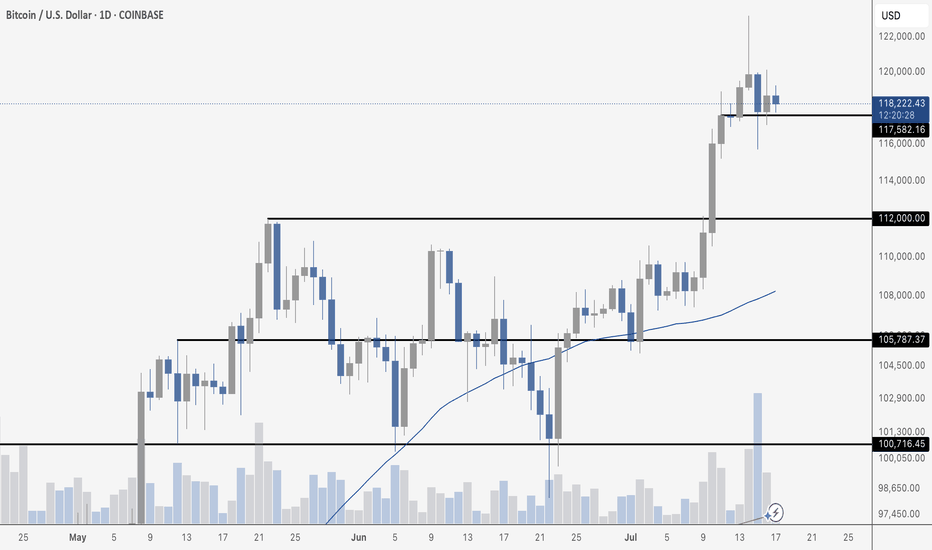

BTC CONSOLIDATESBitcoin is consolidating just below \$120,000 after Tuesday’s sharp pullback – which came on the highest daily volume since the \$74,000 bottom in March – mostly driven by selling. Despite the pressure, price held support cleanly at \$117,582 and continues to range tightly, suggesting healthy consolidation after a strong breakout above \$112,000. As long as \$117,582 holds, the structure remains bullish. A close above \$120,000 could ignite the next leg higher.

BTCUSD trade ideas

Bitcoin Strategic Compression Beneath the Cloud Gate.⊣

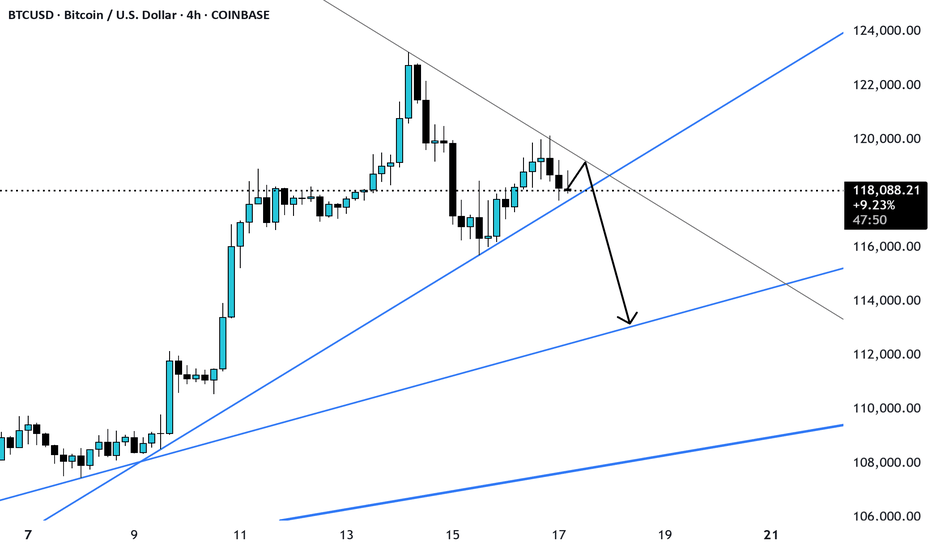

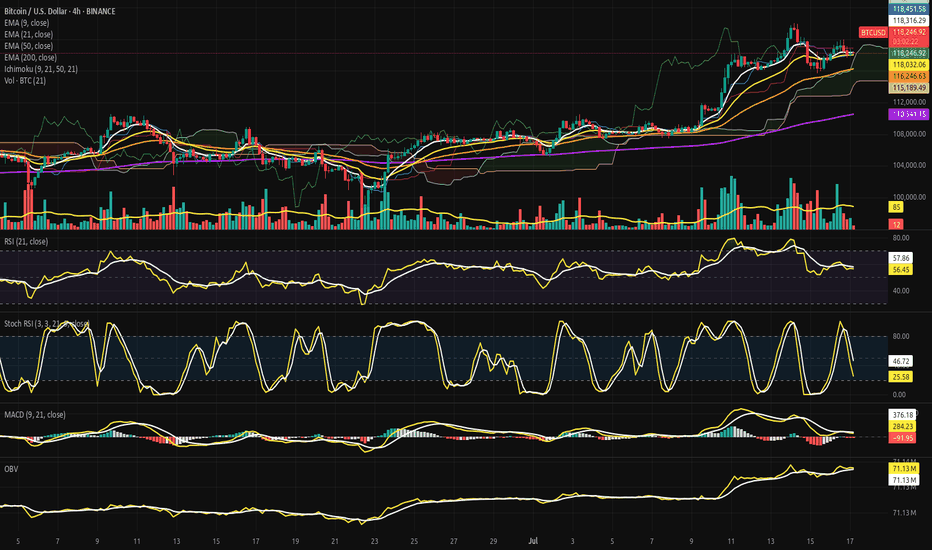

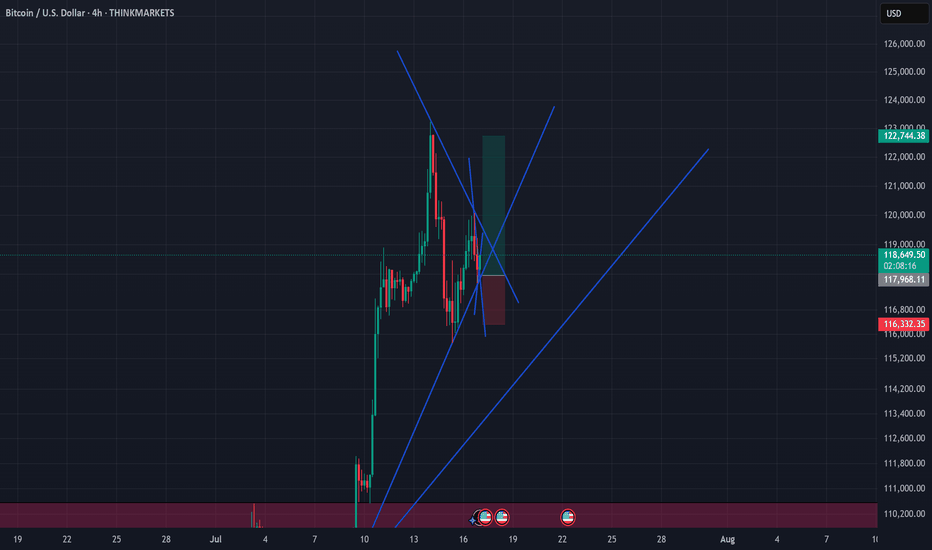

⟁ BTC/USD - BINANCE - (CHART: 4H) - (July 17, 2025).

◇ Analysis Price: $118,099.62.

⊣

⨀ I. Temporal Axis - Strategic Interval – (4H):

▦ EMA9 - (Exponential Moving Average - 9 Close):

∴ EMA9 is currently positioned at $118,286.83, marginally above the current price of $118,099.62;

∴ The slope of the EMA9 has begun to turn sideways-to-downward, indicating loss of short-term acceleration;

∴ The price has crossed below EMA9 within the last two candles, suggesting an incipient rejection of immediate bullish continuation.

✴️ Conclusion: Short-term momentum has weakened, positioning EMA 9 as immediate dynamic resistance.

⊢

▦ EMA21 - (Exponential Moving Average - 21 Close):

∴ EMA21 is measured at $118,018.67, positioned slightly below both price and EMA9, indicating a recent tightening of trend structure;

∴ The slope of EMA21 remains positive, preserving the medium-range bullish structure intact;

∴ EMA21 has been tested multiple times and held as support since July 15 - confirming tactical reliability as dynamic floor.

✴️ Conclusion: EMA21 stands as a critical pivot zone; any sustained breach would denote structural stress.

⊢

▦ EMA50 - (Exponential Moving Average - 50 Close):

∴ EMA50 is currently located at $116,240.85, well below current price action;

∴ The curve maintains a healthy positive inclination, affirming preservation of broader intermediate trend;

∴ No contact or proximity to EMA50 over the last 20 candles - indicating strong bullish detachment and buffer zone integrity.

✴️ Conclusion: EMA50 confirms medium-term bullish alignment; not yet challenged.

⊢

▦ EMA200 - (Exponential Moving Average - 200 Close):

∴ EMA200 stands at $110,539.69, forming the base of the entire 4H structure;

∴ The gradient is gradually rising, reflecting accumulation over a long time horizon;

∴ The distance between price and EMA200 reflects extended bullish positioning, yet also opens risk for sharp reversion if acceleration collapses.

✴️ Conclusion: Long-term structure remains bullish; early signs of overextension exist.

⊢

▦ Ichimoku Cloud - (9, 21, 50, 21):

∴ Price is currently above the Kumo (cloud), placing the pair within a bullish regime;

∴ Tenkan-sen (conversion) and Kijun-sen (base) lines show narrowing separation, suggesting momentum compression;

∴ Senkou Span A > Span B, and the cloud ahead is bullishly twisted, though thinning - indicating potential vulnerability despite structural advantage.

✴️ Conclusion: Bullish regime intact, but loss of momentum and cloud compression warrant caution.

⊢

▦ Volume + EMA21:

∴ Current volume for the latest candle is 3 BTC, compared to the EMA21 of 84 BTC;

∴ This indicates an extremely low participation phase, often associated with distribution zones or indecisive consolidation;

∴ Previous impulsive candles (July 15) reached well above 100 BTC - the current contraction is stark and strategically significant.

✴️ Conclusion: Absence of volume threatens trend continuation; energy depletion apparent.

⊢

▦ RSI - (21) + EMA9:

∴ RSI (21) is positioned at 55.73, marginally above neutral zone;

∴ EMA 9 of RSI is 57.71, crossing downward against RSI - bearish micro signal;

∴ No divergence is present versus price action - oscillator confirms current stagnation rather than exhaustion.

✴️ Conclusion: RSI losing strength above neutral; lacks momentum for breakout, but no capitulation.

⊢

▦ Stoch RSI - (3,3,21,9):

∴ %K is 21.44, %D is 45.34 - both pointing downward, in deacceleration phase;

∴ Recent rejection from overbought zone without full reset into oversold - signaling weak bullish thrust;

∴ Historical cycles show rhythmical reversals near current levels, but only with supportive volume, which is absent now.

✴️ Conclusion: Short-term momentum failed to sustain overbought breakout - micro-correction expected.

⊢

▦ MACD - (9, 21):

∴ MACD line is at -104.80, Signal line at 268.16 - large separation, histogram deeply negative;

∴ The bearish crossover occurred with declining volume, implying fading momentum rather than aggressive sell-off;

∴ No bullish divergence formed yet - continuation of correction remains technically favored.

✴️ Conclusion: MACD confirms trend exhaustion; no reversal in sight.

⊢

▦ OBV + EMA 9:

∴ OBV is 71.13M, perfectly aligned with its EMA9 - indicating equilibrium in volume flow;

∴ No directional bias in accumulation or distribution - flatlining suggests passive environment;

∴ Prior OBV uptrend has stalled since July 15 - reinforcing narrative of hesitation.

✴️ Conclusion: Institutional flow is neutral; no aggressive positioning detected.

⊢

🜎 Strategic Insight - Technical Oracle: The current price structure presents a classic post-impulse compression configuration within a preserved bullish environment. Despite the higher timeframe alignment, multiple short-term indicators exhibit tactical dissonance and signs of momentum decay. This inconsistency reflects a market caught between structural optimism and tactical hesitation.

♘ Key strategic signals - Structural Alignment:

∴ All major EMA's (9, 21, 50, 200) remain stacked in bullish order with no bearish crossovers imminent;

∴ Price remains above the Ichimoku Cloud and above EMA50 - both confirming structural dominance by buyers.

♘ Momentum Degradation:

∴ RSI (21) is drifting below its EMA9, weakening the momentum required for further upside continuation;

∴ Stochastic RSI has rolled over aggressively, failing to reach oversold before reversing - mid-cycle weakness is confirmed.

♘ Volume Collapse:

∴ The current volume profile is critically weak - 3 Bitcoin against an average of 84 Bitcoins (EMA21);

∴ Price attempting to sustain above EMA's with no conviction signals distribution or passivity.

♘ MACD & OBV:

∴ MACD histogram remains deep in negative territory, and no bullish crossover is visible;

∴ OBV is flat - neither accumulation nor distribution dominates, leaving directional thrust suspended.

✴️ Oracle Insight:

∴ The technical field is Structurally Bullish, but Tactically Compressed.

∴ No breakout should be expected unless volume decisively returns above baseline (84 Bitcoins EMA);

∴ Below $117,800, the structure risks transition into a corrective phase;

∴ Above $118,450, potential trigger zone for bullish extension if accompanied by volume surge.

♘ Strategic posture:

∴ Wait-and-observe regime activated;

∴ No entry condition satisfies both structure and momentum at present;

∴ Tactical neutrality is advised until confirmation.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Reserve - (All Exchanges):

∴ The total Bitcoin reserves held on all exchanges continue a sharp and uninterrupted decline, now at ~2.4M BTC, down from over 3.4M in mid-2022;

∴ This downtrend has accelerated particularly after January 2025, with a visible drop into new lows - no accumulation rebound observed;

∴ Historically, every prolonged depletion of exchange reserves correlates with structural bullish setups, as supply becomes increasingly illiquid.

✴️ Conclusion: On-chain supply is structurally diminishing, confirming long-term bullish regime intact - mirrors technical EMA alignment.

⊢

▦ Fund Flow Ratio - (All Exchanges):

∴ Current Fund Flow Ratio stands at 0.114, which is well below historical danger thresholds seen near 0.20-0.25 during local tops;

∴ The ratio has remained consistently low throughout the 2025 uptrend, indicating that on-chain activity is not directed toward exchange-based selling;

∴ Spikes in this indicator tend to precede local corrections - but no such spike is currently present, reinforcing the notion of non-threatening capital flow.

✴️ Conclusion: Capital is not rotating into exchanges for liquidation - volume weakness seen in 4H chart is not linked to sell intent.

⊢

▦ Miners' Position Index - (MPI):

∴ The MPI sits firmly below the red threshold of 2.0, and currently ranges in sub-neutral levels (~0.5 and below);

∴ This suggests that miners are not engaging in aggressive distribution, and are likely retaining Bitcoin off-exchange;

∴ Sustained low MPI readings during price advances confirm alignment with institutional and long-term accumulation behavior.

✴️ Conclusion: Miner behavior supports structural strength - no mining-induced supply pressure present at this stage.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ Across the three strategic indicators, no on-chain evidence supports short-term weakness;

∴ Supply is declining - (Exchange Reserve ↓);

∴ Funds are not preparing for exit - (Flow Ratio stable);

∴ Miners are not selling - (MPI subdued).

✴️ This constellation reinforces the thesis of Structural Bullishness with Tactical Compression, and suggests that any pullback is not backed by foundational stress.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The multi-timeframe EMA stack remains intact and aligned - (9 > 21 > 50 > 200);

∴ Price floats above Ichimoku Cloud, and above EMA21 support, confirming elevated positioning within a macro bull channel;

∴ On-chain metrics confirm supply contraction, miner retention, and absence of fund rotation toward exchanges - structure remains sovereign;

∴ RSI - (21) slips under its EMA9 with low amplitude, indicating absence of energetic flow;

∴ Stoch RSI fails to reset fully and points downward - suggesting premature momentum decay;

∴ MACD histogram remains negative, while volume is significantly beneath EMA baseline (3 BTC vs 84 BTC);

∴ Price faces resistance at Kijun-sen ($118.451), acting as tactical ceiling; no breakout signal detected.

⊢

✴️ Interpretatio Finalis:

∴ Structural integrity remains unshaken - the architecture is bullish;

∴ Tactically, however, the battlefield is fogged - silence reigns in volume, hesitation in oscillators;

∴ A true continuation requires volume resurrection and resolution above $118,450. Until then, neutrality governs the edge.

⊢

⧉

Cryptorvm Dominvs · ⚜️ MAGISTER ARCANVM ⚜️ · Vox Primordialis

⌬ - Wisdom begins in silence. Precision unfolds in strategy - ⌬

⧉

⊢

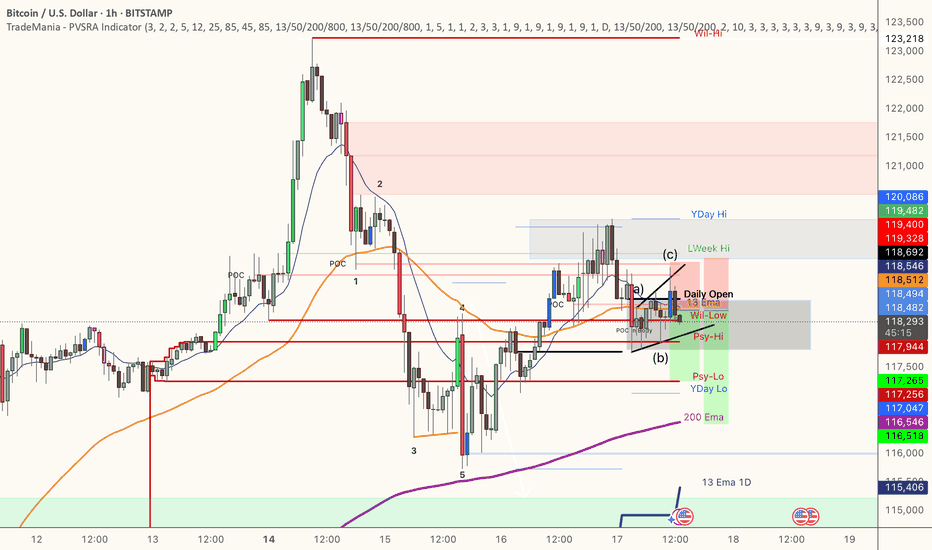

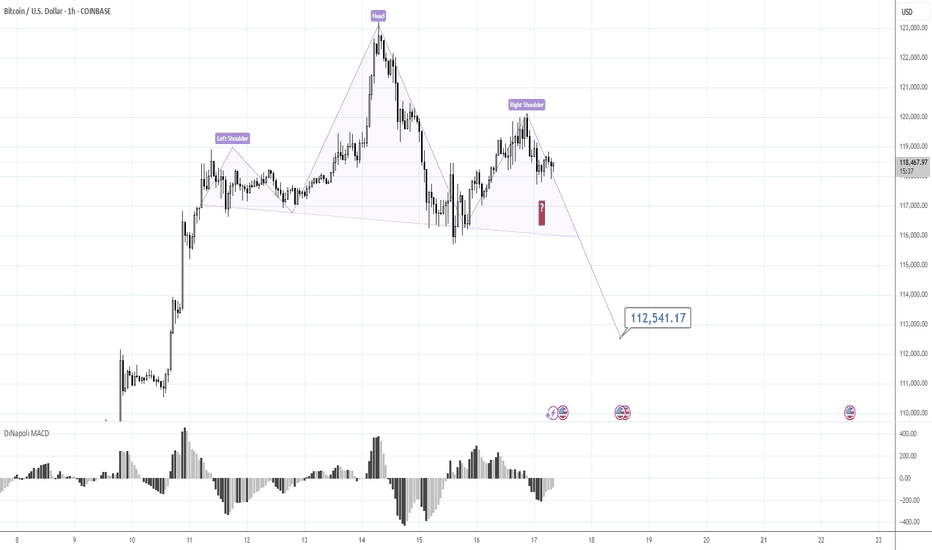

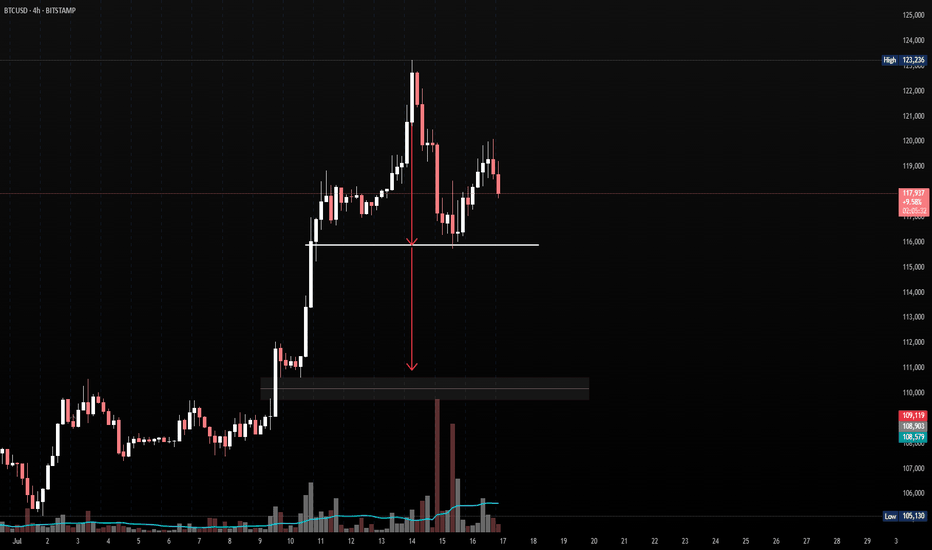

120K is the Key.Morning folks,

Our last plan worked perfect - market re-tested 117K support and jumped out. If you have longs - you could keep it.

We consider now two alternative scenarios, although we think that this one with triangle is more probable, we do not exclude the H&S shape on 1H chart that could lead BTC down to 112-113K support area.

So, if you do not know how to deal with this - keep an eye on the 120K area and top of the right arm. Upside breakout will confirm H&S failure and triangle scenario. Otherwise, until market stands under 120K - consider H&S as a basic scenario, just for safety.

Take care, S.

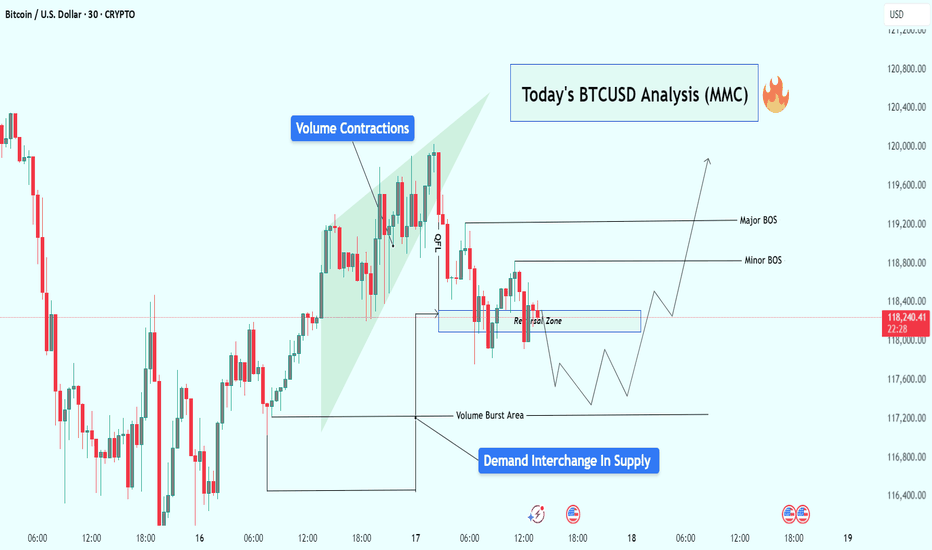

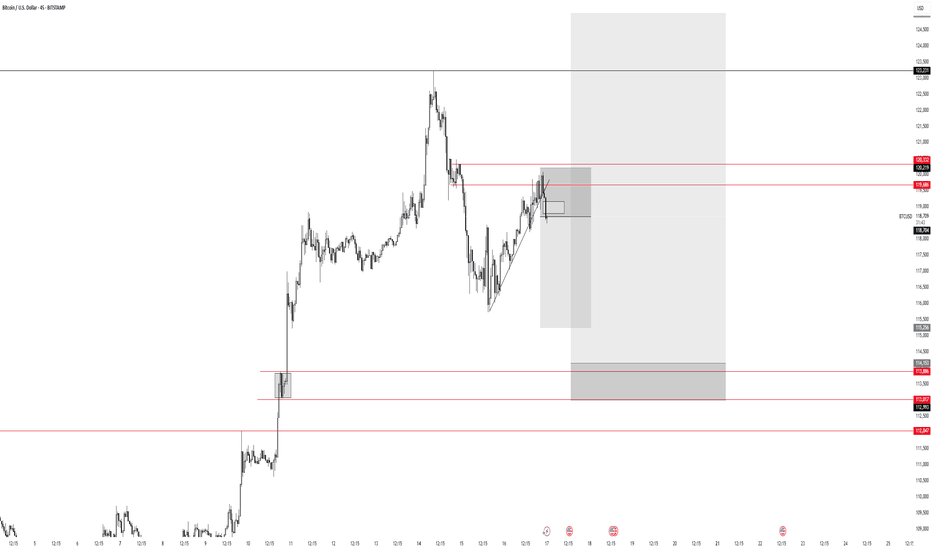

BTCUSD Analysis : Reversal Brewing from Volume Burst Demand Zone🧠 Overview:

Bitcoin is currently showing signs of a potential bullish reversal, following a classic Market Maker Cycle (MMC) pattern. The price action has been clean, respecting both volume dynamics and structural levels, setting the stage for a possible breakout above key areas of interest.

Let’s dive into the detailed breakdown:

🔍 Key Technical Elements:

1️⃣ Volume Contractions – Early Sign of Momentum Shift

At the top left of the chart, we observe a sharp upward move, followed by volume contraction within a rising wedge. This typically represents:

Absorption of orders

Reduced volatility

Market indecision

This kind of structure often precedes a reversal or aggressive breakout, depending on how price behaves near liquidity zones.

2️⃣ Fakeout/Trap Above – Classic MMC Manipulation Phase

After the rising wedge formed, BTC experienced a quick fakeout (stop hunt) just above the highs, then dropped sharply. This was the manipulation leg — a clear signal that liquidity above the wedge was taken and smart money is now repositioning.

🧠 Market makers love to trap breakout traders before moving the opposite way. The drop confirms manipulation is complete.

3️⃣ Reversal Zone + Demand Interchange into Supply

Price then entered a marked reversal zone which was previously an area of demand — now interchanging into supply. This zone is critical because:

It aligns with volume burst zones

It acted as support turned resistance

Multiple rejections confirm order flow shift

This tells us smart money is now testing this area to accumulate or trap sellers.

4️⃣ Volume Burst Area – Institutional Involvement Confirmed

We can clearly identify a Volume Burst Area, where price spiked with strong momentum — this is not retail trading. This zone is now being revisited for a potential bullish re-accumulation.

Expect reaction from this area, as it likely contains unmitigated buy orders from institutions.

5️⃣ Break of Structure (BOS) Mapping:

Minor BOS: Breaks short-term lower highs, showing early intent.

Major BOS: Breaks significant structure, confirming shift in trend direction.

A successful retest of demand and then break of both BOS levels will likely lead to a strong bullish continuation.

📈 Trade Plan & Potential Price Path:

There are two potential bullish entry strategies forming:

✅ Scenario 1: Clean Breakout Plan

Price holds the current reversal zone

Breaks Minor BOS, then Major BOS

Retest of BOS confirms continuation

📍 Target: $119,600+

✅ Scenario 2: Liquidity Sweep Entry

Price dips lower into Volume Burst Area

Sweeps liquidity below and prints a bullish reaction

Enters from discount zone

Same upside targets apply

🧠 This would be a smart money entry — entering from the lowest point of pain for retail traders.

🧵 Final Thoughts:

BTC is setting up beautifully for a reversal continuation pattern within the MMC framework. We’ve seen:

📉 Initial drop (accumulation phase)

🎭 Fake breakout (manipulation phase)

📈 Upcoming expansion (breakout phase)

All signs point to a high-probability move upward, especially if price confirms with BOS + retest. Be patient, wait for price action to align with structure and volume clues.

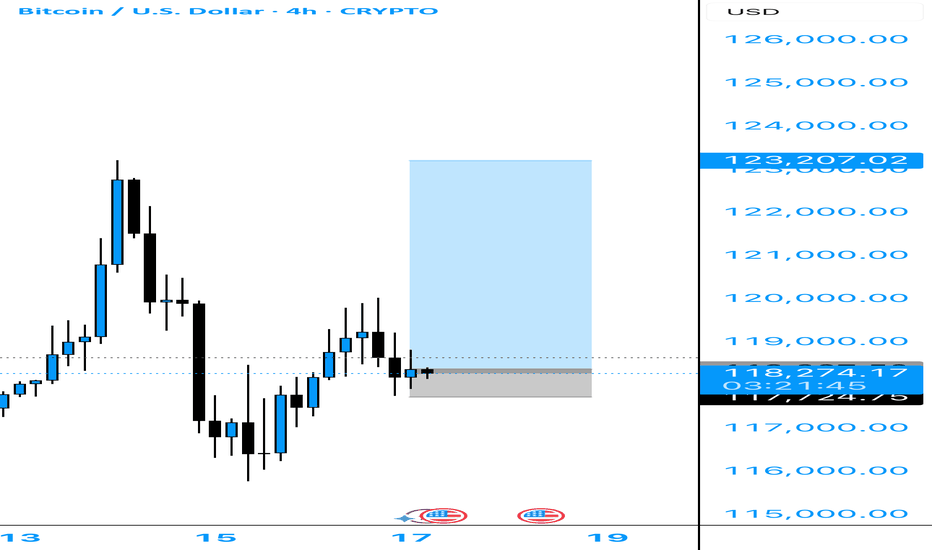

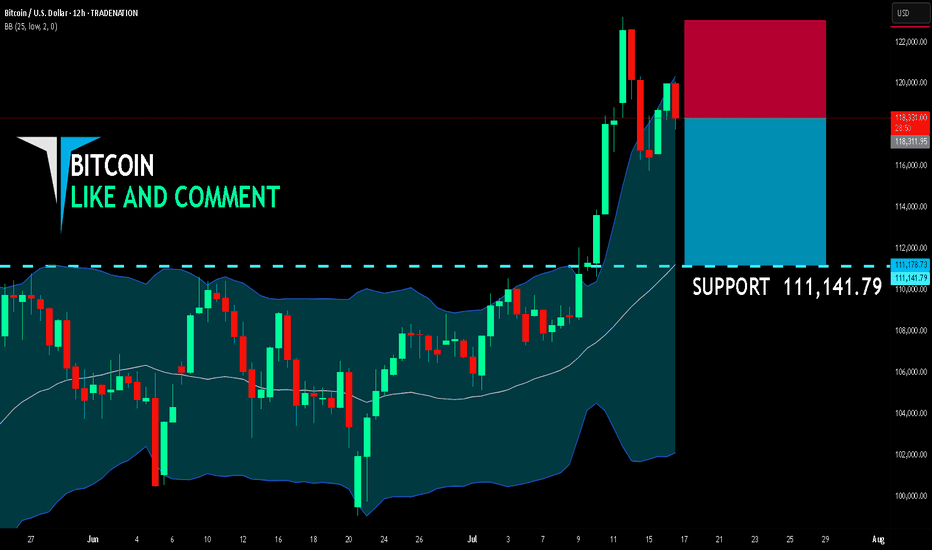

BITCOIN SHORT FROM RESISTANCE

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 118,311.95

Target Level: 111,141.79

Stop Loss: 123,054.98

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

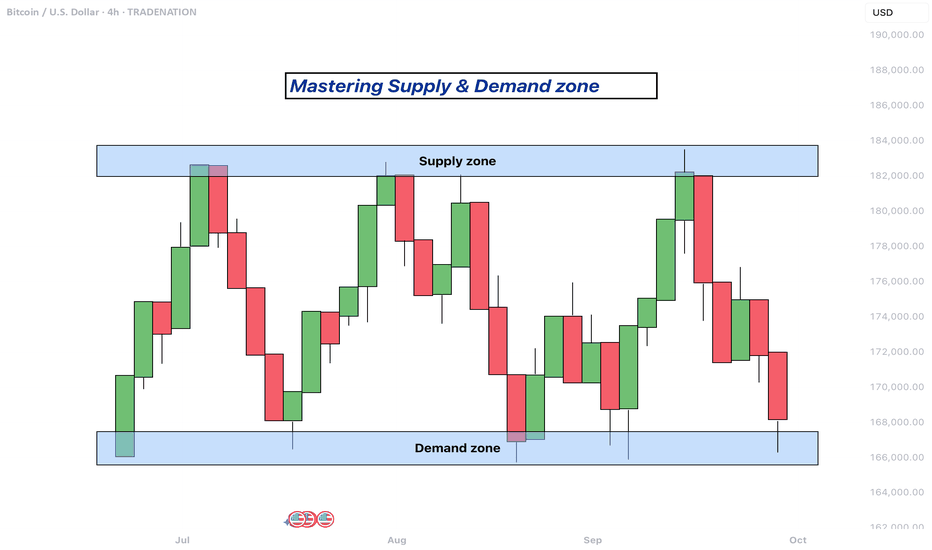

Mastering supply and demand zones - how to use it in trading?Supply and demand zones are key concepts in technical analysis used by traders to identify potential price reversal areas on a chart. They are based on the idea that prices move due to an imbalance between buyers (demand) and sellers (supply).

-------------------------

What will be discussed?

- What are supply and demand zones?

- How to detect supply and demand zones?

- Examples from supply and demand zones?

- How to trade using supply and demand zones?

-------------------------

What are supply and demand zones?

Supply and demand zones are areas on a price chart where the forces of buying and selling are strongly concentrated, causing significant movements in price. In simple terms, a supply zone is an area where selling pressure exceeds buying pressure, often leading to a drop in price. It usually forms when price moves upward into a region where sellers begin to outnumber buyers, pushing the price back down. On the other hand, a demand zone is a region where buying pressure exceeds selling pressure, typically resulting in a rise in price. This occurs when price moves downward into a region where buyers see value and begin to outnumber sellers, causing the price to increase again.

These zones reflect areas of imbalance in the market. In a supply zone, sellers are more eager to sell than buyers are to buy, often due to overbought conditions, news, or fundamental changes. In a demand zone, buyers are more eager to buy than sellers are to sell, often because the price has become attractive or undervalued. Traders look for these zones because they provide clues about where price may reverse or stall, offering potential entries or exits for trades.

-------------------------

How to detect supply and demand zones?

Identifying supply and demand zones involves analyzing price action on a chart, typically using candlestick patterns. A common way to detect a supply zone is to look for a sharp upward move followed by a sudden reversal or strong drop in price. The area where the price stalled before falling sharply is likely to be a supply zone. This zone includes the highest candle body or wick before the drop, and a few candles before it that mark where the selling pressure began.

To identify a demand zone, you would look for a sharp drop in price followed by a strong rally upward. The area where the price paused before rising significantly can be considered a demand zone. Like with supply zones, the demand zone includes the lowest candle before the price reversed and a few candles leading up to it.

These zones are not exact price levels but rather ranges. Price does not have to touch an exact line to react; it often moves within the general area. For more accuracy, traders often refine their zones by identifying them on higher time frames such as the 4-hour or daily chart, then adjusting them slightly on lower time frames like the 1-hour or 15-minute chart.

-------------------------

Examples from supply and demand zones:

-------------------------

How to trade using supply and demand zones?

Trading supply and demand zones involves anticipating how price is likely to behave when it returns to one of these key areas. A common method is to wait for price to enter a zone and then watch for confirmation that it is going to reverse. For example, if price rises into a supply zone, you might look for signs like a bearish candlestick pattern, a drop in volume, or a rejection wick to signal that sellers are stepping in again. This would be an opportunity to enter a short trade with the expectation that price will fall.

Conversely, if price falls into a demand zone, you would wait for bullish signals—such as a strong bullish candle, a double bottom pattern, or clear rejection of lower prices—to confirm that buyers are returning. This would be a potential setup for a long trade, expecting the price to move up from the zone.

Traders often place stop losses just beyond the zone to limit risk in case the level fails. For a supply zone, the stop loss would go just above the zone, while for a demand zone, it would go just below. Targets can be set at recent support or resistance levels, or by using risk-reward ratios like 1:2 or 1:3 depending on the trader’s strategy.

Patience and discipline are important when trading these zones. Not every zone will lead to a reversal, and false breakouts can occur. Therefore, combining supply and demand analysis with other tools such as trendlines, moving averages, or indicators can improve the chances of a successful trade.

In summary, supply and demand zones help traders understand where large buying or selling forces are likely to influence price. By learning to identify these zones and waiting for confirmation signals, traders can enter high-probability trades with clear risk and reward levels.

-------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like and leave a comment, I’d love to hear your thoughts!

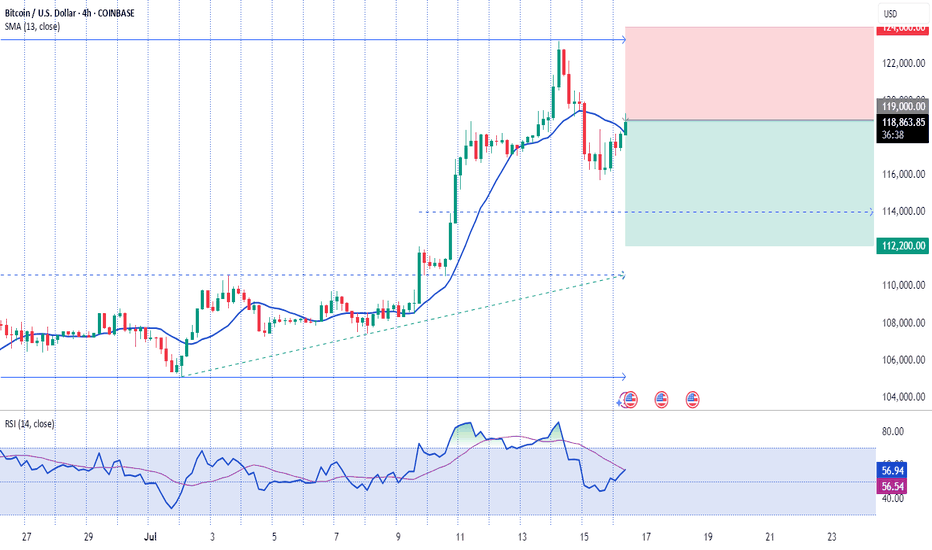

BTCUSD – Pullback Imminent?📉 BTCUSD – Pullback Imminent?

Buyers beware ⚠️ — The bullish FVG on the daily chart is no longer holding. Price has shown signs of rejection from the premium zone , and a deeper pullback toward the Fair Value Area at 111,740 seems likely.

🧠 Let the market breathe... we’ll catch the real ride from below.

👀 Eyes on the Monthly FVG (T2,4) as the ultimate demand zone if price accelerates lower.

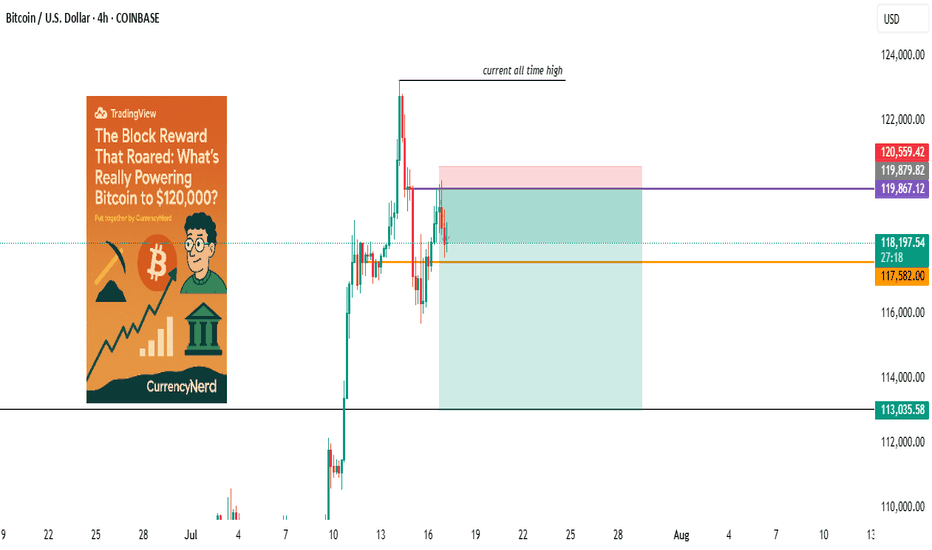

wall Street has set camp on Satoshi's backyard...Bitcoin didn’t just wake up and choose violence. It chose velocity.

As BTC blasts through the six-figure ceiling and fiddles $120k with laser precision, everyone’s pointing to “the halving” like it’s some magical switch. But let's be real, Bitcoin bull runs don’t run on fairy dust and hope. They run on liquidity, macro dislocations, structural demand shifts, and a pinch of regulatory chaos.

Here’s the nerdy breakdown of what’s really driving the Bitcoin Rocketship (and why this one’s different):

1. The Halving Effect (Not Just the Halving)

Yes, the April 2024 halving slashed miner rewards from 6.25 to 3.125 BTC. But this time, the reflexivity is louder. Miners now have to sell less, and buyers (especially ETFs) have to beg for more.

Miners = Reduced Sell Pressure.

ETFs = Constant Buy Pressure.

That’s a one-way order book squeeze. Simple math, but powerful dynamics.

2. ETF Flows: The "Spot" That Launched a Thousand Rallies

When the SEC finally gave the green light to Bitcoin spot ETFs, TradFi didn’t walk in—they stormed in.

Think BlackRock, Fidelity, and friends becoming daily buyers. It's not retail FOMO anymore, it's Wall Street with billions in dry powder doing dollar-cost averaging with institutional consistency.

🧠 Nerd Note: The top 5 U.S. spot ETFs alone are now hoarding more BTC than MicroStrategy.

3. Dollar Liquidity is Leaking Again

Despite Fed jawboning, real rates are still under pressure and global liquidity is quietly creeping back. Look at the TGA drawdowns, reverse repo usage, and China’s stealth QE.

Bitcoin, being the apex predator of liquidity, smells it from a mile away.

“In a world flooded with fiat, Bitcoin doesn’t float. It flies.”

4. Sovereigns Are Quietly Watching

El Salvador lit the match. Now, Argentina, Turkey, and even Gulf countries are tiptoeing toward a Bitcoin pivot, hedging USD exposure without broadcasting it to CNN.

Central banks don’t need to love BTC to stack it. They just need to fear the dollar system enough.

5. Scarcity Narrative Goes 3D

With 99% of BTC supply already mined and over 70% HODLed for over 6 months, every new buyer is bidding for a smaller slice of the pie. ETFs and institutions are trying to drink from a faucet that only drips.

This is not a market with elastic supply. This is financial physics with a scarcity twist.

6. Market Microstructure is Fragile AF

Order books are thin. Real liquidity is fragmented. And the sell-side has PTSD from getting blown out at $70k.

This creates a “skateboard-on-a-freeway” scenario, when a few billion in inflows hit, prices don’t just rise. They gap.

Nerdy Bonus: The Memecoin Effect (No, Really)

The memecoin mania on Solana, Base, and Ethereum has been injecting dopamine into degens—and their profits are increasingly flowing into the OG digital gold.

It’s the 2021 cycle all over again, just with more liquidity bridges and fewer inhibitions.

Nerdy Insight: The Bull Run Has Layers

What’s driving BTC to $120,000 isn’t a single headline. It’s a stacked convergence of macro, structure, psychology, and coded scarcity.

Bitcoin isn’t “going up” just because of hope or halving hype. It’s going up because it’s the cleanest asset in a dirty system, and now both retail and institutions agree.

Still shorting? That’s not “fading the crowd.” That’s fighting thermodynamics.

Stay nerdy, stay sharp.

put together by : @currencynerd as Pako Phutietsile

Crypto Week in the U.S. – Bitcoin SurgesCongressional Crypto Week: Bitcoin Hits All-Time Highs in a Decisive Week for the U.S.

Ion Jauregui – Analyst at ActivTrades

Bitcoin (BTCUSD) is back in global headlines after breaking above $123,203 this Tuesday, setting a new all-time high in the same week. So far in July, the leading cryptocurrency has surged 17%, fueled by a combination of institutional inflows, political momentum, and evolving regulation. This week, Washington is hosting “Crypto Week,” a key event that may define the legal and financial future of digital assets in the United States. At the same time, institutional backing shows no signs of slowing down—Bitcoin ETFs continue to set records for net inflows, particularly BlackRock’s IBIT, now managing over $85 billion in assets.

ETFs, Trump, and Regulation: All Roads Lead to Crypto

BlackRock’s spot Bitcoin ETF, IBIT, attracted $729 million in net inflows last week alone, setting a historic milestone by becoming the fastest ETF ever to reach $80 billion in assets under management—just 374 days, compared to over 1,800 days for the previous record held by the Vanguard S&P 500 ETF. The growing institutional interest—with over 265 funds and entities now actively investing in BTC—not only validates the asset class but also tightens supply: BlackRock reportedly acquired an average of more than 860 bitcoins per day last week. This persistent demand is directly contributing to the price momentum.

A Legal Framework in Progress

Three major bills are on the Congressional agenda this week:

The Genius Act: Aims to regulate stablecoins and has already passed the Senate with bipartisan support.

The Clarity Act: Seeks to define which cryptocurrencies qualify as securities or commodities, clarifying regulatory oversight.

The Anti-CBDC Act: Proposes restricting the government’s ability to issue an official digital currency, favoring decentralized ecosystems.

This regulatory push is seen by the market as a sign of institutional consolidation in the crypto space, paralleling the already advanced European MiCA framework.

Technical Analysis of BTCUSD

On the daily chart, Bitcoin broke decisively above the previous ceiling at $112,000 on July 12 and has since been validating a consolidation pattern near the $120,000 level—forming a bullish pennant on the 1-hour chart. The RSI remains overbought at 64.92%, but with no current signs of bearish divergence. The next technical target lies in the $130,000–$135,000 zone, while the nearest support is found at $118,000. A daily close below that level could trigger a technical correction toward $108,000–$109,000, marking the base of the current impulse. The point of control sits far lower at $85,195, although the current move appears to be unfolding within the third of three key volume profile levels. The MACD continues to support price expansion, though trading volume appears to be declining. Delta level indicators suggest strong resistance near current price highs, meaning another push may be needed—possibly triggered by continued regulatory momentum.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

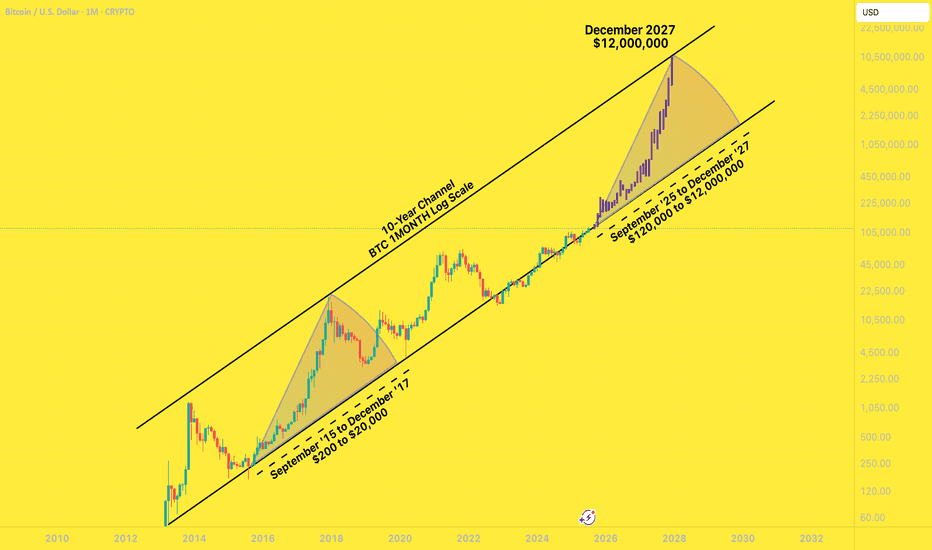

BTC to $12,000,000 December '27I had a years-old bookmarked chart from @MillionaireEconomics that I wanted to update and pick a random, extremely bullish candle pattern from the last time BTC came off the bottom channel to slap on it.

Riddle me this:

Why shouldn't Bitcoin go to $12,000,000 by December 2027?

Saylor continues to lead the way for global companies to scramble to build their own BTC warchests. These early adopters are having investor money dumped into them by the truckload.

Countries are stacking BTC

The BTC ETFs are a smash hit

Trump is all for making his own multi-billy family bitty stack

Mid-curvers will sell far too early, for far too little.

In the next two years, you'll be bombarded with countless, seemingly good reasons to sell your Bitcoins for hundreds of thousands of dollars - and then millions of dollars.

A shocking number of people will be far too early to sell. They will wake up in a cold sweat, night after night, haunted by their "could-have-been" stack, the number that updates in their head ten times a day, going up by six or seven figures a day .

... until they FOMO right back in at $11,999,999.

BTCUSD 7/16/2025Come Tap into the mind of SnipeGoat, as he gives you a Full Top-Down Analysis with a Deep Dive Down into the 30min Timeframe. This is One you don't want to miss.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

BTCUSD – Potential Head & Shoulders Forming⚠️If and only if the price break below $115,000

⚠️ BTCUSD – Potential Head & Shoulders Forming

Pair: BTC/USD

Timeframe: 4H

Pattern in Focus: Head and Shoulders

Key Neckline: ~$115,000

Confirmation Trigger: Only valid if price breaks below the neckline zone with strong volume

🧠 Idea Summary:

Bitcoin has formed what appears to be a classic head and shoulders pattern. The right shoulder is completing, and the neckline is clearly respected. A break below $115K could confirm this bearish setup, with a measured move pointing toward the demand zone between $108K–$109K.

📌 Watch for:

Volume spike on breakdown

Retest of neckline turning into resistance

Potential long setups only if price reclaims $119K+

Bias: Bearish if $115K breaks. Neutral until then.

BTC intra? RECAP

Hi

Hope yest was a successful day trading for you.

Initial Bias for the DAY was up

I found : 3 white soldiers

Instant entry at found

or wait for retrace and my stop was below pattern

Profit. take when satisfied

So very important what risk i put in

say 100$ for a trade would be happy at 200$-300$

1:2 /3

or whatever i'm willing

adjusting to every trade

Easier said than done; your confidence will suddenly peak

You'll push your luck .. n risking way more than should

Be discipline

I hope the force will be with you.. n be lucky in 99.999% of the time

Not a guru

*& sharing is not a sin

nb/ all guru can slideee :)

Looking for your nx entry???

Bullish Patterns - will be in pdf in www

If new; print it

trade when see one (forexbee.co)

Do 20-50 trades.

Journal it.

Then your report card; positive or negative

pass or fail, is the pattern in web telling you the truth or lie

You decide

I hope your confidence will spike and won't depend on anyone anymore.

It's like learning to walk..

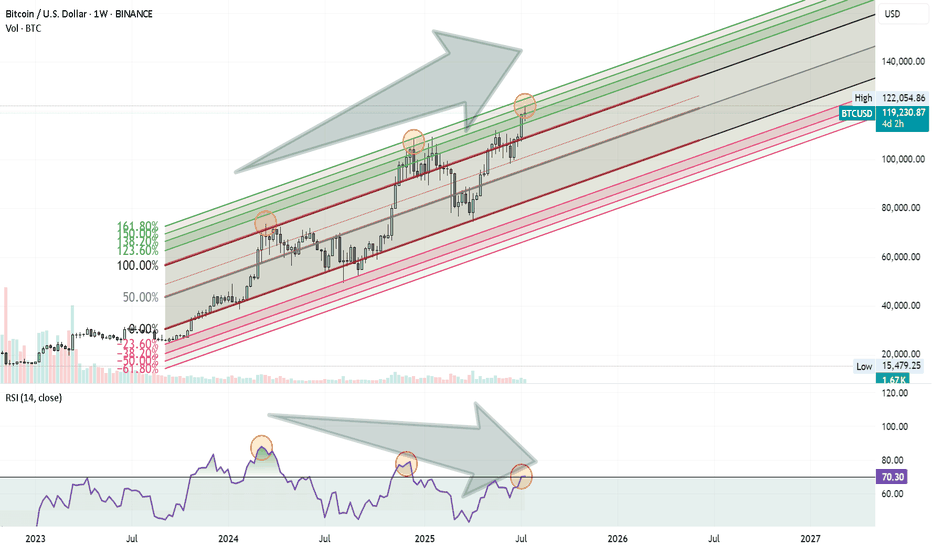

Bitcoin Rally Losing Steam?Bitcoin might be approaching a Turning Point . Here’s what I’m seeing on the weekly chart:

Price is moving inside an ascending Fibonacci channel.

It’s getting close to the 1.60 (160%) extension level, which has acted as a reversal zone before.

At the same time, the RSI is showing a clear negative divergence, suggesting that momentum is weakening.

These signs combined could mean we’re not far from a significant correction.

Nothing is confirmed yet, but it’s a setup worth keeping an eye on.