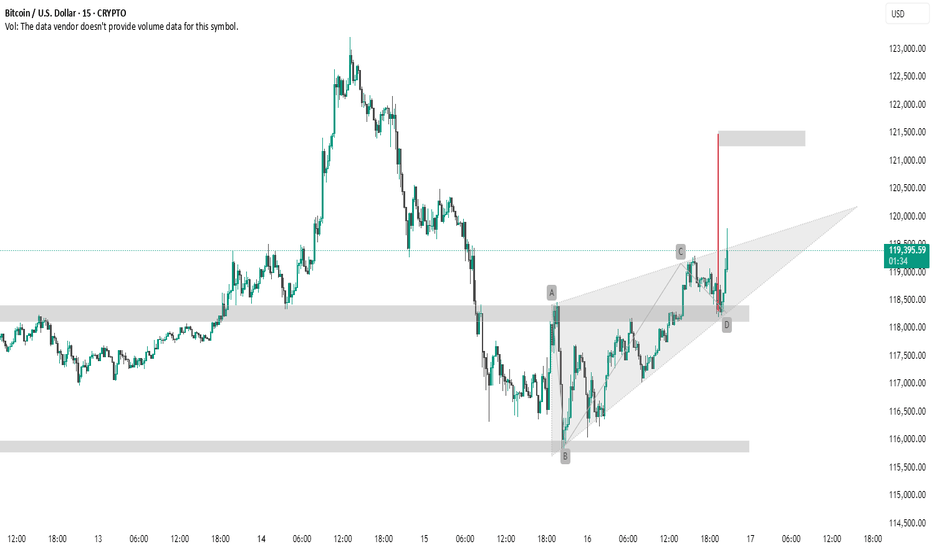

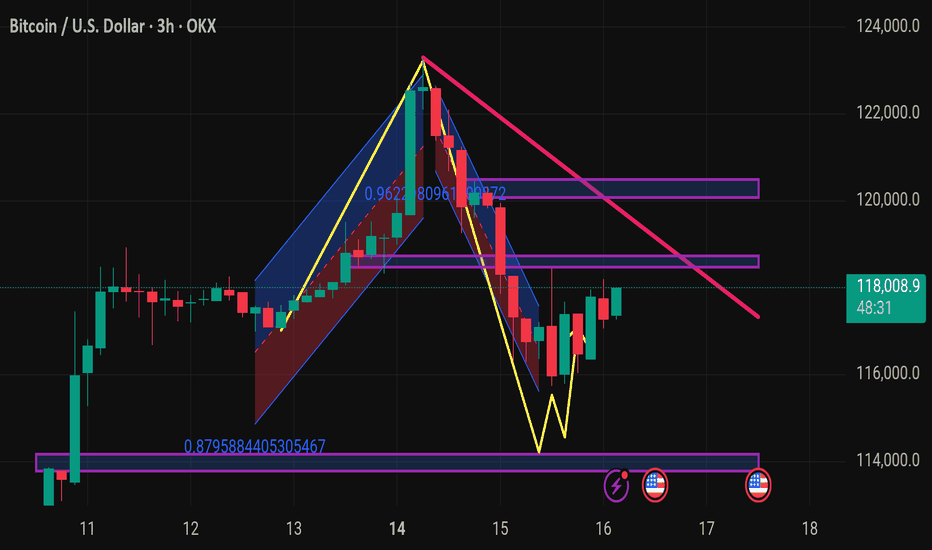

BTC #Trangle BreakoutThis 15-minute BTC/USD chart presents a **bullish breakout** from a **rising wedge pattern**, which typically has bearish connotations but in this case broke upward — suggesting strong buying pressure.

Key Observations:

* **AB=CD Pattern**: The chart shows a completed harmonic AB=CD pattern, typically a **reversal** or **continuation** signal, depending on context.

* **Breakout & Target Zone**: Price broke above the wedge resistance near point D, with a projected target zone around **\$121,500**, shown with the red vertical line and grey box.

* **Support Zones**: Well-defined support areas near **\$118,000** and **\$116,000** provide a strong base for the bullish move.

Summary:

This setup indicates a **bullish continuation** with a breakout from the wedge, validated by the harmonic pattern and volume momentum (if available). Traders may watch for price holding above \$118,000 to confirm continuation toward \$121,500.

thank u

BTCUSD.PM trade ideas

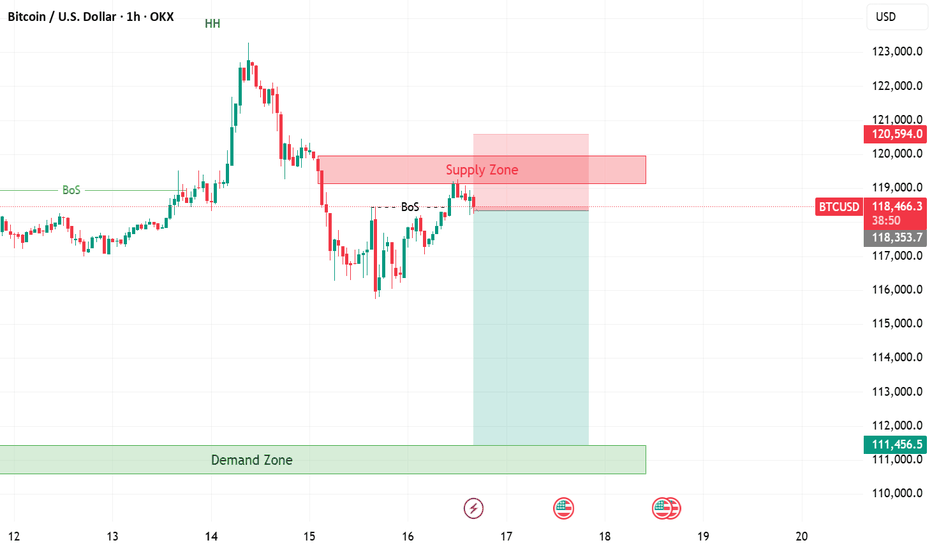

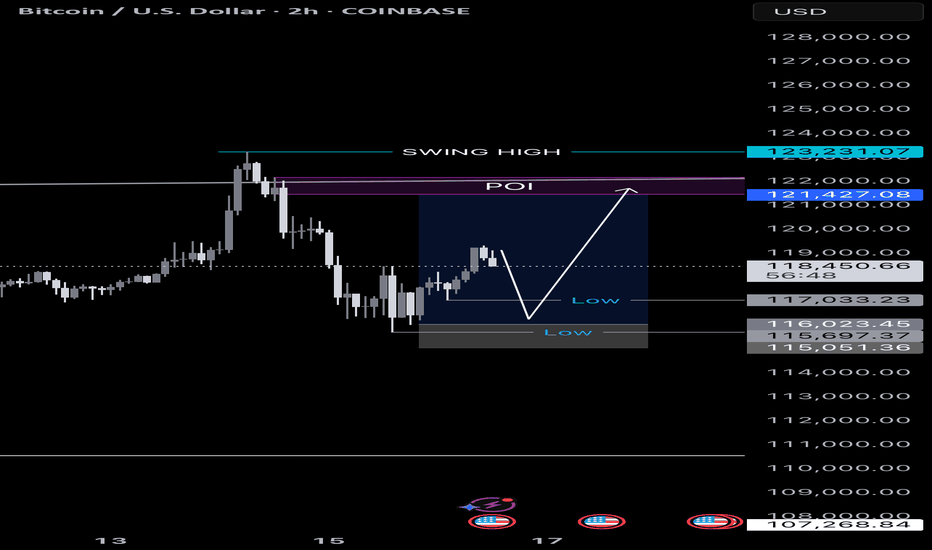

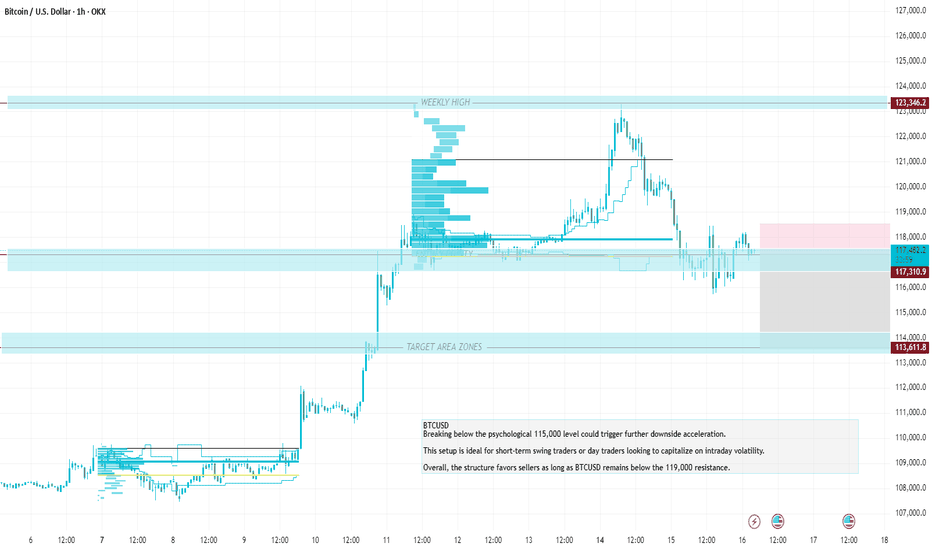

BTCUSD ShortBTCUSD 1H Technical Analysis

⚙️ Scenario Outlook:

Bias: Bearish

Preferred Play: Wait for price to enter the 119,000–120,000 supply zone. If price shows signs of exhaustion or bearish confirmation (e.g. bearish engulfing, strong rejection), a short position becomes favorable.

Targets: First target at 117,200; final target near 115,600–115,000 range, depending on how price behaves within the intermediate demand.

🔼 Supply Zone (Resistance):

Zone: 119,000–120,000

This red zone marks a previously unmitigated supply area aligned with the 50% Fibonacci retracement level from the prior bearish impulse. It's expected to act as the final resistance before the next move lower. A rejection from here would confirm bearish intent and offer optimal risk-to-reward for short setups.

🔽 Demand Zones (Support Targets):

First Demand Zone: 117,200–117,600

This green border is your first liquidity pocket to watch. It may offer a brief reaction or bounce, but if bearish momentum holds, price is likely to continue through it.

Deeper Demand Zone: 115,600–116,200

This is the stronger accumulation area, marked by your lower green zone. It sits just above the previous CHoCH and BOS lows, making it a prime liquidity sweep and reversal candidate if price moves deeply into it.

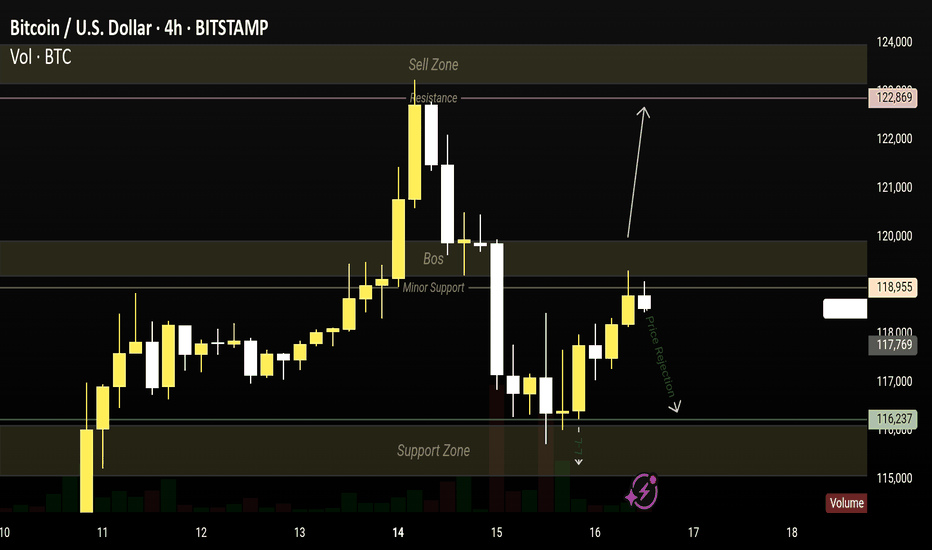

KOG BTC 4H chart updates.

KOG BTC 4H CHART

🔹 Sell Zone: 122,869

🔸 Resistance Holding Strong!

🔻 Price Rejected from 118,955 Minor Support

• Watch for pullback toward 116,237 Support Zone

• Possible BOS retest before next move

• If breaks → watch for continuation to 115,000

• If holds → bullish bounce possible

• Volume spike confirms reaction level.

Whales Impact on BTC and XRP MarketsKey Points:

Whales drive market dynamics, focusing on BTC, ETH, XRP.

Whales influence price movements and trader behavior.

Institutional inflows increase, spotlighting large-cap assets.

Whale activities have drawn attention due to their potential to alter market dynamics, indicating possible price shifts and investment strategies for traders.

Recent Influences of Whale Activity on Cryptocurrency Markets

Recent whale activity has driven interest in Bitcoin and XRP, as whales accumulate assets, influencing market trends. Abdullah “Abs” Nassif emphasized the strategic importance of holding, advising caution.

"If you hold it and play the game like we do, you have a chance at freeing people around the world from the debt slavery system. I can promise you that." - Abdullah “Abs” Nassif, Host, Good Morning Crypto

Financial markets are adapting, with noticeable movements in cryptocurrency prices due to whales' actions. Their accumulation signals rising confidence, especially in Bitcoin, which hit a new all-time high.

BTC's surge influenced the broader market, encouraging capital flow into large-cap assets. These movements reflect potential shifts in trader strategies, highlighting the impact of significant investments.

Insiders suggest regulatory developments may affect prices, yet whale activity implies potential long-term growth. Historical patterns highlight institutional investors' stability during volatile periods, underscoring the strategic value of holding as exhibited by these whales.

Plan on bracing yourself for Monday most likely. That's when we'll really see the test as to whether crypto can maintain the momentum. OKX:BTCUSD BITFINEX:BTCUSD BITFINEX:BTCUSD OANDA:BTCUSD

10 Types of Cryptocurrencies: Explanations and ExamplesCryptocurrencies go far beyond Bitcoin. Today’s digital asset market includes a wide variety of coins and tokens, each serving distinct purposes. Below are 10 key categories of cryptocurrencies with brief explanations and examples:

Store of Value Cryptocurrencies:

Used as a digital form of gold or a long-term value reserve.

▶ Example: Bitcoin (BTC)

Smart Contract Platforms:

Support decentralized applications and programmable transactions.

▶ Example: Ethereum (ETH)

Stablecoins:

Pegged to fiat currencies to reduce volatility.

▶ Examples: USDT, USDC

Payment Tokens:

Designed for fast, low-cost money transfers.

▶ Examples: XRP, Stellar (XLM)

Governance Tokens:

Allow holders to vote on protocol decisions.

▶ Examples: UNI, MKR

Meme Coins:

Inspired by internet culture and social trends.

▶ Examples: Dogecoin (DOGE), Shiba Inu (SHIB)

Gaming Tokens:

Used in blockchain-based games and metaverses.

▶ Examples: AXS, SAND

Privacy Coins:

Focused on anonymous, untraceable transactions.

▶ Examples: Monero (XMR), Zcash (ZEC)

NFT Tokens:

Represent digital collectibles or assets on-chain.

▶ Examples: Bored Ape, CryptoPunks (ERC-721)

Infrastructure Tokens:

Power scalability, cross-chain solutions, or protocols.

▶ Examples: Polkadot (DOT), Cosmos (ATOM)

Understanding these categories helps investors and users navigate the complex crypto ecosystem more effectively.

Clean BTC Trade – Bounce from Key Trendline SupportHi traders! , Analyzing BTC/USD on the 30-minute timeframe, we can observe that price is respecting the ascending channel and reacting to the dynamic trendline support (blue line). This bounce, aligned with prior structure, signals a potential bullish continuation.

🔹 Entry: 116,249

🔹 Take Profit (TP): 119,434

🔹 Stop Loss (SL): 113,105

Price remains above the 200 EMA while continuing to respect the ascending trendline, signaling sustained bullish structure. The RSI is showing a bullish divergence, which supports the idea of upward momentum. We also saw a strong reaction at the pivot point (115,373), and a bullish engulfing candle formed right near the trendline — adding further confirmation to this potential long setup.

This long setup presents a favorable risk/reward ratio within the context of the broader trend. Targeting a clean break above previous resistance and return to the R1 zone.

⚠️ DISCLAIMER: This is not financial advice. Trade at your own risk and always use proper risk management

Global Market Overview | July 15President Trump’s latest statements made headlines again, but market reactions have become more measured. The Dow declined slightly, while Asian markets presented mixed performances; Japan remained flat, Korea and Australia posted losses, and Taiwan outperformed. The US dollar strengthened as the yen weakened. Bitcoin recovered near $118,000 after dropping from its $123,000 high. Silver held firm above $38.

Today, market focus turns to U.S. PPI data and key bank earnings reports.

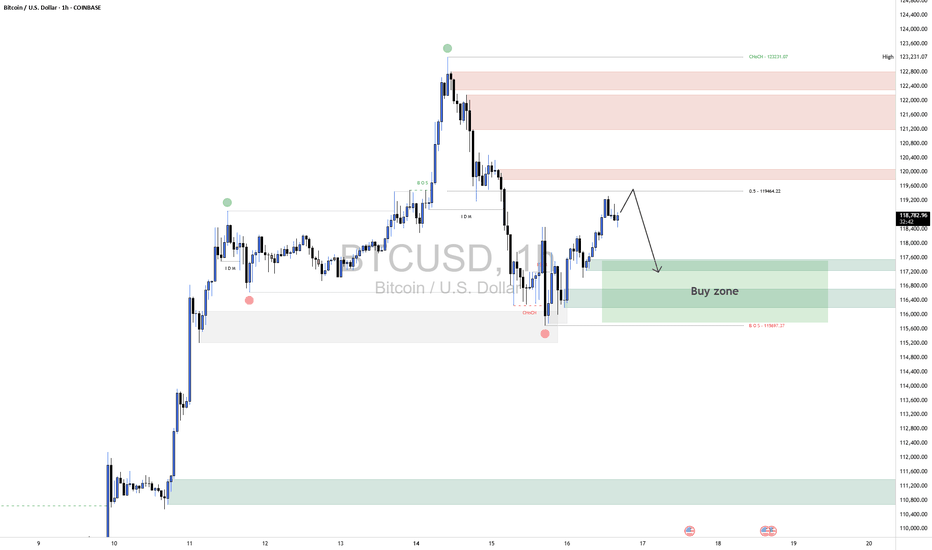

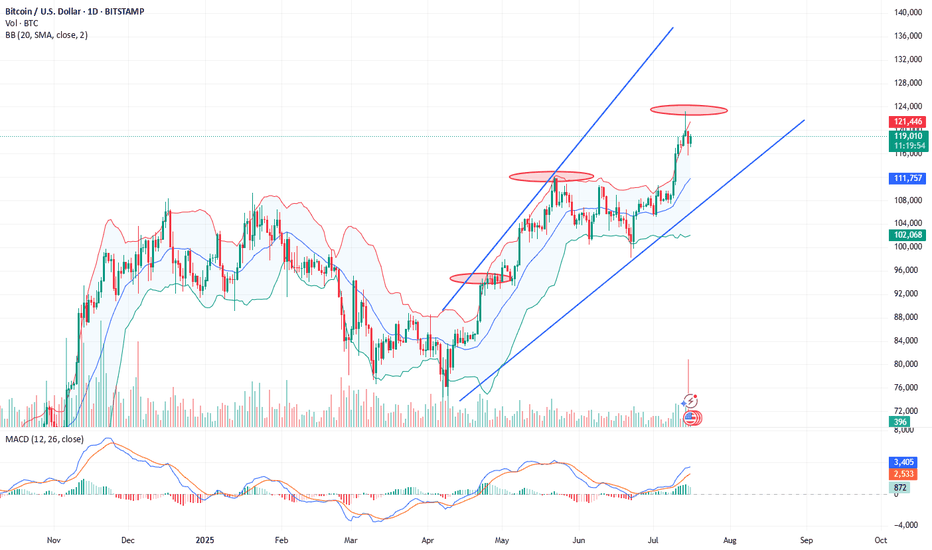

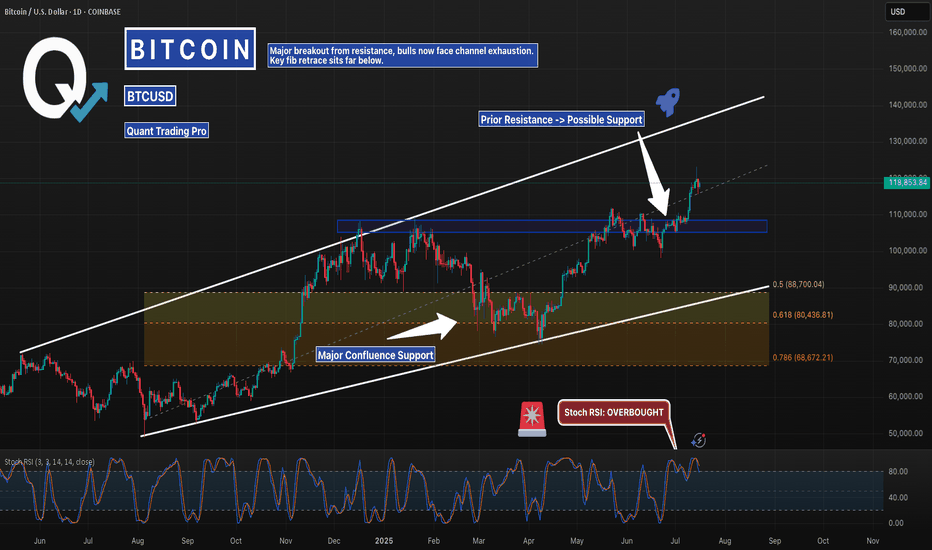

BTCUSD - Breakout Or Bull Trap? Watching the Fib Reload ZoneBitcoin just cleared the prior resistance zone near 114K–115K, breaking higher within the macro ascending channel. But with Stoch RSI overheated and price stretching toward the upper trendline, this move may exhaust soon.

I’m watching the Fib confluence zone between 88K–80K — which aligns with the mid-channel and prior breakout structure. If bulls lose steam, that’s where the real bid could return.

Set alerts. Let the algo hunters chase.

This is where smart traders prepare.

#BTCUSD #Bitcoin #Crypto #PriceAction #Fibonacci #SmartMoney #Backtesting #QuantTradingPro #TradingView

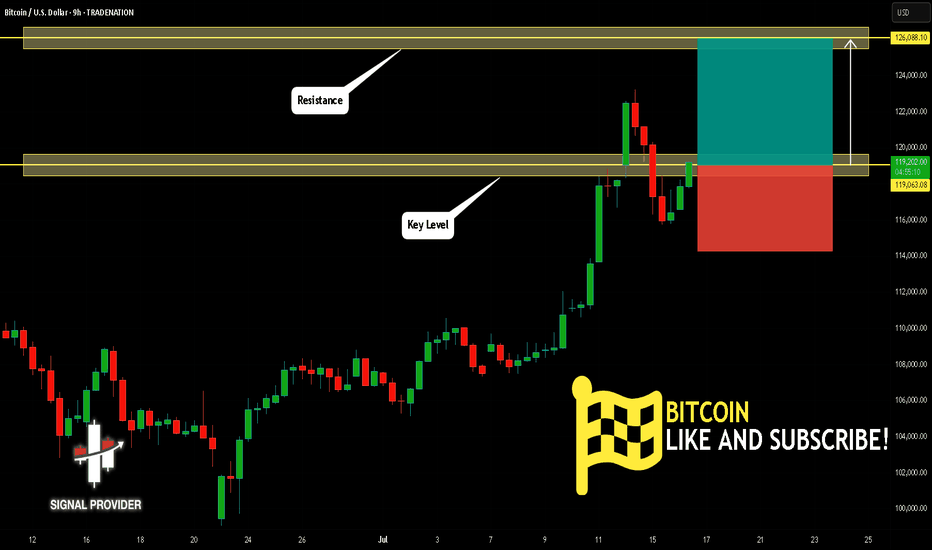

BITCOIN Will Go Higher! Long!

Here is our detailed technical review for BITCOIN.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 119,063.08.

The above observations make me that the market will inevitably achieve 126,088.10 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

BTC Bottom & New ATH..... when ?!!! Hello Guys

There are some notes of BTC weekly Chart:

1. We have a new ATH every 4 years ( 1428-1477 ) days..

2. After the ATH we take about ( 52-59 ) weeks to make a new bottom then we go up a little ...

3. Every time we reach a new ATH we drop down in a same angle (-55) before the new bull run starting .... look at my chart ( Red angles and curves ):

****** We dropped from ATH 2013 to Bottom 2015 by an angle ( -55 ) .

****** We dropped from ATH 2017 to Bottom 2018 by an angle ( -55 ) .

****** Same (24 July 2019) we dropped from local top to the local bottom by Angle ( -56 ) .

****** Will we drop from ATH 2021 to Bottom (2022 - 2023) by the same angle ( -55 or -56 )??

4. In my opinion , I expect we will reach the final bottom between ( 26 December 2022 : 6 march 2023 ).

5. I don't care what will be the price of BTC then , but I care only for when will be the possible bottom !!.

But if we can try to expect the price it will be in a range of ( 11900 : 9000$) ...

Note:( 10K - 10500$) is very very strong demand area for BTC .

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Finally , I think the new ATH will not be before Nov 2025 ( 150k $ ).

It is not a financial advice , I am only share my thoughts with u :)

Thank u and good luck.

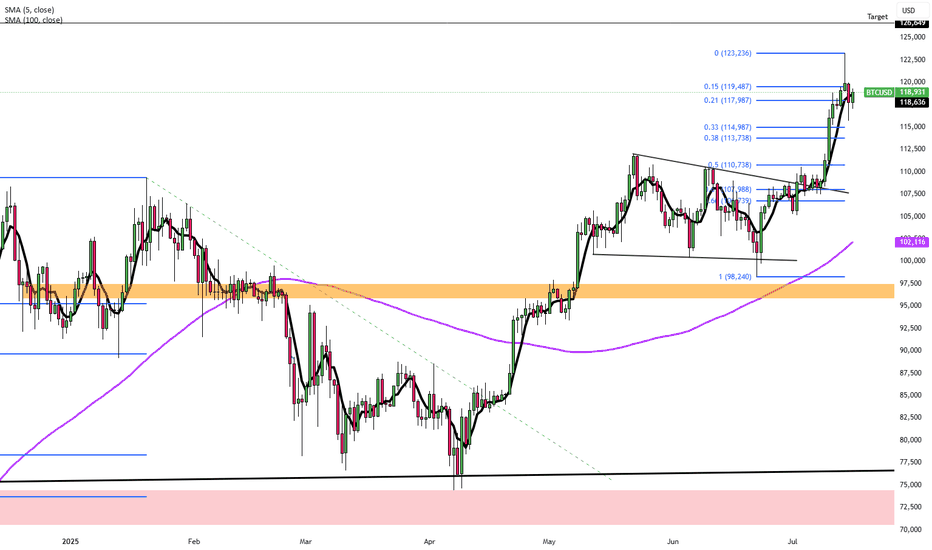

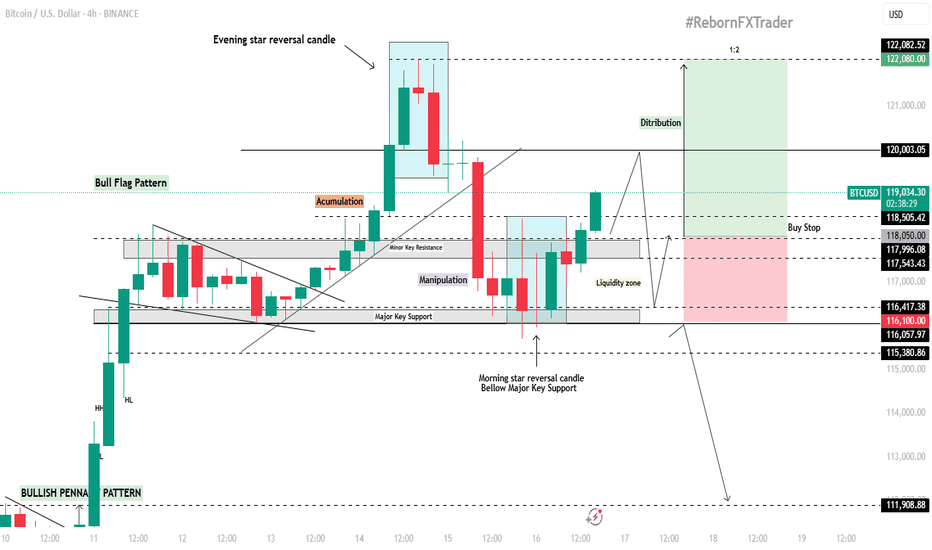

BTC/USD 4H Technical & Fundamental AnalysisBTC/USD 4H Technical & Fundamental Analysis

Bitcoin remains fundamentally bullish as institutional adoption continues to rise through Spot ETF inflows, while post-halving supply pressure tightens the available BTC in circulation. Additionally, the upcoming regulatory clarity such as the GENIUS Act could pave the way for major institutions like JPMorgan to issue their own stablecoins, further bridging the gap between crypto and traditional finance. On the technical side, BTC is currently consolidating around the 116,200 level, potentially forming a bull flag pattern on the 4H timeframe. This zone has acted as a major support level due to multiple historical touches.

Previously, price reached an all-time high around 122,000 before forming an Evening Star reversal pattern, leading to a pullback back to the 116,200 zone. A Morning Star reversal then formed on this key support, suggesting renewed bullish momentum.

Our current objective is to wait for price to climb toward the 120,000 level, where we anticipate a potential liquidity grab within the highlighted liquidity zone.

📍Buy Stop Setup:

Buy Stop Entry (AOI): Around 118,050

Stop Loss: 116,100 (below liquidity zone)

Take Profit: 122,080

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

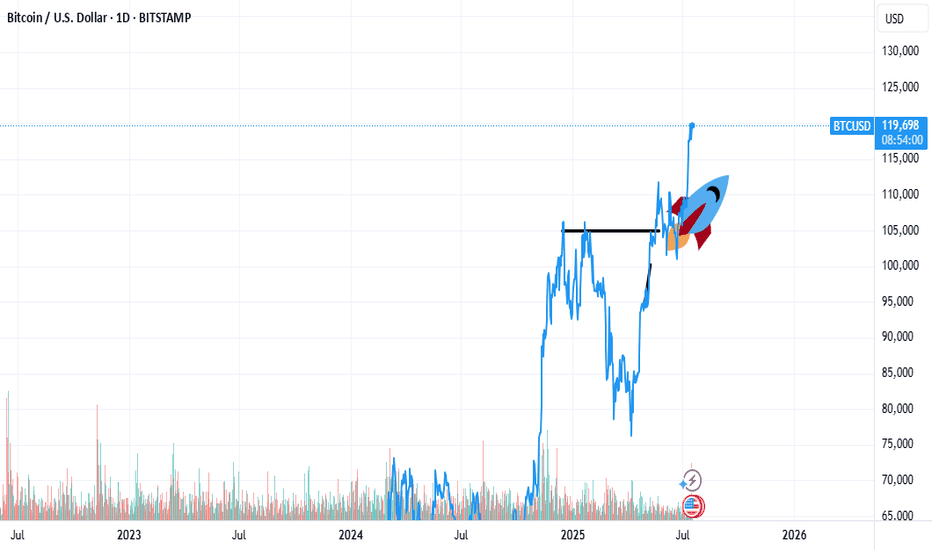

$300k+: LVDT estimated BTC ATH target this cycle.According to my old LVDT indicator, BTC should reach $300k or even higher at ATH this cycle.

The real parabolic (banana zone) run will only start when BTC touches the thick red line again.

Time to gradually DCA sell every time BTC pierces significantly above the thick red line (signaling a potential point of Blow-off-Top).

I plan to be updating this tread from time to time as the chart progresses until the absolute "Sell" signal is triggered.

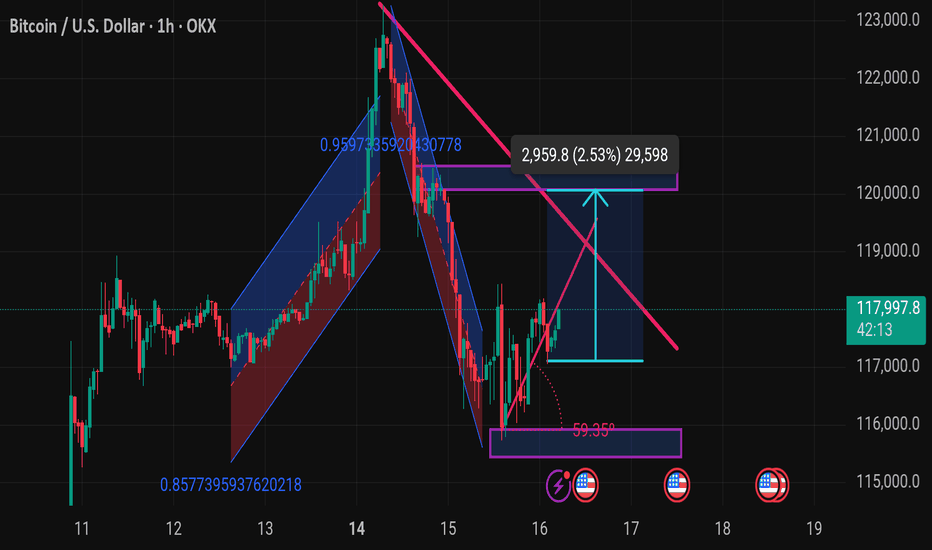

Btcusd techinical analysis.This Bitcoin (BTC/USD) chart from TradingView illustrates a technical analysis on the 1-hour timeframe. Here's a breakdown of the key elements and possible implications:

---

🔍 Chart Overview:

Current Price: $117,997.8

Timeframe: 1-hour candles

Exchange: OKX

Date/Time: July 16, 2025, 05:16 UTC

---

🧠 Key Technical Patterns & Indicators:

1. Descending Triangle Breakout Setup:

A descending resistance line (in pink) is converging with a horizontal support level (around $116,000–$117,000).

The price appears to be testing the upper boundary, indicating a potential breakout.

2. Target Measurement:

The blue arrow pointing upward suggests a measured move after a breakout.

Target Price: ~ $120,957.8 (approx. 2.53% move or +2,959.8 points from breakout level)

3. Support Zone:

Strong horizontal support zone marked in purple near $116,000.

This zone has held despite a sharp dip, indicating buyer interest.

4. Previous Trend Channels:

Blue and red channels represent bullish and bearish trends.

Recent bearish

Breaking below the psychological 115,000 level could trigger furMomentum indicators such as RSI and MACD likely show bearish divergence or downward momentum, supporting the short thesis.

The recommended stop-loss for this setup is at 119,000, which is just above recent resistance and protects against false breakouts.

This SL level offers a good risk-reward ratio, with approximately 2:1 or better depending on entry precision.

If price fails to reclaim 119,000 or form higher highs, the bearish momentum is expected to persist.

Price rejection candles or bearish engulfing patterns near 117,500 further validate short entries.

Breaking below the psychological 115,000 level could trigger further downside acceleration.

This setup is ideal for short-term swing traders or day traders looking to capitalize on intraday volatility.

Overall, the structure favors sellers as long as BTCUSD remains below the 119,000 resistance.

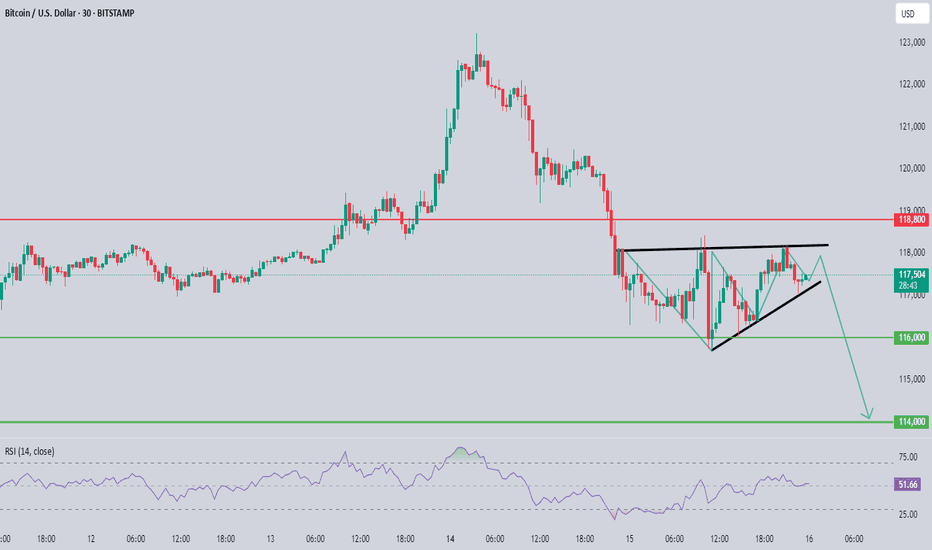

XAU/USD Chart Pattern ObservedBased on the image you've shared, this is a technical analysis chart for gold (XAU/USD), with a visible bearish setup in play. Here’s a detailed sell-side analysis:

Chart Pattern Observed

Bearish Pennant/Wedge Breakout:

The price appears to be breaking out downward from a rising wedge or bearish pennant pattern.

These patterns typically indicate a continuation to the downside after a short consolidation or pullback.

Key Levels Identified

Resistance Zone:

118.800 (Strong resistance level marked in red)

Price failed to break above this and reversed, confirming it as a solid supply zone.

Current Price: Around 117.500

Support Levels (Take Profit Targets):

116.000 – Minor support/first TP level

114.000 – Major support/final TP level (likely the full target of the move)

RSI Indicator

RSI at 50.71 – neutral but pointing slightly downward.

This gives room for further bearish momentum to unfold.

Sell Trade Setup

Entry: After confirmed break below the rising trendline (around 117.800 - 117.500)

Stop Loss: Above 118.800 (just above the resistance zone to avoid fakeouts)

Take Profits:

TP1: 116.000

TP2: 114.000

Trade Justification

Clear lower highs forming.

Rejection at strong resistance.

Breakdown of rising structure = bearish continuation.

Bearish projection arrows on chart suggest institutional outlook favors sell.

Risk Management

Use proper lot sizing based on your account balance and risk %.

Look for a retest of the trendline as a safer sell entry if missed the initial break.