BTC/USDT – Trade Review & New Plan (15m, Ichimoku) by RiscoraYesterday’s short setup didn’t work out as planned — stop-loss was hit as bulls showed strong momentum. However, I still believe that a move to the yellow block (downside liquidity zone) is possible, and the idea remains valid.

The main mistake was with the stop placement, not the scenario itself. After taking a loss, I’m more cautious: reducing risk, lowering position size, and entering with less conviction. Bulls were dominant yesterday, so I’m keeping my risk tight on this trade.

I’ll take the setup again, but with a more conservative approach. If price breaks and holds above my stop-loss level, it will confirm a shift in sentiment to bullish, and I’ll look to flip my bias accordingly.

Key points:

Previous short was stopped out — reviewing risk

Still see potential for a move to the yellow block

Lower risk, smaller size after a loss

If price holds above stop, trend flips bullish

Let’s see how this plays out.

#BTC #Crypto #Trading #Ichimoku #Riscora

BTCUSDT.5L trade ideas

Bitcoin Short-Term Outlook – Coming Week📈 Bitcoin Short-Term Outlook – Coming Week

Currently, Bitcoin is expected to gather liquidity around the $106,000 zone, potentially initiating a move toward the $110,000 resistance level.

This area will be crucial in determining the next directional move.

🔍 The market's reaction around $110,000 will be closely monitored, and the analysis will be updated once that level is reached.

📌 Note: This outlook is based on current market conditions and may require adjustments if sentiment or price structure changes.

BTC - Still StrugglingPlease refer to the last post:

We have been monitoring BTC at this red trendline for a potential breakout. In this post we are examining a lower timeframe (6H) to see how this structure is developing.

Price tried to rally to the red line, but sellers came in and swiftly pushed price back down. This is looking to be a third rejection at this red trendline so far.

Buyers are also fighting on the LTF. We have seen the low/mid $106k levels acting a support.

A break below $106k could lead to a drop back to our white trendline. This white trendline was recently established with 2 points of resistance (red arrows) followed by it being flipped into new support with 2 touchpoints (green arrows). Depending on when/if this trendline is tested it could bring BTC anywhere between $103-105k. Will update this post if that does happen.

In the meantime our three areas to watch on the lower timeframes.

-A break above the red trendline

-The midline around $106k continuing to hold

-The white trendline being tested

Dollar's Decline: Global Economic ShiftsYou're probably wondering why I'm talking about the dollar on the Bitcoin chart. It's because I want you to look a few steps ahead.

That's why this post is for people like that.

1. Global Economic Transformations: Collapse of the Jamaican Monetary System

Insights and Logic:

We are witnessing the end of the Jamaican monetary system, established in 1976 following the collapse of the Bretton Woods system.

The Jamaican system's key feature is free (yet conditionally market-driven) exchange rates and the global dominance of the U.S. dollar.

For decades, the U.S. utilized the dollar's reserve currency status to finance budget and trade deficits without equivalent value returns—a beneficial "global tax."

Facts:

Currently, over 60% of global reserves are denominated in dollars (IMF data), but diversification is accelerating.

The U.S. is facing a "liquidity trap": to sustain markets, the Fed must print money, exacerbating inflation and weakening the dollar's global effectiveness.

Analogy:

Just as Nixon abolished the gold standard in 1971, we are now witnessing the abolition of the dollar's global standard—not abandoning the dollar as a reserve currency, but its monopoly.

2. Political Environment in the U.S.: Trump, Tariffs, and Managed Uncertainty

Insights:

Court decisions against Trump's tariffs are political tools, especially prior to congressional elections.

Democrats aren't just fighting for power—they systematically undermine Trump's economic policies in voters' eyes.

Systematic Explanation:

Virtually any presidential decree in the U.S. can be challenged legally. Lower-court decisions rarely withstand appeals, yet they create temporary buffers allowing policy adjustments.

This enables Trump to recalibrate his trade model systematically without losing face.

Conclusion:

The U.S. operates under "managed uncertainty," where seemingly chaotic political behaviors are structured adaptation mechanisms to global changes.

3. Mass Market and Sixth Technological Paradigm: NBIC as Foundation for Future Growth

Insights:

The future mass market will be built around NBIC technologies:

* Nano—new materials and sensors;

* Bio—biotech, genetic engineering, life extension;

* Info—digital platforms, neural networks, blockchain;

* Cogno—cognitive interfaces, AI, neural interfaces.

Historical Analogy:

Just as cars and mobile phones defined the mass market of the 20th century, longevity treatments, AI services, and neural devices will define the 21st century.

Facts:

Examples of current "false starts": Nvidia, Palantir, OpenAI—stock price volatility relates not to technology failures but premature valuation.

Forecast:

The next 20 years will see growth in new sectors, dominated by those capturing mass consumers, not just investors.

4. Digitalization and Geo-economics: Telegram, AI, and Control

Facts:

Telegram plans to integrate Grok neural network—a signal of the digital merger of communication, payment platforms, and behavioral analytics.

Insight:

Telegram as a future super-app: messaging, finance, AI assistance—all-in-one.

This is a media reset: traditional platforms like Bloomberg and CNBC lose influence to those controlling data flows directly.

Conclusion:

Information landscapes become automated—algorithms, not journalists, manage narratives.

5. **Europe: From "Progress Locomotive" to Stagnation and Subcontracting**

Facts:

Germany has been in recession for three consecutive years. The average age is 46.

Pension burdens and social standards make the economic model (Rhineland capitalism) unsustainable.

Ideological Crisis:

Europe is split into "transhumanist" (West) and "neoconservative" (East) factions.

The neoconservative revolution is gaining ground in Hungary, Poland, Slovakia, Romania, and even eastern Germany.

Conclusion:

Europe is skipping the sixth technological paradigm, becoming a "comfortable but uncompetitive" zone. Europe's "Japanification"—a path without acute crises but also without growth.

6. Future Growth Centers: Asia and the Global South with Risks

Facts and Locations:

Indonesia, Vietnam, Thailand—dynamic economies with high ROI and moderate political risks.

Philippines, Taiwan—potential proxy-conflict zones between the U.S. and China.

Logic:

Global capital moves towards higher returns rather than better living standards.

Asia becomes a new economic and geopolitical battleground similar to 20th-century Europe.

7. Role of Cryptocurrencies and USDT, USDC: Transition to Digital Dollar

Facts:

U.S. authorities view cryptocurrencies, especially USDT, as tools to reboot the dollar model.

USDT effectively integrates the dollar into the crypto economy, maintaining Treasury demand and allowing dollar exports outside the U.S.

Insights:

Unlike CBDCs, the U.S. digital dollar (via stablecoins) enables global expansion rather than local control.

The U.S. aims to lead the new monetary evolution—digital dominance instead of fiat.

8. Prospects in Latin America: Argentina, Mexico, and Risks

Argentina Analysis:

President Milei implements neoliberal reforms akin to Ukraine's: reduced state role and deregulation.

Possible outcomes: deindustrialization, increased poverty, export dependency.

Positives:

No war risks, resource-rich (oil, wine, food), good medicine and education standards (legacy).

Mexico:

High growth yet severe crime levels—excellent for business, risky for life.

9. Global Hybrid War Instead of a Third World War

Concept:

Not a "world war" but a global hybrid war: multiple power centers, proxy conflicts, shifting alliances.

Theaters of conflict: Asia (especially the South China Sea), potentially the Middle East and Africa.

Strategic Conclusion:

Avoid proxy countries; prefer "neutral dynamic" regions like Indonesia, Vietnam.

About DXY

I have been talking about the fall of the dollar index for a very long time.

September is coming soon

Best regards EXCAVO

BTC Bullish Engulfing – Multiple Long Opportunities🚀 BTC Bullish Engulfing – Multiple Long Opportunities

Following the bullish engulfing candle, there are two potential long entries for Bitcoin:

🎯 Aggressive Entry: at $107,853.7 (higher risk)

✅ Conservative Entry: at $108,497.3

🔐 Stop-loss advice:

Place your stop either:

At a level that won’t be easily hit by short-term noise, or

At a level that confirms a short-term trend reversal if breached.

📈 If neither trigger plays out, set a stop-buy order at $110,246. A strong breakout is likely above this level, so don't miss it if momentum kicks in.

🧠 The choice is yours:

Enter early and accept the risk of getting stopped out

Or wait for confirmation and risk missing the trade

📌 If you’re already in a BTC long based on earlier signals, consider opening a position in high market cap altcoins to diversify exposure.

---

💬 Which entry level are you going for — early risk or breakout confirmation? Let me know in the comments! Always curious to see your strategies.

The Pattern That Could Launch Bitcoin, pt. 2There appears to be an IH&S pattern forming inside of the larger IH&S's right shoulder (see my previous post for the larger one). I've seen this happen a few times and then a break out upwards! Results may vary of course lol.

If it drops from here support could be at around $102k and then $100,500.

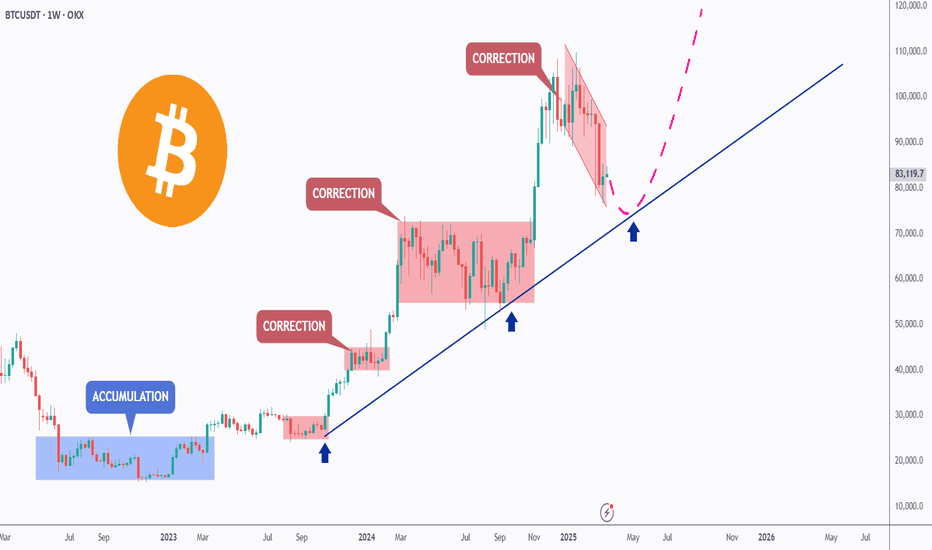

BTC - Bullish SOON!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

BTC has been in a correction phase, and it feels like it's taking forever! ⏳

As long as the blue trendline holds, the overall bias remains bullish. 📈

As BTC approaches the blue trendline—perfectly aligning with a demand zone and support—we'll be watching for trend-following longs to catch the next big impulse move upward. 🚀

For now, we wait! ⏳

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC next boom beginning I'm going to see boom in btc

Here’s the analysis of Bitcoin’s (BTC) next expected move in English, based on current market conditions and technical indicators:

---

### **1. Short-Term Outlook (Next 24-48 Hours)**

- Bitcoin is currently trading around **$107,400**, with **$108,000-$109,000** acting as a strong resistance zone.

- If BTC breaks above **$109,870** and closes above it, the next target could be **$114,950**.

- If the price fails to break resistance, a pullback to **$105,300** or **$103,900** (support levels) is possible.

- The **30-minute RSI is at 52.22** (neutral-bullish), and the MACD histogram is in positive territory.

---

### **2. Medium-Term Outlook (1 Week to 1 Month)**

- **Coincodex predicts**:

- **$116,914** (+8.98%) by July 2025.

- **$136,858** in the next 3 months.

- **DigitalCoinPrice forecasts**:

- Average price of **$221,961** by late 2025, with a potential high of **$235,354**.

---

### **3. Key Technical Indicators**

- **4-Hour Chart**:

- BTC is testing the **upper Bollinger Band ($108,672)**. A breakout could target **$114,956**.

- **Support Levels**:

- Immediate support: **$105,358** (EMA 100).

- Strong support: **$103,996**.

---

### **4. Market Sentiment**

- The **Fear & Greed Index** is currently at **74 (Greed)**, indicating bullish sentiment but also potential overbought conditions.

- **Volume**: Stable buying volume suggests sustained interest, but a drop could signal consolidation.

---

### **5. Potential Scenarios**

- **Bullish Case**: Break above **$109,870** → Rally toward **$114,950-$116,000**.

- **Bearish Case**: Rejection at resistance → Drop to **$105,300-$103,900**.

BTC/USD Multi-Timeframe Analysis – 1H & 5m🕐 1-Hour Overview:

BTC is currently consolidating inside a range-bound structure, showing signs of indecision.

Resistance Zone: $105,000 – $106,000

Support Zone: $100,000 – $101,000

The price must break out of this box to define the next major direction.

➡️ A bullish breakout above 106K could lead to $108K+

⬅️ A breakdown below 100K may trigger downside momentum.

⏱ 5-Minute Execution Zone:

The 5m chart shows a rebound from an oversold move, forming higher lows and approaching key resistance.

Minor Resistance: $107,000

Key Breakout Level: $107,400

🎯 Trading Scenario:

If we get a strong bullish candle closing above $107,400

Then: Entry Long with target near $108,000

Stop Loss: Below recent 5m low – around $106,800

✅ Strategy Context:

Timeframe alignment between HTF and LTF

Scalp entry with confirmation

Risk managed around structural zones

🔗 Powered by ALIP FX

📌 Follow for more ideas, and smart scalping setups

#Bitcoin #BTCUSD #Scalping #PriceAction #ALIPFX

BTC & USDT.D => Bullish Correction Incoming?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Both BTC and USDT.D are sitting around key rejection zones.

💰 BTC is hovering near the $100,000 level — a major previous low and a psychological round number.

📊 Meanwhile, USDT.D is testing the 5% resistance — a supply zone and another critical round number.

As long as $100,000 holds as support on BTC and 5.1% holds as resistance on USDT.D, we could expect a bullish correction across the crypto market.

What do you think? Will these levels hold or break? 🤔

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC Weekly Analysis : Rise or Fall ? Let's SeeBy analyzing the #Bitcoin chart on the weekly timeframe, we can see that last week’s candle closed at $108,350, and BTC is currently trading around $107,500. If the price manages to hold above $105,700, we could expect further upside momentum. The next potential bullish targets are $111,700, $124,000, and $131,800.

So far, this analysis has yielded over 9% return, and we’ll be sharing more updates soon from lower timeframes!

🎥 If you enjoyed this video analysis and found it helpful, please show your support with a LIKE and COMMENT below!

These video-style breakdowns take time and effort, and I’ll only continue them with your support 🙌

Your engagement is my biggest motivation to keep going 💛

Thanks for being part of the journey!

BTC/USDT – 4H Chart Technical AnalysisBTC/USDT – 4H Chart Technical Analysis

Market Structure & Trend

Overall Trend : Bearish (clearly defined by a consistent downtrend channel).

Current Structure : Price is in a corrective downtrend within a descending channel, after multiple rejections from the supply zone.

Key Technical Zones

1. Supply Zone

Strong rejection zone where the price previously reversed sharply.

Still acting as resistance, located around the upper range.

2. Demand Zone

Currently being retested for the fifth time, weakening its strength.

Recent price action shows liquidity sweep and swing low break inside this zone, potentially trapping early longs.

Fair Value Gaps (FVG) & Fibonacci Levels

1D FVG sits below the current demand, aligning with:

Golden Pocket (0.618–0.65 Fib).

Acts as a high-probability bounce zone for long entries if demand fails.

A break below this FVG could open up deeper downside toward the 0.786 Fib or beyond.

Psychological Levels

105,000 – Major resistance & potential take-profit area for long positions.

100,000 – Key support and liquidity magnet if the demand zone fails.

Volume Profile

High Volume Node: 102,000 – 106,800 — price tends to gravitate here, indicating potential consolidation or resistance.

Low Volume Area: Below 100,500 — suggests thin liquidity, which may cause sharp moves if price drops into this range.

Scenarios & Trade Ideas

Bullish Scenario

If price holds above the demand zone (after multiple retests) and confirms on LTF:

Potential Long to local resistance.

On breakout, target the 105,000 psychological level.

Confluence: High volume area offers both support and a magnet.

Bearish Scenario

If price fails to hold the demand zone:

Enter short position targeting the 1D FVG and 100,000 psychological level.

If that breaks, expect sharp continuation due to low volume below.

Conclusion

Price is at a pivotal point — currently balancing on weakened demand after multiple retests. Watch for LTF confirmation:

Above demand = bullish recovery setup.

Below demand = bearish continuation toward 100,000 and the FVG.

Manage risk tightly due to the proximity of both key zones.

Bitcoin - What's next ? BINANCE:BTCUSDT (12H CHART) Technical Analysis Update

Now that ceasefire is announced, bitcoin price has successfully recovered to the resistance level and currently trading at the resistance zone. It's critical that bitcoin breaks this resistance for it to hit the next resistance around 110K .

I'm expecting price to reach 110k this week and we can see some consolidation in that range before moving further up.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

Bitcoin Playing Below The Crucial Area, Im Out of The Market🥱 I’ve been active in this market since 2017, and I’ve never seen it this dull and exhausting.

👉 Bitcoin has been ranging around the $110K level for nearly six months now, and once again, it’s trading below a critical resistance level. In my opinion, staying out of the market and just observing is still the best approach.

📥 Trading in such market conditions can be mentally draining, which is why I prefer to stay on the sidelines and simply watch for now

📉 Any rejection from this area could lead to a price drop down to the 95K zone. Although there’s a possibility of a buying pressure up to the 115K level as a shadow, even if this scenario plays out, it won’t change my overall outlook on Bitcoin

SatochiTrader Expecting a huge BTC CRASH AFTER This..BTC Market Update by SatochiTrader

EVERY CRASH DID START WITH A FALSE INCREASE TREND.

Depending on the market sentiment and price action, BTC is currently showing strength with a positive trend. However, based on deeper data and insights held by myself and a small group of early-cycle followers, this current movement may be a deceptive signal — potentially foreshadowing a major crash.

This is not trading advice. Those who are confident in the long position should continue, and those on the other side should stay prepared as well.

We have previously explained that the current cycle appears to have ended. Since 2013, BTC has consistently respected its macro cycle targets. The end of such a cycle typically leads to significant corrections.

A cycle ending implies not just a retracement, but the potential for a major crash. Hedge funds and real BTC whales understand the underlying indicators and risks at play. Our expectation remains clear: BTC may soon fall below the 100K level, with $85K identified as a critical support and target zone.

Stay sharp. Stay informed. The market may look bullish — until it isn't.

The best way to follow BTC is not the news.. but the cycle overview.

This update is an education update, which means the high expectations of the upcoming correction for BTC.

Compared to last quarter, miners are now less severely underpaid, though profitability remains low

Trade of the day!These are the areas I have my eyes on. We are in a range and can get a long or short play here. If we break bullishly, I will be wary of the supply above, if we break down here there's a lot of liquidity to sweep. Lets see what happens

Confirmation: MS change on secondary TF or Divergences

BTCUSDT SHORT SIGNAL Setup Type: Liquidity Trap & Distribution

Trade Idea (SHORT):

Entry Zone: $108,000 – $110000

Stop Loss: Above $113000

Take Profit Targets:

TP1: $104,000

TP2: $100,000

TP3: 98000

TP4: 74000

This analysis is for educational purposes only and does not constitute financial advice.

Always do your own research and apply proper risk management.

Trading involves risk, and you are solely responsible for your decisions.

Use this information as a guide — not a guaranteed outcome.

Wait for clear confirmation before executing any trade.