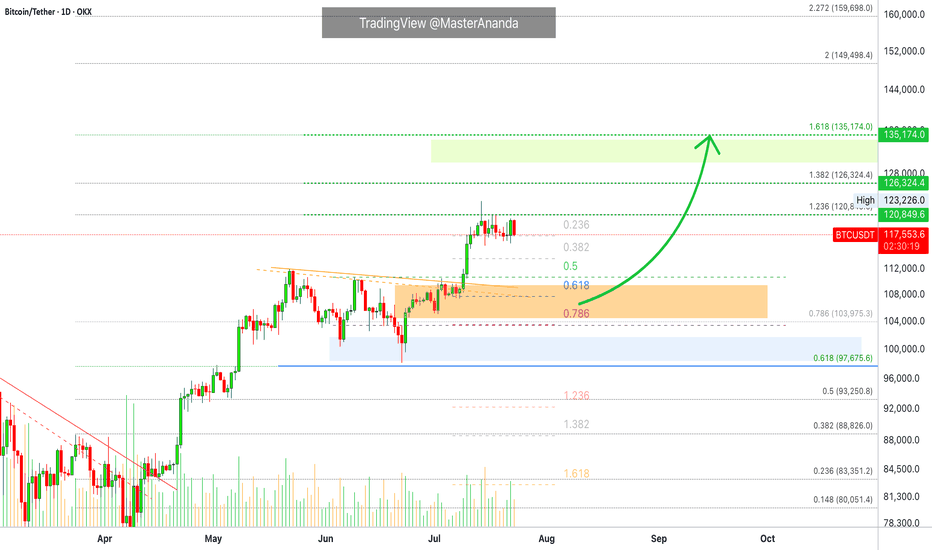

What's The Lowest Bitcoin Can Go? (Top Altcoins Choice —Comment)Bitcoin just hit a new all-time high recently and is consolidating just below resistance. I have a question: How far down can Bitcoin go on a sudden retrace?

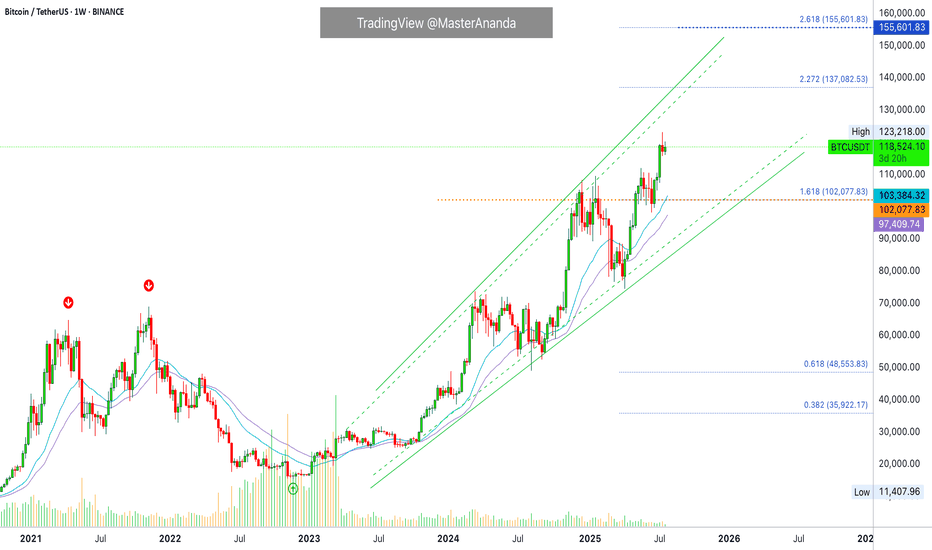

That's a great question. Assuming that Bitcoin will continue growing mid-term and long-term, we can expect some more consolidation before higher prices. A retrace is not mandatory but is possible. A correction is almost impossible; low probability; not likely.

The worst case scenario Bitcoin does go down and the action should stop right at the previous high. Resistance turned support. That is, $112,000 to $110,000 would the first and main support range. Harder for Bitcoin to move much lower but these levels are not active yet.

If Bitcoin were to produce an extreme shakeout before additional growth, I would say the worst possible would be a touch of $104,000, but this is still a low probability setup. The chances are that Bitcoin will continue sideways while the altcoins grow. The fact that the altcoins are bullish means that Bitcoin will resume growing in due time. The next major move is another advance exceeding $130,000. It can happen within weeks or next month.

Patience is key on Bitcoin, the altcoins need to catch up.

Sometimes, Bitcoin can go sideways for months wile the altcoins grow. Prepare to wait or switch yourself to some mid-sized and small-cap altcoins. The big pairs tend to move like Bitcoin. Each chart needs to be considered individually.

Thanks a lot for your support.

Feel free to leave a comment with your favorite altcoin for an update. I will do an analysis for you in the comments section below.

Namaste.

BTCUSDT trade ideas

Volatility Period: July 24-26

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

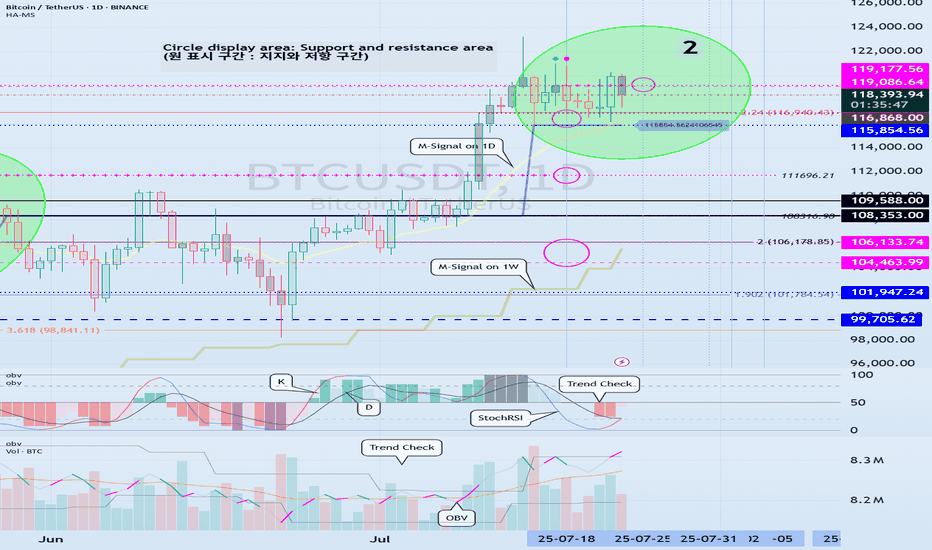

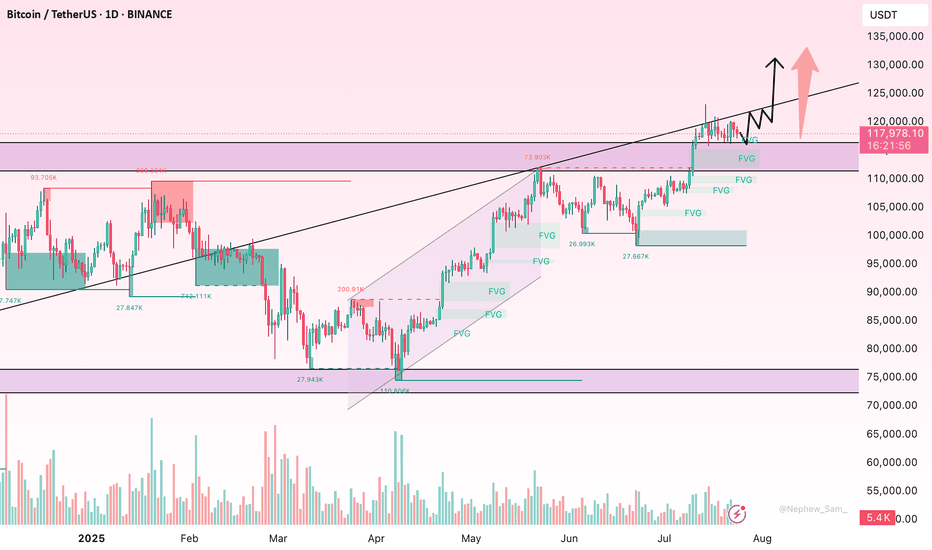

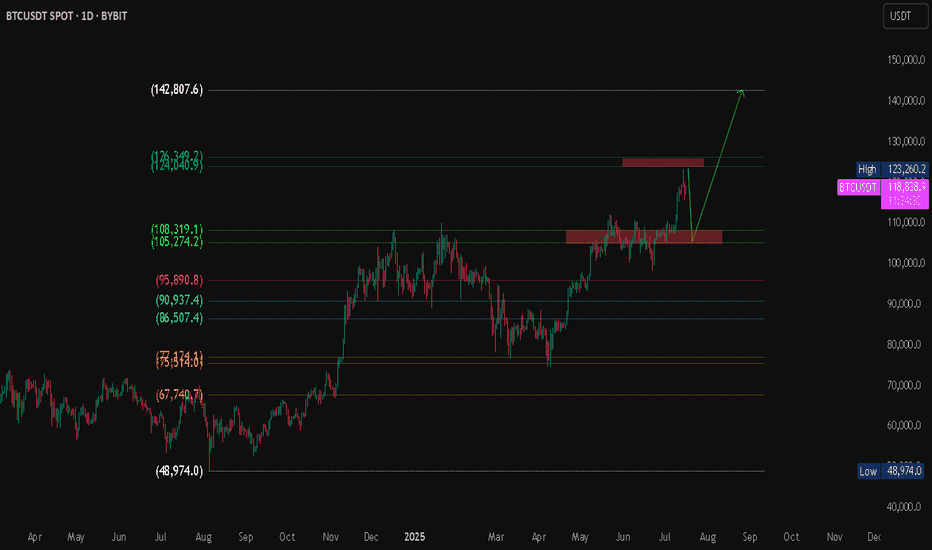

(BTCUSDT 1D chart)

BTC is in a step up trend.

Looking at the bigger picture, it can be seen that it is in the second step up trend.

The important volatility period in this step-up is expected to be around August 2-5 (up to August 1-6).

Therefore, we need to look at what kind of movement it makes as it passes through the previous volatility period of around July 25 (July 24-26) and around July 31 (July 30-August 1).

In other words, we need to check which section is supported and which section is resisted, and see if it breaks through that section.

What we can see now is that it is checking whether there is support in the 115854.56-119086.64 section, that is, the HA-High ~ DOM (60) section.

Since the M-Signal indicator on the 1D chart has risen to the 115854.56 point, the key is whether it can receive support at the 115854.56 point and rise.

If it falls below the M-Signal indicator of the 1D chart and shows resistance, it is likely to meet the M-Signal indicator of the 1W chart.

This flow is an interpretation of the separation learned when studying the price moving average.

Therefore, we can see that the maximum decline point is when it meets the M-Signal indicator of the 1M chart.

-

Industries (coins, tokens) that are renewing the ATH are actually outside the predictable range.

Therefore, we should think of it as a situation where it is not strange whether it falls or rises at any time and think of a response plan.

Since it is currently within the predictable range, we can create a response strategy by checking whether there is support in the 115854.56-119086.64 section.

However, as I mentioned earlier, the volatility period is about to begin, so caution is required when making new transactions.

That is, you need to check whether it breaks out of the 115854.56-119086.64 range during the volatility period that continues until July 26.

And if it breaks out, you need to check whether it is supported or resisted in that area and respond accordingly.

-

The OBV indicator of the Low Line ~ High Line channel is showing a pattern of rising above the High Line.

Accordingly, if the OBV indicator is maintained above the High Line, it is expected to show an additional rise.

In accordance with this, you need to check whether the K of the StochRSI indicator shows a movement to rise in the oversold range and a transition to a state where K > D.

You also need to check whether the TC (Trend Check) indicator continues its upward trend and can rise above the 0 point.

If these conditions are met, it is expected that BTC will rise above 119086.64 or show a pattern of rising.

-

This decline created a low trend line, creating a perfect rising channel.

Therefore, we need to see how far we can go up along the rising channel created this time.

In that sense, we should pay close attention to the movement during the volatility period around July 25th (July 24-26).

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

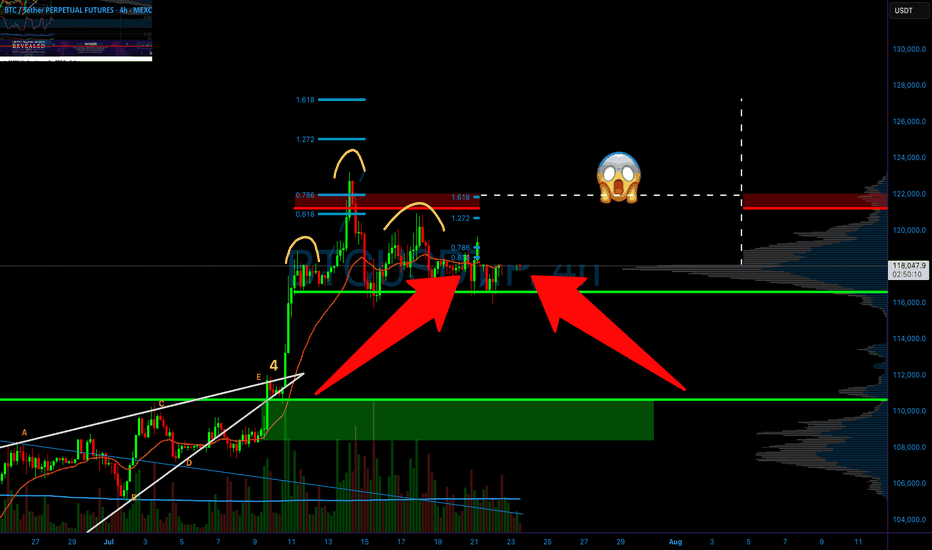

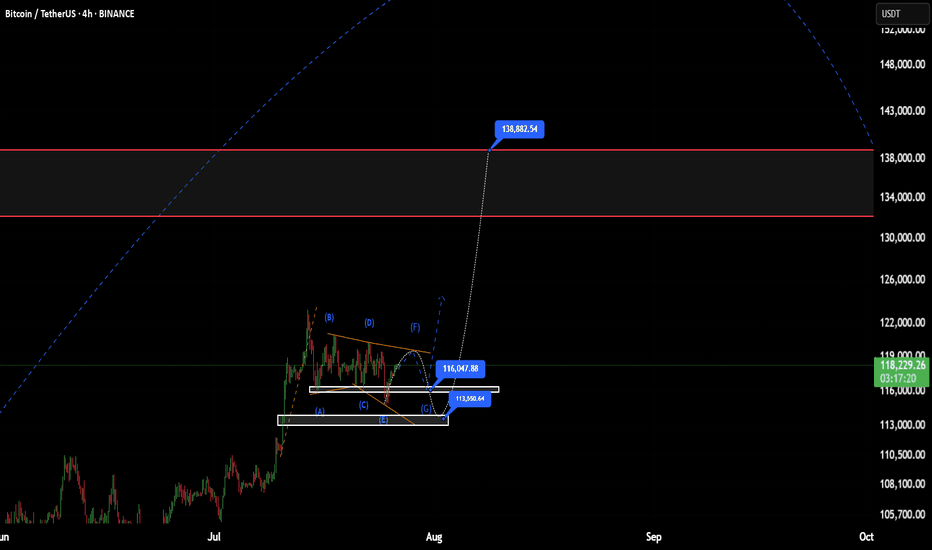

BITCOIN IS CREATING A SECRET PATTERN! (Huge move incoming?!)Yello paradisers! I'm describing to you what's going on with Bitcoin right now. We are creating a secret pattern that is forming, and once its neckline is reclaimed, we are going to have a huge movement.

In this video, I'm sharing with you the most important support and resistances on multiple time frames. We are describing Elliott wave theory wave count, and taking a look at candlestick patterns. We are talking about confirmations necessary for bullish and bearish cases. I'm explaining to you what the professional trading signals need for long-term profitability.

Some of the points are great risk-reward ratios. I'm talking about that in the video. One of them is taking only the highest probability trade setups, and having the patience and discipline to wait for them.

I'm talking about proper strategy which is needed, and systemology in your overall trading and how important it is. Here on TradingView, I'm describing to you the overall bias I have on Bitcoin right now.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

It's an Evacuation Through Green Candles💥 "One Last Leap of Faith?" - What Bitcoin Might Be Hiding Before September

The world’s on fire: Israel, Iran, Strait of Hormuz, oil, elections, the dollar, rates, black swan whispers.

And someone’s out here saying Bitcoin might still go up?

Yes. We are. Not because we believe - but because we see.

📉 Everyone’s afraid. The whales aren’t.

When the crowd goes into survival mode, the real game begins.

Whales aren’t exiting - they’re accumulating.

ETFs aren’t pausing - they’re inflowing.

The technical setup isn’t breaking - it’s compressing like a spring.

$104,000. Coil building.

If we break out - targets at $132K–$140K are absolutely in play.

👉 But that’s not the point.

The point is why this is happening while the world is burning.

🧠 The idea: Bitcoin isn’t a safe haven. It’s a distribution machine.

Gold is for panic.

Bitcoin is for structure.

Institutions don’t ask “is it scary?” - they ask “where’s liquidity?”

Everything is aligning for one last upside move.

Until September. After that - chaos is back on the table.

💣 The Global Playbook:

Now (Summer) - Consolidation, ETF flows, geopolitical fear - Strategic entries, low exposure

Breakout - FOMO panic, retail rushes in - Profit-taking via options

September–Fall - Macro/geopolitical shock - Already in cash or hedged

📌 Bottom Line

Yes, Bitcoin might pump. Not because the world is fine - but because someone needs to exit beautifully.

If you're reading this - you're early enough to think.

Markets don’t reward justice. They reward positioning.

🛠 What to do right now:

Watch the $104,000 level - it's the pivot

Breakout = final upside push to $132K–140K

Keep your eyes on September - reversal zone

Think in scenarios: entry, exit, protection

Follow EXCAVO - we don’t guess, we read the game

I've been talking about this scenario for a long time

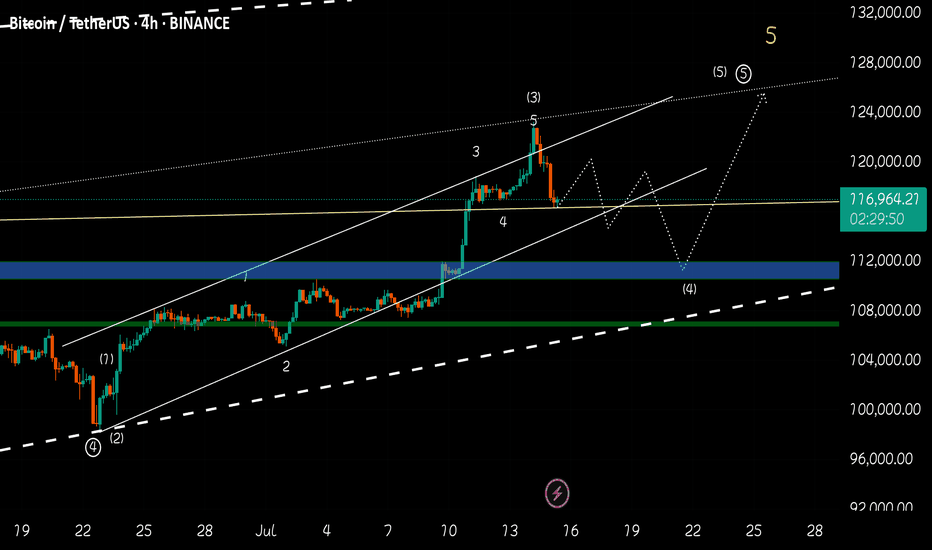

BTC CAN HIT 125K AFTER SHORT CORRECTIONHello friends, Bitcoin has made an incredible climb, carefully looking at the chart and also based on Elliott wave theory, it is clear that Bitcoin is completing submicro wave 4 of micro wave 5, wave 4 is usually an extended wave that covers a large time period with up and down fluctuations, I think the end of submicro wave 4 will be in the 110k-112k range in the four-hour timeframe. I think Bitcoin will break the 25k range in the coming days.

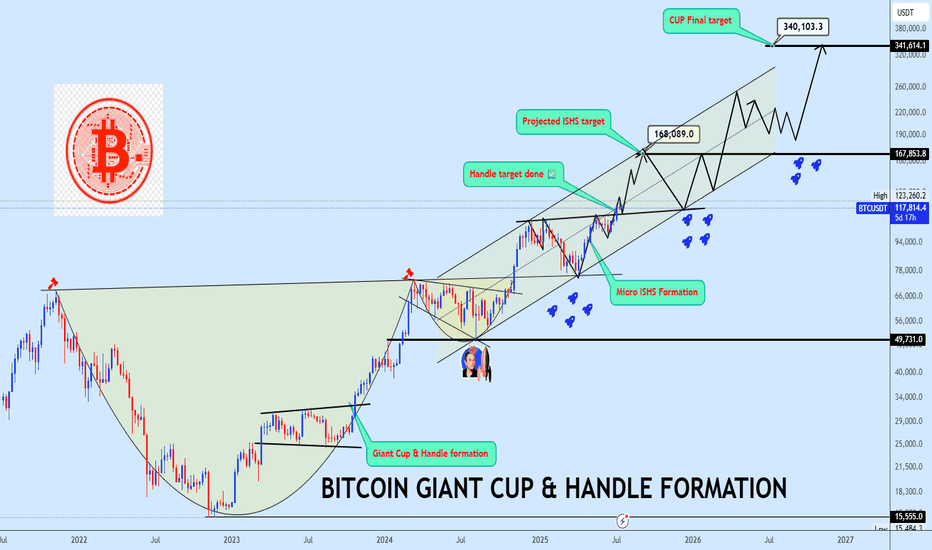

Bitcoin Bottom Three in progress targeting $340kBitcoin continues to defy the doubters, extending its dominance and triggering milestones that once seemed unreachable. A few years ago, we projected a massive rounding bottom with a target near $123K to complete the bottom two of the third halving cycle a bold forecast that has now played out in full:

📌

With bottom two now in the rearview, our focus shifts to bottom three of the fourth halving cycle, projected to mature around October 2025, barring time shifts:

📌

As shown on the chart, price has now split into a giant Cup & Handle formation and successfully broken out from the neckline. BTC is currently coiling inside a rising channel structure with trajectory toward the final projected target at $340K. A micro inverse head and shoulders (ISHS) formation has also emerged, offering a key accumulation zone near the neckline, this will be a crucial region to watch for entries.

Let price action do the talking. Share your view and let’s dissect this historic setup together.

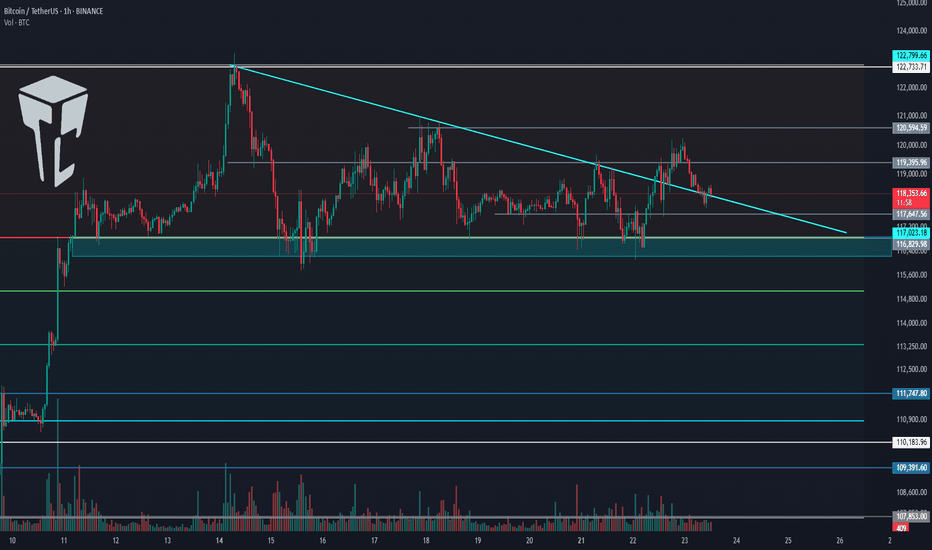

TradeCityPro | Bitcoin Daily Analysis #136👋 Welcome to TradeCity Pro!

Let’s get into the analysis of Bitcoin and major crypto indices. As usual in this analysis, I’m going to review the futures triggers for the New York session.

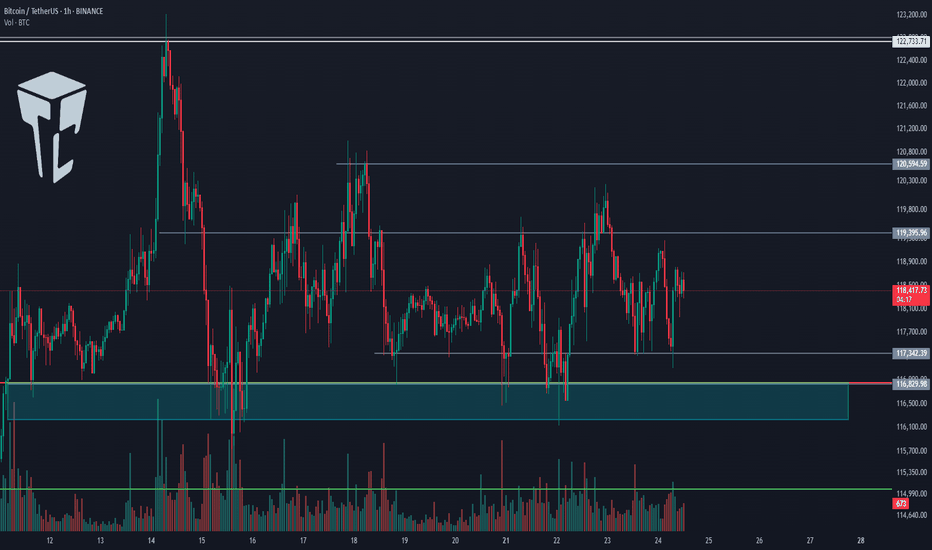

⏳ 1-Hour Timeframe

On the 1-hour timeframe, price is still ranging inside the box, and none of its triggers were activated yesterday.

✔️ The support floor is at 117,342, and another key support zone is around 116,000.

✨ If these zones break, Bitcoin may begin a deep correction. In that case, we can open short positions or close long-term long positions that we’re already holding.

⭐ For long positions, we still have the 119,395 and 120,594 triggers. A breakout of either zone could provide a very good entry point for the next bullish leg of Bitcoin.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. Yesterday, dominance stabilized above the 61.20 zone, and as I mentioned before, breaking this zone led to a bullish leg, which continued up to 62.41, and currently, it has more bullish momentum.

💥 If 62.41 breaks, the bullish momentum will intensify. However, I still believe the overall trend is bearish, and if 60.46 breaks to the downside, the decline could continue.

📅 Total2 Analysis

Let’s go over Total2. This index has continued to correct and has now dropped to the 1.41 zone, which corresponds to the 0.5 Fibonacci level. It has now created a trigger around 1.47.

⚡️ If 1.47 breaks, we can open a long position. Our next trigger will be 1.53.

A breakout of 1.53 would signal the start of the next bullish wave.

📅 USDT.D Analysis

Now to Tether Dominance. This index has finally exited its range box and has broken the 4.25 level.

The current resistance stopping price is 4.36.

🔔 If dominance drops back below 4.25, strong bearish momentum could hit, increasing the likelihood of a breakdown of 4.13.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Bitcoin Correction Maturing – Long Setup Brewing!Bitcoin ( BINANCE:BTCUSDT ) has fallen by more than -4% over the past day.

Let's take a look at the reasons for the decline.

One of the key reasons behind Bitcoin’s decline in the past 24 hours ( July 25 ) could be the reduced likelihood of Jerome Powell being replaced as Chair of the Federal Reserve.

In recent days, market participants were speculating that Donald Trump might replace Powell — a scenario that was considered bullish for risk assets like Bitcoin. However, recent reports of a meeting between Trump and Powell, and signs that Powell might not be dismissed, have weakened this fundamental narrative.

This meeting may signal a truce or reduced tension between Trump’s team and Powell , which could imply a continuation of current Fed policies. That’s bad news for Bitcoin, as it removes a potential psychological tailwind from the market and dampens speculative sentiment.

As a result:

Over $500 million in liquidations(Long Positions) occurred

Weak inflows into Bitcoin ETFs

A stronger U.S. Dollar Index ( TVC:DXY )

And declining Gold( OANDA:XAUUSD ) prices over the past two days

all added additional selling pressure on BTC. Now let's take a look at Bitcoin's conditions on the 4-hour time frame .

Bitcoin currently appears to have broken the Support zone($116,900-$115,730) , Support lines , 100_SMA(4-hour TF) , and the lower line of the Symmetrical Triangle Pattern with a bearish Marubozu candle .

Note : In general, trading was difficult when Bitcoin was inside a symmetrical triangle (about 10 days).

It also seems that the pullback to these zones has ended and Bitcoin is waiting for the next decline .

In terms of Elliott Wave theory , Bitcoin appears to be completing microwave 5 of microwave C of major wave 4 . There is a possibility that main wave 4 will create a descending channel and complete at the bottom of the descending channel (at Potential Reversal Zone(PRZ) ).

I expect Bitcoin to start rising again after completing the CME Gap($115,060-$114,947) from Cumulative Long Liquidation Leverage($114,480-$114,000) or Cumulative Long Liquidation Leverage($113,284-$112,603) near the PRZ and Heavy Support zone($111,980-$105,820) .

Cumulative Short Liquidation Leverage: $117,904-$116,665

Cumulative Short Liquidation Leverage: $121,046-$119,761

Do you think Bitcoin has entered a major correction, or does it still have a chance to create a new ATH?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTC Consolidates Below Key Resistance – Is a Breakout Imminent?Bitcoin is currently consolidating beneath the major psychological resistance near $120,000. The medium-term trend remains bullish, supported by a series of higher highs and higher lows. However, recent candlesticks with long upper wicks reflect hesitation among buyers at elevated levels, pointing to potential exhaustion in short-term momentum.

Despite this, there are no clear signs of bearish divergence or strong reversal patterns. The sideways range between $112,000–$120,000 likely represents a healthy consolidation phase after a strong rally. If the price maintains support around $113,000 and breaks above $120,000 with convincing volume, the next leg higher could follow swiftly.

For now, buyers remain in control, provided BTC holds key structural supports. A breakout confirmation is crucial for bullish continuation.

Calling the Unthinkable: Why a Bitcoin Drop May Be ComingCOINBASE:BTCUSD BITSTAMP:BTCUSD OKX:BTCUSD BINANCE:BTCUSDT.P

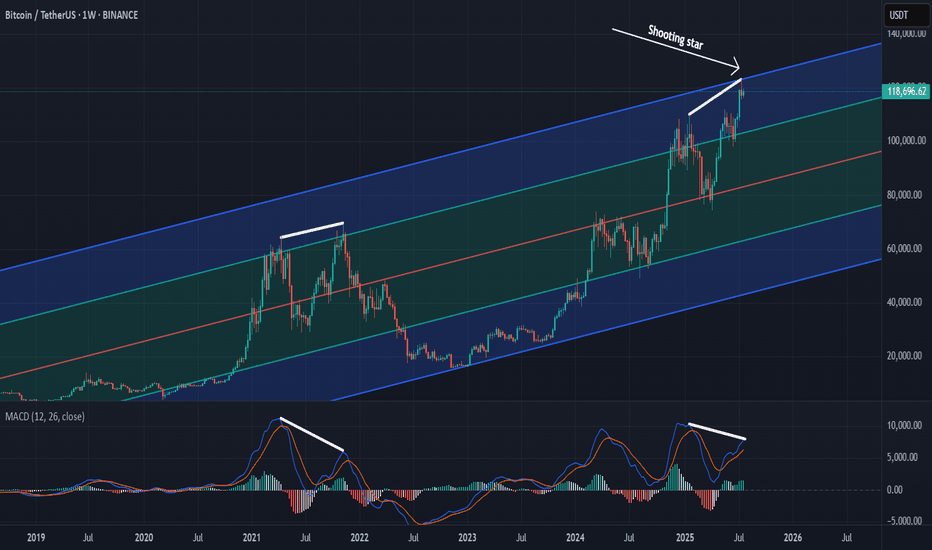

Predicting a drop in Bitcoin's price during a strong uptrend is extremely difficult and calling it takes real courage. It puts my credibility at risk, but based on everything I see, I believe BTC has reached dangerously high levels.

From a psychological perspective , investor behavior is sending warning signs. There’s a rush of people buying in out of FOMO, amplified by heavy promotion on social media and mainstream claiming BTC is the safest investment out there. Many who missed earlier buying opportunities now regret betting on altcoins instead, and they see this as a last chance to profit. Even if BTC drops below their entry points, most of these “late buyers” won’t sell. They’ll convince themselves it’s just another minor correction like what happened in the previous 2 years, and that they’re in it for the long term.

From a technical analysis point, the signs are just as concerning. A “ shooting star ” candle has formed on the weekly chart. This candle is often seen at market tops. The MACD histogram on the same timeframe is showing a potential divergence, suggesting weakening momentum. The Fear and Greed Index is approaching 70, indicating strong market greed. On top of that, traders are opening high-leverage long positions in anticipation of another big bullish candle.

These technical and psychological signals combined paint a risky picture. If this kind of setup is confirmed , it will lead to sharp corrections.

Bitcoin · $137,000 Next Target Followed by $155,000There won't be a correction for Bitcoin. Not now, not yet. The reasons why I already explained in several earlier publications that predicted the current scenario. The bullish breakout that is from the long-term consolidation range. That's the reason, that's the reason why Bitcoin will not go lower without first going higher.

Since Bitcoin consolidated for 7 months below $110,000, it will continue climbing until it reaches higher.

The next target is $137,000. At this point a correction can develop and if it does, we don't expect this correction to last long. The correction can be strong, deep, surprising, but it cannot be long in duration. That is because Bitcoin is headed toward $155,000 and that's the main level for this bullish wave. Until this target is achieved, nothing can stop the future of finance, Bitcoin is moving ahead.

The proof is in the altcoins market. "The altcoins follow Bitcoin." In the current situation, Bitcoin is consolidating while the altcoins grow. If Bitcoin were to crash, the altcoins wouldn't move one dollar higher. In fact, they would be crashing even stronger and faster.

Bitcoin would need to just falter for one day for the altcoins to crash to new lows. What is happening now? Bitcoin can shake; Bitcoin drops; Bitcoin consolidates, and the altcoins continue to grow. That's the proof that the next main—major—move is an advance for Bitcoin. Never SHORT Bitcoin when the market is bullish and strong.

Bitcoin is a growing phenomenon, it is very young. Just think of the US Dollar or Gold. How old are these instruments? How old are market securities and stocks? Some corporations are hundreds of years old. Countries? Thousands of years and still living... Bitcoin can have a life span of 80 years, 140 years, 200 years, 500... who knows. It is a question market. But there is no doubt that it is young. When you are young, you cannot stop your own growth. Bitcoin is already growing and will continue to do so. I will not be surprised when I see Bitcoin trading at $1,000,000+. It might take several years, but several years back Bitcoin was trading at $5k. What's the price now?

$120,000. Trading near resistance is bullish. No corrections. No drops. No retrace.

Thank you for reading.

Namaste.

BTC/USDT Technical Analysis Market Overview

Bitcoin is currently trading at $118,788, with an intraday high of $119,311. The market has recently tested a major resistance zone and is showing signs of a potential pullback toward a key demand zone before a possible continuation to higher levels.

Projected Scenario (Bullish Bias)

Expected pullback to the support zone around $105K – $108K.

If price holds and shows a bullish reversal, a breakout above $124K is expected.

Primary upside target: $142,807 (Fibonacci projection / potential new high).

BITCOIN PREDICTION: HUGE BREAKOUT SOON!! (watch this level) Yello Paradisers! I'm sharing with you multi-timeframe analysis on Bitcoin, levels to watch out for, confirmations we are waiting for, and everything needed for successful professional trading that is being profitable in the long run.

I'm sharing with you zig-zag from the Elliot Wave pattern formation. I'm also sharing a possible impulse we are going through, a head and shoulders pattern and its target, and the next major resistance and support levels.

I'm sharing with you a contracting triangle setup and how to trade it, along with an ending diagonal setup and how to trade it. Watch out for confirmations and how the price is developing based on what I have been talking about in this video, then trade it as a professional trader should.

Make sure that you have a great risk management, trading strategy, and tactic for entering the trades. I have explained some tactics that I'm watching for in this video, but make sure that all these tactics are well within your larger trading strategy and that you're approaching the market professionally. Don't try to get rich quick.

Make sure that you are focusing on long-term profitability and survival. This is the only way you can make it in crypto trading!

BITCOIN: THE PERFECT STORM - MULTIPLE BREAKOUT PATTERNS ALIGNED⚠️ CRITICAL SUPPORT LEVELS

🛡️ Support 1: $115,000 (-3%) - Triangle support

🛡️ Support 2: $110,000 (-7%) - Channel support

🔴 DANGER ZONE: $105,000 (-11%) - Multiple pattern failure

So...

Strategy: Quick profits on pattern completion 🎨

Entry: $115k (Triangle breakout confirmation) 📊

Stop Loss: $114k below (Tight risk management) ❌

Target: $125k (+10%) ✅

Time Horizon: 2-3 weeks 📅

Risk/Reward: 1:6 🎯

________________ NOTE _____________

⚠️ This is not financial advice. Bitcoin is highly volatile and risky. Only invest what you can afford to lose completely. Always do your own research and manage risk appropriately 🚨

BITCOIN PREDICTION - MASSIVE CANDLE INCOMING!!! (WARNING) Watch this Bitcoin Prediction video now, you will love it!

Yello, Paradisers! Big warning sign: #Bitcoin is about to liquidate more traders soon if we get these confirmations that I'm sharing with you in this video. Loads of people will get wrecked again. Be careful not to get trapped into fakeouts.

In this video, I'm describing exactly what I'm seeing on Bitcoin, what patterns I'm waiting to form, and what confirmations I want to see before being able to say with 100% accuracy guaranteed that MARKETSCOM:BITCOIN is moving in that direction.

I'm sharing with you all the important targets and also how professional trading works: how risk-reward proper ratio trading works, and how high-probability trading depends a lot on how you choose to create your trades.

Watch this Bitcoin prediction to understand what I'm seeing right now on the chart and how I'm acting and making my decisions.

TradeCityPro | Bitcoin Daily Analysis #135👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and major crypto indices. In this analysis, as usual, I’m going to review the futures triggers for the New York session.

⏳ 1-Hour Timeframe

Yesterday, Bitcoin broke the 119,395 level but couldn’t hold above it and has now returned below this level, currently sitting on its previous trendline.

✔️ Today, the market will probably try to form more structure, and I think Bitcoin will range.

⭐ However, if it wants to move, we can enter a long position with the trigger at 120,594.

🔽 For a short position, we can enter if the 116,000 support area breaks.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. Yesterday, dominance had a bullish move, and finally, a support floor managed to prevent further drop in dominance.

🧩 A retracement to 61.20 has occurred. If this retracement continues, the upper levels are 61.53 and 62.

A break of 60.46 will start the next bearish leg.

📅 Total2 Analysis

Let’s go to Total2. This index has formed a range box between 1.48 and 1.55 and is still oscillating within it.

🎲 If 1.55 breaks, we can open a long position, and on the other hand, if 1.48 breaks, the price could correct to lower support levels.

📅 USDT.D Analysis

Let’s move on to Tether Dominance. This index also has a range box and is still moving inside it.

🔑 Breaking 4.13 is very important for the future market trend and could lead to a drop in dominance.

Bitcoin at Descending Channel Resistance – Rejection Imminent?🔻 Bitcoin at Descending Channel Resistance – Watch This Level Closely!

📉 BTC/USDT is currently testing the top boundary of a well-defined descending channel on the 2H chart.

🟨 This zone has acted as strong resistance in the past, and the current reaction suggests the potential for a short-term rejection.

Unless we see a clean breakout above $120K with strong volume and follow-through, the more probable scenario is a pullback towards the midline or lower boundary of the channel.

💡 Notably, this area also aligns with a local supply zone and prior liquidity sweep, making it a key decision point.

⸻

🧭 CryptoPilot’s Take:

This is where patience pays off. No breakout = no FOMO. Watch for confirmation before acting.

⸻

❓ What’s your view?

Will BTC break out and flip bullish here — or is a deeper correction on the way?

👇 Share your thoughts in the comments!

💬 Follow for daily high-probability setups using Smart Money & Wave Theory. Let's grow together!

BTC TRADE PLAN 11/07/2025 - Diamond PatternDear traders,

Technical Analysis of BTCUSDT (Bitcoin/USDT) – July 11, 2025

🕐 Timeframe: 4H

Price has broken above the major resistance at $110,000 and is now trading around $118,000, forming a Diamond Top pattern — a classic reversal formation that may signal an upcoming downtrend or correction.

🔻 Key Highlights:

Major Resistance: $118,000 – current top and potential reversal point.

Key Support: $110,000 – if broken, next targets may lie around $95,000–$100,000.

Diamond Pattern: Typically a bearish reversal signal after a strong uptrend.

RSI Indicator: Currently in overbought territory (above 85), suggesting buyer exhaustion.

📉 Possible Scenario:

Price may reverse from $118,000 -120,000 and test the $110,000 support. A break below that could lead to a deeper correction in the coming weeks.

Regards,

Alireza!

BitcoinBitcoin/TetherUS (BTC/USDT) Trading Analysis - Jul 15, 2025

Key Observations:

Price Movement:

Current Price: $117,692.46

24h Change: -2,148.72 (-1.79%)

Range: Low of $116,250.00 to High of $119,940.83

The price is currently near the lower end of the day's range, indicating bearish pressure.

Support and Resistance:

Support Levels:

Strong Support: $112,000.00 (marked as S/L)

Intermediate Support: $113,500.00 and $110,000.00

Resistance Levels:

Immediate Resistance: $119,900.00

Higher Resistance: $120,000.00 and $122,500.00

Profit Levels:

The "Profit" section lists potential take-profit targets, with the highest at $135,000.00.

The price has recently dipped below the $120,000.00 psychological level, suggesting weakening bullish momentum.

Trend Context:

The chart spans from June to September, but the current price action (July) shows consolidation after a potential pullback from higher levels.

The presence of multiple support levels ($112K–$116K) suggests a critical zone for buyers to defend.

Actionable Insights:

Bearish Short-Term: The price is below key levels ($119,900–$120,000) and has broken below $118,250.00. A retest of support at $112,000.00 is plausible.

Bullish Reversal Signal: If BTC holds above $112,000.00 and reclaims $120,000.00, it could target $122,500.00 or higher.

Risk Management: A break below $112,000.00 (S/L) may trigger further downside toward $110,000.00 or lower.

Conclusion:

The market is currently in a corrective phase. Traders should monitor the $112,000.00 support for potential reversals or breakdowns. A close above $120,000.00 would shift bias to bullish.

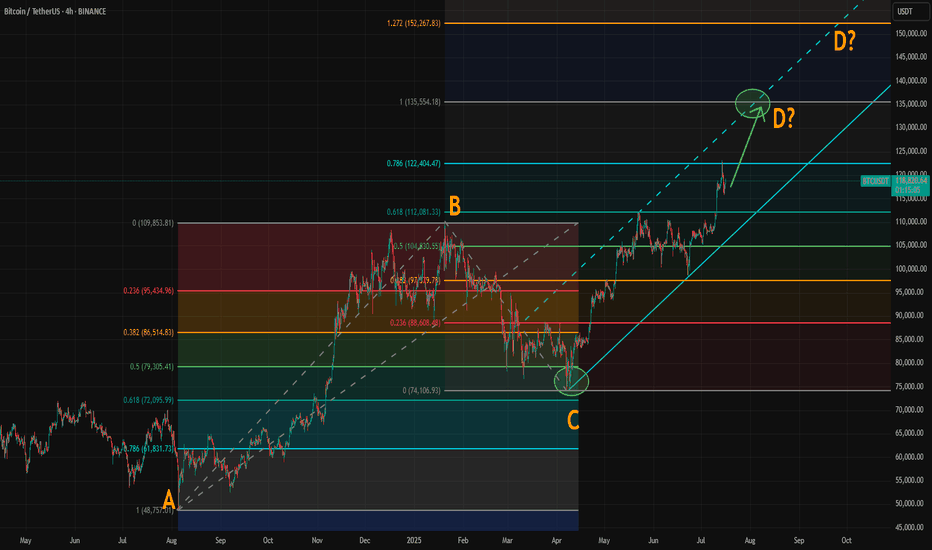

Where Could Bitcoin Make Its Cycle Top? Model and ABCD AlignedWith the breakout above resistance around 110,000, Bitcoin’s rally appears to be back on track. If you've been following our crypto analysis, either here or on our website, you’ll know our target range for this bull cycle is between 135,000 and 150,000, with the top of the range possibly extending further depending on the strength of the final wave.

Now, a possible ABCD pattern is forming, with point D potentially landing at either 135,000 or 150,000. A coincidence? Maybe, maybe not.

How Did We Arrive at the 135K–150K Target?

We based this range on historical halving cycle returns:

Halving Year - Return to Cycle Top

2012 - 9,076%

2016 - 2,122% (↓ 4.27x)

2020 - 541% (↓ 3.92x)

Two things stand out:

Each cycle has shown diminishing returns.

The rate of decline appears roughly consistent, dropping by around 4x each time—but slightly less with each cycle.

So depending on the multiplier used:

If returns fall by 4.27x again → target: 135K

If reduced by 4x → target: 140K

If reduced by 3.92x → target: 142K

If the rate of reduction itself slows (difference of 0.35 between 4.27 and 3.92) → target: 150K

While the sample size is too small, we believe the model holds reasonable logic with fundamental backing from various metrics.

The chart now shows a possible ABCD pattern:

If it becomes a classic AB = CD structure, point D could form near 135K.

If it becomes an extended ABCD (with CD = AB × 1.272), then point D could reach just above 150K.

These technical targets align closely with our halving model projections, increasing our confidence in the 135K–150K range as a likely top zone for this cycle.

Also, please check our earlier post for possible altseason start. A correlation between BTC/ETH and Gold/Silver might give some tips about possible Ether surge.

Multi-timeframe analysis, strong momentum, FOMC risk/reward plan__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Strong momentum and bullish consensus confirmed across all timeframes.

Key support/resistance : 114k–116k (critical support), 123k (major pivot).

Healthy organic volume , no extreme peaks except isolated moments (30min/15min).

Risk On / Risk Off Indicator : Dominant bullish signal, neutral only on 15min.

Multi-timeframe structure : Perfect alignment daily/4H/2H/1H, caution on 15/30min (slight inflection but no abnormal divergence).

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias : Structural bull market, intact dynamic.

Opportunities : Tactical buys on pullbacks (114–116k), swing on breakout 123k.

Risk areas : Below 114k = risk of invalidation, targets 111k–105k.

Macro catalysts : FOMC imminent (high volatility expected), watch geopolitical tensions.

Action plan : Favor swing/cautious trading ahead of FOMC, dynamic stops, act on first post-Powell trigger.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D : Active range 114k–123k; strong supports, momentum maintained; Risk On / Risk Off Indicator strongly bullish.

12H/6H/4H : Clean bullish structure, no excesses or divergence; price sits within major horizontal clusters.

2H/1H : Healthy impulse/correction phases; key intermediate supports 114.6k, 117.5k to watch.

30min/15min : Slightly weaker momentum but constructive microstructure, no immediate sell threat; localized volume spikes on support reactions.

ISPD DIV : No behavioral stress observed throughout.

Cross-timeframe summary : Bullish confluence dominant; caution on short-term reversals tied to FOMC and on-chain volatility spikes.

__________________________________________________________________________________

Multi-timeframe Cross Analysis & Decisional Rationale

__________________________________________________________________________________

As long as BTC > 114k = bullish bias, buying pullbacks, swing target 123k.

Active management post-FOMC strongly advised (enter/reduce after first H4 close).

Increased volatility risk in case of Fed/geopolitical shock; mandatory stops.

Sector momentum (Risk On / Risk Off Indicator) and volume underpin the bullish case unless exogenous alert.

Invalidation below 114k = prudent, neutral, or tactical shorts towards 111k–105k.

__________________________________________________________________________________

Macro, On-chain & Economic Calendar

__________________________________________________________________________________

FOMC July 29th : pivotal event, any surprise = strong intraday move (BTC sensitive to Powell speech).

US Macro: strong fundamentals but caution on trade war, inflation "contained."

On-chain : realized cap BTC >$1T, high open interest in derivatives = leveraged risk, beware speculative altcoin excess.

Global risk : market remains buyer until bearish Fed/geopolitical shock; swing trading favored, tight stops recommended.

__________________________________________________________________________________

Action plan

__________________________________________________________________________________

Favor buying/reloading on pullbacks to 114.6k–116k (stop <114k).

Break above 123k = bull confirmation, further extension likely to 126–128k depending on FOMC outcome.

Prioritize strict risk management; monitor liquidity/supports on macro/on-chain volatility peaks.

__________________________________________________________________________________