BTCUSD trade ideas

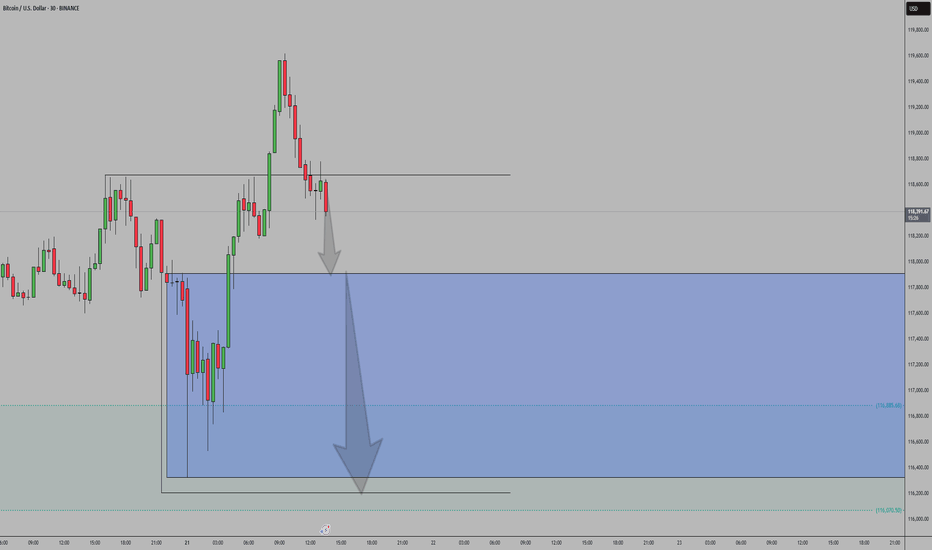

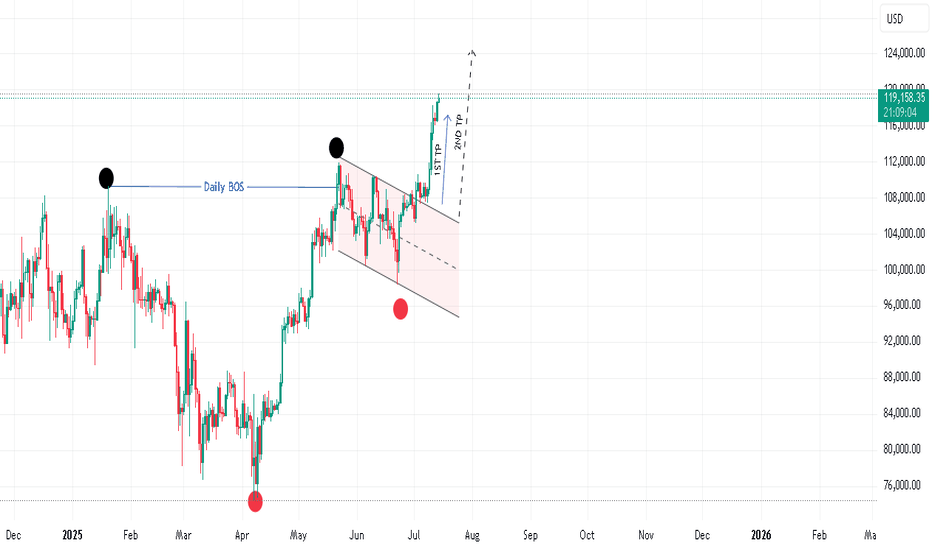

Range in BitcoinBitcoin has been ranging for nearly 12 days, and based on range-trading strategies, it's now possible to take a position. There's a high probability that the price will move toward the top of the range. For taking positions near the bottom of the range, we need to wait for a trigger since we're trading against the current direction. In case of a breakout above the range, we should be cautious of fakeouts.

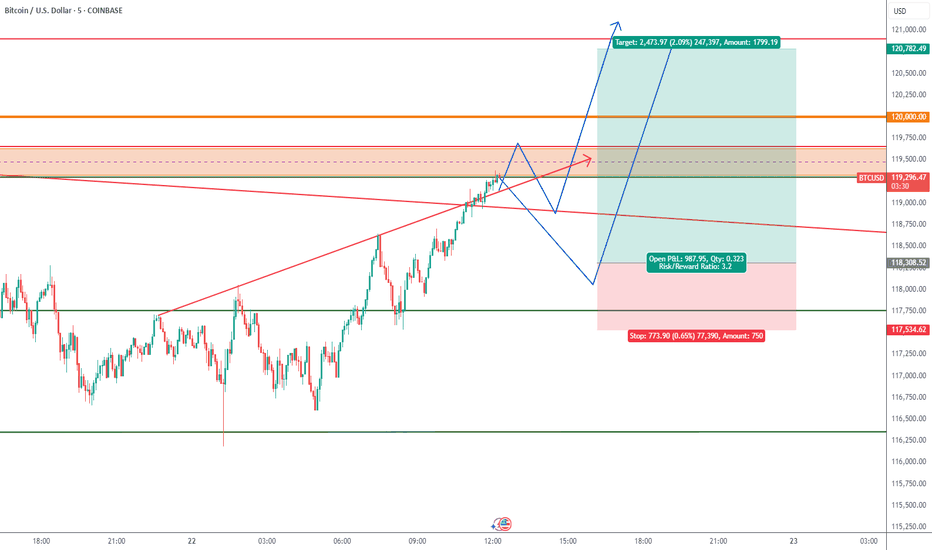

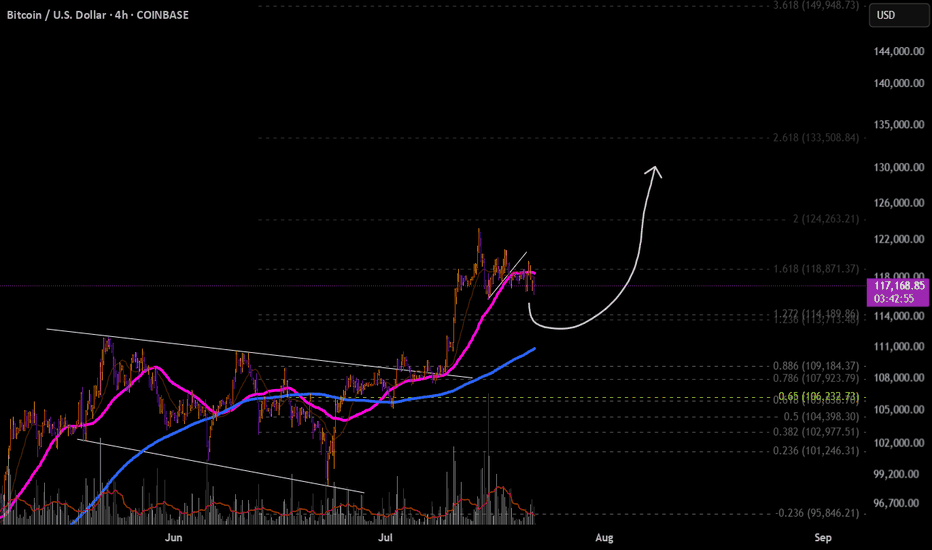

BTC USD LONG RESULTPrice had held been in a narrow falling wedge before breaking out with strong volume and held the support order block at the 0.6fib level and expecting to retest before going to the supply zone where TP zone was set.

Price did move as I predicted just missing and leaving our entry behind.

Better Setups ahead 💪💯

_THE_KLASSIC_TRADER_.

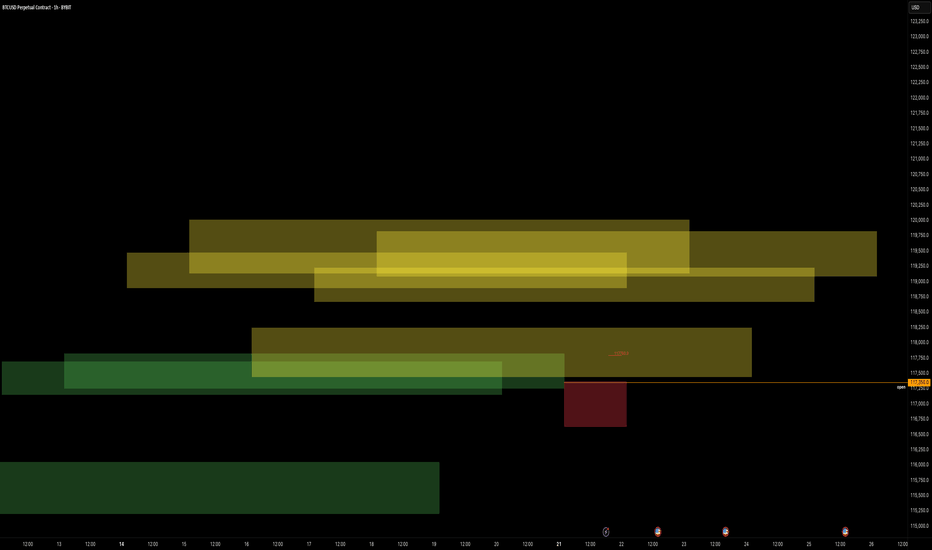

July 18 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

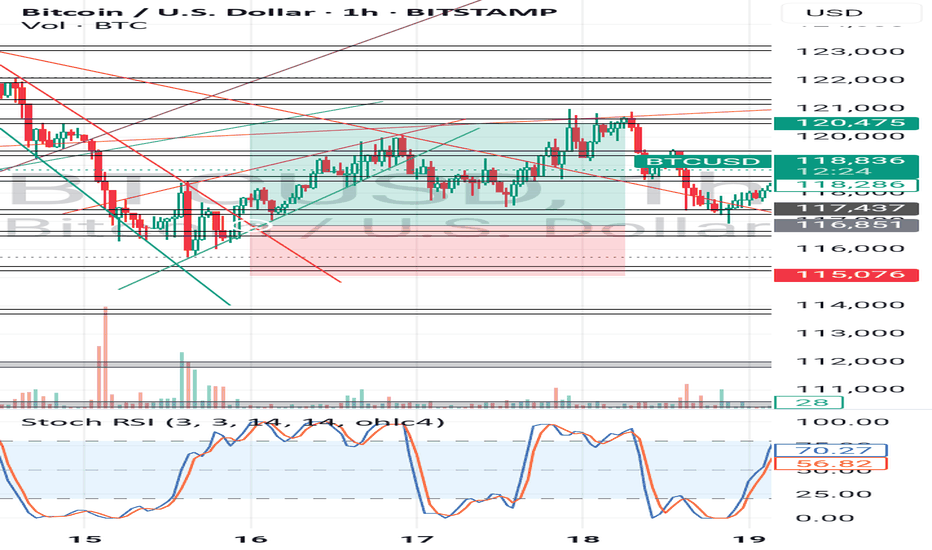

Bitcoin 30-minute chart.

There is no Nasdaq indicator announcement today.

The mid-term pattern was broken in the morning wave,

but I proceeded as safely as possible.

At the bottom left, I connected the final long position switching section in the analysis article on the 15th with a purple finger.

*When the blue finger moves,

Bidirectional neutral

Short->Long or long waiting strategy

1. Short position entry section of $120,338 / Stop loss price when orange resistance line is broken

2. Long position switching of $118,886.8 / Stop loss price when blue support line is broken

3. Long position 1st target of $121,756.2 -> Target price in the order of Good and Great

If it falls immediately from the current position or

touches the top once and falls, it is a vertical decline condition.

If it falls immediately, it is the final long waiting in section 2.

(When the sky blue support line breaks, the stop loss price is the same)

From the sky blue support line break, the 6+12 section is where the mid-term pattern is restored,

and it is roughly the bottom section.

If the strategy is successful, I have left a simulation with a pink finger on the right,

so please check the switching and profit-taking section,

and operate safely in each position, long, short, and no position, based on whether the purple support line breaks from the current position.

From the green support line break, the low point of today's daily candle is broken,

so it would not be good for a long position, right?

Up to this point, please use my analysis article only for reference and use,

and operate safely with principle trading and stop loss price.

Thank you.

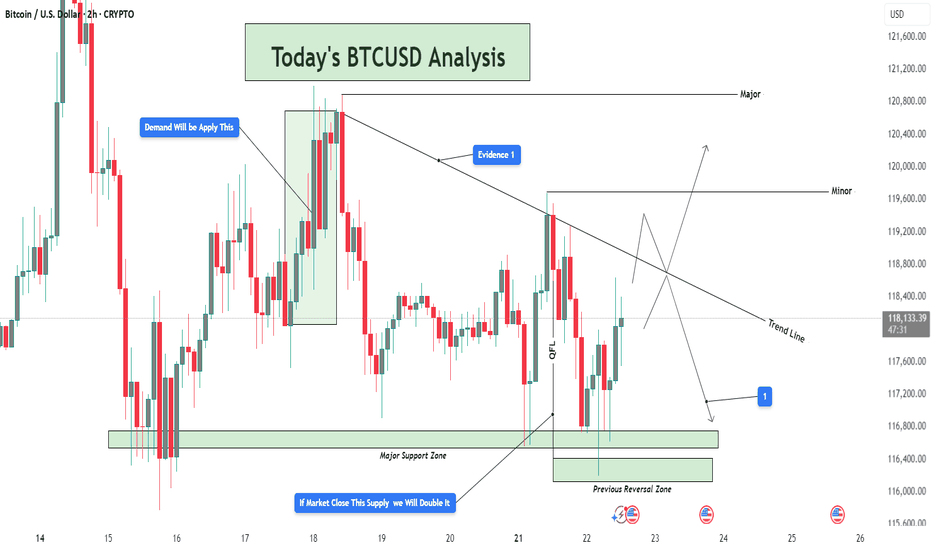

BTCUSD Analysis – Supply Pressure vs Demand Rejection 📊 Overview:

This BTCUSD 2-hour chart is giving us a clear structure of how price is currently reacting between a strong demand base and a descending trendline supply. We're at a critical decision point, where both buyers and sellers are gearing up for a potential breakout or breakdown. Let’s break it down level by level.

🟢 Demand Zone – Major Support Holding Firm

The Major Support Zone marked at the bottom of the chart is not just any random area—it has been tested multiple times and acted as a launchpad for bullish moves previously. This is also aligned with the Previous Reversal Zone, which adds confluence to this demand base.

Price dipped into this zone and immediately rejected with strong bullish candles, showing aggressive buyer interest.

This is a high-probability area for long setups as long as price stays above it.

You’ve noted on the chart: “If market closes this supply, we will double it” – that makes sense because a confirmed hold above this base increases the probability of upside continuation.

🔻 Trendline & Supply Zone – The Wall Ahead

Moving up the chart, price is being pressured by a descending trendline, acting as dynamic resistance. This trendline is not just drawn for decoration—it has rejected price at least twice already, and is also intersecting with a minor horizontal resistance zone.

This creates a confluence of resistance, making it a tough wall for buyers to break through without strong volume.

You’ve labeled it as “Evidence 1”, meaning the first confirmation of supply reacting here.

If BTC fails here again, we could easily see another pullback to the 116,800 – 116,400 range.

⚖️ QFL Pattern in Play

The QFL (Quick Flip Logic) is in action, where price aggressively dropped and formed a base, followed by a sharp move up. Price is now attempting to return to that base (demand zone) for a potential flip back upward.

If QFL holds and price breaks above the trendline, this will be a strong reversal confirmation.

This aligns with many institutional trading strategies which look for such formations near support zones.

📈 Potential Bullish Scenario:

Break above the descending trendline resistance

Price sustains above Minor Resistance Zone (around 118,800 – 119,600)

Next target: Major Resistance Zone between 120,800 – 121,200

This could create a higher-high structure and resume overall bullish trend

📉 Potential Bearish Scenario:

Failure to break the trendline

Rejection leads to price retesting the Major Support

If that zone breaks cleanly (especially below 116,400), price may drop toward 115,600 or lower

This opens up a possible short opportunity depending on price action and momentum

🎯 Conclusion:

This chart is a textbook example of consolidation between major zones. Bulls are defending hard at the bottom while bears are pushing down from the top. The direction of the breakout will dictate the next major move. Until then, wait for confirmation, avoid early entries, and let the market show its hand.

🧠 Patience = Profits.

🕒 Chart Timeframe: 2H

📌 Strategy in Focus: Supply & Demand Zones, Trendline Breakout, QFL Base Pattern

📍 Sentiment: Neutral-Bullish (Watching Trendline Reaction)

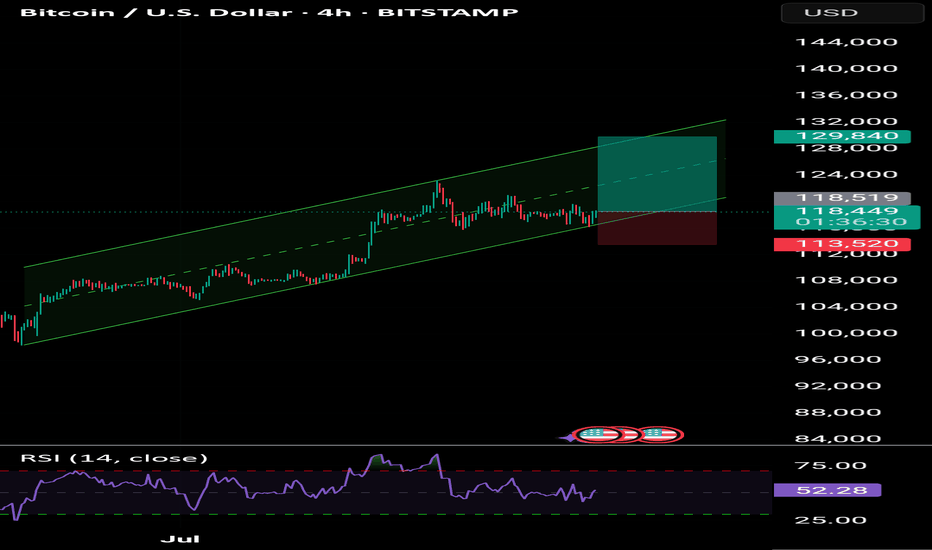

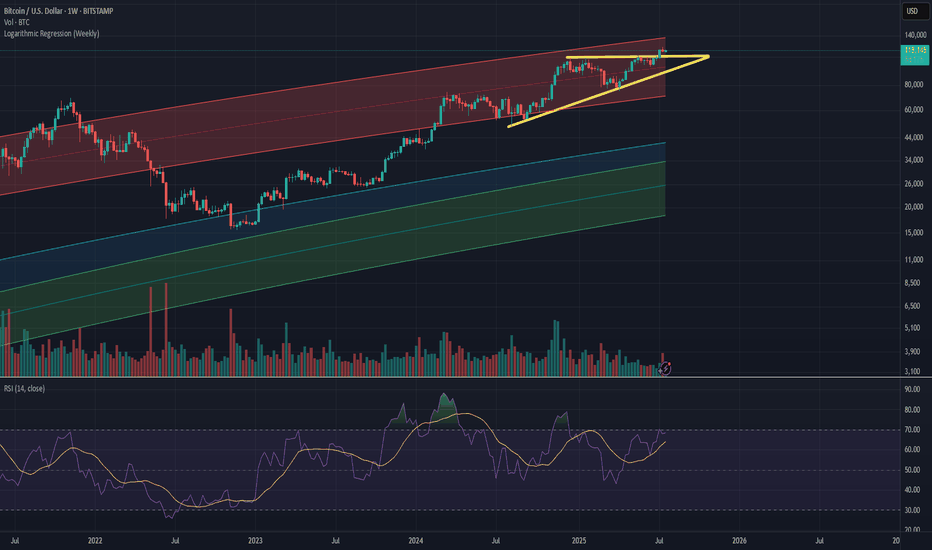

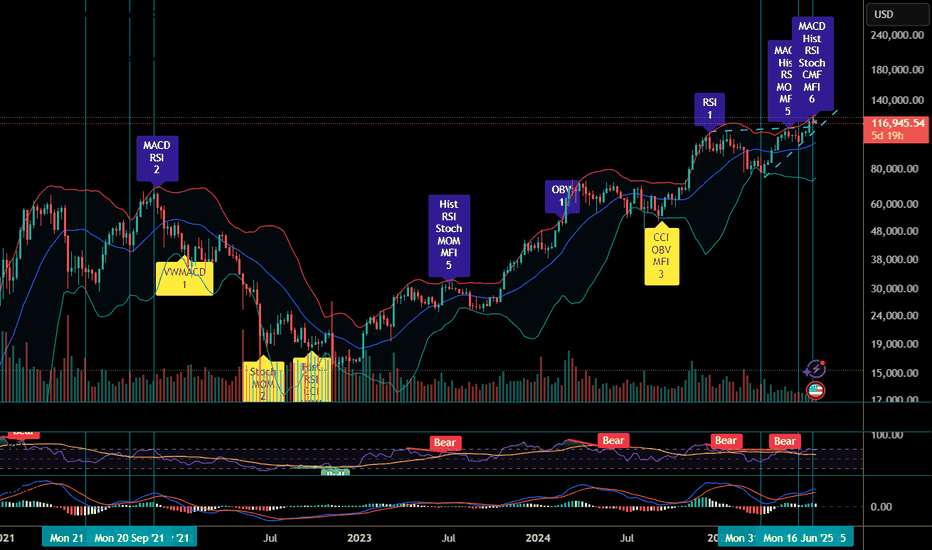

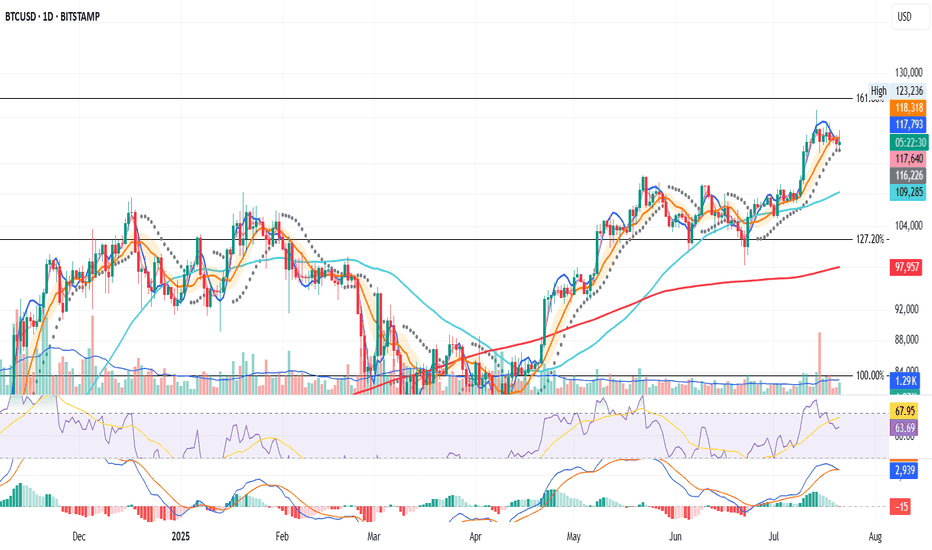

Final Push?In a previous analysis I used the range of the yellow triangle as grounds for suspicion that the bull run may be over. Now, thankfully, it appears to have formed a support on top of this triangle, instead.

I believe its possible for a big breakout here that will pop out of the red log zone, which would signal the top of this cycle/bubble.

However, for this we will need lots of volume, for which we need lots of euphoria.

$192,000 seems to be the target based on the target of the yellow triangle drawn, as well as the fib retrace. The fact that we are consolidating above $115,000 speaks to me that we still have plenty of juice, but moving the price at this market cap will require a lot of juice. Thus, I have ladder sells starting at $130,000

Comparison to 2021

I think the structure so far is quite similar to that of 2021.

1. Massive run up, piercing the upper BB and quickly falling down to the lower bound.

2. Double bottom on the lower BB.

3. Second run up, touching upper BB with a retracement to the midline.

4. Another run up higher, this time it seems it couldn't pierce the upper BB, but we already have some divergences and MACD is about to cross over, too.

If history rhymes, we should see next a drop to the midline, potentially overshooting it. The midline will then serve as an upper bound to the PA, before it drops to the lower bound and the ride continues.

Of course, it could also try to pierce the upper BB first, because of the sheer amount of trade deals (🌮)...

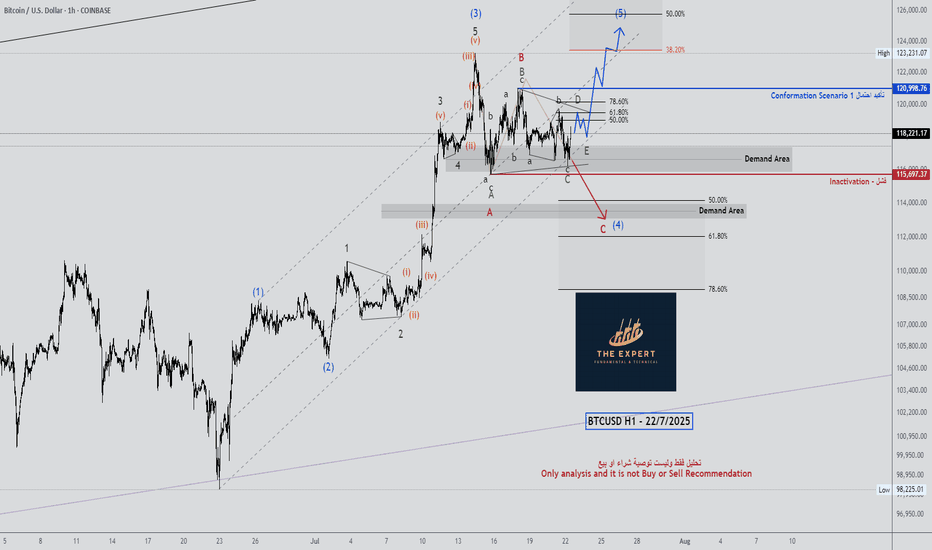

Bitcoin’s Crossroads: Shooting Star Pressure vs. Bullish Pennantwe examine a classic battle of signals: the daily chart reveals a dominant shooting star candle—hinting at overhead resistance and possible downside risk—while the 4-hour setup unfolds a bullish pennant triangle, often a prelude to continuation moves. This presentation balances caution with opportunity, highlighting key breakout zones, invalidation points, and what traders should watch next. As Bitcoin hovers at this technical tension point, will bulls find the strength to punch through? Unfortunately bulls have been faked out and we currently have a confirmed candle open and close below the 50EMA on 4H. This confirms a strong pullback initiated by the shooting star on the daily chart to a potential target of $114k.

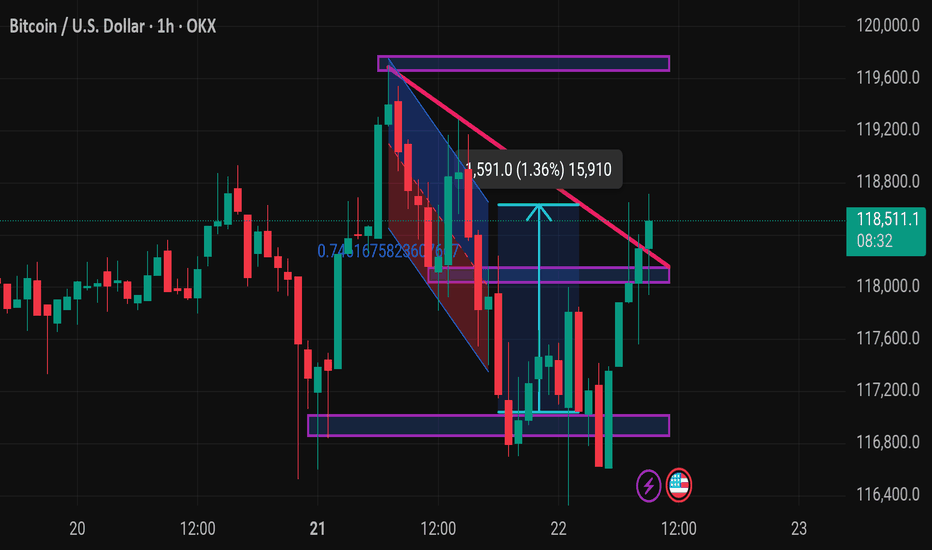

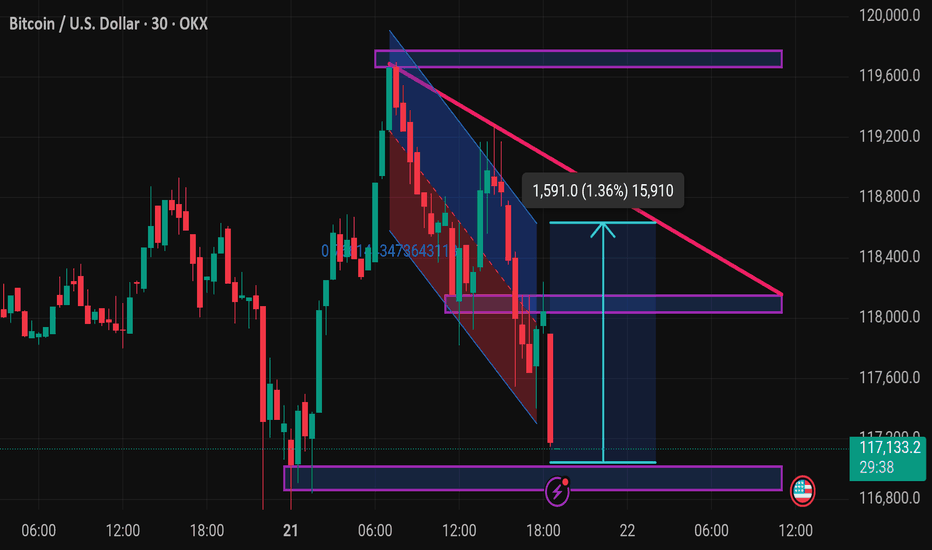

Btusdt techinical analysisThis chart shows a BTC/USD (Bitcoin to US Dollar) 30-minute time frame with a falling wedge pattern and potential bullish breakout setup. Here’s a breakdown of the key technical elements:

---

🔍 Chart Analysis Summary:

1. Pattern:

Falling wedge (highlighted by the converging pink trendlines): typically a bullish reversal pattern, especially after a downtrend.

Price has broken above the wedge, indicating a possible breakout.

2. Price Action:

BTC found strong support near $116,800.

After the breakout, the expected upward move is projected by the blue measured move box, targeting around $118,400–$118,800, a 1.36% gain (~$1,591).

3. Resistance & Target Zones:

First resistance zone: $118,400–$118,800 (wedge top and measured move target).

Next major resistance: $119,600–$120,000 area.

4. Support:

Strong support marked around $116,800 (purple zone at the bottom).

If BTC breaks below this, the bearish scenario could resume.

---

📈 Potential Trade Setup:

Bullish bias above wedge breakout.

Entry: Current level (if breakout holds).

Target: $118,400–$118,800.

Stop loss: Below $116,800 support zone.

---

Let me know if you'd like a bearish scenario, RSI/volume analysis, or a follow-up chart.

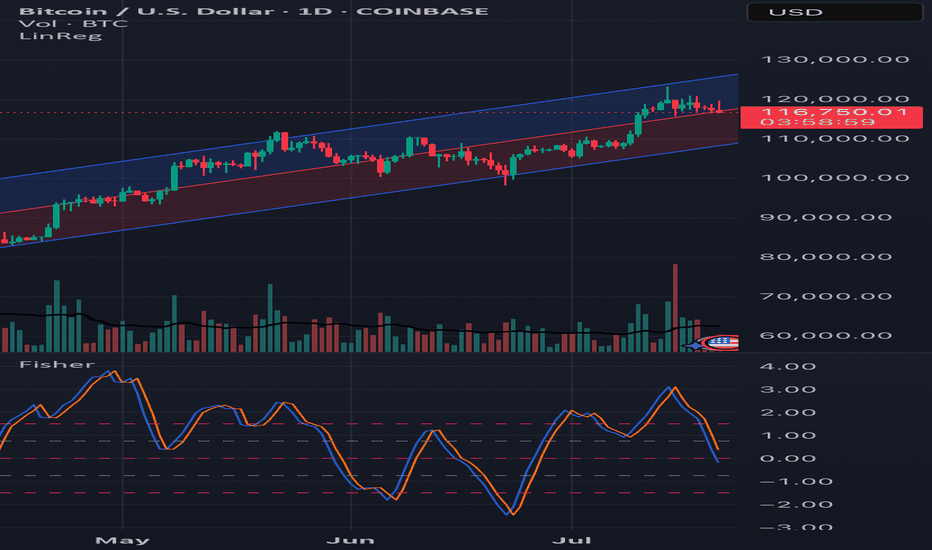

BTC Update – Short-Term Pressure Building

Bitcoin is still being pushed down below the BB center.

RSI is trending lower, and MACD is nearing a bearish crossover.

PSAR is hovering close to price, a warning sign.

This could still be a pause before the next leg up — but don’t ignore the signs.

And just a thought: Trump Media buying $2B in BTC might’ve marked a local top.

Prepare in advance.

Always take profits and manage risk.

Interaction is welcome.

vision paintingthis is sort of a game, i would like to play with anyone interested in chart riddles. i'm being very specific with my inputs, and coloring, painting a picture of what i need to see and when. painting whats there, guiding to where itll be. wondering if i could actually create art pieces here. hypothetically the 'paintings' would need to be back checked, to artificialy create any worth to it. market involvement is day/week trades. *no advice whatsoever. so, i think ill give it a go. from here onwards, these posts are the only ill post, with updates, within the comments of such post. happy trading

ballino