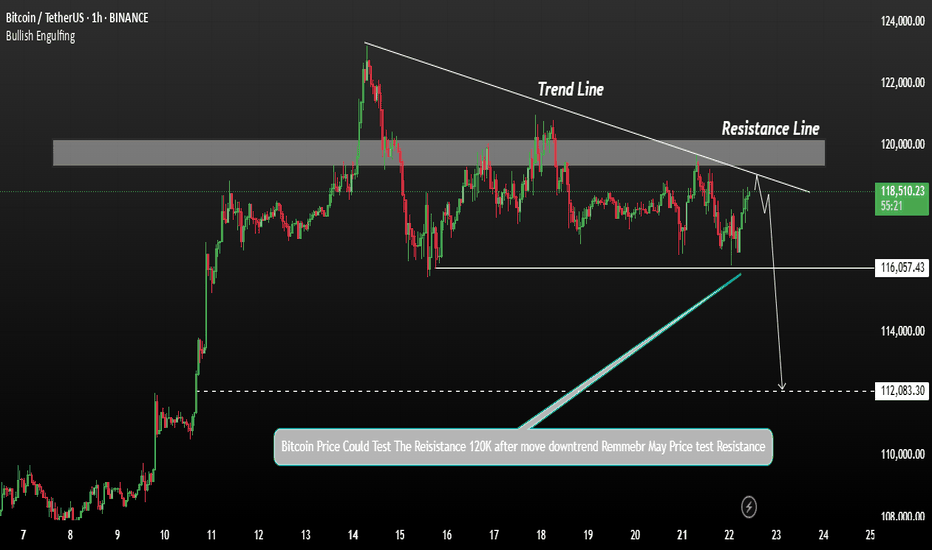

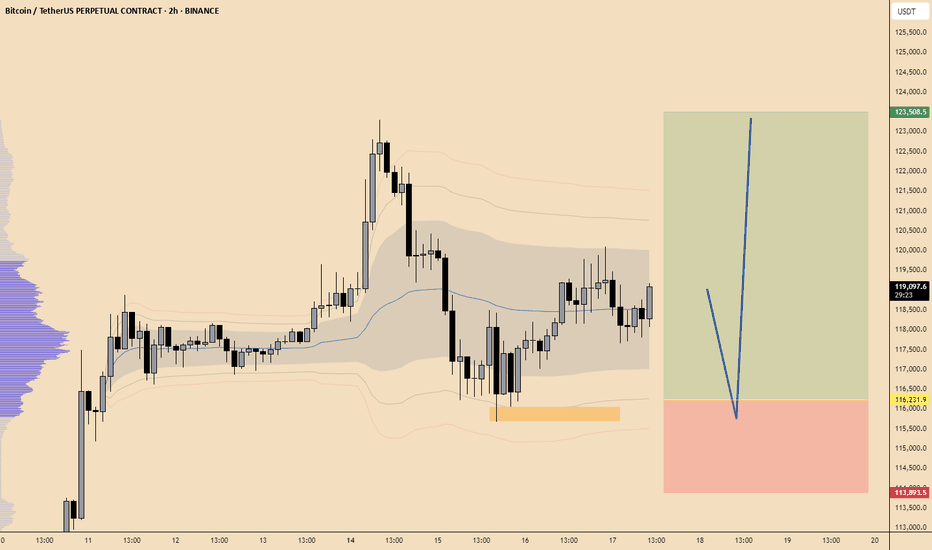

Bitcoin shows signs of a potential declineBitcoin's price shows signs of a potential decline after testing resistance levels. A correction at this stage is generally a healthy sign for the market, allowing for consolidation before any strong upward move.

Bitcoin may test the resistance line after the current decline. If the price falls below 118,000, there is interim support, but further downside may be expected. 116K and 112K A break below 112,000 could open the door for deeper bearish momentum.

You May find more details in the chart.

Trade wisely best of Luck.

Ps Support with like and comments for better analysis Thanks for Supporting.

BTCUSDT trade ideas

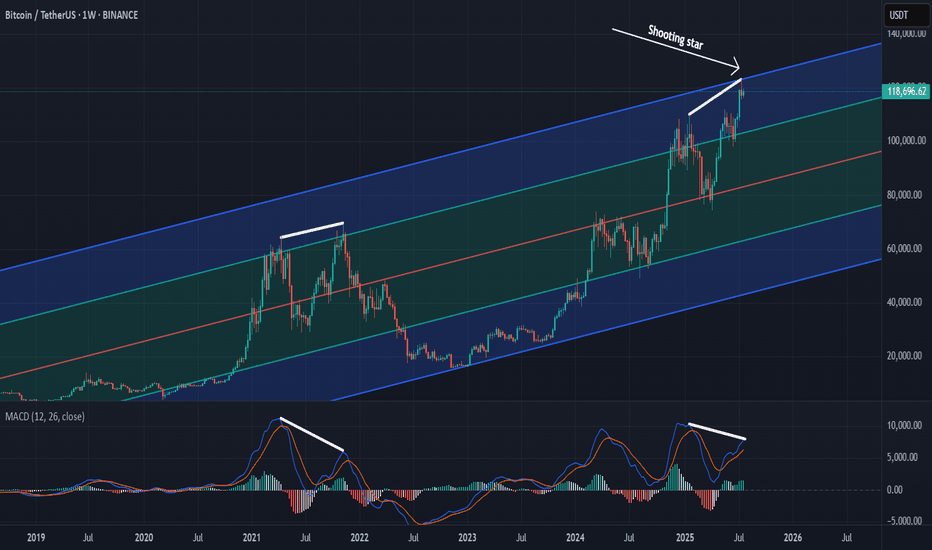

Calling the Unthinkable: Why a Bitcoin Drop May Be ComingCOINBASE:BTCUSD BITSTAMP:BTCUSD OKX:BTCUSD BINANCE:BTCUSDT.P

Predicting a drop in Bitcoin's price during a strong uptrend is extremely difficult and calling it takes real courage. It puts my credibility at risk, but based on everything I see, I believe BTC has reached dangerously high levels.

From a psychological perspective , investor behavior is sending warning signs. There’s a rush of people buying in out of FOMO, amplified by heavy promotion on social media and mainstream claiming BTC is the safest investment out there. Many who missed earlier buying opportunities now regret betting on altcoins instead, and they see this as a last chance to profit. Even if BTC drops below their entry points, most of these “late buyers” won’t sell. They’ll convince themselves it’s just another minor correction like what happened in the previous 2 years, and that they’re in it for the long term.

From a technical analysis point, the signs are just as concerning. A “ shooting star ” candle has formed on the weekly chart. This candle is often seen at market tops. The MACD histogram on the same timeframe is showing a potential divergence, suggesting weakening momentum. The Fear and Greed Index is approaching 70, indicating strong market greed. On top of that, traders are opening high-leverage long positions in anticipation of another big bullish candle.

These technical and psychological signals combined paint a risky picture. If this kind of setup is confirmed , it will lead to sharp corrections.

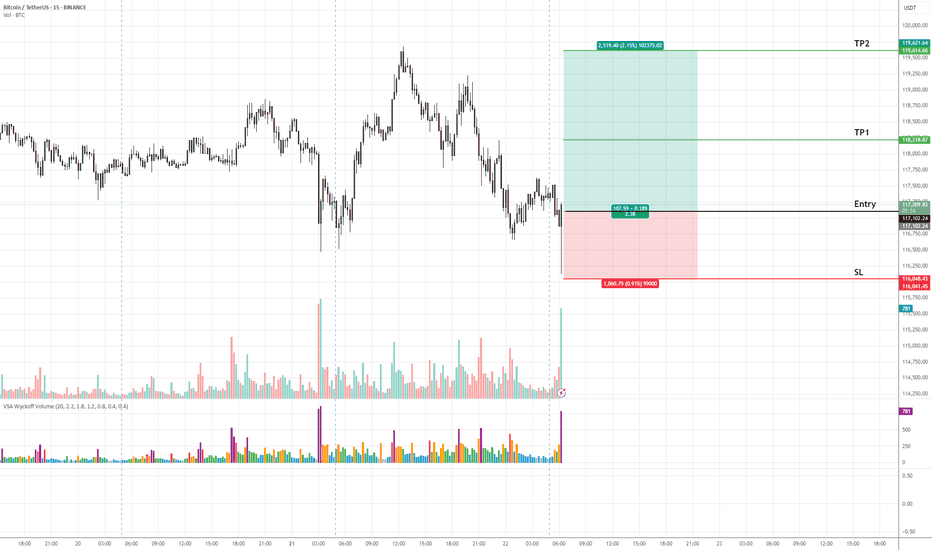

BTCUSD (Bitcoin) Buy Setup – VSA & Market Structure Analysis✅ Entry: As marked on chart

🎯 Take Profit 1 (TP1): Highlighted zone on chart

🎯 Take Profit 2 (TP2): Highlighted zone on chart

🛑 Stop Loss (SL): Defined below recent demand zone

📊 Technical Insight (VSA & Market Structure):

The recent decline into the support zone occurred on diminishing volume, indicating a lack of selling pressure.

A climactic volume spike (stopping volume) followed by a wide spread bullish candle suggests strong professional buying activity.

Subsequent bars show narrow range candles with low volume, characteristic of an absorption phase, hinting at smart money accumulation.

Price is now attempting to break above the previous minor resistance, which would confirm demand overcoming supply.

The broader market structure aligns with this setup: Bitcoin is in a higher timeframe accumulation range, and this move could initiate a markup phase as per Wyckoff/VSA principles.

📍 As long as price holds above the stop loss zone, we expect a bullish leg towards TP1 and TP2, in line with the emerging demand dominance.

Guys. Thoughts?Just having a conversation with a trading jedi master and then they taught them to set a buy stop with heavy risk above the lower high at the top of the market cycle in the sell side of a previously resolved block after exceeding the statistical high of the dealers range for the day. Just for some more insight, this all happened while venus was in retrograde. Hopefully that paints a clear enough picture. Don't hesitate to ask questions.

Signing off, yours faithfully,

ChartCharmer.

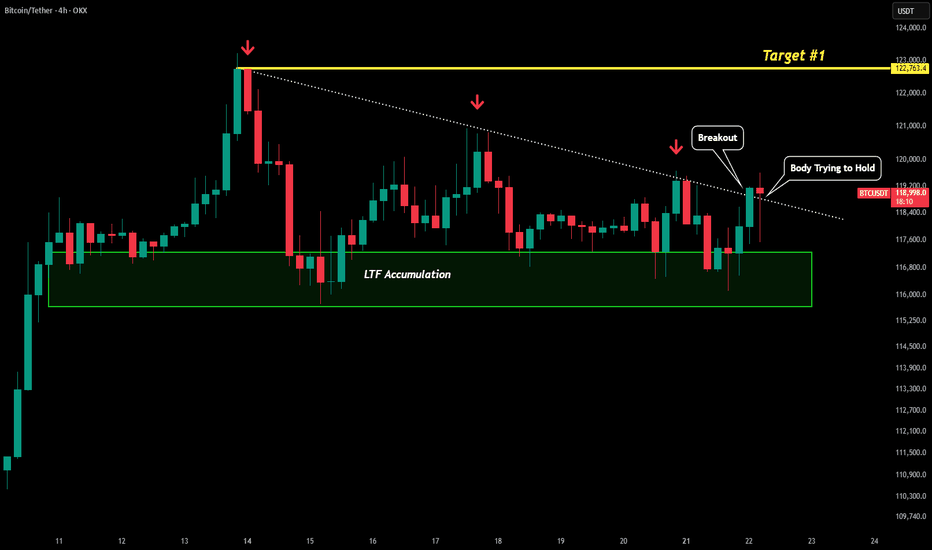

BTC - LTF Breakout? Here is an update to our last post:

After monitoring for a breakout we are seeing early signs of just that.

We saw a rejection from yesterday's test but this morning have broken above our white dotted line with the first breakout candle. Now with this 4H candle we could be seeing the confirmation breakout. After wicking down the bulls have pushed price back up where the candle is holding support above the white dotted trendline.

Technically this current 4H candle would be considered a bearish candle, but due to the circumstances it could easily be negated.

If price does fall in the next 4H period and we do not see another close above the white dotted line, then this would be considered a fakeout and we would most likely see much lower prices. However, what we want to see is price push above this current candles 4H high which would negate the bearish candle and most likely start the rally towards our yellow line target.

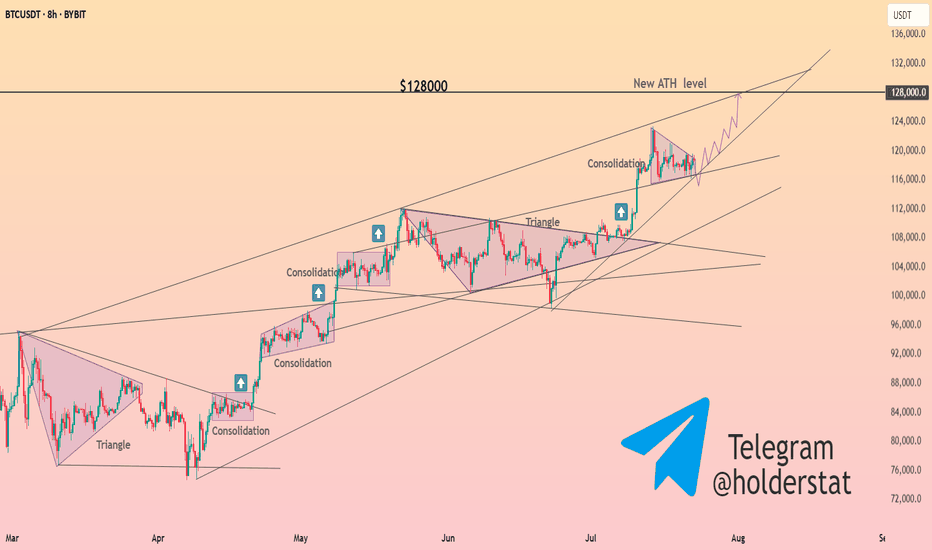

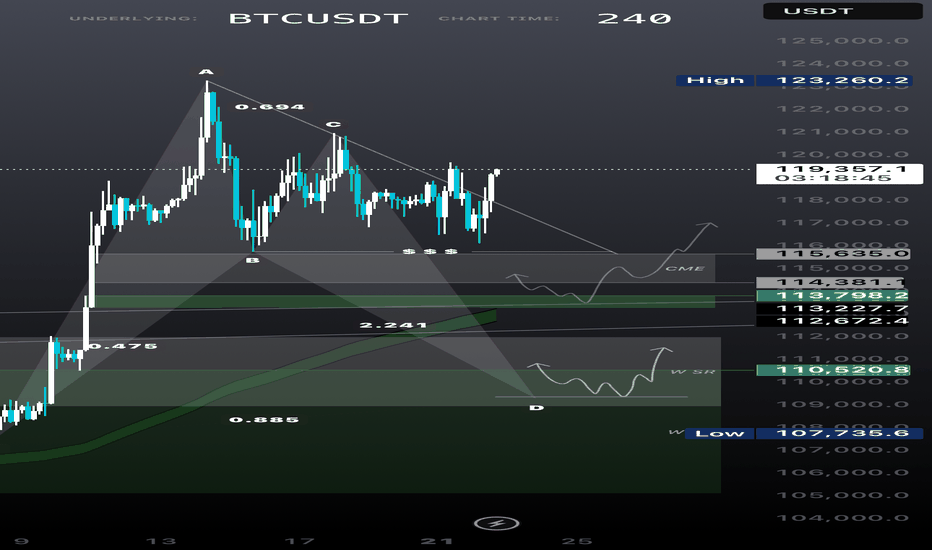

Trading plan for BitcoinLast week, Bitcoin established a new ATH at $123k before entering a corrective phase. The price action has since developed into a clear consolidation pattern and currently trades below the weekly pivot point.

Key Observations:

Proximity to last week's low increases probability of a full ABC correction targeting $113k

Break above noted resistance could invalidate bearish scenario and suggest ATH retest

Critical Levels:

Resistance: $119,500

Support: $113,000 (ABC target)

Trade the range until the market declares its next direction.

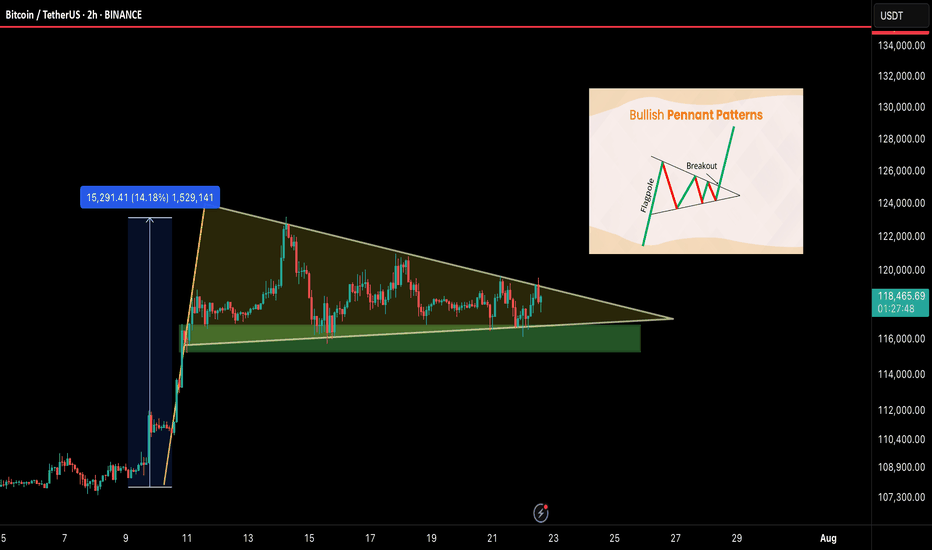

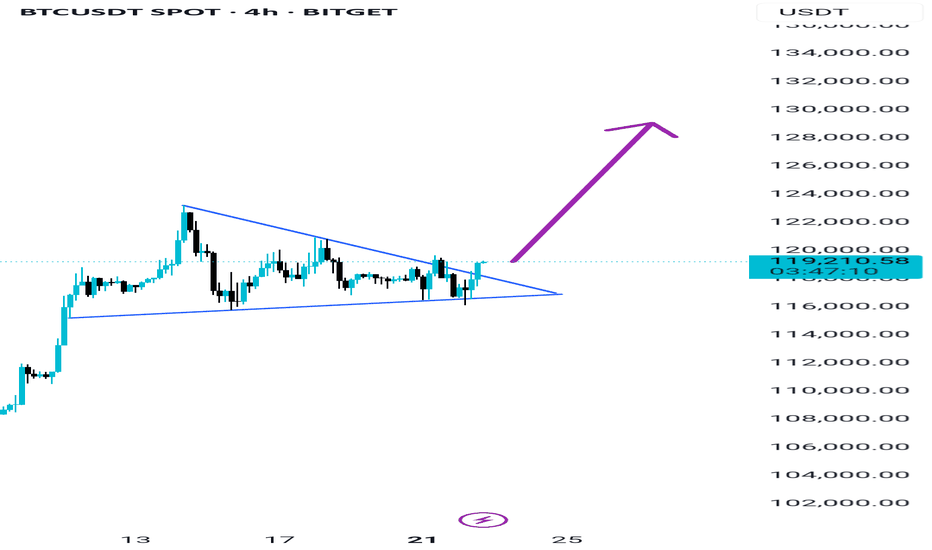

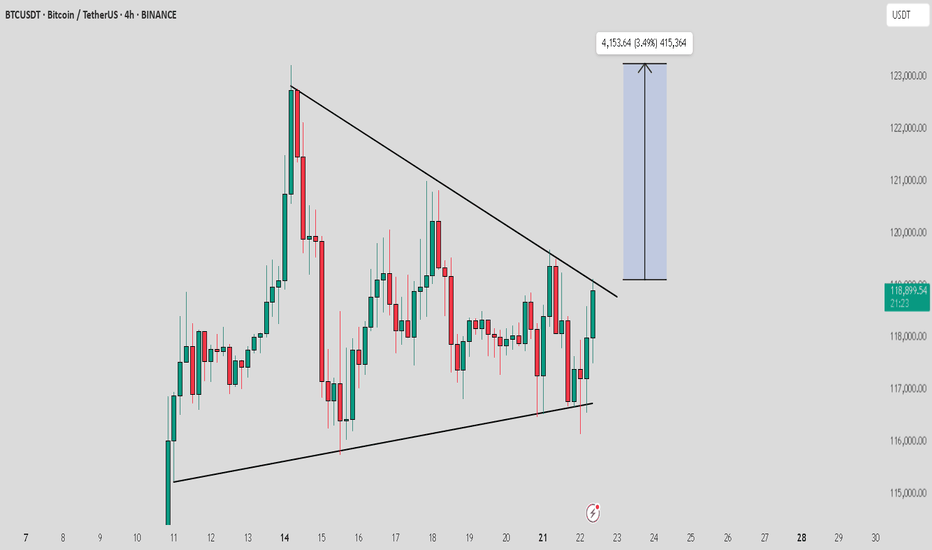

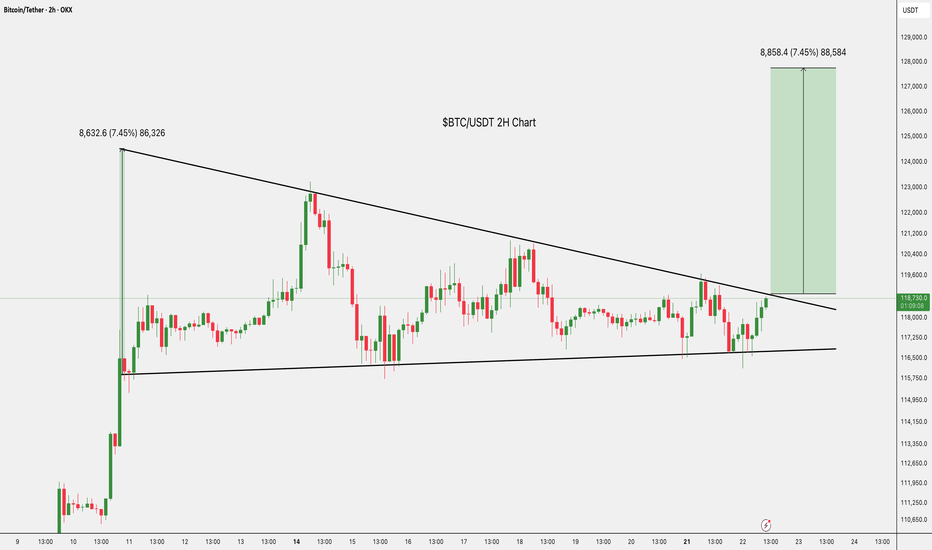

BTC/USDT – Bullish Pennant Setting Up for the Next Leg!Bitcoin is currently forming a bullish pennant — a classic continuation pattern — right after a strong 14% impulse move. This type of structure often leads to a breakout followed by another powerful rally. And it’s coiling up nicely.

🧠 Technical Breakdown:

🟢 Bullish pennant formation in progress

🔽 Support zone: $115.5K – $116.5K

📏 Flagpole projection targets $135K+ on breakout

⚠️ Currently consolidating with lower volatility — breakout could be near

🔍 What to Watch For:

Clean breakout above pennant = breakout confirmation

Daily close below $115K = invalidation zone

Volume spike will likely signal the next move

📢 Final Take:

BTC is showing healthy consolidation after a strong move, and this pennant could launch us toward $135K and beyond. Keep your eyes on the breakout and manage risk wisely.

💬 Share your thoughts below & smash that ❤️ if you’re watching this move!

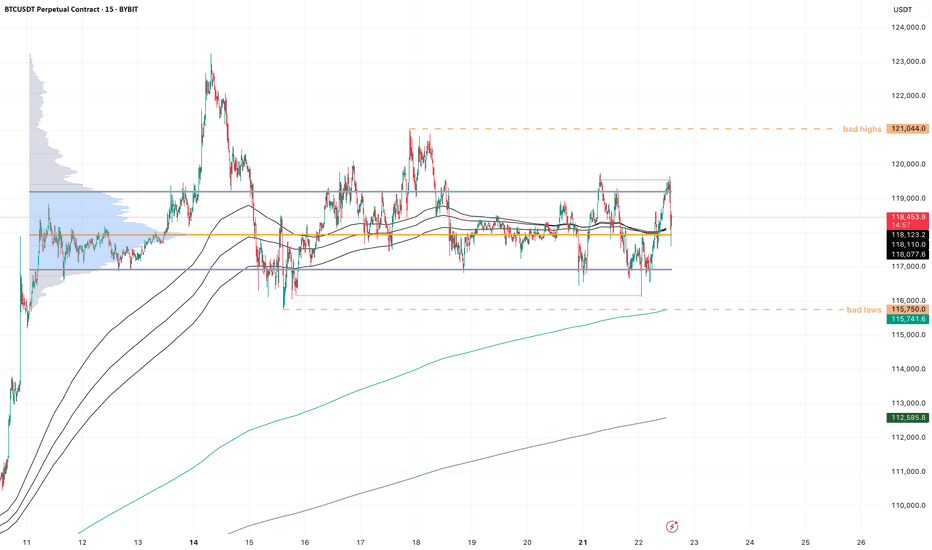

BTC - Sideways forever?!Compressing really hard here on BTC, look at:

- volume range becoming very concentrated, clean pingpong between VAL and VAH

- H4 trend compressing to almost a single point

- you can see from the purple lines that only internal liquidity is being taken on both sides

imo this sets us up for a potential fake out setup. There is so much liquidity on both sides in this small range, that on a very clean sfp of one side, the other side would have to rush out which pushes price quickly to the other side. We saw a little bit of that already with the sweep during the asia session today.

Of course the sfp needs to be valid, wait for a reclaim setup, there is always the chance the breakout/breakdown is valid, you don't want to be on the wrong side of that either.

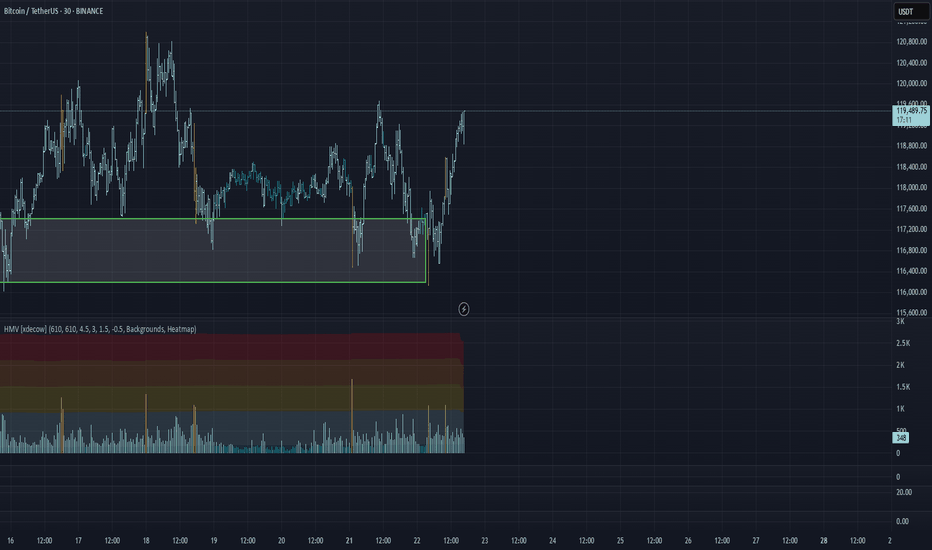

BTC/USDT Analysis: Rotation Continues

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics.

Yesterday, Bitcoin continued to rotate within a narrow sideways range, and so far, there has been no breakout. We retested the lower boundary of the range and once again saw absorption of market selling at that level.

At the moment, the scenario remains valid — we expect a breakout to the upside. Several factors support this outlook: strong defense at the lows, delta absorption across the entire range, and buyer control on the most recent local upward wave.

A less likely scenario is a dip into the lower buy zone, a liquidity grab, and another attempt to move higher.

Buy Zones:

~$115,000 (zone of initiating/pushing volumes)

$110,000–$107,000 (accumulated volumes)

This publication is not financial advice.

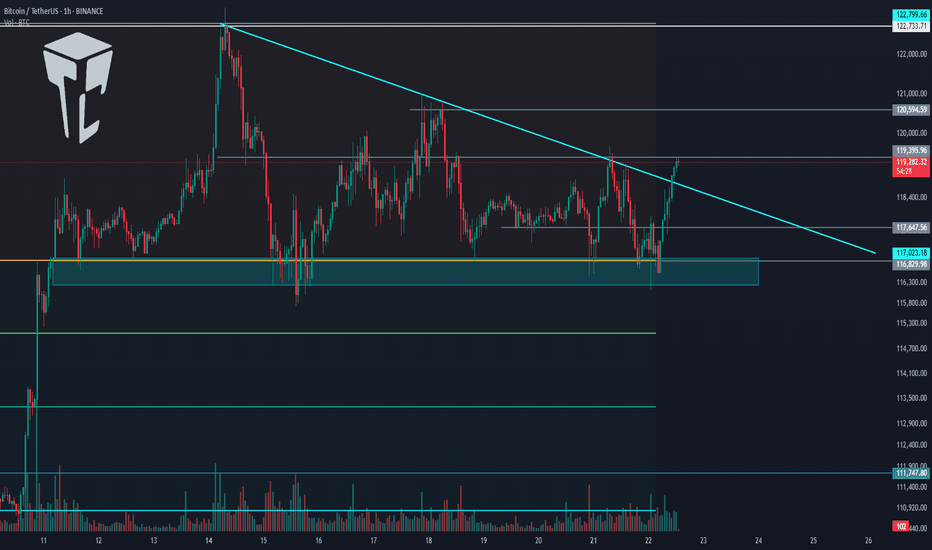

TradeCityPro | Bitcoin Daily Analysis #134👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis I will review the New York futures session triggers for you.

⏳ 1-Hour Timeframe

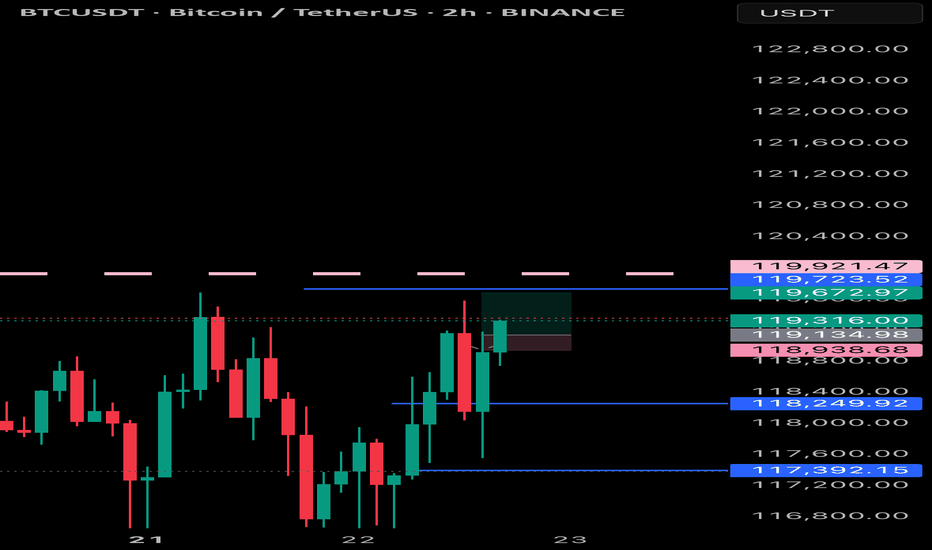

On the 1-hour timeframe, Bitcoin has formed a range box between 116829 and 119395. Yesterday, after getting supported at 116829, it climbed back to the top at 119395.

📊 As you can see, buying volume has increased, which indicates strong buyer momentum.

📈 If 119395 is broken, the price could move toward higher targets like 120594 and 122733.

🧩 This 119395 area is also the breakout trigger of the descending triangle. The bottom at 116829 has supported the price multiple times, and now with the descending trendline being broken, price could aim for higher resistance levels.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. BTC Dominance has been supported at 60.46, which is why Bitcoin is moving upward, while altcoins are dropping.

🎲 The dominance trend is still clearly bearish, and if 60.46 breaks, the next downward leg may begin.

📅 Total2 Analysis

Let’s look at Total2. This index has also formed a range between 1.48 and 1.55, and it is currently sitting at the bottom of the box.

🔔 If we get confirmation of support at 1.48, we can consider entering a long position. The main long trigger would be the break of 1.55.

📅 USDT.D Analysis

This index has also formed a range box. The previous support level was 4.08, which has now shifted to 4.13.

💥 The top of the box is 4.25. Given the bearish momentum in dominance, the probability of 4.13 breaking is higher.

🎲 So keep a close eye on altcoins in the coming days, because a lot of capital is flowing into them and they could see significant pumps.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

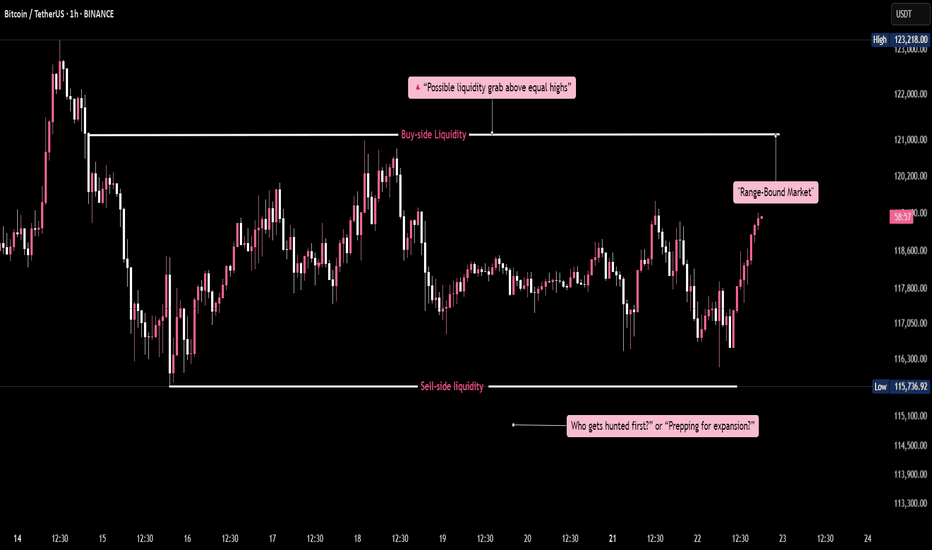

BTC/USDT - Liquidity Loading Zone

Bitcoin is trading within a well-defined range, building liquidity on both sides. Equal highs near 121K signal buy-side liquidity, while equal lows around 115.7K mark the sell-side liquidity. This setup is a classic smart money trap—engineered to gather orders before a major move. The longer the range holds, the more explosive the breakout is likely to be. Watch for a sweep of either side as a potential trigger for expansion.

Whether it’s a fakeout or breakout, liquidity will decide the next move.

BTC Top-Down Analysis (Weekly, Daily, 4H)Weekly, Daily, and overall trend is bullish only 4H internal structure is short-term bearish with price trading inside a 4H demand zone.

From weekly timeframe:

- Inverse head & shoulders is forming showing trend continuation.

- ATH trendline (Nov 2021) has flipped from resistance to support — not retested yet.

- Major supports all align between 113K–109K including:

- CME Gap: 114380–115635

- Trendline: 113798

- Neckline: 112800

- Weekly Bullish OB: 110520

- Harmonic Bat PRZ: 109350

My Thoughts:

This 113K–109K zone is a high-confluence support area I’ll only consider buying BTC within this range.

This analysis remains valid as long as the weekly candle doesn’t close below the Bullish OB (105K) or above the ATH.

BTC #Bitcoin (BTC/USDT) 1-hour chartThis Bitcoin (BTC/USDT) 1-hour chart shows two clear consolidation phases marked by blue rectangles. Each consolidation lasted 164 bars (~6 days 20 hours). After the first range, Bitcoin broke out upwards, leading to a strong rally. The current price action is again testing the upper boundary of the second consolidation range ($119,200), indicating a possible breakout. The gray zone ($116,500) highlights a key support level. A breakout above the range could signal another bullish continuation.

thanking you

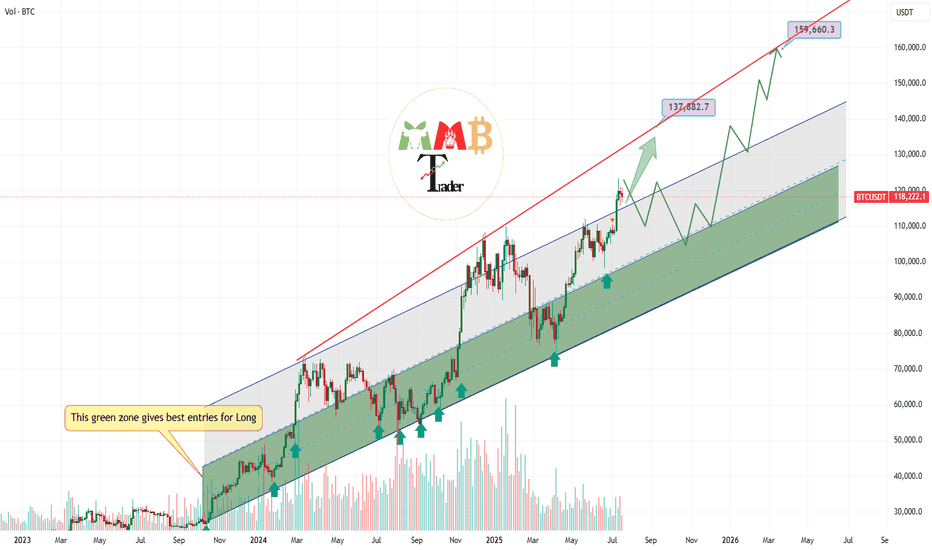

Bitcoin first target and short-term pump at least to 137K$ aheadAs we can see stop and next range zone for price can be near 135K$ to 137K$ and also major support zones now are 115K$ and 105K$ that can pump price once again if they touch.

Red trendline was strong resistance and it usually stop the pump and it is daily high detector now unless it breaks this time.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

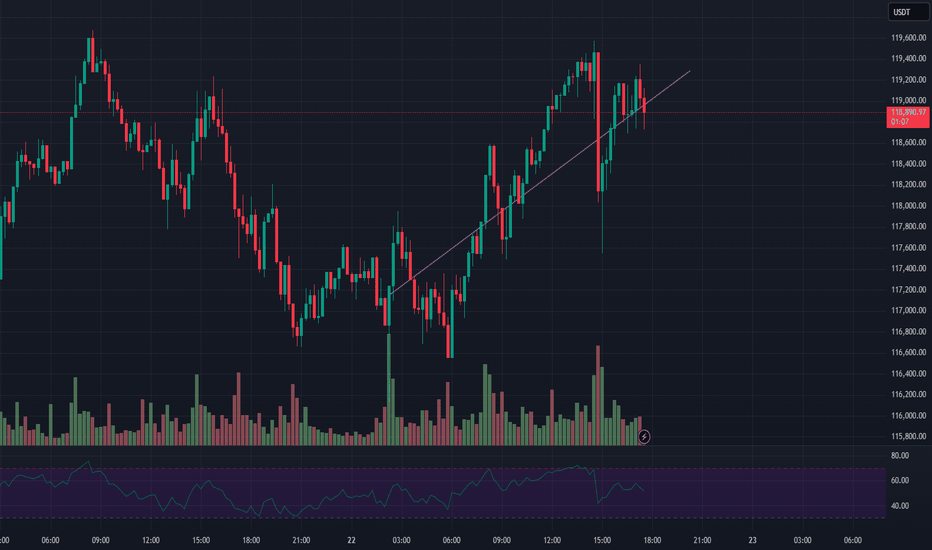

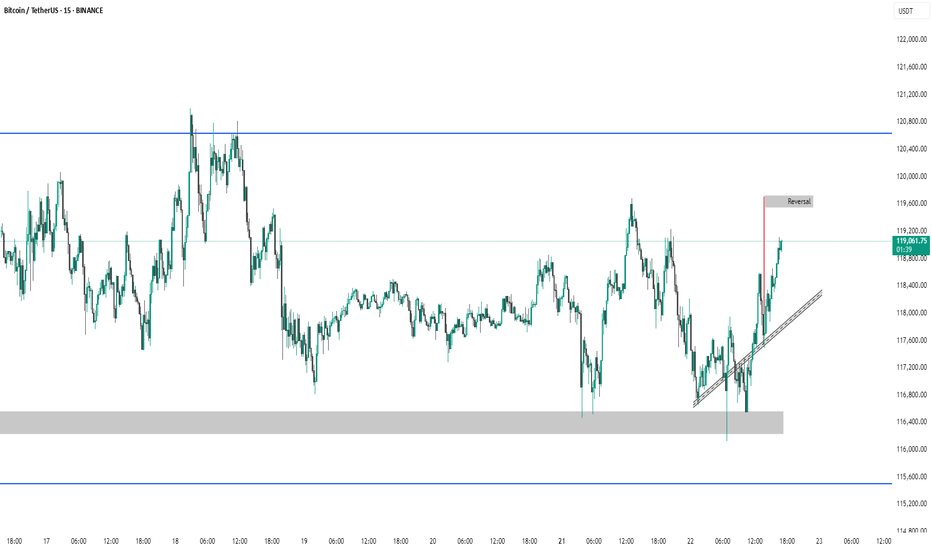

BTC #Bitcoin 15-minute BTC/USDT chart (Updated ChartThis 15-minute BTC/USDT chart (Binance) shows Bitcoin rebounding from a demand zone near 116,000–116,750 USDT and forming higher lows along a short-term ascending trendline. Price is currently around 118,446 USDT, aiming toward a marked supply zone near 119,500 USDT, suggesting a potential short-term bullish move. A rejection at this supply zone could signal a pullback, while a breakout may indicate continued upward momentum. Key support and resistance zones are clearly defined.

thanking you

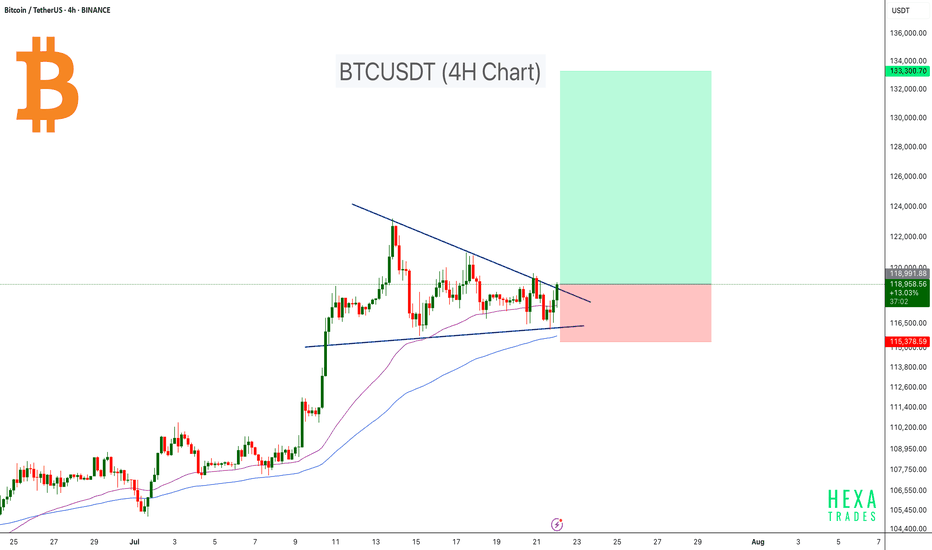

Bitcoin Ready for the Next Leg Higher!Bitcoin is currently consolidating within a symmetrical triangle on the 4-hour timeframe, showing signs of a potential breakout. After a strong rally earlier in July, BTC has entered a compression phase, forming lower highs and higher lows — a classic setup for a volatility breakout.

Price is moving near the apex of the triangle, suggesting that a decisive move is imminent. The 50 EMA and 100 EMA are both acting as dynamic support, helping bulls maintain control of the structure. A breakout above the descending trendline could initiate a sharp move toward the $130K–$133K target zone.

Cheers

Hexa

BINANCE:BTCUSDT