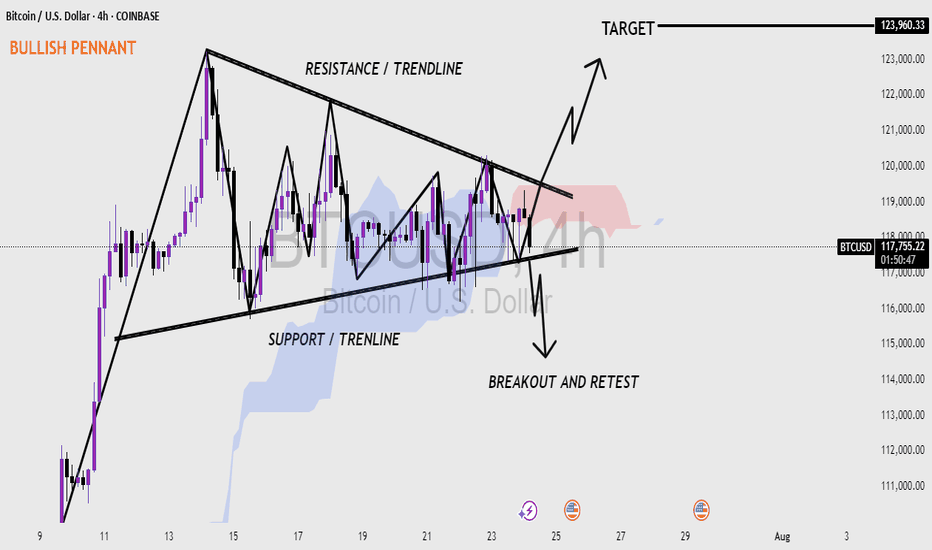

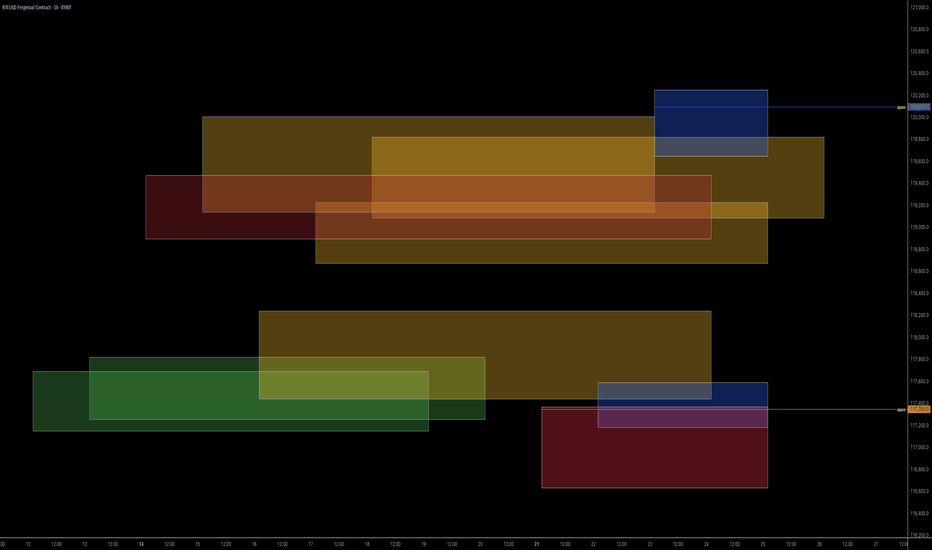

Bitcoin (BTC/USD) 4H CHART - BULLISH PENNANT PATTERN 📊 Bitcoin (BTC/USD) 4-Hour Chart – Bullish Pennant Formation

Bitcoin (BTC) forming a bullish pennant pattern on the 4-hour timeframe.

A bullish pennant often appears after a strong upward move, followed by a period of consolidation, and usually signals a continuation to the upside.

🔍 Key Highlights:

Pattern: Bullish Pennant – a continuation pattern that forms after a strong rally (flagpole), followed by a tightening price range.

Resistance Trendline: The upper black line showing lower highs — where price has repeatedly faced selling pressure.

Support Trendline: The lower black line showing higher lows — where buyers have been stepping in.

Breakout Zone: Price is nearing the apex of the pennant. A breakout above the resistance line would likely confirm the bullish move.

Target Projection: If the breakout is successful, the target is around $123,960, based on the height of the flagpole.

Breakout and Retest: The chart also shows a possible retest of the trendline after breakout, which is common and can offer a second entry point for traders.

Volume Watch: A valid breakout usually comes with increased volume. Monitoring this can help confirm the move.

📉 Downside Possibility:

If the price fails to break out and falls below the support trendline, it could invalidate the pattern and lead to a bearish move — possibly retesting the $110,000 area.

---

The market is at a decision point. If BTC breaks above the resistance and retests successfully, it could push toward $123K. However, traders should watch for both breakout confirmation and false moves.

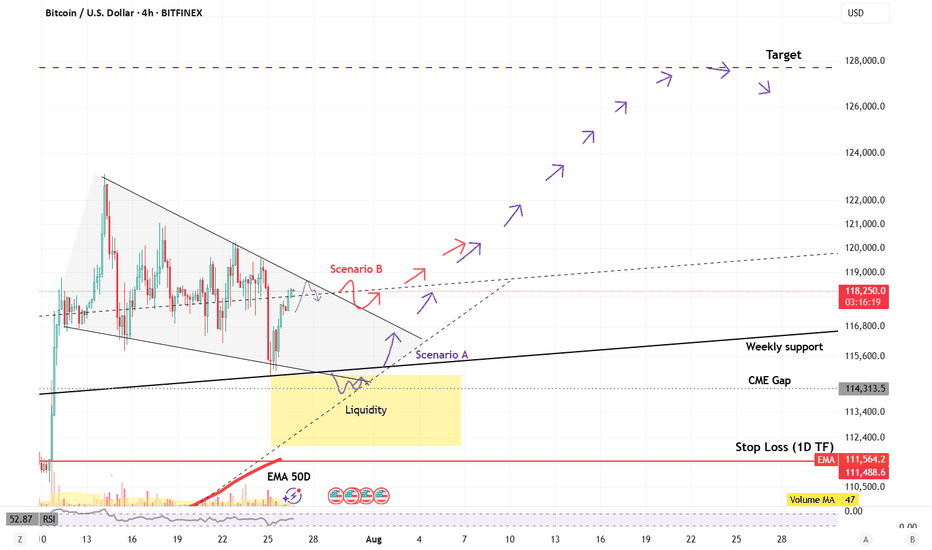

BTCUSD.PM trade ideas

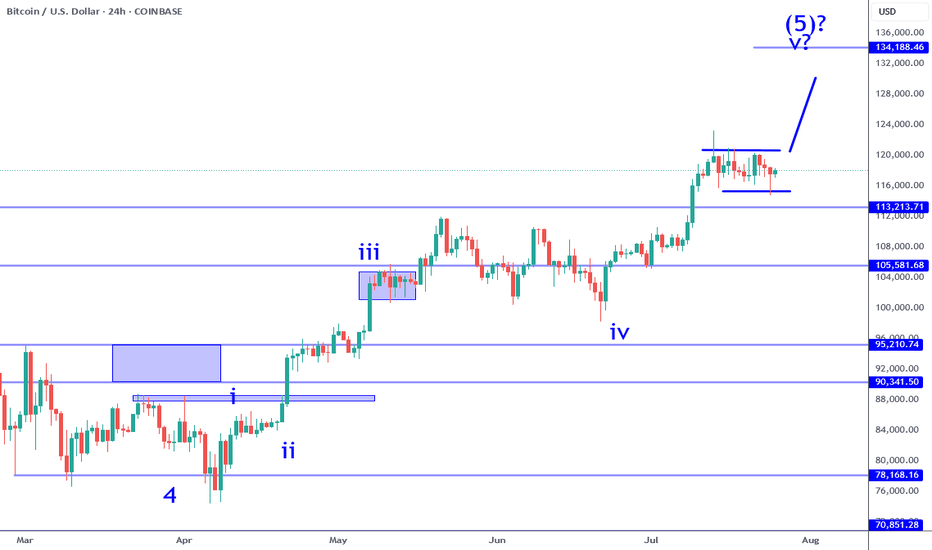

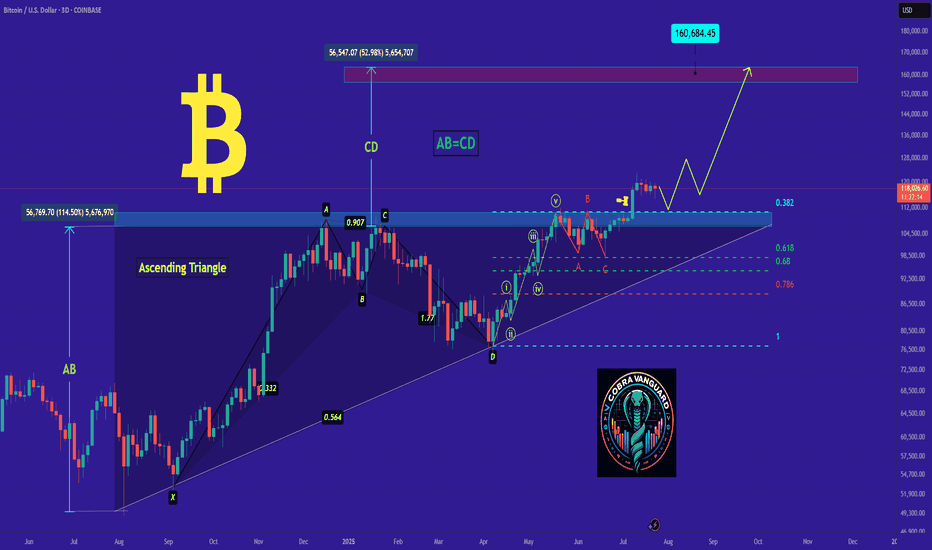

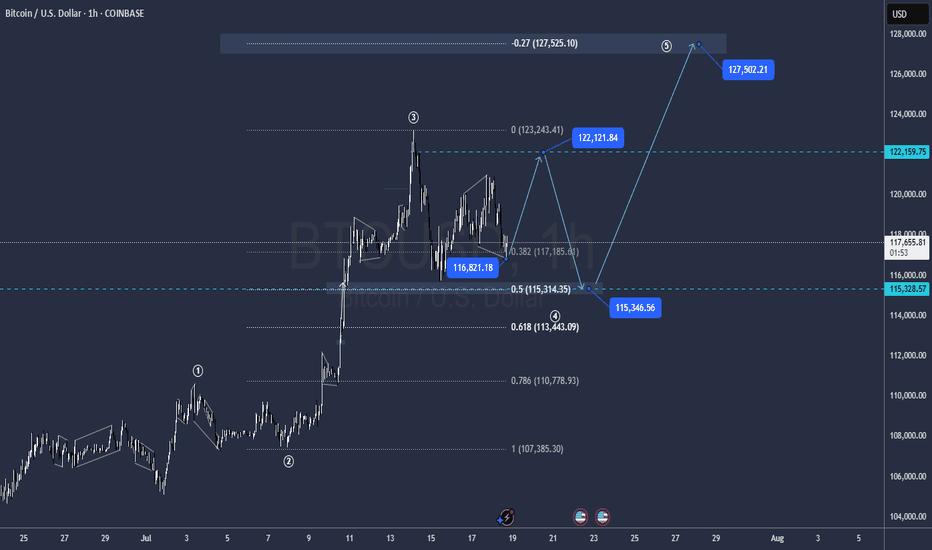

Bitcoin Still Consolidating For Wave 5 RallyBitcoin sub wave 4 consolidation continues to persist. While there was a failed break out over the previous week, it has not changed the bullish impulse at all. The current structure implies that there is a higher probability that one more leg higher (sub wave 5) is likely. It could be the coming week or next, it is all a function of catalyst. Keep in mind this consolidation can test as low at 113K and still be within the criteria of a wave 4. There are numerous opportunities in this situation when it comes to day trade and swing trade longs.

The break out: IF price pushes beyond 120K with conviction (large sustained candle on this time frame) that would be a swing trade long signal. IF there is no instant pullback (fake out), this can be the momentum required to test the 130Ks. Keep in mind, there is an inflection point in the 133K area which serves as a profit objective to measure from. Price can potentially go beyond that point, but participating in that is all about waiting and watching how price behaves. There is NO way to know how this will play out in advance. You have to adjust as new information becomes available.

The retest: if price pulls back into the 116K to 113K area and establishes a reversal on this time frame (or on adjacent time frames like 4H). This can appear in numerous ways: pin bar, engulfing candle, inverse head and shoulders, etc. This scenario would offer greater potential especially if the break out occurred soon after (high probability). IF the 113K level breaks instead, it will put the impulse structure into question. Meaning the probability of a wave 5 to follow will become lower.

This environment in my opinion is not easy to navigate for traders. People who bought into the alt coin weakness months ago are now getting paid and enjoying "alt season", which is great but not good if you are looking to buy something now with a longer time horizon in mind. Wave 5's often signal a corrective move is likely to follow and Bitcoin is potentially completing a very large magnitude Wave 5. I have been pointing this out for months. Most investors will ignore this because they will be biased by greed. The wise this to do is lock in profits along the way at inflection points such as whole numbers, price proportions (like 133K) and/or clear candle reversal signals after significant moves.

Thank you for considering my analysis and perspective.

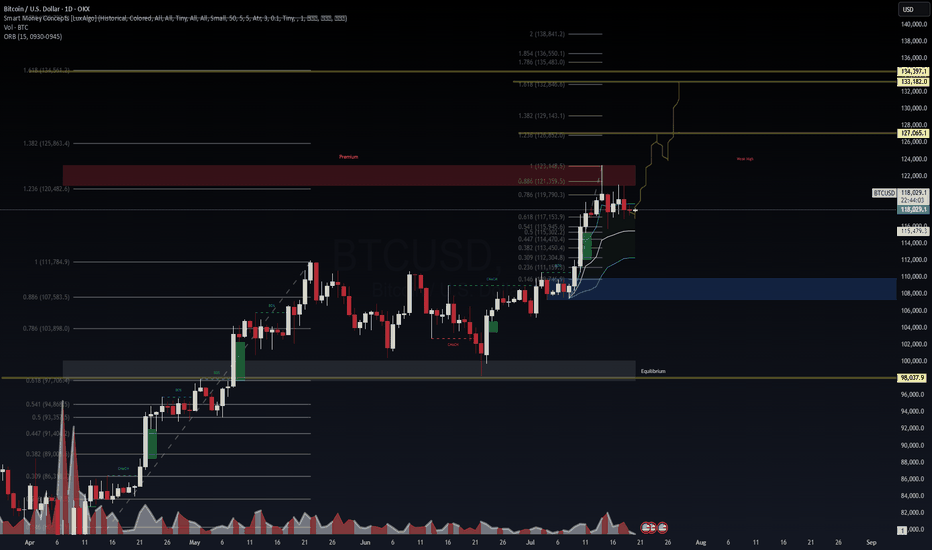

BTCUSD Outlook – Probabilistic Trade Setup in AI Liquidity Cycle

📈 BTCUSD Outlook – Probabilistic Trade Setup in AI Liquidity Cycle

🧠 WaverVanir DSS | VolanX Protocol | SMC x Institutional Forecast Alignment

We are now entering a pivotal BTC phase. Multiple timeframes and AI-backed forecasts converge on a low-volatility accumulation breakout, with price structure aligning for a leg toward $127K–134K. However, short-term model dispersion requires precise risk management.

🧠 Technical Confluence (SMC + Fib):

Clean BOS + CHoCH confirms bullish structure

Retest of equilibrium zone around $116.8K–$117.2K

Institutional FVG demand sits at $115.4K

Fibonacci extensions align with:

🎯 Target 1: $127,065

🎯 Target 2: $133,182

🎯 Max Extension: $134,397

🌐 Macro + Fundamental Catalysts:

Spot BTC ETF inflows remain net positive

AI liquidity theme continues to push institutional demand into BTC and ETH as non-correlated inflation hedges

Fed pivot odds increasing toward Q4 → expected risk-on environment

U.S. CPI cooling, potential for weaker dollar = BTC bullish

Bitcoin dominance holding near highs

🔐 Risk Metrics (WaverVanir DSS):

Metric Value

Forecast 30D Return +3.4% ($122,072.54)

Confidence Interval $105K – $125K

Model Agreement 2/9 Bullish

Prediction Volatility 14.45%

Sharpe Ratio 1.29

Max Drawdown (forecast) 32.9%

Direction Confidence 72.3%

🎯 Trade Setup (VolanX DSS Model + SMC Confluence):

Parameter Level

Entry $118,000–$117,200

Stop Loss $112,528 (4.7%)

Target 1 $120,443

Target 2 $122,072

Target 3 $127,065 (extended)

Target 4 $133,182–$134,397 (macro projection)

Position Size 25% of capital

Time Horizon 7–30 Days (Scalp + Swing Tiered Model)

📊 Probabilistic Scenarios (Next 30 Days):

Scenario Target Range Probability Notes

🔼 Continuation (DSS Base Case) $122K–$127K 60% Model + SMC aligned

⏸ Accumulation Zone $116K–$119K 25% Rangebound/Equilibrium trap

🔽 Breakdown <$112.5K 15% Triggered by macro shock or liquidity flush

📌 This setup is front-tested using the WaverVanir DSS system, institutional ensemble models, and real-time SMC structure. Not financial advice – for educational and strategic insight purposes only.

#WaverVanir #VolanXProtocol #BTCUSD #BitcoinForecast #CryptoStrategy #SmartMoneyConcepts #FibonacciTargets #AITrading #InstitutionalCrypto #MacroAnalysis #TechnicalSetup #RiskManagement #TradingSignals #QuantitativeModels #Bitcoin

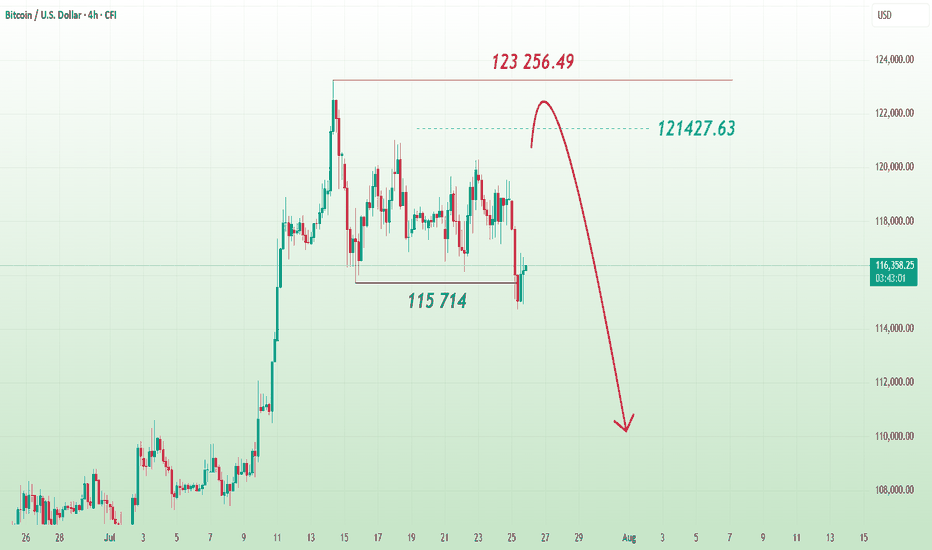

Bitcoin - Bearflag Structure Taking ShapeBitcoin is showing signs of weakness after a clean rejection from a 4H fair value gap, where price also swept the previous swing high. This aligns well with a broader bearish context as the market failed to sustain above the upper bounds of the trend channel, indicating potential exhaustion of the bullish correction.

Rejection Zone and Fair Value Gap

The rejection took place precisely within a 4H imbalance, adding confluence to the idea that this was a premium retracement in a bearish leg. The high formed inside that zone has now been swept, setting up conditions for distribution. A smaller 1H fair value gap was also left behind during the displacement move down, creating a clean area for price to return to and potentially react from.

Channel Structure and Bearflag Formation

Structurally, price has been climbing in a rising channel that resembles a bearflag pattern. The recent market structure shift broke the channel low, confirming that the rising structure is likely corrective. The rejection from the top of the flag and the subsequent breakdown align with a typical bearflag setup, suggesting a continuation move to the downside.

Short-Term Retracement Expectation

Before the next leg down, price may retrace to fill the unmitigated fair value gap while possibly sweeping the minor swing high that caused the current drop. This retracement would offer a premium shorting opportunity in alignment with the bearish bias, especially if internal structure remains weak on the lower timeframes during the return to the FVG.

Draw on Liquidity and Price Objective

The main objective for this setup is a sweep of the last equal lows near 115950, which represents a strong draw on liquidity. If the bearflag setup plays out fully, this area is highly vulnerable and could be the next significant target once the FVG is filled and lower timeframe distribution confirms.

Conclusion

Price has rejected from a 4H imbalance and swept liquidity to the upside, forming a clean bearflag structure. As long as price remains below the recent high and fills the 1H FVG without invalidating the shift, the path of least resistance looks to be down toward the liquidity resting below 115950. I’ll be watching for signs of weakness during the return to the FVG for a potential short trigger.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Bitcoin is set to experience a decline.After hitting a new all-time high at 123,256.49, Bitcoin, the world’s leading cryptocurrency, pulled back this week, closing on the 4-hour chart below the 115,714 level. This indicates a shift in trend from bullish to bearish and increases the likelihood of a short-to-medium-term decline.

The recent price rise appears to be corrective, and the 121,427 level is considered important and carries downside pressure, as it represents the 78% level of the Fibonacci retracement tool when measured from the recent high to the latest low. Holding below the 123,256 mark and failing to break above it would support the bearish scenario for Bitcoin.

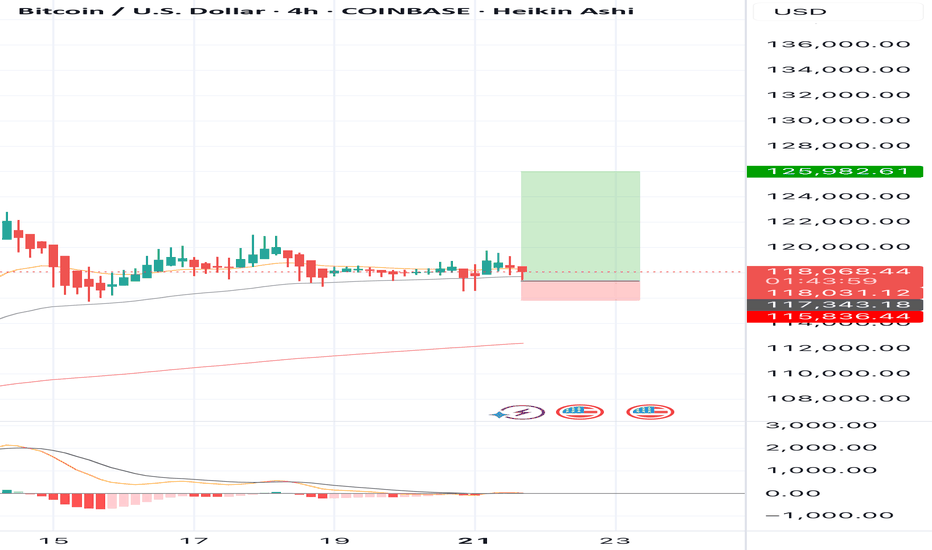

BUY BTCUSD now for 4h time frame bullish trend continuation BUY BTCUSD now for 4h time frame bullish trend continuation ...............

STOP LOSS: 115,836

This buy trade setup is based on hidden bullish divergence trend continuation trading pattern ...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything...

Remember to risk only what you are comfortable with... trading with the trend, patient and good risk management is the key to success here

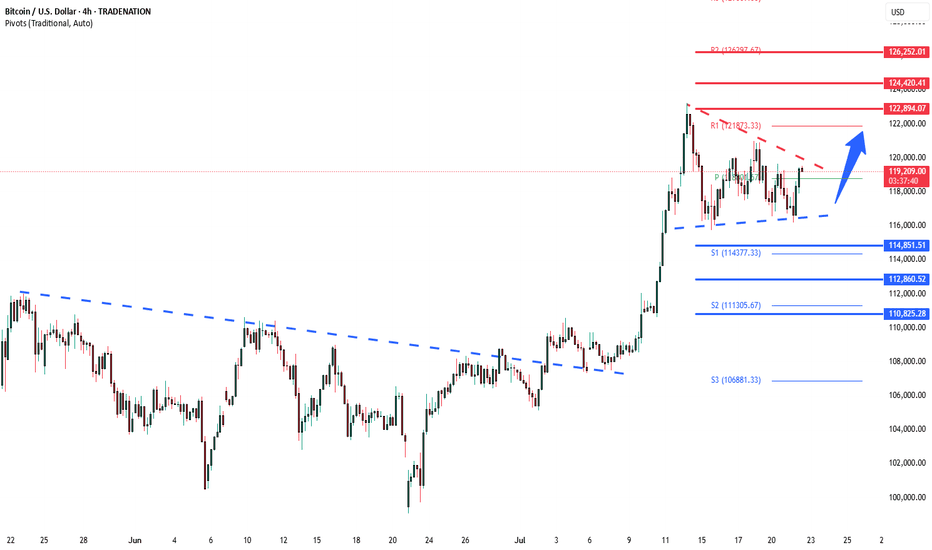

BTCUSD Bullish energy buildup supported at 114,850The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at:

122,900 – initial resistance

124,420 – psychological and structural level

126,250 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 114,850 would weaken the bullish outlook and suggest deeper downside risk toward:

112,860 – minor support

110,825 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the BTCUSD holds above 114,850. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

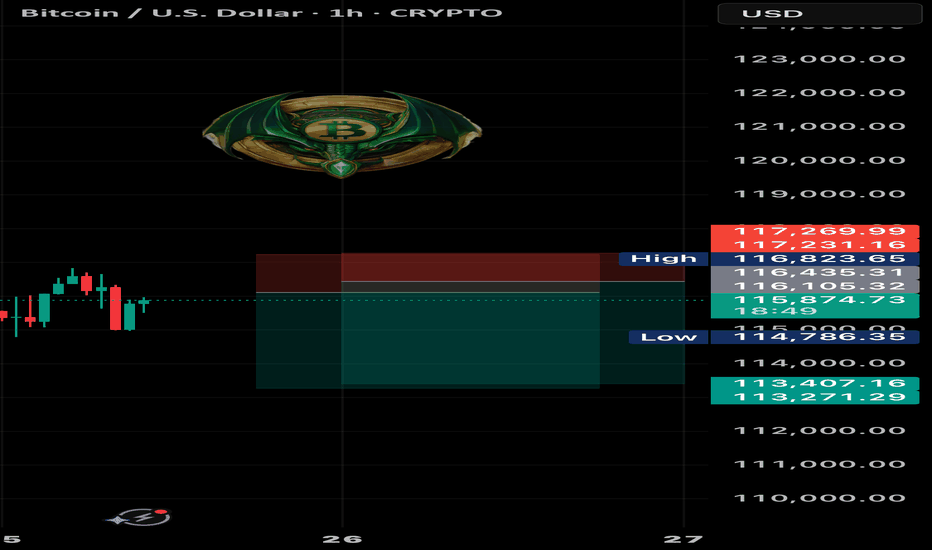

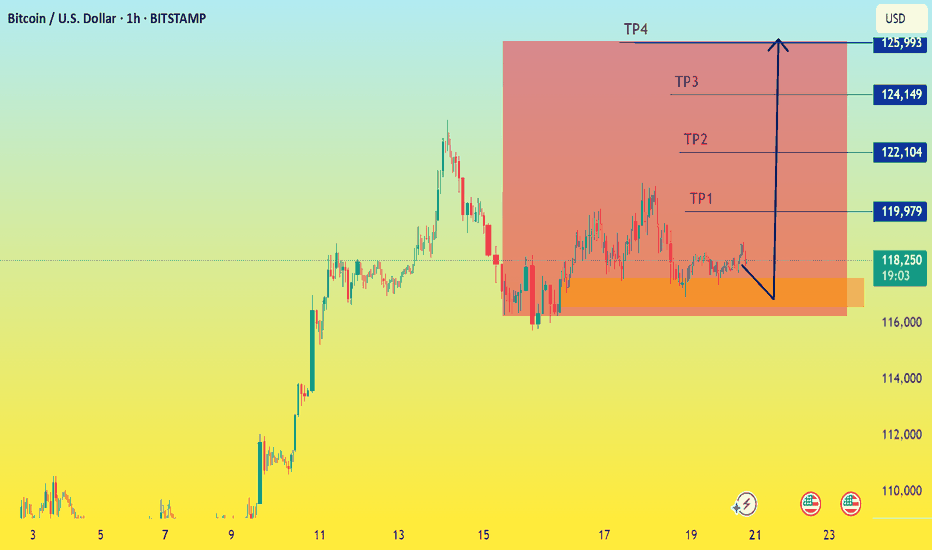

BTC SHORT TP:113,500 25-07-2025We’re looking for a clean short from 116,200 to 116,600, aiming for targets between 113,200 and 113,600.

This move offers an average 3.5 RR on the 2-hour timeframe, and we expect it to play out within 24 hours.

Technical context: This looks like a simple bearish continuation after recent price action. Momentum has shifted and this setup offers a clean entry post-manipulation.

Manage your stop-loss according to your strategy and stay updated for the next move.

We don’t use indicators, we’re not out here drawing lines or cute little shapes — I just give you a clean trade.

If price doesn’t move within the expected time, the trade becomes invalid.

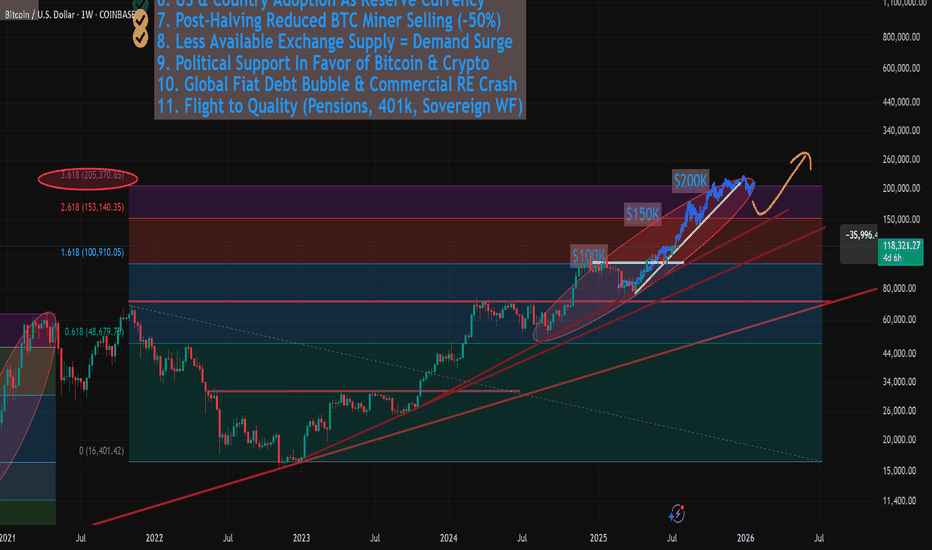

BITCPINS"S WEEKLTY TRAJECTORY AND LEVELS TO WATCH Bitcoin is currently trading at $118,209, demonstrating continued strong bullish momentum in the market. This aligns with broader market sentiment, which has seen significant institutional inflows, particularly through spot Bitcoin ETFs, driving BTC to new all-time highs in July 2025. The transformation of Bitcoin from a speculative asset to a macro asset, coupled with factors like global liquidity and capital reallocation, are providing substantial tailwinds.

Given this robust backdrop and your weekly target of $126,000, the market appears poised for further upside. However, it's crucial to acknowledge the possibility of short-term volatility and technical corrections after such significant gains.

Key Resistance Level:

The immediate key resistance level to watch is around the $12O,000 - $122,500 range. A sustained break above this zone, ideally with strong volume, would reinforce the bullish outlook and open the path towards your $126,000 target and potentially higher. The next significant resistance beyond that is around $130,000 - $136,000.

Key Support Area:

On the downside, a crucial support area to monitor for potential pullbacks is around $110,000 - $112,000. This area has acted as a strong accumulation zone recently and aligns with key moving averages. A deeper correction could see price test the $100,000 psychological support level. As long as Bitcoin holds above the $110,000 - $112,000 range, the bullish structure remains intact for a push towards OUR weekly target."

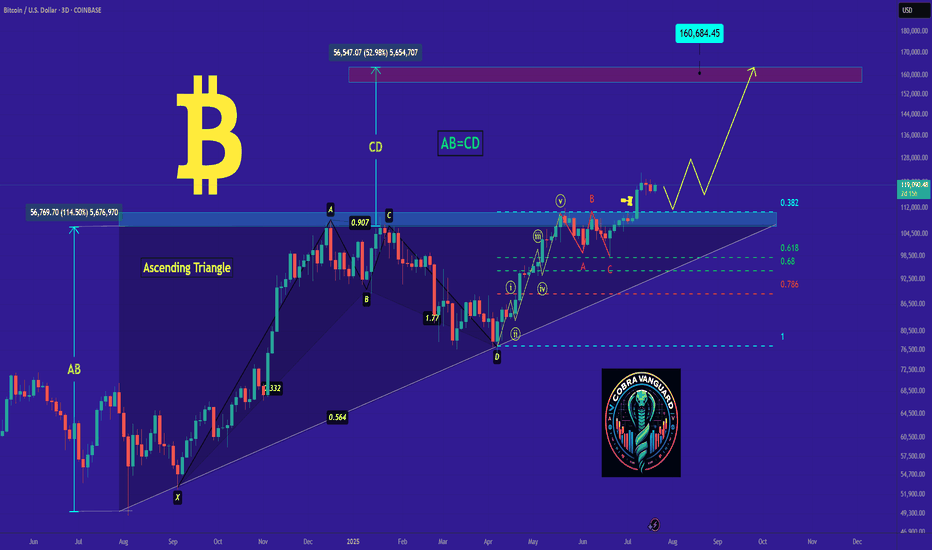

Revsiting $150k - $200k Bitcoin (AND Next Bear Market Bottom)In this video I revisit my 2-year old study showing the potential path for Bitcoin to $150k to $200k and not only how we might get there, but the 11 reasons WHY we can this cycle.

This is the same Fibonacci series that predicted the 2021 cycle high at the 3.618 (Log chart) and used the same way this cycle, with some interesting 2025 forecasts of:

1.618 - $100k

2.618 - $150k

3.618 - $200k

There are quite a few confluences that we get to $150k like the measured moves from both the recent mini bull flag, but also the larger one from earlier this year.

** Also I touch on revisiting my study from 2 years ago where I may have discovered the retracemebnt multiple that correctlty predicted and held the 2022 lowes around $16k. **

It's a VERY interesting number you all will recognize (buy may not agree with).

Let me know what you think.

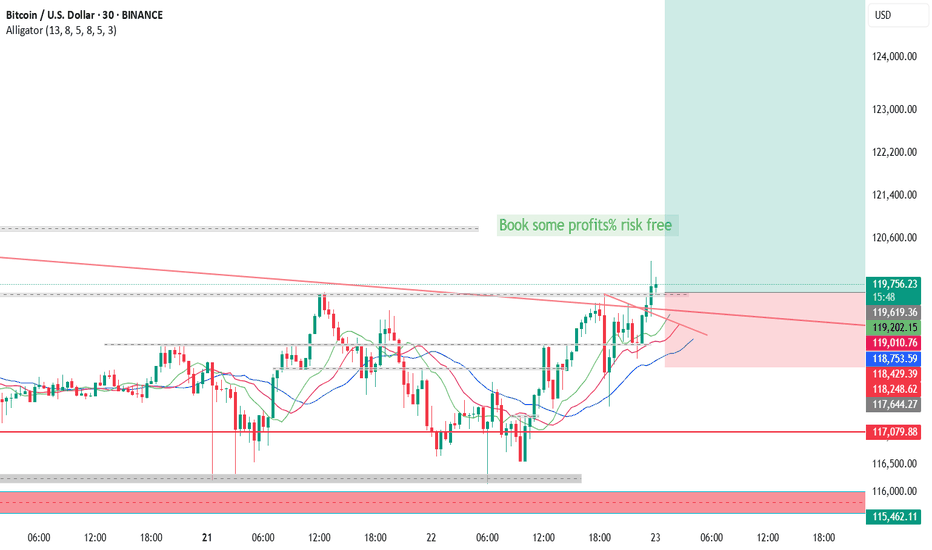

"BTC/USD Breakout Strategy: Identifying Bullish Momentum BTC/USD Technical Analysis – July 22, 2025

📈 Market Structure Overview:

The chart illustrates a recent Break of Structure (BOS) both to the upside and downside, indicating volatility and a shift in market sentiment. The price action formed a descending channel, followed by a breakout with strong bullish candles, suggesting a momentum reversal.

🧱 Support Zone (Demand Area):

Key Level: $116,400 – $116,900

This zone has acted as a strong demand level, with clear evidence of buying pressure pushing BTC higher after testing this area. The volume profile (VRVP) supports this, showing heightened trading activity at this price.

🔄 Bullish Breakout Confirmation:

A bullish breakout from the descending channel occurred just above the support zone, aligning with the label "Bullish Momentum".

The breakout candle has closed above minor resistance, which increases the probability of a trend reversal.

📍 Price Target:

The projection points toward $120,000, aligning with previous resistance and psychological round-number resistance.

This target is highlighted by an expected bullish leg after a possible retest of the breakout zone around $117,500 – $117,800.

🧭 Key Levels to Watch:

Support: $116,400 – $116,900

Retest Zone (Buy Opportunity): $117,500 – $117,800

Immediate Resistance: $118,400

Major Resistance / Target: $120,000

📊 Summary:

BTC/USD has shown a bullish reversal signal from a well-respected support zone after a descending correction phase. The current price structure, volume buildup, and breakout momentum suggest a high probability of continued upside movement toward the $120,000 mark. A successful retest of the breakout zone would provide a strategic entry for long positions with tight risk management.

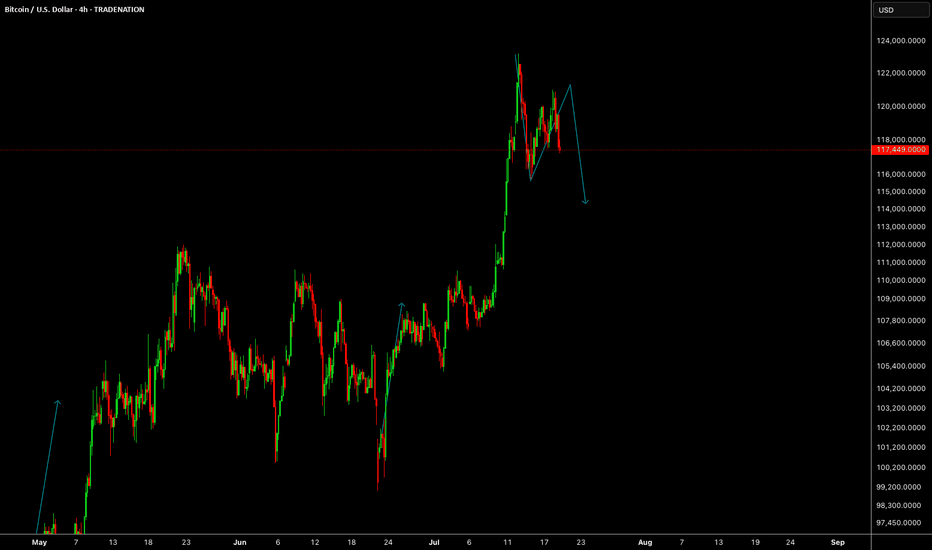

BTC wait for entryBTC has broken above the long-term weekly resistance (dating back to 2021) and is now consolidating above that key level.

On the 4H timeframe, price action is forming a descending wedge, a structure often associated with potential bullish breakouts. Two primary scenarios are unfolding:

Scenario A: Price continues to decline within the wedge, potentially reaching the high-liquidity demand zone (highlighted in yellow). A strong bounce is expected from this area.

Scenario B: A breakout occurs before liquidity is swept—suggesting stronger buyer momentum and early bullish confirmation.

Trade entries will be aligned with whichever scenario plays out, with confirmation signals provided in the accompanying chart.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

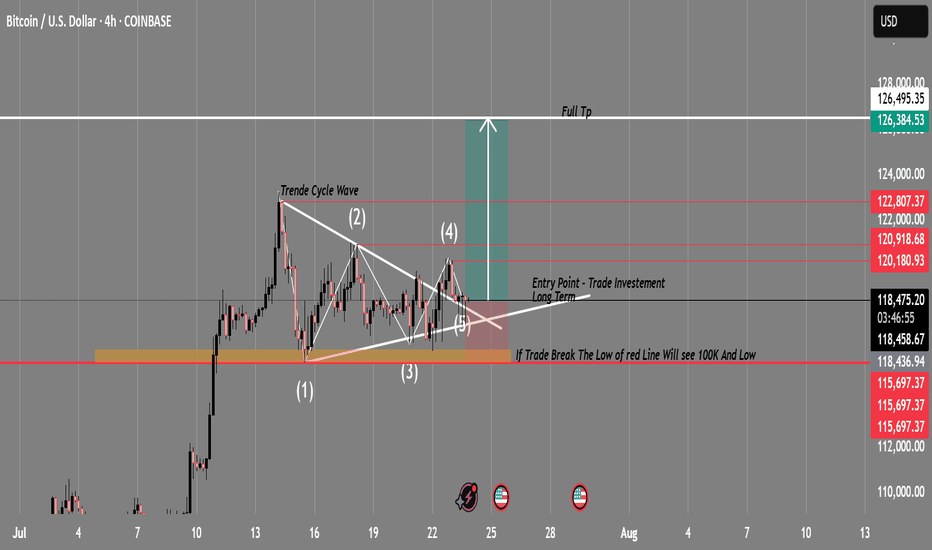

BTC/USD Swing Trade Setup | Breakout Imminent?Timeframe: 4H

Exchange: Coinbase

Strategy: Triangle Breakout + Wave Cycle Analysis

🔍 Technical Overview:

BTC is currently compressing within a symmetrical triangle pattern after completing a 5-wave cycle, suggesting a potential breakout is near. This structure indicates indecision — but also builds up momentum for a major move.

🔹 Wave Analysis: Complete cycle (1-5) within triangle

🔹 Support Zone: 115,697 (critical level — demand zone)

🔹 Resistance Breakout Target: 127,594 (measured move from triangle breakout)

🔹 Entry Point: Confirmed breakout above the triangle resistance (~118,500)

🔹 Invalidation: Strong 4H close below 115,697 = setup invalid

🔹 Risk/Reward: Favorable — breakout above resistance could trigger a strong bullish wave

🟢 Bullish Plan:

Entry: Break + Retest of upper trendline (~118,500)

Stop Loss: Below 115,697

Target 1: 122,800

Target 2: 126,384

Full TP: 127,594

🔴 Bearish Warning:

⚠️ “If price breaks the red support zone (115,697), BTC could drop sharply — possibly toward the 100K level and beyond.”

— a key invalidation level to monitor closely.

🧠 Conclusion:

This is a classic consolidation-to-breakout setup. Monitor volume and breakout confirmation before entering. If bullish momentum holds, this swing trade has great long-term potential.

💬 What do you think? Will BTC break bullish or drop to 100K? Drop your thoughts 👇

📌 Follow for real-time updates and future chart ideas!

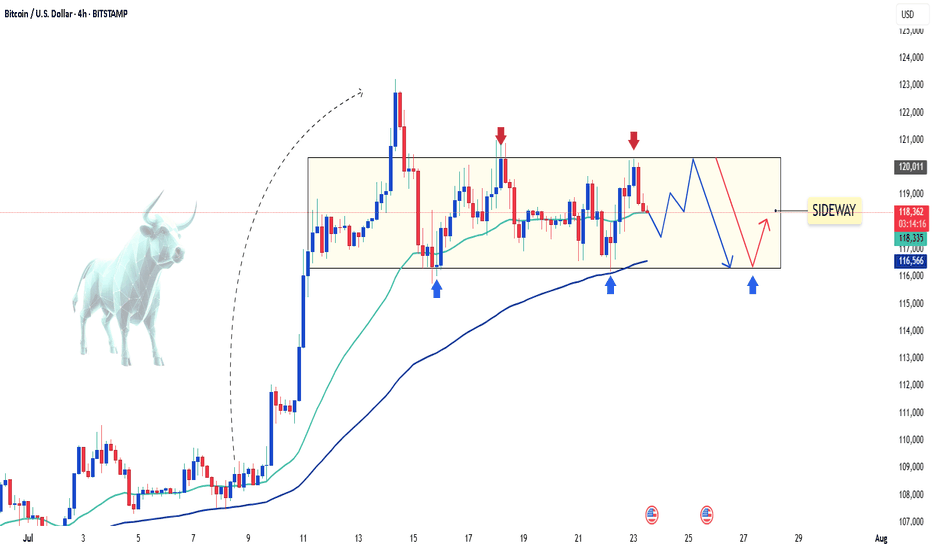

BTCUSDT pauses before the next big moveAfter a strong breakout in early July, BTCUSDT is now consolidating within a clear range between 116,000 and 120,000 USD. The price has repeatedly bounced from the bottom and faced rejection at the top, forming a well-defined sideways pattern on the H4 chart.

The EMA34 and EMA89 are providing solid support to this accumulation phase. If the 116,000 support zone holds and volume confirms, Bitcoin could resume its previous uptrend and aim for the 124,000 level.

At the moment, this looks like a “breather” zone before the market picks its next direction.

Personally, I’m still expecting another bullish leg—how about you?

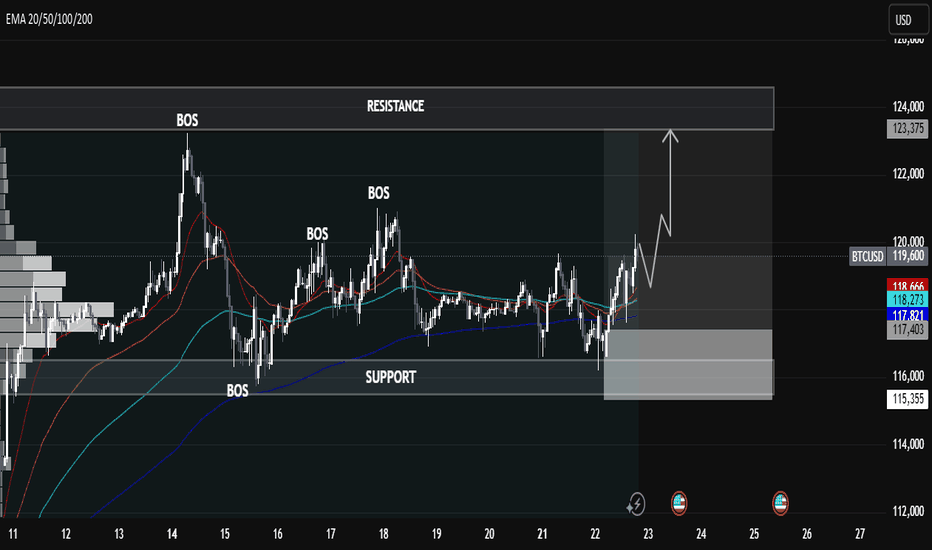

BTC/USD Technical Analysis — Educational BreakdownBTC/USD Technical Analysis — Educational Breakdown

🧠 Key Observations:

🔹 Market Structure: Break of Structure (BOS) Confirmations

The chart highlights multiple BOS points, showing clear transitions in market structure – a strong indication of bullish momentum building up after prior consolidation and retracements.

🔹 Support Zone (Demand Area): 115,355 – 117,403

This area has acted as a liquidity pool where buyers previously stepped in, forming the base for new BOS formations. A retest of this level could offer a high-probability long entry.

🔹 Resistance Zone (Supply Area): 123,375 Region

This marked level is a prior high and expected profit-taking or potential short-trigger zone. Price is likely to target this level if bullish momentum continues.

⸻

📈 EMA Analysis (20/50/100/200)

• Stacked Bullishly: EMAs are layered with the shorter-term EMAs (20/50) above the longer-term ones (100/200), suggesting trend continuation to the upside.

• Price reclaiming above all EMAs signals momentum is shifting from accumulation to expansion.

⸻

🔮 Potential Scenario:

1. Bullish Retest Play

A pullback toward the demand/support zone (116k–117.4k) can present a high-RR entry.

2. Continuation Toward Resistance

If price holds above the EMAs and structure, we could see a push toward 123,375, where profit booking may occur.

⸻

📌 Market Sentiment Bias: Bullish

• Structure: Bullish BOS

• Momentum: Above all EMAs

• Volume Profile: High acceptance near

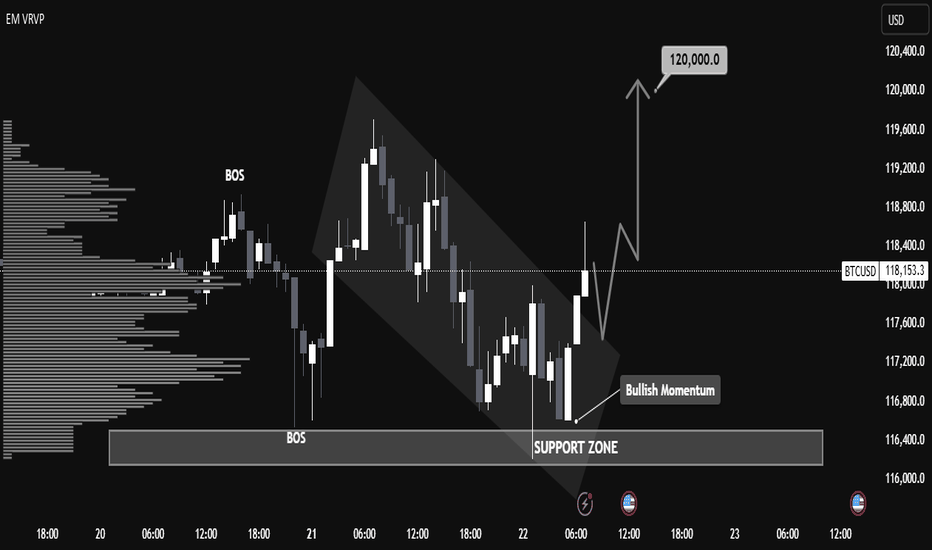

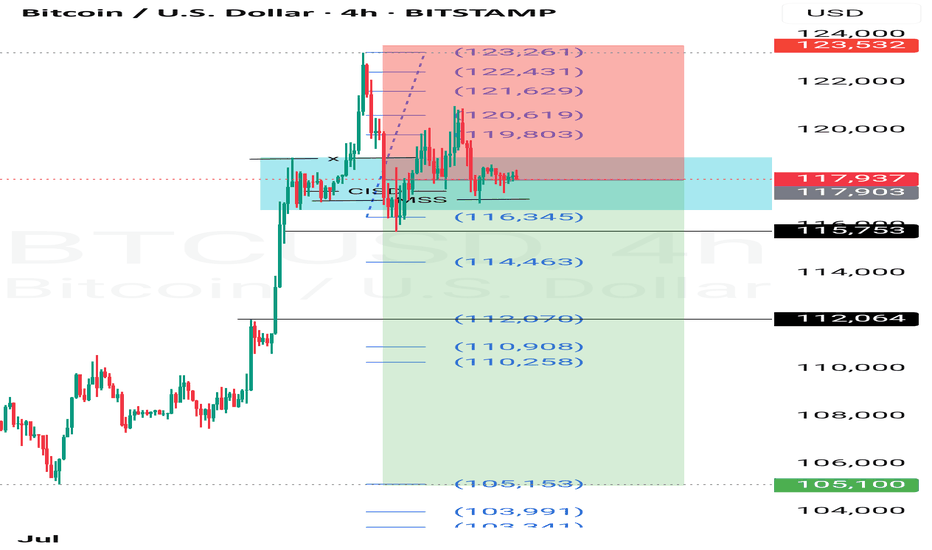

BTC Breaks Structure After Liquidity Grab! Massive Move Loading…BTC/USD Technical Analysis – July 25, 2025

Structure Overview:

The current BTC/USD price action showcases a classic market structure shift, with multiple Breaks of Structure (BOS), liquidity grabs, and a clear intent to revisit premium pricing zones. The chart follows a Smart Money Concepts (SMC) methodology, identifying key supply and demand areas.

Key Highlights:

🔹 Break of Structure (BOS):

Several BOS events indicate momentum shifts and short-term trend reversals. The most recent BOS near the support zone suggests a potential bullish move after liquidity sweep.

🔹 Sell-Side Liquidity & Equal Lows:

BTC swept the Equal Low level near $114,000, triggering Sell-side Liquidity. This liquidity grab is often a manipulative move by institutional players to collect orders before driving price higher.

🔹 Support Zone:

The support zone near $114,900–$114,000 is holding strong. Price wicked into this area, collected liquidity, and reacted with bullish intent.

🔹 Bearish Fair Value Gap (FVG):

A Bearish FVG exists around $117,500–$118,000, which may act as short-term resistance. Price could partially fill this gap before resuming direction.

🔹 Target Zone:

Projected target lies at $119,637, aligning with the prior resistance zone and offering a high-probability area for price delivery based on the current bullish market structure.

🔹 Volume Profile Support:

The volume profile suggests high volume accumulation in the current range, further supporting the possibility of a bullish expansion phase.

Forecast Summary:

Bias: Bullish (Short-term)

Entry Zone: Confirmed after BOS and liquidity sweep near support

Target: $119,637 (resistance zone)

Invalidation Level: Sustained break below $114,000

⚠️ Risk Note:

A rejection from the Bearish FVG or failure to break above $117,800 may cause a deeper pullback. Monitor reactions around key levels before continuation.