BTC/USDT Analysis — Hidden Buyer

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

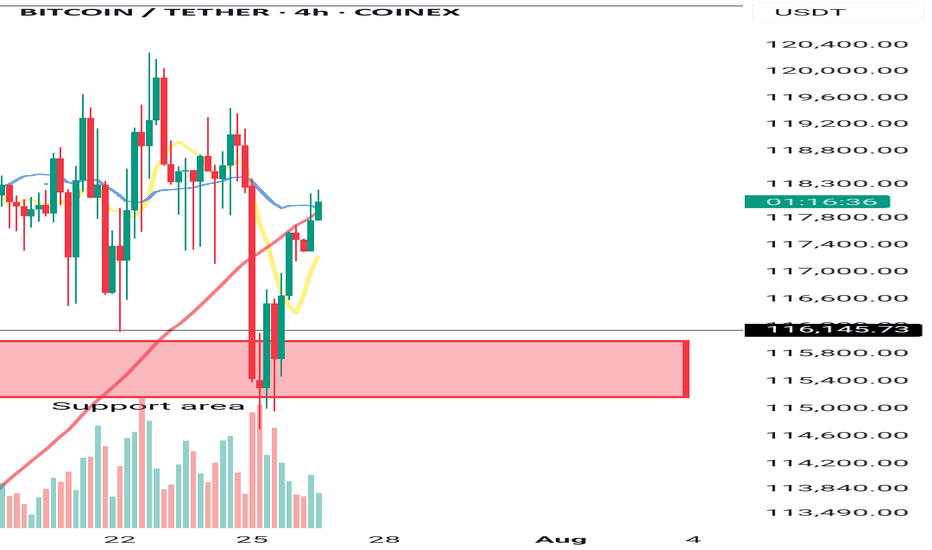

Yesterday, Bitcoin continued its move toward the local low and formed a false breakout.

Throughout the decline, we observed a positive delta, which may indicate gradual accumulation of long positions. At the same time, the descending trendline has not yet been broken, and there was strong absorption of market buys around ~$118,400 and ~$118,800 — which makes entering long positions very risky at the moment.

Our main expectations are based on further rotation within the range marked in yesterday’s analysis. In the short term, we are watching for a test of two local zones to assess the reaction from sellers. If the reaction is weak, a test of the upper boundary of the new sideways range is quite possible.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

Sell zones:

~$118,400 and ~$118,800 (local resistances)

This publication is not financial advice.

BTCUSDT.3S trade ideas

BTC/USDT Analysis — Potential Sideways Range

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin experienced a local reversal. At this point, two zones previously marked by us have been worked out:

Buy zone — $118,300–$117,300

Sell zone — $119,500–$119,000

We now expect continued rotation within the $117,400–$119,800 range, with potential expansion in both directions. The overall context remains positive, so a full breakout to the upside could occur in the near future.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

This publication is not financial advice.

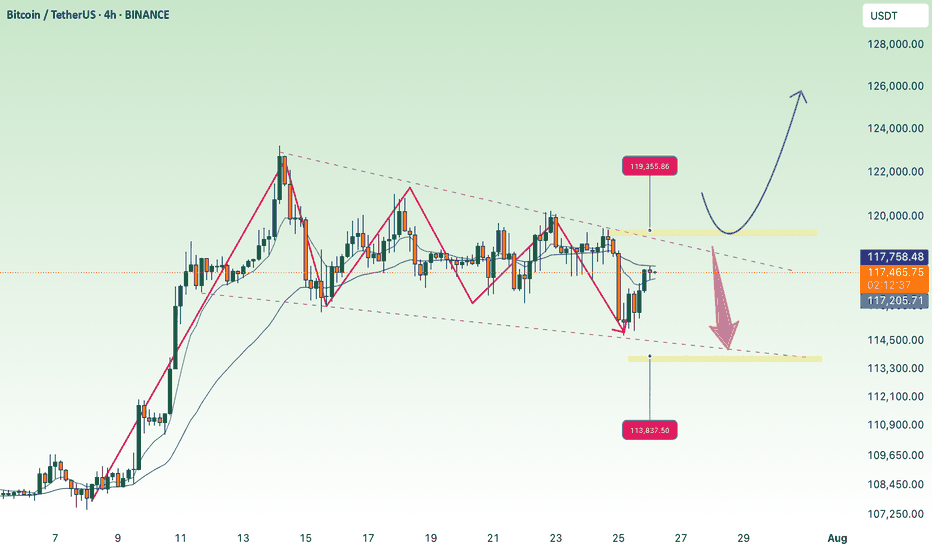

Hunting for liquidity. Retest resistance before a fallBitcoin is still in correction, but is rebounding from the local low of 117.4, formed during the pullback, and is heading back up towards the zone of interest at 119.8-120.1, which it did not reach during the main upward movement. I see no fundamental or technical reasons for the correction to end and for growth beyond 121K. I expect a rebound from the resistance zone towards 115-114K. However, in the medium term, I expect the market to attempt to close half or all of the gap between 112K and 114.8K, thereby expanding the key trading range.

Resistance levels: 119.77, 120.1K, 120.8K

Support levels: 117.4, 116.37, 115.68

Technically, a false breakout (liquidity capture) of key resistance and price consolidation in the selling zone could trigger bearish pressure on the market, which in turn would lead to a correction.

#BTC Update #11 – July 29, 2025#BTC Update #11 – July 29, 2025

Bitcoin continues to move within the channel and has completed several corrections of its last impulsive move. It is currently undergoing a correction within a correction. There was a liquidation zone around the $117,000 level, which was mostly filled, triggering a reaction.

From what we can observe now, Bitcoin is facing rejection from the upper boundary of the channel. If it manages to break out of the channel and continue its climb, I believe it will target the high liquidity zone near $122,000.

At this stage, Bitcoin is not in a suitable position for either long or short trades.

BTC setup projection🚨 BTCUSD Trade Setup – 5M Chart

📉 Entry Zone: 118,950–119,000

🎯 Target 1: 120,280

🎯 Target 2: 120,779

🎯 Final TP: 123,221

🛡️ SL Zone: Below 118,447

✅Confidence level 7.5/10

Bias: Bullish 📈 – anticipating a reversal from the demand zone with clean upside liquidity targets.

Stay patient, wait for confirmation before entry. Let the setup come to you.

As always, manage risk. Risk what you’re okay to lose. 💼

BTCUSDT Range-Bound Market: Short-Term Bearish MoveBTCUSDT

has failed to break through the descending resistance near 120,000 and is now forming a lower high within the broader resistance zone. The price action follows an impulsive leg up and is currently tracing a potential reversal pattern under key structural resistance. As long as the market remains capped below 120,000, continuation toward 117,500 is likely. The downward bias is supported by weakening momentum after the bull trap and resistance rejection.

📉 Key Levels

Sell trigger: Breakdown below 119,000

Sell zone: 119,400 – 120,000

Target: 117,500

Invalidation: Break and close above 120,500

BTC & ETH Structural Market Analysis🚀 Don’t forget to hit follow and smash the 🚀 button if you enjoy this analysis! 🚀

BTC & ETH Structural Market Analysis

⭕️Methodology:

• Dow Theory

• 1D: HWC

• 4H: MDC

• 1H: LWC

Market Outlook:

Yesterday's structural analysis remains valid for today, but let’s review the key levels again.

Today’s approach:

1️⃣ Wait for Total2 to react at 1.53 – if it breaks upward, we hold our positions.

2️⃣ Take profits quickly – if weakness is spotted in the trend, close positions without hesitation.

Note: There’s a chance of fake breakouts on long positions, but personally, I’m willing to take this risk. If TOTAL breaks its key resistance, we may see a strong rally.

Key Levels & Scenarios:

♦️ BTC ♦️

• Important levels: 115 and 120.

• A breakout of these levels will define bullish or bearish scenarios.

• Long trigger remains at 120.

♦️ BTC.D ♦️

• Bullish above 61.44 and 62.17 – bearish momentum in altcoins.

• Bearish below 60.83 and 60.42 – bullish rally in altcoins.

• If BTC dominance climbs, 62.74 is the limit where we stay bullish on BTC pairs. Beyond that, focus shifts fully to BTC itself.

• If BTC breaks 119,500 while dominance drops, it confirms holding or entering longs on altcoins.

♦️ TOTAL ♦️

• Still struggling with the 3.85 resistance level.

♦️ TOTAL2 ♦️

• Successfully broke 1.48, leading to the recent altcoin move.

• Next critical level: 1.55 – a breakout could trigger a strong altcoin rally.

♦️ USDT.D ♦️

• Breakdown of 4.22: keep positions open.

• Breakdown of 4.13: start of a new bullish trend in BTC & altcoins.

• Fake breakout around 4.13: expect range-bound movement between 4.13 – 4.37.

• If 4.37 breaks upward: expect corrections in BTC & altcoins.

♦️ ETH ♦️

• Weakness visible in ETH/USDT chart; candles are not giving strong signals.

• ADX oscillator suggests a sharp move is coming (direction TBD).

• If RSI climbs above 70 with current ADX conditions: expect a sharp bullish move.

🔥 If this analysis helps you, hit that follow & smash the 🚀 to support my updates! And share your comments 🔥

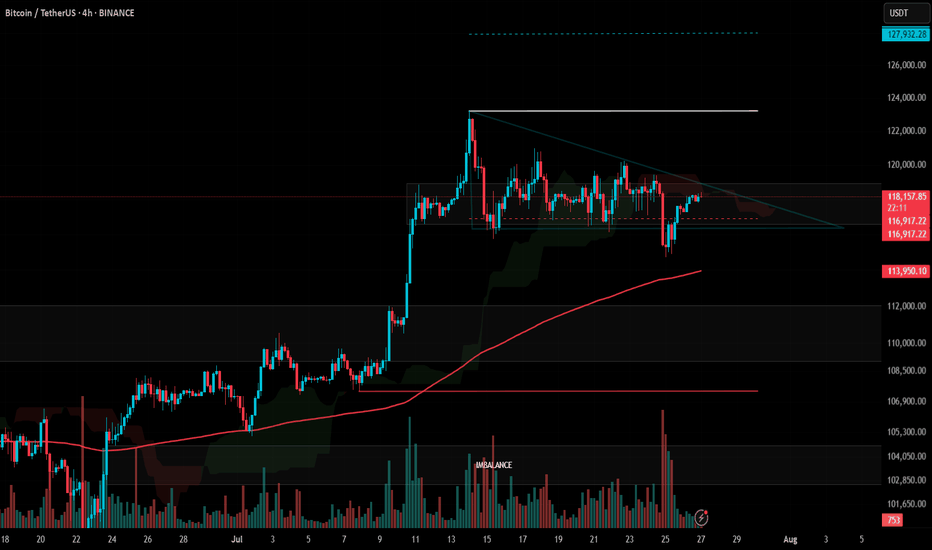

BTC Consolidates Below 119,300 Over the Weekend💎 BTC WEEKEND PLAN UPDATE (26/07)

NOTABLE BTC NEWS

The cryptocurrency market is attempting to stabilize after a wave of sell-offs during Friday’s Asian session, when Bitcoin (BTC) dropped to an intraday low of $114,723. A recovery trend is gradually strengthening, with BTC trading at $115,868 at the time of writing, indicating that buying interest at lower levels may increase in upcoming sessions.

TECHNICAL ANALYSIS PERSPECTIVE

Symmetrical Triangle Pattern

BTC is currently fluctuating within a symmetrical triangle pattern, with converging upper and lower trendlines. This pattern typically signals a strong consolidation phase before a decisive breakout.

Scenario unfolded as planned:

• The price failed to break the resistance zone around $120,000 (previously forecasted as a likely failed breakout zone).

• BTC then dropped sharply to the support zone around $115,000, touching the lower trendline and the potential breakout zone.

• At this level, the price rebounded as expected, indicating strong buying pressure at support.

MA lines supporting the trend:

• The price is currently moving around the 200-day MA (red line), showing that the dynamic support is working effectively.

• The 50-day MA (yellow line) is acting as short-term resistance. If broken, it could support the recovery momentum.

Two potential upcoming scenarios:

🔼 If BTC breaks above the $119,500 – $120,000 zone with strong volume, it may continue to test higher levels around $123,000 – $125,000.

🔽 Conversely, if it faces strong rejection around $119K and turns downward, BTC may retest the support zone at $114,000 – $115,000 once again.

Stay tuned to the channel for the latest and continuous updates on XAUUSD, CURRENCIES, and BTC.

BTC 108K - 112K ZONE Why 108k to 112k zone is important?

Bitcoin recently made a new all-time high and is now undergoing a healthy correction — nothing to worry about.

The $108,000 to $112,000 zone is a key support area due to three major factors:

1. Strong previous support level

2. A daily trendline aligning with this zone

3. 50% Fibonacci retracement of the recent impulse move

If this support holds, there's a strong possibility Bitcoin will form a new ATH around $130,000 to $140,000.

DON'T PANIC wait for confirmation and see the magic 🚀 🚀

2 Scenarios for BTCNow that the cup and handle formation has been reached and the correction finished, I think we have 1 more leg up.

It's also possible that we fall from here, but I think another fakeout upwards is likely as bearish divergence forms on the month, but isn't quite there yet (RSI needs 1 more higher high to confirm bearish divergence)

Either way, my short targets are the 0.618 fibs. I am expecting the typical -70-75% crash by 2027 before the next cycle begins

BTC, ETH & Indexes daily analyze 🚀🔥 BTC, ETH & Indexes daily🔥🚀

💎 Daily Market Routine, Structure-Based Crypto Analysis & Watchlist Insights

💥 Like – Follow – Comment to keep this momentum alive!

👋 Hey everyone! Welcome to our daily crypto trading routine:

📅 Daily:

🔹 BTC & ETH analysis

🔹 Full market structure review (TOTAL, BTC.D, USDT.D…)

📅 Weekly (Every Sunday):

🔸 Top 10 Altcoins Analysis (excluding BTC & ETH)

🔸 🆕 Coming soon: Weekly Watchlist Picks!

💛 Your likes, follows, and comments give me the motivation to continue this journey and share deeper insights!

🟡 Methodology

💠 Long-Term Cycle (HWC): 1D timeframe

💠 Mid-Term Cycle (MWC): 4H timeframe

💠 Short-Term Cycle (LWC): 1H timeframe

💠 Market structure review:

TOTAL / TOTAL2 / TOTAL3 / BTC.D / USDT.D

💠 Technical approach: Dow Theory

💠 Fundamental events + news tracking

🔥 Today Could Be the Most Important Day of the Week!

📢 The Fed’s interest rate decision is expected today. Market consensus leans toward no change, but Powell’s press conference could trigger major volatility.

📈 If BTC starts a bullish trend in the coming days, ETH, BNB, and AVAX are likely to outperform – and this probability is high.

♦️ BTC/USDT – Market Still Ranging

💎 Bulls have failed to break above 120,000, but bears also haven't broken below the critical 115,000 zone.

📊 This two-week range is not surprising – it's likely a time correction, consolidation, or even distribution phase.

🚀 If 120K breaks with strong momentum and volume, price may rally to 123K → 135K → 150K.

❗ If 115K breaks, expect a drop to 110K → 100K.

⭕ Breakouts need strong candles and volume – otherwise expect fakeouts.

🟡 My strategy doesn't allow shorts at this phase. I only seek bullish confirmation – though bearish signs like buying exhaustion and profit-taking near 118K exist.

📌 I’ll re-enter long on breakout above 120K, using buy stops and proper risk control. Even if it hits my stop-loss later, I’m okay with that.

🔥 BTC must break 120K to unlock full altcoin rally potential.

♦️ BTC.D – Decision Time Nears

📉 Recent downtrend shows weakness, but not a bullish reversal yet.

🔸 Watch levels:

• 🟢 Break below 60.42 → Confirmed altcoin rally

• 🔴 Break above 62.17 → Likely altcoin crash

♦️ USDT.D – Position Before the Break!

🟡 We must take altcoin & BTC positions before USDT.D breaks 4.13.

⏳ A break there likely triggers a sharp upward move in alts.

• 🔹 Pullback to 4.64 = still bullish for alts

• 🔹 Current key zones:

• 4.44: Not tested yet

• 4.13: Likely to be retested

♦️ TOTAL Market Cap

💎 Break above 3.91T → Bullish confirmation – be in the market!

♦️ TOTAL2 (Altcoin Market Cap)

🟡 Major resistance ahead: 1.54T

♦️ TOTAL3 (Altcoin Market w/o BTC & ETH)

🟡 Important level: 1.08T

♦️ ETH/USDT – Institutions Are Accumulating!

💼 Institutional buying continues – a strong bullish signal.

💎 Buyers are trying to flip 3750 into support. Heavy order blocks detected.

📌 Key Level: 3900

• 🔹 Break & hold above = Easy ride toward 4000+

• 🔻 Bearish view: Break below 3750 = Drop to 3500–3600

🟡 Recent demand spike and fresh capital inflow = bullish sentiment

♦️ Strategic Outlook

1️⃣ Still focused on long setups

2️⃣ If BTC breaks 120K and ETH breaks 4K then ranges → and BTC.D drops = 🎉 Altcoin Party!

3️⃣ If BTC fails to break 120.3K, we won’t get a strong rally

4️⃣ If BTC keeps ranging and BTC.D keeps dropping → alts will gain, but not full bull run yet

💬 Drop your thoughts in the comments below!

🚀 Smash that ROCKET, hit LIKE, and don’t forget to FOLLOW for daily setups!

#BTC Update #10 – July 27, 2025#BTC Update #10 – July 27, 2025

Bitcoin continues to move between $116,400 and $118,900, and staying within this range is actually a positive sign, even in bearish scenarios. A decisive close below $114,000, however, could open the door for a deeper and more prolonged correction.

Although BTC hasn’t broken to new highs yet, its ability to hold here means the trend isn’t broken. A strong breakout above $118,900 could lead to a rally toward $123,300 and possibly even $128,000.

🔹 On the 4H chart, BTC seems to have completed its minor correction.

🔹 On the daily chart, the correction remains incomplete – despite dipping to $114,700, the key $112,900 zone hasn’t been tested.

In lower timeframes, BTC remains squeezed within a symmetrical triangle. While it occasionally pokes out, it quickly returns inside — showing indecision.

📌 Direction is unclear at the moment. There’s no strong signal for Long or Short. Waiting for confirmation with volume and a clear breakout is the safer play.

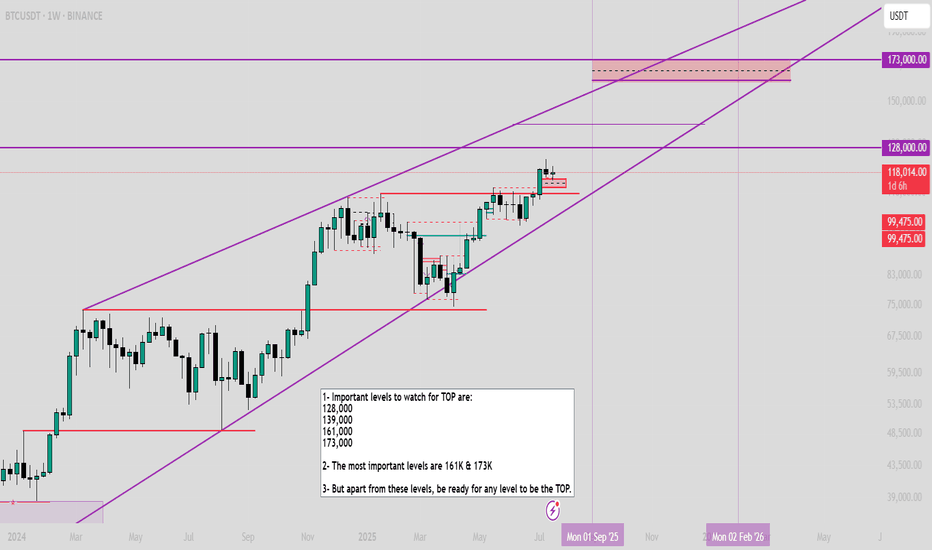

$BTC Important levels to watch1- Important levels to watch for TOP are:

128,000

139,000

161,000

173,000

2- The most important levels are 161K & 173K

3- But apart from these levels, be ready for any level to be the TOP.

(and again, Bull market is not over, watch my previous analysis BTC/XAG on the last post)

Structural and Technical Analysis of Crypto + BTC + Altcoins + TStructural and Technical Analysis of Crypto + BTC + Altcoins + Totals + Dominance

🔔 Follow me & smash that rocket 🚀 if you find this useful! Let's ride the next wave together!

🕒 Timeframe: 4H

🧠 Strategy: Customized Dow Theory + Structural

---

🟡 A critical moment for the market:

Many coins, including top 10 alts, are currently sitting on major key levels. Yes, you can go long — but only IF volume supports the move.

📈 That means we must keep an eye on:

TOTAL, TOTAL2, TOTAL3

BTC.D, USDT.D

---

💎 Bullish Trigger Conditions:

✅ BTC.D must show strong red candles (dominance falling)

✅ USDT.D must break below 4.22-4.23 (money flowing out of stablecoins)

✅ TOTAL must break 3.85T

✅ TOTAL2 must break 1.48T

✅ TOTAL3 must break 1.05T

🔴 If all these confirm, it could be a great trigger to enter alt positions.

---

🔍 BTC Outlook

As previously mentioned:

🟥 If sellers want BTC below $115K, they need to break it fast and sharp — slow breakdowns won’t work due to buyer activity.

🟨 Bullish trend requires a break above $120K.

📊 Most likely scenario? Ranging between $115K - $120K

⚠️ BTC Dominance plays a key role here. If dominance drops while BTC ranges, alts could explode.

---

💸 USDT.D Critical Level:

A clean breakdown of 4.23 on USDT.D = 🚀 Funds rotating into alts

---

✅ Coins To Watch (Long Setup Only IF Above Conditions Hold):

♦️BNB

enter:741.00

Sl: 786.13

♦️ETH

enter:3750

Sl: 3480

♦️SUI

enter:4.10

Sl:3.40

♦️XRP

enter:3.25

Sl:2.92

♦️LINK

enter: 18.60

Sl: 17.4

♦️AAVE

enter:295

Sl:276

♦️ADA

enter:0.8405

Sl: 0.7628

♦️SOL

enter: 192.40

Sl:177

♦️DOGE

enter:0.249

Sl:0.220

🔁 Note: First SUI trigger was 3.80 — next key level is 4.10.

---

⚠️ Important Notes:

Today is Saturday, expect low volume

Manage risk ⚠️ and avoid aggressive Martingale strategies

High chance of fake breakouts

Levels being tested might just be lower highs in a bearish structure

❗️Even for bearish continuation, volume increase is key

---

🟢 If you liked this post, don’t forget to Follow & Hit the 🚀 Rocket to stay updated on live setups and strategic insights!

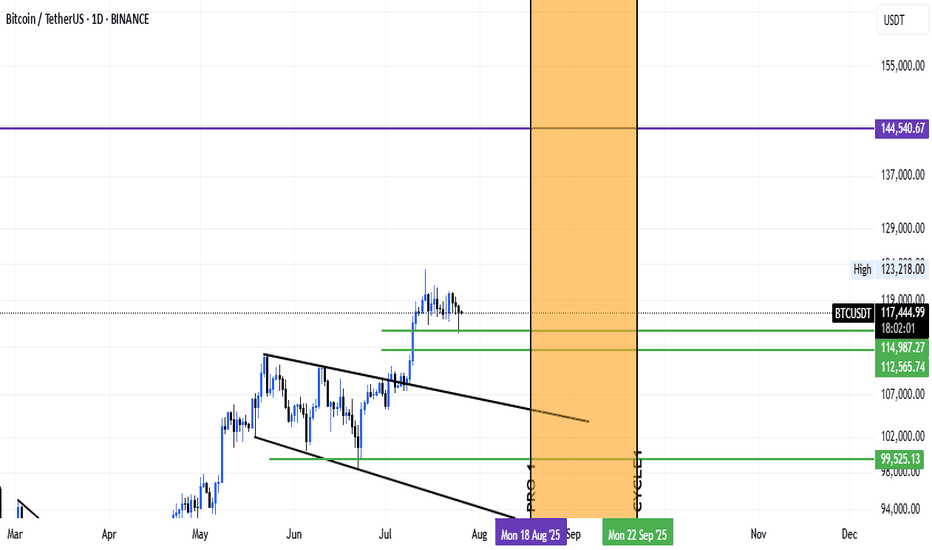

BTCUSDTAccording to previous analysis and its short-term target, Bitcoin has made a correction, and the correction areas, namely $114,000 and $112,000, were the important support areas it saw. However, considering the time, it can be said that the next Bitcoin ceiling will be reached in the period from August 18 to September 22, approximately 35 days.This is a medium-term timeframe on a weekly basis and Bitcoin is expected to reach $144,000 to $148,000 in price. Good luck and be victorious.

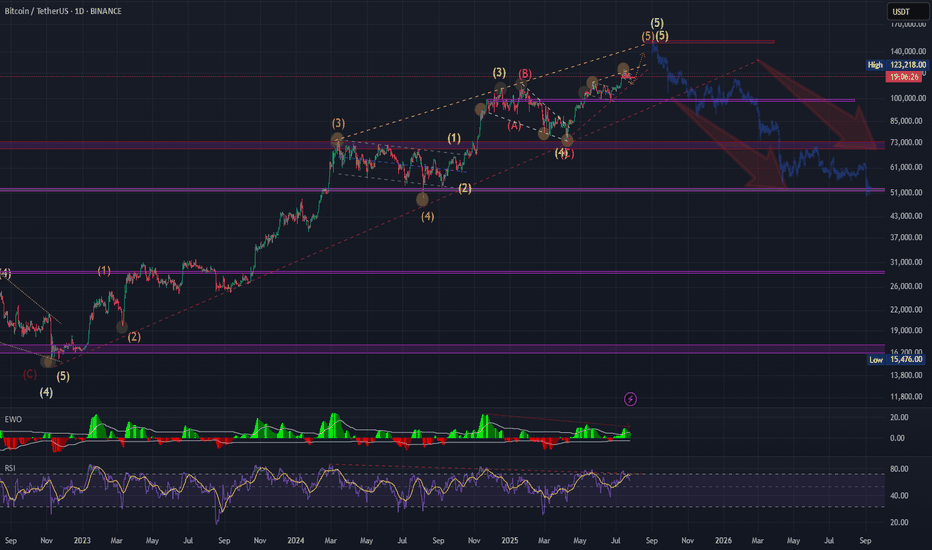

BTC should have one more leg upAccording to Elliot waves BTC should have one more impulse leg up to complete final wave of this cycle. Both daily and weekly RSI charts show bearish divergence, suggesting momentum is weakening even as price attempts to climb. A drop below $110000 would invalidate the current wave count and suggest a shift in market structure.

. Need to watch out reactions at target levels 136-150.