BitcoinBitcoin/TetherUS (BTC/USDT) Trading Analysis - Jul 15, 2025

Key Observations:

Price Movement:

Current Price: $117,692.46

24h Change: -2,148.72 (-1.79%)

Range: Low of $116,250.00 to High of $119,940.83

The price is currently near the lower end of the day's range, indicating bearish pressure.

Support and Resistance:

Support Levels:

Strong Support: $112,000.00 (marked as S/L)

Intermediate Support: $113,500.00 and $110,000.00

Resistance Levels:

Immediate Resistance: $119,900.00

Higher Resistance: $120,000.00 and $122,500.00

Profit Levels:

The "Profit" section lists potential take-profit targets, with the highest at $135,000.00.

The price has recently dipped below the $120,000.00 psychological level, suggesting weakening bullish momentum.

Trend Context:

The chart spans from June to September, but the current price action (July) shows consolidation after a potential pullback from higher levels.

The presence of multiple support levels ($112K–$116K) suggests a critical zone for buyers to defend.

Actionable Insights:

Bearish Short-Term: The price is below key levels ($119,900–$120,000) and has broken below $118,250.00. A retest of support at $112,000.00 is plausible.

Bullish Reversal Signal: If BTC holds above $112,000.00 and reclaims $120,000.00, it could target $122,500.00 or higher.

Risk Management: A break below $112,000.00 (S/L) may trigger further downside toward $110,000.00 or lower.

Conclusion:

The market is currently in a corrective phase. Traders should monitor the $112,000.00 support for potential reversals or breakdowns. A close above $120,000.00 would shift bias to bullish.

BTCUST trade ideas

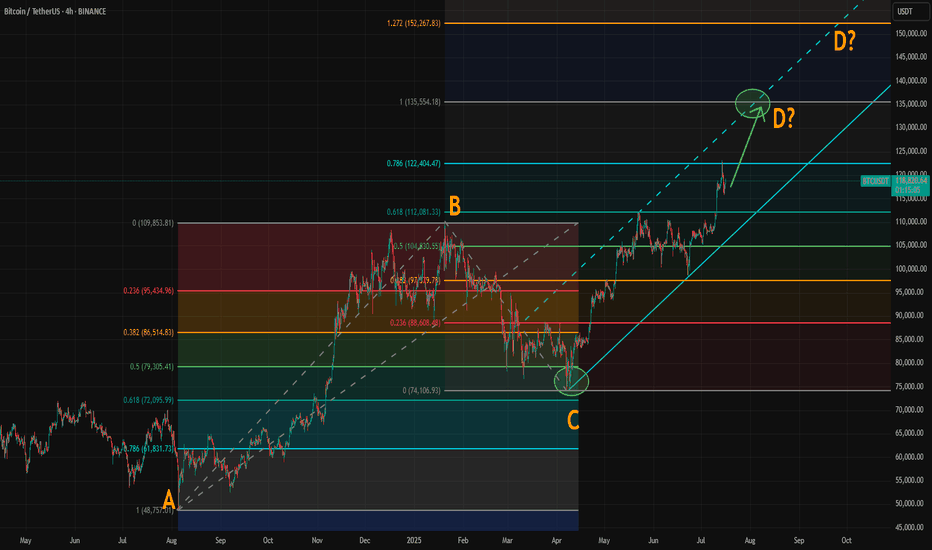

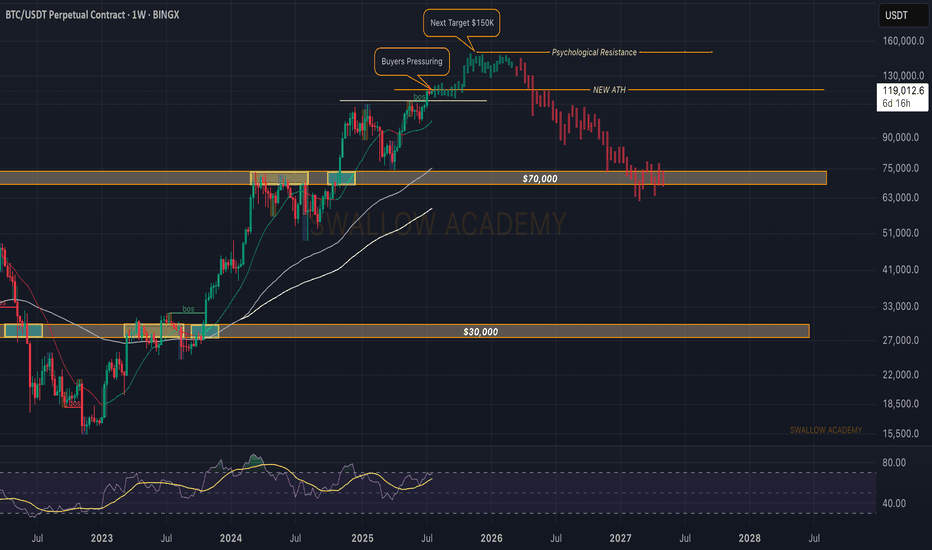

Where Could Bitcoin Make Its Cycle Top? Model and ABCD AlignedWith the breakout above resistance around 110,000, Bitcoin’s rally appears to be back on track. If you've been following our crypto analysis, either here or on our website, you’ll know our target range for this bull cycle is between 135,000 and 150,000, with the top of the range possibly extending further depending on the strength of the final wave.

Now, a possible ABCD pattern is forming, with point D potentially landing at either 135,000 or 150,000. A coincidence? Maybe, maybe not.

How Did We Arrive at the 135K–150K Target?

We based this range on historical halving cycle returns:

Halving Year - Return to Cycle Top

2012 - 9,076%

2016 - 2,122% (↓ 4.27x)

2020 - 541% (↓ 3.92x)

Two things stand out:

Each cycle has shown diminishing returns.

The rate of decline appears roughly consistent, dropping by around 4x each time—but slightly less with each cycle.

So depending on the multiplier used:

If returns fall by 4.27x again → target: 135K

If reduced by 4x → target: 140K

If reduced by 3.92x → target: 142K

If the rate of reduction itself slows (difference of 0.35 between 4.27 and 3.92) → target: 150K

While the sample size is too small, we believe the model holds reasonable logic with fundamental backing from various metrics.

The chart now shows a possible ABCD pattern:

If it becomes a classic AB = CD structure, point D could form near 135K.

If it becomes an extended ABCD (with CD = AB × 1.272), then point D could reach just above 150K.

These technical targets align closely with our halving model projections, increasing our confidence in the 135K–150K range as a likely top zone for this cycle.

Also, please check our earlier post for possible altseason start. A correlation between BTC/ETH and Gold/Silver might give some tips about possible Ether surge.

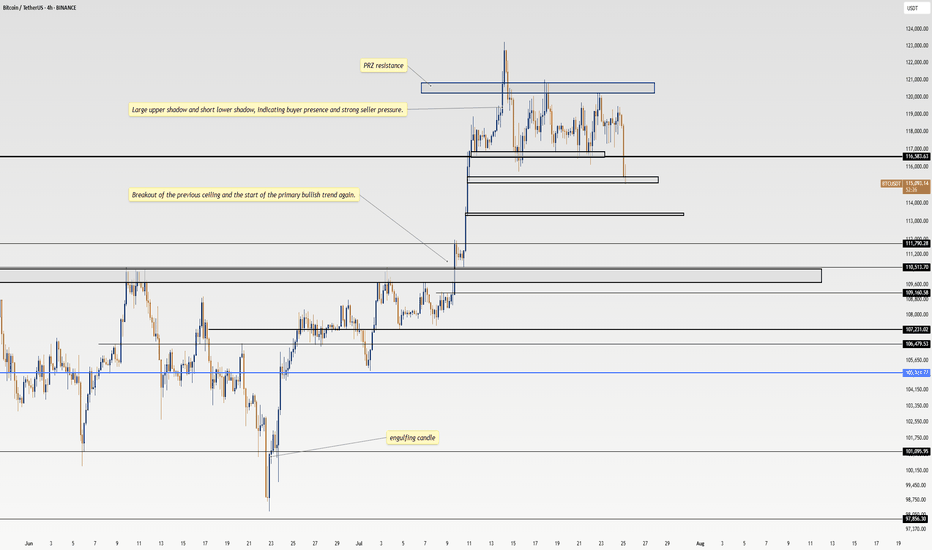

Bitcoin’s Epic Run from 80K to 120K: What’s Next for BTC?Yo traders, it’s Skeptic from Skeptic Lab! 🩵 Diving into Bitcoin’s wild ride from 80K to 120K—breaking down the key supports, resistances, and what’s next for BTC.

From the $76k bounce to smashing $110K, we’re eyeing the $120K PRZ. Will it correct or keep soaring? Check the video for the full scoop! Drop your thoughts or coin requests in the comments, boost if it vibes & Let’s grow together!

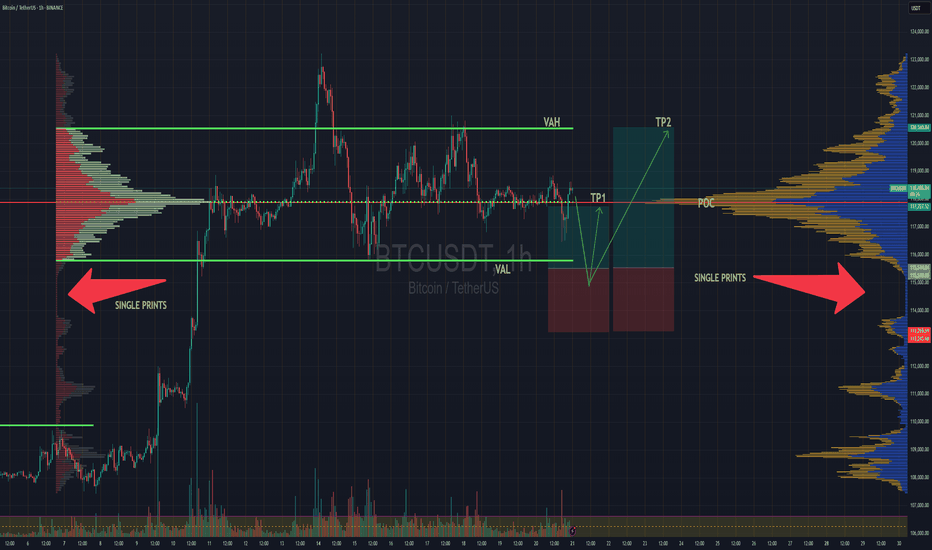

BTC Balanced Volume Profile BTC is now trading in a textbook D-Shape Volume Profile. In english - Buyers & Sellers are happy to transact here and will stay inside the value area & consolidating sideways until further notice.

Consolidation at POC is a signature of this profile, and one of the easiest and least stressful trade setups because now, your mission, should you chose to accept. Is to fade the Highs (VAH) and Lows (VAL) and avoid the middle unless you love donating money to the market.

I'll have buy limit orders waiting right below the VAL where we have the single prints. It doesn't get any easier than this.

Doesn't mean price cant rip through, but this is always the best entry with less risk, especially when the single prints have not been tested yet..

BINANCE:BTCUSD CME:MBT1!

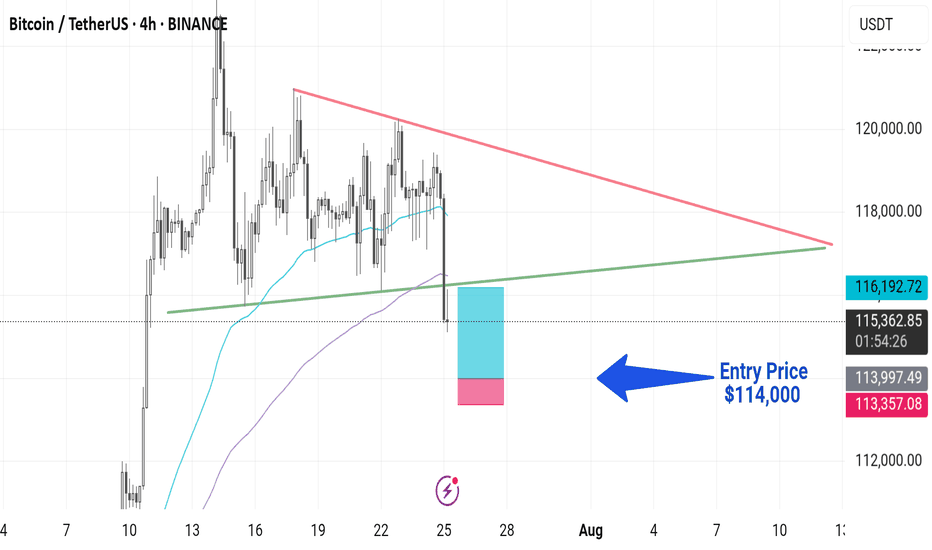

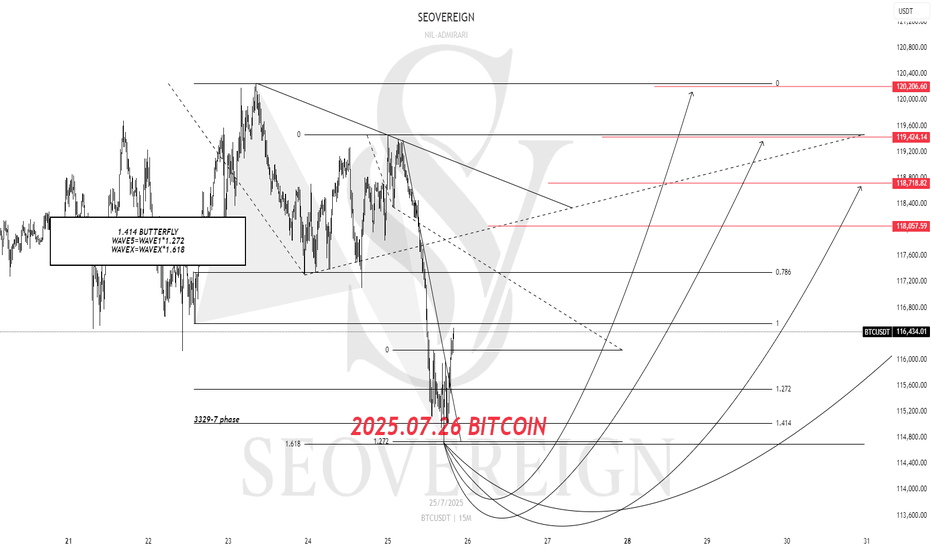

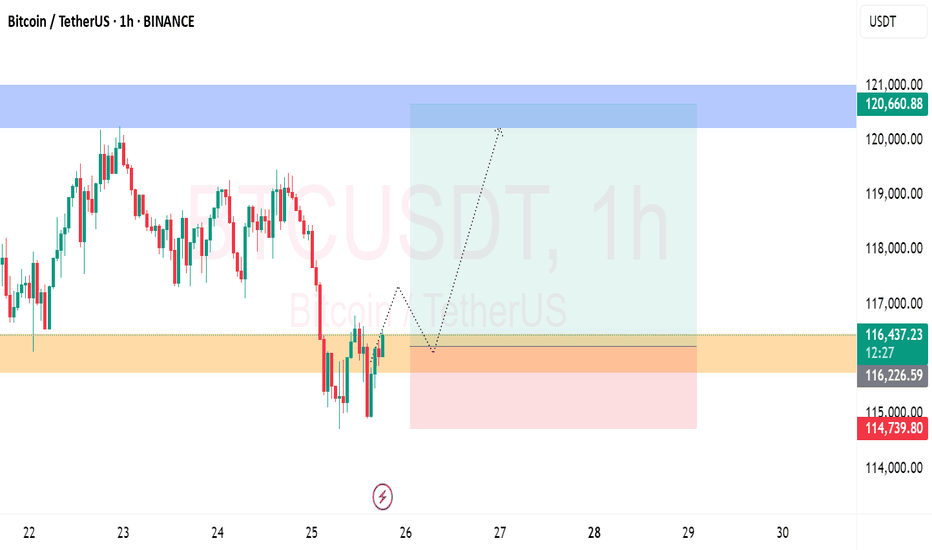

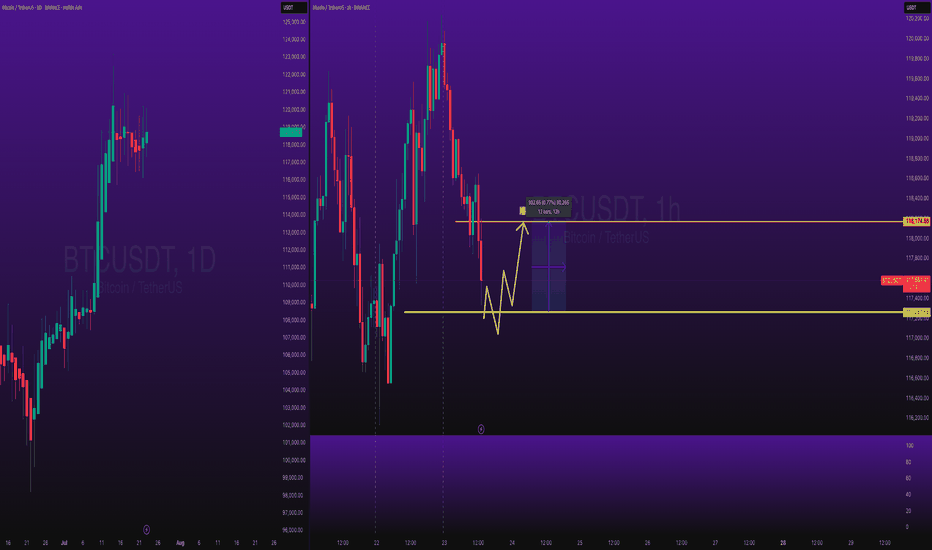

[SeoVereign] BITCOIN BULLISH Outlook – July 26, 2025The previous idea did touch the average TP price, but showed a rather disappointing rebound, so I will once again attempt to capture the starting point of the rebound. It is still considered that one more upward wave remains.

Accordingly, the TP is suggested at 118,057 USDT.

As always, I will carefully observe how the chart develops over time and update this idea with further explanations by organically integrating its specific interpretations and underlying rationale.

Thank you.

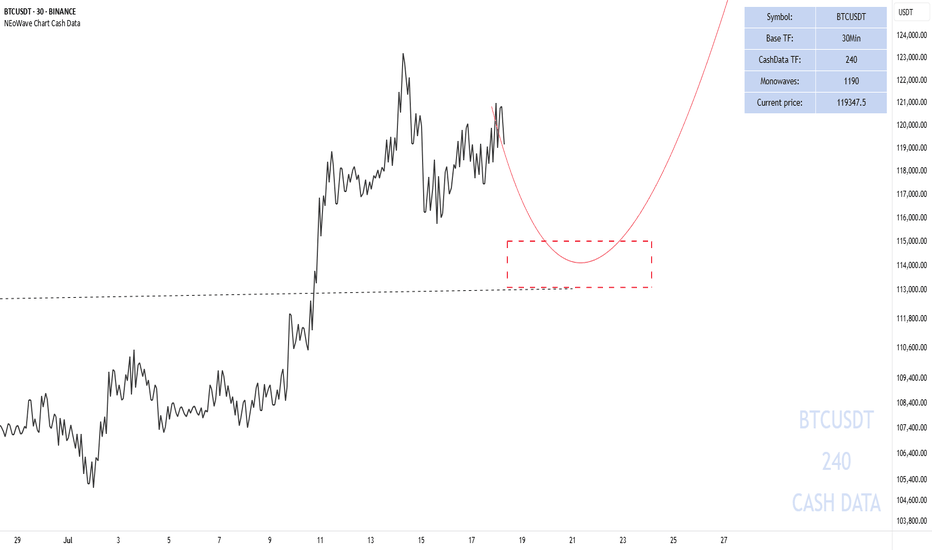

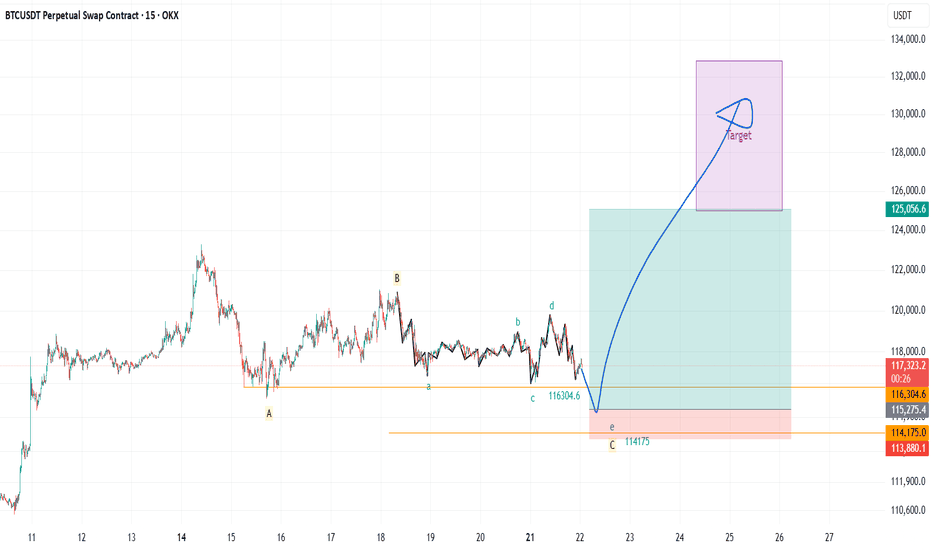

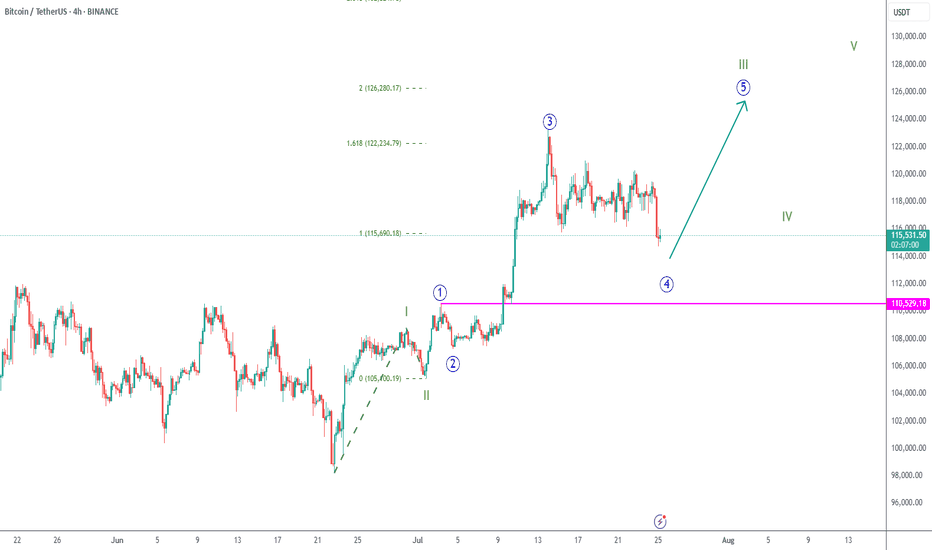

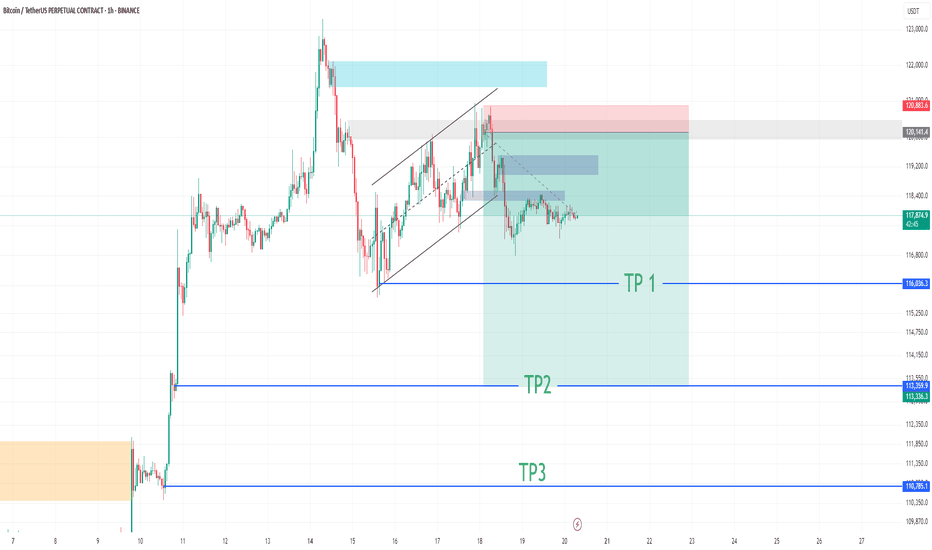

EP 01: BTC correction near completionAfter the impulse to last ATH we got a 3 wave correction, last wave being formed by 5 waves, so all together coming to completion. We should visit the liquidation area under last low and swipe that liquidity and aim closer to last ATH if not exceeding it. When the market gives us more information we will go for episode 02.

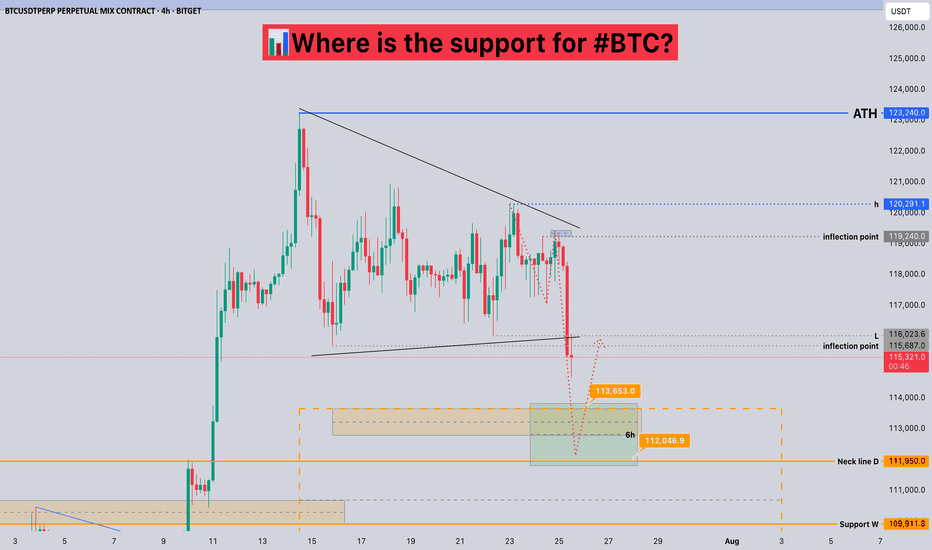

Where is the support for #BTC?📊Where is the support for #BTC?

🧠From a structural perspective, we did not stabilize after breaking through the inflection point of 119240, but broke down quickly. According to the current structure, the short-term support area is 112000-113700.

➡️From a morphological perspective, we failed to successfully break through the h point, but chose to break down, so we need to be vigilant about further pullbacks!

🤜If you like my analysis, please like 💖 and share 💬

BITGET:BTCUSDT.P

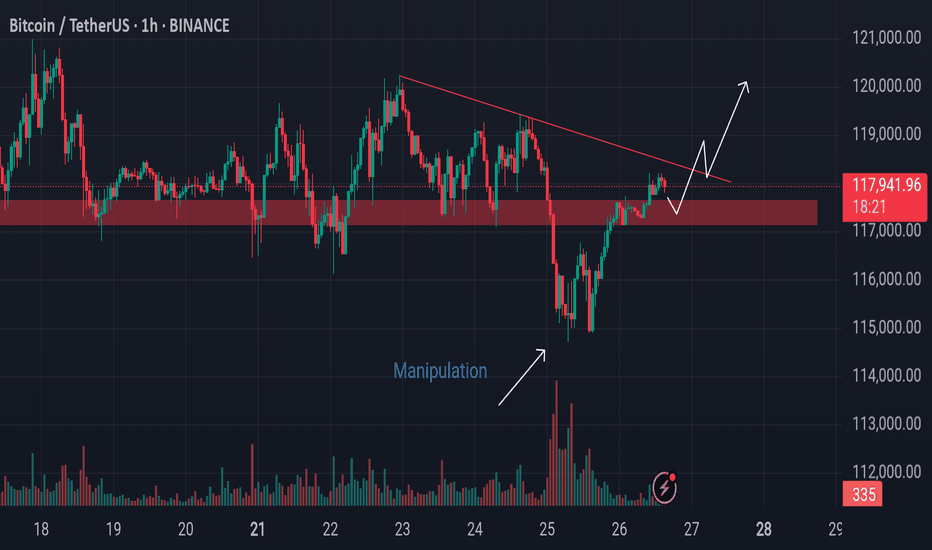

Bitcoin’s Battle at Resistance Watch These Critical Levels.Bitcoin is currently forming an AMD (Accumulation–Manipulation–Distribution) pattern.

The market recently dipped due to manipulation, only to push back up and break through a key resistance level, moving toward the inversion zone. However, it now faces additional resistance from a descending trendline.

If the market decisively breaks above this trendline and successfully retests it, there is potential for further upward movement.

Keep a close watch on these critical levels for confirmation.

Do Your Own Research (DYOR)

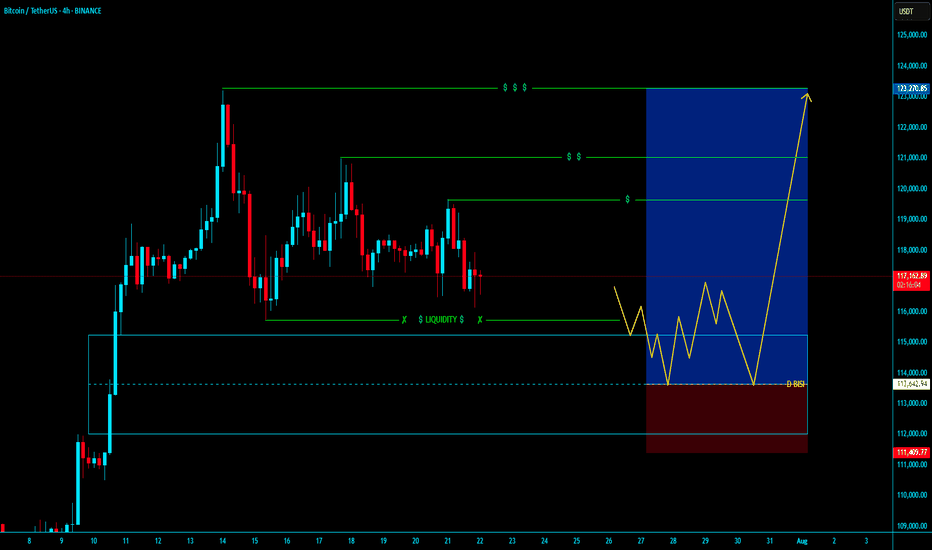

BTCUSDT BUY LONGBTCUSDT BUY LONG FROM DAILY BISI

- Market will fully Bullesh In Every TF with Bullrun with Already Starts

- In Daily TF our Long From Daily BISI

- In LTF after Valid MSS with Valid OBI and Mostly After Run On Stop

- Then our entry for Long time of Holding i think its going to over night holding and book profit Partially / Target is Nearly Liquidity pool

Hold and Enjoyyyyyyyyyyyyyy

~ KGB Priyabrta Behera ~

ICT Trader & Advance Mapping SMC Trader

The combination of the Leo New Moon and the Gann Square support Astrologically, we have two important events, the first is the new moon in Leo, which will cause a new movement in the market and give new life to the market. The second is the opposition of the Sun and Pluto, which caused a power struggle between buyers and sellers and at some point there were several stop hunts, but now it seems that the price above 118 thousand is stabilizing and could start a new rally upwards.

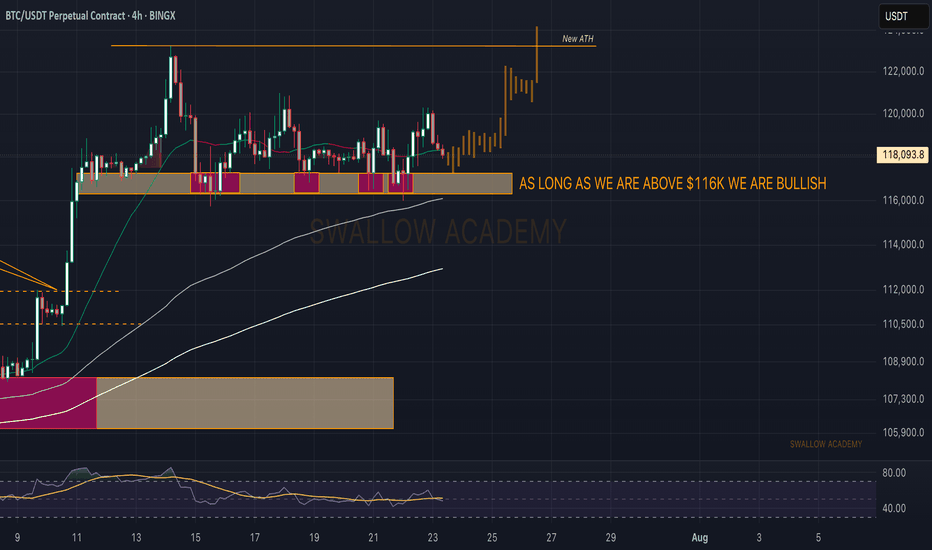

Bitcoin (BTC): as long as we are above $116K we are BULLISH!First things first, we are still above $116K, and since hitting the ATH, we have been forming a perfect zone of accumulation, which is ideal for another retest of the local high and movement to the next ATH.

What we are looking for here is maybe further movement in the sideways channel, which eventually should lead the price to ATH for a breakout attempt!

Swallow Academy

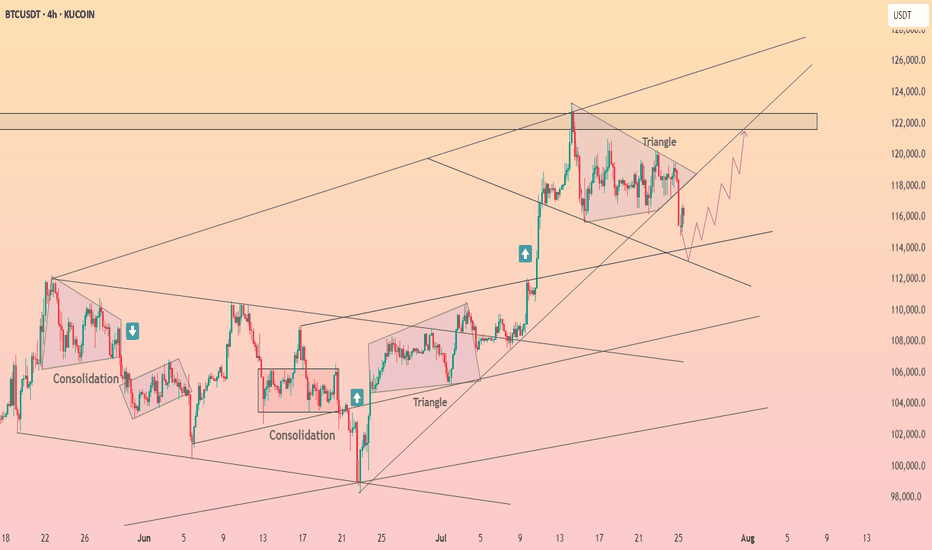

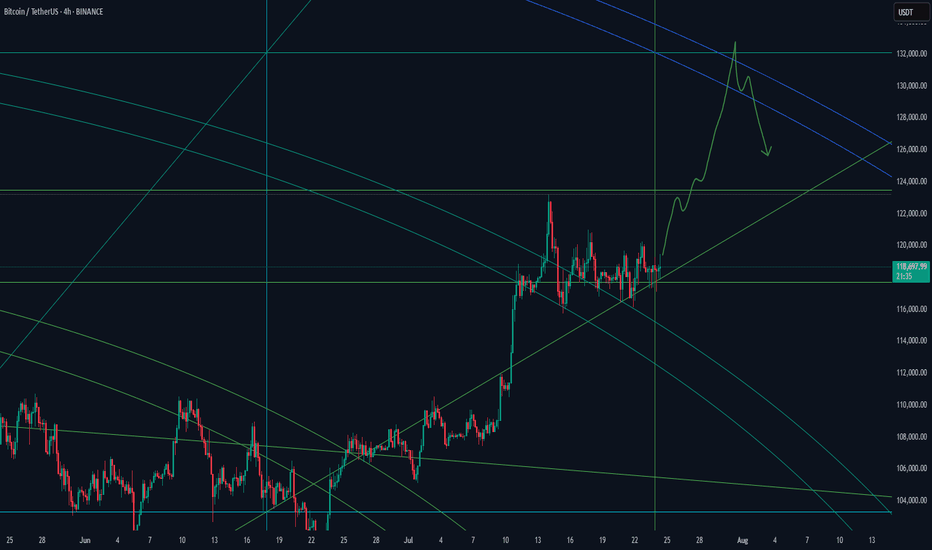

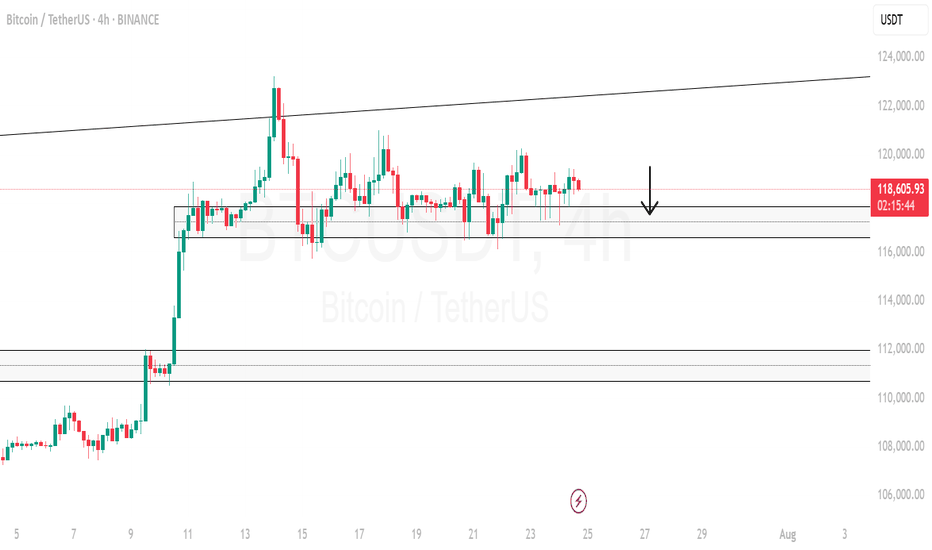

BITCOIN → Consolidation, retest of 120K. Correction of dominanceBINANCE:BTCUSDT , after a rapid rally and touching 123K, rolled back and entered consolidation, giving altcoins a chance. At the same time, Trump signed new crypto laws, but will these laws open new doors?

On June 18, the GENIUS Act was signed. Information can be found in the sources, but there is no direct reference to BINANCE:BTCUSDT.P , except perhaps indirectly: increased confidence in the crypto market, increased liquidity, possible new rules, and pressure on decentralized assets. Bitcoin has not always grown on positive news; more often it has been a deep pullback and liquidation before the momentum.

Technically, Bitcoin is currently consolidating, and I would highlight several key areas: the upper range is 120K-120.9K. The zone between these levels is particularly important, as this is where buyers were previously liquidated and sellers gathered (liquidation is possible).

The bottom is 117K (confirmed) - 116.2K. There is a liquidity pool on the support side.

additional scenario if the market does not reach resistance and decides to form a long squeeze before growth

Theoretically, I am not yet expecting a breakout and growth of Bitcoin. I think that consolidation may continue for some time, especially against the backdrop of a pullback in altcoins and a deep correction in the dominance index.

Resistance levels: 120100, 120850

Support levels: 117000, 116230

Since the opening of the session, the price has been working off the liquidity capture from 117K. There is a reaction - growth, which could bring the price to the zone of interest at 120K. But the question is: will the price hold in the 120K zone? A false breakout of resistance could trigger a correction to 117-116K. Thus, I expect the market to remain in consolidation for some time or even expand the current trading range...

Best regards, R. Linda!

BTCUSD | Long | Volume Confirmation (Jul 25, 2025)BTCUSD | Long | Breakout Momentum & Volume Confirmation (Jul 25, 2025)

1️⃣ Quick Insight:

Bitcoin is showing strong bullish momentum after breaking out of its triangle pattern with volume. The move looks set to continue, and we may see higher levels if momentum holds.

2️⃣ Trade Parameters:

Bias: Long

Stop Loss: $109k (risk-adjusted "invisible" stop)

TP1: $121k (partial take profit)

TP2: $131k (final target if momentum extends)

3️⃣ Key Notes:

Short-term, price could test $96k before reaching higher targets.

Longer-term outlook points to potential upside between $112k–$120k if structure holds.

Watching reaction closely around the $109k area as it will determine if the uptrend stays intact.

I expect the pump phase to potentially wrap up around October 20, 2025.

S&P 500 is also at key levels, and its direction could influence Bitcoin’s momentum.

💬 What are your targets for Bitcoin? 140k? 180k? 240k? Drop your thoughts below!

"Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible."

Disclaimer: This is not financial advice. Always do your own research. This content may include enhancements made using AI.

Bitcoin (BTC): Bullish Start of Week | Aiming For $150KChoppy weekends resulted in a bullish Monday. Once again, we are seeing strong buyside dominance at the start of the week, which is indicating a potential new ATH that we might be going for.

Now as the price is at the $119-120K zone, we are most likely going for a retest today of the current ATH, where we are going to look for some kind of breakout and upward movement.

Markets are on fire, so stay informed and do not FOMO—there will always be plenty of opportunities to gain something from markets, but to lose all it takes is just one stupid decision, so don't FOMO.

Swallow Academy

BTCUSD Long Trade BITSTAMP:BTCUSD Long Trade - this trade is basically based on Key Levels, prices are very intact as exactly shown.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

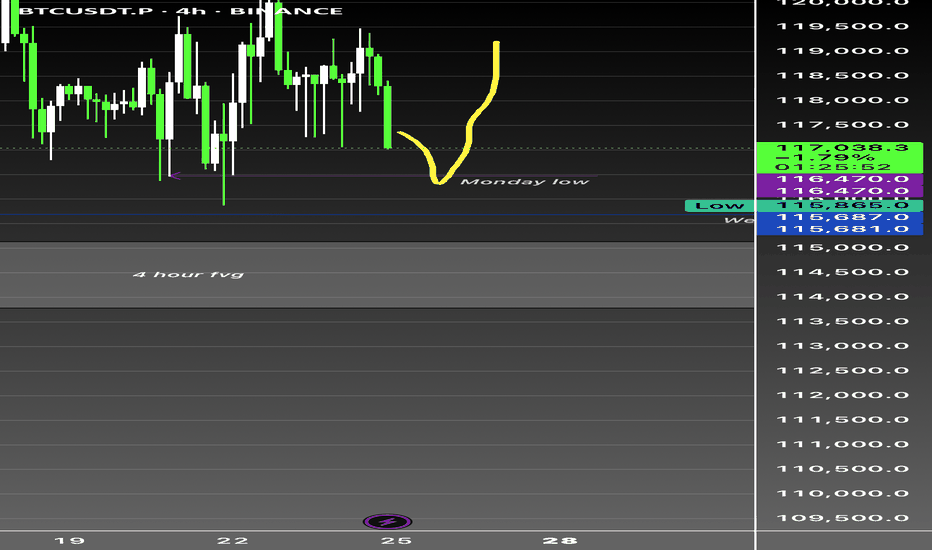

Btc bullish as long as weekly holds CRYPTOCAP:BTC 4H Analysis - Current: $117,150 (-0.97%)

Range-bound between $115,687 week low and $120K+ resistance. Monday low at $116,500 serving as immediate support - critical inflection point.

4H Fair Value Gap clearly defined - institutional liquidity zone demanding respect. Market structure showing inducement above $120K highs with potential liquidity sweep of Monday lows to trigger directional move.

Order blocks forming around $116.5K-$117K zone. Break below $116,500 targets $115,687. Reclaim of $118,500 needed for bullish continuation.

Higher timeframes remain constructive despite 4H consolidation.

#Bitcoin #BTC #SMC