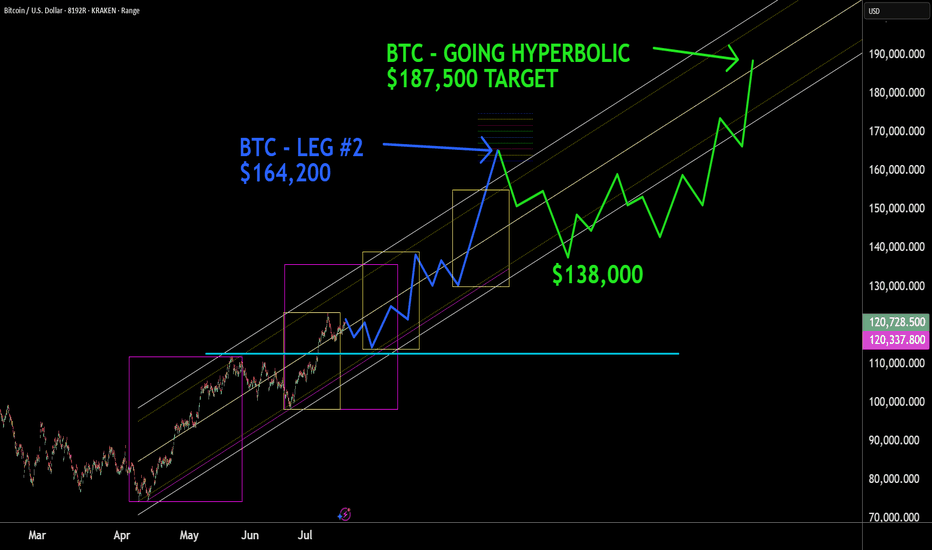

BTC - HYPERBOLIC FINISH This box here where we right shit in, what it really worth? You will never understand technical analysis if you think reading words in a little box mean something. BTC , next top mid frame with a throw over of center to $164,000. Then consolidation around the core to $138,000, then the hyperbolic finish to $187,500+. Nuf said. Good luck. Volatility will be high, but mainly move in one direction. Murrey Math, ( Which trading view wont let me display because its an unpublished indicator , Elliott Wave, Kumar Wave being used for this forecast.

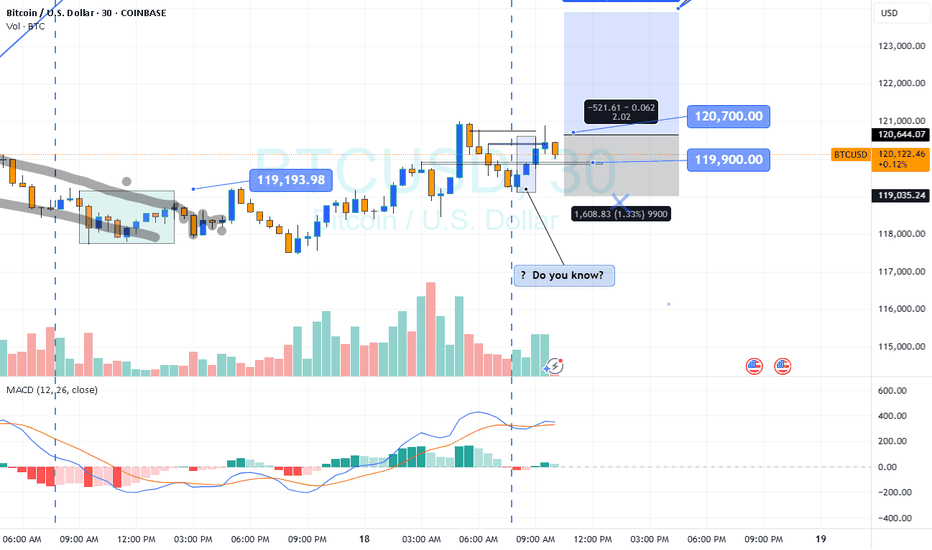

BTC intra?

Hi

Do you know?

www.investopedia.com

If your initial plan is BUY.. whatever reasons: Fundamental/ outlook buy

We'll take this trade; reason

Two Yeses : Outlook BUY Pattern BUY

How will it react?

Answer: I don't know

High probability : Yes

Where do you enter? Your preference

wait retrace or now... just

If you wait.. might not get the ticket

If calculate between entry and stop loss: pips

And divide by what you re risking in $ to pips

All the best

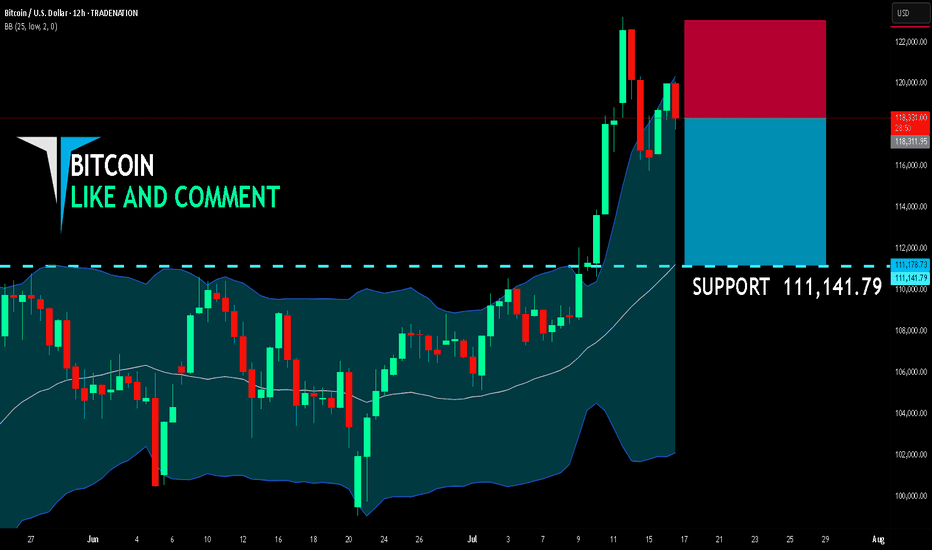

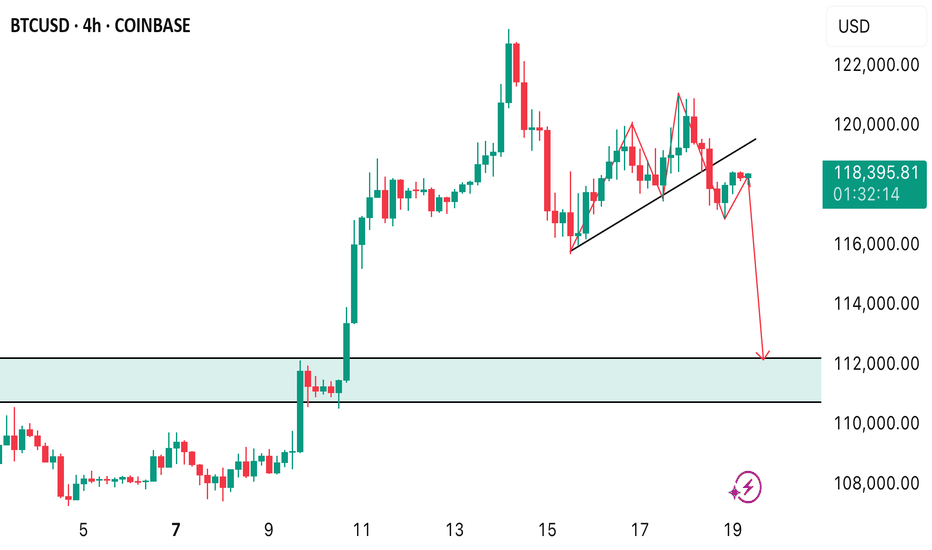

BITCOIN SHORT FROM RESISTANCE

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 118,311.95

Target Level: 111,141.79

Stop Loss: 123,054.98

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

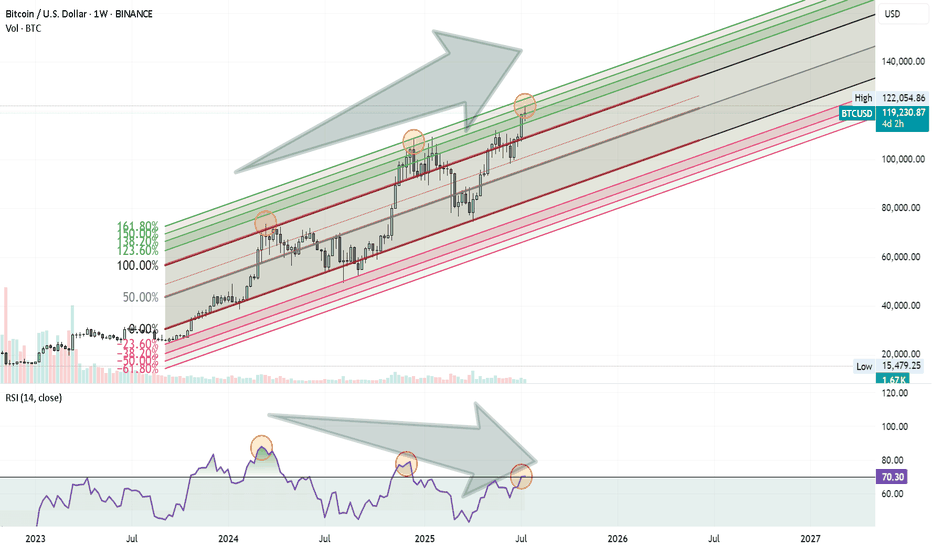

Bitcoin Rally Losing Steam?Bitcoin might be approaching a Turning Point . Here’s what I’m seeing on the weekly chart:

Price is moving inside an ascending Fibonacci channel.

It’s getting close to the 1.60 (160%) extension level, which has acted as a reversal zone before.

At the same time, the RSI is showing a clear negative divergence, suggesting that momentum is weakening.

These signs combined could mean we’re not far from a significant correction.

Nothing is confirmed yet, but it’s a setup worth keeping an eye on.

BTC Hits Predicted 1.618 Fibonacci Target at $122K — What’s Next🎯 BTC Hits Predicted 1.618 Fibonacci Target at $122K — What’s Next?

📅 Posted on: July 16, 2025

📍 Ticker: BTCUSD (BINANCE)

✍️ Author: @darwas121

⸻

🔹 Summary

In October 2023, I shared a long-term bullish projection for Bitcoin (BTC/USD) targeting the 1.618 Fibonacci extension level — projected around $122,000. As of today, BTC has successfully hit this target, validating the Fibonacci-based wave structure and bull market thesis. Now the key question is — what’s next?

⸻

🧠 Prediction Recap (Oct 2023)

• ✅ Projected rally continuation based on wave structure + Fibonacci expansion

• ✅ Long-term target: $122,056 (1.618 Fib level)

• ✅ Based on swing low near $15,550 and prior ATH structure

• ✅ Conditions: Confirmed breakout above $81,500

⸻

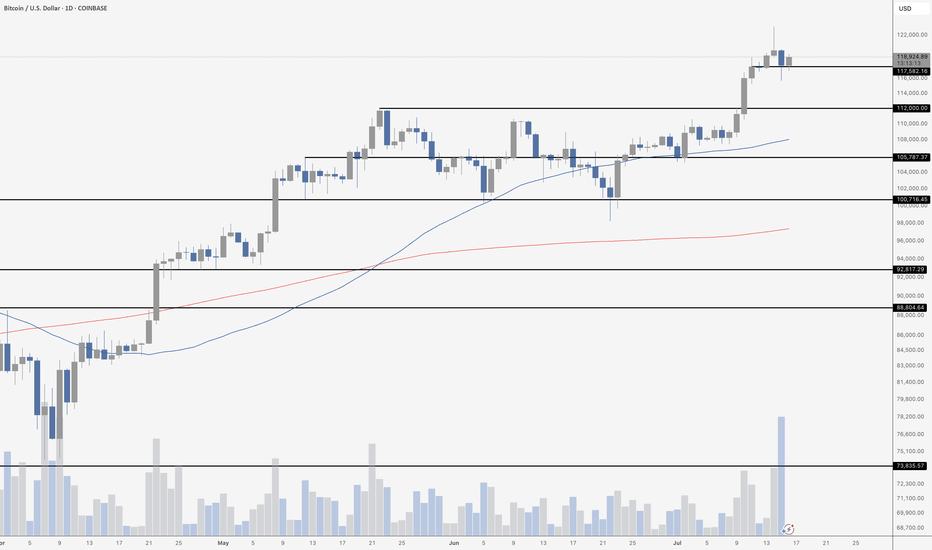

🔍 Current Technical Analysis (1D Chart)

💰 Price Action

• Current Price: $118,701

• Recent High: $122,056 (exact 1.618 Fib hit)

• Structure: Parabolic breakout from previous consolidation range

🔺 Fibonacci Levels

Level Price (USD)

0.236 31,237

0.382 40,849

0.5 48,618

0.618 56,386

0.786 67,092

1.0 (ATH Zone) 81,536

1.618 ✅ 122,056 (Hit)

📉 RSI & Momentum

• RSI is hovering in the overbought zone (>70), signaling potential cooling-off

• Stochastic RSI also indicates overextension — a pause or retracement could follow

• No bearish divergence yet, but watch closely

📊 Volume Trends

• Volume has tapered during this leg up — possible early sign of buyer exhaustion

• Previous volume clusters between $56k–$67k now act as strong support

⸻

⚠️ What to Watch Next

Risk Factors Notes

Overbought RSI Suggests short-term pullback risk

Weakening Volume Caution: Less conviction in highs

Parabolic Structure Vulnerability Break could mean fast correction

⸻

🧭 My View & Strategy

🔹 Short-Term: ⚠️ Cautious

• Book partial profits if holding from lower levels

• Watch for reversal candles near $122k zone

• RSI divergence or low-volume rally = yellow flag

🔹 Mid-Term: 🔼 Bullish

• Buy-the-dip zones: $67k (0.786) and $56k (0.618)

• Any correction into these zones may offer re-entry

🔹 Long-Term: 🔼 Strong Bullish

• BTC is in confirmed macro uptrend

• Sustained close above $122k opens price discovery zone

• Next logical Fib projection zones: $135k–$150k

⸻

📌 Key Levels

• Support: $81,536 / $67,092 / $56,386

• Resistance: $122,056 → Break = price discovery

• Invalidation Zone: Breakdown below $81,000 on volume

⸻

📣 Conclusion

The technical roadmap laid out in 2023 has now played out — Bitcoin has achieved its 1.618 Fibonacci extension target. We are now at a critical inflection point. If BTC consolidates well here and maintains volume, the next leg could launch us into new all-time highs beyond $135,000.

🛑 But caution is warranted — overbought signals + weak volume could bring a healthy correction first. Stick to your risk plan. Let the market come to you.

⸻

💬 Feel free to share your views or ask for updates in the comments.

🔔 Follow me for more swing-to-position analysis using volume, fibs & structure.

📊 Chart shared below for reference.

#Bitcoin #BTCUSD #Crypto #TechnicalAnalysis #Fibonacci #PriceTargets #CryptoForecast #ParabolicMove #BTC

Bitcoin Roadmap to $144K by September – Daily Chart Breakout SetHello traders,

I'm sharing my current outlook on Bitcoin using the daily timeframe. Price is ~109K below a key descending trendline (in red), which has defined the structure since 21 May.

🔍 Key Levels to Watch:

Resistance: $111,000

Support: $91,000

Current Price: ~$109,000

⚡ Breakout Scenario:

If Bitcoin closes above $111K on the daily chart, backed by strong volume (ideally 30% above the 20-day average), I expect the next targets to unfold as:

✅ $122,000

✅ $133,000

✅ $144,000

🗓️ Target date for $144K: Around 22 September 2025

This projection is based on a pivot structure I’m tracking:

🟢 25 March 2025: Pivot low at ~$84K

🔴 12 June 2025: Pivot high

🟡 Expected pivot high: ~4 September 2025 (if symmetry holds)

This pattern suggests a 1-2-3 formation that could lead to a breakout move.

🧯 Failure Scenario:

If BTC fails to break out, I’m watching for a pullback toward the $91K support zone.

🛑 Current Stance:

I’m not in a position yet. Waiting for a daily candle close above $111K with volume confirmation and momentum indicators.

📣 Stay Updated

I’ll be sharing daily updates as the price action evolves.

Follow me here on TradingView, and feel free to share your analysis or ask questions in the comments!

🏷️ Hashtags:

#BTCUSD #BitcoinAnalysis #CryptoTrading #BTC #TechnicalAnalysis #SwingTrade #BreakoutSetup

Let me know your comments.

Bitcoin Dips On High VolumeThe Bitcoin daily chart paints a nuanced picture following Tuesday’s pullback – which came on the highest volume day since the $74K bottom in mid‑April, specifically on Coinbase. But notably, that surge in volume was primarily driven by selling, not buying – a key detail that shifts the tone of the candle.

Despite the aggressive downward move, price found support around $116,000 and recovered into the close, finishing the day above $117,000. However, the heavy sell volume behind that move suggests it wasn’t just a casual dip – it was real distribution.

That said, bulls showed resilience on Wednesday, pushing price back toward $119,000 and defending the key $116,000–$118,000 zone. If Bitcoin can maintain this level and digest the selloff without rolling over, it may absorb the supply and build a base for continuation.

But traders should stay cautious – high‑volume sell days near local highs can sometimes mark short‑term tops or signal a shift in momentum. The $112,000 breakout zone remains the critical downside level to watch if the current range fails.

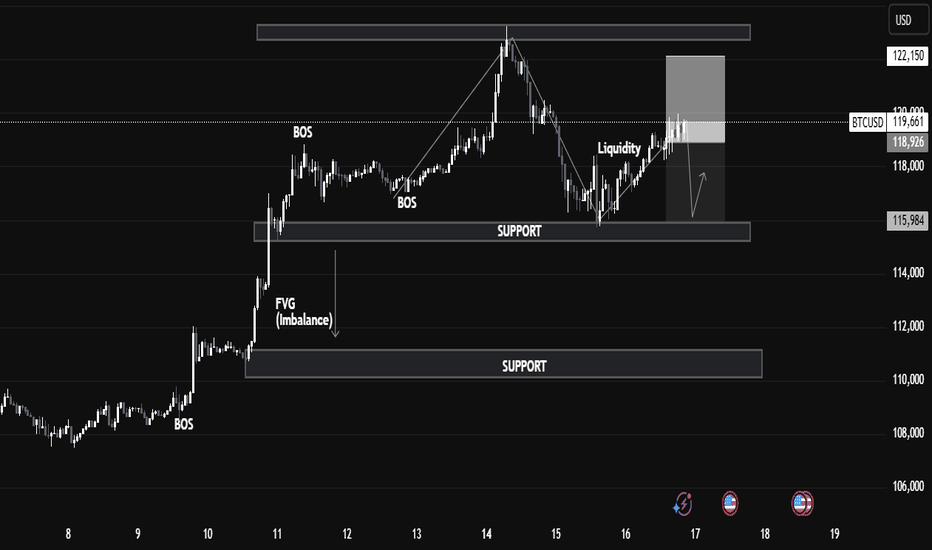

BTCUSD - Smart Money Trap Before the Next Move?1. Market Structure & BOS (Break of Structure):

We can observe multiple BOS levels around July 10–12, signaling a strong bullish transition.

2. Break of Structure (BOS)

Definition: BOS occurs when price breaks above a previous swing high with conviction.

Application on Chart: The BOS on July 11 marked the continuation of bullish market structure.

This indicated strong buying pressure, often driven by institutional order flow.

📉 3. Fair Value Gap (FVG)

Definition: A Fair Value Gap is an inefficiency or imbalance in the market where price moves too quickly, skipping potential orders.

On Chart: The FVG is present between July 11–12.

Expectation: Price often returns to these zones to “rebalance” or mitigate orders before continuing the trend.

Educational Note: FVGs act as magnet zones and are often used to identify entry points or liquidity pools.

💧 4. Liquidity Sweep

Definition: A liquidity grab occurs when price spikes above a recent high or low to trigger stop-loss orders before reversing.

On Chart: Just above resistance, a liquidity grab took place.

Purpose: Institutions often sweep liquidity before large moves to fill larger orders.

🔹 Resistance & Supply Zone:

The resistance area between 122,150–123,500 has held firmly, causing a notable correction.

This region aligns with institutional order blocks, suggesting potential smart money selling.

🔹 Support & Demand Zone:

The nearest support zone lies at 115,984, marked by previous consolidation and BOS.

Price is likely to revisit this zone, acting as a retest for demand re-entry, providing a strong buy-side opportunity if confirmed.

🔹 Current Price Action:

BTC is consolidating around 119,253, with a possible liquidity sweep above short-term highs.

Are we on Super Bullish Express Highway ? Elliott Waves RoadmapHello friends,

Welcome to RK_Chaarts

Today we're attempting to analyze Bitcoin's chart, specifically the BTCUSD chart, from an Elliott Wave perspective. Looking at the monthly timeframe chart, which spans the entire lifetime of Bitcoin's data since 2011, we can see the overall structure. According to Elliott Wave theory, it appears that a large Super Cycle degree Wave (I) has completed, followed by a correction in the form of Super Cycle degree Wave (II), marked in blue.

Now, friends, it's possible that we're unfolding Super Cycle degree Wave (III), which should have five sub-divisions - in red I, II, III, IV, & V. We can see that we've completed red I & II, and red III has just started. If the low we marked in red II doesn't get breached on the lower side, it can be considered our invalidation level.

Next, within red III, we should see five primary degree sub-divisions in black - ((1)), ((2)), ((3)), ((4)) & ((5)). We can see that we've completed black ((1)) & ((2)) and black ((3)) has just started. Within black ((3)), we should see five intermediate degree sub-divisions in blue - (1) to (5). Blue (1) has just started, and within blue one, we've already seen red 1 & 2 completed, and red 3 is in progress.

So, we're currently in a super bullish scenario, a third of a third of a third. Yes, the chart looks extremely bullish. We won't commit to any targets here as this is for educational purposes only. The analysis suggests potential targets could be very high, above $150,000 or $200,000, if the invalidation level of $98,240 isn't breached. But again, friends, this video is shared for educational purposes only.

Many people think that the market doesn't move according to Elliott Waves. But friends, here we've tried to analyze from the monthly time frame to the overly time frame. We've definitely aligned the multi-time frame and also aligned it with the principal rules of Elliott Waves, without violating any of its rules.

I agree that the Elliott Wave theory can be a bit difficult, and for those who don't practice it deeply, it can be challenging. But yes, the market moves according to this methodology, following this pattern. This is a significant achievement.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

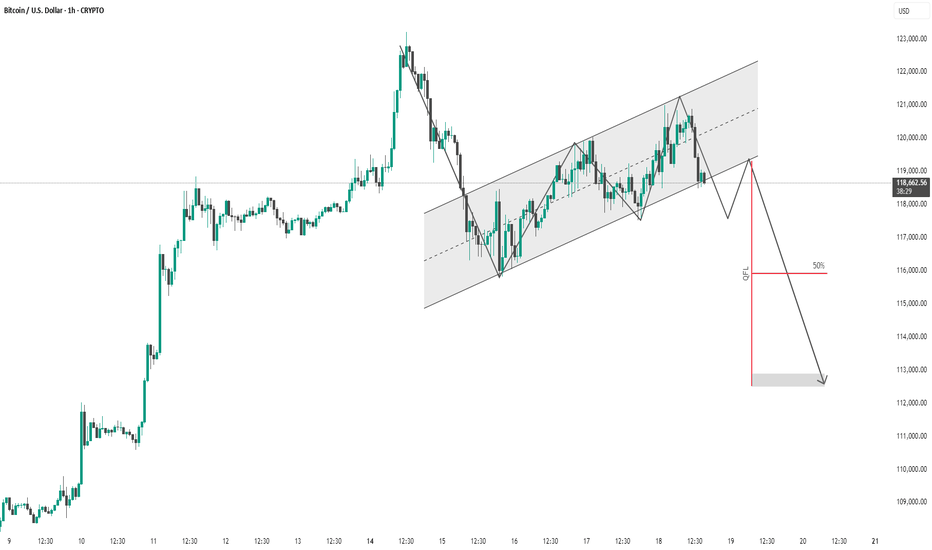

BTC #1-hour chart of Bitcoin (BTC/USD)This is a 1-hour chart of Bitcoin (BTC/USD) with a clear bearish outlook indicated by the analysis:

Key Observations:

Rising Channel:

Price has been moving inside an ascending channel.

Currently testing the lower boundary, suggesting potential for a breakdown.

Price Projection:

A sharp drop is anticipated after breaking the channel, supported by the downward black arrows.

The analyst anticipates a retest of the lower boundary followed by a rejection and continuation downward.

QFL Strategy Reference:

"QFL" (Quick Fingers Luc strategy) is marked with a red line, identifying a key support zone that price may break below.

50% level (retracement or zone midpoint) is noted for confluence.

Target Zone:

Final target appears to be in the $112,500 – $113,000 range.

Summary:

The chart presents a bearish thesis expecting BTC to break the ascending channel and fall toward a previous demand zone marked by the QFL level. The structure supports a short setup if the lower trendline fails to hold.

Risk Note: This is a speculative forecast; always confirm with volume, broader market context, or confirmation patterns.

thank u

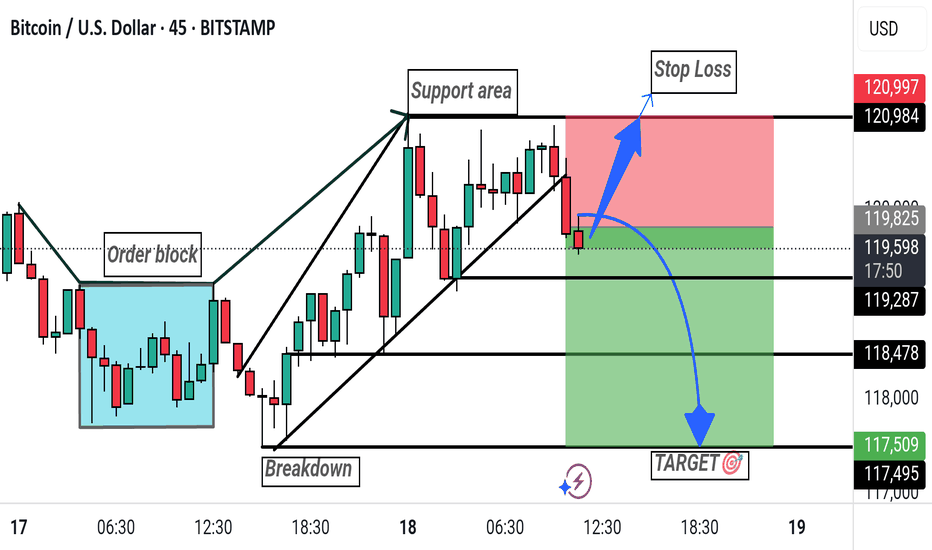

"Bitcoin Bearish Setup: Breakdown Targeting 117,509"This Bitcoin (BTC/USD) 45-minute chart shows a bearish setup with key levels marked. After a breakdown from the support area, price is expected to drop. The suggested short entry is just below 119,639, with a stop loss at 120,984 and a target at 117,509. The chart highlights an order block, support area, and projected downward move.

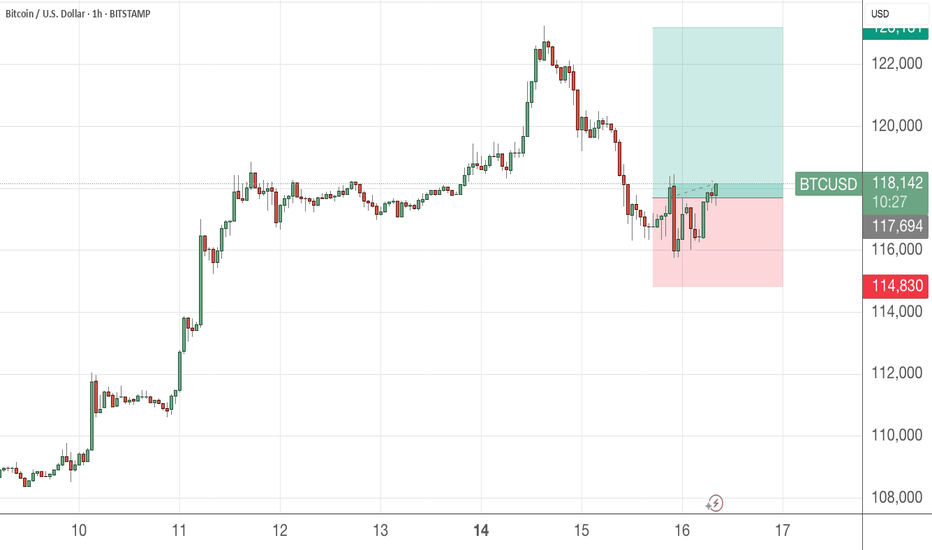

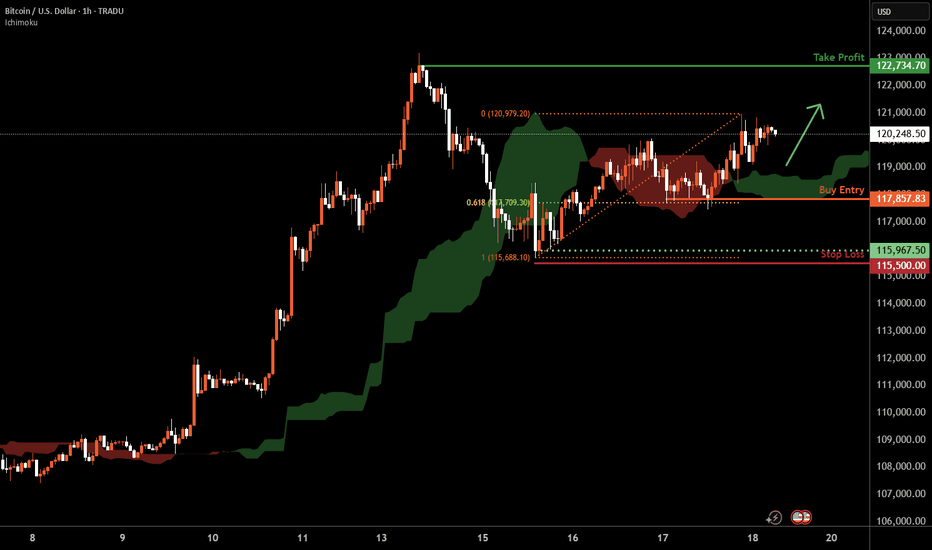

Bitcoin H1 | Falling toward a 61.8% Fibonacci supportBitcoin (BTC/USD) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 117,857.83 which is a swing-low support that aligns with the 61.8% Fibonacci retracement.

Stop loss is at 115,500.00 which is a level that lies underneath a swing-low support.

Take profit is at 122,734.70 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

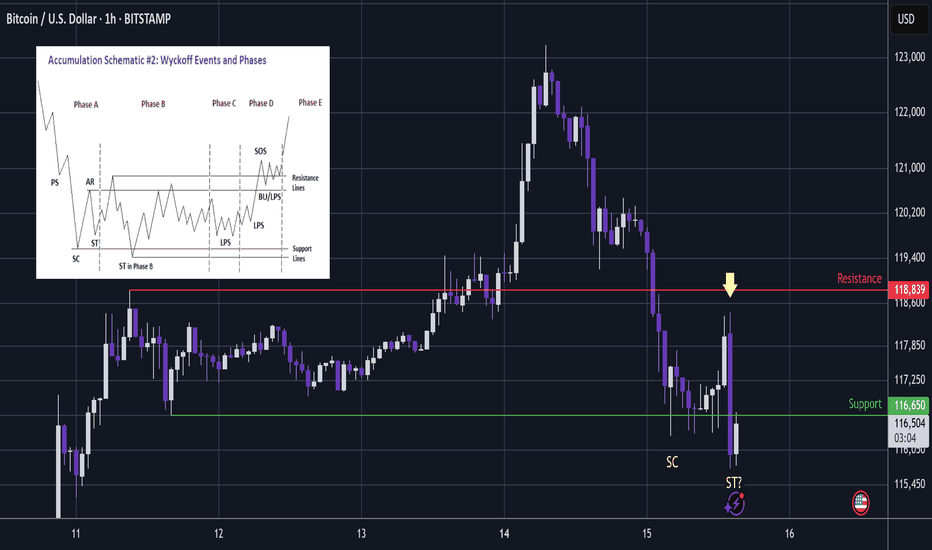

BTC - Capitulation. Now Time For A Bounce?Whenever there is a big impulsive rally, dumb money will come rushing in to buy.

And thus we can somewhat expect the market maker to print a shakeout for them to exit at best price and dumb money to carry the bags at worst price.

...

In this area we have multiple charts providing the liquidity zones for the shakeouts:

The upside shakeout (long wick) printed on TOTAL through ATH:

...

Before I make the next point, lets see the design of the chart bots 10 years ago in 2015.

Notice that the high and low of the trading range is set by the impulsive high then initial slump:

That sets the trading range.

Once set; the chart bots then print a liquidity sweeping slightly higher high...

Which slumps back to liquidity sweep the lows of the trading range.

From there the next wave up begins.

...

Now notice in these charts from the last 2 days, that the trading range was similar to that of 2015.

But once the range was set; rather than printing a simple slightly higher high, the more evolved chart bots printed a wild impulsive move up to draw in buyers.

This then became a very impulsive smackdown.

...

Although going on a wild journey, the price is effectively similar to the pattern of 2015; liquidity sweep at the highs and now it is below the low.

Notice on these 2 charts from the last two days that the support that Bitcoin has hit today was the obvious trading range low - similar to 2015.

And so the question is now; whether it will also be a liquidity sweep at the lows and a bounce will follow?

Notice on the chart, there was a big smackdown and then we have had another fast smackdown (arrow) to take price beneath the lows.

This looks very much like a fear test - where the chart bots try to sell you another immediate capitulation, but yet the price holds in the zone of higher liquidity below support.

Wyckoff would call these 2 lows SC Selling CLimax and ST Secondary Test.

The selling climax completes the real bearish wave down.

Secondary Test is the probe into higher liquidity which is a fear test to scare longs away.

...

So if we consider that history may not repeat, but it does rhyme then there will likely be a bounce in this area - as the market maker gets best price for their short positions while dumb money panic sell their long positions at a loss.

Not advice

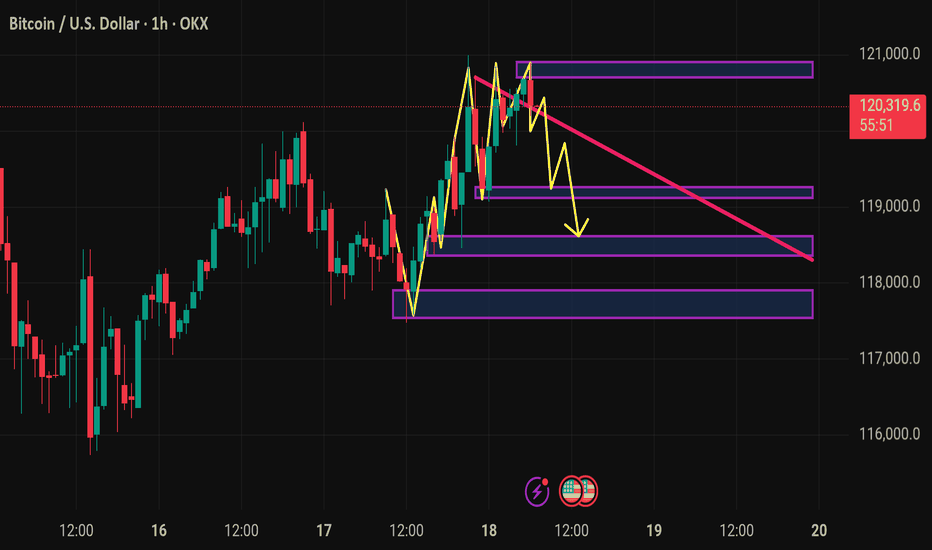

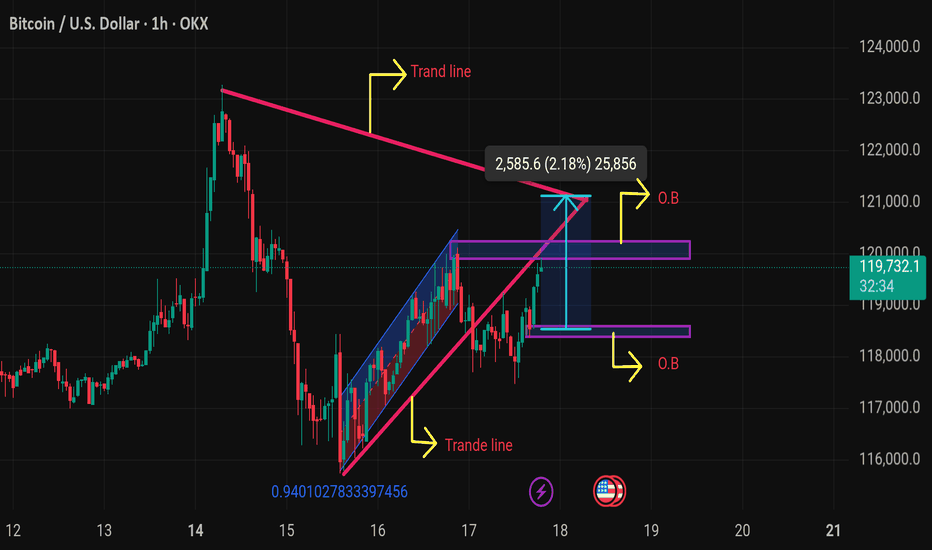

Btcusd techinical analysis.The chart shows a BTC/USD (Bitcoin vs. US Dollar) technical analysis on the 1-hour timeframe. Here's a detailed breakdown:

---

🔍 Chart Elements & Interpretation:

1. Trend Lines:

Upper Pink Trend Line: Acts as a resistance from a previous high.

Lower Pink Trend Line: Represents a support line from the recent upward trend.

Blue Channel: Shows a rising wedge or ascending channel (often a bearish reversal pattern).

2. O.B (Order Blocks):

Upper O.B Zone (~120,000–121,000): Potential supply zone or area of resistance.

Lower O.B Zone (~117,500–118,500): Possible demand zone or support.

3. Price Projection:

A measured move of 2,585.6 points (2.18%) is marked upward from the current breakout attempt.

4. Current Price:

BTC is trading at $119,771.8, with a +0.90% increase at the time of this chart.

---

🧠 Technical Outlook:

Bullish Case:

Breakout above the upper trend line and clearing the upper O.B could lead to a continuation toward 122,000+.

If BTC respects the demand zone and bounces, the uptrend may resume.

Bearish Case:

Failure to break above resistance or rejection at