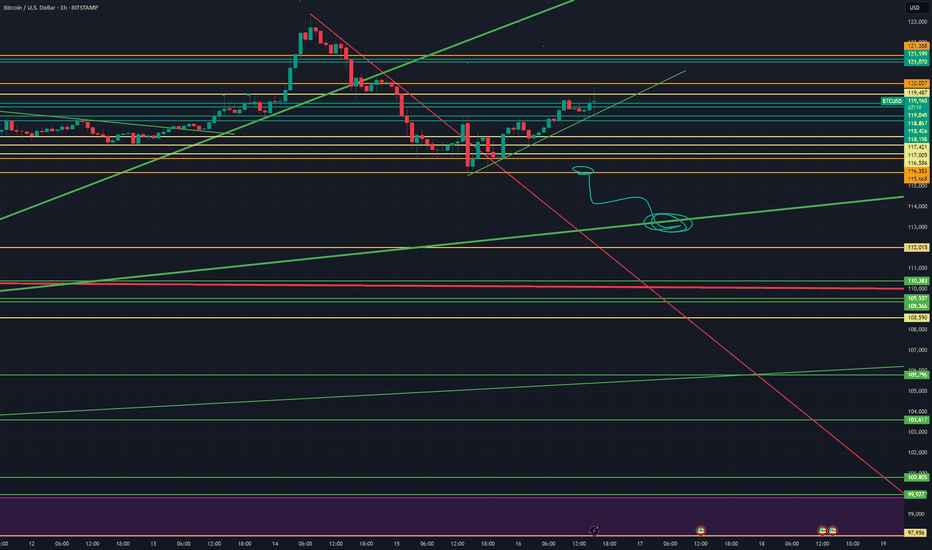

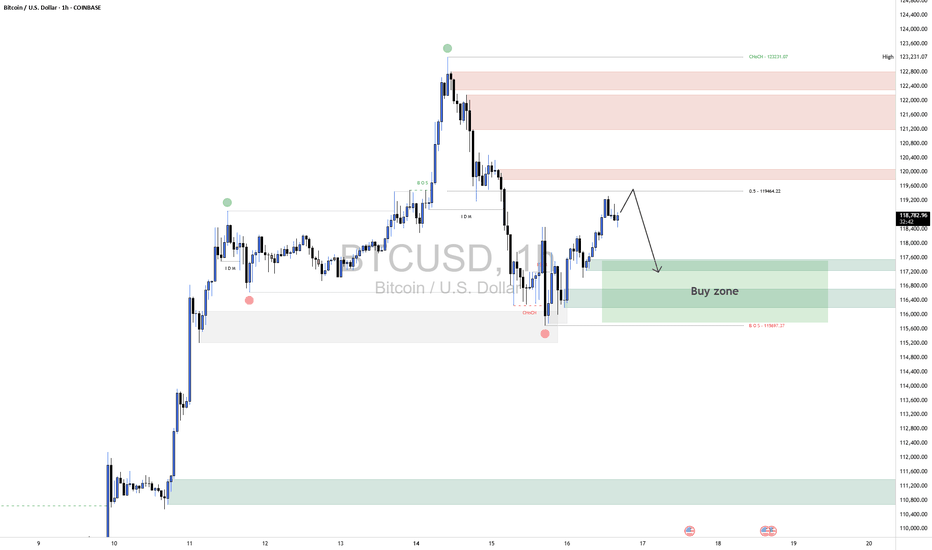

Bullish Correction Complete — Targeting 125,500–126,000Market Overview:

After a strong bullish impulse, BTC retraced to the 116,000–117,000 support area and is now showing renewed momentum. The current price action suggests a move toward the 125,500–126,000 target zone.

Technical Signals & Formations:

— Completed ABC corrective structure

— Weekly support held at 116,000–117,000

— Price bouncing from 144 EMA

— Break above local resistance confirms bullish continuation

Key Levels:

Support: 117,000, 116,000

Resistance: 123,300, 125,500–126,000 (target zone)

Scenario:

Primary: holding above 119,000 opens the way toward 125,500–126,000

Alternative: break below 117,000 could lead to a deeper pullback toward 115,000

BTCUSD trade ideas

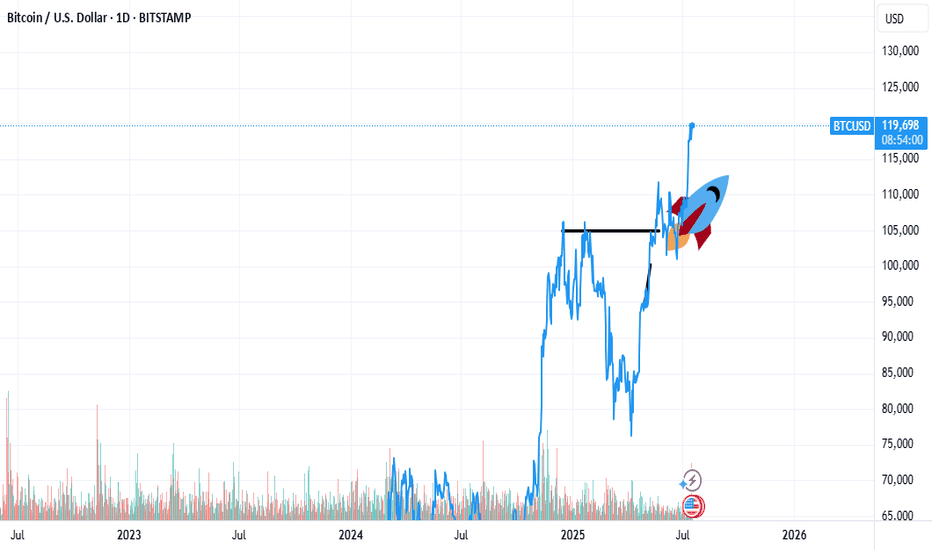

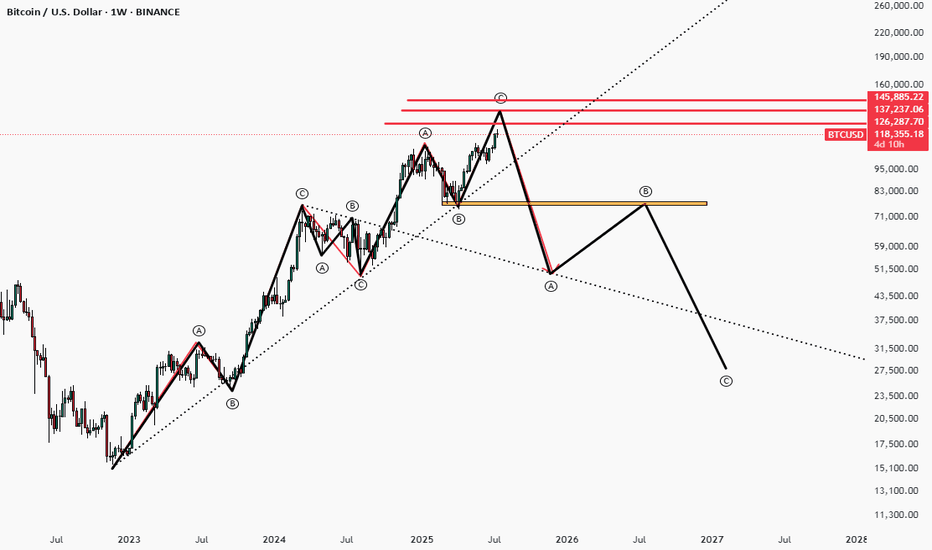

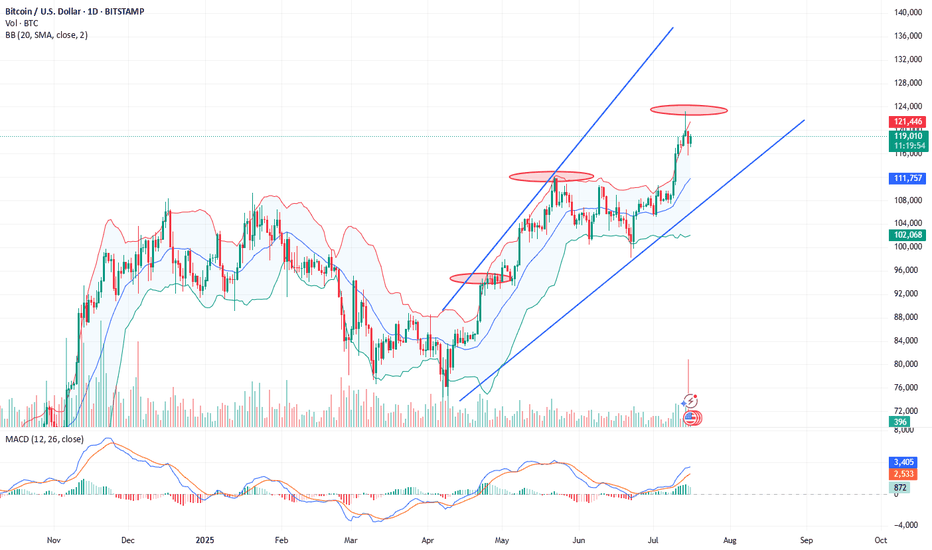

Bitcoin Parabolic Curve - 2022 to 2026 Market CycleThis line chart visualizes the current Bitcoin market cycle from the bear market bottom in November 2022. As you can see, the price has formed a parabolic curve, which was violated around the beginning of March. A couple of weeks later, a retest of the curve occurred, which was rejected. Later in April, the price of BTC was able to push back above the curve. There was another small dip below in June, but BTC was back above the curve by the end of June.

I am also watching the Bitcoin monthly chart and, more specifically, the monthly Stochastic RSI indicator. As you can see in the chart below, between the second and third months after the market cycle peak, the Stochastic RSI indicator has always dropped below the "20" level, and was near zero at the close of the third month.

Back in March and April, there was some speculation that the new all-time high set on January 20th at just over $109k was the peak for this market cycle. At the beginning of April, the Stochastic RSI dropped well below the 20 level but rebounded and was at 16.81 when the April candle closed. The May monthly candle closed with the Stochastic RSI at 31.45, and June closed at 50.17. This indicated to me that this market cycle was far from over.

On July 14th, BTC set a new all-time high at just over $123,000, ending the speculation that this current market cycle had peaked. My assumption for now is that Bitcoin is still following a 4-year market cycle. If this is true, I would expect a market cycle peak sometime in the final months of this year. Either way, it has been a very interesting market cycle with huge changes for the crypto asset class.

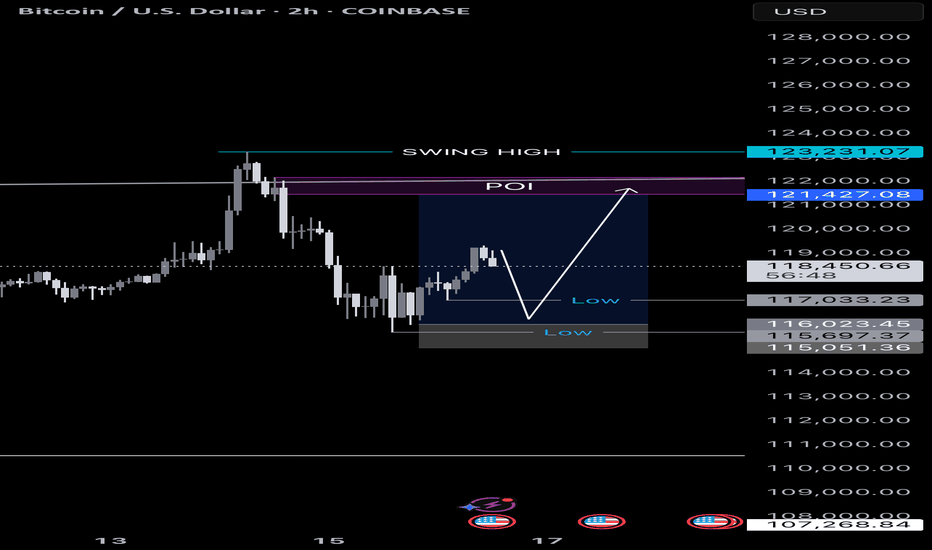

Bitcoin - Reversal Setup or Just a Trap Reset?Price faked below the 1H support zone around 115,800, triggering a clean run through resting sell stops. This classic liquidity sweep flushed out early long positions before immediately reclaiming the range. The move aggressively filled a prior imbalance and flipped sentiment just when it seemed the trend might break lower. The quick rejection and recovery from this level suggests smart money accumulation beneath support.

Formation of a 1H Inversion Fair Value Gap

The rebound from the liquidity grab printed a bullish 1H inversion FVG, now acting as a potential launchpad for continuation. This FVG coincides with the same zone that was previously support, now carrying added confluence. As long as price remains above this gap, the reaction shows bullish intent, with buyers reclaiming initiative after a shakeout.

Trend Shift Trigger and Invalidation Level

The current structure remains technically bearish until we break above the marked 1H high at 118,400. That level is the structure shift trigger. A decisive close above it would confirm a market structure shift and open the door to a broader bullish continuation. However, failure to close above this high would invalidate the setup and suggest that the move from support was just a temporary retracement rather than a full reversal.

Upside Targets and Continuation Outlook

If we get the bullish break above 118,400, I’m looking for price to reach Target 1 near 120,400, followed by Target 2 around the unmitigated FVG at 122,200. These levels align with clean inefficiencies that are likely to get filled if the market gains momentum. With enough volume behind the breakout, BTC could push into ATH territory above 123K as part of a larger macro expansion.

Volume and Higher Timeframe Context

Volume is the final key piece. We need strong follow-through above 118,400 for the setup to remain valid. Weak rejection or consolidation below that red line would signal distribution and potential failure. On the higher timeframes, BTC still looks constructive, but the 1H structure must confirm by breaking higher, or the broader bullish case will need to be re-evaluated.

Conclusion

BTC swept 1H support, ran stops, and printed a bullish inversion FVG. A break and close above 118,400 would confirm trend reversal and initiate a move toward 120,400 and 122,200. If we fail to close above that level, this setup is invalidated and the range could continue or break lower.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

BIG ALERT: Stock Market shown a massive break on a TL support. 🚨BIG ALERT: Tech Sector shown a break on a massive TL support level and this news just came out.

We may see everything reverse here pretty soon, depending how the market responds......

CRYPTO may still trend upward and most likely WILL!

- Crypto wins in the end, stay watchful! #BlackChain

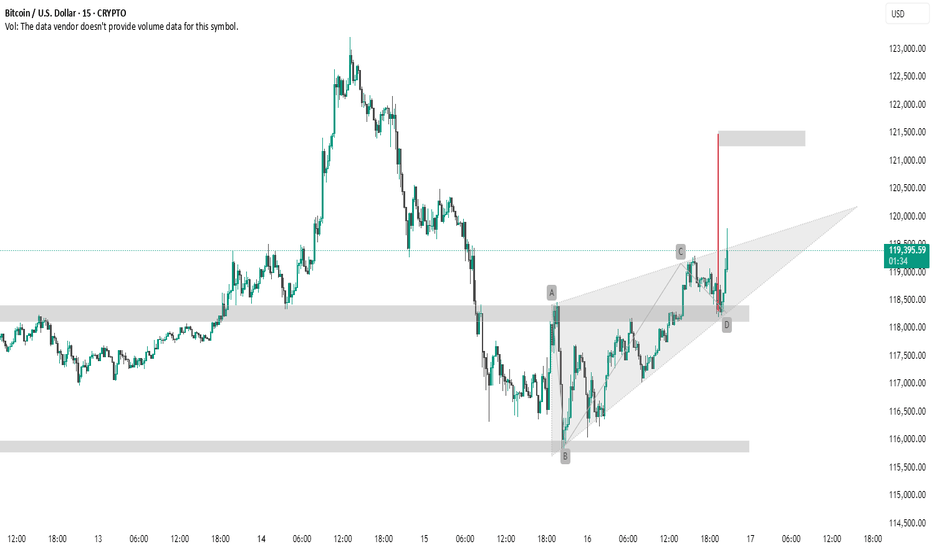

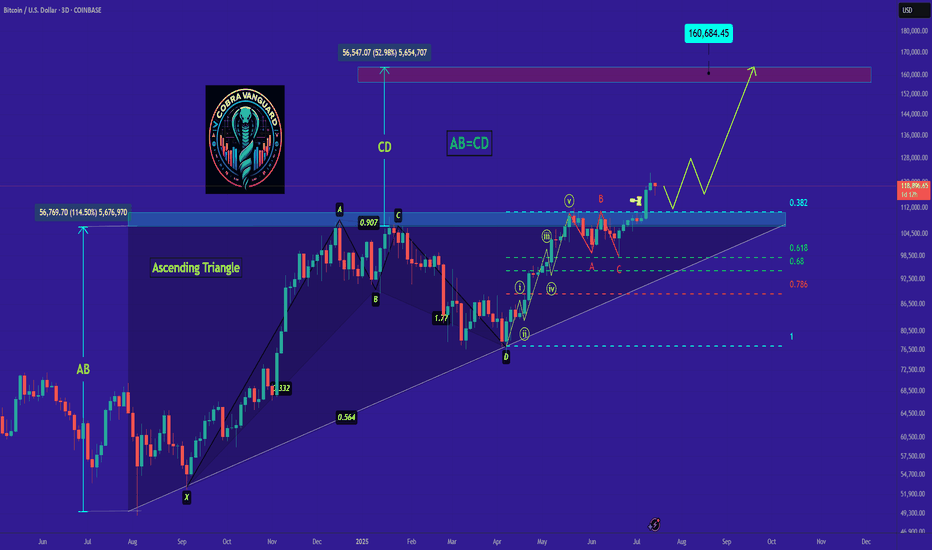

BTC #Trangle BreakoutThis 15-minute BTC/USD chart presents a **bullish breakout** from a **rising wedge pattern**, which typically has bearish connotations but in this case broke upward — suggesting strong buying pressure.

Key Observations:

* **AB=CD Pattern**: The chart shows a completed harmonic AB=CD pattern, typically a **reversal** or **continuation** signal, depending on context.

* **Breakout & Target Zone**: Price broke above the wedge resistance near point D, with a projected target zone around **\$121,500**, shown with the red vertical line and grey box.

* **Support Zones**: Well-defined support areas near **\$118,000** and **\$116,000** provide a strong base for the bullish move.

Summary:

This setup indicates a **bullish continuation** with a breakout from the wedge, validated by the harmonic pattern and volume momentum (if available). Traders may watch for price holding above \$118,000 to confirm continuation toward \$121,500.

thank u

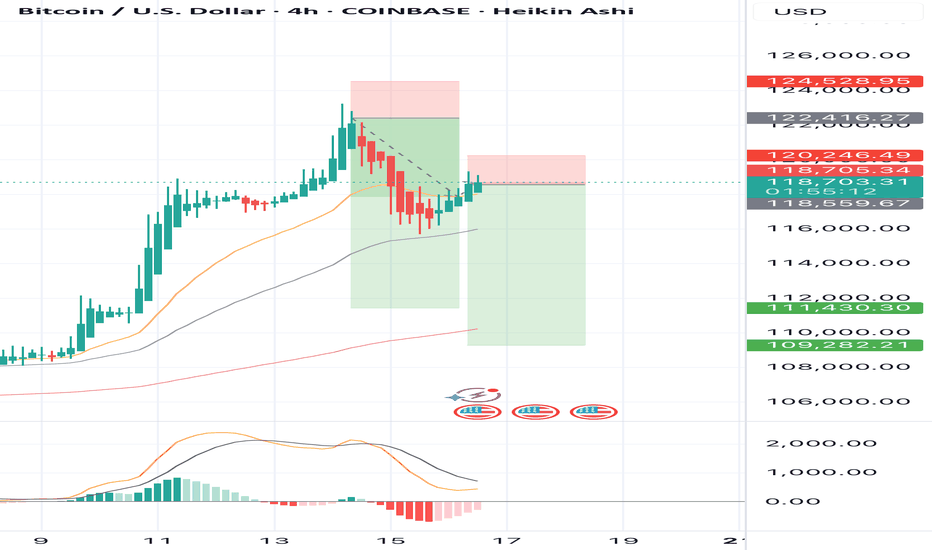

SELL BTCUSD for bullish divergence trend reversal STOP LOSS: 120SELL BTCUSD for bullish divergence trend reversal STOP LOSS: 120,246

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

TAKE PROFIT: take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with........trading with the trend, patient and good risk management is the key to success here...

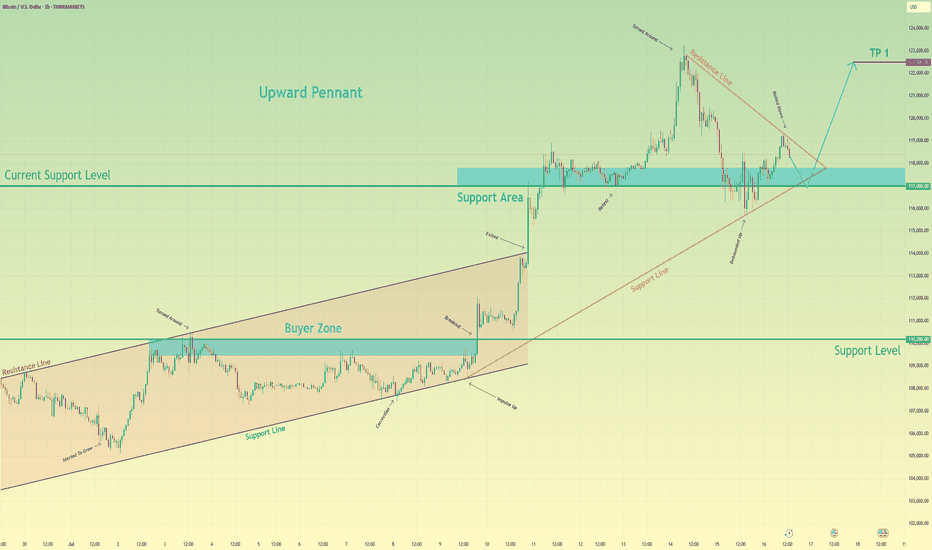

Bitcoin may exit of pennant and then rebound up of support areaHello traders, I want share with you my opinion about Bitcoin. Earlier, the price was moving inside an upward channel, respecting both the resistance and support boundaries. After reaching the buyer zone (110200–109500 points), BTC made a strong impulse up, breaking out of the channel and entering a new phase of growth. This breakout led to the formation of a bullish pennant, which often signals a continuation of the uptrend. Right now, the price is testing the support area between 117000 and 117800, which previously acted as a breakout zone and now serves as a current support level (117000). The structure shows that this level has already worked as a rebound zone multiple times. In my opinion, BTC may continue the correction toward this support area, potentially exiting the pennant to the downside for a short-term pull-back. After that, I expect a new upward movement, targeting the next local high. That’s why I set my TP at 122500 points, which is just below the recent ATH. Given the impulse move, strong support zone, breakout from the channel, and the bullish pennant pattern, I remain bullish and expect BTC to resume its upward trend soon. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

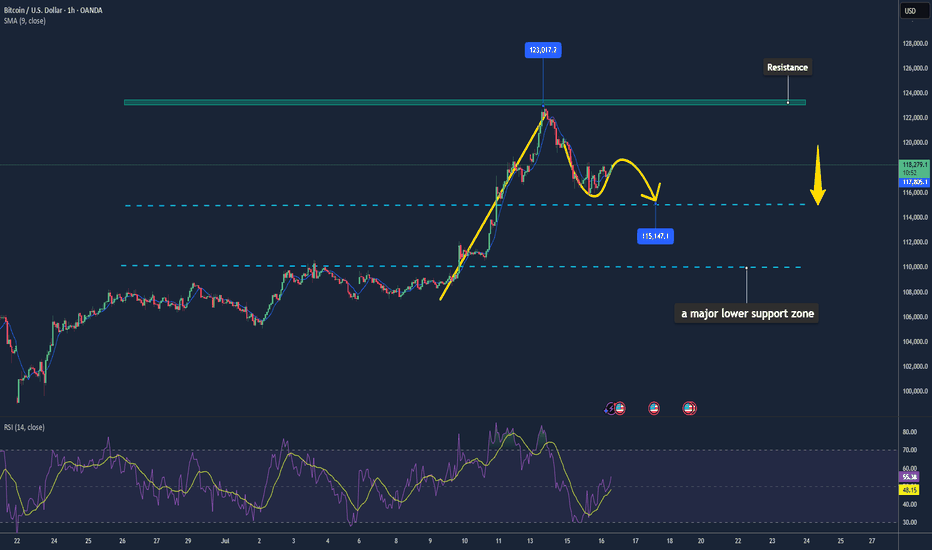

Bitcoin May Face Short-Term Pullback📊 Market Summary

– Bitcoin trades around $118,009, retreating from its intraday high of $118,330 .

– The recent rally was primarily fueled by $14.8 billion inflows into spot BTC ETFs, lifting BTC to an ATH of $123,000 on July 14

– Profit-taking has triggered a ~3% correction

– Market awaits key CPI/PPI inflation data and regulatory clarity in the US to guide next moves.

📉 Technical Analysis

• Resistance: $123,000 – $123,100 (all-time high zone, weekly candle top).

• Support: $114,000 – $115,000 (potential retest zone, IH&S neckline, CME gap)

• EMA 9: Price remains above all major EMAs (10/20/50/100/200 day) – bullish short-term trend

• Candles / Volume / Momentum:

• Confirmed inverted head and shoulders breakout above ~$113,000 neckline

• RSI ~74 suggests overbought; short term pullback possible

• MACD bullish but on chain volumes are cooling, reflecting profit taking

📌 Outlook

– Expect a short-term cooldown/pullback toward $114,000–$115,000 for support testing.

– If support holds and ETF inflows continue, BTC could resume rally toward $130,000–$140,000

💡 Trade Strategy

🟣 SELL BTC/USD upon break below $117,000–$118,000 during retrace

🎯 TP: $115,000

❌ SL: $118,500

🟢 BUY BTC/USD at support $114,000–$115,000

🎯 TP: $120,000 – $123,000

❌ SL: $113,000

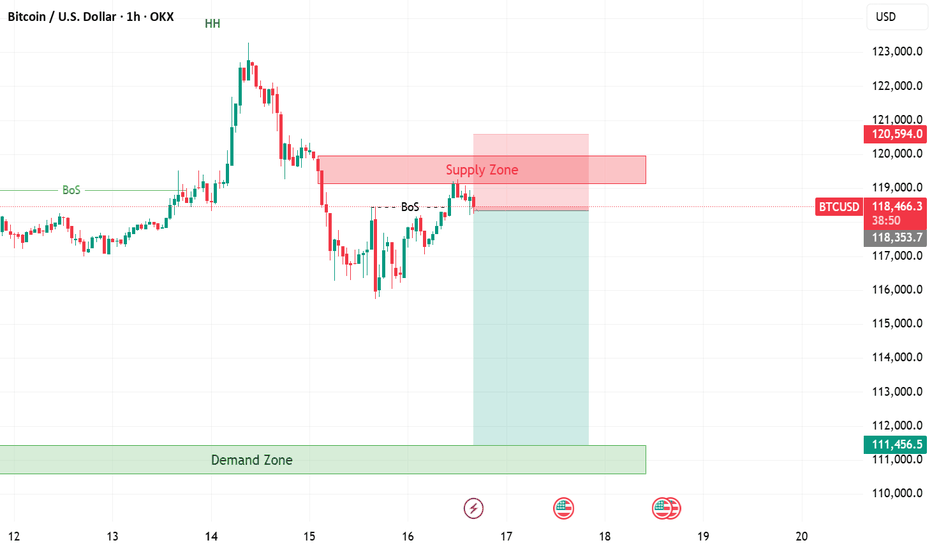

BTCUSD ShortBTCUSD 1H Technical Analysis

⚙️ Scenario Outlook:

Bias: Bearish

Preferred Play: Wait for price to enter the 119,000–120,000 supply zone. If price shows signs of exhaustion or bearish confirmation (e.g. bearish engulfing, strong rejection), a short position becomes favorable.

Targets: First target at 117,200; final target near 115,600–115,000 range, depending on how price behaves within the intermediate demand.

🔼 Supply Zone (Resistance):

Zone: 119,000–120,000

This red zone marks a previously unmitigated supply area aligned with the 50% Fibonacci retracement level from the prior bearish impulse. It's expected to act as the final resistance before the next move lower. A rejection from here would confirm bearish intent and offer optimal risk-to-reward for short setups.

🔽 Demand Zones (Support Targets):

First Demand Zone: 117,200–117,600

This green border is your first liquidity pocket to watch. It may offer a brief reaction or bounce, but if bearish momentum holds, price is likely to continue through it.

Deeper Demand Zone: 115,600–116,200

This is the stronger accumulation area, marked by your lower green zone. It sits just above the previous CHoCH and BOS lows, making it a prime liquidity sweep and reversal candidate if price moves deeply into it.

BTC Hits Predicted 1.618 Fibonacci Target at $122K — What’s Next🎯 BTC Hits Predicted 1.618 Fibonacci Target at $122K — What’s Next?

📅 Posted on: July 16, 2025

📍 Ticker: BTCUSD (BINANCE)

✍️ Author: @darwas121

⸻

🔹 Summary

In October 2023, I shared a long-term bullish projection for Bitcoin (BTC/USD) targeting the 1.618 Fibonacci extension level — projected around $122,000. As of today, BTC has successfully hit this target, validating the Fibonacci-based wave structure and bull market thesis. Now the key question is — what’s next?

⸻

🧠 Prediction Recap (Oct 2023)

• ✅ Projected rally continuation based on wave structure + Fibonacci expansion

• ✅ Long-term target: $122,056 (1.618 Fib level)

• ✅ Based on swing low near $15,550 and prior ATH structure

• ✅ Conditions: Confirmed breakout above $81,500

⸻

🔍 Current Technical Analysis (1D Chart)

💰 Price Action

• Current Price: $118,701

• Recent High: $122,056 (exact 1.618 Fib hit)

• Structure: Parabolic breakout from previous consolidation range

🔺 Fibonacci Levels

Level Price (USD)

0.236 31,237

0.382 40,849

0.5 48,618

0.618 56,386

0.786 67,092

1.0 (ATH Zone) 81,536

1.618 ✅ 122,056 (Hit)

📉 RSI & Momentum

• RSI is hovering in the overbought zone (>70), signaling potential cooling-off

• Stochastic RSI also indicates overextension — a pause or retracement could follow

• No bearish divergence yet, but watch closely

📊 Volume Trends

• Volume has tapered during this leg up — possible early sign of buyer exhaustion

• Previous volume clusters between $56k–$67k now act as strong support

⸻

⚠️ What to Watch Next

Risk Factors Notes

Overbought RSI Suggests short-term pullback risk

Weakening Volume Caution: Less conviction in highs

Parabolic Structure Vulnerability Break could mean fast correction

⸻

🧭 My View & Strategy

🔹 Short-Term: ⚠️ Cautious

• Book partial profits if holding from lower levels

• Watch for reversal candles near $122k zone

• RSI divergence or low-volume rally = yellow flag

🔹 Mid-Term: 🔼 Bullish

• Buy-the-dip zones: $67k (0.786) and $56k (0.618)

• Any correction into these zones may offer re-entry

🔹 Long-Term: 🔼 Strong Bullish

• BTC is in confirmed macro uptrend

• Sustained close above $122k opens price discovery zone

• Next logical Fib projection zones: $135k–$150k

⸻

📌 Key Levels

• Support: $81,536 / $67,092 / $56,386

• Resistance: $122,056 → Break = price discovery

• Invalidation Zone: Breakdown below $81,000 on volume

⸻

📣 Conclusion

The technical roadmap laid out in 2023 has now played out — Bitcoin has achieved its 1.618 Fibonacci extension target. We are now at a critical inflection point. If BTC consolidates well here and maintains volume, the next leg could launch us into new all-time highs beyond $135,000.

🛑 But caution is warranted — overbought signals + weak volume could bring a healthy correction first. Stick to your risk plan. Let the market come to you.

⸻

💬 Feel free to share your views or ask for updates in the comments.

🔔 Follow me for more swing-to-position analysis using volume, fibs & structure.

📊 Chart shared below for reference.

#Bitcoin #BTCUSD #Crypto #TechnicalAnalysis #Fibonacci #PriceTargets #CryptoForecast #ParabolicMove #BTC

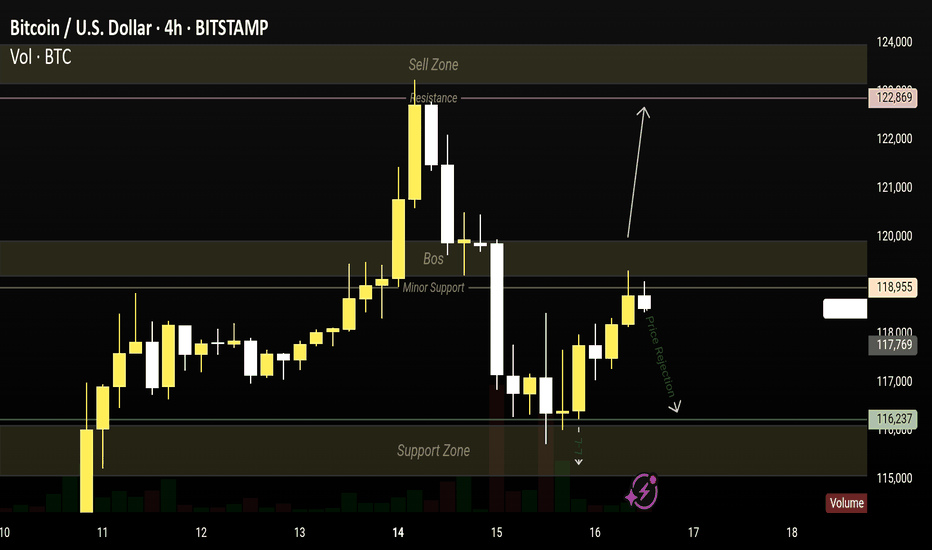

KOG BTC 4H chart updates.

KOG BTC 4H CHART

🔹 Sell Zone: 122,869

🔸 Resistance Holding Strong!

🔻 Price Rejected from 118,955 Minor Support

• Watch for pullback toward 116,237 Support Zone

• Possible BOS retest before next move

• If breaks → watch for continuation to 115,000

• If holds → bullish bounce possible

• Volume spike confirms reaction level.

Whales Impact on BTC and XRP MarketsKey Points:

Whales drive market dynamics, focusing on BTC, ETH, XRP.

Whales influence price movements and trader behavior.

Institutional inflows increase, spotlighting large-cap assets.

Whale activities have drawn attention due to their potential to alter market dynamics, indicating possible price shifts and investment strategies for traders.

Recent Influences of Whale Activity on Cryptocurrency Markets

Recent whale activity has driven interest in Bitcoin and XRP, as whales accumulate assets, influencing market trends. Abdullah “Abs” Nassif emphasized the strategic importance of holding, advising caution.

"If you hold it and play the game like we do, you have a chance at freeing people around the world from the debt slavery system. I can promise you that." - Abdullah “Abs” Nassif, Host, Good Morning Crypto

Financial markets are adapting, with noticeable movements in cryptocurrency prices due to whales' actions. Their accumulation signals rising confidence, especially in Bitcoin, which hit a new all-time high.

BTC's surge influenced the broader market, encouraging capital flow into large-cap assets. These movements reflect potential shifts in trader strategies, highlighting the impact of significant investments.

Insiders suggest regulatory developments may affect prices, yet whale activity implies potential long-term growth. Historical patterns highlight institutional investors' stability during volatile periods, underscoring the strategic value of holding as exhibited by these whales.

Plan on bracing yourself for Monday most likely. That's when we'll really see the test as to whether crypto can maintain the momentum. OKX:BTCUSD BITFINEX:BTCUSD BITFINEX:BTCUSD OANDA:BTCUSD

10 Types of Cryptocurrencies: Explanations and ExamplesCryptocurrencies go far beyond Bitcoin. Today’s digital asset market includes a wide variety of coins and tokens, each serving distinct purposes. Below are 10 key categories of cryptocurrencies with brief explanations and examples:

Store of Value Cryptocurrencies:

Used as a digital form of gold or a long-term value reserve.

▶ Example: Bitcoin (BTC)

Smart Contract Platforms:

Support decentralized applications and programmable transactions.

▶ Example: Ethereum (ETH)

Stablecoins:

Pegged to fiat currencies to reduce volatility.

▶ Examples: USDT, USDC

Payment Tokens:

Designed for fast, low-cost money transfers.

▶ Examples: XRP, Stellar (XLM)

Governance Tokens:

Allow holders to vote on protocol decisions.

▶ Examples: UNI, MKR

Meme Coins:

Inspired by internet culture and social trends.

▶ Examples: Dogecoin (DOGE), Shiba Inu (SHIB)

Gaming Tokens:

Used in blockchain-based games and metaverses.

▶ Examples: AXS, SAND

Privacy Coins:

Focused on anonymous, untraceable transactions.

▶ Examples: Monero (XMR), Zcash (ZEC)

NFT Tokens:

Represent digital collectibles or assets on-chain.

▶ Examples: Bored Ape, CryptoPunks (ERC-721)

Infrastructure Tokens:

Power scalability, cross-chain solutions, or protocols.

▶ Examples: Polkadot (DOT), Cosmos (ATOM)

Understanding these categories helps investors and users navigate the complex crypto ecosystem more effectively.