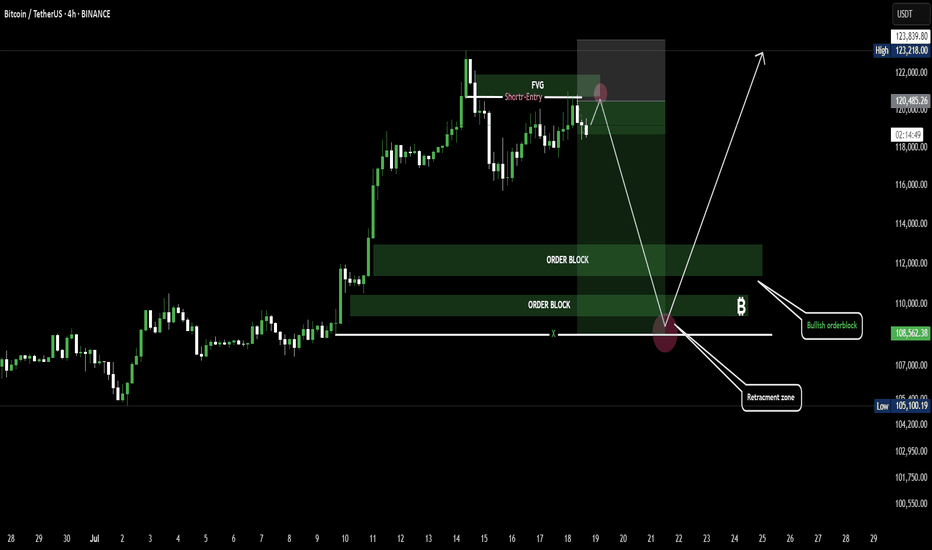

Chart Breakdown – Smart Money Concept in ActionThis chart showcases a textbook example of a bearish setup based on Smart Money Concepts (SMC):

BOS (Break of Structure) at the left confirms a shift in momentum.

A strong engulfing candle pierces into a supply zone, setting the stage for a potential reversal.

Price forms an FVG (Fair Value Gap) and returns to fill the imbalance, offering a high-probability entry within the Bearish Order Block (OB).

A clear CHoCH (Change of Character) signals a bearish trend shift, validated by the second BOS.

The trade targets Sell Side Liquidity, resting below the recent lows—just where smart money aims.

🎯 This setup combines precision, patience, and the power of understanding institutional moves.

BTCUSDT trade ideas

BTC | Swing Plan UpdatePrice failed to break out above 1D supply and sharply rejected, losing key 4H demand at $117,300.

HTF demand at $109,000 (1D FVG + BOS + S/R) is the next major area of interest—this is where I’ll look for fresh swing setups if the market flushes further.

No need to rush new positions until a clean setup prints or levels are reclaimed.

Plan:

Wait for price to test $109,000 zone before considering a swing long.

Only consider LTF scalp longs if we reclaim the 4H BOS at $118,300.

Stay flat until high-probability entry, let the market show its hand.

BTC-----Sell around 114500, target 113500-113000 areaAugust 5th BTC Contract Technical Analysis:

Today, the daily chart closed with a small bullish candlestick pattern, with prices remaining high. However, the accompanying indicator forms a death cross. While the broader trend remains bearish, the market is still trending downwards. However, yesterday's significant upward trend suggests a range-bound trend in the short term. Without a continuation of the trend, a significant unilateral move is unlikely. On the hourly chart, yesterday's intraday gains continued in the European and American sessions, but prices failed to break above the previous high. The current candlestick pattern shows consecutive bearish candlesticks, with prices trading below the moving average and the accompanying indicator forming a death cross. Therefore, continued support is crucial for the day, with the strength and potential breakouts of the European session also key.

Today's BTC Short-Term Contract Trading Strategy:

Sell on pullbacks to the 114,500 area, with a stop-loss at 115,000, and a target of 113,500-113,000.

BTC Retracement Loading.....Bullish Bounce Ahead?Bitcoin is showing signs of a short-term pullback after tapping into a Fair Value Gap (FVG) zone, triggering a potential short setup. Price is likely to retrace toward the bullish order block and retracement zone around 105,000–110,000. If that area holds, we could see a strong bounce back toward the 123,000 level.

BTC Price Prediction and Elliott Wave AnalysisHello friends,

>> Thank you for joining me in my analysis. We have finished the pink X wave directly, then we have gone to the final pink Y wave, which consists of wxy in orange counting. Now we are moving into the final Orange Y wave.

>> our confirmations:

* 4Hr TF: Breaking 118990 for the next hours, we will end the whole Yellow B "correction" wave successfully. .

Keep liking and supporting me to continue. See you soon!

Thanks, Bros

BTC: Calm before the storm on market, or where we go?Sometimes the market is straightforward: there’s momentum, a trend, a clear direction. But other times—like now—there’s complete uncertainty. Over the past few days, Bitcoin has been trading in a tight range, lacking any pronounced momentum. The price moves back and forth, bouncing off local levels but not breaking out in any meaningful way.

📉 This is especially clear on the 4-hour chart: neither bulls nor bears can take control. Every move upward is quickly met with selling pressure, and attempts to drop are countered by buying. It’s like a “ping-pong” match in a sideways market.

📊 Indicators show low volatility and declining volumes, confirming that market participants are simply waiting. Likely, they’re anticipating an external trigger: news, macroeconomic events, interest rate decisions, ETF developments, or something else.

What could this mean?

Such conditions often precede a strong move. The question is—where to? Honestly, there’s no clear signal yet. Personally, I try not to rush in moments like these: if the market isn’t giving a clear direction, it’s better to take a pause.

That’s the essence of a professional approach: don’t trade just for the sake of trading, but wait until the market speaks more confidently.

What can you do now?

– Watch the range boundaries and wait for a breakout or trade bounces.

– Avoid entering positions based on emotions—pullbacks can be sharp and unexpected.

– Reduce trade sizes if you do enter, and set tight stops.

– Keep an eye on the news—sometimes even neutral news can spark a move.

Sometimes the best decision is to do nothing. This might be one of those times. In a sideways market, you’re more likely to lose than gain. But clarity almost always follows a consolidation.

Bitcoin (BTC/USDT) – RTM Reversal Pattern in Action🔸 Market Structure:

Bitcoin has formed a descending channel after a prolonged correction. Recently, price tapped the channel bottom and printed a CHoCH (Change of Character), indicating a potential reversal.

The price has now retraced to the left shoulder of a potential inverse head & shoulders pattern—an RTM classic structure—which held as support, suggesting bullish continuation.

⸻

🔸 Key Technical Signals:

• ✅ CHoCH confirmed at demand zone near $112,300

• ✅ Retest of the left shoulder validates bullish structure

• ✅ Holding above the internal bullish trendline

• ✅ Price aiming toward upper channel resistance

⸻

🎯 Target:

$116,200 – Top of the descending channel & next key resistance.

❌ Invalidation:

Break and close below $112,800 would invalidate the current RTM setup and open room for deeper correction.

⸻

📌 Summary:

This is a textbook RTM reversal:

CHoCH → Retracement → Left Shoulder Test → Continuation

As long as the structure holds, we remain bullish toward the channel top.

Is the current Bitcoin price a good place to buy?Bitcoin has been falling since last night towards $112,000. I don't think it will go below that. I think $113,000 is a good price to buy. Of course, with a stop loss of 111,500. This is not a financial offer. Don't get into futures trading because you might lose all your money.

Bitcoin at Key Support - Watching for Bullish ShiftHello everybody!

Bitcoin has reached a very important demand/support zone between 110,000–112,000.

If this area holds, we could see bullish momentum building on the chart.

Currently, we are waiting for confirmations.

We're watching closely for any change in market structure or a trend shift.

If it happens, we can expect the price to move up to around 118,000.

Manage your risk and trade safe!

$BTC Daily OutlookDaily Chart

Today’s close printed a small bearish doji; visually bearish but still another inside-day that keeps BTC boxed between the High-Volume Node / v-Level cluster at $116 860-$123 300.

Holding $116 860 remains critical; lose it on a daily close and price can easily slide to the weekly breakout shelf near $111 960. We are now 16 days inside this balance. Per Auction-Market-Theory rule #5, the longer price churns at the edge, the more resting liquidity is absorbed, eventually a decisive push will follow. If buyers defend $116 860 again, the path opens toward range high $123 300 and the prior ATH; if they fail, expect a fast flush to the weekly V-Level.

Footprint Read

Value Area High and Low span the full candle, with the POC parked mid-range, classic two-sided trade. Delta finished negative and the heaviest prints sit at session lows: sellers hit the bid hard, yet could not follow through. That absorption leaves shorts vulnerable to a squeeze if new selling momentum doesn’t appear quickly.

Fundamental Pulse – Week Ahead

ETF Flows: Spot-Bitcoin ETFs booked three consecutive inflow days to close last week (+$180 M net). Sustained demand under the range supports the bullish case.

Macro Data: U.S. FOMC & Federal Fund Rates prints for this week; expect more volatility starting from tomorrow.

Game Plan

Primary bias stays long while daily candles close above $116 860; upside trigger is a clean for now or shorts squeeze toward $123 300.

If $116 860 breaks with volume, prepare for a quick liquidity hunt into the weekly shelf at $111 960, where we reassess for swing longs.

Intraday: I’ll monitor the Intraday Chart on tomorrow's High impact events and look for best opportunities across the board. Alt window: a fresh downtick in BTC Dominance could spark rotation; watch high-Open Interest majors if BTC ranges.