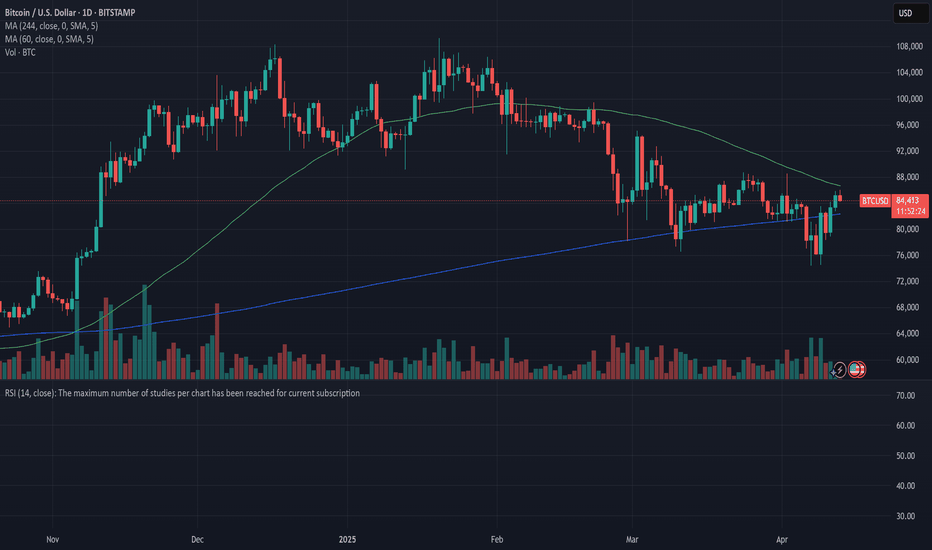

Bitcoin Above The 50 MABitcoin has climbed back above the 50-day moving average (blue line) – a level it hasn’t closed above since January. That alone is notable – it marks a potential shift in momentum after months of trending beneath it. That said, the 200-day moving average (red line) still looms above as overhead resistance and hasn’t been tested on this push yet.

Price action has been constructive off the lows, with higher highs and higher lows forming over the past two weeks. Volume has picked up modestly, though not convincingly, suggesting the rally is cautious rather than euphoric. The $73,835 support level continues to hold firm as the critical line in the sand below.

It’s too early to declare a trend reversal, but closing multiple daily candles above the 50 MA would be a positive signal for bulls. Keep an eye on the 200 MA just above – cracking that level would open the door to more aggressive upside.

BULLUSD trade ideas

BTCUSD is expected to break through 88800On the daily chart, BTCUSD rebounded from a low level, and the price has broken through the downward trend line resistance. Currently, we can pay attention to the support near 83,000. If it does not break, we can consider buying. The upper resistance is around 88,800. After breaking through, the upper resistance is around 92,000.

bitcoin enters a hyper-parabolic state to 753kgm,

this was initially a private post,

but i've decided to open it up to the public, for the people.

---

interest rates are collapsing. not slowly. not in a controlled, measured descent. this is a freefall. the kind that rewrites economic history.

monetary debasement is inevitable. quantitative easing will accelerate, liquidity will flood the system, and the us dollar will plunge. this isn’t speculation. this is math.

and when that happens, the gates open. the largest alt season in history is not a possibility. it is an inevitability. this will be the kind of move that people will talk about for decades. portfolios multiplied beyond reason. valuations pushed to levels most can only dream of.

the everything bubble will expand beyond comprehension. people will call it unsustainable. they will call it madness. but madness is where the greatest opportunities are born.

most won’t be ready. they will hesitate. they will overthink. they will sell too early,

watching in disbelief as the market leaves them behind.

we will not.

🌙

---

tp - 753k

Bitcoin shows local growth - will it continue ?Marked the important levels in this video for this week and considered a few scenarios of price performance

Local support at 80k and first target at 86k

Write a comment with your coins & hit the like button, and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades! MURA

BTC/USD...4H chart pattren...To my analyze Bitcoin with a descending channel pattern, we'll consider the following key aspects based on your provided details:

1. Descending Channel Overview:

A descending channel is a technical pattern where the price is moving within parallel downward-sloping trendlines. In this case, the sell side implies that Bitcoin's price is expected to keep moving downward, adhering to the top line (resistance) and bouncing between the resistance and the lower support line.

2. Key Levels:

High Support (85,000): This suggests that Bitcoin has a significant support zone around the $85,000 price level. If Bitcoin reaches this level, there is likely to be buying pressure or a price bounce.

Sell Target (74,000): Your target suggests that you expect Bitcoin to drop to the $74,000 level, which would likely represent the lower boundary of the descending channel or a previous support zone.

3. Price Action Within the Channel:

If Bitcoin's price is currently within the descending channel and testing the upper resistance, traders might look for short opportunities (sells) at or near the resistance level.

The 85,000 support level could be tested again. If Bitcoin bounces off that level, the downtrend may continue, pushing the price toward the 74,000 target.

If Bitcoin breaks the 85,000 support, a deeper decline could be in the cards, and the sell target of 74,000 may need to be adjusted.

4. Potential Indicators to Watch:

Volume: Pay attention to volume, especially if Bitcoin approaches the 85,000 support level. A low-volume bounce may indicate a short-term relief rally before the next leg down.

RSI: The Relative Strength Index (RSI) can provide insights into whether Bitcoin is oversold or overbought, helping to confirm or challenge the trend within the descending channel.

MACD: A bearish crossover on the MACD can confirm downward momentum, reinforcing the sell setup toward your target of 74,000.

5. Risk Management:

As this setup involves selling in a descending channel, ensure you set stop-loss orders just above the resistance or the 85,000 level to protect against a reversal.

Adjust your stop-loss based on the price action in relation to the channel’s boundaries.

Conclusion:

Sell if Bitcoin reaches or tests the upper resistance in the descending channel (around 85,000).

Target 74,000 as the downside support.

Watch for volume, RSI, and MACD indicators to confirm the continuation of the downtrend or a potential reversal.

Would you like a more detailed chart or analysis using historical data to refine this strategy further?

BITCOIN UPDATE.Nice to see a strong move with the Daily TF joining the party but that's not enough. Bitcoin NOT out of the woods yet. We need to see the same move it just did but now on next Weekly candle to confirm the UP move. As of now the move is UP from the 1hr, 4hrs and Daily point of view and once the Weekly candle closes we'll find out if the Weekly also confirms. I see Bitcoin moving in a trading range between $76500 and $85500 that's from the Daily pov until the Weekly decides what will do. Buckle up ladies and gentlemen good trades ahead.

BITCOIN Just like 2017 - The $300k prediction is happening!Bitcoin / BTCUSD continues to replicate the 2014-2017 Cycle, giving us a clear perspective of the bullish trend amidst the high volatility since the start of the year.

The different phases since the bottom are identical between the two Cycles and right now we are on Phase 4, supported firmly by the 1week MA50.

Hard to believe but if history continues to repeat itself, BTC may skyrocket as high as $300k by the end of this Cycle.

Follow us, like the idea and leave a comment below!!

MORE SHORTS: SON OF A BITLike Comment Follow

comment a coin ill analyse

Continuation of the last post dont get your hopes up the shows not over

price at resistance broke the trendline retest no its continuing the bearish coninuation

notice how it didnt break strucutre yet 25 march is the structural high if you swing

Holding here a little longer and there is a potential for an upHolding here a little longer and there is a potential for an uptrend

The market is getting oversold long term, but we still have to watch out because in bearish scenarios the market goes oversold beyond parameters, but if we see some holding of resistance then we can assume that there is no interest to continue to sell and we should be buying for a long, however waiting for a full bounce is the safer route since there is no risk involve.

On the other hand catching an accumulation early could potential increate profit margins.

My plan is to buy the 74-75k line and put a good stop loss, I will fully go in once the price start moving up.

My get off targets are 80-81k and if that holds then it moves up to the 88-90k line once again.

Trading is a business

The masses have the wrong ideas about Trading. It is a business and just like others it involves risk. We grow, we learn, earn and scale up. Crafting a plan is essential to success and character also play a key role here.

In this business, risk is an inherent part of the equation. Just like any other enterprise, trading exposes you to challenges and setbacks, but it's how you manage these risks that can differentiate a thriving business from one that falters. Careful risk management—whether through proper position sizing, stop-loss strategies, or diversification—is the foundation that helps protect your capital while you grow your business over time.

Crafting a trading plan is essential. This plan should not only outline your entry and exit strategies based on rigorous analysis but also incorporate a framework to evaluate your performance critically. A well-crafted plan serves as a roadmap, guiding your decisions in both favorable and challenging market conditions. Moreover, it creates a discipline that protects you from emotional reactions that can often lead to impulsive decisions—a common pitfall in trading.

Character plays a crucial role as well. In trading, psychological fortitude, resilience in the face of losses, and the humility to learn from mistakes are qualities that separate the successful from the rest. Many people mistakenly believe that a few big wins can offset a series of missteps; however, it is the consistent, calculated, and disciplined approach that leads to sustainable growth. This business mindset—acknowledging that each trade is a learning opportunity and a step in scaling up your efforts—is what ultimately propels traders to long-term success.

In essence, re-framing trading as a business fosters a mindset where every decision is taken seriously, every mistake is analyzed for improvement, and every trade is seen as a building block for growth. This approach not only minimizes unnecessary risks but also enables you to scale up with confidence.

I'm curious—what elements of your trading plan do you find most effective at keeping your business mindset in check, and are there aspects you'd like to refine further?

Bitcoin's Bounce, Your Weekly Scoop on the Bullish Surge !The market has unfolded as anticipated, aligning with our projections.

Short-Term Outlook: Expect a relatively narrow trading range this week due to the absence of major news catalysts.

Bullish Perspective: We maintain a bullish stance, targeting a price range of $88,000–$92,000.

Local Bottom Confirmation: Bitcoin appears to have established a local bottom. Notably, it diverged from Ethereum, which recorded lower lows, while Bitcoin resisted forming a new low.

Technical Analysis: Last week, Bitcoin respected a daily bullish order block, resulting in a strong upward move.

Key Support Level: This week, an inverse fair value gap (FVG) on the daily chart around $82,400 is expected to act as a liquidity zone and support, with price likely to tap this level and rebound higher.

Thank you for your support! Stay tuned for more insights and drop a Like if you loved it 🚀

BITCOIN Can it start an insane rally on CHEAP MONEY??Bitcoin (BTCUSD) seems to be at a point where it last was at the beginning of its current Bull Cycle in October 2022. And that's the point where the Global Liquidity Cycle Indicator (black trend-line) bottomed and started rising, confirming the more on Higher Lows.

This huge buy formation has been present on every BTC Cycle, usually at its bottom (but on the 2015 case, a little after) and signaled the huge monetary supply into the global markets, which translates into rising prices and rallies.

This is the first time we see the same rising liquidity formation twice in a Cycle. Can this be the driving force that BTC needs for its final and strongest parabolic rally of the Cycle towards the end of the year?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC REBOUND? 〉$140,000 NEXTAs illustrated, I'm visualizing what the next impulsive wave could look like.

Price has broken out of a major daily trend line.

It makes sense for the week to have started trading lower to find it's low and potentially bounce with strength sometime this coming up week and into the next.

The next pivot area is between the $82,000 - $80,000 range based on previous week's lows and daily low levels.

An interesting buy opportunity is forming and the potential entry is illustrated as the "pivot area" marked in yellow.

Then we have a major pivot range near the $100,000 psychological price.

.

This could be a price where some short term traders get out "in case it's just a pull back before a collapse" type of decision.

We can't ignore how much price consolidated between 100,000 and 96,000; and so that is the next stepping stone for BTC before breaking to ATH's of at least $120,000.

My personal target is set at the 161.8% extension level as illustrated.

--

GOOD LUCK!

Persa

Bitcoin: it’s a crossDuring the first week of the general market sell-off, two weeks ago, the crypto market was sort of left behind investors' attention. However, the previous week brought some negative movements at the beginning of the week, which were diminished as of the weekend. The problem of margin calls from other traditional markets affected the crypto market at the start of the week. BTC reached its lowest weekly level at $74.860. The second half of the week was supported by news of tariffs delay for 90 days, in which sense, the market optimism was back, as well as the price of BTC. At the Saturday trading session, BTC tested the resistance line at $85K.

The RSI is still struggling to pass the 50 level. During Saturday, RSI reached the 52 level, but it still does not provide a clear signal that the market is heading toward the overbought market side. The most important weekly development was with MA 50 and MA 200 lines. These two MAs created a cross, where MA 50 crossed the MA 200 from the upper side and is currently moving below the MA200 level. In a technical analysis this is called the “dead cross” indicating probability that the uptrend is exhausted.

The current general volatility in markets might still not be over, simply because it is driven by Government narrative related to tariffs, which is quite changeable on a daily basis. Markets have never been happy with uncertainty. To which extent this uncertainty will be transferred to the crypto market is hard to predict at this moment. Some indications of the recovery are modestly seen on charts. However, the question at this moment is whether this is a sustainable recovery? It is positive that BTC headed to test the $85K resistance level. In case that it is broken to the upside, the BTC will seek higher grounds, around the $ 87K and $90K resistance. However, the move toward the opposite side might bring BTC back toward the $ 83K or $80K support levels. Both options are currently open, because the market is not driven by actual sentiment, but the fear of potential consequences from tariff wars.

BITCOIN Are we back in business?Bitcoin (BTCUSD) made a miraculous comeback yesterday as it rebounded with force almost +12% from its session Low, following the 90-day tariff pause news. This rebounded has been performed on both the 1W MA50 (blue trend-line), which has been the key long-term Support of this Bull Cycle, but also on the previous High line, which is the trend-line coming from the previous Higher High of the Bull Cycle that has now turned Support.

As you see, during every Bull Cycle correction, this previous High line held both times before and it is doing so this time also. This justifies the incredible symmetry of this Bull Cycle but it doesn't only stop on the uptrend structure but goes back to the downtrend structure of the Bear Cycle. As you see, the extension of those previous High lines intersect the Lower Highs of the Bear Cycle. Symmetry at its very best.

At the same time, back to the current Bull Cycle, we see that the Vortex Indicator (VI) has already diverged, which has been consistent to both previous bottoms.

As far as what the target of this potential rebound/ rally can be, both previous main rallies hit at least the 1.618 Fibonacci extension. That sits now at $175000.

So do you think this Double Support rebound combo is putting BTC back in Bull Cycle business for a rally to $175k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC/USD 1D CHART PATTERN Bitcoin is making waves today after successfully breaking out of a descending trendline that has capped price action for weeks. This move is signaling renewed strength, with bullish sentiment starting to take hold in the market.

Technical Breakdown:

Trendline Breakout:

BTC has cleared a key downtrend resistance that dates back to early February. This is a significant technical signal suggesting the downtrend might be over.

Price Structure Improvement:

A series of higher lows has formed, showing strong buying pressure around the $80,000 zone. Bulls are defending this level firmly, and now we’re seeing follow-through on the upside.

Volume Confirmation:

The breakout comes with increased trading volume—always a good sign that the move is backed by real market interest rather than a short-lived spike.

Moving Average Flip:

Bitcoin is trading above its short-term moving averages, which are starting to slope upwards. This further supports the bullish case in the near term.

What’s Next?

First Target – $89,000:

A psychological and technical resistance zone. If bulls maintain pressure, this level is well within reach in the short run.

Second Target – $94,000:

A clean break above GETTEX:89K opens up space to test the next major resistance around $94,000. Momentum will be key here.

BTC Bullish Signals: MACD Golden Cross & Rising ChannelOn the daily K - line chart, the highest price of BTC reached 85,400 and the lowest was 82,750. The K - line has broken through the EMA30 trend line at 83,650 and is continuing to rise, challenging the EMA60 trend resistance level at 86,400. Additionally, as the main players significantly increase their BTC holdings, the bullish trend persists.

The MACD has continuously expanded its volume with increased holdings, and the DIF and DEA show a clear golden cross bullish trend. The K - line has even broken through the middle Bollinger Band at 83,100 and is surging upwards. Pay attention to the long - term Bollinger Band resistance level at 89,200. If there is a rapid upward movement, it is advisable to consider placing a short - selling order above 89,000 in advance with a stop - loss to prevent missing the entry point due to the main players driving up the price for selling.

On the four - hour K - line chart, an upward channel has taken shape, and a short - term bullish trend has started. Although bullish on BTC, we should not chase the price. Wait for a pullback to the support level before entering.

The EMA mid - term trend indicator is showing an upward alternating diffusion trend. The MACD has a significant increase in volume and holdings. The DIF and DEA have broken through the 0 - axis and entered the high - level zone. The Bollinger Band is opening upwards to form an upward channel. Pay attention to the upper - rail resistance at 85,900 and the middle - rail support at 82,000. The short - term BTC market has entered a slow - uptrend phase.

BTCUSD

buy@83000-83500

tp:85000-86000

Investment itself doesn't carry risks; it's only when investment is out of control that risks arise. When trading, always remember not to act on impulse. I will share trading signals every day. All the signals have been accurate without any mistakes for a whole month. No matter what gains or losses you've had in the past, with my help, you have the hope of achieving a breakthrough in your investment.

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

SECRET Indicator Says LINK Will Moon🚨MartyBoots here , I have been trading for 17 years and sharing my thoughts on BINANCE:LINKUSDT here.🚨

.

🚨 BINANCE:LINKUSDT is looking beautiful , very interesting chart for more upside

and is now into support🚨

Do not miss out on BINANCE:LINKUSDT as this is a great opportunity

The SECRET Indicator says it will moon

Watch video for more details

BTC SPX Ratio At Its LimitsAs BTC has matured, it has revealed its limits relative to SPX. Any time the price rises above 15, a correction follows.

While it has not yet cracked I find myself violating my own rules again and compelled to share this chart with you BEFORE the crack.

Markets are volatile and I am simply trying to keep people from getting hurt. Do not make the mistake of thinking BTC is a safe asset.

Bulls best to take profits.

Click boost, follow, subscribe, and let me help you navigate these crazy markets.