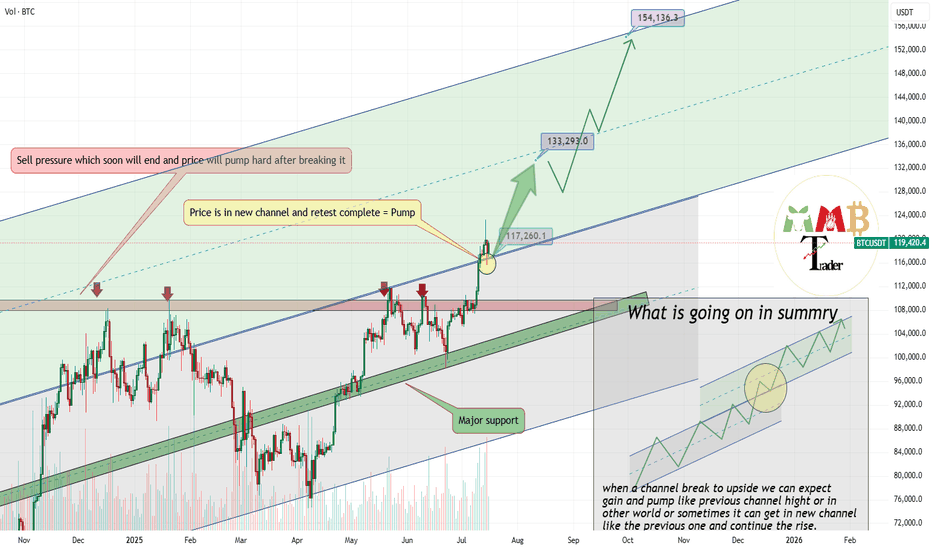

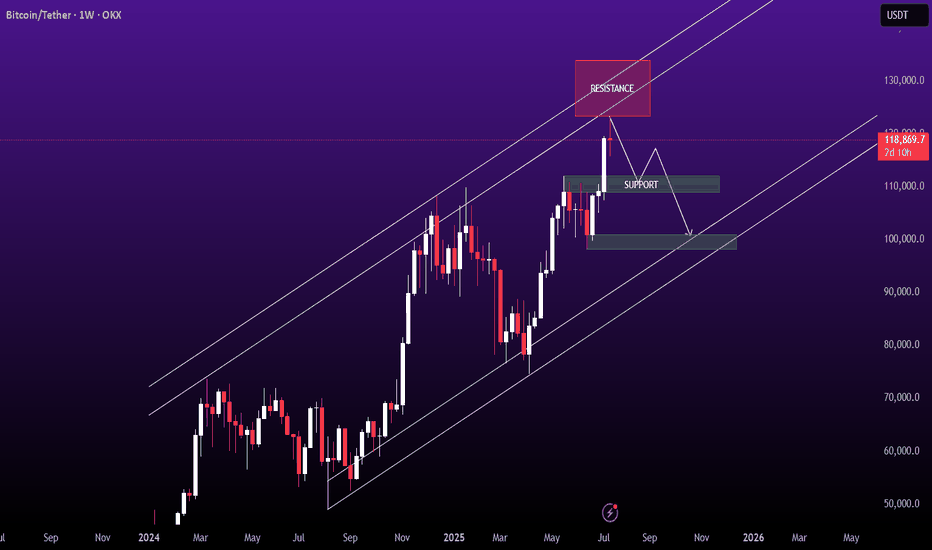

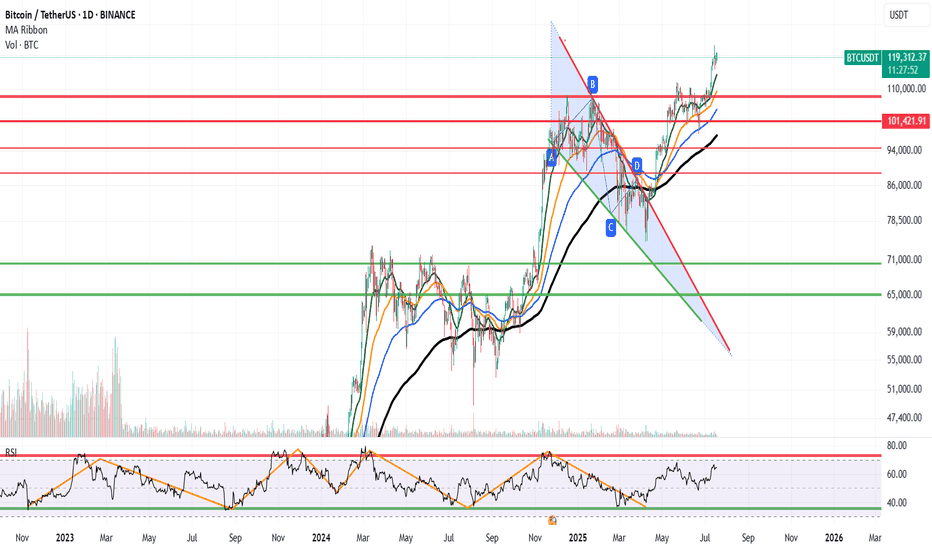

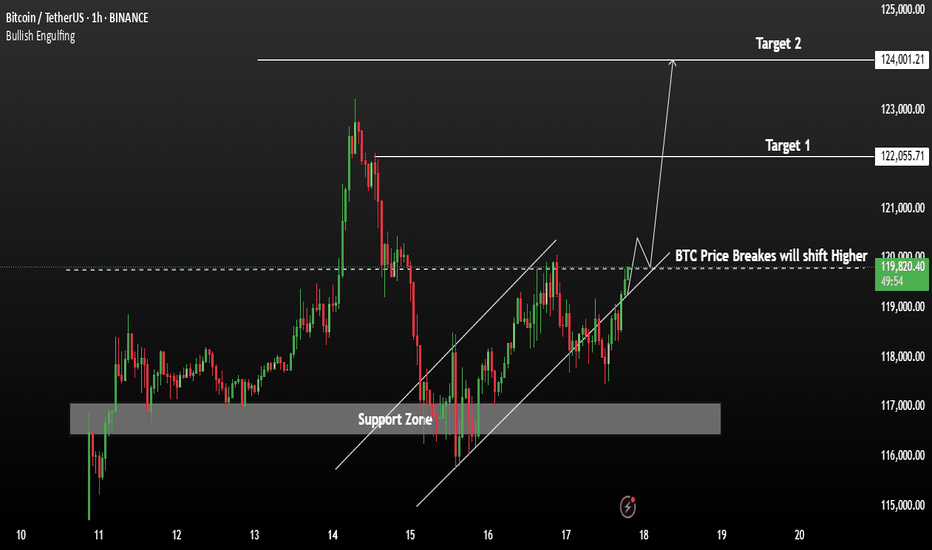

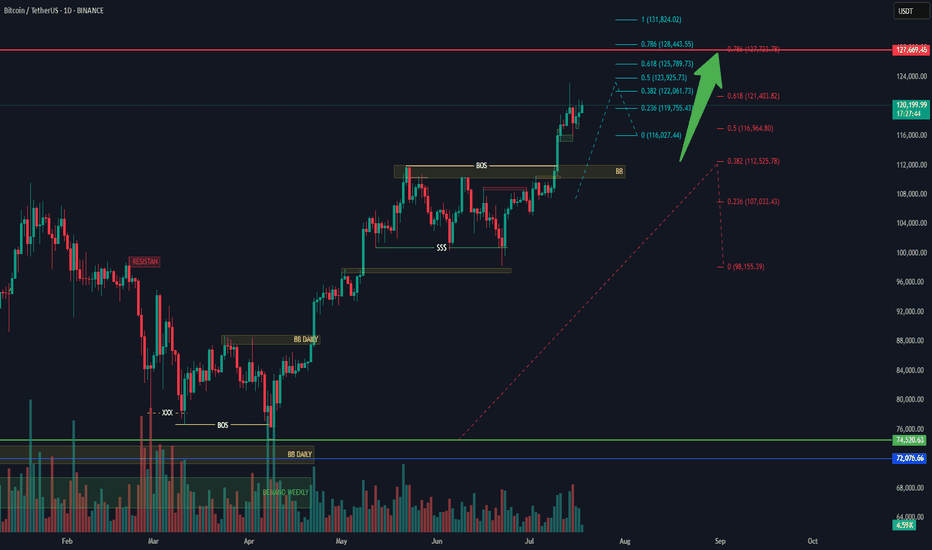

Bitcoin retest of breakout completed soon 133K$As we can see price broke previous channel and now is in new Ascending channel and pointing targets like 133K$ & 150K$.

Major support now is around 116000$ to 117000$ and price hold strong and market can easily continue more pump here like the green arrow.

BINANCE:BTCUSDT is now hitting ATH constantly and this just beginning of this bull run because ALT coins are not yet started.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

BTCUST trade ideas

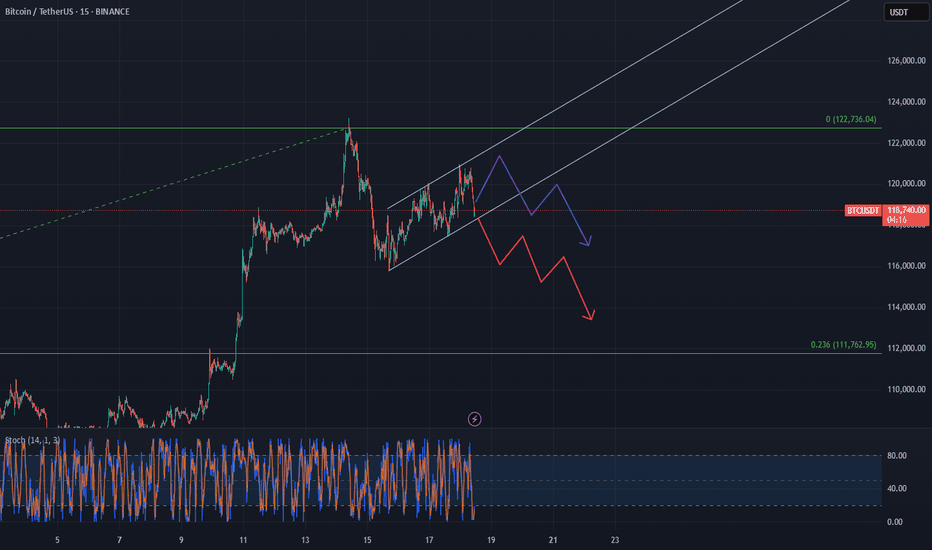

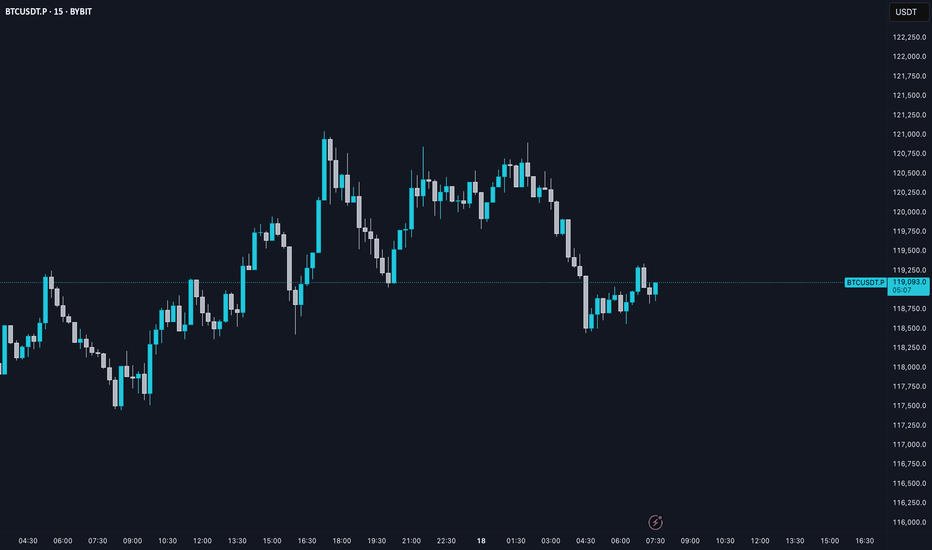

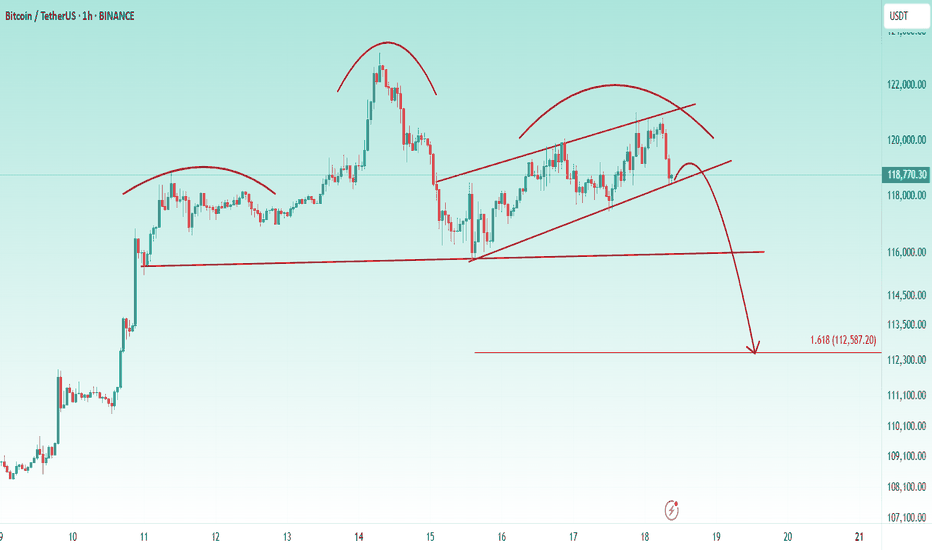

BTC consolidating a short term bearish channelBTC is moving inside a short-term bearish channel right now, even though the bigger trend is still upward. It looks like it's just consolidating for the time being, bouncing between the top and bottom of the channel.

But if it breaks below that lower trendline, we could see a pretty sharp move down—possibly all the way to around $112K , which lines up with the Fibonacci retracement from the last rally. That zone could act as a support.

It might hang out in this range a little longer, but once it breaks down, it’s probably heading toward that level.

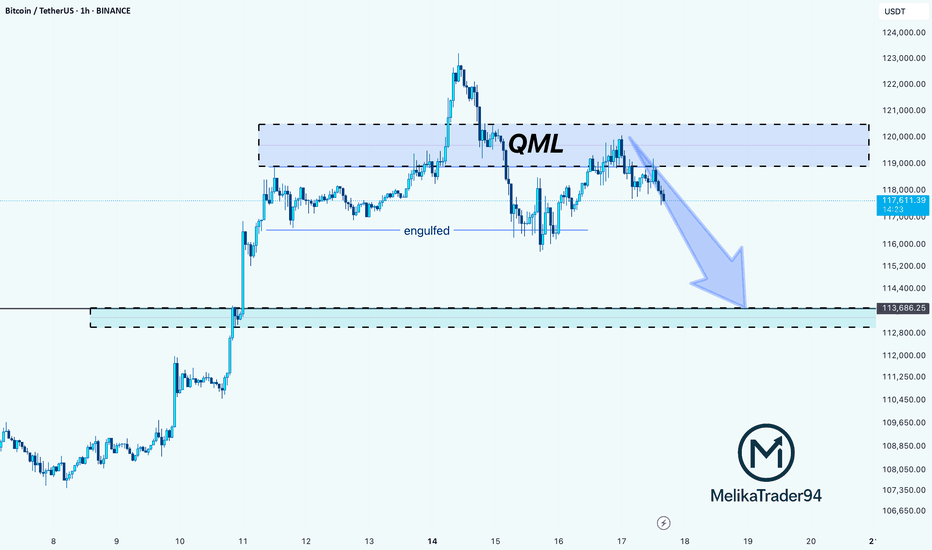

BTC Rejection from QML Zone: Towards on 113,600 SupportHello guys!

This chart shows a QML (Quasimodo Level) setup in play on Bitcoin. After price created a new high and engulfed the previous structure, it returned to the QML zone (around $119K–$121K) and reacted exactly as expected: strong rejection.

The sharp selloff from the QML area confirms a bearish shift in structure, and now the momentum is tilted to the downside.

The next key level to watch is the 113,600 demand zone, where the price may either bounce or consolidate.

As long as the price stays below the QML zone, bears have control.

You should consider that the main trend is bullish, and the stop loss may be hit, so please manage your risk!

TradeCityPro | Bitcoin Daily Analysis #131👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis, I’ll review the futures session triggers for New York.

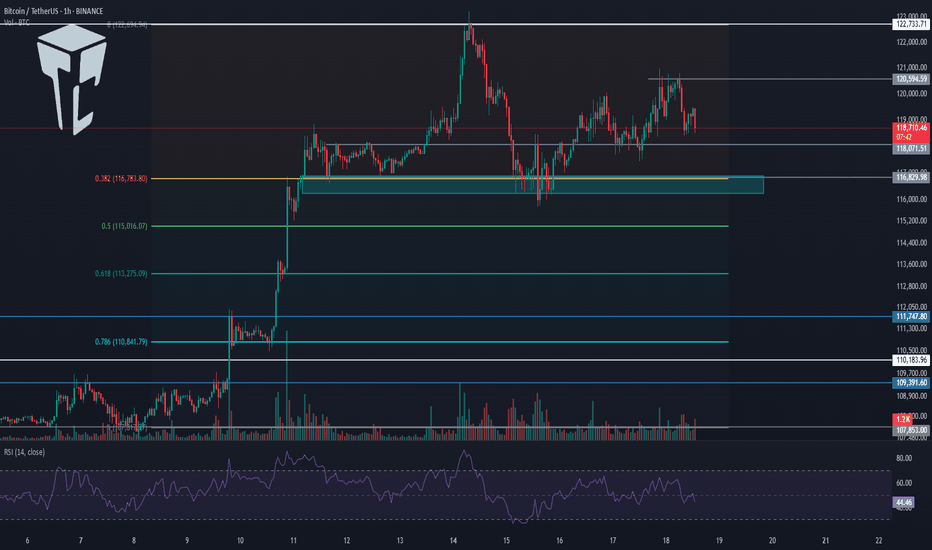

⏳ 1-hour timeframe

Over the past few days, the market hasn't been very focused on Bitcoin, and altcoins have been moving more strongly to the upside.

⚡️ Bitcoin is still ranging between 116829 and 122733 and is fluctuating between these two levels.

💥 Currently, a local top has formed at 120594, and if that level breaks, we can open a long position. The main long trigger will be the breakout of 122733.

📈 If the market decides to correct, key support levels are 118071 and 116829. I’m setting the stop-loss for my previously opened positions below the 116000 zone.

👑 BTC.D Analysis

Let’s look at Bitcoin Dominance. The reason I’m saying Bitcoin isn't currently the center of attention is exactly this dominance chart.

🔔 As you can see, BTC Dominance is in a very sharp downtrend with strong momentum, which means capital is flowing out of Bitcoin and into altcoins—giving us better long setups on alts.

✨ For now, I see the trend as bearish, and the next supports are at 61.34 and 60.49.

📅 Total2 Analysis

Total2 is still moving upward and has broken above 1.46, continuing its upward momentum.

✔️ The new top is at 1.5, and a breakout above this level can be used as a trigger for long entries.

📅 USDT.D Analysis

Let’s move to Tether Dominance. The 4.22 support was broken yesterday, and the index is now moving downward.

💫 The next support level is 4.08, and breaking that will confirm continuation of the downtrend.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

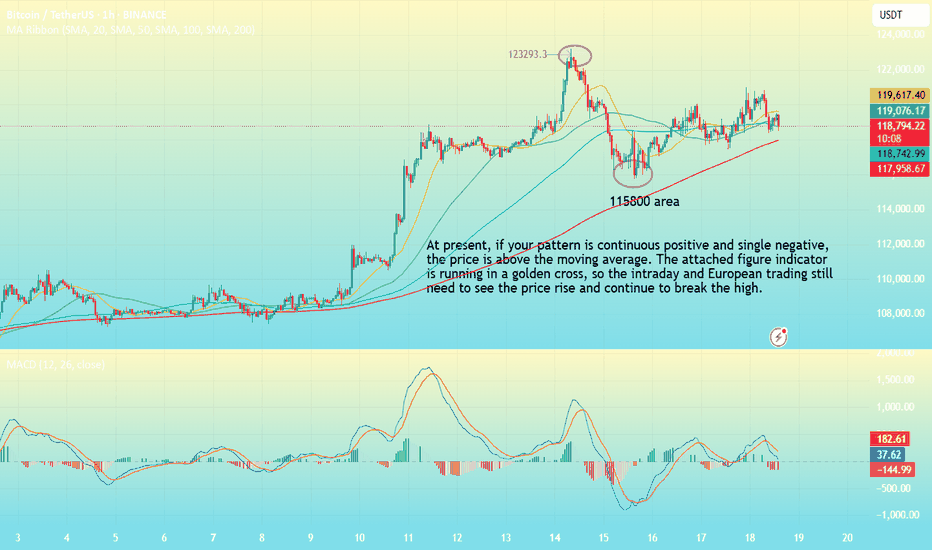

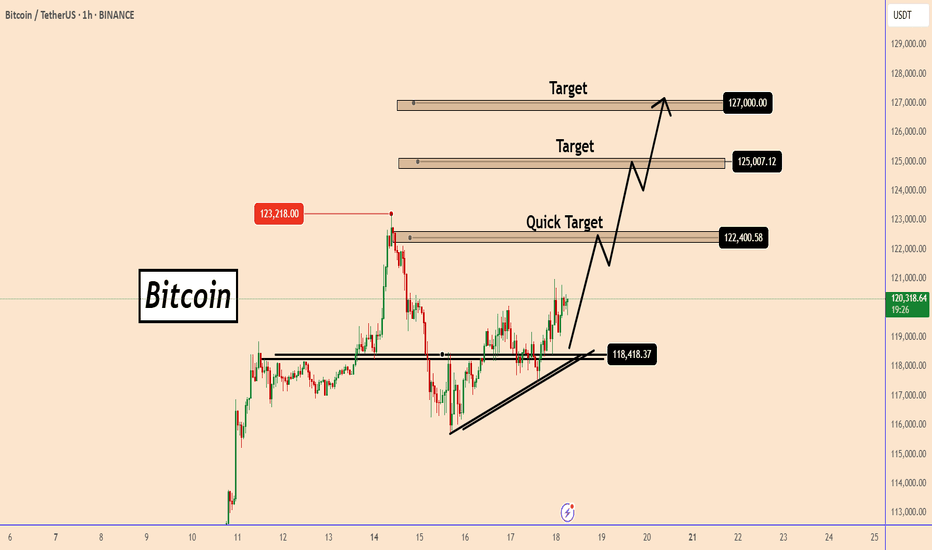

BTC-----Buy around 118000, target 120000 areaTechnical analysis of BTC contract on July 18:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern continued to rise, the price was above the moving average, and the attached indicator was golden cross and running with shrinking volume. The large-scale upward trend is still very obvious. After the previous strong performance, there was a short-term shock correction trend. According to the current trend rules, it is a correction and a trend of market demand. The trend has not changed; the short-term hourly chart yesterday's European session price support rebound, the current K-line pattern continued to rise and the attached indicator was golden cross, so we still have to look at the continuation of the break in the day and the European session. The moving average support position is 120,000 area; the high point is near 121,000 area.

Today's BTC short-term contract trading strategy:

Buy in the 118,000 area, stop loss in the 117,000 area, target the 121,000 area, break the position and look at the 121,500 area;

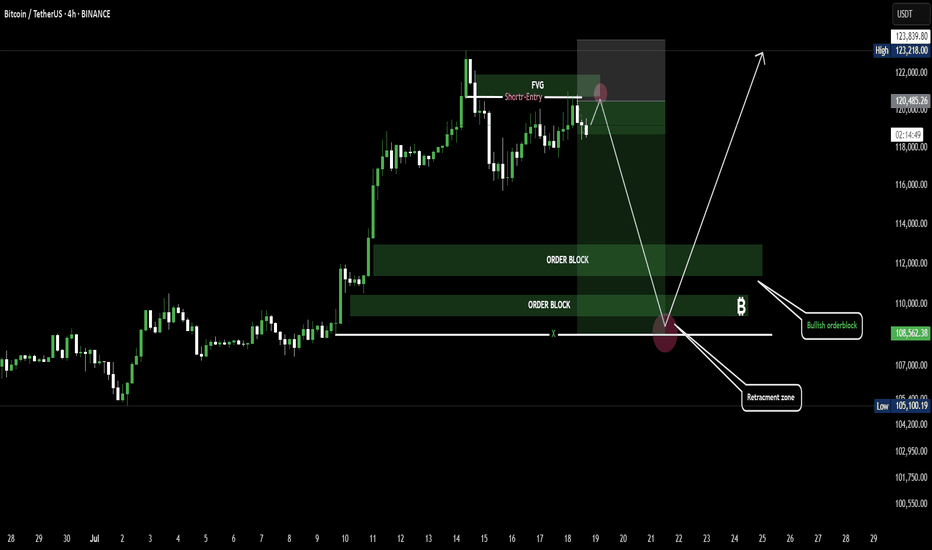

BTC Retracement Loading.....Bullish Bounce Ahead?Bitcoin is showing signs of a short-term pullback after tapping into a Fair Value Gap (FVG) zone, triggering a potential short setup. Price is likely to retrace toward the bullish order block and retracement zone around 105,000–110,000. If that area holds, we could see a strong bounce back toward the 123,000 level.

BTCUSDT Smart Zone Entry + Take Profit MapThe BTCUSDT chart on both the 1H and 4H timeframes shows a clear consolidation above a high-timeframe support zone with early signs of bullish continuation. This setup outlines a well-defined "Buy Zone," backed by recent demand re-tests, with Take Profit (TP) levels mapped out based on prior highs and price inefficiencies.

Buy Zone (Demand Zone):

The shaded area on the 1H/4H chart marks a critical support zone between ~$117,800 and $119,300. This range aligns with past consolidation, a 4H EMA cluster, and prior bullish reactions. Entries within this zone offer a high reward-to-risk setup.

Support Level:

$117,800, the base of the demand zone, is the final line of support. A clean break and close below this level would invalidate the current long bias.

Take Profit Levels (TPs):

TP1 (~$122,000): Previous local resistance and recent high.

TP2 (~$123,300): Upper wick high and liquidity zone.

TP3 (~$124,500): Untapped zone from early July, likely liquidity pool.

Supporting Indicators:

RSI: Recovering from mid-range, showing hidden bullish divergence on lower timeframes.

QQE MOD: Flipping from bearish to bullish momentum.

ATR: Declining volatility post-drop indicates possible accumulation before breakout.

After a sharp pullback, BTC is stabilizing above a demand zone and forming a potential base. As long as price remains above ~$117,800, there's confluence for a continuation higher, with the outlined TP levels offering natural exit points for partial or full profits.

BTC AI Prediction Dashboard - 6h Price Path (18.07.25)

Prediction made using Crypticorn AI Prediction Dashboard

Link in bio

BTCUSDT Forecast:

Crypticorn AI Prediction Dashboard Projects 6h Price Path (Forward-Only)

Forecast timestamp: ~11:30 UTC

Timeframe: 15m

Prediction horizon: 6 hours

Model output:

Central estimate (blue line): -118,806

Represents the AI’s best estimate of BTC’s near-term price direction.

80% confidence band (light blue): 118,801 – 119,424

The light blue zone marks the 80% confidence range — the most likely area for price to close

40% confidence band (dark blue): 118,228 – 119,973

The dark blue zone shows the narrower 40% confidence range, where price is expected to stay with higher concentration

Volume on signal bar: 171.10

This chart shows a short-term Bitcoin price forecast using AI-generated confidence zones.

Candlesticks reflect actual BTC/USDT price action in 15-minute intervals.

This helps visualize expected volatility and potential price zones in the short term.

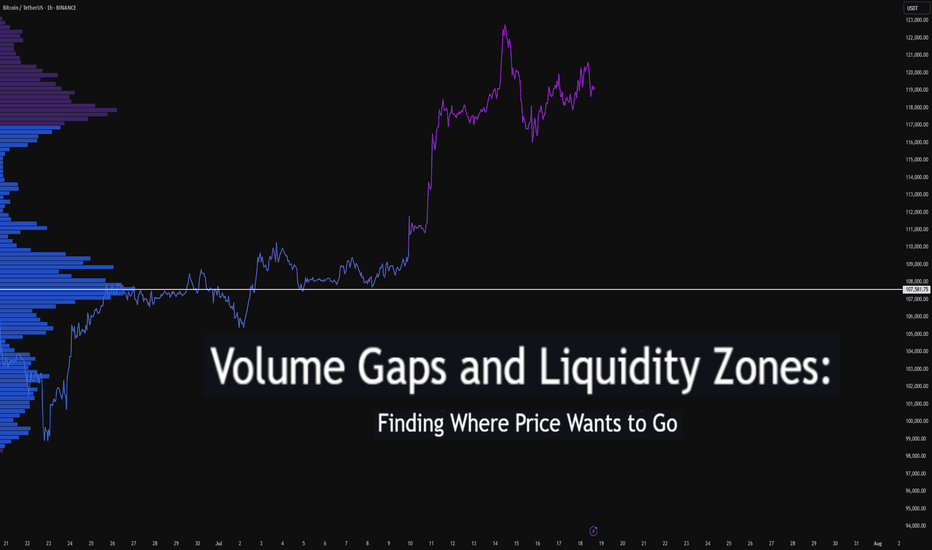

Volume Gaps and Liquidity Zones: Finding Where Price Wants to GoDifficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is best suited for traders familiar with volume profile, liquidity concepts, and price structure. It blends practical trading setups with deeper insights into how price seeks inefficiency and liquidity.

🔵 INTRODUCTION

Ever wonder why price suddenly accelerates toward a level — like it's being magnetized? It’s not magic. It’s liquidity . Markets move toward areas where orders are easiest to fill, and they often avoid areas with little interest.

In this article, you’ll learn how to identify volume gaps and liquidity zones using volume profiles and price action. These tools help you anticipate where price wants to go next — before it gets there.

🔵 WHAT ARE VOLUME GAPS?

A volume gap is a price region with unusually low traded volume . When price enters these areas, it often moves quickly — there’s less resistance.

Think of a volume gap as a thin patch of ice on a frozen lake. Once the market steps on it, it slides across rapidly.

Volume gaps usually show up on:

Volume Profile

Fixed Range Volume tools

Session or custom volume zones

They’re often created during impulsive moves or news events — when price skips levels without building interest.

🔵 WHAT ARE LIQUIDITY ZONES?

Liquidity zones are price areas where a large number of orders are likely to be sitting — stop losses, limit entries, or liquidation levels.

These zones often form around:

Swing highs and lows

Order blocks or fair value gaps

Consolidation breakouts

Psychological round numbers

When price approaches these areas, volume often spikes as those orders get filled — causing sharp rejections or breakouts.

🔵 WHY THIS MATTERS TO TRADERS

Markets are driven by liquidity.

Price doesn’t just move randomly — it hunts liquidity, clears inefficiencies, and fills orders.

Your edge: By combining volume gaps (low resistance) with liquidity zones (target areas), you can forecast where price wants to go .

Volume gap = acceleration path

Liquidity zone = destination / reversal point

🔵 HOW TO TRADE THIS CONCEPT

1️⃣ Identify Volume Gaps

Use a visible range volume profile or session volume. Look for tall bars (high interest) and valleys (low interest).

2️⃣ Mark Liquidity Zones

Use swing highs/lows, OBs, or EQH/EQL (equal highs/lows). These are magnet areas for price.

3️⃣ Watch for Reactions

When price enters a gap, expect speed.

When it nears a liquidity zone, watch for:

Volume spike

Wick rejections

S/R flip or OB retest

🔵 EXAMPLE SCENARIO

A strong bearish move creates a volume gap between 103 000 – 96 000

Below 96 000 sits bullish order blocks — clear liquidity

Price enters the gap and slides fast toward 96 000

A wick forms as buyers step in, volume spikes — the reversal begins

That’s price filling inefficiency and tapping liquidity .

🔵 TIPS FOR ADVANCED TRADERS

Use higher timeframes (4H/1D) to define major gaps

Look for overlapping gaps across sessions (Asia → London → NY)

Align your trades with trend: gap-fills against trend are riskier

Add OB or VWAP as confirmation near liquidity zones

🔵 CONCLUSION

Understanding volume gaps and liquidity zones is like reading the market’s intention map . Instead of reacting, you start predicting. Instead of chasing, you’re waiting for price to come to your zone — with a plan.

Price always seeks balance and liquidity . Your job is to spot where those forces are hiding.

Have you ever traded a volume gap into liquidity? Share your setup below

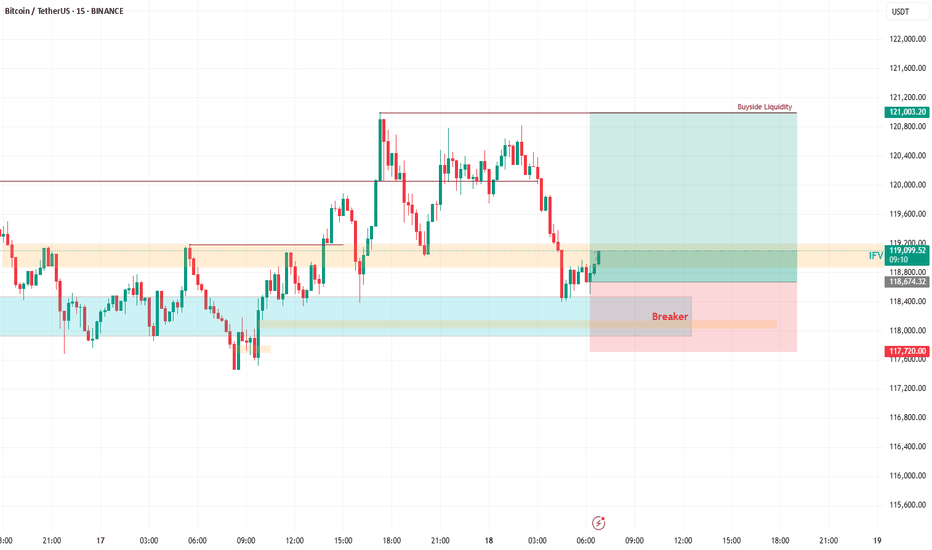

The Setup: Bullish Breaker in Play!Yesterday, BTC smashed into a strong bullish breaker and bounced like a champ. Today, it’s retracing back to this key level, setting up for what I expect to be another explosive buy reaction. Why? Because this breaker is rock-solid, and the price action is giving us all the right signals! Plus, it’s Friday—the last trading day of the week—and I’m betting BTC will stretch its legs to cover the weekly range. 🏃♂️

🎯 Trade Details: Where to Jump In

Buy Area: Right now, the price is teasing the breaker zone.

Stop Loss: Protect your capital with a stop loss at around ~117,700.

Target: We’re aiming for the Buyside Liquidity sitting pretty around 121,000. That’s a juicy move with solid risk-reward potential! 💪

🧠 Why This Trade Makes Sense

Bullish Breaker Strength: This level has proven itself as a springboard for price action.

Weekly Range Play: Fridays often see BTC push to cover its weekly range, and we’re in prime position to catch it.

Liquidity Grab: The Buyside Liquidity at 121,000 is like a magnet for price—let’s ride it there!

⚠️ Risk Management Reminder

Always trade smart! Use proper position sizing, stick to your risk management rules, and don’t go all-in like it’s a casino. Keep those stops tight to avoid getting wrecked by any sudden volatility. 😎

💬 Join the Conversation!

What do you think of this setup? Are you jumping on this BTC train or waiting for more confirmation? Drop your thoughts in the comments below! 👇 Also, if you like this idea, smash that LIKE button ❤️ and follow for more trade ideas to keep your portfolio poppin’! 🚀

Happy trading, and let’s stack those pips! 💰

#BTC #CryptoTrading #BuyTrade #Bullish #TradingView

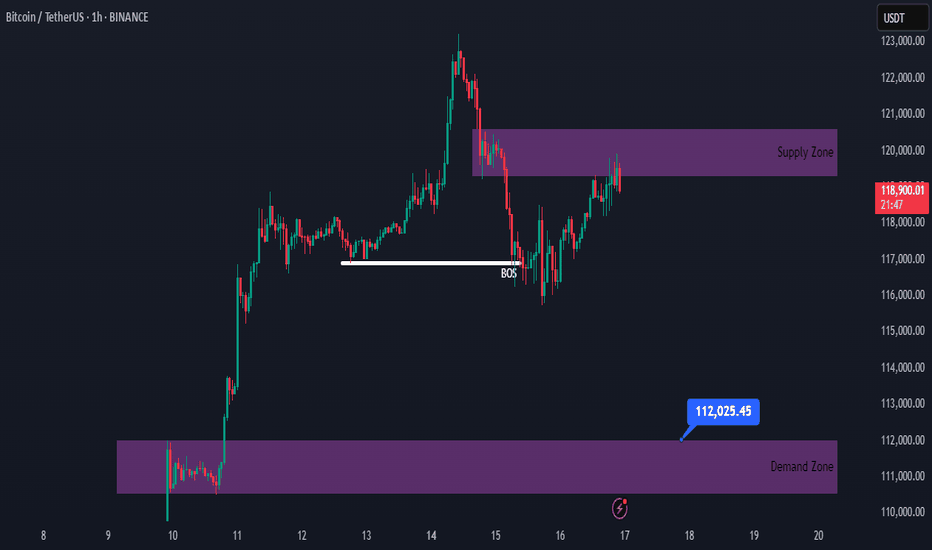

BTCUSDT Another correction and Bounce to topBTCUSDT strong support in the 1H timeframe, with quick rejection and recovery from the lower levels. This behaviour often signals stop-hunting activity, followed by a potential bullish reversal, suggesting accumulation by smart money.

📊 Key Technical Levels:

Immediate Resistance: 118,500

A break and 1H candle close above 118,500 would be a bullish trigger. If price holds and builds above this level, we could see momentum towards: 120,000 / 122,000 / 124,000 (next potential targets)

You May find more details in the chart.

PS: Support with like and comments for more analysis Thanks for Supporting.

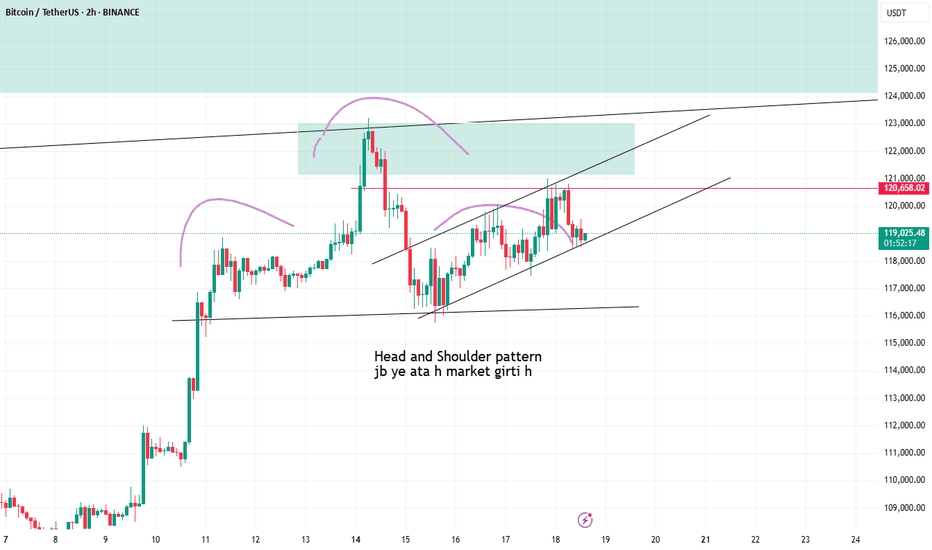

Possible correction toward a 112,600$📥 On the lower timeframes, a head and shoulders pattern has formed, which could trigger selling pressure down to the 112,600 level in the short term. This correction on the lower timeframes might also cause a minor pullback in the altcoin market, potentially creating a good buying opportunity

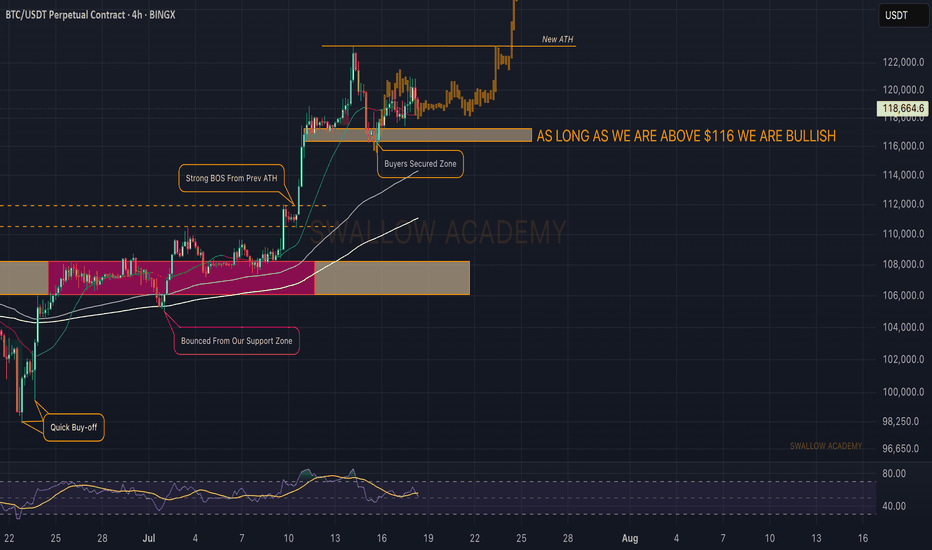

Bitcoin (BTC): Small Correction Happening | Attentions at $116KBitcoin still looks bullish, with no major signs of potential sell-side movement to happen. The least we look for here is the retest of the current ATH, which is the $123K zone, and we will keep this game plan as long as the price stays above $116K.

If we see any signs of a breakdown happening, we might be heading for a bigger correction towards $108K (only if we see a break of $116K).

Swallow Academy

Bitcoin Bullish, but a Correction Might Be AheadHello traders!

Obviously, Bitcoin has a strong bullish momentum.

However, after noticing a minor shift in market structure, we may see a correction toward the 112,000 area.

If the supply area doesn’t break, we can look for a sell position here.

#BTC #Bitcoin

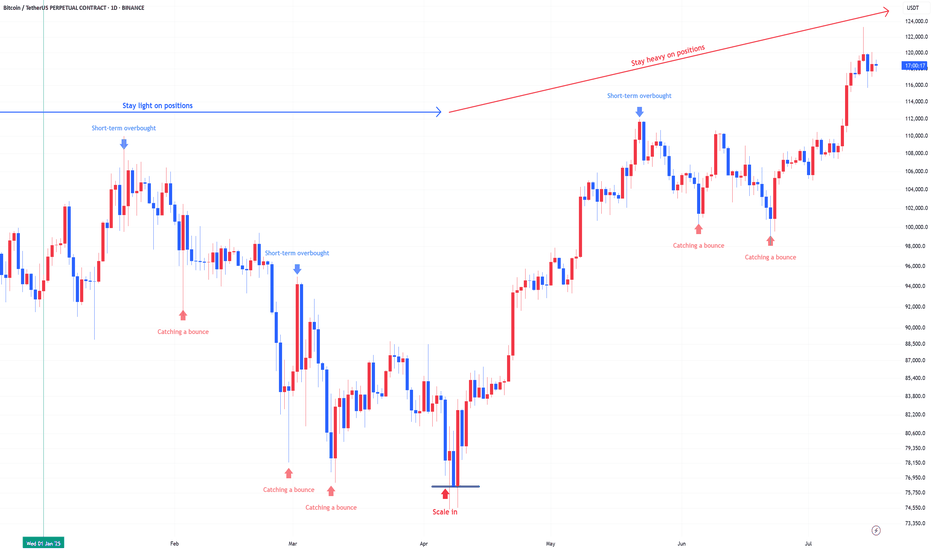

Bitcoin : Stay heavy on positionsApril was the scale-in zone:

Back in April, the US stock market flashed a split-entry buy signal—a classic zone for gradual accumulation.

That same setup applied to Bitcoin. Buying the fear worked again.

We’ve moved out of the fear zone:

Both Bitcoin and equities have left the extreme fear territory behind. Sentiment has shifted.

Short-term overbought now:

Bitcoin is currently in a short-term overbought phase. Some consolidation or cooling off is natural here, but no major trend reversal signs yet.

Stay heavy on positions:

I’m maintaining an overweight position in Bitcoin as long as the US stock market stays intact. The Nasdaq is holding up, so Bitcoin likely stays in risk-on mode.

Warning:

If US equities take a hit, expect Bitcoin to follow.

Negative moves in the stock market will likely translate directly into crypto weakness.

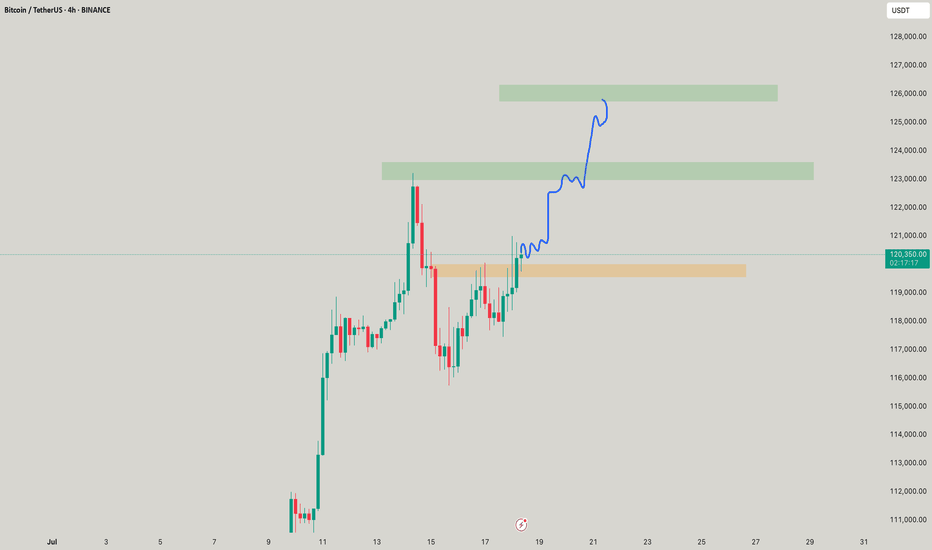

BTC Could Start Another Bullish WaveBTC Could Start Another Bullish Wave

Over the past two days, bitcoin has been holding strong above 118400. It seems that this small structural area could push BTC higher.

For now, ETH has performed better and BTC may follow suit.

I am looking for short-term targets near 122400, 125000 and 127000.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

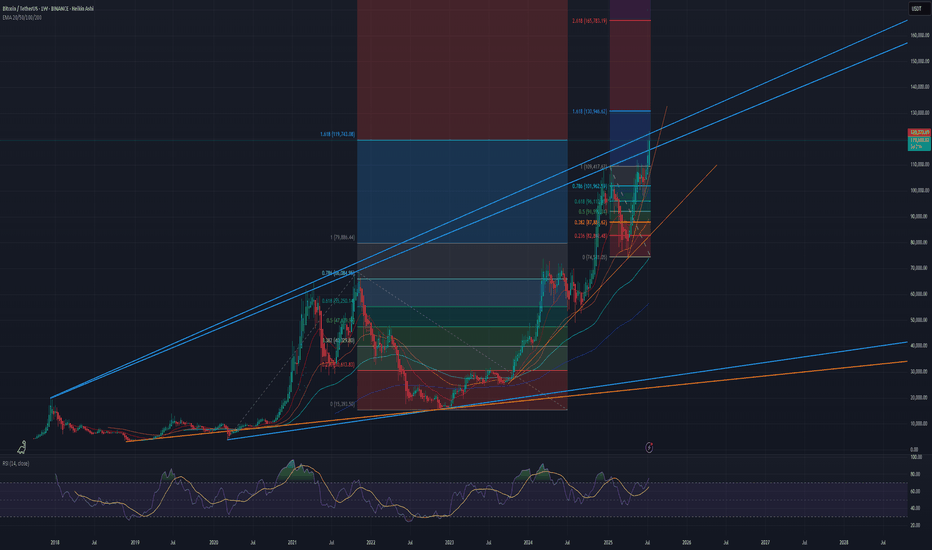

Bitcoin is ULTRA MEGA Bullish!See the trend lines and fib levels for your resistance and support levels. It's great that Bitcoin is breaking through the blue trend line on top. If it chops sideways here for a while at this level, this will serve as a strong new support level for bitcoin when it comes back down in Q4.

I believe $130k is the lowest potential target for bitcoins ATH this cycle. Until that level is approaching, I'm ultra mega bullish and trading altcoins with leverage. USDT Dominance and BTC Dominance are in free fall right now so altcoins are pumping hard while bitcoin chills at the resistance levels.

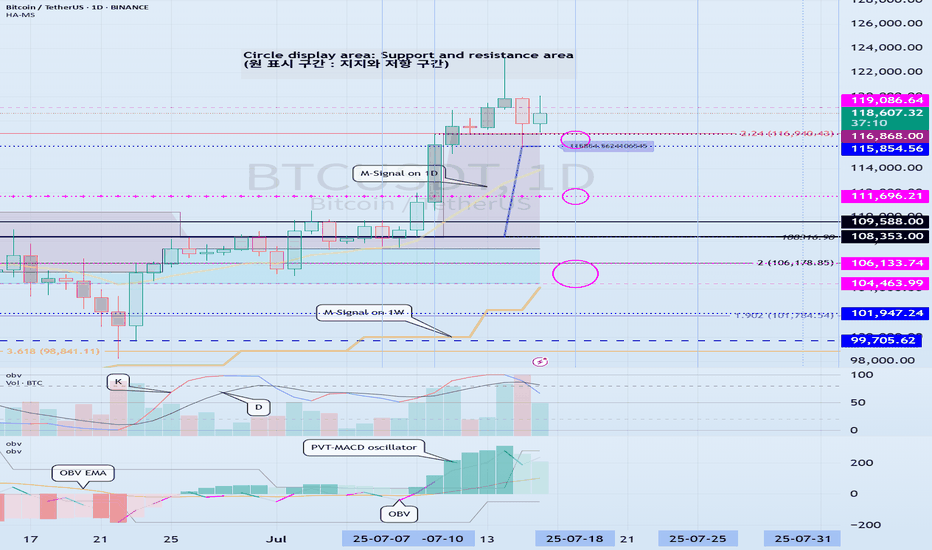

Check support at 115854.56-119086.64

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

On the 1W chart, the DOM(60) indicator was created at the 119086.64 point.

Accordingly, the key is whether it can be supported near 119086.64.

The meaning of the DOM(60) indicator is to show the end of the high point.

In other words, if it rises above HA-High ~ DOM(60), it means that there is a high possibility of a stepwise upward trend.

On the other hand, if it fails to rise above DOM(60), it is likely to turn into a downtrend.

The basic chart for chart analysis is the 1D chart.

Therefore, if possible, check the trend of the 1D chart first.

The DOM(60) indicator of the 1D chart is currently formed at the 111696.21 point.

And, the HA-High indicator was created at the 115854.56 point.

Therefore, since it cannot be said that the DOM(60) indicator of the 1D chart has been created yet, if the price is maintained near the HA-High indicator, it seems likely to rise until the DOM(60) indicator is created.

We need to look at whether the DOM(60) indicator will be created while moving sideways at the current price position or if the DOM(60) indicator will be created when the price rises.

If the price falls and falls below 111696.21, and the HA-High indicator is generated, the HA-High ~ DOM(60) section is formed, so whether there is support in that section is the key.

-

Since the DOM(60) indicator on the 1W chart was generated, if it fails to rise above the DOM(60) indicator, it is highly likely that the HA-High indicator will be newly generated as it eventually falls.

Therefore, you should also look at where the HA-High indicator on the 1W chart is generated when the price falls.

-

The next volatility period is around July 18 (July 17-19).

Therefore, you should look at which direction it deviates from the 115854.56-119086.64 section after this volatility period.

Since the K of the StochRSI indicator fell from the overbought section and changed to a state where K < D, it seems likely that the rise will be limited.

However, since the PVT-MACD oscillator indicator is above 0 and the OBV indicator is OBV > OBV EMA, it is expected that the support around 115845.56 will be important.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------