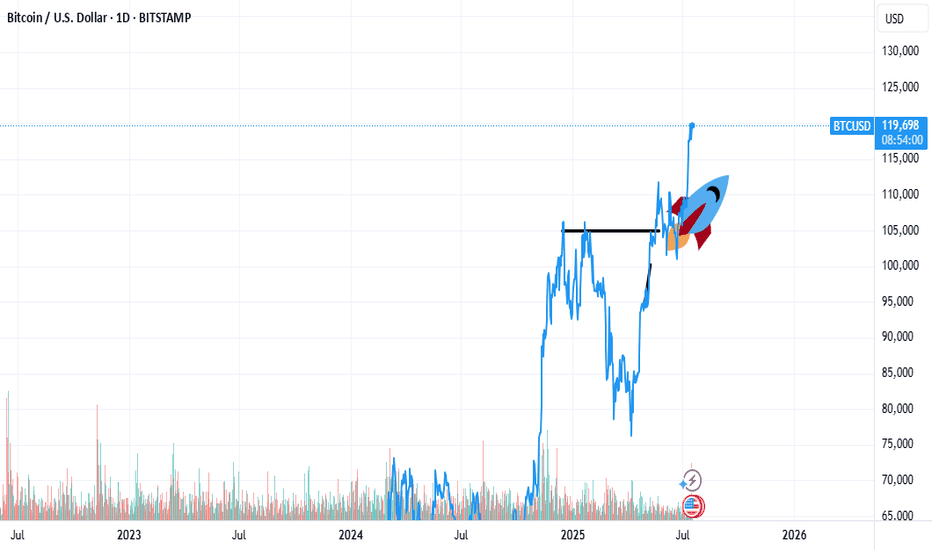

Btcusd breaking above cup and handle necklineIf it confirms the bullish breakout the target is 150k. Also by breaking above 116k and solidifying that level as strong support, we will trigger an even bigger inverse head and shoulders pattern (not shown here) with a breakout target around 208k! I will provide a link below to the chart I posted of that pattern. Thanks for reading, liking, and following. *not financial advice*

BTCUSD trade ideas

Btcusd techinical analysis.Chart Overview (BTC/USD - 2H, OKX):

Current Price: $119,240.5 (+1.23%)

Key Zones:

Support Zone: Around $118,695.8 (highlighted for July 17, 12:00)

Resistance/Target Zone: Around $123,250 (based on the measured move)

Fibonacci Levels: Drawn from the recent swing high to swing low

Important retracement levels: 0.236, 0.382, 0.5, 0.618, 0.786

Price is currently testing the 0.5–0.618 zone, which is a common area for potential breakout or rejection

Potential Price Move:

Bullish Projection:

Upside target of $4,009.7 (3.38%) from the breakout area

Reaching the $123,250 range by July 17 at 12:00 (UTC)

Technical Patterns:

It looks like you're tracking:

A potential bullish breakout from a consolidation range

Possibly a bullish flag or continuation pattern

Momentum is shifting after a clean bounce off the 0.236 zone

---

Let me know if you want:

A deeper analysis (e.g., RSI, MACD, volume)

Confirmation for long/short entries

Risk management suggestions

What’s your goal here — are you planning to trade this move or just analyzing the pattern?

BRIEFING Week #29-30 : BTC stalling, ETH & then Alts ?Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

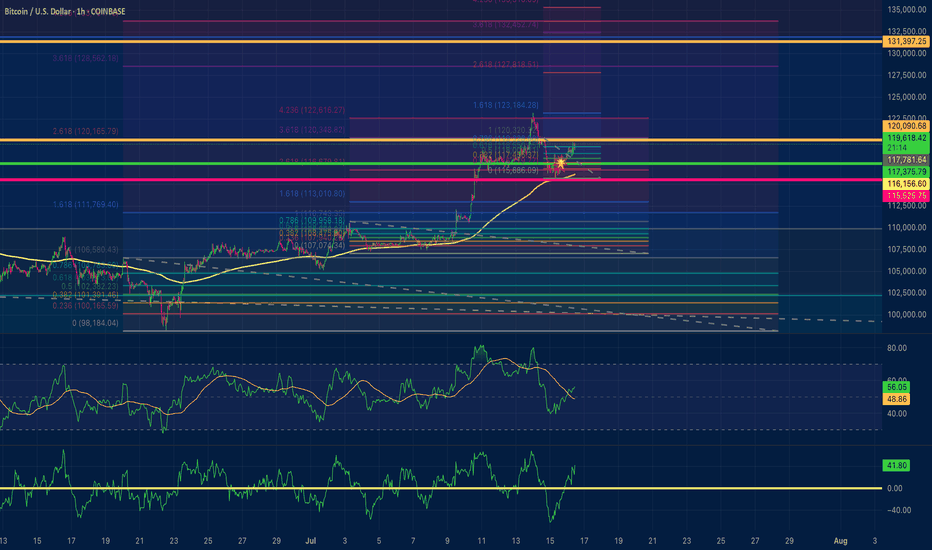

BITCOIN- MONSTER ORDERS IN THE BOOK -> You Know What This Means COINBASE:BTCUSD “Monster orders” are exceptionally large buy-limit orders clustered roughly 7 % beneath the current market price.

Large buy-limit walls can act like a price magnet—deep liquidity attracts algos and traders hunting fills, often pulling price straight toward the level.

Once the wall absorbs the selling pressure, the magnet flips: liquidity dries up, supply thins, and price can rip away from that zone with force.

They create a visible demand wall in the order book, signalling that whales / institutions are ready to absorb a dip and accumulate at that level.

Price will often wick into this zone to fill the wall, then rebound sharply—treat the 7 % band as potential support or entry.

Such walls can act as liquidity traps : market makers may push price down to trigger retail stop-losses before snapping it back up.

Confirm that the wall persists as price approaches and that spot + derivatives volume rises; if the wall disappears, it may have been spoofing.

Always combine order-book context with trend, momentum and higher-time-frame support for higher-probability trades, Just like the extremely powerful indicators on the chart.

🚀 Marty Boots | 17-Year Trader — smash that 👍, hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

Bitcoin positive diversion to $131,000Using fibonacci retracements for price targets based off of positive divergences on the 15 min time frame and hourly time frame. I am utilizing 2 ioscilating indicators: RSI length is 36 with smma at 50 and the Chande momentum oscillator with a length of 24. My conservative estimate is $131,000 for a safe trade close. $132,400 exact area for pullback to $128,500?

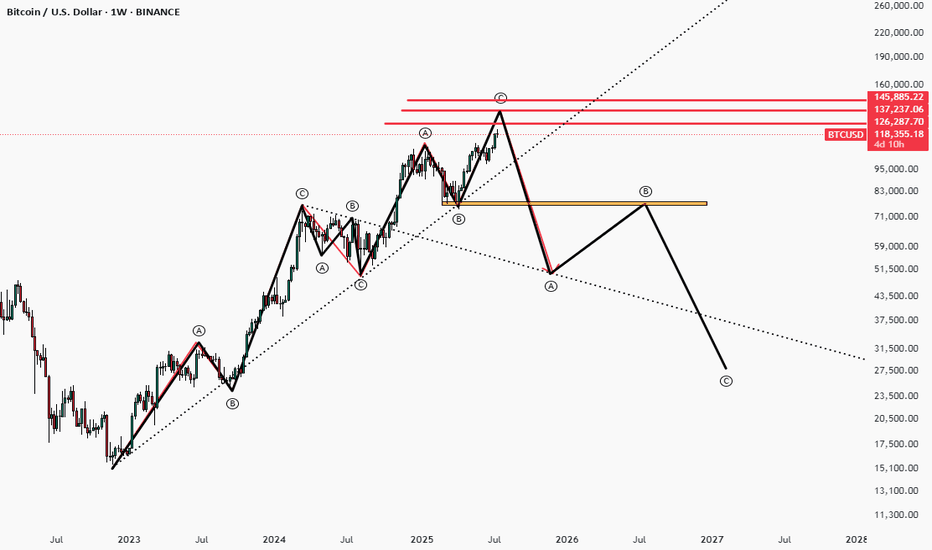

Bitcoin -> The bullrun is not over!📣Bitcoin ( CRYPTO:BTCUSD ) is still totally bullish:

🔎Analysis summary:

A couple of months ago Bitcoin broke above the previous all time high. This was basically just the expected creation of new highs, perfectly following the underlying cycles. With respect to the long term rising channel formation, this bullrun on Bitcoin is just starting.

📝Levels to watch:

$100.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Bullish Correction Complete — Targeting 125,500–126,000Market Overview:

After a strong bullish impulse, BTC retraced to the 116,000–117,000 support area and is now showing renewed momentum. The current price action suggests a move toward the 125,500–126,000 target zone.

Technical Signals & Formations:

— Completed ABC corrective structure

— Weekly support held at 116,000–117,000

— Price bouncing from 144 EMA

— Break above local resistance confirms bullish continuation

Key Levels:

Support: 117,000, 116,000

Resistance: 123,300, 125,500–126,000 (target zone)

Scenario:

Primary: holding above 119,000 opens the way toward 125,500–126,000

Alternative: break below 117,000 could lead to a deeper pullback toward 115,000

Bitcoin Parabolic Curve - 2022 to 2026 Market CycleThis line chart visualizes the current Bitcoin market cycle from the bear market bottom in November 2022. As you can see, the price has formed a parabolic curve, which was violated around the beginning of March. A couple of weeks later, a retest of the curve occurred, which was rejected. Later in April, the price of BTC was able to push back above the curve. There was another small dip below in June, but BTC was back above the curve by the end of June.

I am also watching the Bitcoin monthly chart and, more specifically, the monthly Stochastic RSI indicator. As you can see in the chart below, between the second and third months after the market cycle peak, the Stochastic RSI indicator has always dropped below the "20" level, and was near zero at the close of the third month.

Back in March and April, there was some speculation that the new all-time high set on January 20th at just over $109k was the peak for this market cycle. At the beginning of April, the Stochastic RSI dropped well below the 20 level but rebounded and was at 16.81 when the April candle closed. The May monthly candle closed with the Stochastic RSI at 31.45, and June closed at 50.17. This indicated to me that this market cycle was far from over.

On July 14th, BTC set a new all-time high at just over $123,000, ending the speculation that this current market cycle had peaked. My assumption for now is that Bitcoin is still following a 4-year market cycle. If this is true, I would expect a market cycle peak sometime in the final months of this year. Either way, it has been a very interesting market cycle with huge changes for the crypto asset class.

Bitcoin - Reversal Setup or Just a Trap Reset?Price faked below the 1H support zone around 115,800, triggering a clean run through resting sell stops. This classic liquidity sweep flushed out early long positions before immediately reclaiming the range. The move aggressively filled a prior imbalance and flipped sentiment just when it seemed the trend might break lower. The quick rejection and recovery from this level suggests smart money accumulation beneath support.

Formation of a 1H Inversion Fair Value Gap

The rebound from the liquidity grab printed a bullish 1H inversion FVG, now acting as a potential launchpad for continuation. This FVG coincides with the same zone that was previously support, now carrying added confluence. As long as price remains above this gap, the reaction shows bullish intent, with buyers reclaiming initiative after a shakeout.

Trend Shift Trigger and Invalidation Level

The current structure remains technically bearish until we break above the marked 1H high at 118,400. That level is the structure shift trigger. A decisive close above it would confirm a market structure shift and open the door to a broader bullish continuation. However, failure to close above this high would invalidate the setup and suggest that the move from support was just a temporary retracement rather than a full reversal.

Upside Targets and Continuation Outlook

If we get the bullish break above 118,400, I’m looking for price to reach Target 1 near 120,400, followed by Target 2 around the unmitigated FVG at 122,200. These levels align with clean inefficiencies that are likely to get filled if the market gains momentum. With enough volume behind the breakout, BTC could push into ATH territory above 123K as part of a larger macro expansion.

Volume and Higher Timeframe Context

Volume is the final key piece. We need strong follow-through above 118,400 for the setup to remain valid. Weak rejection or consolidation below that red line would signal distribution and potential failure. On the higher timeframes, BTC still looks constructive, but the 1H structure must confirm by breaking higher, or the broader bullish case will need to be re-evaluated.

Conclusion

BTC swept 1H support, ran stops, and printed a bullish inversion FVG. A break and close above 118,400 would confirm trend reversal and initiate a move toward 120,400 and 122,200. If we fail to close above that level, this setup is invalidated and the range could continue or break lower.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

BIG ALERT: Stock Market shown a massive break on a TL support. 🚨BIG ALERT: Tech Sector shown a break on a massive TL support level and this news just came out.

We may see everything reverse here pretty soon, depending how the market responds......

CRYPTO may still trend upward and most likely WILL!

- Crypto wins in the end, stay watchful! #BlackChain

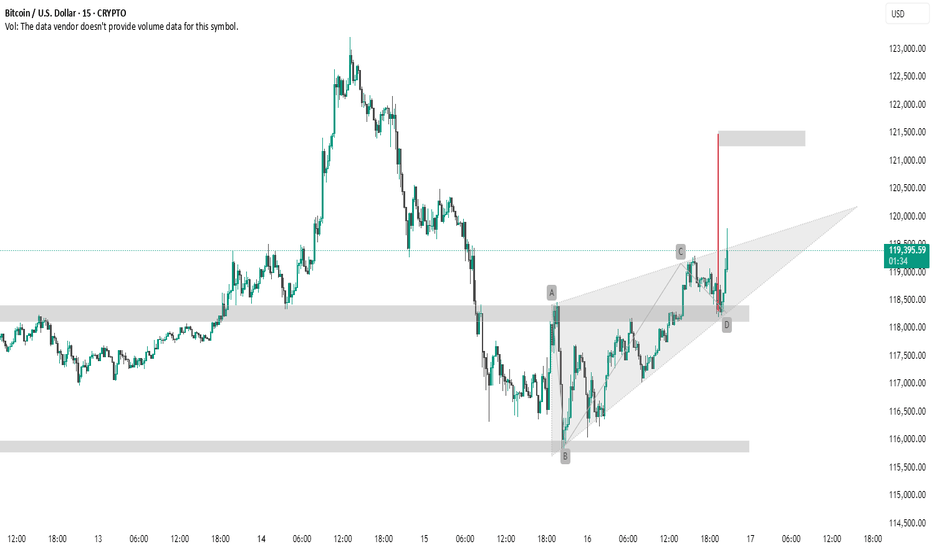

BTC #Trangle BreakoutThis 15-minute BTC/USD chart presents a **bullish breakout** from a **rising wedge pattern**, which typically has bearish connotations but in this case broke upward — suggesting strong buying pressure.

Key Observations:

* **AB=CD Pattern**: The chart shows a completed harmonic AB=CD pattern, typically a **reversal** or **continuation** signal, depending on context.

* **Breakout & Target Zone**: Price broke above the wedge resistance near point D, with a projected target zone around **\$121,500**, shown with the red vertical line and grey box.

* **Support Zones**: Well-defined support areas near **\$118,000** and **\$116,000** provide a strong base for the bullish move.

Summary:

This setup indicates a **bullish continuation** with a breakout from the wedge, validated by the harmonic pattern and volume momentum (if available). Traders may watch for price holding above \$118,000 to confirm continuation toward \$121,500.

thank u

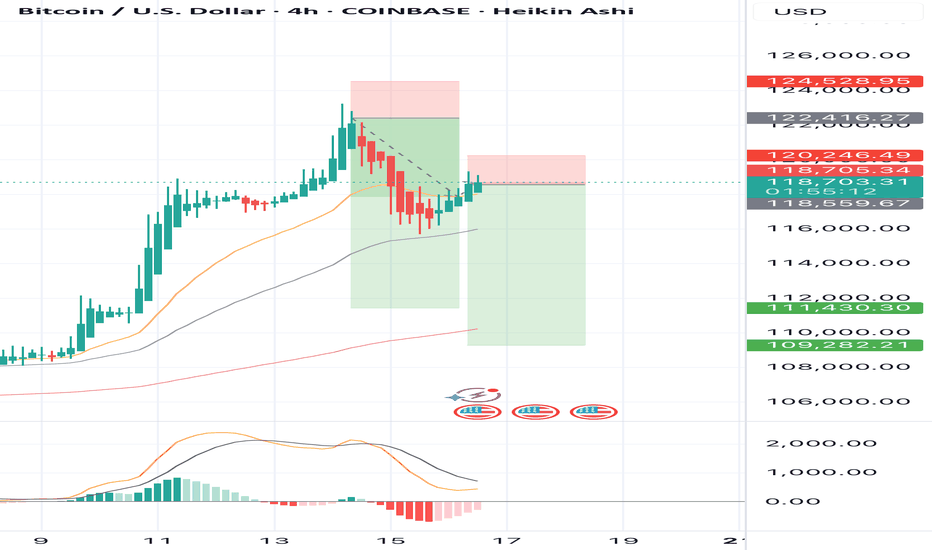

SELL BTCUSD for bullish divergence trend reversal STOP LOSS: 120SELL BTCUSD for bullish divergence trend reversal STOP LOSS: 120,246

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

TAKE PROFIT: take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with........trading with the trend, patient and good risk management is the key to success here...

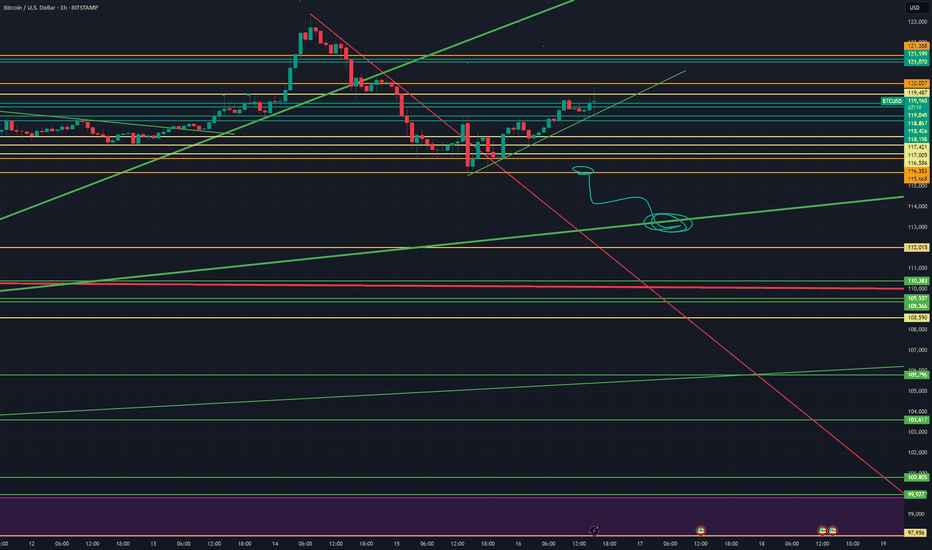

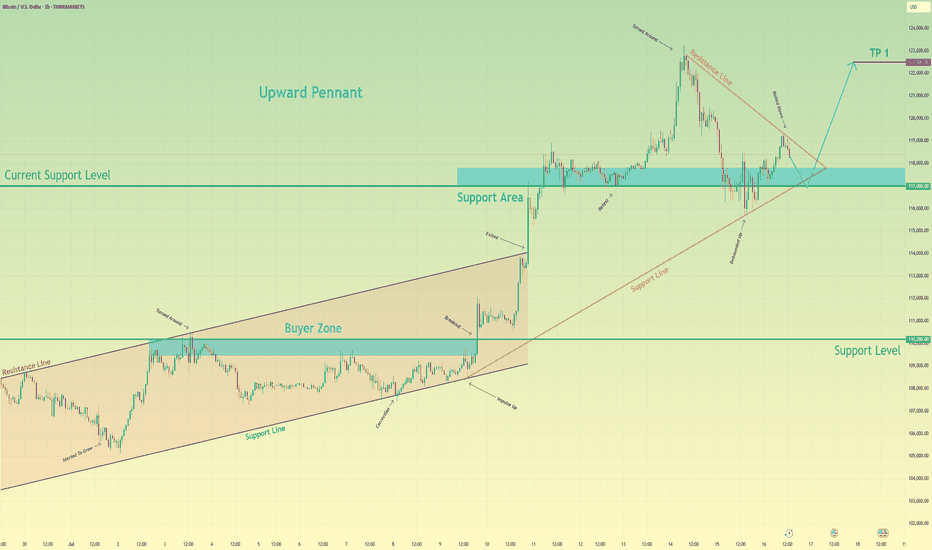

Bitcoin may exit of pennant and then rebound up of support areaHello traders, I want share with you my opinion about Bitcoin. Earlier, the price was moving inside an upward channel, respecting both the resistance and support boundaries. After reaching the buyer zone (110200–109500 points), BTC made a strong impulse up, breaking out of the channel and entering a new phase of growth. This breakout led to the formation of a bullish pennant, which often signals a continuation of the uptrend. Right now, the price is testing the support area between 117000 and 117800, which previously acted as a breakout zone and now serves as a current support level (117000). The structure shows that this level has already worked as a rebound zone multiple times. In my opinion, BTC may continue the correction toward this support area, potentially exiting the pennant to the downside for a short-term pull-back. After that, I expect a new upward movement, targeting the next local high. That’s why I set my TP at 122500 points, which is just below the recent ATH. Given the impulse move, strong support zone, breakout from the channel, and the bullish pennant pattern, I remain bullish and expect BTC to resume its upward trend soon. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

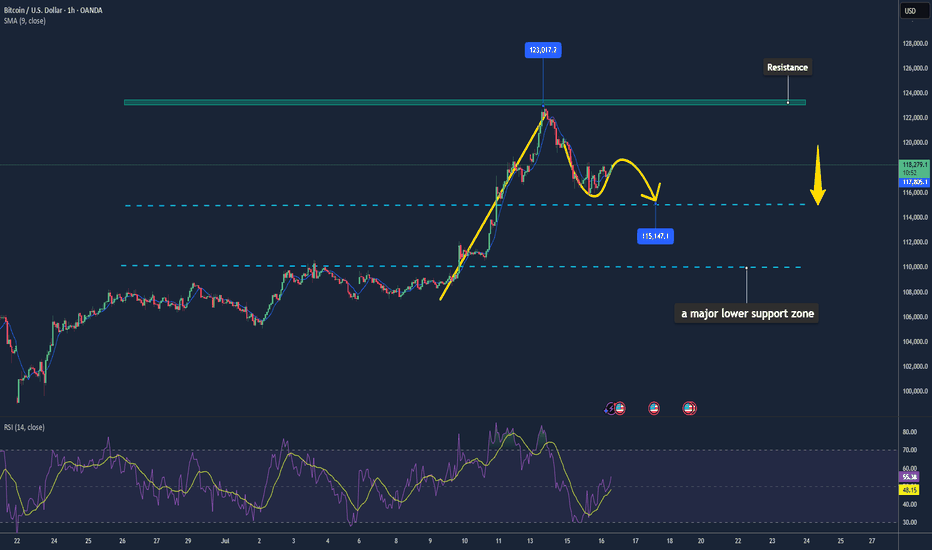

Bitcoin May Face Short-Term Pullback📊 Market Summary

– Bitcoin trades around $118,009, retreating from its intraday high of $118,330 .

– The recent rally was primarily fueled by $14.8 billion inflows into spot BTC ETFs, lifting BTC to an ATH of $123,000 on July 14

– Profit-taking has triggered a ~3% correction

– Market awaits key CPI/PPI inflation data and regulatory clarity in the US to guide next moves.

📉 Technical Analysis

• Resistance: $123,000 – $123,100 (all-time high zone, weekly candle top).

• Support: $114,000 – $115,000 (potential retest zone, IH&S neckline, CME gap)

• EMA 9: Price remains above all major EMAs (10/20/50/100/200 day) – bullish short-term trend

• Candles / Volume / Momentum:

• Confirmed inverted head and shoulders breakout above ~$113,000 neckline

• RSI ~74 suggests overbought; short term pullback possible

• MACD bullish but on chain volumes are cooling, reflecting profit taking

📌 Outlook

– Expect a short-term cooldown/pullback toward $114,000–$115,000 for support testing.

– If support holds and ETF inflows continue, BTC could resume rally toward $130,000–$140,000

💡 Trade Strategy

🟣 SELL BTC/USD upon break below $117,000–$118,000 during retrace

🎯 TP: $115,000

❌ SL: $118,500

🟢 BUY BTC/USD at support $114,000–$115,000

🎯 TP: $120,000 – $123,000

❌ SL: $113,000

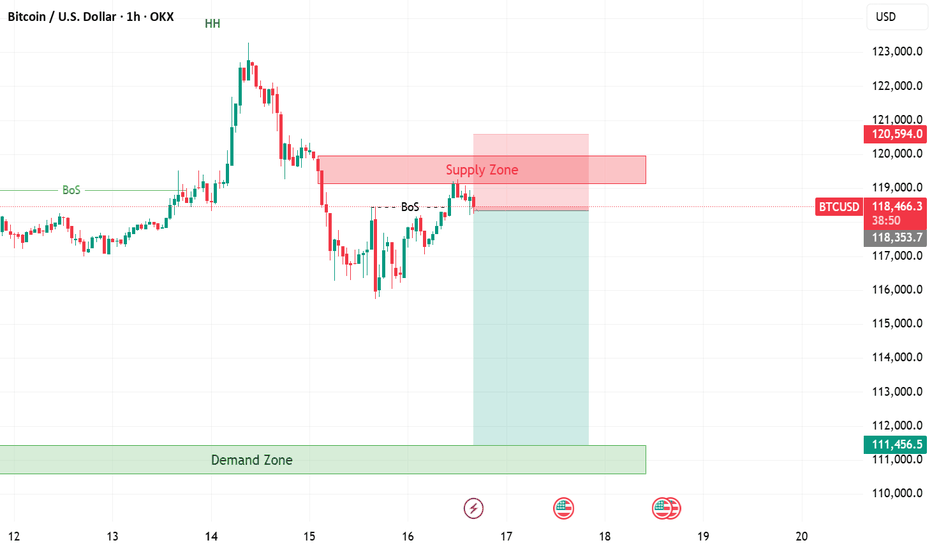

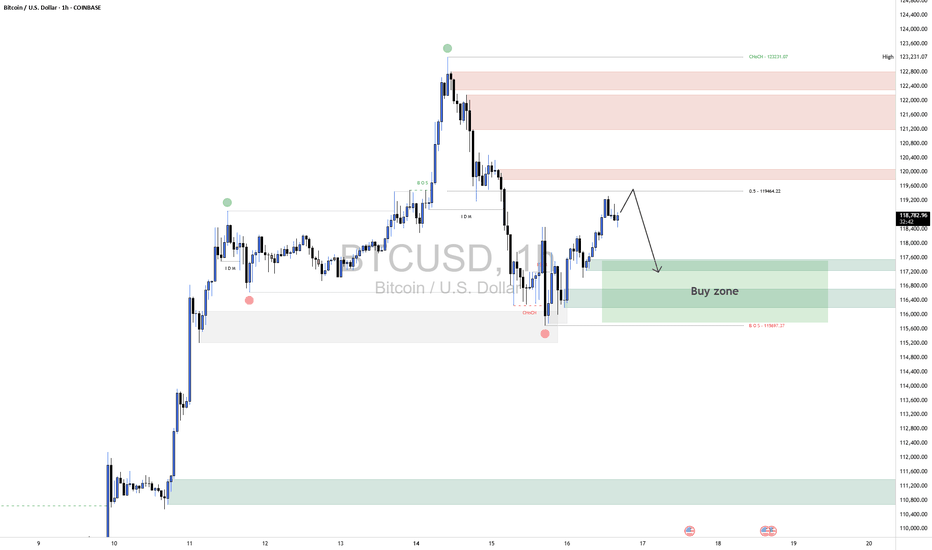

BTCUSD ShortBTCUSD 1H Technical Analysis

⚙️ Scenario Outlook:

Bias: Bearish

Preferred Play: Wait for price to enter the 119,000–120,000 supply zone. If price shows signs of exhaustion or bearish confirmation (e.g. bearish engulfing, strong rejection), a short position becomes favorable.

Targets: First target at 117,200; final target near 115,600–115,000 range, depending on how price behaves within the intermediate demand.

🔼 Supply Zone (Resistance):

Zone: 119,000–120,000

This red zone marks a previously unmitigated supply area aligned with the 50% Fibonacci retracement level from the prior bearish impulse. It's expected to act as the final resistance before the next move lower. A rejection from here would confirm bearish intent and offer optimal risk-to-reward for short setups.

🔽 Demand Zones (Support Targets):

First Demand Zone: 117,200–117,600

This green border is your first liquidity pocket to watch. It may offer a brief reaction or bounce, but if bearish momentum holds, price is likely to continue through it.

Deeper Demand Zone: 115,600–116,200

This is the stronger accumulation area, marked by your lower green zone. It sits just above the previous CHoCH and BOS lows, making it a prime liquidity sweep and reversal candidate if price moves deeply into it.