BTCUST trade ideas

BTCUSDT-4H {Now Eyes on the Buy-Side Sweep}BTC on the 4H chart just executed a classic liquidity grab at support, followed by a strong bullish push.

🔹 Descending trendline tapped multiple times (indicating compression)

🔹 Entry zone forming on retest of previous demand

🔹 Target: Buy-side liquidity above $123K

🔹 Volume + RSI divergence supports the bullish bias

BTCUSD 8H – Long Triggered on Cloud Flip, Can This Trend Keep?This BTC 8H setup highlights how the Enhanced Ichimoku Cloud Strategy V1 caught a +27% move using clean trend confirmation and a low-noise entry.

📊 Setup Breakdown:

Major Support Zone held 5+ times between March and April — confirming buyer interest.

Entry triggered once:

Ichimoku Cloud flipped bullish

Price crossed the 171 EMA

Strategy alignment confirmed by Ichi + EMA + Cloud filters

Entry candle: ~$93,400

Current price: ~$119,000 → +27% trend continuation.

📈 Strategy Logic:

This system combines:

Custom Ichimoku (7 / 255 / 120 / 41) for cloud confirmation

A 171 EMA filter to block noise

A trend-following “state memory” logic to avoid premature reversals

This BTC move is a textbook example of how the strategy avoids second-guessing and holds strong trends without constant recalibration.

⚠️ What to Watch Next:

Price is currently ranging near prior highs

Cloud remains bullish, but RSI and momentum divergence should be monitored

If support holds above ~112K, continuation is likely — break below could shift structure

✅ Backtest this strategy on your charts to see how it handles your favorite assets.

It’s best used on high-timeframe trends where precision and conviction matter most.

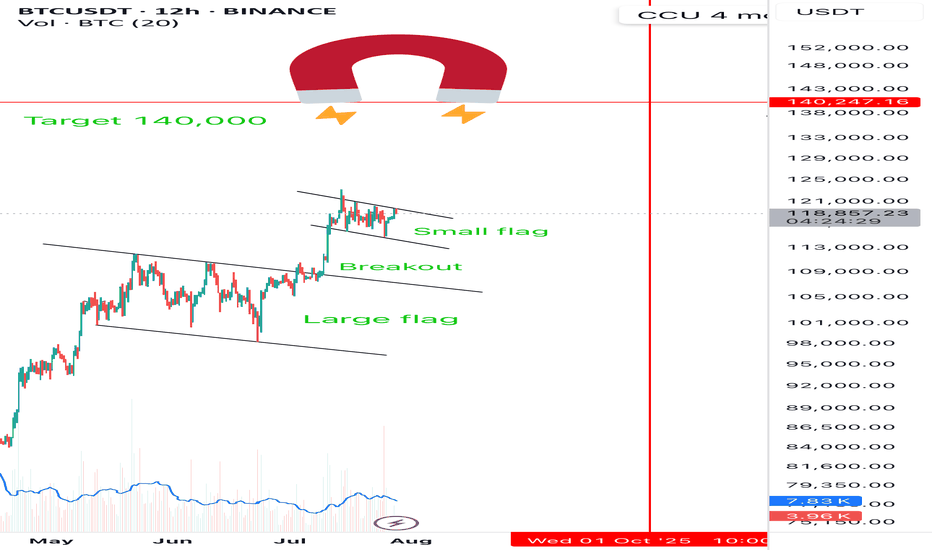

Weekly trading plan for BitcoinLast week price followed our orange scenario. Right now, we're stuck in a sideways correction, and here's what matters:

1. $118K is the big level this week

Stay above it? Good chance we retest ATH

Break below with no recovery? That's trouble

2. If we lose $116,780 next → $112K becomes the target

I've got all the charts and details covered in this video idea—check it out for the full picture!

BTC MACD Liquidity Tracker Strategy – High Timeframe Long CallsThis BTC 8H chart shows how the MACD Liquidity Tracker Strategy has tracked trend structure cleanly across multiple long signals — each aligning momentum and EMA bias on the mid-to-high timeframe.

First long: Triggered at ~64,565 and exited near 99,560 as momentum peaked

Second long: Re-entry at 83,419 after reclaiming structure, closed near 111,958

Third long (active): Triggered at 108,342 and currently holding above 117,000 with trend still intact

Color-coded bias (blue/pink) helps confirm context at a glance. The combination of MACD momentum shifts + 60/220 EMA filters prevents early entries and helps capture large legs without excessive noise.

Want to explore or customize the strategy?

Search “MACD Liquidity Tracker Strategy ” and run your own backtests to refine parameters per asset.

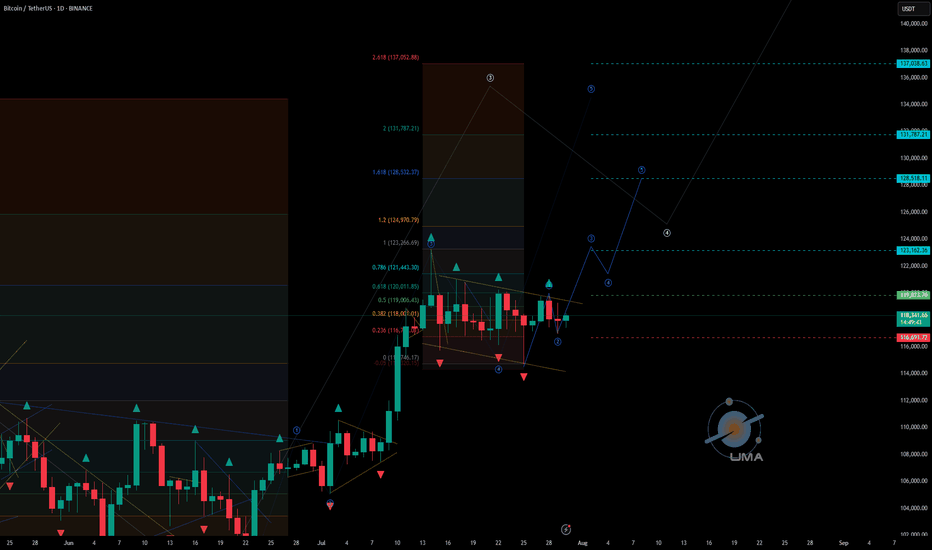

BTC Long Outlook – Grand Supercycle Perspective (2025.05.21)Hello everyone,

This is SeoVereign, the operator of the SeoVereign team.

It's been nearly a month since I returned to TradingView and started posting ideas again.

During that time, I’ve frequently shared short-term ideas based on minute charts.

However, since real-time responses are crucial in short timeframes,

there are practical limitations in explaining all the reasoning behind our analysis in detail each time.

But when it comes to larger timeframes like the daily chart,

we have a bit more flexibility.

So I see this as a valuable opportunity to explain our thought process and key reasoning more thoroughly.

Now, let’s get into the Bitcoin daily chart briefing.

Please refer to the following link first.

This is a post I made on April 18, 2025:

🔗

At the time, I shared the view that the upward wave starting near 75K

had the potential to extend to 88K and even 96K.

However, it was difficult to determine exactly how far the wave would extend at that point.

Now, I want to make one thing very clear.

If someone uses wave theory to say something like

"Bitcoin will definitely go to X price,"

that person is either a scammer or someone who fundamentally misunderstands wave theory.

Elliott Wave Theory can be somewhat useful in anticipating short-term moves,

but it has clear limitations when applied to long-term predictions.

After many years of studying Elliott Wave Theory in depth,

I've come to a simple but important conclusion:

"You cannot predict the distant future with technical analysis alone."

That said, there is one exception:

very short-term movements — the immediate price action right in front of us —

can often be approached with some confidence using technical analysis.

Here’s an example.

If someone bought Bitcoin at 10K and says,

“I’m going to sell at 100K,”

while it hasn’t even broken past 50K,

that’s just reckless optimism.

But if Bitcoin has already approached 100K,

and several bearish signals are starting to emerge and become confirmed,

that’s when we can begin considering short positions.

The key is to make decisions based on the data right now — not based on hopes or assumptions.

That was a long introduction.

Now, let me explain why I believe Bitcoin could break to new all-time highs

and possibly reach as high as 130K.

As I mentioned in the April 18 post,

I believe an Ending Diagonal was completed around the 74K region,

and I anticipated an upward impulse wave to follow.

In my view, the current market structure clearly suggests we are in an uptrend.

Many of you have reached out via private messages asking,

“What kind of wave are we in right now?”

But in this case, that question doesn’t hold much value.

Whether this current move is part of an impulse wave or a corrective structure,

what matters is that the price is going up.

If, for instance, the A-wave has completed — as confirmed by Fibonacci —

then the B-wave would follow, and we can plan accordingly with long positions.

Or, if the ABC correction is already over,

then a new impulse wave could be starting.

Either way, the key takeaway is that we’re likely in an upward phase.

Back to the main point:

A Deep Crab harmonic pattern formed near 74K,

and that zone concluded with an Ending Diagonal,

which is now leading to a bullish reversal.

I've studied harmonic patterns for years,

and in the case of the Deep Crab,

the upper boundary of the Potential Reversal Zone (PRZ)

is typically around the 2.24 Fibonacci extension.

As long as this level is not broken,

the pattern remains valid.

And when a reversal happens near the 1.618 or 1.902 zones,

it’s often a highly reliable bullish signal.

So, what are our targets in this current rally?

🎯 SeoVereign’s Target Strategy

1st Target: 109,000

2nd Target: 118,600

3rd Target: 128,100

Right now, before the market enters a full-scale bullish breakout,

we’re seeing unusually high volatility.

In times like this, staying calm and grounded is more important than ever.

I sincerely wish all of you the best of luck in navigating this volatility,

and may a wave of growth come to your accounts as well.

🍀 I genuinely hope great fortune finds its way to all of you.

See you in the next daily briefing.

Thank you.

— SeoVereign

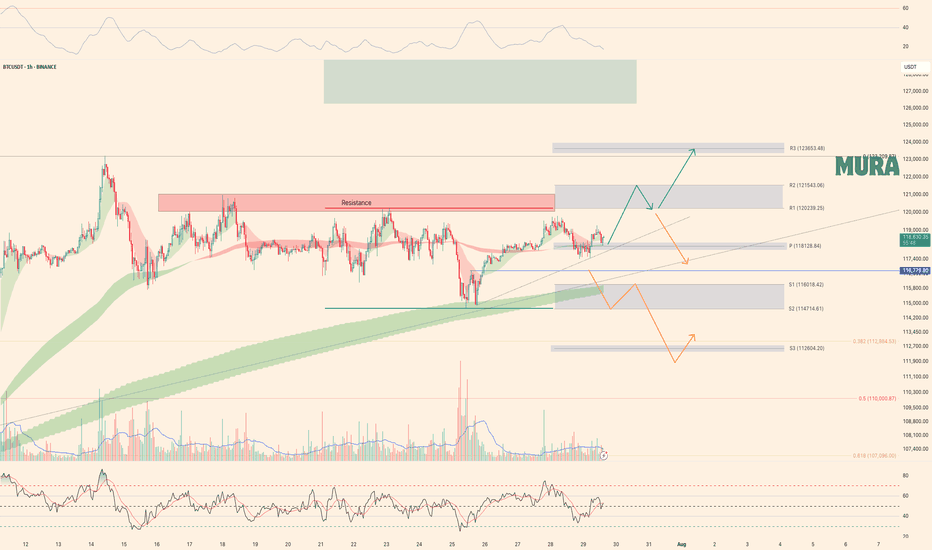

Here’s Why Bitcoin Price Could Rewrite History in AugustBINANCE:BTCUSDT price is currently hovering at $118,938, within a consolidation range between $117,261 and $120,000 . While this range has held steady, the possibility of breaking through $120,000 is high if investor sentiment remains strong.

The current sell-side risk ratio for BINANCE:BTCUSDT is at 0.24, well below the neutral threshold of 0.4 and closer to the low-value realization threshold of 0.1. This suggests that the market is experiencing consolidation, with investor behavior indicating a pause in large sell-offs.

Historically, August has been a bearish month for BINANCE:BTCUSDT , with the median monthly return sitting at -8.3%. However, given the current accumulation trend and the low sell-side risk, Bitcoin may defy its historical trend this year. If Bitcoin can secure $120,000 as support, it would likely push past $122,000 and move toward the ATH .

However, there remains a risk that the market could turn bearish if investors shift their stance due to unforeseen market factors. In this case, BINANCE:BTCUSDT could lose support at $117,261 and slide to $115,000, reversing the bullish thesis.

Strategic Multi-Swing Analysis – Pivots and Post-FOMC Outlook__________________________________________________________________________________

Technical Overview – Summary Points

➤ Sustained bullish momentum on BTCUSDT across all swing timeframes.

➤ Key supports: 116400–117400 (likely rebound), major supports: 105047–114674.

➤ Main resistances: 119000–120000 (short term), major ceiling at 123240 (1D/12H).

➤ Risk On / Risk Off Indicator: "Strong Buy" signal – tech sector leadership confirmed.

➤ Volumes normal to moderately elevated, no excess or behavioral anomaly (ISPD "Neutral").

➤ No euphoria or capitulation flags; general wait-and-see attitude, FOMC event ahead.

__________________________________________________________________________________

Strategic Summary

➤ Strategic bullish bias remains as long as 116400/117400 supports hold.

➤ Opportunity window: buy pullbacks towards 117400–116400 with tight stops; clear invalidation below 115900.

➤ Risks: FOMC-induced volatility, increased leverage on alts, potential capitulation if key support breaks.

➤ Catalysts: FOMC communication, geopolitical context (no immediate threat), background risk-off climate not yet triggered.

➤ Action plan: Prioritize post-event reaction over anticipation; maintain strict technical protection.

__________________________________________________________________________________

Multi-Timeframe Analysis

1D: Uptrend confirmed. Price above all major supports. Strong resistance at 123240, key support at 105047, normal volumes, Risk On / Risk Off Indicator "Strong Buy", ISPD "Neutral".

12H: Bullish bias. Resistance cluster 120002–123240. Intermediate supports 114674/111949. Momentum/volume supported, no excesses.

6H: Bullish near range top, supports at 114674/111949, ceiling at 120002–123240. Solid Risk On / Risk Off Indicator.

4H–2H: Up momentum, resistance 119003–120002–123240, supports 116474/117800. Moderate/normal volumes.

1H: Strong uptrend, thick resistance at 119000–120000, immediate supports 117800/116474. Slight volume uptick ahead of FOMC.

30min–15min: Resistance 119003–120000 (~H4 pivot). Intraday support 117400–117800/118200. Both Risk On / Risk Off Indicator and ISPD neutral, normal volumes, bullish as long as 116474 holds.

SYNTHESIS: Broad bullish confluence on MTFTI from 1H to 1D/W.

Supports at 116474/117400 are key pivots for maintaining bullish swing view.

No behavioral alerts or extreme volumes.

Consolidation/waiting likely before FOMC release – monitor reactions at pivot zones.

__________________________________________________________________________________

Strategic decision & macro

Opportunities: Swing bullish scenario favored as long as key supports hold, buy strategic pullbacks, reverse on clear break.

Main risk: FOMC volatility, altcoin excesses, possible post-announcement fake moves. Active monitoring essential.

Macro/on-chain: No excess, BTC realized cap > $1T; aggressive rotation into alts, high open interest. No capitulation. Major on-chain & technical support aligned at 114500–118000.

Action plan: Favor reactivity (post-FOMC), tight stops, progressive take profits at 119500–123240 resistance. No aggressive pre-positioning.

__________________________________________________________________________________

Macro catalysts overview

FOMC expected: status quo, market sensitive to any Powell tone shift.

Global macro: latent risk-off, geopolitical drivers closely watched.

BTC stable, no technical disruptor in the immediate term.

__________________________________________________________________________________

Final Decision Summary

Robust technical setup with a clear bullish bias. Optimal entries on 117400-116400 pullbacks, stops below support, active management needed during FOMC. No on-chain excess; constructive background unless exogenous shock or resistance failure (119000–123240). Stay alert for breakout/reject pivot.

__________________________________________________________________________________

Market overview

📈 WHAT HAPPENED?

Last week, a less priority but expected scenario was realized for Bitcoin. We broke through the sideways in a downward direction and fell to the area of pushing volumes ~$115,000. At this level, strong volume anomalies were recorded, and a rebound occurred.

On Friday, the daily analysis on TradingView indicated a point to join the long movement, which confirmed its accuracy. The price reached the accumulated volume zone of the sideways at $117,600-$119,200 and was able to consolidate above without any significant reaction, which strengthens the buyers' position.

💼 WHAT WILL HAPPEN: OR NOT?

At the moment, the first protection from sellers has appeared. Let's consider possible scenarios:

1. A decline to the mirror zone of $118,300-$117,300, from which, if the buyers' reaction is confirmed, buys are expected to resume.

Next, a narrow sideways formation within the mentioned zone and a local sell zone of $119,500-$119,000 is possible, followed by a long position.

Another option is to develop a further long divergence from the current levels. In this case, the local sell zone of $119,000-$119,500 will provide additional support.

2. A less priority scenario is a decline to the volume anomaly zone of $116,200-$115,000, with a test of the local minimum. In this case, the recovery will take longer.

Buy Zones:

$118,300–$117,300 (mirror volume zone)

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volumes)

Sell Zone:

$119,500–$119,000 (potential resistance if a correction develops)

📰 IMPORTANT DATES

Macroeconomic events this week:

• July 29, Tuesday, 14:00 (UTC) - publication of the US Consumer Confidence Index from CB for July;

• July 29, Tuesday, 14:00 (UTC) - publication of the US Job Openings and Labor Turnover (JOLTS) for June;

• July 30, Wednesday, 08:00 (UTC) - publication of Germany's GDP for the second quarter of 2025;

• July 30, Wednesday, 12:15 (UTC) — ADP's July change in the number of non-agricultural employees in the United States;

• July 30, Wednesday, 12:30 (UTC) — U.S. GDP for the second quarter of 2025;

• July 30, Wednesday, 13:45 (UTC) — Canada's interest rate decision;

• July 30, Wednesday, 18:00 (UTC) — US FOMC statement and announcement of the US Federal Reserve interest rate decision;

•July 30, Wednesday, 18:30 (UTC) — US FOMC press Conference;

• July 31, Thursday, 01:30 (UTC) — publication of the Chinese Manufacturing PMI for July;

•July 31, Thursday, 03:00 (UTC) — announcement of Japan's interest rate decision;

• July 31, Thursday, 12:00 (UTC) — publication of Germany's July Consumer Price Index (CPI);

• July 31, Thursday, 12:30 (UTC) — publication of the United States' June Personal Consumption Expenditure Price Index and Initial Jobless Claims;

• August 1, Friday, 09:00 (UTC) — publication of the Eurozone Consumer Price Index (CPI) for July;

• August 1, Friday, 12:30 (UTC) — publication of the average hourly wage, changes in the number of employees in the non-agricultural sector, and the unemployment rate in the United States for July;

• August 1, Friday, 13:45 (UTC) — publication of the U.S. Manufacturing Purchasing Managers' Index (PMI) for July.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics

BTC Price Prediction and Elliott Wave AnalysisHello friends,

>> Thank you for joining me in my analysis. I think we will finish the 1st wave A in pink X wave as Gray ABCm. I am waiting for its confirmation.

>> Reminder about our previous confirmations:

* Day TF: Breaking 118451 for today and the next couple of days, and keep on above it, leads to ending the B wave successfully.

* 4Hr TF: Breaking 118451 for the past hours and keep on above it, we ended W wave successfully ( maybe also B ?)

Keep liking and supporting me to continue. See you soon!

Thanks, Bros

Consistency and reliable performance with real time validationMy cutting edge tech has been put to the test with daily real time validation

It's been correct for over 4 weeks

It's been my mission to defy market odds and revolutionize trading, and with thanks to AI my mission is being fulfilled

I would love to hear your thoughts...or if not, I hope you're getting really excited by what you see

BTC-----Buy around 119000, target 120000-1205000 areaTechnical analysis of BTC contract on July 28:

Today, the daily level of the large cycle closed with a small positive line yesterday, the K-line pattern continued to rise, the price was above the moving average, and the attached indicator was dead cross. The general trend of rising is still very obvious, but from the trend law, it is not a very strong trend at present. The trend of oscillating upward and range is highly likely. In this case, we must find a good rhythm for trading, keep short-term, and don’t be greedy, otherwise it is easy to have profit-taking problems; the short-term cycle hourly chart yesterday’s US market rose and then fell under pressure to correct the low position near the 118700 area. The current K-line pattern is continuous, and the price is at a high level. The attached indicator is golden cross and shrinking. In general, the trend is still strong and the retracement is relatively small. If we look at the continuation of the rise today, it is still the old rule. The retracement cannot be large and cannot break the intraday low.

Today’s BTC short-term contract trading strategy:

Trade in the 119000 area when retreating, stop loss in the 118500 area, target 120000 and break to the 120500 area;