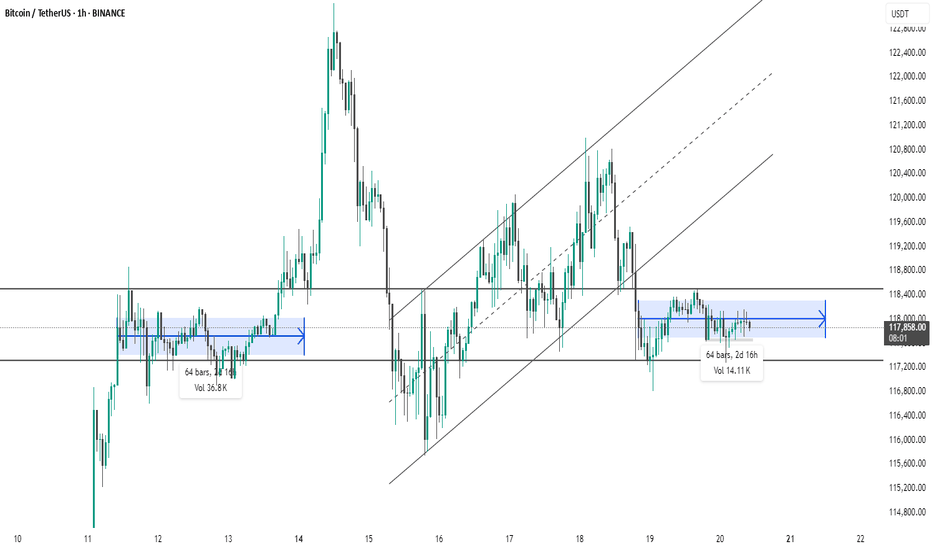

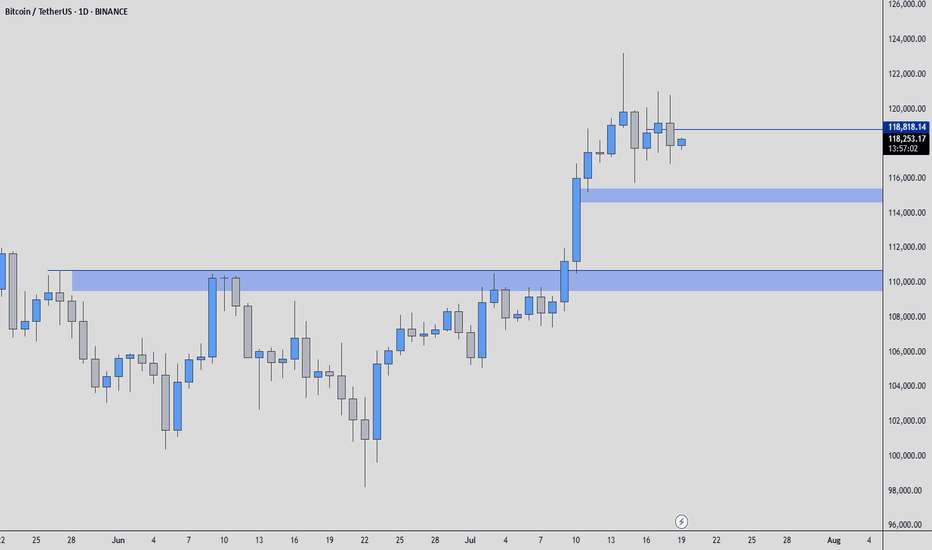

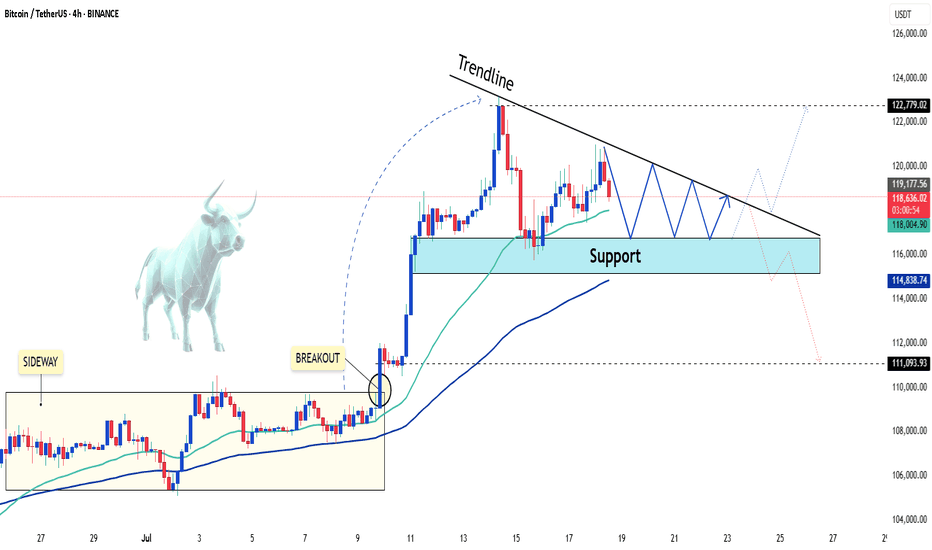

BTC #Bitcoin (BTC/USDT) on the 1-hour timeframeThis chart shows Bitcoin (BTC/USDT) on the 1-hour timeframe, highlighting two periods of sideways consolidation (marked in blue).

Both zones lasted 64 bars (2d 16h), indicating similar market indecision or accumulation/distribution phases.

The first consolidation (left) was followed by a strong bullish breakout, while the second (right) is currently unresolved.

Price is trading within a tight range between ~117,600 and ~118,400 USDT, suggesting potential for an imminent breakout or breakdown.

Volume during the current consolidation is lower than the previous one, hinting at reduced momentum.

This setup may signal a key move once the price exits this range.

thanking you

BTCUST trade ideas

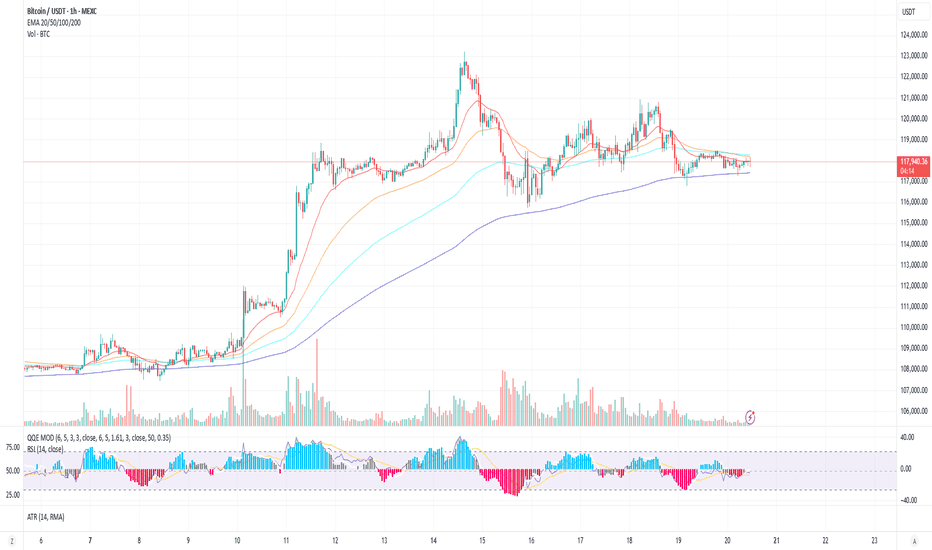

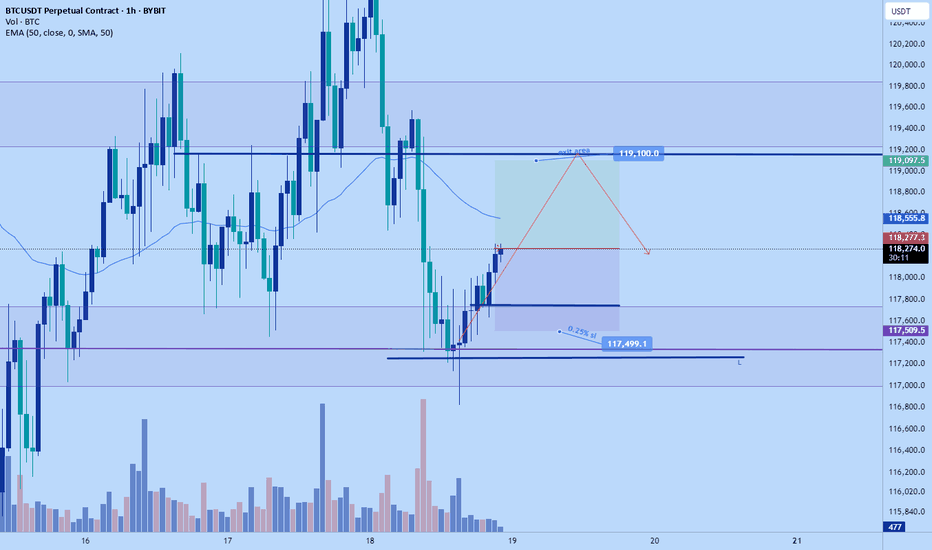

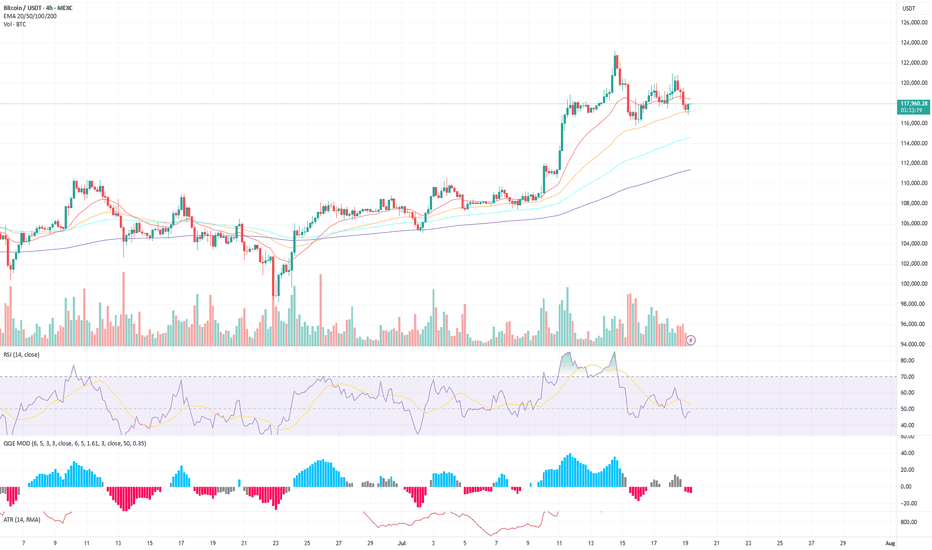

Buy Signal at 117k, Eyeing 118.5k BreakoutDescription:

Bitcoin is consolidating just above the 200 EMA on the 1H timeframe, forming a slight ascending triangle. A buy around 117,000 with TP set at 118,421. With RSI near neutral and QQE MOD potentially flipping bullish, we are watching for a breakout above 118,500 for continuation. SL sits below the recent swing low at 116,485.

Trade Setup

Long Entry: 117,000 (as signaled)

Take Profit: 118,421 or higher (watch 118,800 zone)

Stop Loss: 116,485

Alternate Trigger: Break and close above 118,500 with increased volume = breakout entry

Invalidation:

A break below 116,400 (below SL zone and 200 EMA) could invalidate the bullish thesis and open downside toward 114,000.

Confirmation to Watch

Breakout candle above the 50 EMA with volume spike

QQE MOD crossover with histogram flipping blue

RSI moving above 50 confirming strength

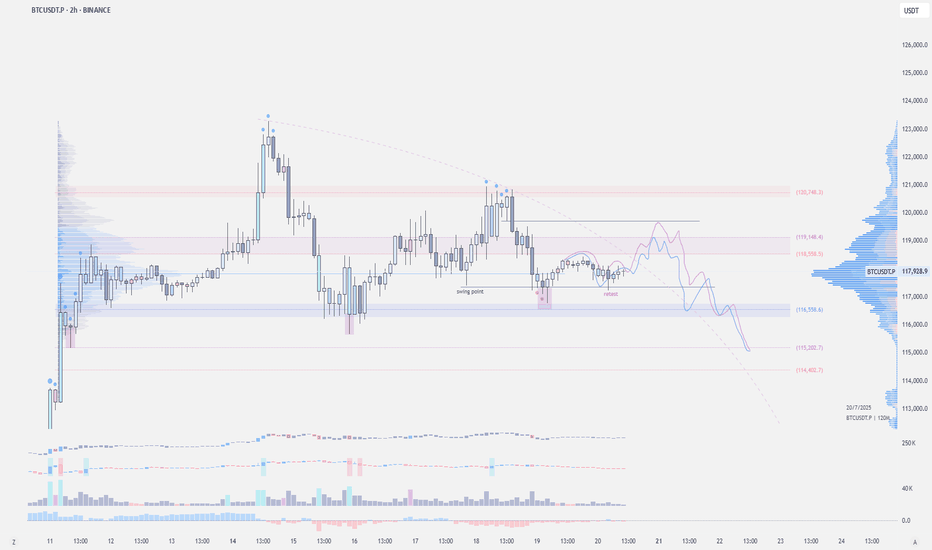

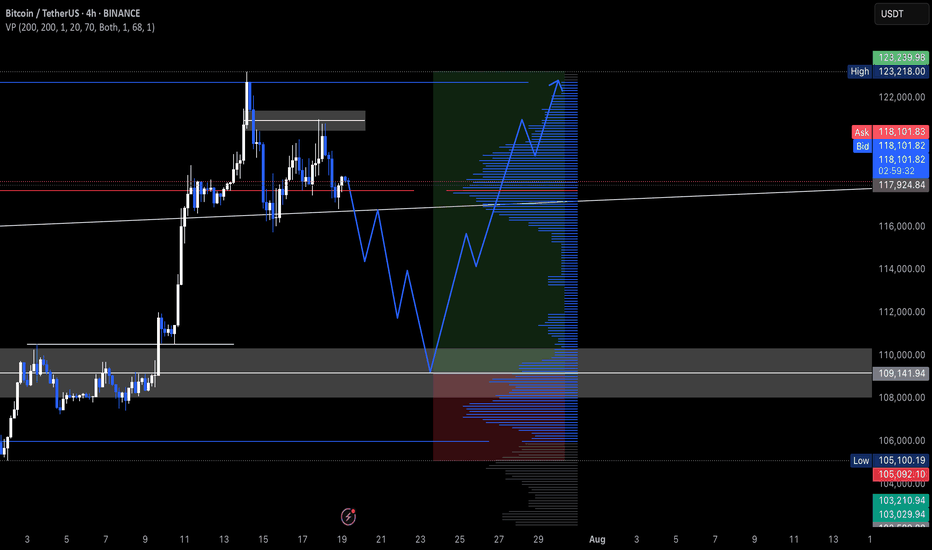

BTC/USDT – 4H Chart Technical AnalysisBTC/USDT – 4H Chart Technical Analysis

Market Structure & Trend

Overall Trend : Bearish (clearly defined by a consistent downtrend channel).

Current Structure : Price is in a corrective downtrend within a descending channel, after multiple rejections from the supply zone.

Key Technical Zones

1. Supply Zone

Strong rejection zone where the price previously reversed sharply.

Still acting as resistance, located around the upper range.

2. Demand Zone

Currently being retested for the fifth time, weakening its strength.

Recent price action shows liquidity sweep and swing low break inside this zone, potentially trapping early longs.

Fair Value Gaps (FVG) & Fibonacci Levels

1D FVG sits below the current demand, aligning with:

Golden Pocket (0.618–0.65 Fib).

Acts as a high-probability bounce zone for long entries if demand fails.

A break below this FVG could open up deeper downside toward the 0.786 Fib or beyond.

Psychological Levels

105,000 – Major resistance & potential take-profit area for long positions.

100,000 – Key support and liquidity magnet if the demand zone fails.

Volume Profile

High Volume Node: 102,000 – 106,800 — price tends to gravitate here, indicating potential consolidation or resistance.

Low Volume Area: Below 100,500 — suggests thin liquidity, which may cause sharp moves if price drops into this range.

Scenarios & Trade Ideas

Bullish Scenario

If price holds above the demand zone (after multiple retests) and confirms on LTF:

Potential Long to local resistance.

On breakout, target the 105,000 psychological level.

Confluence: High volume area offers both support and a magnet.

Bearish Scenario

If price fails to hold the demand zone:

Enter short position targeting the 1D FVG and 100,000 psychological level.

If that breaks, expect sharp continuation due to low volume below.

Conclusion

Price is at a pivotal point — currently balancing on weakened demand after multiple retests. Watch for LTF confirmation:

Above demand = bullish recovery setup.

Below demand = bearish continuation toward 100,000 and the FVG.

Manage risk tightly due to the proximity of both key zones.

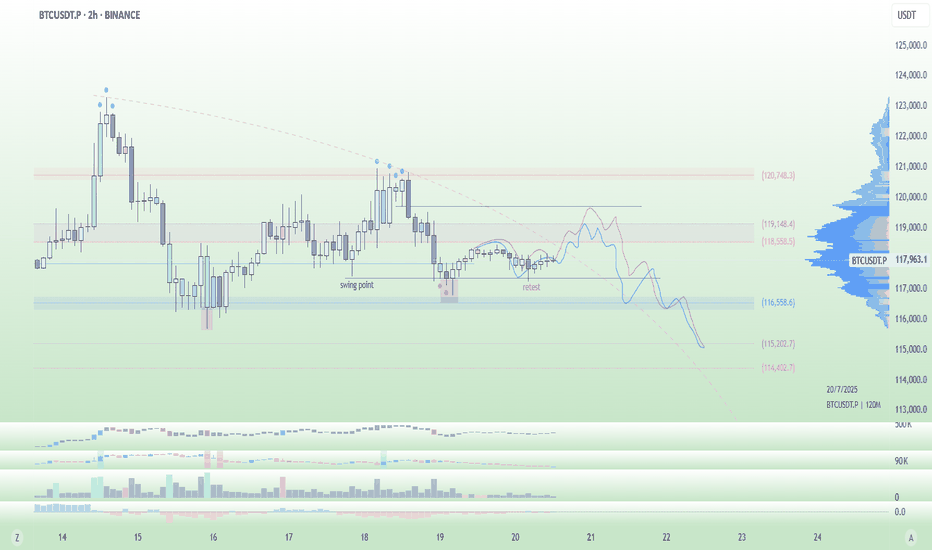

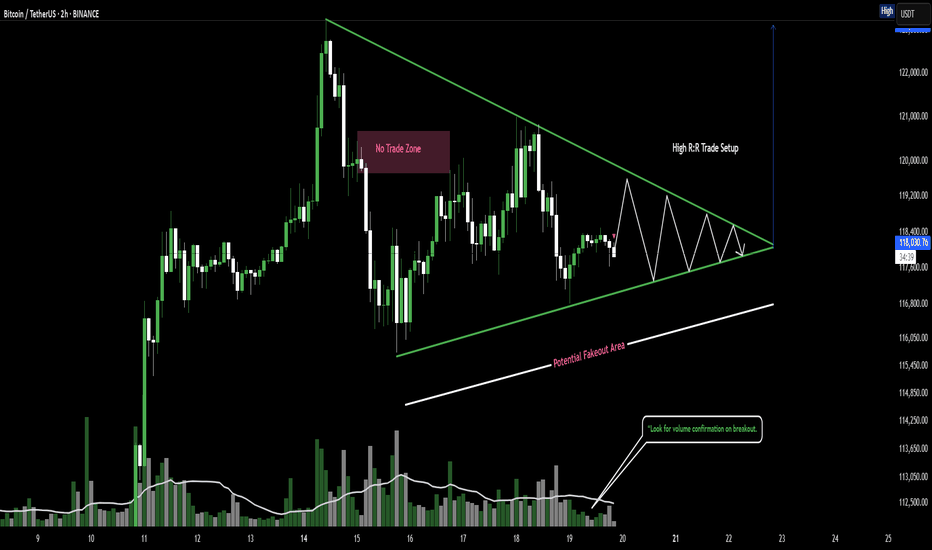

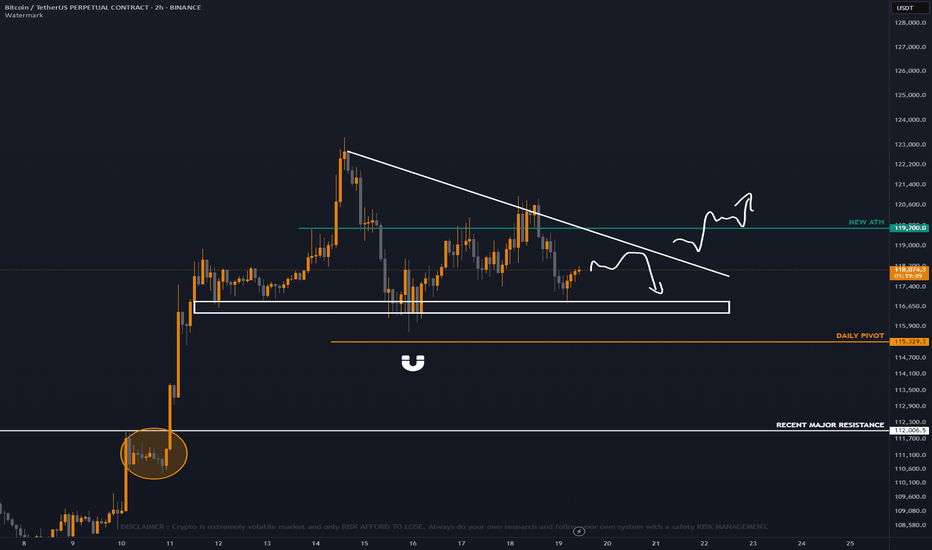

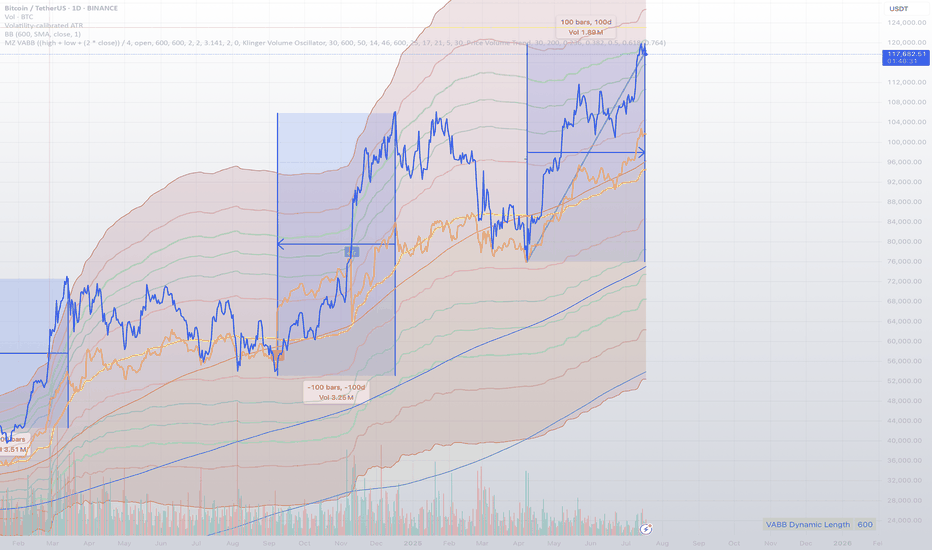

Bitcoin Technical Outlook -2HA symmetrical triangle is forming with declining volume — signaling a likely breakout.

🔼 Break above ~$119.5K → Target: $123K

🔽 Break below ~$116K → Target: $113.5K

⚠️ Await confirmation before entering. Risk management is key.

Bitcoin (BTC/USDT) Technical Outlook – 2H Chart

Drop Your Token – I’ll Do The AnalysisHey everyone! Hope you’re having an amazing weekend !

Want me to analyze your favorite token ? Just drop your request in the comments using this format:

Request Format

Project Name: Bitcoin

Token Symbol: BTC( BINANCE:BTCUSDT )

Important Notes:

I’ll pick and analyze only the first 10 tokens requested .

One request per person — so choose wisely!

I’ll reply directly under your comment with the analysis.

If you find this helpful, don’t forget to Like ❤️ and Share this post with your friends!

Here’s to your success — health, wealth, and great trades! 🚀

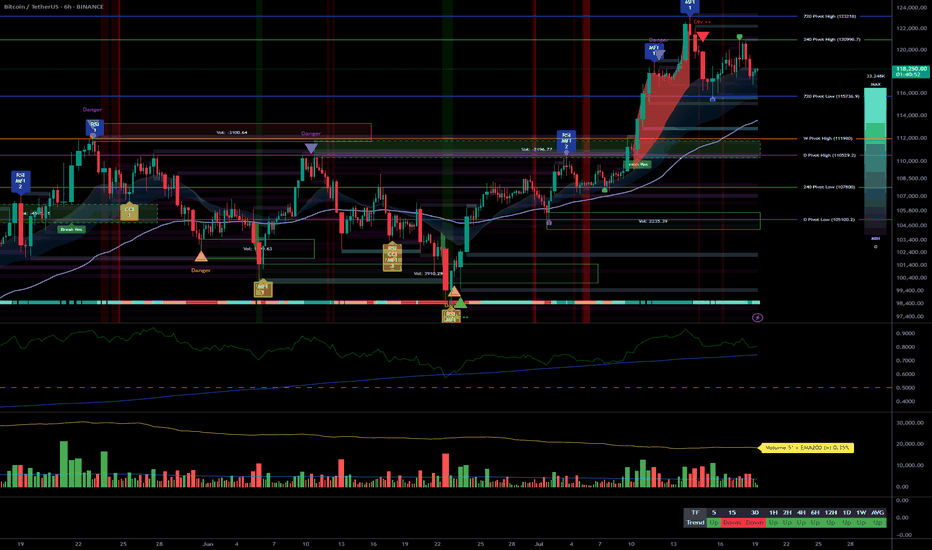

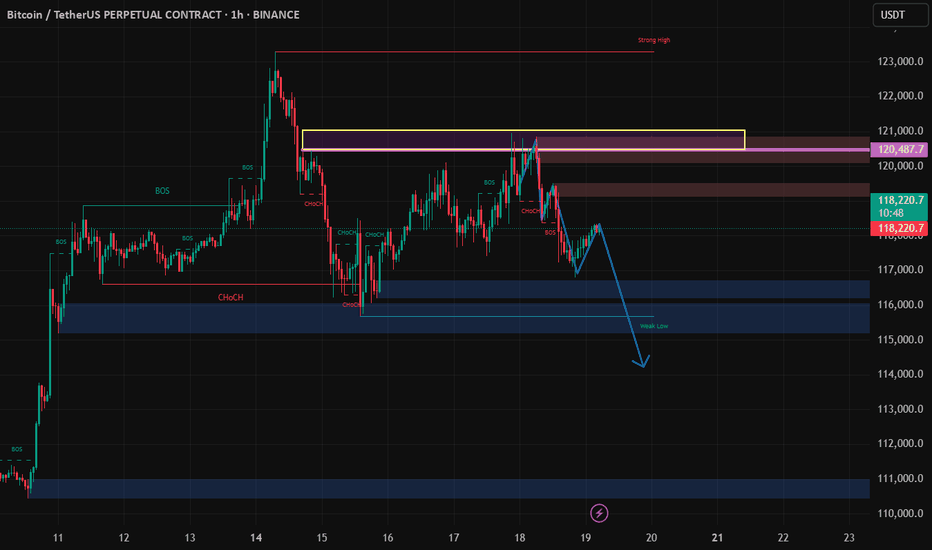

BTC Double QML Setup: Is Another Drop Loading?Hello guys!

Do you remember the last analysis?

Now this BTC chart shows a textbook example of two consecutive QML (Quasimodo Level) patterns forming (QML1 and QML2), each confirmed by clean engulfed lows.

QML1 caused a strong drop after the high was broken and a new low formed.

Price retraced and created QML2, again with a confirmed engulfed low (engulfed2).

We're now likely to see a reaction at the QML2 supply zone.

If price respects this second QML zone, we could see another bearish move toward the 116k zone, possibly lower.

Bitcoin at 120,000: Decisive Breakout or Renewed Consolidation?__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strongly bullish on H1 and above; healthy consolidation below ATH.

Supports/Resistances: 120,000 USDT (pivot resistance), 116,400–117,000 (major support), 104,000–110,000 (long-term support).

Volumes: Normal, no anomaly nor climax detected.

Risk On / Risk Off Indicator: Strong buy signal on all timeframes except very short term. Sectoral health confirmed.

Multi-timeframe: Short-term bearish divergence on 15/30min, but robust technical structure above H1-D1.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias: Confirmed bullish across all timeframes; no major break detected.

Opportunities: Strategic buys between 116,400–117,000 (pullback); confirmed breakout above 120,000 (target 130,000).

Risk zones: Below 116,000 (potential correction to 112,000–104,000), false breakout at the top.

Macro catalysts: Monitor Fed (next FOMC July 29-30), volatility on risk assets, geopolitical tensions.

Action plan: Prioritize stop management, stay reactive ahead of macro events. Main scenario: buy confirmed pullback or validated breakout.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D / 12H: Bullish structure intact but facing historical resistance (120k), strong supports in place (104–107k).

6H / 4H / 2H: Consolidation below resistance, no signs of exhaustion, tactical supports at 116,000–117,000.

1H / 30min / 15min: Weakness on shorter timeframes (sellers at top), confirmation of range polarization. No emotional excesses (ISPD DIV neutral), standard volumes.

Risk On / Risk Off Indicator: Strong buy except for very short-term fatigue.

Summary:

Multi-horizon bullish bias, technical and sectoral confluence for upside extension if clear breakout >120,000. Key support to hold at 116,400–117,000. Buy dips, ride breakout up to 130,000. Focus on risk management, flexibility advised as macro (Fed) nears.

__________________________________________________________________________________

Key macro events to watch

__________________________________________________________________________________

2025-07-18: Fed rate/volatility debate (Equity, Bonds, BTC).

2025-07-29: FOMC (potential pivot for risk assets).

__________________________________________________________________________________

Strategic decision & final summary

__________________________________________________________________________________

Main bias: Bullish, to be validated at key levels, favor buying dips/breakouts.

Risk management: Stop below 116,000, scale out progressively after 125k, reinforced protection ahead of FOMC.

Opportunities: Pullback 116,400–117,000 (RR >3); H4/D breakout >120,000 targeting 130,000 (RR >2).

Monitoring: Macro (Fed, geopolitics), dynamic management according to market response to news.

Conclusion:

A validated move above 120,000 projects target to 130,000 (next statistical/on-chain extension). Deep dips can be bought above 104,000. Do not loosen risk management as Fed date approaches.

BTC/USDT: Define Your Next Winning MoveHere's the reality: While others panic and second-guess, successful traders recognize the blueprint when they see it.

The Setup That Separates Winners From Losers

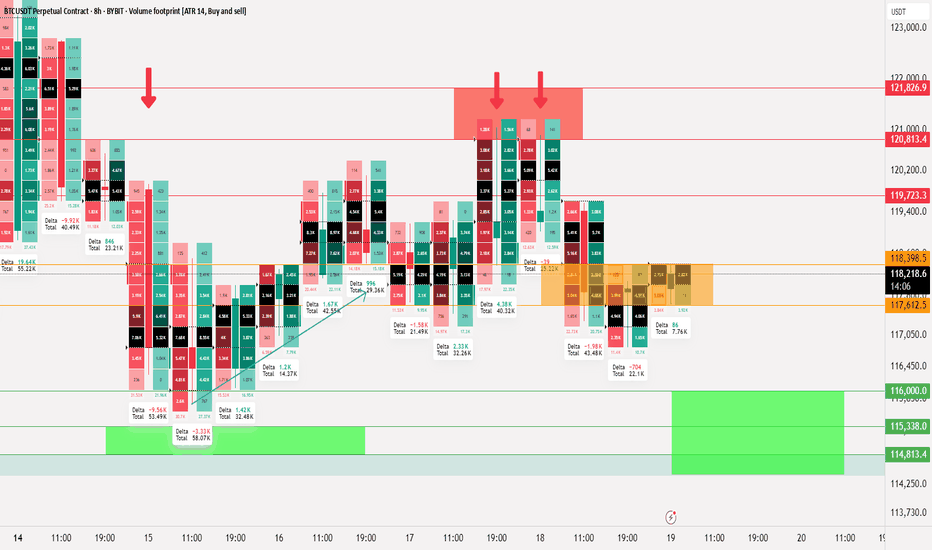

Two major support zones (marked in blue) tell the complete story. My footprint CDV analysis confirms what institutional money already knows - these levels aren't suggestions, they're battle lines.

Your Proven Path Forward

Zone 1: Primary accumulation target - where smart money loads up

Zone 2: Final defense line - where rebounds launch

The Choice Is Simple

Execute at these levels with precision, or watch from the sidelines as others capitalize. My track record speaks for itself - these aren't hope-based predictions, they're data-driven opportunities.

What Happens Next

Follow this blueprint: You position at support, manage risk precisely, and capture the inevitable bounce that follows institutional accumulation.

Ignore it: Watch others profit while you chase price higher later.

Bottom Line

The market has drawn the map. The footprint data confirms the plan. Your success depends on one thing: execution when opportunity knocks.

The zones are marked. The analysis is complete. The choice is yours.

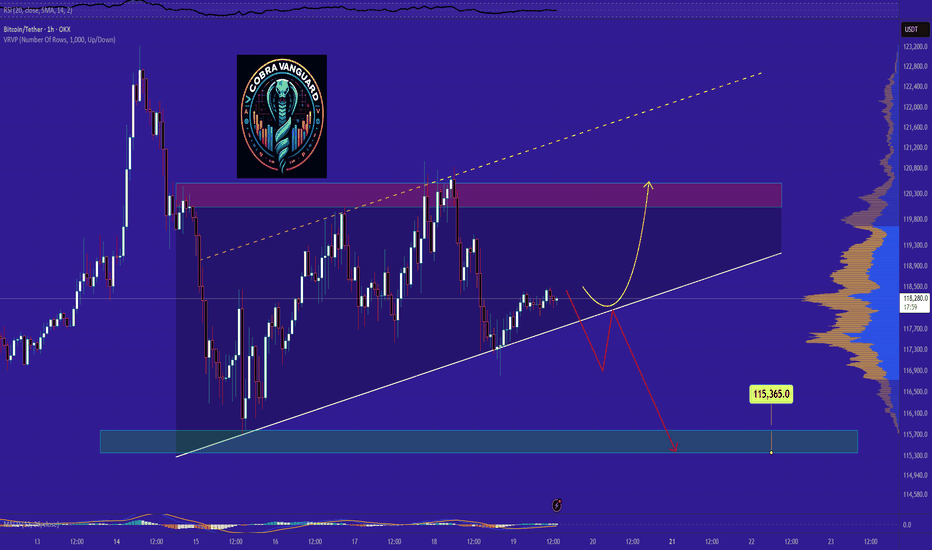

Bitcoin Liquidity updateCRYPTOCAP:BTC

📄 Update on liquidity movement and key liquidity cluster points

◀️ Summary of the first movement: A sale occurred at 121826 and a break happened at 117612, after which liquidity was collected between 116 - 115

◀️ After collecting liquidity, we mentioned that breaking 117612 would allow testing 119723, and that is what happened

⭕️ Now, a selling range has formed between 120813 - 121826, which is clear on the price chart and the way it bounced down

🟣 The current movement is confined between 118398 - 117612

📄 Regarding trading ideas:

⭕️ The thought here is to buy between 11600 - 114813 if a break occurs at 117612 and trading starts below it

⭕️ The second idea, in case this break does not happen, is to wait for confirmation of trading above 118398, and in this case, it's preferable to wait until Monday

Bitcoin Bearish Outlook | Rejection from Key Resistance – TargetBitcoin has recently tested a strong structural resistance zone and showed clear signs of rejection, marked by bearish candlestick formations and declining bullish momentum.

This reaction suggests a potential short-term correction, especially as price begins to move away from the resistance with increased bearish pressure.

The next area of interest lies around the Fair Value Gap (FVG) formed in the range of [insert your FVG zone, which could act as a magnetic target for price in the coming sessions.

Should the price continue its downward move and break below minor support levels, this FVG zone becomes a probable destination.

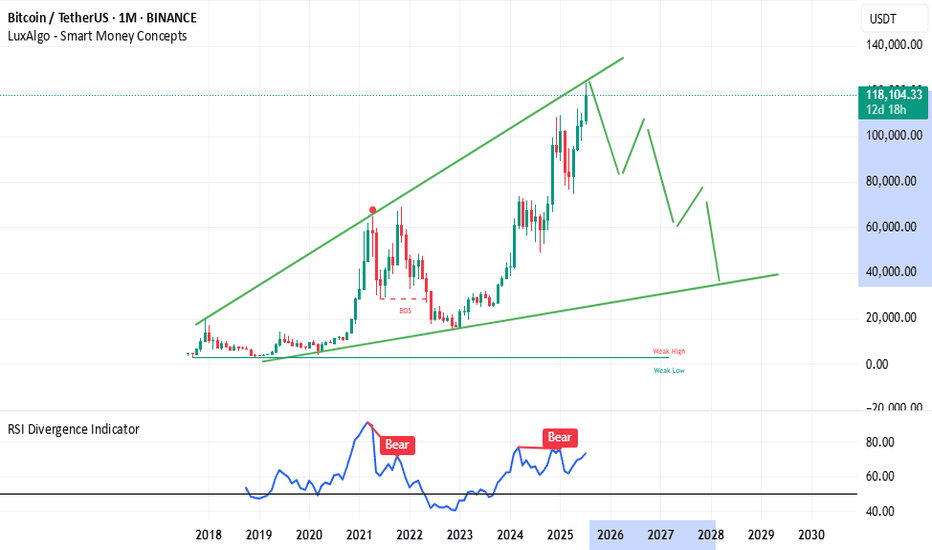

BTCUSDT BTC/USDT (Bitcoin):

Trend: Strong uptrend.

Current Conditions: Price is near key resistance around $117,000-$121,000 after a sharp rise.

Entry Recommendation: Entry is not recommended at this time. It is better to wait for a correction to the previous support area (e.g., $109,000-$111,000 or $105,000-$108,000) and look for confirmation of a bullish reversal. Entry at current levels is high risk due to the potential for a correction.

Cryptocurrency Futures Market Disclaimer 🚨🚨🚨

Trading cryptocurrency futures involves high risks and is not suitable for all investors.

Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period.

Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

thanks for like and follow @ydnldn to have more information outlook and free signal.

About me :

"I am a passionate swing trader focused on analyzing financial markets to capture profit opportunities from medium-term price movements. With a disciplined approach and in-depth technical analysis, I concentrate on identifying trends, support-resistance levels, and price patterns to make informed trading decisions. I prioritize strict risk management to protect capital while maximizing profit potential. Always learning and adapting to market dynamics, I enjoy the process of refining strategies to achieve consistency in trading."

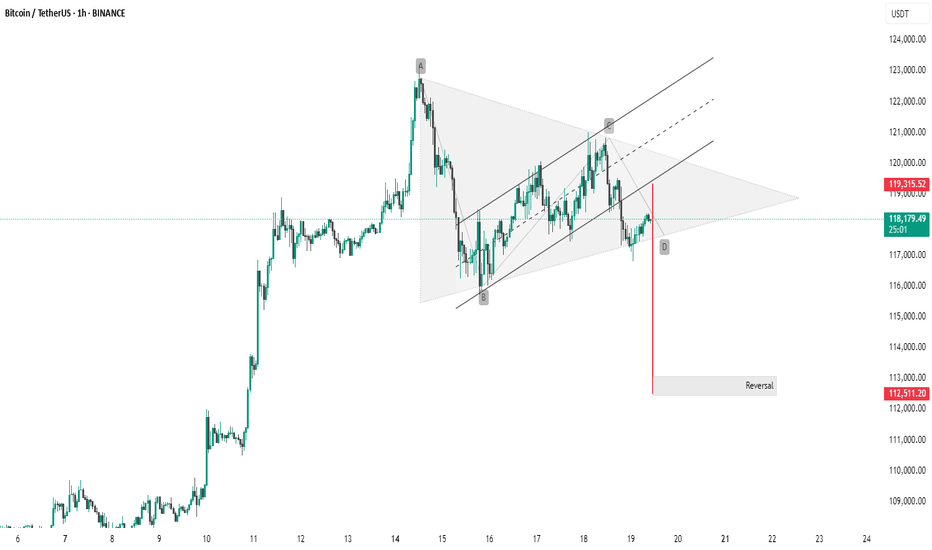

BTC #Bitcoin (BTC/USDT) 1-hour chartThis Bitcoin (BTC/USDT) 1-hour chart shows a bearish breakout from a symmetrical triangle or rising wedge pattern. The breakout is confirmed by a strong red candle below the lower trendline, suggesting downward momentum.

Pattern: Bearish wedge/triangle.

Breakout Level: ~118,000 USDT.

Target Zone: Around 112,511 USDT, marked as a potential reversal area.

Resistance: ~119,315 USDT.

This indicates bearish sentiment in the short term unless BTC quickly reclaims the upper trendline.

Thanking you

_Bitcoin Update

As you all know recently BTC just made a ATH record and aggressive move up panda fam right ? 🚀

Now bitcoin is consolidating or moving sideways in this structure panda fam same time altcoins are moving crazy upwards like altszn 🤯🚀

GOOD NEWS : Bitcoin is forming a possible good bullish structure for continuation pump panda fam, First confirmation will be break on trend resistance and reclaim above NEW ATH.

TAKE NOTE : As long as we are inside on the structure its still consider as sideways panda fam or ranging in short undecided directional bias. ✍️

BTCUSDT: A Period of Adjustment and the Next TrendAfter a strong rally to record highs, BTCUSDT is currently entering a period of slight correction. The coin is now trading around 118,500 USD, down more than 0.57% on the day.

From a technical perspective, BTCUSD is moving within a narrowing price wedge, showing a slight downtrend. The support level at 116,500 USD is acting as a springboard for the Bulls. However, as the price approaches the tip of the wedge, a breakout may occur at any time, with two possible scenarios highlighted on the chart.

My personal outlook is that BTCUSDT will continue to decline in the short term before breaking out of the wedge in an upward direction. What do you think about BTCUSDT?

Please share your thoughts in the comments and don’t forget to like this post!

Wishing you all happy and successful trading!

BTC Pullback Near 200 EMA – Bounce or Breakdown?Bitcoin is currently undergoing a measured pullback after its recent push toward $121K. On the 1H timeframe, price has tested the 200 EMA and held so far, forming a short-term support near $117K. This aligns with a prior consolidation area and is showing some early signs of bottoming.

On the 4H chart, price is also consolidating after a healthy run-up. While momentum has cooled, BTC remains above key moving averages. RSI is approaching mid-range levels (~48), and the QQE is lightly bearish but not aggressive.

Key Zones to Watch:

Support (1H + 4H confluence):

🔹 $117,000 – $117,300 (EMA 200 + historical pivot + bounce region)

Resistance/Breakout Target:

🔹 $118,500 – $119,500 → Area where shorter EMAs are clustered

🔹 $121,000 → Previous local high

Take Profit (if bounce plays out):

🔹 TP1: $119,200

🔹 TP2: $120,800

🔹 TP3: $122,800

Scenarios:

Bullish Bias (if price reclaims $118.5K+):

Reclaiming EMAs and printing higher lows would suggest continuation.

RSI crossing 50 and increasing volume would confirm short-term bullish momentum.

Bearish Bias (if $117K breaks):

Breakdown from this base could send BTC to test $116K or even back to $114.5K range.

Look for volume spike + MACD/QQE confirmation for further downside.

Summary:

BTC remains in a constructive uptrend on higher timeframes. The current pullback is still within normal range, especially while price respects the 200 EMA on both 1H and 4H charts. This is a key decision zone—bulls want to see a reclaim of $118.5K, while bears need to break below $117K to take control.

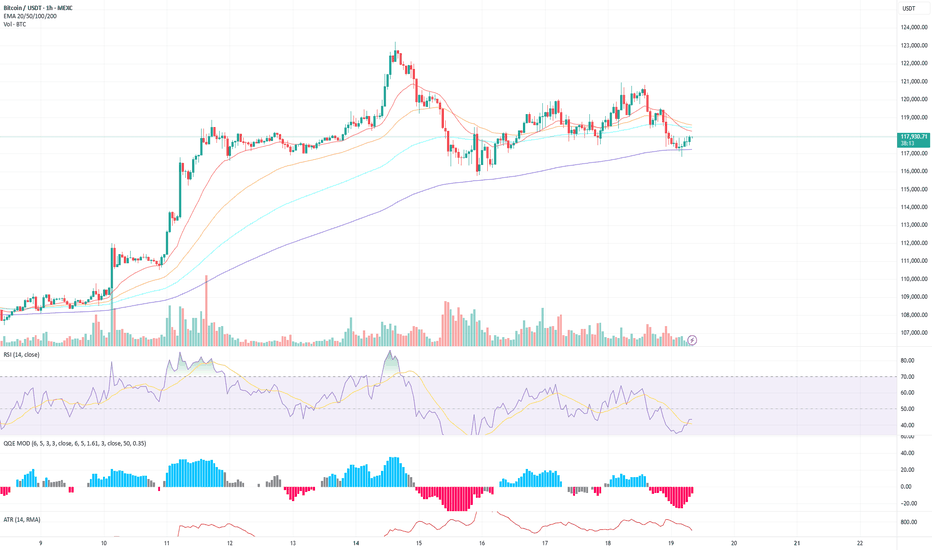

BTC/USDT (1H) Market Analysis – July 19

BTC is hovering just below the 200 EMA, having recently bounced off it with a small recovery candle.

The recent downtrend from the $121K peak has flattened, and price is forming a potential short-term base above the $117K support.

There's low-volume chop, suggesting indecision or a pause before the next leg.

Key Technical Levels

Support zone: $117,200 – $117,500 (200 EMA + recent wick support)

Resistance zone: $118,500 – $119,000 (cluster of short EMAs + prior supply)

Breakout level: $119,500 (for a bullish continuation)

Breakdown level: $116,800 (for further downside)

Indicator Insights

RSI: 42.86 and curling up slightly → shows a potential recovery attempt but still below neutral.

QQE MOD: Deep in bearish territory (–8.53), but we’re seeing the first signs of easing negative momentum.

ATR: 681 and gradually falling → declining volatility, aligning with consolidation.

Bias & Scenarios

Bullish Case:

If BTC holds above the 200 EMA and breaks above $118.5K with volume, we could see a retest of the $119.5K–$120K zone.

RSI breaking 50 and QQE printing lighter red would confirm upward momentum.

Bearish Case:

Failure to reclaim EMAs and a drop below $117K could send price toward $116K or even back to the breakout base at $114.5K.

Watch for volume spikes on red candles and RSI breaking back under 40.