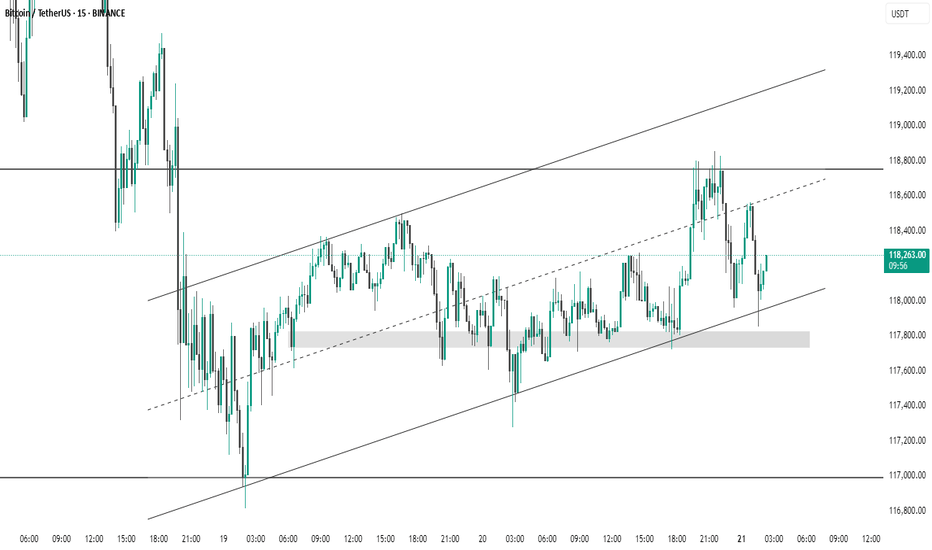

BTC #15-minute BTC/USDT chart This 15-minute BTC/USDT chart from Binance shows Bitcoin trading within an ascending channel. Price recently bounced off the lower trendline and a highlighted demand zone around 117,800 USDT, suggesting strong support. The upper channel and resistance near 118,800 USDT may act as potential targets. Short-term momentum appears bullish as long as price holds above the support trendline.

BTCUSDT.3S trade ideas

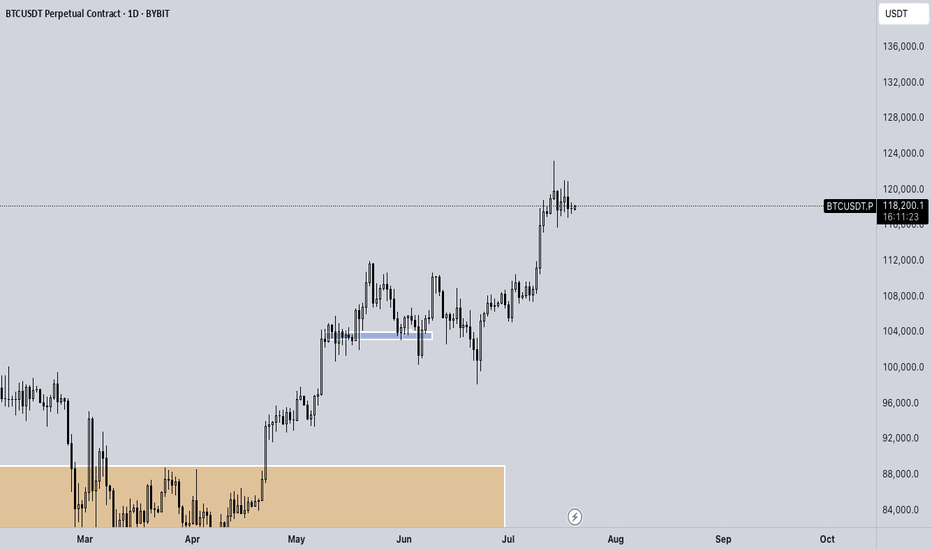

Bitcoin: Promising Patterns and Potential BreakoutBitcoin's recent price action has been nothing short of captivating for traders and analysts alike. On the daily chart, we've observed the formation of an Inverse Head & Shoulders and a Cup & Handle pattern, both of which have now transitioned into a Bull Flag. These bullish signals suggest a strong potential for upward movement.

Zooming into the 4-hour and 1-hour charts, we can see prominent Ascending Triangles taking shape. These patterns are often harbingers of significant breakouts, and it appears that Bitcoin is winding up for a substantial move.

Moreover, when utilizing a Trend-based Fibonacci Extension on the daily timeframe, the golden pocket points to a target of $126k, with the next pocket at $185k. This aligns with historical data and technical indicators, suggesting that Bitcoin might be poised to rewrite history once again.

Stay tuned as we monitor these developments and anticipate what could be a historic breakout for Bitcoin!

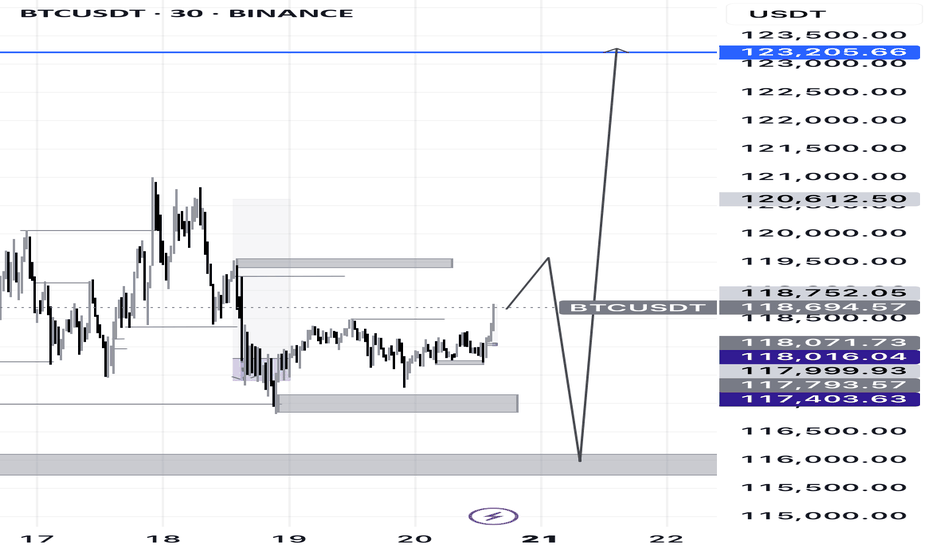

BTC - Ranges overview (update) BTC has been moving nicely lately so let's see where we go from here.

As previously mentioned, we should expect an aggressive move upwards towards 110K and eventually new ATH. As expected we got the move and are now trading around 120K.

IF we fail to hold the sellside at 115K expect us to trade back towards 110K.

IF we hold our current levels expect further upside towards new ATH.

No NEED TO FRONTRUN THE MARKET. BE PATIENT AND TRADE WITH IT.

Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

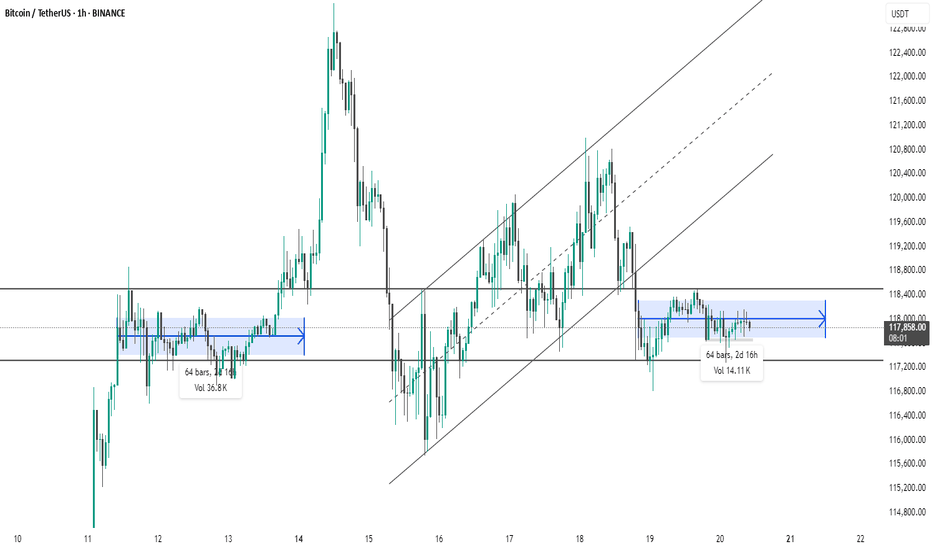

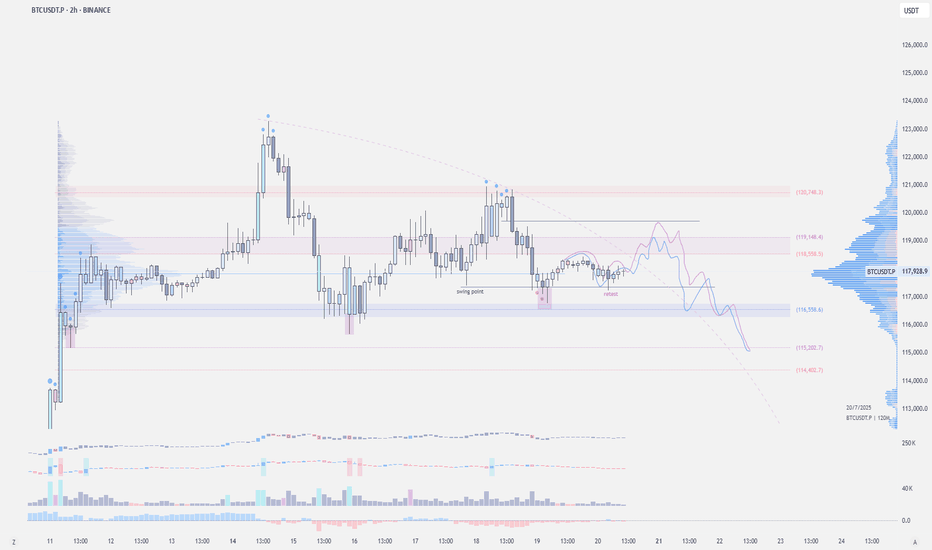

BTC #Bitcoin (BTC/USDT) on the 1-hour timeframeThis chart shows Bitcoin (BTC/USDT) on the 1-hour timeframe, highlighting two periods of sideways consolidation (marked in blue).

Both zones lasted 64 bars (2d 16h), indicating similar market indecision or accumulation/distribution phases.

The first consolidation (left) was followed by a strong bullish breakout, while the second (right) is currently unresolved.

Price is trading within a tight range between ~117,600 and ~118,400 USDT, suggesting potential for an imminent breakout or breakdown.

Volume during the current consolidation is lower than the previous one, hinting at reduced momentum.

This setup may signal a key move once the price exits this range.

thanking you

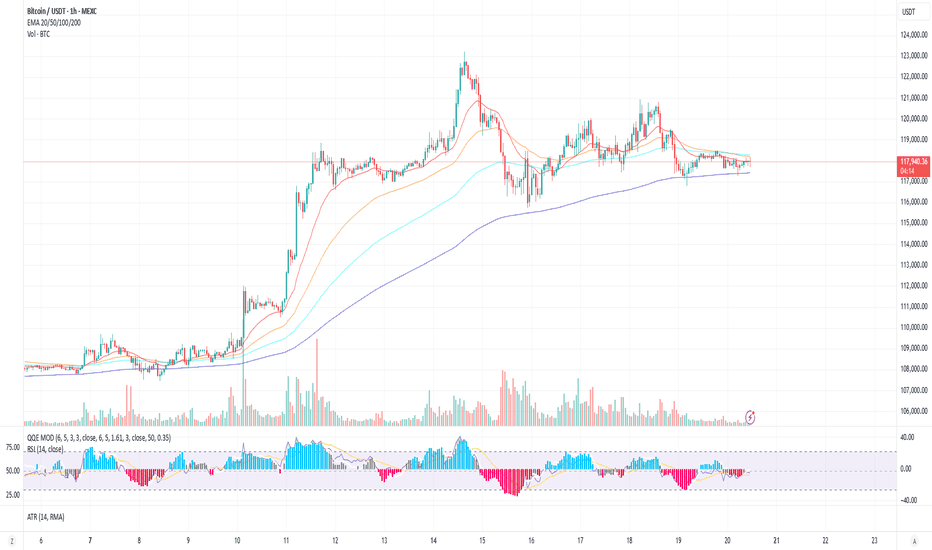

Buy Signal at 117k, Eyeing 118.5k BreakoutDescription:

Bitcoin is consolidating just above the 200 EMA on the 1H timeframe, forming a slight ascending triangle. A buy around 117,000 with TP set at 118,421. With RSI near neutral and QQE MOD potentially flipping bullish, we are watching for a breakout above 118,500 for continuation. SL sits below the recent swing low at 116,485.

Trade Setup

Long Entry: 117,000 (as signaled)

Take Profit: 118,421 or higher (watch 118,800 zone)

Stop Loss: 116,485

Alternate Trigger: Break and close above 118,500 with increased volume = breakout entry

Invalidation:

A break below 116,400 (below SL zone and 200 EMA) could invalidate the bullish thesis and open downside toward 114,000.

Confirmation to Watch

Breakout candle above the 50 EMA with volume spike

QQE MOD crossover with histogram flipping blue

RSI moving above 50 confirming strength

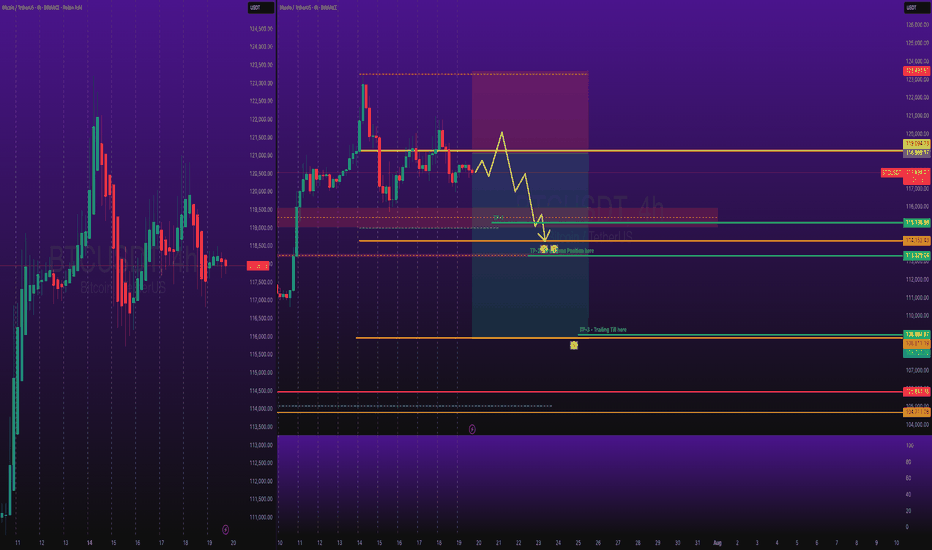

BTC/USDT – 4H Chart Technical AnalysisBTC/USDT – 4H Chart Technical Analysis

Market Structure & Trend

Overall Trend : Bearish (clearly defined by a consistent downtrend channel).

Current Structure : Price is in a corrective downtrend within a descending channel, after multiple rejections from the supply zone.

Key Technical Zones

1. Supply Zone

Strong rejection zone where the price previously reversed sharply.

Still acting as resistance, located around the upper range.

2. Demand Zone

Currently being retested for the fifth time, weakening its strength.

Recent price action shows liquidity sweep and swing low break inside this zone, potentially trapping early longs.

Fair Value Gaps (FVG) & Fibonacci Levels

1D FVG sits below the current demand, aligning with:

Golden Pocket (0.618–0.65 Fib).

Acts as a high-probability bounce zone for long entries if demand fails.

A break below this FVG could open up deeper downside toward the 0.786 Fib or beyond.

Psychological Levels

105,000 – Major resistance & potential take-profit area for long positions.

100,000 – Key support and liquidity magnet if the demand zone fails.

Volume Profile

High Volume Node: 102,000 – 106,800 — price tends to gravitate here, indicating potential consolidation or resistance.

Low Volume Area: Below 100,500 — suggests thin liquidity, which may cause sharp moves if price drops into this range.

Scenarios & Trade Ideas

Bullish Scenario

If price holds above the demand zone (after multiple retests) and confirms on LTF:

Potential Long to local resistance.

On breakout, target the 105,000 psychological level.

Confluence: High volume area offers both support and a magnet.

Bearish Scenario

If price fails to hold the demand zone:

Enter short position targeting the 1D FVG and 100,000 psychological level.

If that breaks, expect sharp continuation due to low volume below.

Conclusion

Price is at a pivotal point — currently balancing on weakened demand after multiple retests. Watch for LTF confirmation:

Above demand = bullish recovery setup.

Below demand = bearish continuation toward 100,000 and the FVG.

Manage risk tightly due to the proximity of both key zones.

BTC/USD Fake out before Pump | Bullish Flag formationBTC/USDT (1D) Market Outlook – July 1, 2025

Introduction

BTC is currently consolidating within a bullish flag pattern after printing a swing high at 108.9K and a recent swing low at 98K. The price sits just below a major supply zone.

Context 1: Key Zones

Supply: 104.6K – 112.1K

Demand: 74.4K – 82.5K

Fair Value Gaps (FVG): 3 zones below price, with one near 88–90K

Context 2: Technical Confluence

Liquidation Zone: 106.2K

Golden Pocket (Fib 0.618): 102.1K

Psychological Levels: 105K and 110K

Context 3: Market Structure

Pattern: Bullish flag

Trend (LTF): Sideways/consolidation

Volume Profile: Heavy activity near 105K–110K

Bullish Scenario

Breaks above 106.2K (liq zone)

Pulls back to 102.1K (golden pocket), forms higher low

Retests resistance for continuation

Alt scenario: clean breakout above resistance → ATH retest

Bearish Scenario

Breaks below 106.2K and flag support

Fills FVG, breaks prior low at 98K

Triggers macro downtrend toward 88–90K zone

Summary

BTC is at a decision point inside a bullish flag, facing supply. A break above 106.2K favors upside continuation, while rejection and a lower low could trigger a deeper retracement. Watch key levels closely.

Bitcoin's Critical Zone: Breakout or Breakdown?

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

🔍 Bitcoin Analysis (BTC)

📌 Scenario 1:

For BTC to break above 122 this time, it’ll need a real whale push. There are still many micro sellers at that level, and a slow, gradual move like yesterday likely won’t work.

Since buyers already spent their dry powder, they might not have enough left to defend 110 if price gets rejected again.

📌 Scenario 2:

But if price doesn’t attempt 122 again from here, we probably won’t see the 110 bottom either — simply because buyers haven’t deployed capital yet and may be waiting for entries around 115. That forms a potential range between 115 and 122.

🕰️ Daily timeframe:

Market is resting for now.

🎯 Entry trigger: 120.35

If price struggles at this level and BTC dominance isn't strong, we’ll likely shift attention to altcoins.

If BTC gets rejected at 122 and dominance turns red, again — alts may outperform.

💡 Current BTC & ETH positions remain open. No interest in shorts.

As long as we stay above 115, the focus remains on alt/BTC pairs during dips.

📊 TOTAL Market Cap:

🟡 Although we moved above 3.78 yesterday, we don’t call that a breakout — unless price moves away from the level significantly. Right now, it’s still struggling near resistance.

Next key level to watch for a true breakout: 3.91

This is the same region BTC needs a whale to push through.

📈 TOTAL2 – Entry Trigger: 1.05

If any altcoin shows strong momentum and volume before this level breaks (⚠️ low weekend volume is expected), we can consider that a signal.

On Saturdays, volume confirmation is tricky, so we may take small breakout trades using only 0.25% of capital, with fewer positions.

💠 OTHERS.D:

If BTC dominance drops, BTC ranges, and OTHERS.D rises ⬆️

➡️ It suggests that non-top-10 coins are starting to move.

That’s when we should analyze dominance of each top 10 coin individually.

🎯 Entry trigger: 7.80

💵 USDT.D:

No clean level for now, but keep an eye on 3.80 going forward.

🌐 ETH/BTC:

Still bullish, showing no signs of pullback. Price continues to push up.

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

Bitcoin's Critical Zone: Breakout or Breakdown?

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

🔍 Bitcoin Analysis (BTC)

📌 Scenario 1:

For BTC to break above 122 this time, it’ll need a real whale push. There are still many micro sellers at that level, and a slow, gradual move like yesterday likely won’t work.

Since buyers already spent their dry powder, they might not have enough left to defend 110 if price gets rejected again.

📌 Scenario 2:

But if price doesn’t attempt 122 again from here, we probably won’t see the 110 bottom either — simply because buyers haven’t deployed capital yet and may be waiting for entries around 115. That forms a potential range between 115 and 122.

🕰️ Daily timeframe:

Market is resting for now.

🎯 Entry trigger: 120.35

If price struggles at this level and BTC dominance isn't strong, we’ll likely shift attention to altcoins.

If BTC gets rejected at 122 and dominance turns red, again — alts may outperform.

💡 Current BTC & ETH positions remain open. No interest in shorts.

As long as we stay above 115, the focus remains on alt/BTC pairs during dips.

📊 TOTAL Market Cap:

🟡 Although we moved above 3.78 yesterday, we don’t call that a breakout — unless price moves away from the level significantly. Right now, it’s still struggling near resistance.

Next key level to watch for a true breakout: 3.91

This is the same region BTC needs a whale to push through.

📈 TOTAL2 – Entry Trigger: 1.05

If any altcoin shows strong momentum and volume before this level breaks (⚠️ low weekend volume is expected), we can consider that a signal.

On Saturdays, volume confirmation is tricky, so we may take small breakout trades using only 0.25% of capital, with fewer positions.

💠 OTHERS.D:

If BTC dominance drops, BTC ranges, and OTHERS.D rises ⬆️

➡️ It suggests that non-top-10 coins are starting to move.

That’s when we should analyze dominance of each top 10 coin individually.

🎯 Entry trigger: 7.80

💵 USDT.D:

No clean level for now, but keep an eye on 3.80 going forward.

🌐 ETH/BTC:

Still bullish, showing no signs of pullback. Price continues to push up.

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

BTCUSDT Short Swing TradeBINANCE:BTCUSDT Short Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

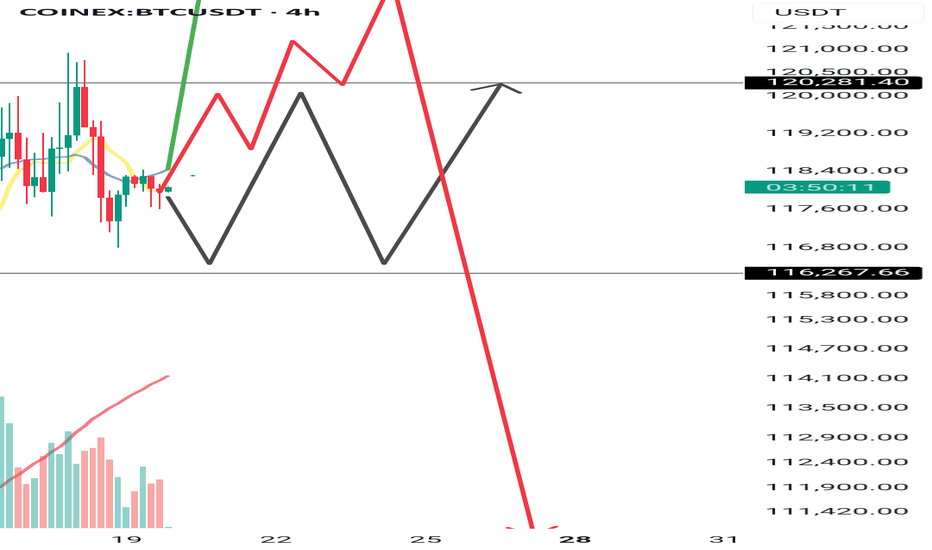

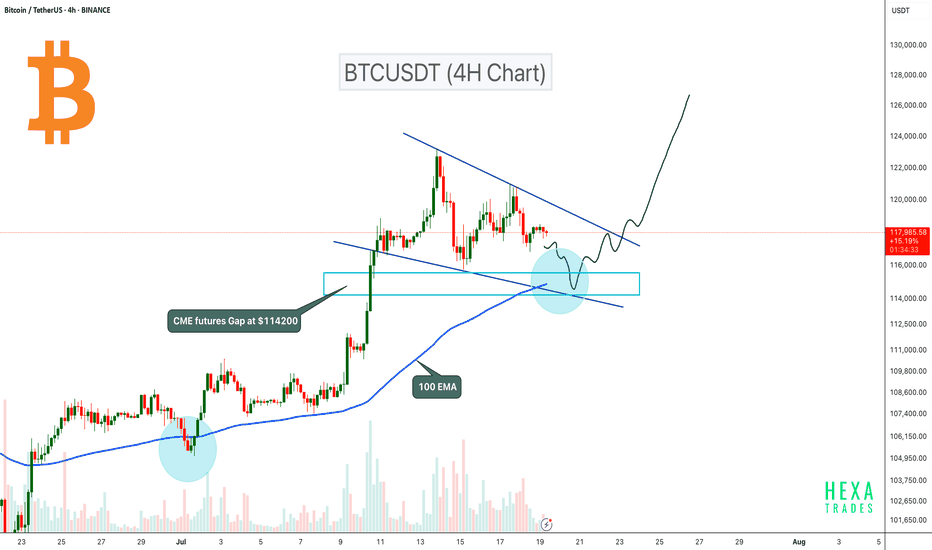

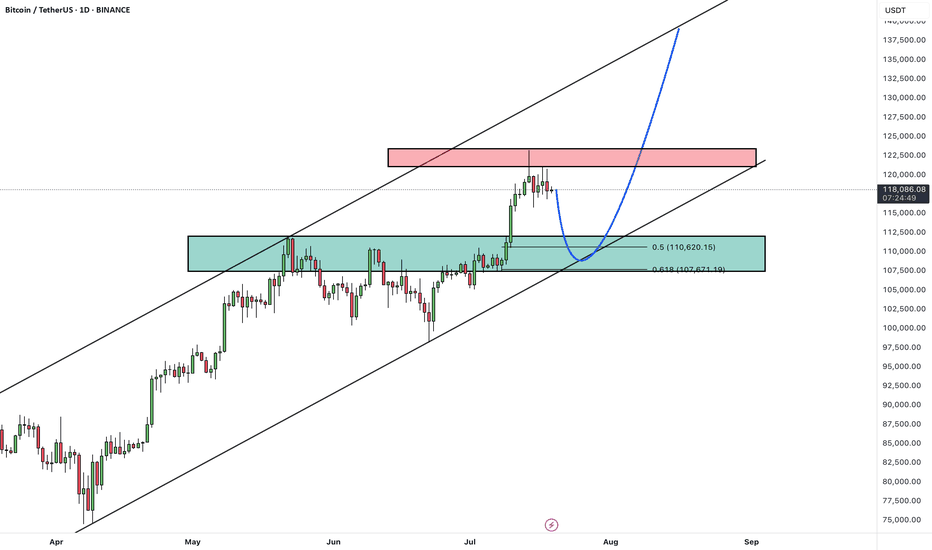

BTC Pullback Expected to $114K Before Next Leg Up!Bitcoin is currently consolidating inside a bullish flag pattern on the 4H timeframe. The price could retest the flag support, where the 100 EMA will act as dynamic support. Additionally, there is a CME futures gap at the $114,200 level, which also aligns with the 0.5 Fibonacci retracement level. Therefore, a retest to the $114,200 zone is likely before the next potential upward move.

A potential bullish reversal could occur if BTC retests this zone and confirms a bounce. A breakout from the bullish flag pattern could signal the next leg up.

Cheers

Hexa🧘♀️

BITSTAMP:BTCUSD CRYPTOCAP:BTC

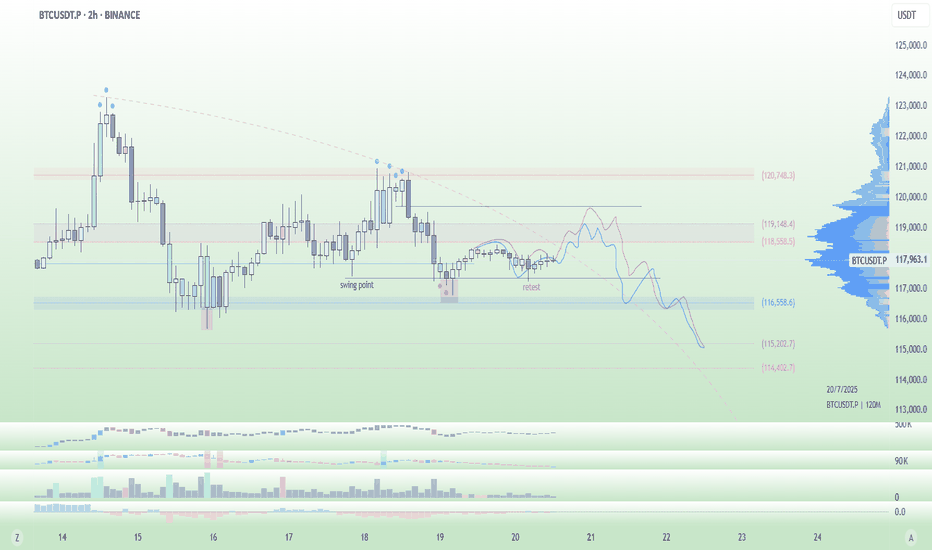

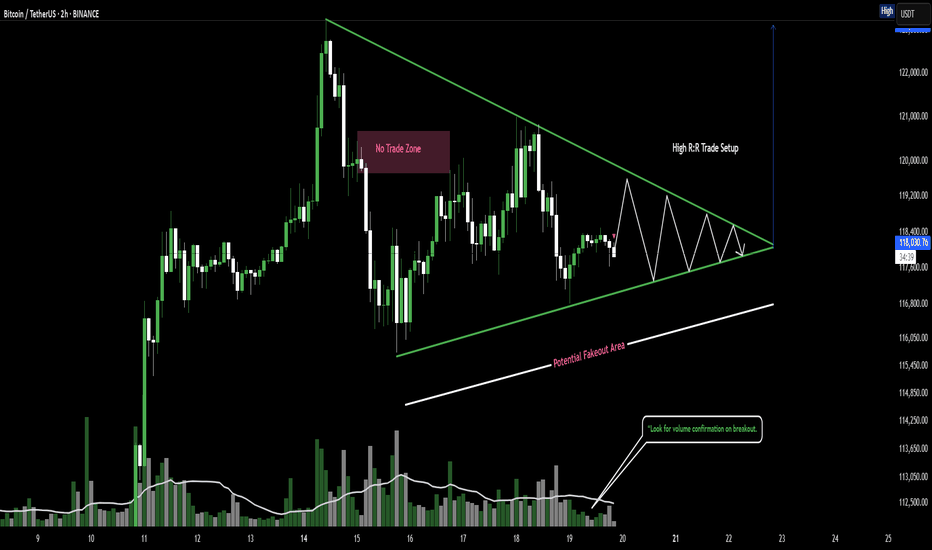

Bitcoin Technical Outlook -2HA symmetrical triangle is forming with declining volume — signaling a likely breakout.

🔼 Break above ~$119.5K → Target: $123K

🔽 Break below ~$116K → Target: $113.5K

⚠️ Await confirmation before entering. Risk management is key.

Bitcoin (BTC/USDT) Technical Outlook – 2H Chart

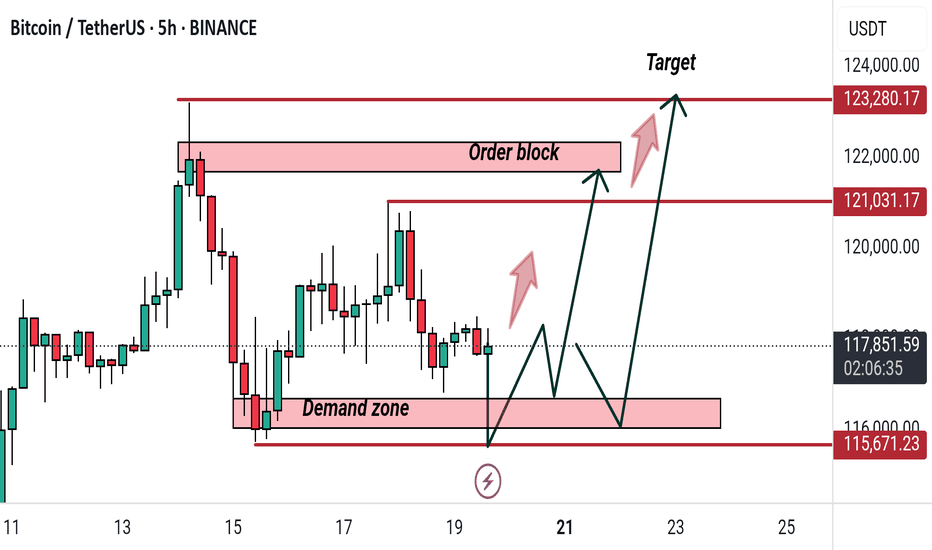

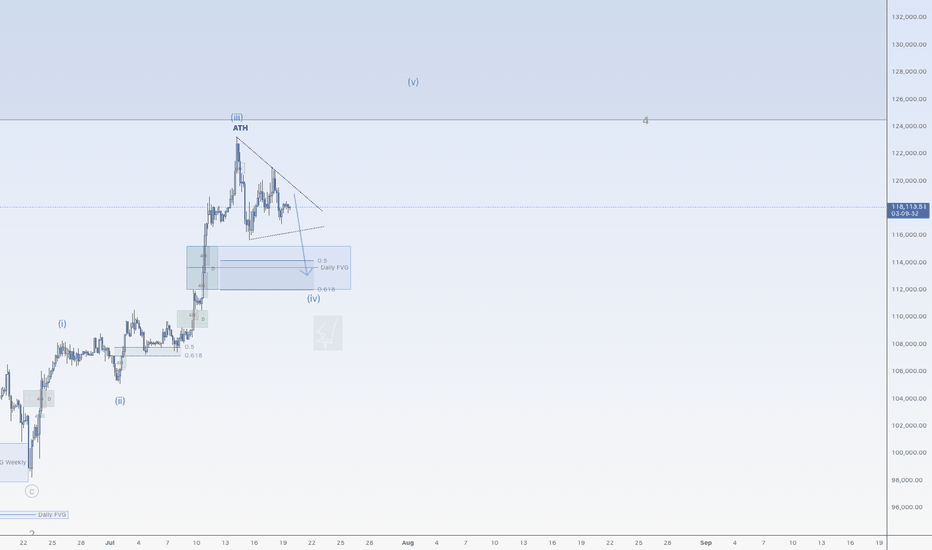

Correction down for BitcoinHi traders,

Last week Bitcoin made a small correction down and up again to finish wave 3 (blue).

After that it started a bigger correction down for wave 4 (blue). This could be a Triangle (no break of previous low) or Zigzag (break of previous low into the bullish Daily FVG).

After the finish of the correction down we could see more upside again.

Let's see what the market does and react.

Trade idea: Wait for the correction down to finish.

Then after an impulse wave up, a small correction down on a lower timeframe and a change in orderflow to bullish you could trade longs.

If you want to learn more about trading FVG's with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my analysis.

Don't be emotional, just trade your plan!

Eduwave

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin has recently posted a new all-time high and is now undergoing a healthy correction. This pullback is expected to extend toward a key support zone, which aligns with both the previous breakout level and the bottom of the ascending channel.

Once the correction is completed near the channel support / previous high, we anticipate a bullish continuation.

The next leg higher could take Bitcoin toward the upper boundary of the current channel.

As long as price remains above the key support area, the overall structure stays bullish and this correction is likely to be a buy-the-dip opportunity within a broader uptrend.

Will Bitcoin use this pullback as a launchpad for new highs? Share your view in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

Drop Your Token – I’ll Do The AnalysisHey everyone! Hope you’re having an amazing weekend !

Want me to analyze your favorite token ? Just drop your request in the comments using this format:

Request Format

Project Name: Bitcoin

Token Symbol: BTC( BINANCE:BTCUSDT )

Important Notes:

I’ll pick and analyze only the first 10 tokens requested .

One request per person — so choose wisely!

I’ll reply directly under your comment with the analysis.

If you find this helpful, don’t forget to Like ❤️ and Share this post with your friends!

Here’s to your success — health, wealth, and great trades! 🚀

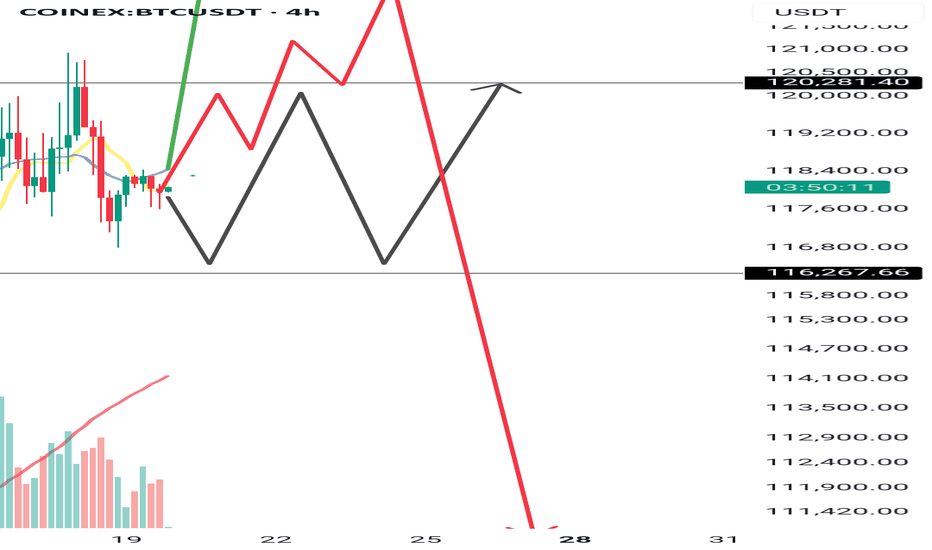

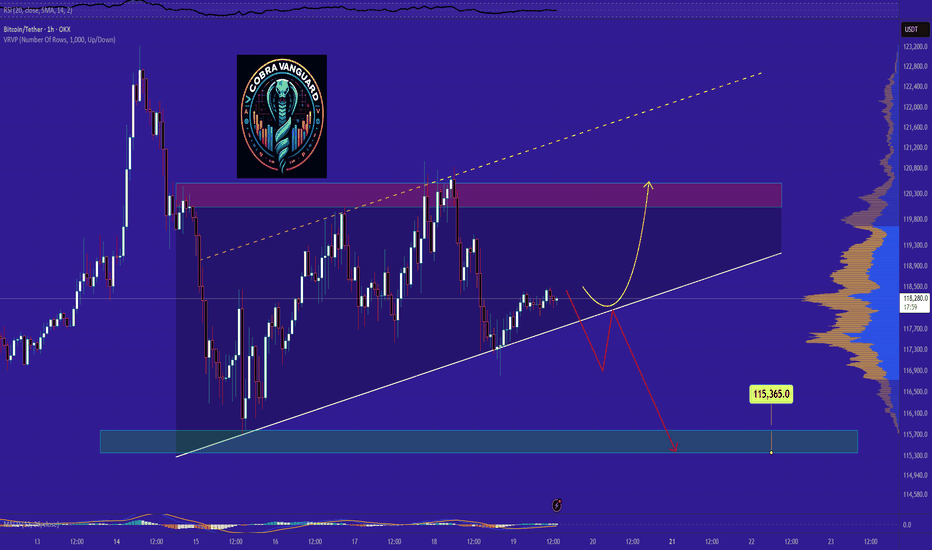

BTC Double QML Setup: Is Another Drop Loading?Hello guys!

Do you remember the last analysis?

Now this BTC chart shows a textbook example of two consecutive QML (Quasimodo Level) patterns forming (QML1 and QML2), each confirmed by clean engulfed lows.

QML1 caused a strong drop after the high was broken and a new low formed.

Price retraced and created QML2, again with a confirmed engulfed low (engulfed2).

We're now likely to see a reaction at the QML2 supply zone.

If price respects this second QML zone, we could see another bearish move toward the 116k zone, possibly lower.