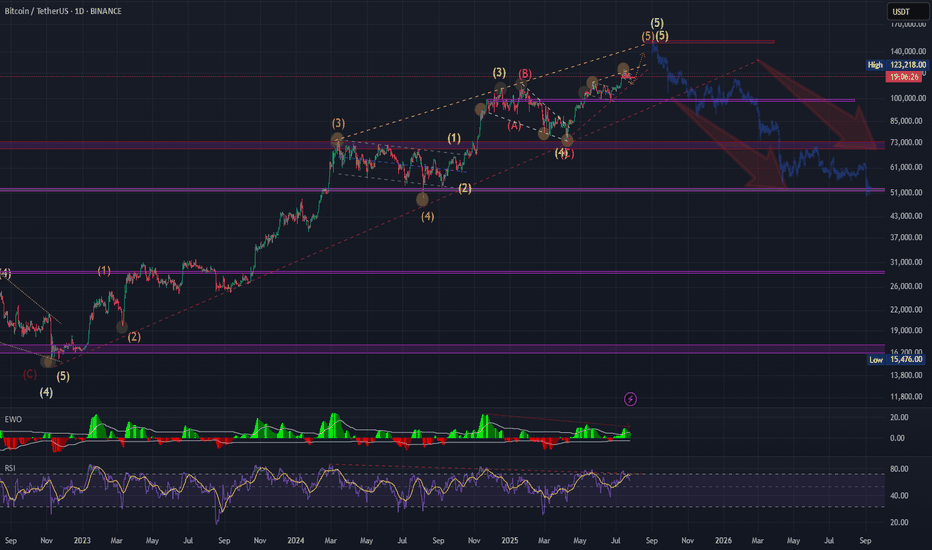

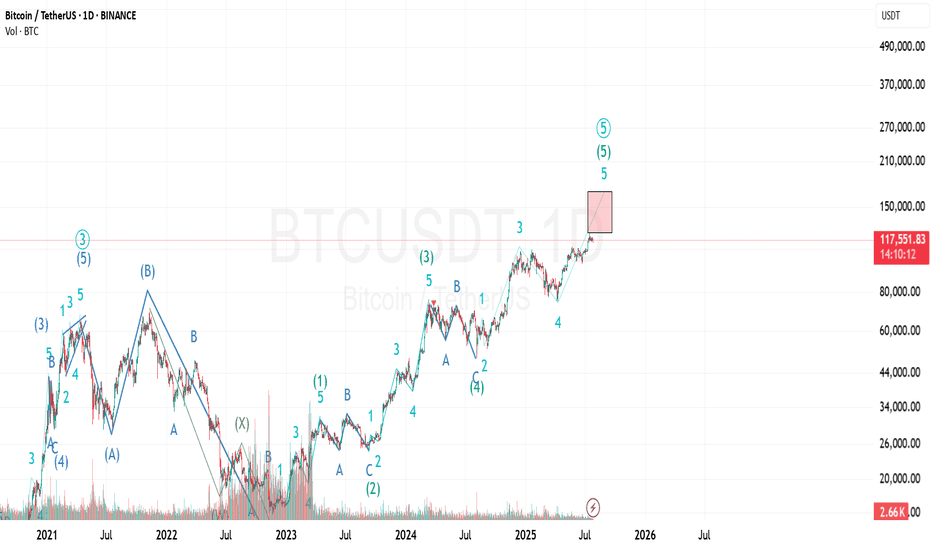

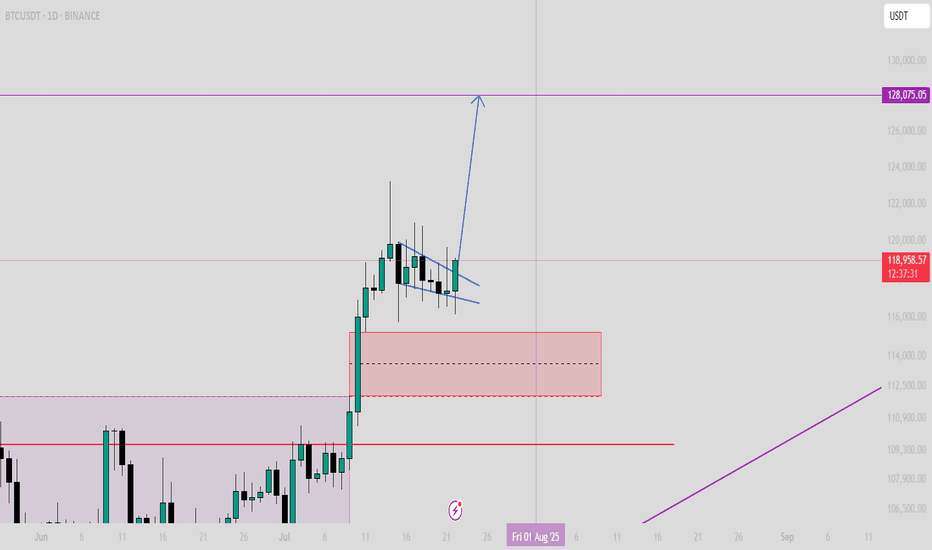

2 Scenarios for BTCNow that the cup and handle formation has been reached and the correction finished, I think we have 1 more leg up.

It's also possible that we fall from here, but I think another fakeout upwards is likely as bearish divergence forms on the month, but isn't quite there yet (RSI needs 1 more higher high to confirm bearish divergence)

Either way, my short targets are the 0.618 fibs. I am expecting the typical -70-75% crash by 2027 before the next cycle begins

BTCUST trade ideas

The Curtain Falls on the Script: Why I Believe It's Time to StopHello everyone, this is EC.

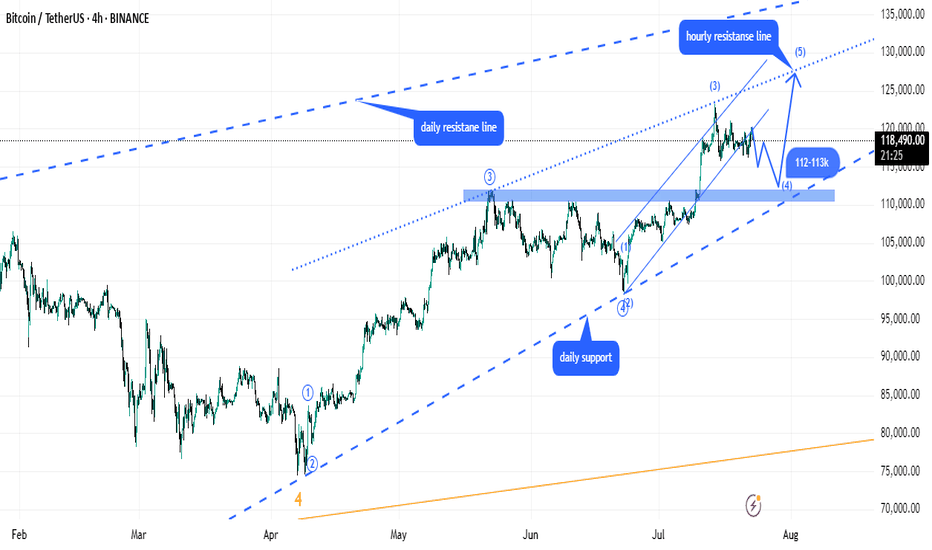

From late June through July, we experienced a full-fledged primary uptrend in crypto, driven by a weakening U.S. Dollar. From the script preview to the execution of the plan, every step has been clearly documented.

However, today, I want to share a different, more cautious perspective: I believe this script may be nearing its end.

I. Reviewing the Script and the "Bubble's" Manifestation

After our call on July 4th that the "main bull wave" was starting, the market perfectly delivered on our expectations. What was more interesting was the clear internal divergence we saw, which precisely confirms our thesis about the "bubble phase" from my June 20th article, "The Restlessness Before the Storm."

When the market's sentiment "balloon" is inflated to its limit, capital flows from the leader (BTC) to assets with higher elasticity (ETH).

The data shows that from July 11th until now, ETH took the baton and rallied approximately 35%, while BTC gained only around 6% in the same period. When BTC is already showing signs of fatigue while ETH is still in a solo rally, that in itself is a major signal that the bubble is nearing its end.

II. A Shift in the Winds: The Hand Inflating the Balloon is Loosening

I've chosen to end this script at this moment based on signal changes on two levels:

The "External Factor" Shift: The Potential Strengthening of the USD

As I pointed out in my July 28th analysis, "The Market's Rebalancing," the market has entered a phase of "strength-weakness divergence." This trend is now becoming more evident: the U.S. Dollar, cushioned by the extreme weakness of currencies like the Japanese Yen, has begun to show signs of a broad strengthening. Concurrently, U.S. and European stock markets are pulling back in sync, and global risk appetite is cooling.

The external environment that fueled the bubble (a weak USD) is beginning to falter.

The "Internal Factor" Signal: The Needle Point Inside the Balloon

The crypto market itself is also showing warning signs of resistance (see attached ETH daily chart). When the leading asset, ETH, begins to show signs of stagnation and distribution at its highs, it's like the balloon meeting the needle point. The exhaustion of internal momentum is a more direct warning than changes in the external environment.

III. Conclusion: Don't Be Greedy for the Last Dessert

When the core logic driving the rally (a weak USD) begins to waver, and the market simultaneously shows internal signs of exhaustion, my choice is to end this script and take profits off the table.

This doesn't mean I think crypto will crash immediately. But "no longer suitable to hold" implies that, in my view, the risk/reward ratio at the current level is no longer attractive. A grand feast is coming to an end, and being greedy for the last dessert is not a wise move. Shifting from "buying the dip" to "cautious observation" is the rational choice.

Thank you for your attention and for following along this past month.

#Crypto #BTC #ETH #TradingView #MarketAnalysis #RiskManagement

BTC, ETH & Indexes daily analyze 🚀🔥 BTC, ETH & Indexes daily🔥🚀

💎 Daily Market Routine, Structure-Based Crypto Analysis & Watchlist Insights

💥 Like – Follow – Comment to keep this momentum alive!

👋 Hey everyone! Welcome to our daily crypto trading routine:

📅 Daily:

🔹 BTC & ETH analysis

🔹 Full market structure review (TOTAL, BTC.D, USDT.D…)

📅 Weekly (Every Sunday):

🔸 Top 10 Altcoins Analysis (excluding BTC & ETH)

🔸 🆕 Coming soon: Weekly Watchlist Picks!

💛 Your likes, follows, and comments give me the motivation to continue this journey and share deeper insights!

🟡 Methodology

💠 Long-Term Cycle (HWC): 1D timeframe

💠 Mid-Term Cycle (MWC): 4H timeframe

💠 Short-Term Cycle (LWC): 1H timeframe

💠 Market structure review:

TOTAL / TOTAL2 / TOTAL3 / BTC.D / USDT.D

💠 Technical approach: Dow Theory

💠 Fundamental events + news tracking

🔥 Today Could Be the Most Important Day of the Week!

📢 The Fed’s interest rate decision is expected today. Market consensus leans toward no change, but Powell’s press conference could trigger major volatility.

📈 If BTC starts a bullish trend in the coming days, ETH, BNB, and AVAX are likely to outperform – and this probability is high.

♦️ BTC/USDT – Market Still Ranging

💎 Bulls have failed to break above 120,000, but bears also haven't broken below the critical 115,000 zone.

📊 This two-week range is not surprising – it's likely a time correction, consolidation, or even distribution phase.

🚀 If 120K breaks with strong momentum and volume, price may rally to 123K → 135K → 150K.

❗ If 115K breaks, expect a drop to 110K → 100K.

⭕ Breakouts need strong candles and volume – otherwise expect fakeouts.

🟡 My strategy doesn't allow shorts at this phase. I only seek bullish confirmation – though bearish signs like buying exhaustion and profit-taking near 118K exist.

📌 I’ll re-enter long on breakout above 120K, using buy stops and proper risk control. Even if it hits my stop-loss later, I’m okay with that.

🔥 BTC must break 120K to unlock full altcoin rally potential.

♦️ BTC.D – Decision Time Nears

📉 Recent downtrend shows weakness, but not a bullish reversal yet.

🔸 Watch levels:

• 🟢 Break below 60.42 → Confirmed altcoin rally

• 🔴 Break above 62.17 → Likely altcoin crash

♦️ USDT.D – Position Before the Break!

🟡 We must take altcoin & BTC positions before USDT.D breaks 4.13.

⏳ A break there likely triggers a sharp upward move in alts.

• 🔹 Pullback to 4.64 = still bullish for alts

• 🔹 Current key zones:

• 4.44: Not tested yet

• 4.13: Likely to be retested

♦️ TOTAL Market Cap

💎 Break above 3.91T → Bullish confirmation – be in the market!

♦️ TOTAL2 (Altcoin Market Cap)

🟡 Major resistance ahead: 1.54T

♦️ TOTAL3 (Altcoin Market w/o BTC & ETH)

🟡 Important level: 1.08T

♦️ ETH/USDT – Institutions Are Accumulating!

💼 Institutional buying continues – a strong bullish signal.

💎 Buyers are trying to flip 3750 into support. Heavy order blocks detected.

📌 Key Level: 3900

• 🔹 Break & hold above = Easy ride toward 4000+

• 🔻 Bearish view: Break below 3750 = Drop to 3500–3600

🟡 Recent demand spike and fresh capital inflow = bullish sentiment

♦️ Strategic Outlook

1️⃣ Still focused on long setups

2️⃣ If BTC breaks 120K and ETH breaks 4K then ranges → and BTC.D drops = 🎉 Altcoin Party!

3️⃣ If BTC fails to break 120.3K, we won’t get a strong rally

4️⃣ If BTC keeps ranging and BTC.D keeps dropping → alts will gain, but not full bull run yet

💬 Drop your thoughts in the comments below!

🚀 Smash that ROCKET, hit LIKE, and don’t forget to FOLLOW for daily setups!

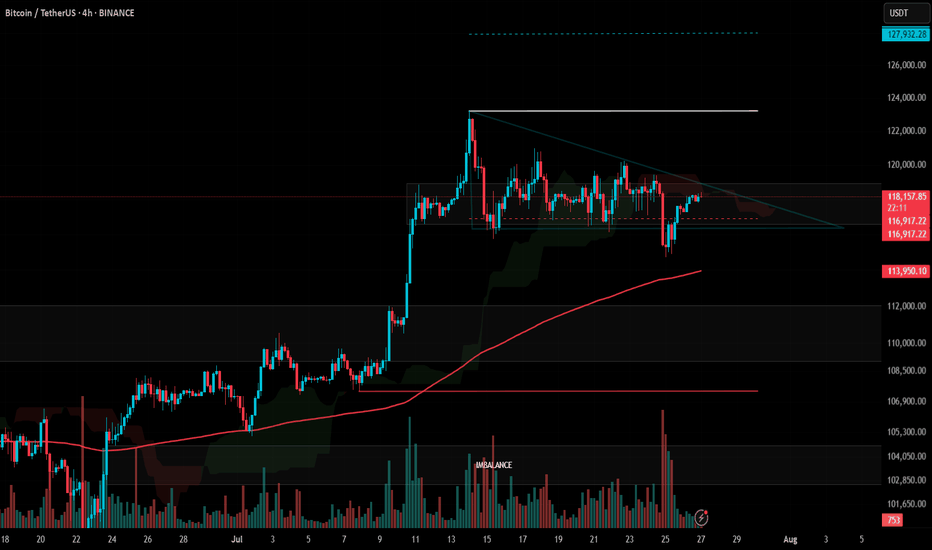

#BTC Update #10 – July 27, 2025#BTC Update #10 – July 27, 2025

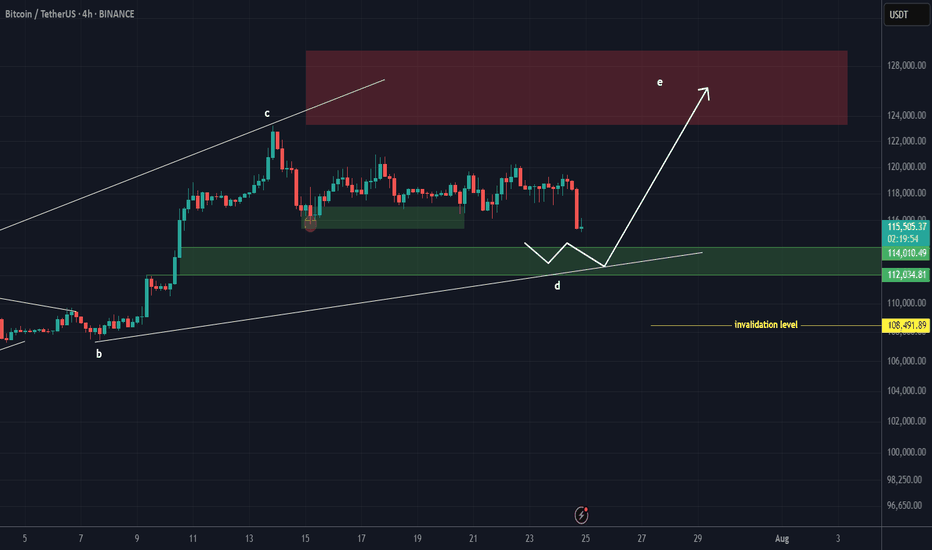

Bitcoin continues to move between $116,400 and $118,900, and staying within this range is actually a positive sign, even in bearish scenarios. A decisive close below $114,000, however, could open the door for a deeper and more prolonged correction.

Although BTC hasn’t broken to new highs yet, its ability to hold here means the trend isn’t broken. A strong breakout above $118,900 could lead to a rally toward $123,300 and possibly even $128,000.

🔹 On the 4H chart, BTC seems to have completed its minor correction.

🔹 On the daily chart, the correction remains incomplete – despite dipping to $114,700, the key $112,900 zone hasn’t been tested.

In lower timeframes, BTC remains squeezed within a symmetrical triangle. While it occasionally pokes out, it quickly returns inside — showing indecision.

📌 Direction is unclear at the moment. There’s no strong signal for Long or Short. Waiting for confirmation with volume and a clear breakout is the safer play.

Structural and Technical Analysis of Crypto + BTC + Altcoins + TStructural and Technical Analysis of Crypto + BTC + Altcoins + Totals + Dominance

🔔 Follow me & smash that rocket 🚀 if you find this useful! Let's ride the next wave together!

🕒 Timeframe: 4H

🧠 Strategy: Customized Dow Theory + Structural

---

🟡 A critical moment for the market:

Many coins, including top 10 alts, are currently sitting on major key levels. Yes, you can go long — but only IF volume supports the move.

📈 That means we must keep an eye on:

TOTAL, TOTAL2, TOTAL3

BTC.D, USDT.D

---

💎 Bullish Trigger Conditions:

✅ BTC.D must show strong red candles (dominance falling)

✅ USDT.D must break below 4.22-4.23 (money flowing out of stablecoins)

✅ TOTAL must break 3.85T

✅ TOTAL2 must break 1.48T

✅ TOTAL3 must break 1.05T

🔴 If all these confirm, it could be a great trigger to enter alt positions.

---

🔍 BTC Outlook

As previously mentioned:

🟥 If sellers want BTC below $115K, they need to break it fast and sharp — slow breakdowns won’t work due to buyer activity.

🟨 Bullish trend requires a break above $120K.

📊 Most likely scenario? Ranging between $115K - $120K

⚠️ BTC Dominance plays a key role here. If dominance drops while BTC ranges, alts could explode.

---

💸 USDT.D Critical Level:

A clean breakdown of 4.23 on USDT.D = 🚀 Funds rotating into alts

---

✅ Coins To Watch (Long Setup Only IF Above Conditions Hold):

♦️BNB

enter:741.00

Sl: 786.13

♦️ETH

enter:3750

Sl: 3480

♦️SUI

enter:4.10

Sl:3.40

♦️XRP

enter:3.25

Sl:2.92

♦️LINK

enter: 18.60

Sl: 17.4

♦️AAVE

enter:295

Sl:276

♦️ADA

enter:0.8405

Sl: 0.7628

♦️SOL

enter: 192.40

Sl:177

♦️DOGE

enter:0.249

Sl:0.220

🔁 Note: First SUI trigger was 3.80 — next key level is 4.10.

---

⚠️ Important Notes:

Today is Saturday, expect low volume

Manage risk ⚠️ and avoid aggressive Martingale strategies

High chance of fake breakouts

Levels being tested might just be lower highs in a bearish structure

❗️Even for bearish continuation, volume increase is key

---

🟢 If you liked this post, don’t forget to Follow & Hit the 🚀 Rocket to stay updated on live setups and strategic insights!

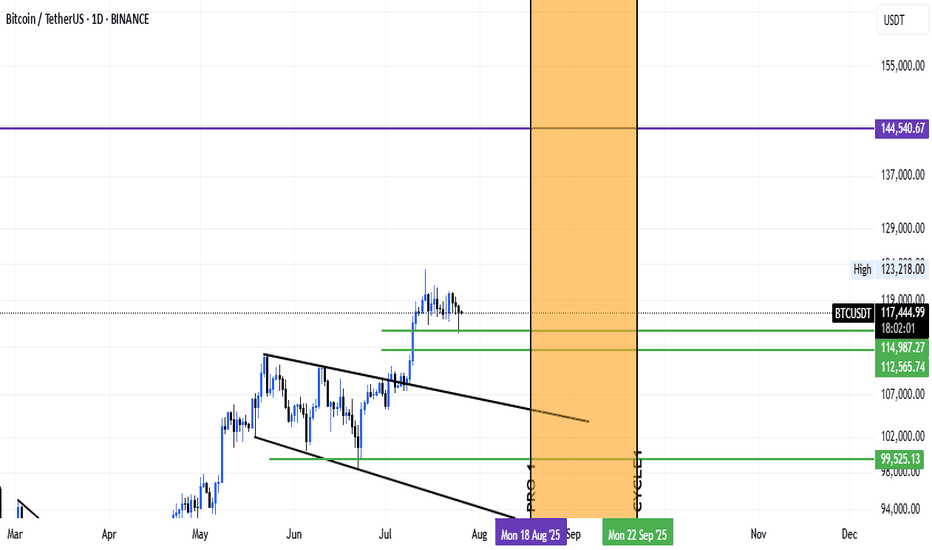

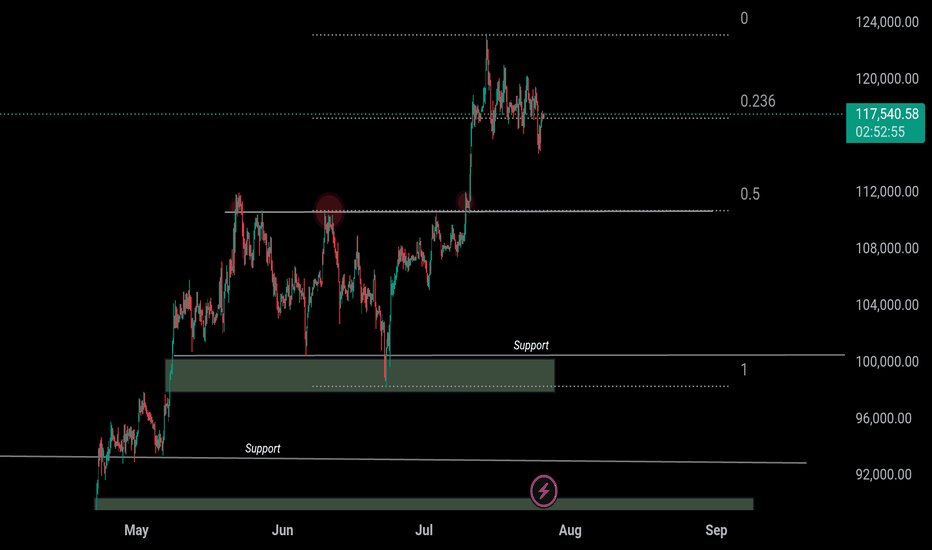

BTCUSDTAccording to previous analysis and its short-term target, Bitcoin has made a correction, and the correction areas, namely $114,000 and $112,000, were the important support areas it saw. However, considering the time, it can be said that the next Bitcoin ceiling will be reached in the period from August 18 to September 22, approximately 35 days.This is a medium-term timeframe on a weekly basis and Bitcoin is expected to reach $144,000 to $148,000 in price. Good luck and be victorious.

BTC should have one more leg upAccording to Elliot waves BTC should have one more impulse leg up to complete final wave of this cycle. Both daily and weekly RSI charts show bearish divergence, suggesting momentum is weakening even as price attempts to climb. A drop below $110000 would invalidate the current wave count and suggest a shift in market structure.

. Need to watch out reactions at target levels 136-150.

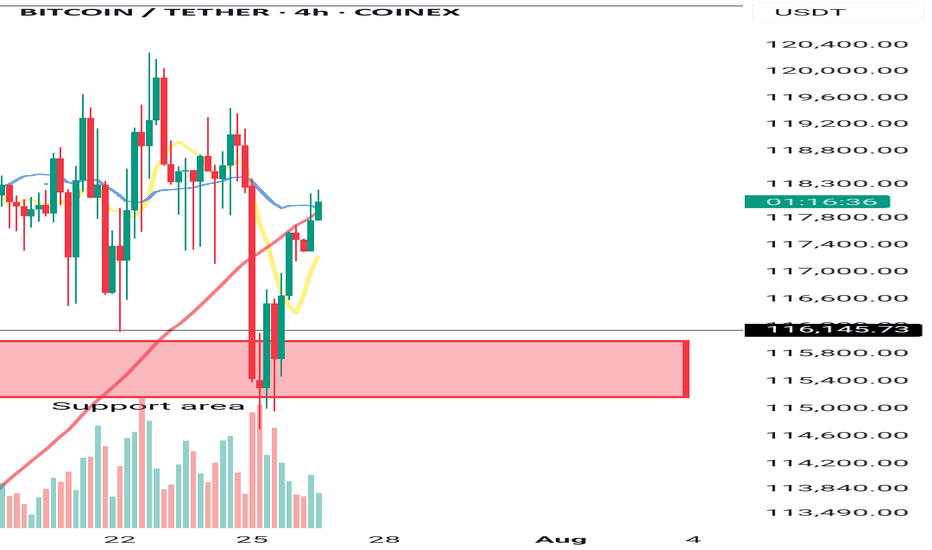

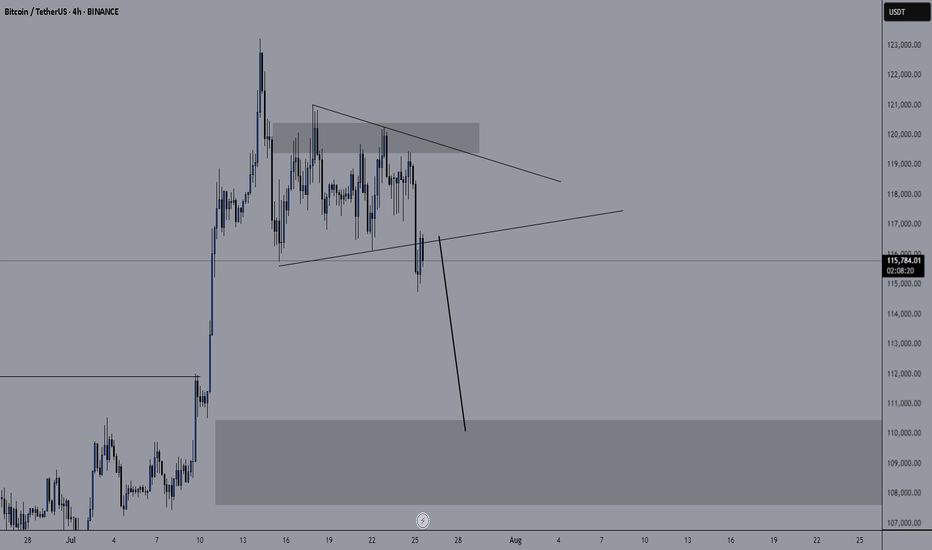

BTC New Upodate (4H)This analysis is an update of the analysis you see in the "Related publications" section

We previously stated that Bitcoin lacks the strength to move upward, and we expect the price to soon reach the green zone (114K-112K).

The price is now dropping toward this zone, which is the rebuy area.

The process of reaching the green zone has been and still is somewhat time-consuming, and during this time, it may repeatedly mislead beginners.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

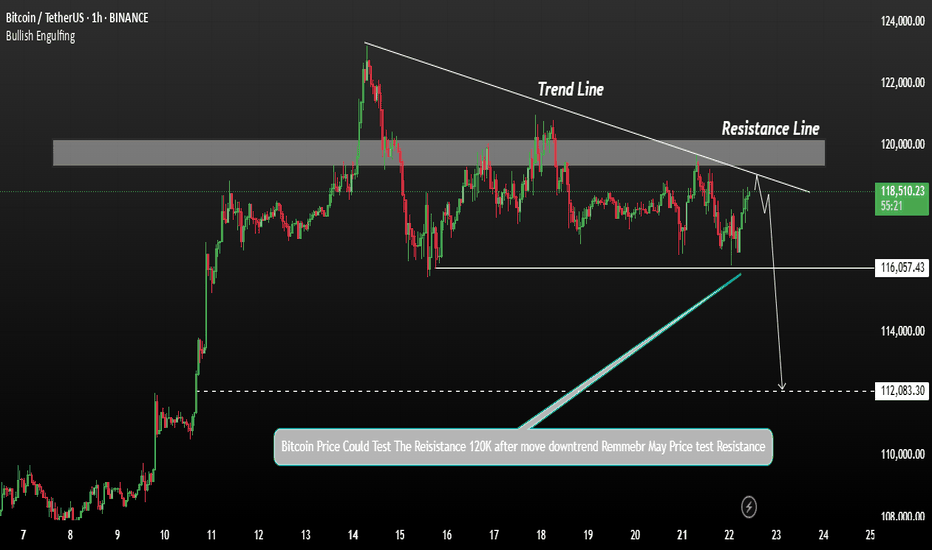

Bitcoin shows signs of a potential declineBitcoin's price shows signs of a potential decline after testing resistance levels. A correction at this stage is generally a healthy sign for the market, allowing for consolidation before any strong upward move.

Bitcoin may test the resistance line after the current decline. If the price falls below 118,000, there is interim support, but further downside may be expected. 116K and 112K A break below 112,000 could open the door for deeper bearish momentum.

You May find more details in the chart.

Trade wisely best of Luck.

Ps Support with like and comments for better analysis Thanks for Supporting.

BTC 110k or 150k ??𝗪𝗶𝗹𝗹 CRYPTOCAP:BTC 𝗕𝗼𝘂𝗻𝗰𝗲 𝗮𝘁 $𝟭𝟭𝟬𝗞 𝗼𝗿 𝗖𝗿𝗮𝘀𝗵 𝗕𝗲𝗹𝗼𝘄 $𝟭𝟬𝟬𝗞? ‼️‼️

Breakout rallied from $110,500 → $123,293

Now pulling back toward 0.5 Fib retracement $110K

Retest Scenario:

– Hold above $110K = Bullish continuation toward $150K ATH

– Breakdown below $110K = Risk of deeper correction below $100K

Drop your thoughts below — bounce or breakdown?

CRYPTOCAP:BTC

BTC Retested and Ready for the Next Leg Up?This CRYPTOCAP:BTC weekly chart shows a clean pattern of breakout → retest → rally.

The 50 EMA has been acting like a strong dynamic support throughout the uptrend, keeping the structure intact. Every time price broke out of a consolidation or resistance zone, it came back, retested it, and then continued moving higher.

Most recently, BTC broke above a key resistance, pulled back to retest it, and now it looks like the breakout has held. This is a classic bullish continuation setup, and historically, it’s led to strong follow-through moves.

As long as BTC stays above the 50 EMA and holds support, the bullish structure remains intact.

Thanks for reading! Stay sharp and trade safe.

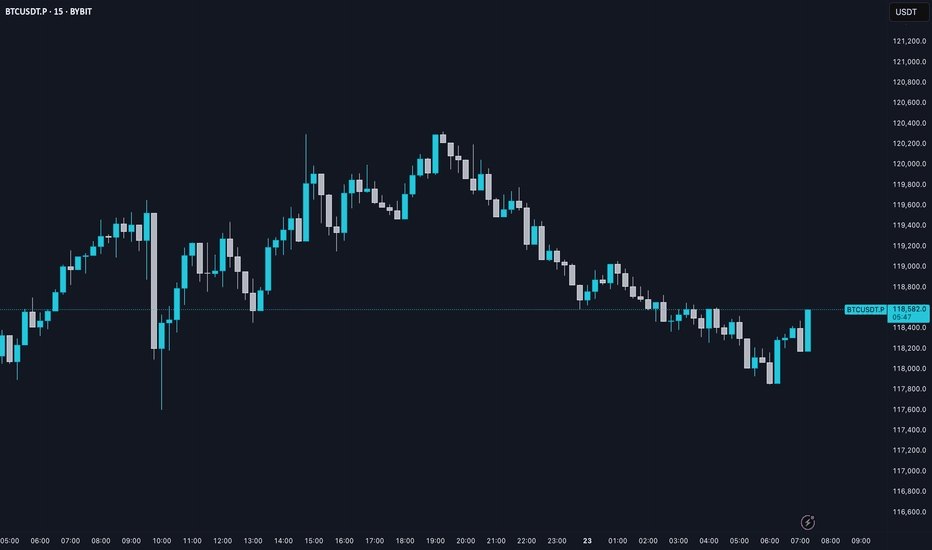

TradeCityPro | Bitcoin Daily Analysis #133👋 Welcome to TradeCity Pro!

Let's dive into the Bitcoin analysis and key crypto indexes. As usual, in this analysis, I’m going to review the triggers for the New York futures session.

⏳ 1-Hour timeframe

On the 1-hour timeframe, Bitcoin has once again dropped to the support area at 116829 and reacted to it. Currently, it is fluctuating above this level.

✨ If 119395 is broken, the price could move toward the highs at 120594 and 122733.

📈 So for a long position, we can enter on the breakout of 119395. Pay attention to Bitcoin dominance, because if it’s in a downtrend, Bitcoin setups might not be ideal, and altcoins may offer better opportunities.

✔️ If the price stabilizes below 117647, it will enter the box between 116829 and 117647, and this time the likelihood of breaking the 116829 bottom and heading toward lower supports for deeper corrections becomes very high.

👑 BTC.D Analysis

Now let’s look at Bitcoin Dominance. BTC.D is still falling and after breaking the 61.45 level, it has reached 60.46.

⭐ If this level breaks, the next bearish leg may begin. The trend is strongly bearish with no visible weakness, and we’ll have to see how long this continues.

📅 Total2 Analysis

Let’s move to Total2. This index has broken the 1.5 resistance and is moving toward 1.62.

💫 At the moment, I don’t have a trigger for it, and we need to wait until its structure gives us the next setup.

📅 USDT.D Analysis

Now let’s look at Tether Dominance. This index has stabilized below the 4.22 level and is now moving downward after a pullback to this area.

🧩 The next support is at 4.08, and the index has room to fall to that level. I still see the USDT Dominance trend as bearish for now.

BTC AI Prediction Dashboard - 6h Price Path (23.07.25)

Prediction made using Crypticorn AI Prediction Dashboard

Link in bio

BTCUSDT Forecast:

Crypticorn AI Prediction Dashboard Projects 6h Price Path (Forward-Only)

Forecast timestamp: ~11:15 UTC

Timeframe: 15m

Prediction horizon: 6 hours

Model output:

Central estimate (blue line): -118,153

Represents the AI’s best estimate of BTC’s near-term price direction.

80% confidence band (light blue): 117,892 – 118,573

The light blue zone marks the 80% confidence range — the most likely area for price to close

40% confidence band (dark blue): 117,390 – 119,187

The dark blue zone shows the narrower 40% confidence range, where price is expected to stay with higher concentration

Volume on signal bar: 85.84

This chart shows a short-term Bitcoin price forecast using AI-generated confidence zones.

Candlesticks reflect actual BTC/USDT price action in 15-minute intervals.

This helps visualize expected volatility and potential price zones in the short term.

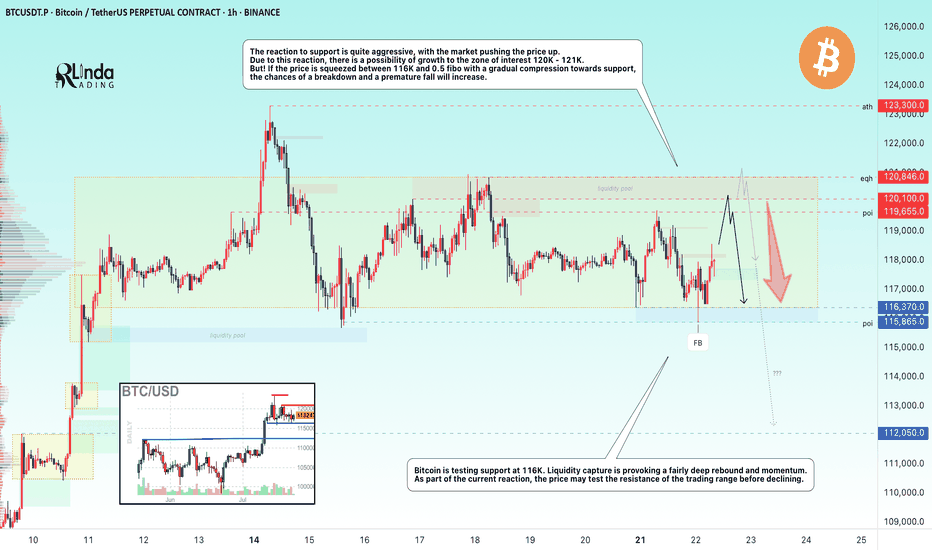

BITCOIN → Consolidation and compression to 116K. Correction?BINANCE:BTCUSDT.P continues to consolidate, with the price testing support at 116K, leaving behind the zone of interest at 120K-121K. Are there any chances for further growth?

(Alternative scenario (if growth to 120K does not occur))

Fundamentally, there is nothing particularly new, and the hype surrounding Bitcoin is stagnating. Technically, on D1, consolidation is underway with pressure from bears against the backdrop of an outflow of funds into altcoins. However, the dominance index is starting to rise, which could trigger some correction in the market. The price on the working timeframe, without updating local highs, is testing lows, and the latest retest of the liquidity zone is provoking a fairly aggressive reaction that could bring the price to retest the zone of interest at 120K-121K.

But! If the price is squeezed between 116K and 0.5 Fib with a gradual squeeze towards support, the chances of a breakdown and a premature fall will increase.

Support levels: 116370, 115860

Resistance levels: 119650, 120100

Technically, the market needs a breather or correction, which is generally a sign of health. The nuance with Bitcoin is that below 115860 there is no support until 112K, and if the market breaks the current consolidation boundary, the further correction could be quite deep. In the current situation, I do not yet see any drivers or reasons for another rally.

Best regards, R. Linda!

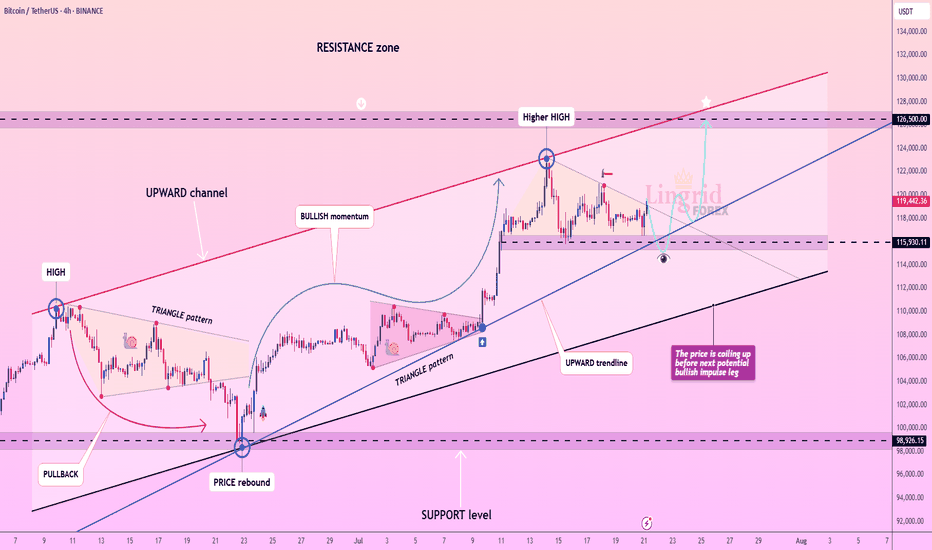

Lingrid | BTCUSDT Consolidation Expansion ScenarioBINANCE:BTCUSDT is coiling within a bullish continuation zone after rebounding strongly from the 115,930 support and holding above the blue ascending trendline. Price formed a higher high inside the rising channel, followed by sideways consolidation, suggesting preparation for another bullish leg. The triangle pattern breakout and price stability above the trendline favor upward continuation toward the resistance at 126,500. Momentum remains intact while the structure supports the next breakout push.

📉 Key Levels

Buy trigger: Break and hold above 120,000

Buy zone: 117,500–118,200

Target: 126,500

Invalidation: Close below 115,930

💡 Risks

Loss of support at the trendline

Strong rejection near red channel resistance

Weak market sentiment or macro news shocks

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!