BTCUSDT trade ideas

TradeCityPro | Bitcoin Daily Analysis #132👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis I’ll review the futures triggers for the New York session.

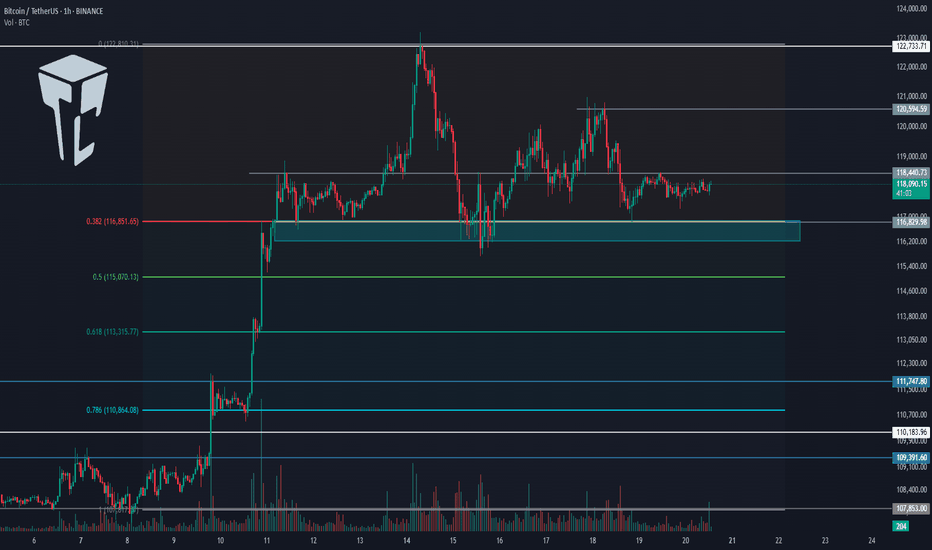

📅 1-Hour timeframe

On the 1-Hour timeframe, as you can see, Bitcoin is still holding the key support at 116829 and has been ranging between 116829 and 118440 since yesterday.

✨ Today, if the 118440 level breaks, we can open a solid long position. However, I still believe that due to Bitcoin Dominance being in a downtrend, altcoins are a much better choice for opening positions.

✔️ If you're only planning to trade Bitcoin, this trigger is suitable. The next entry points would be 120594 and 122733. If we open positions at all three triggers and the market moves upward, we can get strong risk-to-reward setups since we’ve entered with significant volume across three positions.

📊 If the 116829 level breaks downward, we might see sharper corrections. In that case, the next supports will be the 0.5 and 0.618 Fibonacci levels.

👑 BTC.D Analysis

Looking at Bitcoin Dominance, as you can see, the trend is heavily bearish and moving downward.

⭐ The downtrend in dominance is quite steep, and the next support we have is at 60.49. There’s still room for dominance to drop to this level.

📅 Total2 Analysis

Moving to Total2, yesterday the 1.46 trigger was activated and price moved to 1.5, and it is now sitting just below that level.

💫 If this level breaks, another bullish wave towards 1.62 could form.

📅 USDT.D Analysis

Looking at Tether Dominance, this index is also in a downtrend similar to Bitcoin Dominance, which shows that money is exiting both Bitcoin and Tether and entering altcoins.

🎲 So keep a close eye on altcoins in the coming days, because a lot of capital is flowing into them and they could see significant pumps.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

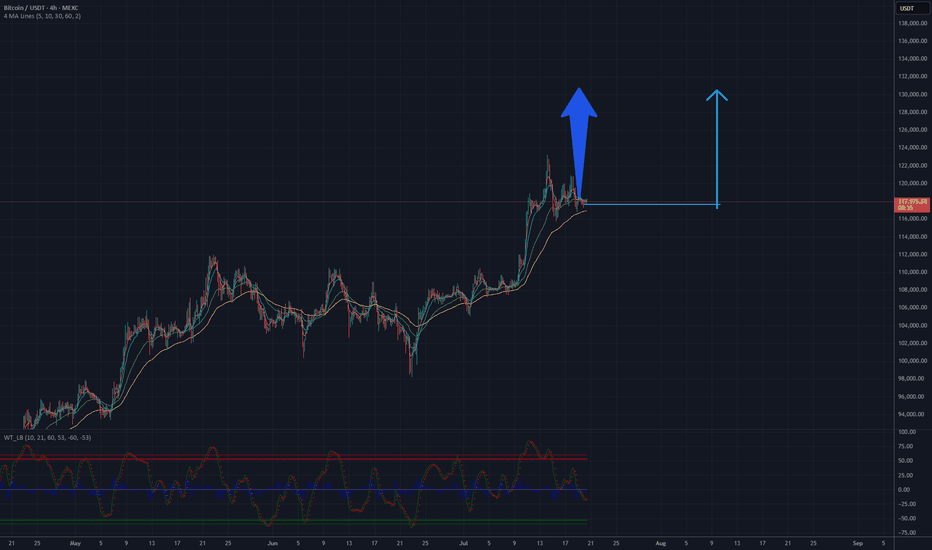

BTC will be 130 K USD? Potential target 130 000 USDAnalysis of the Bitcoin (BTC/USDT) chart on the MEXC platform indicates a positive upward trend. The price is currently hovering around $117,823, with clear support at approximately $100,000, as confirmed by the lower channel line. Moving averages (MA) suggest a sustained upward trend, and the trend line drawn from the lows points to potential for further growth. The current resistance is in the $120,000-$125,000 range, but if momentum holds and this level is breached, the price could head toward $130,000 in the short to medium term. It is recommended to monitor volume and key support and resistance levels to confirm further upward movement.

Potential TP: 130 000 $

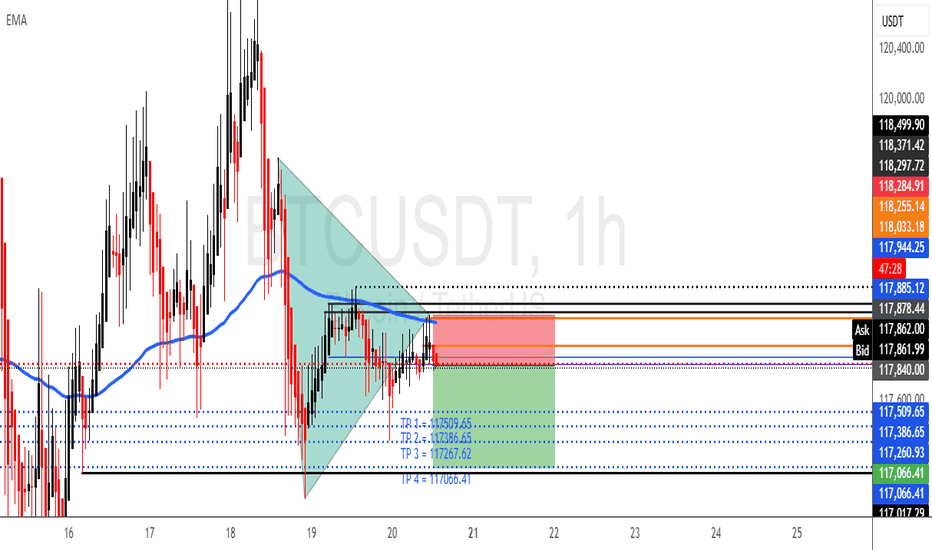

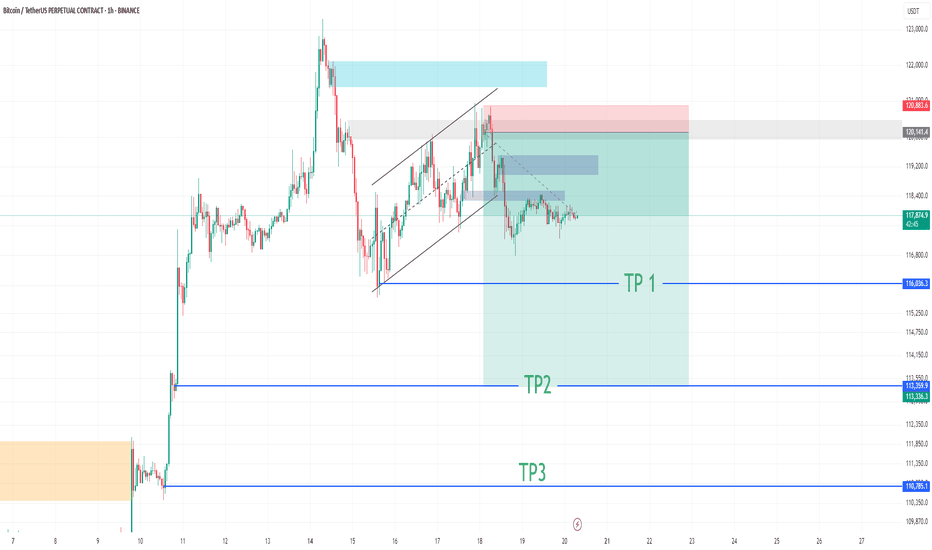

BTCUSD SHORT POSITION = SELLWe can see that BTCUSD consolidated a and ended up given us a possible sell.

To my point of view, we can take a sell position at an Entry = 117878.44 with a proper calculated risk of a SL = 118285.00.

With this short position we can expect to take our profits at the following zones:

TP1: 117509.65

TP2: 117386.65

TP3: 117267.62

TP4: 117066.41

The takes profits are a calculated Risk Reward Ratio of 1.00 to 2.00

It is advisable to use a small lot size or according to your account

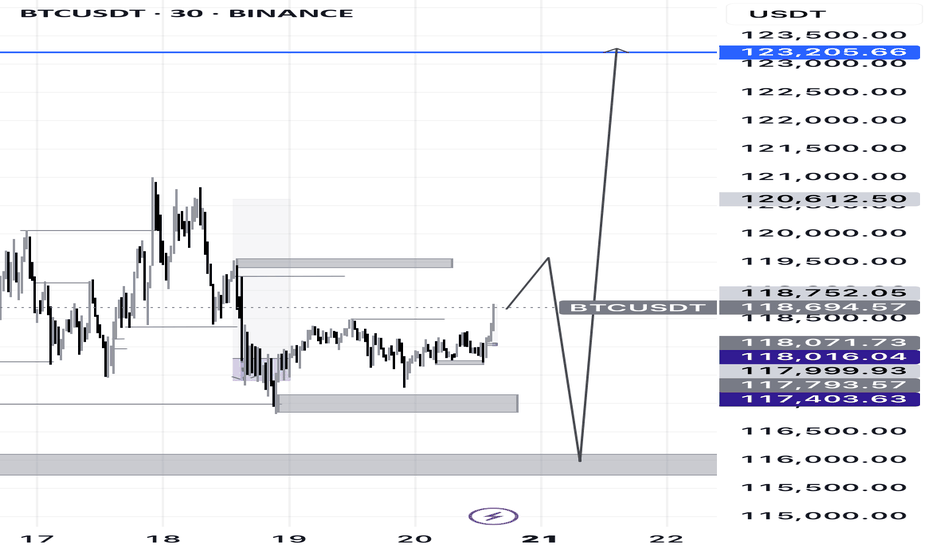

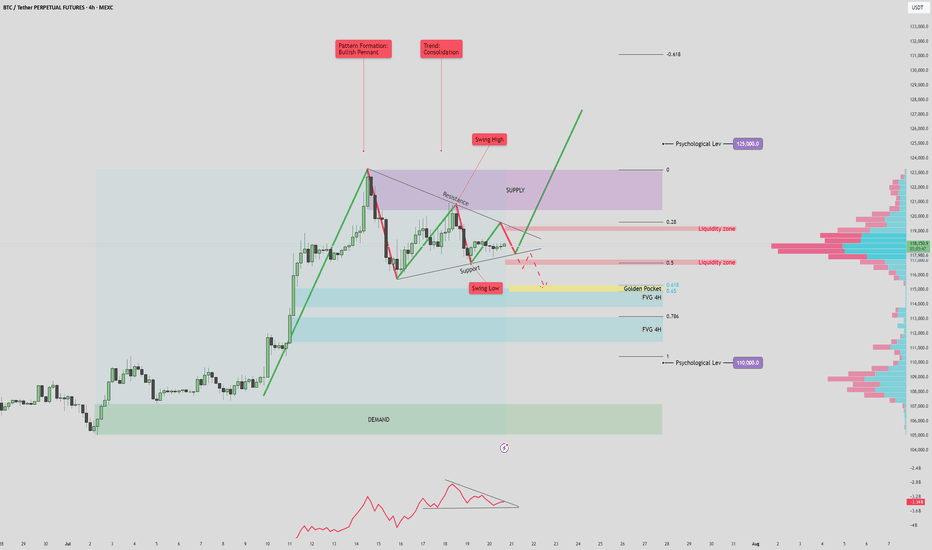

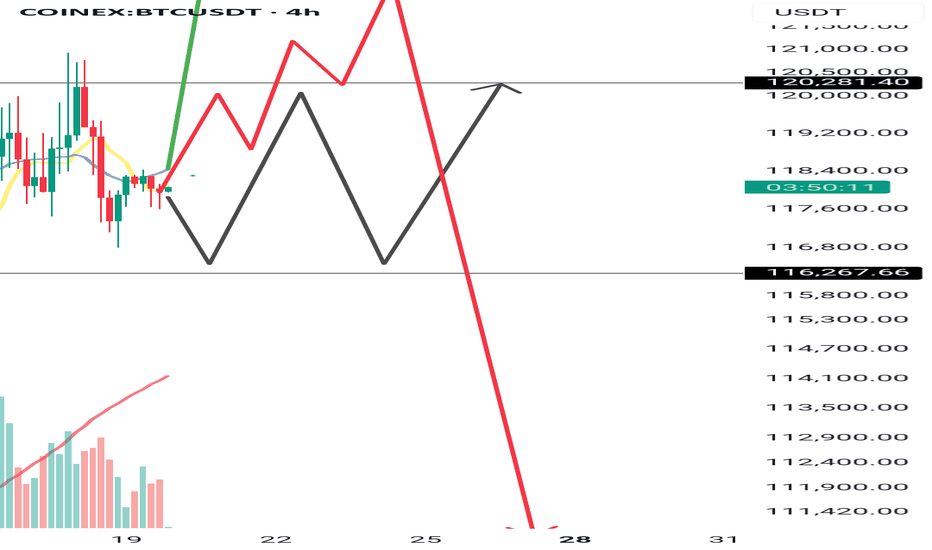

BTC/USDT 125k? or 110k fall again?BTC/USDT 4H Analysis – July 20, 2025

The current market structure shows a bullish pennant forming after a strong impulsive move upward, with price consolidating between key support and resistance levels. This pattern, combined with volume signals and key price zones, suggests a potential for a high-volatility breakout.

🔷 Volume Profile & OBV Insights

The On-Balance Volume (OBV) indicator is forming a symmetrical triangle, indicating a volume squeeze. This suggests a potential sudden spike in volume that could confirm the next major move.

Anchored Volume Profile (VPVR) on the right shows a notable low-volume area between 112K–115K. If price breaks below this zone, it could lead to a rapid selloff toward deeper fair value areas due to reduced liquidity support.

📈 Bullish Scenario

If price breaks above the pennant resistance and 119.5K liquidity zone, it may signal bullish continuation.

A successful retest of the breakout level as support would confirm strength, opening the door to:

Short-term target: 123K (supply zone and previous swing high)

Mid-term target: 125K (key psychological level and potential ATH)

Watch for confirmation via OBV breakout and strong bullish volume. Failure to sustain above the 118K–119K area could signal a bull trap.

📉 Bearish Scenario

A breakdown below pennant support and the 115K level would likely trigger a move into the low-volume range.

First key downside target: 114.7K–115.7K, which aligns with the Golden Pocket (Fib 0.618 zone) and a 4H Fair Value Gap (FVG).

This zone may act as a support or a liquidity grab reversal area.

If this zone fails to hold, deeper downside targets become likely:

FVG 2 (~112K)

Psychological support at 110K, which aligns with strong historical demand and a major VPVR node.

This bearish move may either confirm further downside momentum or present a fakeout opportunity if price sharply reverses from one of these deeper levels.

✅ Summary

BTC is coiled within a bullish pennant, with both bullish continuation and bearish breakdown scenarios in play. Volume confirmation and breakout direction will be key. Traders should monitor how price reacts around the 115K–118K zone for directional clarity. A move beyond this range, especially with volume support, will likely define the next trend leg.

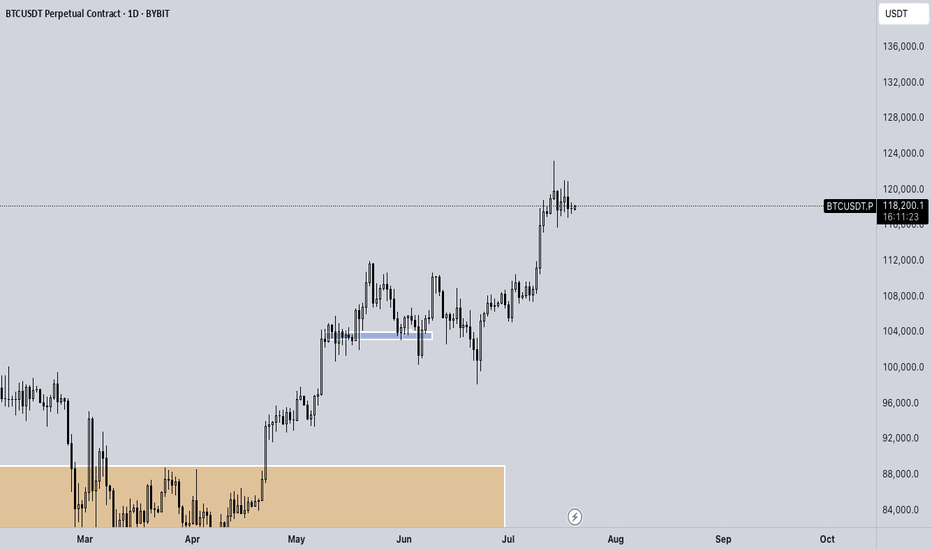

BTC - Ranges overview (update) BTC has been moving nicely lately so let's see where we go from here.

As previously mentioned, we should expect an aggressive move upwards towards 110K and eventually new ATH. As expected we got the move and are now trading around 120K.

IF we fail to hold the sellside at 115K expect us to trade back towards 110K.

IF we hold our current levels expect further upside towards new ATH.

No NEED TO FRONTRUN THE MARKET. BE PATIENT AND TRADE WITH IT.

Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Entering Green Markets or Getting Close to Liquidation?They told you it’s a green market, time to buy... but something’s off.

Most major losses begin with a green candle, not a red one!

Before jumping in, ask yourself: why does everything suddenly look so clear?

Hello✌

Spend 3 minutes ⏰ reading this educational material.

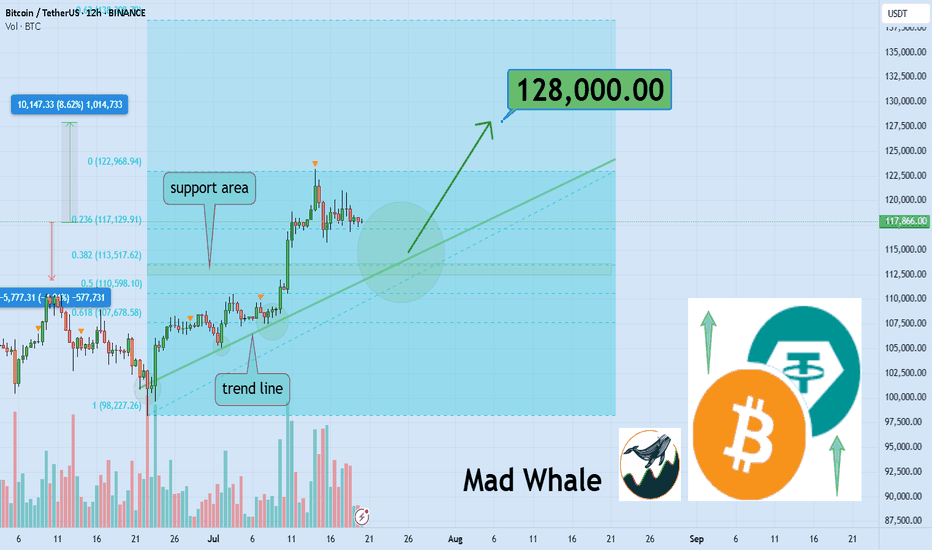

🎯 Analytical Insight on Bitcoin:

Strong volume confirming daily trendline and Fibonacci support signals a potential 8% upside, with a key target near $128,000 📈. This confluence could offer a solid entry opportunity for BINANCE:BTCUSDT traders 🧭.

Now , let's dive into the educational section,

📉 Green Doesn’t Always Mean Safe

Many traders jump into green candles, feeling they’re missing out. But most pumps end where excitement begins. The market isn’t always bullish it’s often just using collective emotion against you.

🧠 They’re Targeting Your Mind, Not Just Your Capital

Whales don’t need your money they need your mind first. The moment you think you're "too late" and must enter now, is often when they’re selling.

💡 You’re Fueling Their Profits, Not Your Trade

Those who bought early are waiting for someone like you. If you enter now, you're not beating the market you’re just helping others close in profit.

🔍 Why Most Liquidations Happen After Green Moves

Contrary to belief, major liquidations often come after green runs. That’s when confidence is high, stops are forgotten, and greed kicks in perfect timing for a rug-pull.

📊 History Doesn’t Repeat It Rhymes (Loudly)

Go back and look at Bitcoin’s chart since 2017. Nearly every major drop followed a smooth-looking pump. It’s not a warning. It’s a recurring pattern.

🎯 Hidden TradingView Tools for Spotting Green Traps

The market looks bullish. But the truth is, many pumps are just emotional traps built to bait late entries. TradingView has tools that, if used right, help you spot these traps before you step into them:

✅ Volume Profile (Fixed Range):

Use this to identify where the most trading volume occurred. If price rises on weak volume, be suspicious. It could be a fakeout or engineered pump by whales.

✅ RSI + Manual Divergence Drawing:

RSI seems simple, but traps often hide when RSI climbs while price action lags. TradingView allows manual drawing spot bearish divergence before the fall.

✅ On-Balance Volume (OBV):

If price is rising and OBV is flat or falling, warning lights should flash. A rally without money inflow is often a visual illusion.

✅ Session Volume HD (from Public Library):

See when most liquidity enters. Many fake bullish moves happen during the Asia session when volume is low and price is easier to manipulate.

✅ Multi-Timeframe Analysis:

If you're looking at the 15-min chart while the 4-hour sits in resistance, you may just be playing into a bull trap. Cross-reference your timeframes.

🧭 How to Avoid the Green Traps

Watch volume, not just candle color

Wait for level confirmations, not hype

Use TradingView’s combo indicators

Always ask: who profits if I enter right now?

✅ Final Thoughts

Not every green candle is hope sometimes it’s bait. The market is after your emotions, not your charts. Step back, zoom out, and use the right tools before you act.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

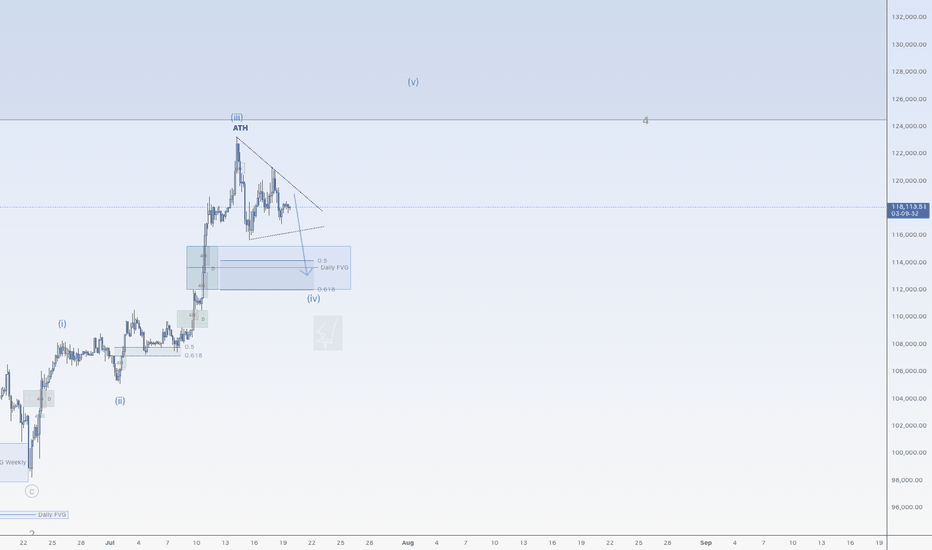

Bitcoin is still bullish (4H)Bitcoin appears to be in a dual bullish structure, currently in the second bullish phase following wave X.

Considering the expansive nature of the correction in the second pattern, it seems we are within an expanding triangle or a diametric structure.

Based on the duration of wave C, it appears that the bullish wave of the second structure is not yet complete.

We expect such fluctuations for Bitcoin in the coming period.

A daily candle close below the invalidation level would invalidate this outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

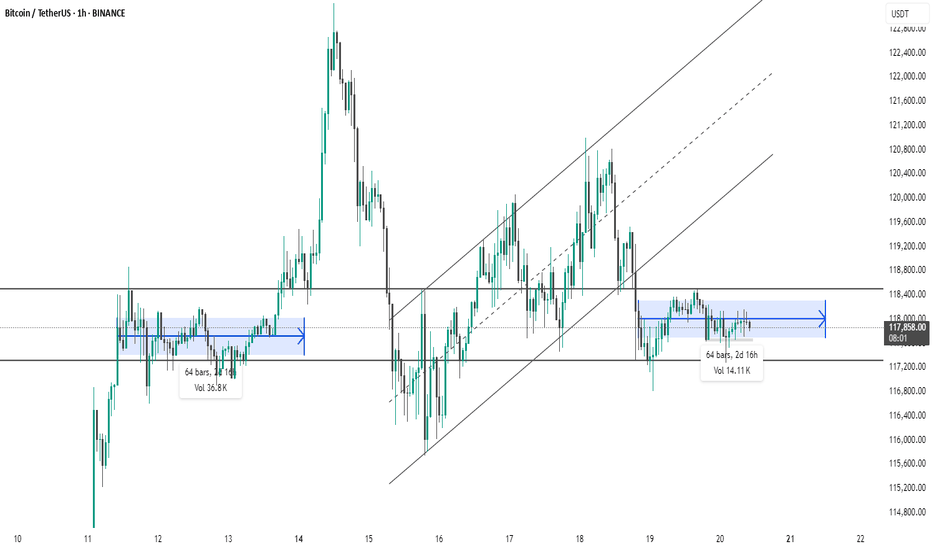

BTC #Bitcoin (BTC/USDT) on the 1-hour timeframeThis chart shows Bitcoin (BTC/USDT) on the 1-hour timeframe, highlighting two periods of sideways consolidation (marked in blue).

Both zones lasted 64 bars (2d 16h), indicating similar market indecision or accumulation/distribution phases.

The first consolidation (left) was followed by a strong bullish breakout, while the second (right) is currently unresolved.

Price is trading within a tight range between ~117,600 and ~118,400 USDT, suggesting potential for an imminent breakout or breakdown.

Volume during the current consolidation is lower than the previous one, hinting at reduced momentum.

This setup may signal a key move once the price exits this range.

thanking you

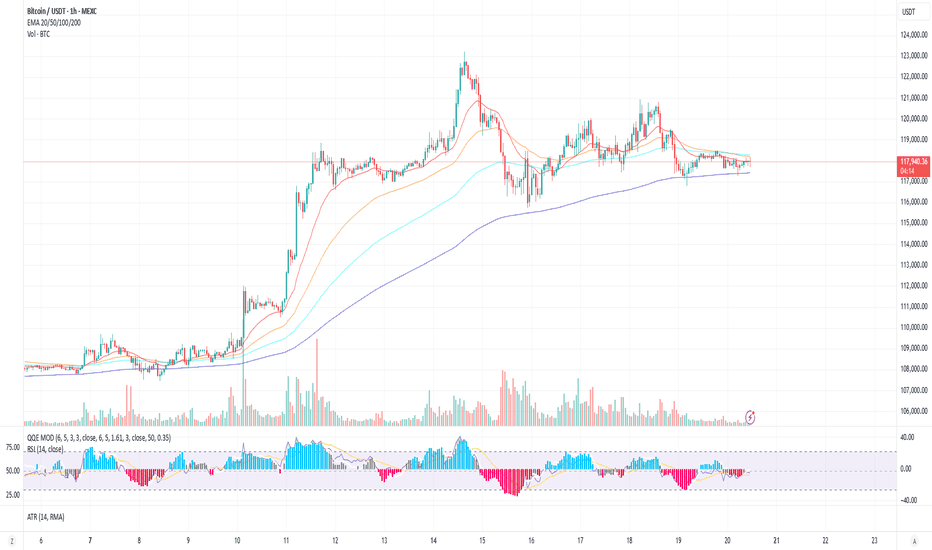

Buy Signal at 117k, Eyeing 118.5k BreakoutDescription:

Bitcoin is consolidating just above the 200 EMA on the 1H timeframe, forming a slight ascending triangle. A buy around 117,000 with TP set at 118,421. With RSI near neutral and QQE MOD potentially flipping bullish, we are watching for a breakout above 118,500 for continuation. SL sits below the recent swing low at 116,485.

Trade Setup

Long Entry: 117,000 (as signaled)

Take Profit: 118,421 or higher (watch 118,800 zone)

Stop Loss: 116,485

Alternate Trigger: Break and close above 118,500 with increased volume = breakout entry

Invalidation:

A break below 116,400 (below SL zone and 200 EMA) could invalidate the bullish thesis and open downside toward 114,000.

Confirmation to Watch

Breakout candle above the 50 EMA with volume spike

QQE MOD crossover with histogram flipping blue

RSI moving above 50 confirming strength

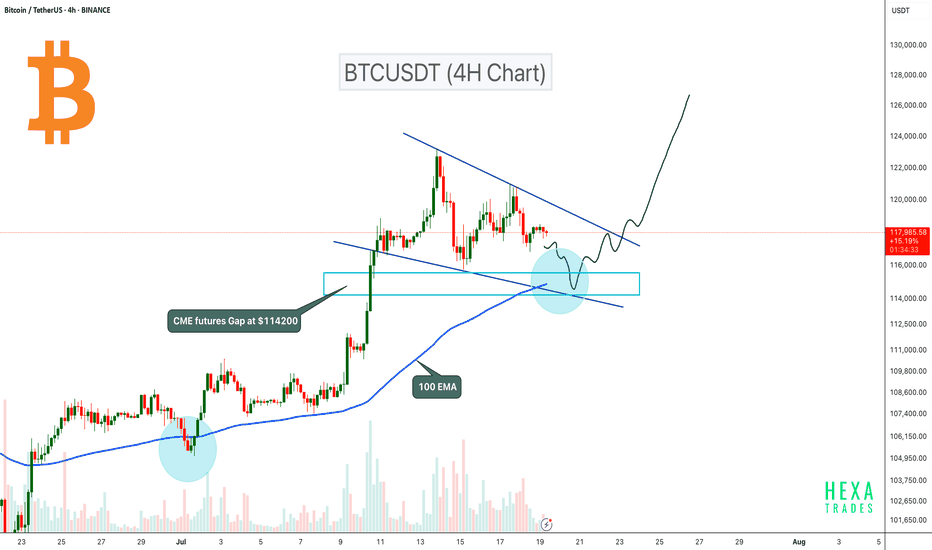

BTC/USDT – 4H Chart Technical AnalysisBTC/USDT – 4H Chart Technical Analysis

Market Structure & Trend

Overall Trend : Bearish (clearly defined by a consistent downtrend channel).

Current Structure : Price is in a corrective downtrend within a descending channel, after multiple rejections from the supply zone.

Key Technical Zones

1. Supply Zone

Strong rejection zone where the price previously reversed sharply.

Still acting as resistance, located around the upper range.

2. Demand Zone

Currently being retested for the fifth time, weakening its strength.

Recent price action shows liquidity sweep and swing low break inside this zone, potentially trapping early longs.

Fair Value Gaps (FVG) & Fibonacci Levels

1D FVG sits below the current demand, aligning with:

Golden Pocket (0.618–0.65 Fib).

Acts as a high-probability bounce zone for long entries if demand fails.

A break below this FVG could open up deeper downside toward the 0.786 Fib or beyond.

Psychological Levels

105,000 – Major resistance & potential take-profit area for long positions.

100,000 – Key support and liquidity magnet if the demand zone fails.

Volume Profile

High Volume Node: 102,000 – 106,800 — price tends to gravitate here, indicating potential consolidation or resistance.

Low Volume Area: Below 100,500 — suggests thin liquidity, which may cause sharp moves if price drops into this range.

Scenarios & Trade Ideas

Bullish Scenario

If price holds above the demand zone (after multiple retests) and confirms on LTF:

Potential Long to local resistance.

On breakout, target the 105,000 psychological level.

Confluence: High volume area offers both support and a magnet.

Bearish Scenario

If price fails to hold the demand zone:

Enter short position targeting the 1D FVG and 100,000 psychological level.

If that breaks, expect sharp continuation due to low volume below.

Conclusion

Price is at a pivotal point — currently balancing on weakened demand after multiple retests. Watch for LTF confirmation:

Above demand = bullish recovery setup.

Below demand = bearish continuation toward 100,000 and the FVG.

Manage risk tightly due to the proximity of both key zones.

BTC/USD Fake out before Pump | Bullish Flag formationBTC/USDT (1D) Market Outlook – July 1, 2025

Introduction

BTC is currently consolidating within a bullish flag pattern after printing a swing high at 108.9K and a recent swing low at 98K. The price sits just below a major supply zone.

Context 1: Key Zones

Supply: 104.6K – 112.1K

Demand: 74.4K – 82.5K

Fair Value Gaps (FVG): 3 zones below price, with one near 88–90K

Context 2: Technical Confluence

Liquidation Zone: 106.2K

Golden Pocket (Fib 0.618): 102.1K

Psychological Levels: 105K and 110K

Context 3: Market Structure

Pattern: Bullish flag

Trend (LTF): Sideways/consolidation

Volume Profile: Heavy activity near 105K–110K

Bullish Scenario

Breaks above 106.2K (liq zone)

Pulls back to 102.1K (golden pocket), forms higher low

Retests resistance for continuation

Alt scenario: clean breakout above resistance → ATH retest

Bearish Scenario

Breaks below 106.2K and flag support

Fills FVG, breaks prior low at 98K

Triggers macro downtrend toward 88–90K zone

Summary

BTC is at a decision point inside a bullish flag, facing supply. A break above 106.2K favors upside continuation, while rejection and a lower low could trigger a deeper retracement. Watch key levels closely.

Bitcoin's Critical Zone: Breakout or Breakdown?

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

🔍 Bitcoin Analysis (BTC)

📌 Scenario 1:

For BTC to break above 122 this time, it’ll need a real whale push. There are still many micro sellers at that level, and a slow, gradual move like yesterday likely won’t work.

Since buyers already spent their dry powder, they might not have enough left to defend 110 if price gets rejected again.

📌 Scenario 2:

But if price doesn’t attempt 122 again from here, we probably won’t see the 110 bottom either — simply because buyers haven’t deployed capital yet and may be waiting for entries around 115. That forms a potential range between 115 and 122.

🕰️ Daily timeframe:

Market is resting for now.

🎯 Entry trigger: 120.35

If price struggles at this level and BTC dominance isn't strong, we’ll likely shift attention to altcoins.

If BTC gets rejected at 122 and dominance turns red, again — alts may outperform.

💡 Current BTC & ETH positions remain open. No interest in shorts.

As long as we stay above 115, the focus remains on alt/BTC pairs during dips.

📊 TOTAL Market Cap:

🟡 Although we moved above 3.78 yesterday, we don’t call that a breakout — unless price moves away from the level significantly. Right now, it’s still struggling near resistance.

Next key level to watch for a true breakout: 3.91

This is the same region BTC needs a whale to push through.

📈 TOTAL2 – Entry Trigger: 1.05

If any altcoin shows strong momentum and volume before this level breaks (⚠️ low weekend volume is expected), we can consider that a signal.

On Saturdays, volume confirmation is tricky, so we may take small breakout trades using only 0.25% of capital, with fewer positions.

💠 OTHERS.D:

If BTC dominance drops, BTC ranges, and OTHERS.D rises ⬆️

➡️ It suggests that non-top-10 coins are starting to move.

That’s when we should analyze dominance of each top 10 coin individually.

🎯 Entry trigger: 7.80

💵 USDT.D:

No clean level for now, but keep an eye on 3.80 going forward.

🌐 ETH/BTC:

Still bullish, showing no signs of pullback. Price continues to push up.

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

Bitcoin's Critical Zone: Breakout or Breakdown?

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

🔍 Bitcoin Analysis (BTC)

📌 Scenario 1:

For BTC to break above 122 this time, it’ll need a real whale push. There are still many micro sellers at that level, and a slow, gradual move like yesterday likely won’t work.

Since buyers already spent their dry powder, they might not have enough left to defend 110 if price gets rejected again.

📌 Scenario 2:

But if price doesn’t attempt 122 again from here, we probably won’t see the 110 bottom either — simply because buyers haven’t deployed capital yet and may be waiting for entries around 115. That forms a potential range between 115 and 122.

🕰️ Daily timeframe:

Market is resting for now.

🎯 Entry trigger: 120.35

If price struggles at this level and BTC dominance isn't strong, we’ll likely shift attention to altcoins.

If BTC gets rejected at 122 and dominance turns red, again — alts may outperform.

💡 Current BTC & ETH positions remain open. No interest in shorts.

As long as we stay above 115, the focus remains on alt/BTC pairs during dips.

📊 TOTAL Market Cap:

🟡 Although we moved above 3.78 yesterday, we don’t call that a breakout — unless price moves away from the level significantly. Right now, it’s still struggling near resistance.

Next key level to watch for a true breakout: 3.91

This is the same region BTC needs a whale to push through.

📈 TOTAL2 – Entry Trigger: 1.05

If any altcoin shows strong momentum and volume before this level breaks (⚠️ low weekend volume is expected), we can consider that a signal.

On Saturdays, volume confirmation is tricky, so we may take small breakout trades using only 0.25% of capital, with fewer positions.

💠 OTHERS.D:

If BTC dominance drops, BTC ranges, and OTHERS.D rises ⬆️

➡️ It suggests that non-top-10 coins are starting to move.

That’s when we should analyze dominance of each top 10 coin individually.

🎯 Entry trigger: 7.80

💵 USDT.D:

No clean level for now, but keep an eye on 3.80 going forward.

🌐 ETH/BTC:

Still bullish, showing no signs of pullback. Price continues to push up.

✨ Stay ahead of the market — follow for daily crypto insights & smart analysis.

🧠 Think smart. Trade smart.

🚀 Tap the rocket if you're ready for liftoff!

BTCUSDT Short Swing TradeBINANCE:BTCUSDT Short Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

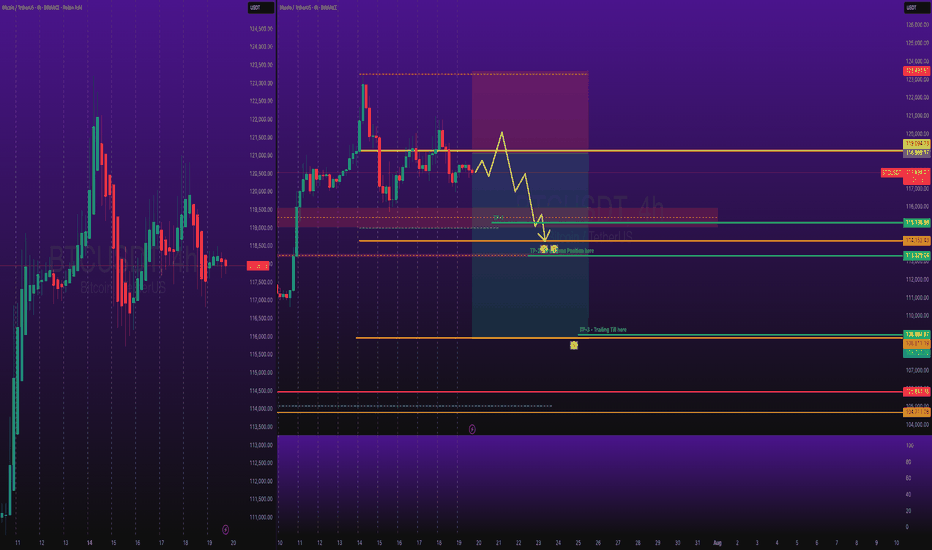

BTC Pullback Expected to $114K Before Next Leg Up!Bitcoin is currently consolidating inside a bullish flag pattern on the 4H timeframe. The price could retest the flag support, where the 100 EMA will act as dynamic support. Additionally, there is a CME futures gap at the $114,200 level, which also aligns with the 0.5 Fibonacci retracement level. Therefore, a retest to the $114,200 zone is likely before the next potential upward move.

A potential bullish reversal could occur if BTC retests this zone and confirms a bounce. A breakout from the bullish flag pattern could signal the next leg up.

Cheers

Hexa🧘♀️

BITSTAMP:BTCUSD CRYPTOCAP:BTC

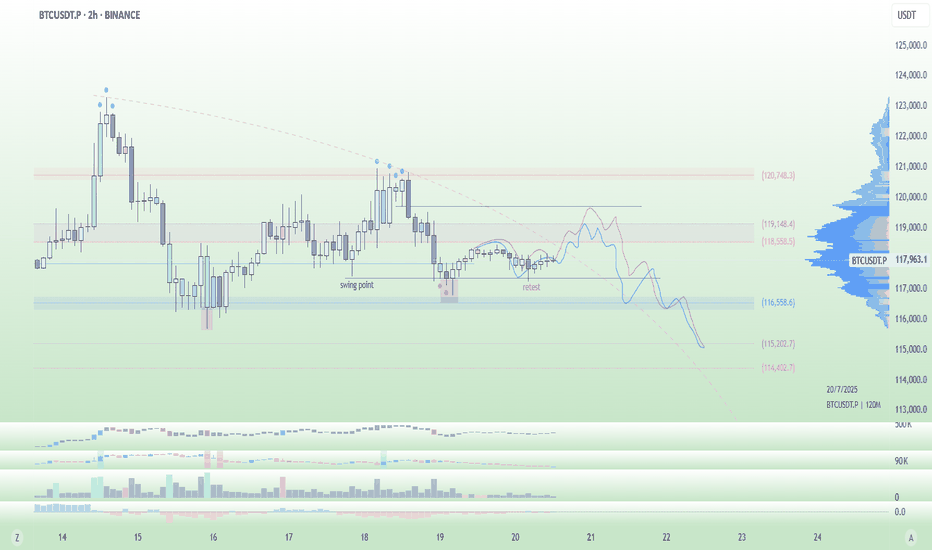

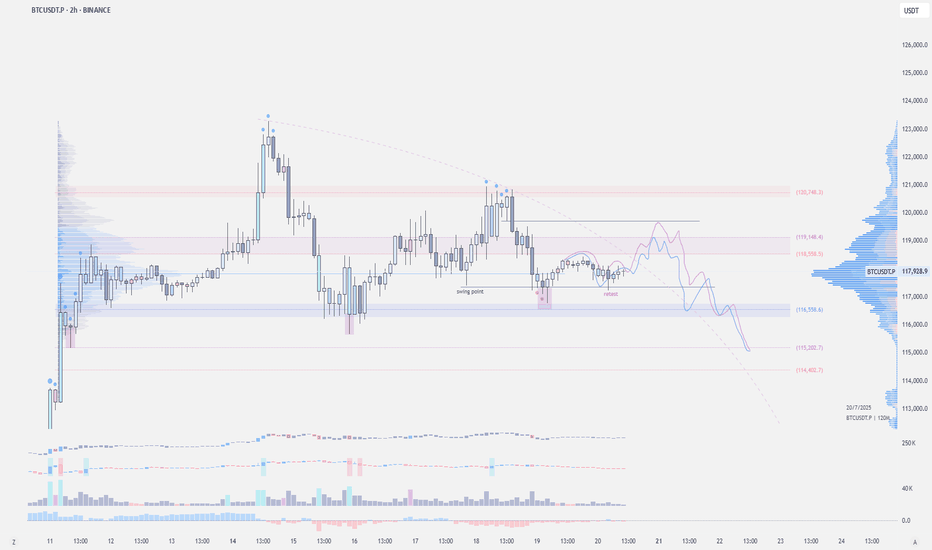

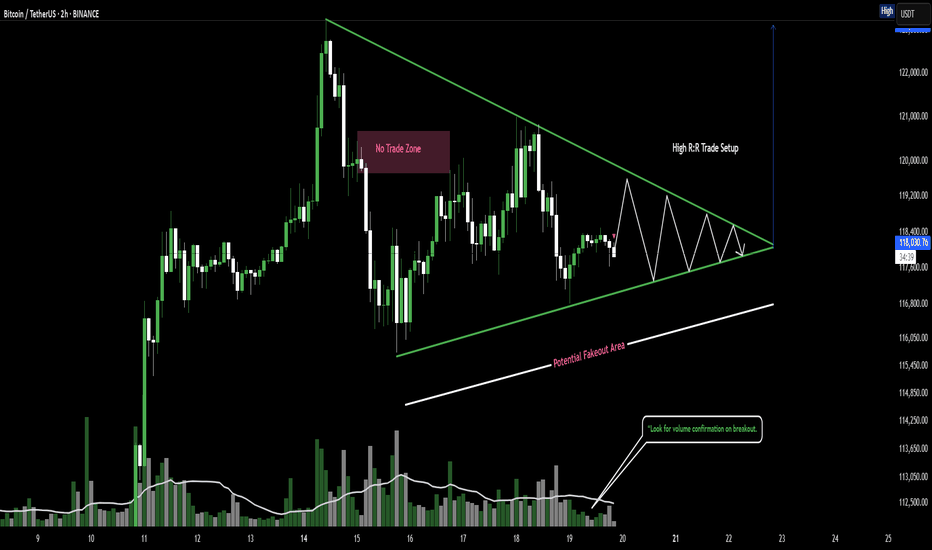

Bitcoin Technical Outlook -2HA symmetrical triangle is forming with declining volume — signaling a likely breakout.

🔼 Break above ~$119.5K → Target: $123K

🔽 Break below ~$116K → Target: $113.5K

⚠️ Await confirmation before entering. Risk management is key.

Bitcoin (BTC/USDT) Technical Outlook – 2H Chart

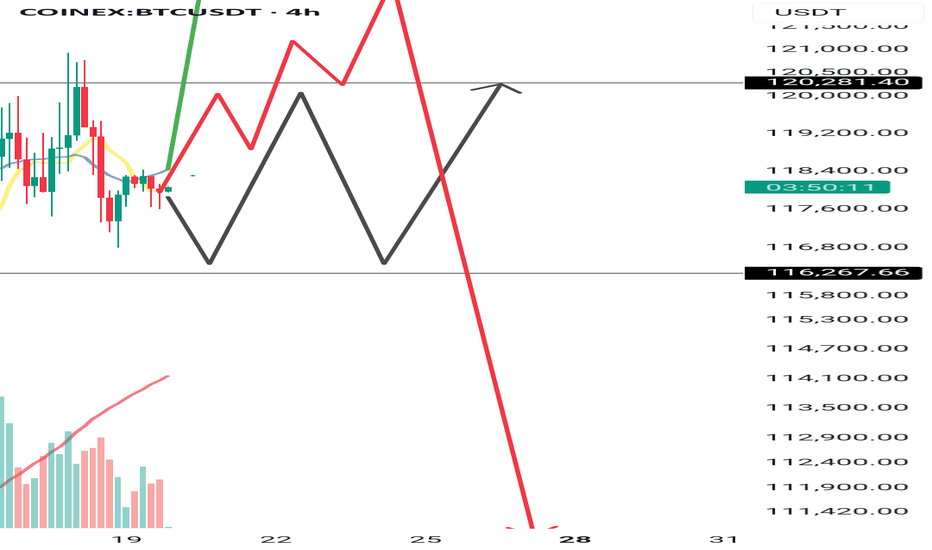

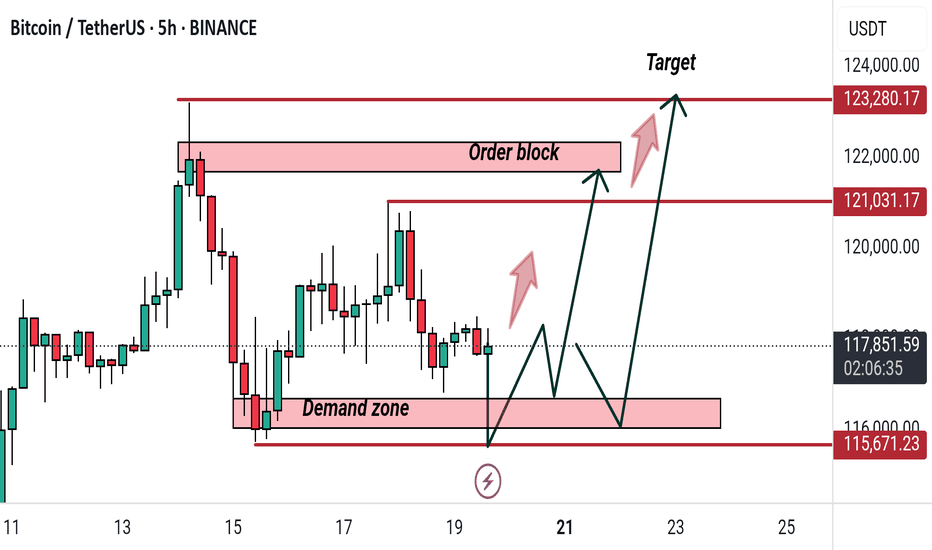

Correction down for BitcoinHi traders,

Last week Bitcoin made a small correction down and up again to finish wave 3 (blue).

After that it started a bigger correction down for wave 4 (blue). This could be a Triangle (no break of previous low) or Zigzag (break of previous low into the bullish Daily FVG).

After the finish of the correction down we could see more upside again.

Let's see what the market does and react.

Trade idea: Wait for the correction down to finish.

Then after an impulse wave up, a small correction down on a lower timeframe and a change in orderflow to bullish you could trade longs.

If you want to learn more about trading FVG's with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my analysis.

Don't be emotional, just trade your plan!

Eduwave