Bitcoin BTC price analysis by the end of 2025🕯 July is coming to an end, with 3 weeks of OKX:BTCUSDT consolidation between $117k–121k.

Tomorrow begins the last month of summer — and it promises to be "hot" as, according to our earlier published calendar Trump's administration plans to send letters with new, increased tariffs to "all countries" on 01.08.

💰 Also, take a look at Bitcoin Monthly Returns. In our view, 2025 resembles 2020 the most.

What do you think?

👉 According to this dynamic, the real "hot" may come not in summer, but late autumn.

💰 We've also tried to find a price fractal for #BTCUSD that fits the current structure — and for now, it looks plausible:

◆ In the coming days, CRYPTOCAP:BTC should not rise above $121k.

◆ A low of correction might hit mid-September around $93k.

◆ A cycle top for #BTC could arrive to the end of 2025, near $147k.

📄 Now that you've seen our version — share your forecasts on future #BTCUSDC price action in the comments 👇

BTCUSDT trade ideas

Bitcoin Could Accept bearish TrendBitcoin is currently testing a key resistance zone between 120,000 and 121,000. While price action is attempting to break higher, market conditions suggest the possibility of a false breakout rather than a sustained bullish continuation.

BTC has approached a significant resistance band, and early signs of exhaustion are visible. Unless the price decisively holds above 121,000, any breakout may lack conviction. Given the broader unresolved downtrend, a corrective move remains likely.

If the breakout fails to sustain, we anticipate a pullback toward the 117,000 to 115,000 range. This would align with a retest of previous support zones and continuation of the short-term bearish structure.

Ps: Support with like and comments for better analysis Thanks.

#BTC Potential Trading Opportunities📊#BTC Potential Trading Opportunities🔥

🧠We've been trading sideways for quite some time, and selling pressure has largely been exhausted, so we need to find support to enter a long trade.

➡️From a structural perspective, there's a chance for a bullish head-and-shoulders pattern to form. If this pattern holds, we could see a move above $120,000 or even higher.

Potential support is likely between $116,300 and $117,000.

Short-term resistance is around $120,000.

⚠️Note: A break below L1 would destabilize the structure and significantly reduce bullish expectations.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

#BTCUSDT: Minor Correction In Price Then $150,000?Hi everyone,

Hope you are doing great we are witnessing some minor bearish correction in the price and think this might be a sellers trap. We think $110,000 can be a good area to buy. Our target is at $150,000 area which look possible after looking at how price recently behaved.

One last Correction till breakoutWith the most recent SFP printed on the higher timeframe and BTC still failing to break a significant high, all signs point toward one final dip – a move to shake weak hands and reload for the breakout that’s been brewing in silence.

⚡ If the orange level holds, consider it a highly bullish signal – supercycle potential unlocked?

Naturally, the Wizard plays both sides of the board:

📉 Short ideas would activate around the blue Order Block / green correction level.

📈 But should we bounce strong from orange… well, let’s just say you’ll want a seat for what comes next.

🟥 Bullish invalidation rests at the red line.

Let’s see how the game unfolds.

Deep Dive Into Bollinger Bands 🗓This article explores the Bollinger Bands indicator—a powerful volatility tool used by traders worldwide. You'll learn how it works, how to calculate it, and how to use it to detect potential breakouts, trend reversals, and overbought or oversold conditions in the market.

📚 Introduction to Bollinger Bands

In the fast-paced world of trading, understanding market volatility is key to making informed decisions. Bollinger Bands, developed by John Bollinger in the 1980s, offer a visual and statistical method to measure this volatility. Unlike simple moving averages, which only tell you the trend, Bollinger Bands expand and contract based on recent price action, helping traders spot overbought, oversold, or consolidation phases.

These bands dynamically adjust to market conditions, making them one of the most popular indicators for trend-following, mean-reversion, and breakout strategies. Whether you’re trading crypto, stocks, or forex, Bollinger Bands can help you identify high-probability setups by combining trend direction with volatility.

📚 How Bollinger Bands Are Calculated

Bollinger Bands consist of three lines:

Middle Band – This is a simple moving average (SMA) of the price, typically over 20 periods.

Upper Band – The middle band plus two standard deviations.

Lower Band – The middle band minus two standard deviations.

Middle Band = SMA(n)

Upper Band = SMA(n) + (k × σₙ)

Lower Band = SMA(n) - (k × σₙ)

Where σₙ is the standard deviation of the price for n periods and k is the multiplier, typically set to 2, which captures ~95% of price action under normal distribution. The middle band shows the average price over the last 20 candles. The upper and lower bands adjust based on how volatile the price has been — expanding in high volatility and contracting in low volatility.

🤖 For those traders who want to implement Bollinger Bands into algorithmic strategy we provide formula it's calculation in Pine Script:

basis = ta.sma(src, length) // Middle Band (SMA)

dev = mult * ta.stdev(src, length) // Standard Deviation × Multiplier

upper = basis + dev // Upper Band

lower = basis - dev // Lower Band

📚 How to Use MACD in Trading Strategies

⚡️Bollinger Band Squeeze (Volatility Contraction and Expansion)

The idea is pretty simple, а squeeze indicates low volatility and often precedes a breakout. The squeeze is the situation when the Upper Band and Lower Band contract, and BB width is at a local minimum. In this case you shall be prepared for the high volatility after the period of low volatility. This strategy doesn’t predict direction — it prepares you for volatility.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open long trade when candle shows a breakout and closes above the Upper Band.

Set a trailing stop-loss at the Middle Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open short trade when candle shows a breakdown and closes below the Lower Band.

Set a trailing stop-loss at the Middle Band

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open long trade when candle closes above the Upper Band.

4. Close trade when price touched the Middle Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open short trade when candle closes below the Lower Band.

4. Close trade when price touched the Middle Band.

⚡️Mean Reversion (Rebound from the Bands)

This is the most common approach to use Bollinger Bands. The idea is also very simple, we just want to open long if price touches Lower Band and short if price reaches Upper Band. Price tends to revert to the mean (Middle Band), especially in range-bound markets. It's very important to trade in the direction of the major trend to reduce the probability of the large move against you.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Open long trade when price touches the Lower Band.

Set the initial stop-loss at the fixed percentage below entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Upper Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Open short trade when price touches the Upper Band.

Set the initial stop-loss at the fixed percentage above entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Lower Band.

🧪 Important: the most common approach to close trades is the Middle Band touch, this is classic mean reversion. We experimented multiple times with different approached and revealed that usually it's better to take profit at the Upper/Lower band for long/short trades and use Middle Band only for setting stop-loss at breakeven. This approach provides better risk to reward ratio.

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open long trade the Lower Band.

3. Put Initial stop-loss 2% below the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close long trade at the Upper Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open short trade the Upper Band.

3. Put Initial stop-loss 2% above the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close short trade at the Lower Band.

🧪 Important tip: notice that initial stop-loss is needed only to avoid disaster in case of price moves strongly against you. This percentage shall give enough space to avoid its reaching too often. Mean reversion strategy provides fast trades with the small average gain, so you shall maintain the high win rate (perfectly above 70%). You have to choose stop-loss based on particular asset volatility.

⚡️Combined Approach: Mean Reversion + Trend Following

Skyrexio made multiple researches about Bollinger Bands strategies and we found that we can receive better gains in combination of different approaches. Mean reversion gives you great entry with discount but you don't need to exit that early. Use the trading stop and allow to gain profit while market is moving in your direction.

This approach you can find in our advanced strategy Bollinger Bands Enhanced Strategy which we shared in 2024. Click on the link to read about it and understand how you can combine best features of this popular indicator.

📚 Conclusion

Bollinger Bands are more than just a volatility indicator — they provide a flexible framework for understanding price dynamics and market conditions. By visualizing the relationship between price and standard deviation around a moving average, traders can gain valuable insights into whether an asset is consolidating, trending, or preparing for a breakout.

The real strength of Bollinger Bands lies in their versatility. They can adapt to different trading styles — whether you’re a short-term scalper, a swing trader, or a long-term position holder. From identifying squeeze setups to riding strong trends or capturing mean reversion moves, BBs offer a strategic edge when used correctly.

However, Bollinger Bands should never be used in isolation. Like any technical tool, they work best when combined with momentum indicators like RSI or MACD, volume analysis, and price action signals. Context is key: a signal that works well in a ranging market may fail during high momentum trends.

Ultimately, Bollinger Bands help traders make more informed, disciplined decisions by clarifying where price stands relative to recent history. When paired with sound risk management and broader market awareness, they become a powerful ally in navigating market uncertainty.

BTCUSD going to touch 116,800BITSTAMP:BTCUSD Long trade, with my back testing of this strategy, BTCUSD need to touch 116,800

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

BTCUSD long setup: Targeting the next bull move.Hello IGT FOLLOWERS

Here is my BTCUSD overview, Bitcoin is showing bullish momentum after holding strong support near $112,000. A breakout above the $115000 resistance suggests buyers are regaining control. RSI is turning upward, and volume is increasing on green candles signaling demand. As long as price holds above $113,000, bulls may push toward the $117,500 target.

Key points :

Entry point : 113500

1st Target : 115000

2nd Target : 117500

Follow me for more latest updates and signals

Accumulate waiting for btc price increase💎 BTC PLAN UPDATE – End of July (31/07)

📊 BTC Technical Analysis (4H Timeframe – End of July)

✅ Positive Signals:

• BTC has broken out of the consolidation triangle pattern (blue diagonal line), indicating a potential strong uptrend.

• The current price is retesting the breakout support zone around 117,800–118,000 → showing a good reaction and creating upward momentum.

• MA50 and MA200 are starting to slope upwards → confirming increasing buying strength.

📈 Bullish Scenario:

• If BTC holds above 118,000, it is likely to move toward the nearest resistance zone at 119,900.

• After breaking 119,900, the next targets are:

→ 122,792 (Fibonacci 1.618)

→ Further target: 127,900 (Fibonacci 2.618)

🛑 Risk Note:

• If the price drops below 117,000, it’s important to monitor again, as it may retest a deeper support zone around 114,500.

daily #bitcoin analysisBitcoin is fluctuating between the two price areas of $115,000 and $120,000 and I don't think it will trend either up or down anytime soon. Unless it breaks the two mentioned areas from above or below. As we can see, the new RSI indicator also shows a sideways trend. This analysis is not a financial recommendation in any way.

The Only Bitcoin Chart You NeedUnderstanding Price Action is essential for successful trading as it allows traders to interpret market dynamics and make informed decisions based on pure price movements. By focusing solely on price movements, traders can eliminate noise and distractions caused by indicators or external factors, leading to a clearer understanding of market trends and patterns.

Bitcoin Turned Down — It Was Only a Matter of TimeBitcoin Turned Down — It Was Only a Matter of Time

When the price gets stuck at the top and can’t move higher, it’s always a reason to stop and think. BTC got stuck around $118,000, started to form long upper wicks, and the volume started to decline. All of this pointed to a classic case of fading bullish momentum.

At this point, my indicator gave several key signals: weakening buying power, a change in momentum, and the formation of a potential reversal zone. I refrained from opening long positions — and this decision turned out to be the right one. The price went down and is now trading around $114,000.

Next, I will wait for a retest of the imbalance zone and work from the reaction from this zone.

It is important to understand: this correction is not something unusual. This is a technically sound phase after a strong rally. The market gets rid of speculative positions, gets rid of excessive leverage and prepares for either a reset or a deeper correction.

The market has weakened predictably, and that's actually a good thing. When the structure becomes clear, we can trade with a plan rather than just following our gut instinct.

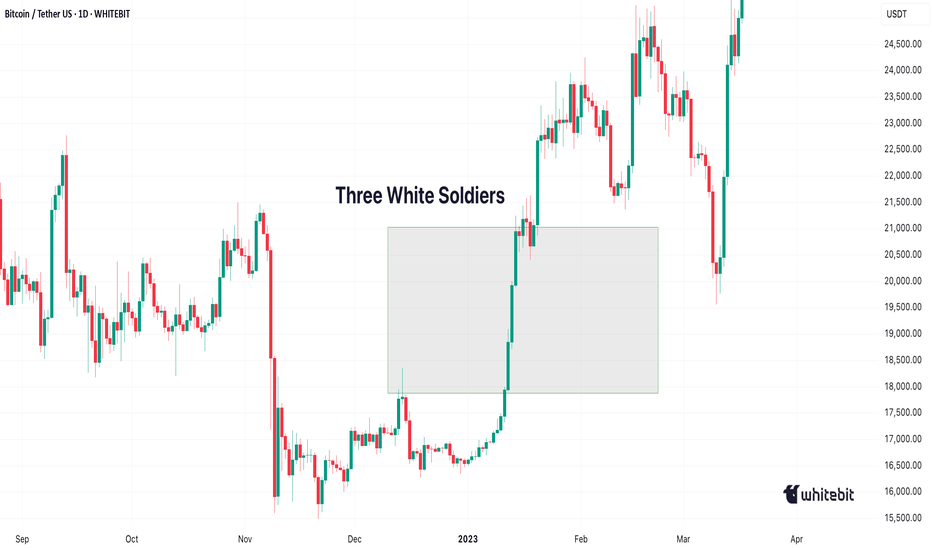

Three White Soldiers & Three Black CrowsHello, Traders! 😎

In technical analysis, not all candlestick patterns are created equal. While some merely hint at indecision or short-term corrections, others shout with conviction: "Trend reversal is coming…" Two of the most powerful momentum candlestick formations are the Three White Soldiers and the Three Black Crows. When they appear, traders PAY ATTENTION. In this article, we’ll dive deep into: What do these patterns look like? Why do they form? What do they tell us about market psychology? How to trade them?+ Their limitations 👇🏻

What Are Three White Soldiers and Three Black Crows?

These Are Multi-Candle Reversal Patterns That Suggest A Strong Shift In Market Sentiment:

Three White Soldiers. A 🐂bullish reversal pattern that occurs after a downtrend. It consists of three consecutive long-bodied green (or white) candles, each closing higher than the last, and ideally opening within the previous candle’s real body.

Three Black Crows. A 🐻bearish reversal pattern that shows up after an uptrend. It’s made of three consecutive long-bodied red (or black) candles, each closing lower than the last and opening within the previous candle’s real body. They signal not just a change in price, but a shift in power, from sellers to buyers (or vice versa).

Candles With a Message

Unlike most one-candle signals or minor patterns, these sequences tell a real story. They show that one side has taken clear control over the market — not for an hour, not for a single day, but for multiple sessions. And that kind of shift, especially on higher timeframes like daily or weekly charts, is something seasoned traders pay close attention to.

Let’s get into the psychology for a second. Imagine you’re a trader who just watched BTC drop for two weeks. Then out of nowhere, three strong green candles appear, each more bullish than the last. You’re seeing buyers push through resistance levels like they don’t even exist. That’s not just a bounce, that’s confidence. That’s the kind of thing that makes people FOMO back in, or finally close out their shorts. Same with the Black Crows. If the price has been climbing and suddenly sellers start hammering it for three days straight? That’s not retail panic. That’s big money exiting.

Now, How do Traders Trade Them?

Well, a lot of people jump in right after the third candle closes. If you’re going long on the Three White Soldiers, you’re betting that the breakout has legs. Same for shorting the Black Crows.

But, and here’s the trap, not all of these patterns play out. Sometimes, that third candle is the climax, not the beginning. So confirmation matters. Volume should increase. The move should break a recent key level. Indicators like RSI or MACD should support the shift. Otherwise, you might just be catching the end of a move, not the start of one.

Another mistake? Ignoring context. These patterns mean nothing if they’re forming in the middle of chop or during low-volume holiday trading. They work best when they signal the end of exhaustion.

And let’s be honest. Even if the pattern is clean, you still need a plan. Stops should go below the first green candle (for bullish setups) or above the first red one (for bearish setups). If price moves against you, it means momentum never really shifted. That’s your cue to get out fast.

Final Thoughts

Three White Soldiers and Three Black Crows are powerful tools in the hands of a patient trader. Of course, these patterns aren’t perfect. They don’t account for time, so a 3-day move might seem powerful, but if it happens slowly over 12-hour candles, it’s not as strong as the same pattern on a daily chart with volume.

The takeaway? These are patterns worth knowing, not because they’re magic, but because they reflect a real shift in market behavior. When Three White Soldiers or Three Black Crows show up in the right place, at the right time, with the right confirmation… that’s when charts stop being random and start making sense. But remember. They are indicators, not guarantees. The best traders use them in conjunction with other tools and a clear trading plan.

Quick Bitcoin Analysis – 30-Minute TimeframeQuick Hey friends 👋

Bitcoin was recently moving inside a weak upward channel on the 30-minute chart. But now, it has broken below the channel with a strong bearish candle. This suggests we’re entering a short-term correction.

🔹 However, don’t forget — the overall trend is still bullish.

This drop looks more like a healthy pullback, not the start of a full downtrend.

🎯 Possible Targets for This Correction:

✅ Target 1: Around $114,500

(This comes from measuring the width of the broken channel.)

✅ Target 2: Strong support near $113,500

(This level has shown solid buyer interest in the past.)

📊 The RSI is also approaching the oversold zone, which means we might see a small bounce or slowdown in the drop soon.

📌 In short:

This is likely just a dip in a bigger uptrend. Be patient, watch key support zones, and don’t rush into trades.

Always stick to proper risk management! 💼

Bitcoin Analysis – 30-Minute Timeframe

3 Bitcoin Tops, Weak Green Candles, and What’s Next? If you're closely monitoring the Bitcoin (BTC) market, patterns often begin to reveal themselves in surprising ways. In the attached chart, I’ve highlighted three major local tops that Bitcoin has made, each marked by a weak green daily candle. What’s even more striking is what comes next: a dramatic increase in trading volume, followed by steep corrections.

Spotting the Pattern: Weak Green, Heavy Volume

At each pointed top (see red arrows), BTC formed an all-time high (ATH) with a relatively weak green candle, hardly the sign of euphoric buying strength.

Look closely at the volume bars below (blue arrows). Each time, as price struggled to push higher, volume surged after the top, often a signal of major sellers stepping in or longs closing en masse.

What followed? Significant corrections: -13.6%, -29.2%, and, now it might be shaping up for another potential drop (-24.1%) if history rhymes.

Why Does This Matter?

From a technical analysis perspective, volume is the fuel behind price moves. When a new high is reached with limp buying (weak green candles) but is swiftly met with rising volume on the way down, it’s a classic sign of distribution, a strong hand selling into retail euphoria.

Is Another Drop Coming?

Given the consistency in behavior, it’s not unreasonable to ask: are we about to witness another similar correction now that BTC has again hit a top with a weak green candle and volume is ticking up? The historical evidence certainly makes it plausible.

Long-Term Perspective: Still Bullish

Despite these corrections, my long-term outlook remains bullish. Every cycle has corrections, they’re opportunities for healthy consolidation, allowing strong hands to accumulate and the market to reset for its next leg higher.

*not investment advice

#crypto #btc #bitcoin #finance #trading

BTC - HOOOLLDDD!!!!Looks like we got our downside first.

Short update, but important level to watch is that 112k high from May this year. I longed on a ltf low hold, looking for a bounce into the highs of this sell-off cluster, then see what's what.

Flow is still very heavy; I expect to get stopped on this but it's one of those setups I just have to take, or I kick myself tomorrow.

BTCUSD As I prepare for the continuation of the weekly Bitcoin bullish trend, I foresee a potential price retracement down to the 109k zone. This dip could offer a valuable opportunity for a robust bullish continuation, setting the stage for upward momentum in the market. The anticipation of this movement encourages a strategic approach, as we watch for signs of strength and confirmation in buying pressure. I'm preparing to capitalize on the ongoing weekly bullish trend in Bitcoin. I anticipate a price retracing to 109k zone, which could provide a strong opportunity for bullish continuation

Make or Break. This next move is a big deal for me personallyTo stand behind the AI I have gone all in on this next move

Many things can go wrong, including a wick that liquidates my position, me getting in too soon or perhaps the AI did as well as it could until now, but did not get the next move correct.

Whatever happens, I'm all in. (this is not to say you should do the same, its to say I believe in my craft and am backing it with massive action).

Lets see what the Bitcoin Gods have in stall