Bitcoin (BTC): Aiming For Re-Test of ATH | $123KBitcoin is back in the bullish zone, where we had a good bounce from $115K, where we had a huge order sitting and since then we have been seeing continuous movement to upper zones.

We are looking for further movement from here towards the ATH zone, where we then expect some huge volatility to occur!

Swallow Academy

BTCUST trade ideas

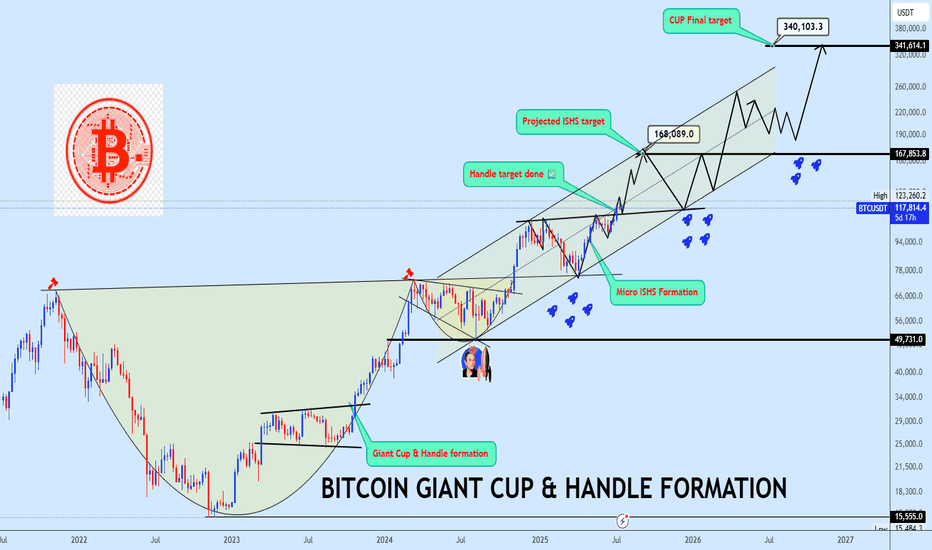

Bitcoin Bottom Three in progress targeting $340kBitcoin continues to defy the doubters, extending its dominance and triggering milestones that once seemed unreachable. A few years ago, we projected a massive rounding bottom with a target near $123K to complete the bottom two of the third halving cycle a bold forecast that has now played out in full:

📌

With bottom two now in the rearview, our focus shifts to bottom three of the fourth halving cycle, projected to mature around October 2025, barring time shifts:

📌

As shown on the chart, price has now split into a giant Cup & Handle formation and successfully broken out from the neckline. BTC is currently coiling inside a rising channel structure with trajectory toward the final projected target at $340K. A micro inverse head and shoulders (ISHS) formation has also emerged, offering a key accumulation zone near the neckline, this will be a crucial region to watch for entries.

Let price action do the talking. Share your view and let’s dissect this historic setup together.

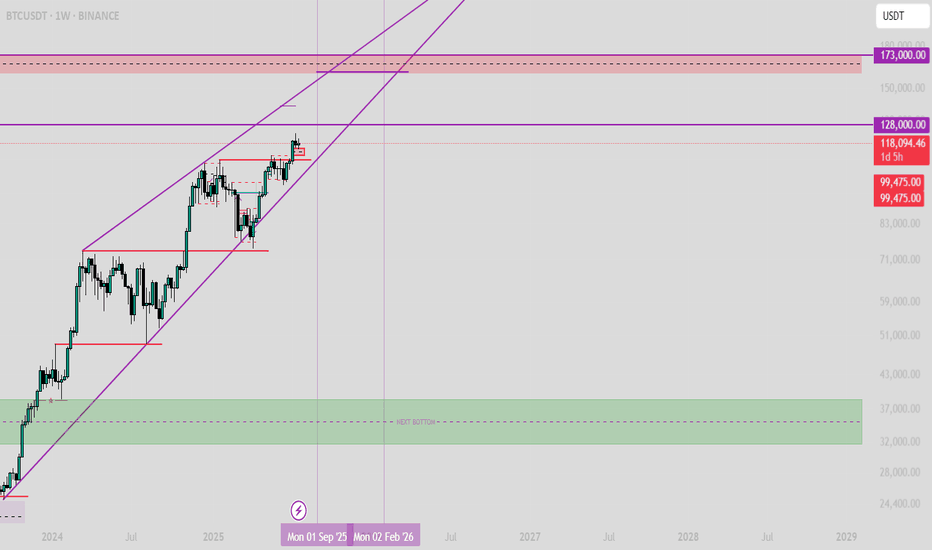

BTCUSD : Key levelsI added meaningful levels to my past forecast (I can't add a link to my last forecast by the way, because as it turns out I have to actively participate in other people's discussions, which I am unlikely to do. And if I do, then to be able to add links to my predictions. So you have to check my prev forecast in the my profile overview).

So far, all levels are inactive except for the ~116,600 level. It's still in play.

$BTC/USDT – Bull Flag Breakout on 4H | Targeting $133,700Bitcoin has just broken out of a well-defined bull flag structure on the 4H chart, signaling a potential continuation of the previous uptrend.

This breakout comes after a strong impulsive move upward, followed by a textbook flag consolidation with lower highs and lows forming a descending channel. The breakout above the flag resistance suggests a bullish continuation pattern is in play.

Technical Breakdown:

Pattern: Bull Flag (Continuation)

Flagpole base: ~106,700

Breakout zone: ~117,600

Retest Support: 116,000

Immediate Resistance: 122,300

Expected Target: 133,700 (based on flagpole projection)

Invalidation: Breakdown below 115,500

Expected Move:

Measured Move Target: ~13% upside from breakout

Confluence: Target aligns with past supply zone near 133K–135K

Price has also reclaimed the 50 EMA on the 4H chart, and the volume on the breakout shows bullish interest. Watching closely for a clean retest of the breakout zone for confirmation.

Conclusion:

BTC is showing bullish continuation after breaking out of a flag. A successful retest of 117.6K–116K range could offer further upside. Traders should manage risk accordingly.

DYOR | Not Financial Advice

BTC - Prediction for the Final TOP AND the next BOTTOMAfter several analyses that I published on Trading View, I want to share my opinion on the Final Top and the next Bottom for Bitcoin!

The final Top will be between 160,000 and 174,000.

The next Bottom will be between 31,000 and 40,000. (Simply under 40,000).

This is not guaranteed, and it's just an analysis; it can happen or not, so be careful.

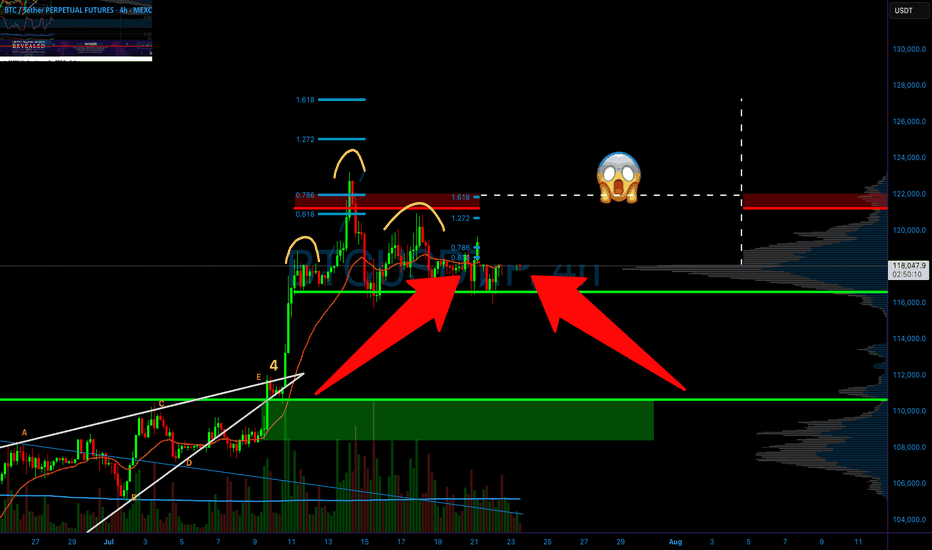

BITCOIN IS CREATING A SECRET PATTERN! (Huge move incoming?!)Yello paradisers! I'm describing to you what's going on with Bitcoin right now. We are creating a secret pattern that is forming, and once its neckline is reclaimed, we are going to have a huge movement.

In this video, I'm sharing with you the most important support and resistances on multiple time frames. We are describing Elliott wave theory wave count, and taking a look at candlestick patterns. We are talking about confirmations necessary for bullish and bearish cases. I'm explaining to you what the professional trading signals need for long-term profitability.

Some of the points are great risk-reward ratios. I'm talking about that in the video. One of them is taking only the highest probability trade setups, and having the patience and discipline to wait for them.

I'm talking about proper strategy which is needed, and systemology in your overall trading and how important it is. Here on TradingView, I'm describing to you the overall bias I have on Bitcoin right now.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

BITCOIN FALL TO 78K ! OR GOING TO 170K ?📊 Bitcoin Possible Scenarios (BTC/USDT Analysis)

🟢 Green Scenario (Immediate Bullish Breakout):

If the price breaks above the $120,000 resistance without any significant pullback, this would signal strong bullish continuation. It suggests buyer dominance and could lead to a fast move toward higher levels.

🟡 Yellow Scenario (Bullish Correction):

If BTC fails to break $120,000, we may see a drop toward $112,000. If this level breaks, price could head down to $100,000 to collect liquidity and attract buyers. From there, a strong rebound is likely, restoring bullish momentum (with weekly trendline support)

🔴 Red Scenario (Bearish Reversal):

If price breaks clearly below $100,000, especially with a violation of the weekly trendline, this could trigger a deeper correction toward the $78,000 – $74,000 zone. This scenario would mark a potential shift in long-term market structure.

Main Target : 170,000

It's an Evacuation Through Green Candles💥 "One Last Leap of Faith?" - What Bitcoin Might Be Hiding Before September

The world’s on fire: Israel, Iran, Strait of Hormuz, oil, elections, the dollar, rates, black swan whispers.

And someone’s out here saying Bitcoin might still go up?

Yes. We are. Not because we believe - but because we see.

📉 Everyone’s afraid. The whales aren’t.

When the crowd goes into survival mode, the real game begins.

Whales aren’t exiting - they’re accumulating.

ETFs aren’t pausing - they’re inflowing.

The technical setup isn’t breaking - it’s compressing like a spring.

$104,000. Coil building.

If we break out - targets at $132K–$140K are absolutely in play.

👉 But that’s not the point.

The point is why this is happening while the world is burning.

🧠 The idea: Bitcoin isn’t a safe haven. It’s a distribution machine.

Gold is for panic.

Bitcoin is for structure.

Institutions don’t ask “is it scary?” - they ask “where’s liquidity?”

Everything is aligning for one last upside move.

Until September. After that - chaos is back on the table.

💣 The Global Playbook:

Now (Summer) - Consolidation, ETF flows, geopolitical fear - Strategic entries, low exposure

Breakout - FOMO panic, retail rushes in - Profit-taking via options

September–Fall - Macro/geopolitical shock - Already in cash or hedged

📌 Bottom Line

Yes, Bitcoin might pump. Not because the world is fine - but because someone needs to exit beautifully.

If you're reading this - you're early enough to think.

Markets don’t reward justice. They reward positioning.

🛠 What to do right now:

Watch the $104,000 level - it's the pivot

Breakout = final upside push to $132K–140K

Keep your eyes on September - reversal zone

Think in scenarios: entry, exit, protection

Follow EXCAVO - we don’t guess, we read the game

I've been talking about this scenario for a long time

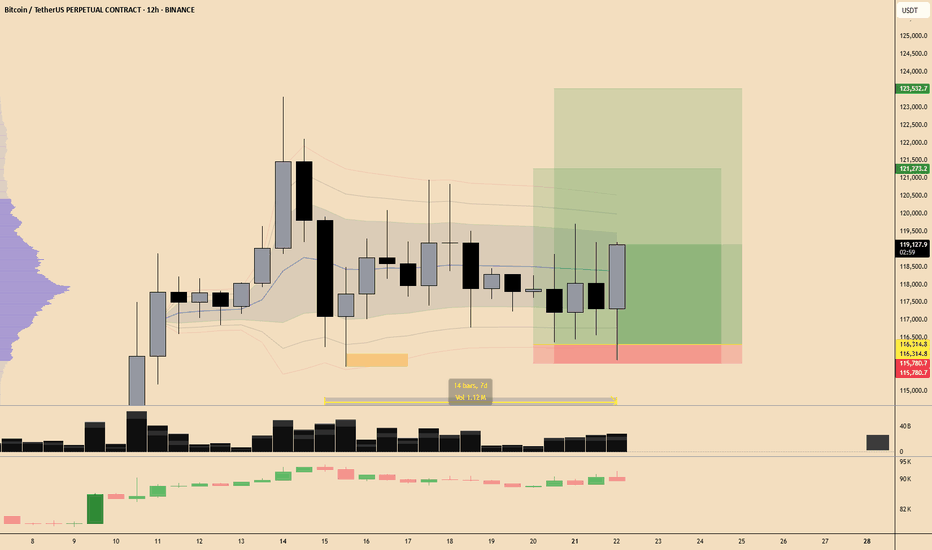

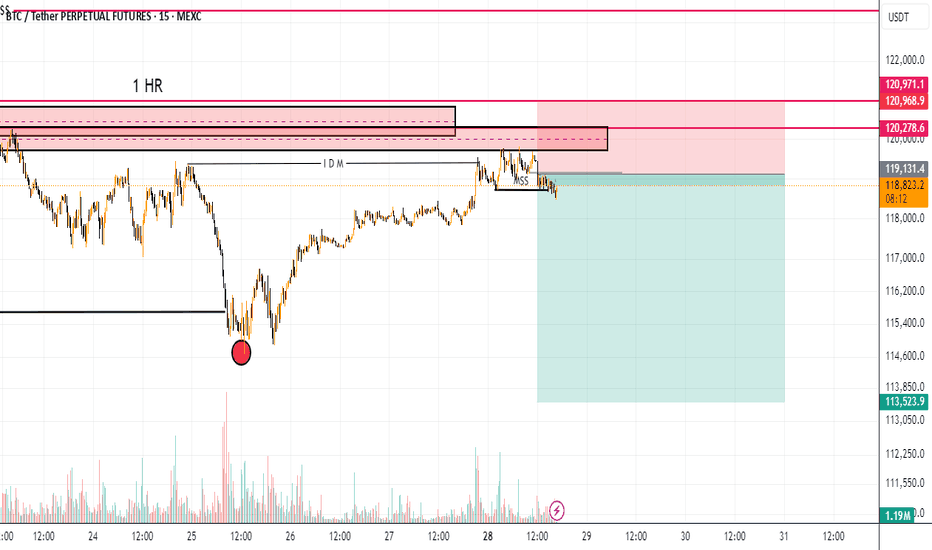

Bitcoin (BTCUSDT) - Possible Completion of a Complex CorrectionTimeframe: 4H + 1H

Methodology: NeoWave (Glen Neely) + Smart Money Concepts (ICT/SMC)

Posted by: @CryptoPilot

⸻

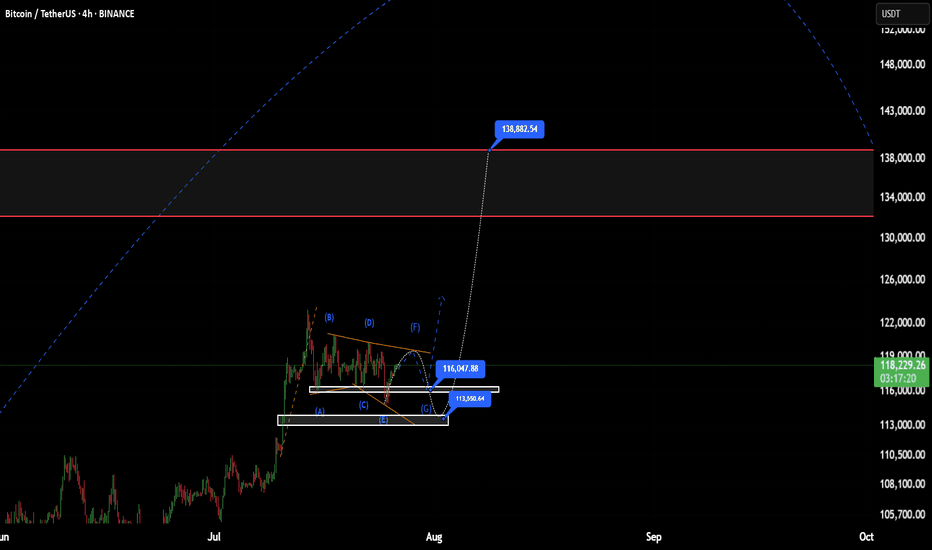

🧠 NeoWave Analysis: Complex Correction Ending?

From a NeoWave perspective, BTC seems to be in the final stages of a Complex Correction that started in March 2025 from ~72k. The upward move appears to form a Contracting Diametric structure (7 legs: A–B–C–D–E–F–G), with the current leg G potentially unfolding now.

• ✅ Wave A: Sharp recovery from March lows

• ✅ Waves B–F: Alternating corrective legs with varied time and complexity

• 🔄 Wave G: Could be starting now, expected to break structure to the downside

This suggests that the entire move from March till now may represent a large Wave B, setting the stage for a deeper Wave C down.

⸻

🔍 Price Action + Smart Money Confluence

The following observations strengthen the NeoWave scenario:

• 🟨 Liquidity Pools above 120k were swept recently, creating a potential Buy-side Liquidity Grab

• 🟥 Imbalance/FVGs below 114.5k remain unfilled

• 🔻 Market Structure Shift (MSS) evident on 1H chart — lower highs forming

• 🧠 Price rejected from a key Supply Zone, aligning with end of Wave F

• 🟩 If price re-tests the internal bearish OB (near 119.5k–120k), it may provide an ideal short trigger

⸻

📌 Key Levels to Watch:

Level

Description

120.2k

Liquidity sweep zone / MSS confirmed

118k

Current structure base (pivot)

114.5k

FVG + potential Wave G target

111–112k

Strong demand zone (accumulation support)

🧭 Scenario Outlook:

Primary:

→ Price is in Wave G of a Diametric (NeoWave)

→ Likely to unfold as a 3-leg Zigzag down or a Complex combination

→ Objective: break below Wave E low and target the unmitigated imbalances

Alternative:

→ Extended Flat or Triangle, if 120.5k is broken impulsively

→ Invalidation = clean break and hold above 121k

⸻

⚠️ Risk Note:

This analysis assumes Wave G is beginning. If bulls manage to reclaim 120.5k with momentum and close above, the bearish structure will be invalidated.

⸻

💬 Final Thought:

We are potentially nearing the end of a complex corrective rally. The confluence of NeoWave structural symmetry, Smart Money traps, and market inefficiencies suggests that BTC may be preparing for a retracement. Stay alert for confirmations before executing.

⸻

📌 Follow @CryptoPilot for advanced wave structure updates, market geometry insights, and ICT-style smart money traps.

💬 Share your views or alternate wave counts in the comments!

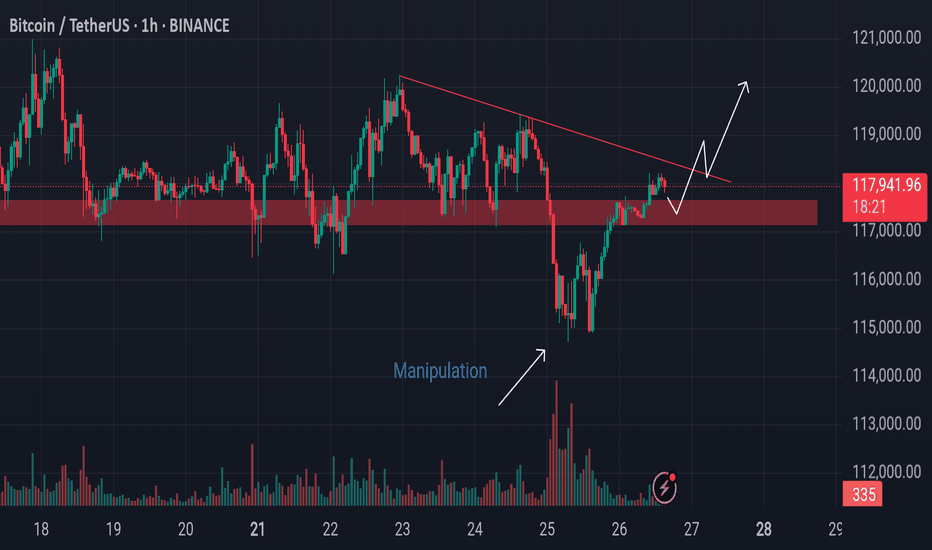

Bitcoin’s Battle at Resistance Watch These Critical Levels.Bitcoin is currently forming an AMD (Accumulation–Manipulation–Distribution) pattern.

The market recently dipped due to manipulation, only to push back up and break through a key resistance level, moving toward the inversion zone. However, it now faces additional resistance from a descending trendline.

If the market decisively breaks above this trendline and successfully retests it, there is potential for further upward movement.

Keep a close watch on these critical levels for confirmation.

Do Your Own Research (DYOR)

Pessimistic scenario for BITCOINAfter Bitcoin touched the price of 123,218, it entered a corrective phase. According to previous analysis, we expected the price to touch the range of $115,000-113,000. With the formation of more waves, it seems that the recent correction that started on July 14, 2025 is a diametric (bowtie) where waves f and g of this diametric are not yet complete and this pattern is part of a higher degree diametric and after this pattern is completed I expect a move towards the range of 140,000-150,000

Pessimistic scenario:

The pessimistic scenario is that this wave becomes a double pattern and enters the price range of wave-b (marked with a red dashed line) of the higher degree diametric. The probability of this scenario occurring is low and I consider the first scenario more likely, but we must be prepared for all market movements.

Good luck

NEoWave Chart

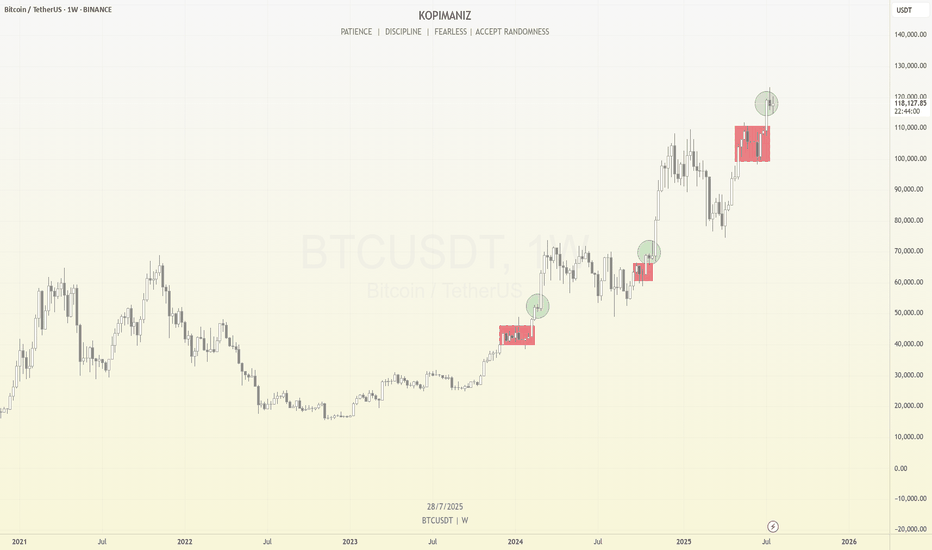

Bitcoin Weekly Structure: Repeating Rhythms and What’s Next

Bitcoin continues to follow a consistent structural rhythm on the weekly timeframe. We can observe that before every major breakout, price enters a multi-week consolidation phase, which I’ve marked using red boxes on the chart. These red box zones represent long periods of sideways movement, typically acting as reaccumulation phases. Once price breaks above these levels, it often results in a strong impulsive move, confirming that these areas serve as foundational support for trend continuation.

After each of these longer consolidations, Bitcoin tends to enter a brief 1–2 week consolidation right after the breakout, which I’ve marked with green circles. These short pauses are signs of healthy bullish momentum, often acting as flags or continuation patterns before the next leg up. What’s notable is that each of these green circle phases occurs after a clean breakout from a red box, and they consistently lead to further price appreciation.

Currently, Bitcoin has just broken out of another red box zone between ~$100k and ~$110k. Over the past two weeks, it has formed a small range near $118k, resembling the same green circle structures we’ve seen earlier in the trend. Given this recurring pattern, there’s a high probability that we are once again in the early stages of a bullish continuation. If the pattern plays out as it has in the past, the next move could be another strong weekly candle pushing toward new highs.

However, I’m paying close attention to the $125k–$126k level. This psychological zone may act as a major turning point. It could lead to either a prolonged consolidation phase that lasts for months, or potentially trigger a significant correction if the market faces strong resistance. This level marks a critical area where momentum may shift, so it deserves extra caution as we approach it.

This type of structural repetition helps me stay grounded in my analysis—focusing not just on price, but also on how long and where Bitcoin consolidates. So far, the rhythm has been clean and reliable.

Let’s see if Bitcoin respects the rhythm once again.

BTC | Short Bias — Targeting $113kPrice rejected perfectly off the 0.5 retracement and is now filling the previous imbalance.

Yesterday's daily close was decisively bearish, confirming downside momentum.

There’s a lack of convincing reversal signals at current levels.

Plan:

Main expectation is continued downside toward the $113k support.

Not interested in longs until price stabilizes at or below that level.

Bitcoin is testing the boundaries of the triangle ┆ HolderStatBINANCE:BTCUSDT is printing higher lows along trendline support near $67,800. The price is compressing into a wedge below $69,000 resistance. A breakout would confirm continuation toward $71,000–$72,000. Momentum remains intact unless $67.5k is broken. The market is building pressure for the next impulsive move.