BITCOIN MAPPING 2025This report provides a comprehensive analysis of Bitcoin (BTC), focusing on recent price movements, trading volume, market sentiment, and key technical indicators. It examines short-term and long-term trends, identifies support and resistance levels, and evaluates potential breakout or correction scenarios. The analysis also considers macroeconomic factors and developments in the broader cryptocurrency market that may impact Bitcoin’s performance.

BULLUSD trade ideas

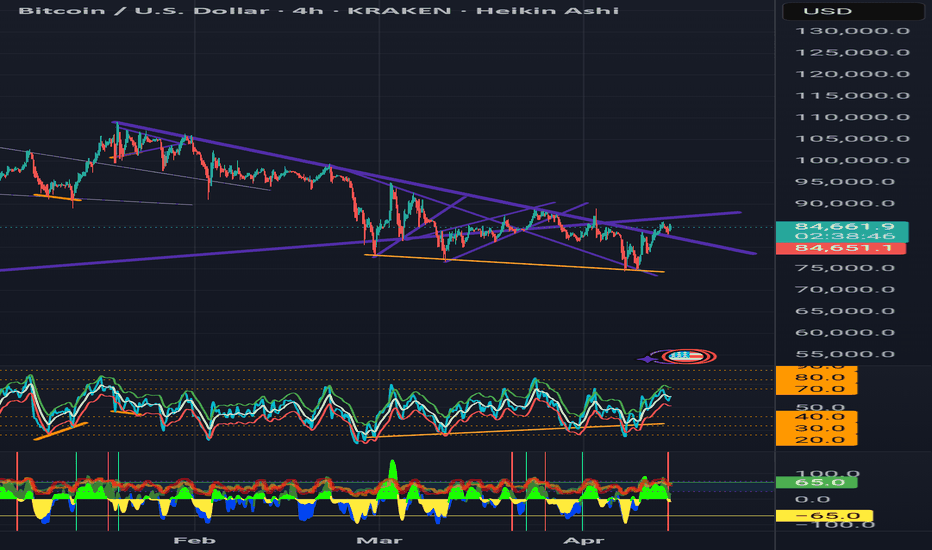

BTC Still in Downtrend – Watch for Breakdown Below 82.7k📌 Structure & Price Pattern

- Still forming lower highs & lower lows.

- Signs of a potential reversal are appearing, but the overall structure remains bearish.

- Based on Elliott Wave count, it may still be completing a major 5th wave down.

- As long as the upper trendline holds, downside pressure remains.

📈 Technical Indications

- Bearish momentum still dominant despite a Bullish Divergence on the Daily timeframe.

- Weekly timeframe shows price is struggling near resistance areas, although still above EMA.

- On M30, price remains under pressure even if it's hovering near EMA.

⏰ Key Timing

- Peak reversal expected around *April 15* (Monday–Tuesday), potential swing high ➜ correction ➜ sideways ➜ continuation down.

📍 Key Levels

- 🔽 Bearish Confirmation: If price breaks below *82,700*, expect further downside towards:

- 🎯 Target 1: 79,000

- 🎯 Target 2 (final): 76,000

🚀 Focus:

• Reversal expected on April 15

• Break below 82.7k = short-term sell

• Downtrend remains intact unless major structure breaks

Ahmed NagarAhmad Nagar Trading is a trusted stock market investment company committed to empowering individuals and businesses with smart, strategic, and secure financial growth opportunities. Based on deep market insights, advanced analytics, and personalized investment strategies, we help our clients navigate the complexities of the stock market with confidence.

With a team of experienced traders and financial advisors, Ahmad Nagar Trading offers a wide range of services, including portfolio management, equity investments, trading consultation, risk assessment, and long-term wealth planning. Whether you're a beginner or a seasoned investor, we tailor our solutions to suit your goals and risk appetite.

At Ahmad Nagar Trading, our mission is to build financial freedom and trust—one investment at a time.

bitcoin dips below 60kbitcoin dips below 60k, but we're unfazed.

i see this playing out as we move into the depths of winter,,,

this crypto winter ❄️

why would this happen, you ask?

the answer is simple: a stop-loss raid.

a sharp wave 4 designed to shake out weak hands.

distribution may have already started, hypothetically speaking, but it'll take the rest of the year to unfold.

think of it like the jan 2021 -> april 2021 vibe, only on a slightly higher degree and timeframe.

---

take note of the highlighted wave 2's and wave 4's on my chart.

what i'm illustrating is "the law of alternation," which states:

if wave 2 is flat, wave 4 will be sharp, and vice versa.

all the wave 2's in this cycle have been flats,

so by design, all of our wave 4's are set to be sharps.

this fits neatly into the larger cycle:

sharp retracements triggered by over-leveraged positions,

yet consistently bought up thanks to strong demand.

with each sharp retracement, however, the upward moves become smaller,

as momentum gradually fades.

---

w4 target: below 60k

w5 target: between 150k-200k (conservatively).

---

ps. i have recently shared a much more bullish idea via:

BTC to likely kiss the $74K - $69KBitcoin Market Analysis and Forecast

Bitcoin has retraced over 50% from its all-time high (ATH). Despite a rebound from the Fibonacci 50% level to its current price of $84,600, continued selling pressure could push BTC lower toward the Fibonacci 61.8% retracement zone, which lies between $74,000 and $69,000.

This potential pullback presents strategic entry points for long-term investors who have the patience to hold through market cycles.

Given the current market conditions, I will continue to accumulate using a Dollar-Cost Averaging (DCA) strategy to mitigate volatility and optimize long-term gains.

I will be monitoring the price action closely and providing further updates as the market develops.

BITCOIN NEXT MOVES!Bitcoin’s Next Move

In the long run, it's clear—Bitcoin is the new digital gold. Any dip at this stage is a potential opportunity. With over 7 years of experience in Bitcoin analysis, I believe in the bigger picture and long-term value.

If you'd like me to analyze or give insights on any other coin, feel free to ask. And don’t forget to follow for more crypto updates and analysis!

BTC/USD @84,700 sell 4h chart analysistrade plan looks when interpreted as key support and resistance levels on the chart:

Resistance (SL): 86.500 — Strong resistance zone, price invalidation point

Entry Level: 84.700 — Near a potential resistance-turned-entry zone

Support 1 (TP1): 80.000 — First major support, possible bounce zone

Support 2 (Final TP): 75.000 — Longer-term support, possible reversal or consolidation area

This setup suggests you're expecting the market to respect 83.500 as a lower high or a failed rally, aiming for continuation to the downside. Watch for:

Bearish confirmation candles around 83.500

Momentum indicators showing divergence or downtrend strength

Price rejection or volume spikes near resistance

If you’re on a higher time frame (like H4 or Daily), this could be a strong swing trade setup. Want help drawing this up visually or adding confluence zones like Fibonacci or moving averages?

BTCUSD Downside - Is Yesterday the swing high?Yesterday closed bearish, and there is a trendline break pattern suggesting a bears to enter the market.

Watching the recent two days low, if we can make a break below 83K then it should be clear sailing to the 80K mark.

Alternatively, a break above yesterdays high would signal further buying.

Watch this space!

Short on BTCUSDBitcoin (BTC/USD) – Bearish Outlook Amid Economic Uncertainty

We anticipate a short-term bearish trend for BTC/USD, driven by escalating economic concerns and the recent resurgence of trade tensions. The imposition of new tariffs has negatively impacted market sentiment, contributing to downward pressure on Bitcoin. The current price structure also suggests limited bullish momentum, favoring another potential sell-off.

From a technical perspective, forming a Bearish Butterfly Harmonic pattern further supports the expectation of a downward move.

Trade Setup:

Entry Level: 84,500

Take Profit 1: 78,500

Take Profit 2: 74,500

We recommend monitoring macroeconomic developments closely, as further deterioration could accelerate the bearish trend.

BTC - Has the market stopped falling?Ive been looking for a bottom at FWB:73K -72k for some time. We saw $74,400 and I'm not sure that was THE low. And now we have begun what looks like a false break out. The price is good, but the wave structure is all wrong. In this would be strong counter wave rally we could see prices to around $98,400. Its time to close the shorts, and open the longs but stay very vigilant as this is not another bull leg that leads to a new high. ( In my opinion) It is a decent opportunity to make some money on the long side, but at the end of this rally, I would be opening shorts again. Ill keep posting as developments occur. Prices above $87,600 are very bullish.

BTCUSD 4/13/2025Come Tap into the mind of SnipeGoat, as he gives you an outstanding update to his previous Analysis. Showing that Price did in fact do exactly what he said it was about to do. But this next Analysis is a Jaw Dropper! Tune in to find out this MEGA MOVE that Price is gearing up for.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

Bitcoin Testing the Gaussian Midline – Bounce or Starts Reversal🟡 Weekly Macro View – Gaussian Channel Holds the Truth

The Gaussian Channel on the weekly chart is painting a high-risk environment:

* Price is hovering below the Gaussian midline, which is currently acting as dynamic resistance at ~$84K.

* A red Gaussian channel is flashing caution — these phases typically indicate distribution or early-stage downtrends.

* BTC previously lost the mean and retested the lower channel, bouncing aggressively off the ~ FWB:73K region — this bounce is the first sign of life, but it’s not confirmation of a trend reversal yet.

What to watch this week:

* If BTC can reclaim the Gaussian mean and close above ~$85K with strong volume, we may see a macro reversal pattern forming.

* However, another rejection from the midline would point to a slow bleed down toward FWB:73K and possibly the lower channel edge near $63K–$65K.

🧭 Weekly Bias:

Cautiously Bearish — Price is below the Gaussian midline in a red channel. Reclaiming $85K flips the tone.

⚠️ Daily Chart View – Bearish Control, Weak Bounce

The daily chart confirms short-term bearish pressure is still intact:

* BTC remains within a down-sloping channel and is struggling to break through key lower highs.

* Volume footprint shows no major demand spike — each bounce is getting sold into.

* The trendlines drawn from recent highs form a clear wedge; price is compressing, signaling a big move is coming.

Support/Resistance Zones:

* ⚔️ Resistance: $84K–$85K

* 🛡️ Support: $80K > $73.6K major zone > $69.9K panic support

* 📉 If we lose $80K again, a retest of $73.6K is very likely.

* 📈 If bulls push above $85K, BTC could rally quickly toward $92K.

What to look for this week:

* A daily close above the upper trendline of the channel on rising volume = first bullish signal.

* A daily lower high + lower low continuation below $80K confirms bears still in charge.

🧠 Final Thoughts – Strategy This Week

BTC is caught in a macro correction but trying to build a base. The Gaussian Channel on the weekly says we're in a danger zone, but the daily shows traders testing the bears’ strength.

🧩 My read:

* Swing traders: Wait for daily close above $85K before going heavy long.

* Scalp traders: Monitor $80K– GETTEX:82K for bounce-to-fade plays.

* HODLers: Prepare for longer consolidation — weekly Gaussian phases take time to resolve.

🧠 This is a "watch, not chase" environment. Let the breakout confirm — not predict.

What to expect from the markets this weekWith markets taking a break from the US and China going off on each other for 5 days straight, investors are bracing for a potentially turbulent week ahead.

Cryptocurrencies seem to have recovered a large chunk of their losses from the first week of April, but how long can we expect this upward reversal to last?

Well, if we're being realistic, not long . If you take a look at the price charts of most cryptocurrencies, you'll notice a common theme: we're in a mid- to long-term downtrend.

If you've been trading cryptocurrencies (or any other type of security) for a while, you're probably familiar with the saying that goes “ The trend is your friend ”. With that in mind, if you're looking to hold any short-term crypto trades, shorts might offer better, less-risky opportunities.

Now's not the time to panic and FOMO into the market. Big players are still looking to shake weak hands out of the market. My advice: Observe market fluctuations through the first days of the week before committing your money to any trade.

69K Or 95kI think this is a crucial time for crypto, both technically and fundamentally, but I’ll be focusing on the technical side. Price needs to break above the upper resistance trend line for btc to break out of a descending channel. If btc fails to break above the channel, then it may head for a double bottom or back down to the support trend line of the descending channel. My thoughts are we will see a break out soon, but that’s only my opinion and not a fact.

B/$This is my expectation for next week

The waves have shifted a bit, but the direction is the same for now

...

I will open positions against the trend in both directions and rely on the reversal to take me to +

It is unlikely that we will see a price above 100k in the next month.

I think the range will continue for a long time.

Time to get Bitcoin Range in perspective again -where are we ?

This chart clearly shows us where BTC PA is in relation to the ATH it created in Early 2025.

PA sits just above centre line of current Lower range box.

There is still a Long way to go, against some strong resistance, to get back into the upper Range box and to that ATH line

We will manage it, I have no doubt about that But we may get to top of current Range box and be rejected before that time comes.

There are a number of different scenarios that exist right now and it is next to impossible to pin point when we may reach higher, to a New ATH.

My Feeling is that we will hit top of this current range box in the near future ( in april )

From that point, we have to weigh up the Macro and Sentiments of Markets and see.

But for now, Bitcoin PA is with Strength and has tha bility to reach higher.

I am still Bullish fora Cycle ATH in Q4

Bitcoin Cyclical Pattern Analysis: 2017 vs 2025-2026The charts provide compelling evidence of fractal patterns between Bitcoin's 2017 bull run and the current 2025 cycle, revealing both striking similarities and meaningful differences in market behavior.

Key Similarities

Both periods display remarkably similar structural patterns with consistent sequence of movements:

Initial pulldowns (~34% in 2017 vs ~33% in 2025)

Series of uptrends followed by corrective pullbacks

Progressive upward momentum with higher highs and higher lows

Similar number of major price waves (four significant uptrends in each case)

Key Differences

Timeframe Extension: The 2025 cycle shows significantly extended durations compared to

2017

Initial pulldown: 3 weeks (2017) vs 21 weeks (2025) – 7x longer

First major uptrend: 12 weeks (2017) vs 11 weeks (2025) – similar duration

Second uptrend: 12 weeks (2017) vs 14 weeks (2025) – slightly longer

Overall cycle progression is approximately 2-3x longer

Magnitude Reduction: The 2025 cycle shows diminished percentage movements:

First major uptrend: 230% (2017) vs 120% (2025) – roughly half

Second uptrend: 172% (2017) vs 85% (2025) – roughly half

Final uptrend: 253% (2017) vs 125% (2025) – roughly half

Technical Analysis Support

This pattern correlation would likely be supported by other technical indicators:

Bollinger Bands would show:

Similar pattern of band expansion during strong directional moves

Band contraction during consolidation periods before breakouts

2025 likely exhibiting less volatility (narrower bands) but with similar repeating patterns of price touching upper bands during uptrends and lower bands during corrections

Ichimoku Cloud would demonstrate:

Similar cloud breakout patterns preceding major uptrends

Price respecting key Ichimoku components (Tenkan-sen, Kijun-sen) as support/resistance

2025 showing extended time within the cloud during longer consolidation periods

Similar bullish/bearish crossovers of the conversion and base lines, but occurring over longer timeframes

Predictive Value

This comparative lens offers valuable predictive power for several reasons:

Market Psychology Consistency: Despite Bitcoin's maturation, market psychology (fear, greed cycles) remains remarkably consistent, expressed through similar percentage retracements and fractal patterns.

Macro Context Integration: The longer durations and reduced volatility in 2025 reflect Bitcoin's increased market capitalization and institutional adoption, creating a logical evolution of the same underlying patterns.

Specific Forecasting Application: If the pattern correlation holds, we might anticipate:

The current cycle extending into mid-2026

One more major uptrend followed by a 30-40% correction

A final explosive move of approximately 125-150%

Total cycle appreciation significantly less than 2017 but still substantial

Risk Management Framework: These patterns provide clear pivot points for position sizing and risk management, with defined percentage targets and timeframes.

This analysis suggests we're witnessing an evolved expression of the same market dynamics that drove the 2017 cycle, with the extended timeframes and reduced percentage movements reflecting Bitcoin's maturation as an asset class while maintaining its fundamental cyclical character.RetryClaude can make mistakes. Please double-check responses.