BTCUST trade ideas

One last Correction till breakoutWith the most recent SFP printed on the higher timeframe and BTC still failing to break a significant high, all signs point toward one final dip – a move to shake weak hands and reload for the breakout that’s been brewing in silence.

⚡ If the orange level holds, consider it a highly bullish signal – supercycle potential unlocked?

Naturally, the Wizard plays both sides of the board:

📉 Short ideas would activate around the blue Order Block / green correction level.

📈 But should we bounce strong from orange… well, let’s just say you’ll want a seat for what comes next.

🟥 Bullish invalidation rests at the red line.

Let’s see how the game unfolds.

BTCUSD long setup: Targeting the next bull move.Hello IGT FOLLOWERS

Here is my BTCUSD overview, Bitcoin is showing bullish momentum after holding strong support near $112,000. A breakout above the $115000 resistance suggests buyers are regaining control. RSI is turning upward, and volume is increasing on green candles signaling demand. As long as price holds above $113,000, bulls may push toward the $117,500 target.

Key points :

Entry point : 113500

1st Target : 115000

2nd Target : 117500

Follow me for more latest updates and signals

Teach me to fish, don’t hand me the catch.

---

🎯 **“Teach me to fish, don’t hand me the catch.”**

That’s the mantra behind what we do.

We’re not here to hand you quick wins—we’re here to equip you with the tools, mindset, and precision to master the art of **technical analysis**.

📚 **Follow Us** as we unlock proven strategies, crafted through years of experience and sharpened by real market conditions.

💼 **What You'll Get:**

- High-performance analysis techniques

- Visual case studies from our **actual trades**

- Clear examples from the insurance sector and beyond

- A blueprint to recognize and seize winning setups with confidence

💥 Whether you're new or seasoned, this isn't textbook theory.

This is **applied strategy**, built for clarity and verified by results.

---

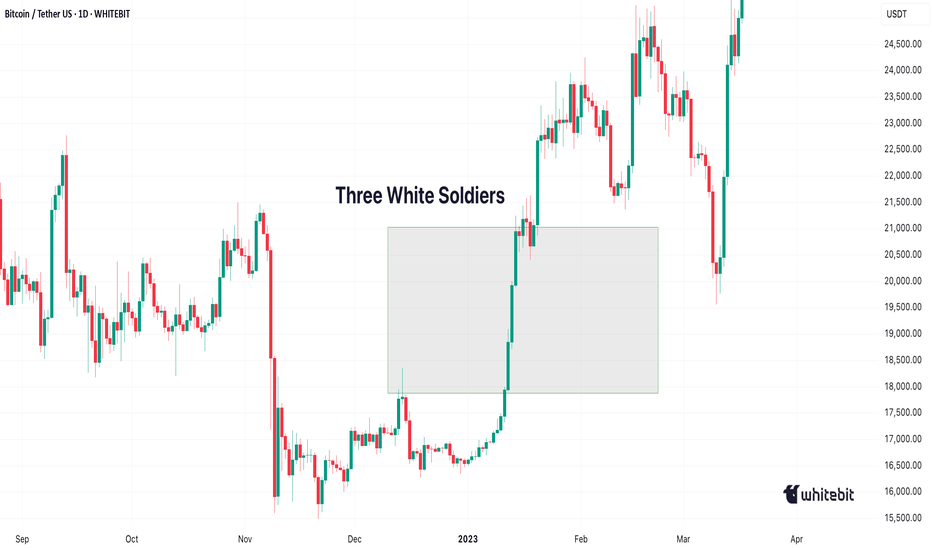

Three White Soldiers & Three Black CrowsHello, Traders! 😎

In technical analysis, not all candlestick patterns are created equal. While some merely hint at indecision or short-term corrections, others shout with conviction: "Trend reversal is coming…" Two of the most powerful momentum candlestick formations are the Three White Soldiers and the Three Black Crows. When they appear, traders PAY ATTENTION. In this article, we’ll dive deep into: What do these patterns look like? Why do they form? What do they tell us about market psychology? How to trade them?+ Their limitations 👇🏻

What Are Three White Soldiers and Three Black Crows?

These Are Multi-Candle Reversal Patterns That Suggest A Strong Shift In Market Sentiment:

Three White Soldiers. A 🐂bullish reversal pattern that occurs after a downtrend. It consists of three consecutive long-bodied green (or white) candles, each closing higher than the last, and ideally opening within the previous candle’s real body.

Three Black Crows. A 🐻bearish reversal pattern that shows up after an uptrend. It’s made of three consecutive long-bodied red (or black) candles, each closing lower than the last and opening within the previous candle’s real body. They signal not just a change in price, but a shift in power, from sellers to buyers (or vice versa).

Candles With a Message

Unlike most one-candle signals or minor patterns, these sequences tell a real story. They show that one side has taken clear control over the market — not for an hour, not for a single day, but for multiple sessions. And that kind of shift, especially on higher timeframes like daily or weekly charts, is something seasoned traders pay close attention to.

Let’s get into the psychology for a second. Imagine you’re a trader who just watched BTC drop for two weeks. Then out of nowhere, three strong green candles appear, each more bullish than the last. You’re seeing buyers push through resistance levels like they don’t even exist. That’s not just a bounce, that’s confidence. That’s the kind of thing that makes people FOMO back in, or finally close out their shorts. Same with the Black Crows. If the price has been climbing and suddenly sellers start hammering it for three days straight? That’s not retail panic. That’s big money exiting.

Now, How do Traders Trade Them?

Well, a lot of people jump in right after the third candle closes. If you’re going long on the Three White Soldiers, you’re betting that the breakout has legs. Same for shorting the Black Crows.

But, and here’s the trap, not all of these patterns play out. Sometimes, that third candle is the climax, not the beginning. So confirmation matters. Volume should increase. The move should break a recent key level. Indicators like RSI or MACD should support the shift. Otherwise, you might just be catching the end of a move, not the start of one.

Another mistake? Ignoring context. These patterns mean nothing if they’re forming in the middle of chop or during low-volume holiday trading. They work best when they signal the end of exhaustion.

And let’s be honest. Even if the pattern is clean, you still need a plan. Stops should go below the first green candle (for bullish setups) or above the first red one (for bearish setups). If price moves against you, it means momentum never really shifted. That’s your cue to get out fast.

Final Thoughts

Three White Soldiers and Three Black Crows are powerful tools in the hands of a patient trader. Of course, these patterns aren’t perfect. They don’t account for time, so a 3-day move might seem powerful, but if it happens slowly over 12-hour candles, it’s not as strong as the same pattern on a daily chart with volume.

The takeaway? These are patterns worth knowing, not because they’re magic, but because they reflect a real shift in market behavior. When Three White Soldiers or Three Black Crows show up in the right place, at the right time, with the right confirmation… that’s when charts stop being random and start making sense. But remember. They are indicators, not guarantees. The best traders use them in conjunction with other tools and a clear trading plan.

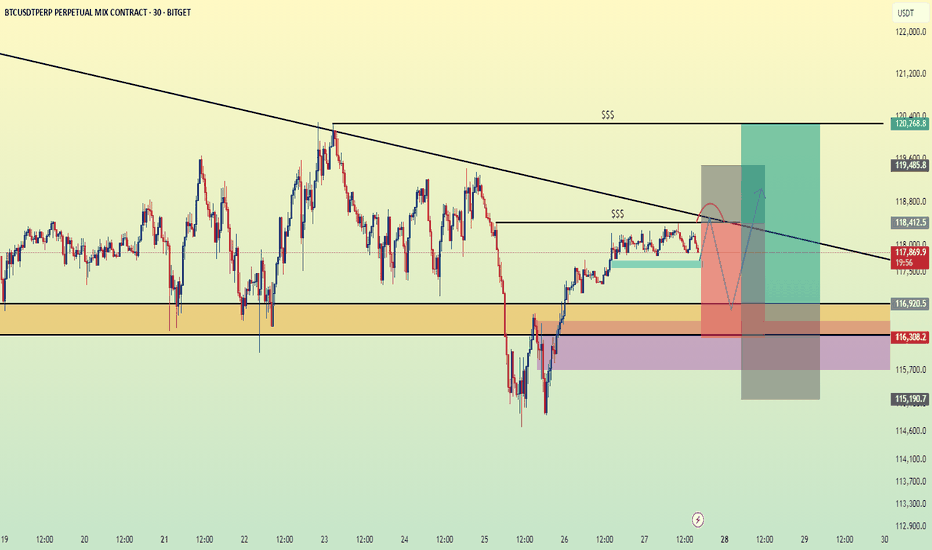

BTC SHORT SETUP INTRADAY ( 02 AUG 2025 )If you have doubt on our trades you can test in demo.

Details:

Entry: 113,680 $ - 113,450 $

Target Price: 112,300 $

Stop loss: 114,370 $

Trade Ideas:

Idea is clearly shown on chart + we have some secret psychologies and tools behind this.

What is required to Join VIP?

- Nothing just you have to share 10% of your profit with us at the end of the month which you earned from our signals. Yeah this is just the requirement, trade where ever you like your favorite broker or else you don't need to pay fees first or create account thru our link.

Trade Signal:

I provide trade signals here so follow my account and you can check my previous analysis regarding BITCOIN. So don't miss trade opportunity so follow must.

BINANCE:BTCUSDT BINANCE:BTCUSDT.P BINANCE:BTCUSD

What Nobody Taught You About Risk Management. Part 1

Numerous authors and communicators have addressed the importance of risk management, more or less comprehensively, but I have not come across any who present what I intend to share with you today. Once my presentation is complete, I will share some useful resources with which you can complement what you learn here, as I will only cover an important but small part of the topic: execution.

What is risk management?

Risk management is the planning an investor undertakes to protect capital and maximize profits. It encompasses factors surrounding the creation of a profitable system or method, the allocation of our capital, and the execution of our trades.

Some key concepts:

Risk-Reward Ratio

The risk-reward ratio is a metric used in trading and investing to assess the relationship between the risk taken in a trade and the expected potential profit. It is expressed as a ratio, for example, 1:1, 1:2, 2:1, etc.

Stop Loss (SL)

The SL, or stop-loss, is an automatic order placed in a trading operation to close your position at a specific price, with the aim of limiting losses if the market moves against you.

Take Profit (TP)

The TP, or take-profit, is an automatic order placed in a trading operation to close your position at a specific price to secure profits when the market reaches a favorable level. It is the point where you decide to "take" your profits and exit the trade.

Margin

In trading, margin is the amount of money a trader must deposit or maintain in their account to open and sustain a position.

Volatility

Volatility, in the context of trading and financial markets, measures the magnitude and frequency of changes in an asset's price.

Leverage

Leverage in trading is a tool that allows investors to control a larger market position using only a fraction of their own capital. It acts as a "loan" provided by the trading platform, amplifying both potential profits and potential losses.

Risk Management and Trade Execution:

The most common problem among other investors, beyond psychological factors or lack of experience, is the absence of total control over their trades. They use random leverage, take entries with risk-reward ratios below 1:1, and some don’t even know what percentage of profits or losses they will have at the end of the trade.

For an investor to execute a successful trade, they must meet the following criteria:

1. Ensure minimum risk-reward ratios of 1:1.

2. Properly allocate their investment capital, adhering to strict rules to avoid undermining their statistical performance.

3. Adapt to volatility and know how to adjust their leverage accordingly.

4. Set a fixed stop-loss (SL) price and determine what percentage of losses they are willing to accept per trade.

5. Set a fixed price for taking profits from the trade and know what percentage of profits they will achieve.

Failing to meet these parameters will not only destroy traders’ profitability but also make it impossible for them to develop reliable investment systems and methods.

Incorrect Execution:

For example, if I see an entry opportunity in BTC/USDT, it would be a mistake to choose random leverage and plan to manually close when I think I’ve gained or lost enough. The volatility of the price chart itself may or may not require leverage, and that leverage must be adjusted to our risk management strategy. Trading in the manner described above is a recipe for failure, which is why it’s a lucrative business to allow inexperienced investors to access markets through online platforms.

Correct Execution:

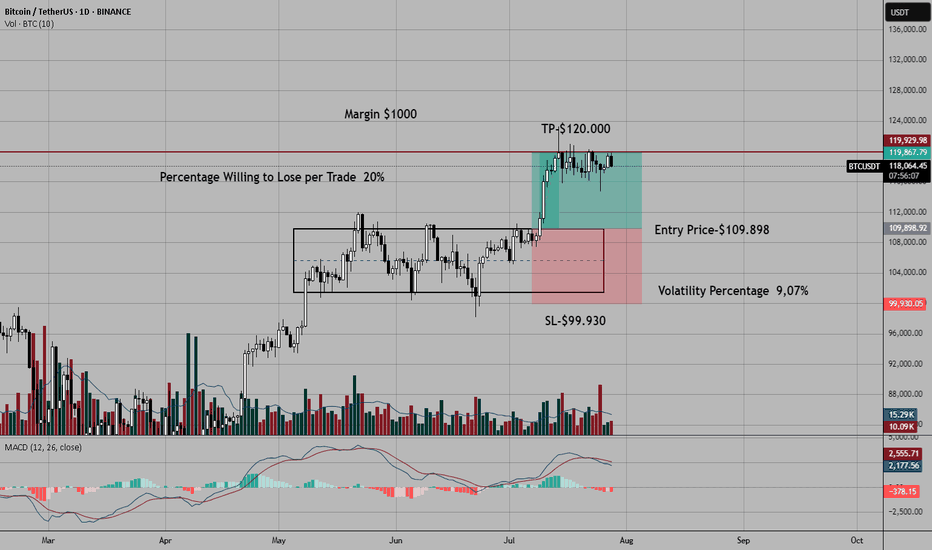

Before explaining a practical case, let’s assume I use a $1,000 amount per trade and am willing to risk a 20% stop-loss (SL). These parameters are non-negotiable to avoid undermining my statistical performance.

A few days ago, I took the trade shown in the chart. To enter this long position in BTC/USDT, the first thing I did was identify the entry point and the exit points for my trade (SL and TP). The trade met a minimum risk-reward ratio of 1:1, so I considered whether leverage was necessary. A volatility of 9.07% from the entry point to my SL price offered low profit expectations relative to what I was willing to risk from my margin per trade (20% of $1,000). I needed leverage.

In the toolbar on the left, once you have a price chart open in TradingView, you can use the ruler to easily measure the percentage of volatility.

How can I ensure that 20% of the margin I’m investing is triggered when the price reaches my SL zone using leverage?

To calculate the exact leverage, we divide the SL percentage we’re willing to risk (20%) by the volatility percentage from the entry point to the SL price (9.07%).

For example, my entry point in BTC was $109,898, and the exit point or SL was $99,930. I measured the volatility between the entry price ($109,898) and the exit price ($99,930), resulting in 9.07%. Since the volatility was somewhat low and I wanted to risk 20% of my margin per trade when the price hit my SL, I calculated the required leverage. To do this, I divided 20% (the percentage I was willing to lose per SL) by 9.07% (the volatility percentage from the entry price to the SL price). The result was approximately 2x leverage when rounded.

In summary: At 2x leverage, we would lose approximately 20% of our capital if the price reached $99,930. Since I had a 1:1 risk-reward ratio before entering the trade, I assumed I would gain approximately 20% of the invested margin when the price reached $120,000.

The trade was a winner, reaching the TP price without issues and generating a 20% profit on the margin I invested ($1,000).

Use investment platforms that allow you to manually adjust leverage, such as 1x, 2x, 3x, 4x… 38x, 39x, 40x, and avoid platforms where leverage is set to default values like 1x, 5x, 10x, 20x, 50x… This seemingly minor detail for most small investors allows platforms to pocket large fortunes from failed trades.

Conclusions and Recommendations:

Risk management is the backbone of investors, and knowing how to execute entries with precision is rare among retail traders. Even so, I’ve only covered a small part of this topic. To complement this knowledge, I recommend searching on YouTube for the video by investor and educator Yuri Rabassa titled “The Secrets of Good Money Management.” This video will help you develop basic statistical skills that are vital for creating a trading system. Additionally, in the book *Forex Price Action Scalping* by renowned author Bob Volman, you’ll find a very insightful chapter titled “The Principle of Probability.”

Final Note:

If you’d like to take a look at my analysis log, you can find my profile in Spanish, where I transparently share well-defined market entries. Send your good vibes if you enjoyed this article, and may God bless you all.

Bitcoin projection for the rest of the year. Bullish.We are in a retracement phase , i think btc will retrace deep enough to convince people that bull run is over . Once that happens it will flip to the upside and leave everyone shocked.

A retrace towards 108k-104k is possible.

Once they get tapped btc will start a new run towards a new all time high where everything will get to an end and a new besr market will start. Until then lets enjoy the rest of the year.

$BTC Daily OutlookBINANCE:BTCUSDT.P

Weekly Chart:

Bitcoin has now printed three consecutive weekly closes above the former higher-high threshold at $111 960. That series is enough to confirm a clean breakout of the prior HH-HL range and keeps the long-term bias pointed firmly higher.

That said, a near-term pullback is still on the table:

• First support — the breakout shelf at $111 960 (re-test of structure).

• Deeper support — the next V-level around $98 115.

Why the caution?

Last week’s candle left a small Failed Auction just above the new high, and Footprint data shows a cluster of aggressive buy-delta trapped in that wick. Those buyers may need to get washed out before the trend resumes.

Big picture: weekly structure is bullish; any dip into the levels above is a potential reload zone while the breakout holds.

Daily Chart:

Price action remains firmly bullish: multiple Failed-Auction rejections at the $116 860 higher-low vLevel keeps supply thin and reinforce the up-trend toward the prior ATH.

That said, remember Auction Market Theory rule #5: “When time or volume builds at the edge of balance, price often pushes through.”

• Each failed auction is absorbing resting bids.

• If sellers lean in again with size, the level can flip from support to resistance very quickly.

In practice that means:

•Base case – continuation to the highs while the Daily structure holds.

•Risk scenario – a clean break of $116 860 would open room for a deeper weekly pullback toward $107456.0

For now we treat the current weekly pullback as a fresh opportunity: scouting intraday longs as price reacts to the 1-Hourly zone.

From the footprint read-out, today’s bar finished with a neutral delta, but note where the profile is stacked: both the Value Area Low and the POC sit right at the bottom of the candle. That tells us the bulk of volume printed down at the session lows and it skewed negative, sellers were leaning hard, trying to extend the move lower.

BTC ANALYSIS🔮 #BTC Analysis 💰💰

🌟🚀As we said #BTC performed same. Now, In daily chart we can see a formation "Rising Wedge Pattern in #BTC. There is a strong resistance zone and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $1,18,590

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #BTC. 🚀💸

#BTC #Cryptocurrency #DYOR #PotentialBreakout

Bitcoin: Nothing Changed, Still BullishBitcoin: Nothing Changed, Still Bullish

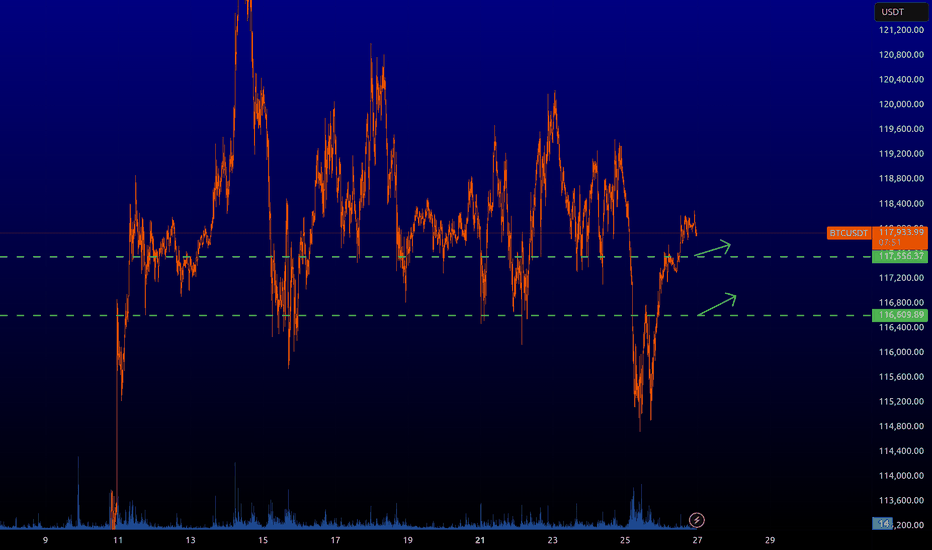

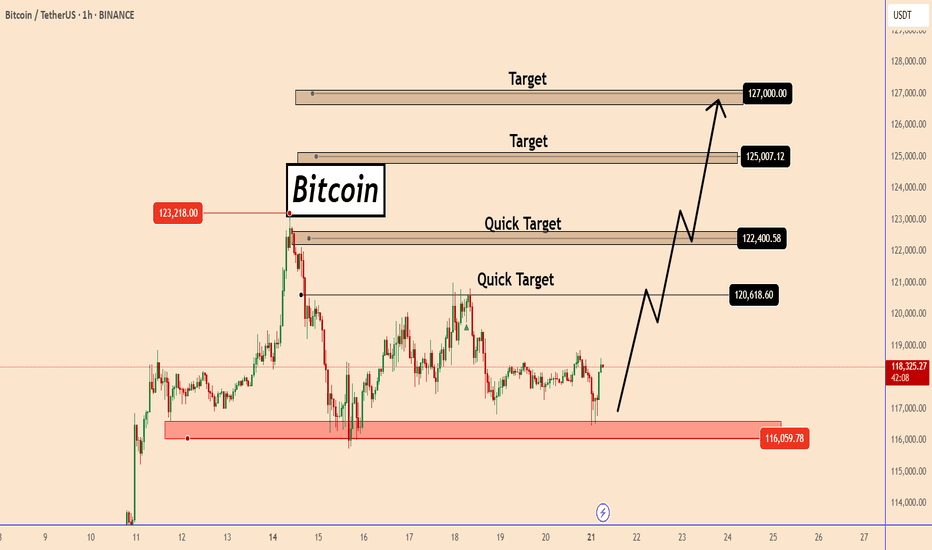

BTC still maintains a strong upward momentum. Immediate strong support was found again near 116K.

It seems that the market has set a new low for BTC around this area for now. I think that as long as BTC stays above this area, there is a good chance that the increasing volume and buyers will increase further pushing BTC further, as shown in the chart, to 120,600; 122,400; 125,000 and 127,000.

If it moves below the red zone, we should be careful as it could undergo a major correction before taking a clear direction.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

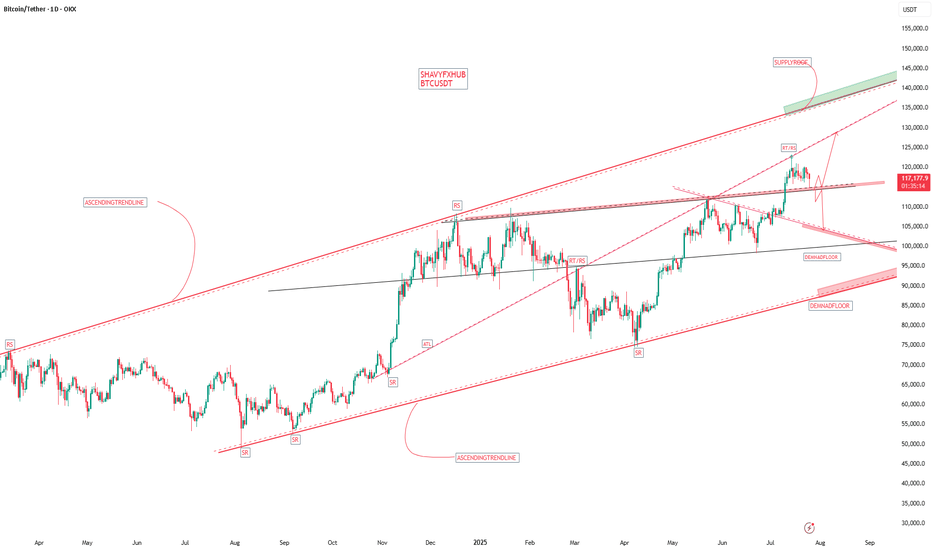

This is why I firmly believe we'll witness BTC reach 150K soon.No caption needed and every reasons are kept in the chart. Zoom In and analyze every single lines in the chart and hope you will see what I tend to see as far as my capabilities allows me. Let me know your comments on the idea. I am looking forward to witness $150K in the next 3 to 4 months time. I will be updating my confluences to say this on higher timeframes too.

With Regards. And stay Tuned.

BTC : The future of Bitcoin...Hello friends🙌

👀According to the price history, the price has always been bullish and is in a long-term bullish channel.

📈Now that the price is struggling in the middle of the channel and is gathering strength for a big move, which is expected to break the middle of the channel in the form of a resistance or middle channel, the price will move to the ceiling of the channel.

⚠Don't forget risk and capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

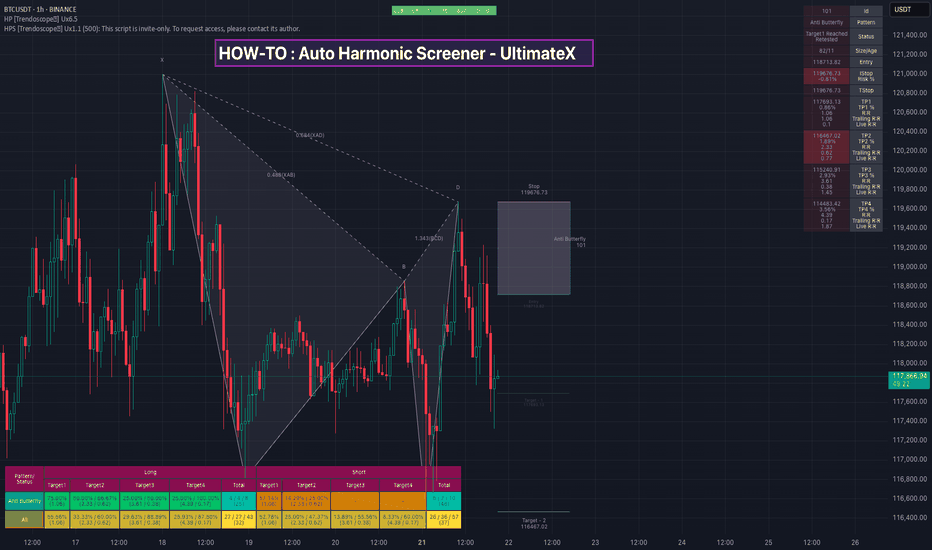

HOW-TO: Auto Harmonic Screener - UltimateXHello Everyone,

In this video, we have discussed on how to use our new Auto Harmonic Screener - UltimateX. We have covered the following topics.

Difference between Auto Harmonic Screener - UltimateX (Current script) and Auto Harmonic Pattern - UltimateX and how to use both the scripts together

Difference between Auto Harmonic Screener - UltimateX (Current script) and the existing screener Auto Harmonic Pattern - Screener which is built on request.security calls. We have discussed how the limitations of old script and how using the new script with Pine screener utility will help overcome those problems.

We have gone through the indicator settings (which are almost similar to that of Auto Harmonic Pattern UltimateX

Short demo on how to use the script with Pine Screener

Also check our existing video on How to use the new Pine Screener Utility.

Important Volatility Period: August 2nd - 5th

Hello, fellow traders!

Follow us for quick updates.

Have a great day!

-------------------------------------

(BTCUSDT 1M Chart)

Let's take a moment to check the trend before the new month begins.

There have been two major declines so far, and a third major decline is expected next year.

For the reason, please refer to the "3-Year Bull Market, 1-Year Bear Market Pattern" section below.

-

My target point for 2025 is around the Fibonacci ratio of 2.618 (133889.92).

However, if the price surges further, it could touch the Fibonacci range of 3 (151018.77) to 3.14 (157296.36).

If it rises above 133K, it's expected that prices will never fall below 43823.59 again.

Since the HA-Low indicator hasn't yet been created on the 1M chart, we need to monitor whether it appears when a downtrend begins.

Based on the current trend, the HA-Low indicator is expected to form around 73499.86.

More details will likely be available once the movement begins.

-

The basic trading strategy involves buying in the DOM(-60) ~ HA-Low range and selling in the HA-High ~ DOM(60) range.

However, if the price rises above the HA-High ~ DOM(60) range, a step-up trend is likely, while if the price falls below the DOM(-60) ~ HA-Low range, a step-down trend is likely.

Therefore, the basic trading strategy should be a segmented trading approach.

The further away from the HA-High indicator, the more likely it is that the DOM(60) indicator will act as a strong resistance when it forms.

Therefore, if the current price and the HA-High indicator are trading far apart, and the DOM(60) indicator forms, it is expected to face significant resistance.

-

Looking at the current trend formation, the high trend line is drawn correctly, but the low trend line is not.

This is because the StochRSI indicator failed to enter the oversold zone.

Therefore, the low trend line is marked with a dotted line, not a solid line.

Therefore, what we should pay attention to is the high trend line.

We need to see if the uptrend can continue along the high trend line.

-

(1D chart)

If we use the trend lines drawn on the 1M, 1W, and 1D charts to predict periods of volatility, the periods around August 5th and August 13th are significant periods of volatility.

By breaking this down further, the volatility periods are around July 31st, August 2nd-5th, and August 13th.

Therefore, trading strategies should be developed based on the assumption that the volatility period extends from July 30th to August 14th.

The current price is moving sideways in the 115,854.56-119,177.56 range.

This range, the HA-High ~ DOM (60), is a crucial area to consider for support.

This will determine whether the price will continue its upward trend by rising above 119,177.56, or whether it will turn downward by falling below 115,854.56.

If the price falls below 115854.56, it is expected to meet the M-Signal indicator on the 1W chart and reestablish the trend.

The HA-High indicator on the 1W chart is forming at 99705.62, and the DOM (60) indicator on the 1W chart is forming at 119086.64.

Therefore, when the price declines, it is important to check where the HA-High indicator on the 1W chart forms and determine whether there is support near that point.

-

The On-Board Value (OBV) indicator within the Low Line ~ High Line channel is showing a downward trend.

If the OBV falls below the Low Line, the price is expected to plummet.

Therefore, it is necessary to closely monitor the movements of the OBV indicator.

The Trend Check indicator is a comprehensive evaluation of the StochRSI, PVT-MACD Oscillator, and On-Board Value (OBV) indicator.

The TC (Trend Check) indicator interprets a rise from the 0 point as a buying trend, while a decline indicates a selling trend.

In other words, a rise from the 0 point is likely to indicate an uptrend, while a decline is likely to indicate a downtrend.

Currently, the TC (Trend Check) indicator is below the 0 point, suggesting a high probability of a downtrend.

However, if the TC (Trend Check) indicator touches a high or low, the trend may reverse.

In other words, touching a high increases the likelihood of a reversal from an uptrend to a downtrend, while touching a low increases the likelihood of a reversal from a downtrend to an uptrend.

When such movements occur, it's important to consider the support and resistance levels formed around the price level to determine a response.

In other words, consider the support and resistance levels formed at the current price level.

As a significant period of volatility approaches, prepare to transition from box trading to trend trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------