BTC BULLISH RUNBTC'S BULLISH RUN IS BACK ON. The price has been dumped down to trap traders, stop hunt, and liquidate long buyers. I created a three-stage process to analyse the markets. The Jan trading range trapped traders above and was dumped down for three months, FEB,MAR, and APR. This is causing FUGAZI in the market!

BULLUSD trade ideas

Bitcoin H4 | Approaching an overlap supportBitcoin (BTC/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 80,285.10 which is an overlap support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 74,000.00 which is a level that lies underneath a multi-swing-low support.

Take profit is at 88,532.50 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Bitcoin (BTC/USD) Technical Analysis – Bullish Setup🔵 Key Levels:

🎯 Target Point: 87,050.22 (🔼 Expected upward move)

🔵 Support Zone: 79,833.82 (🛡️ Strong demand area)

🔴 Current Price: 82,254.27

📊 Analysis:

🔵 RBS + RBR Zone (🔄 Role Reversal Support & Rally Base Rally) - Possible entry point for a long position.

🟠 Stop Loss: Below 79,833.82 (🚨 Risk Management)

🟣 Resistance Zone: Near 83,000 (🔄 Possible short-term pullback)

📈 Strategy:

1️⃣ Price might retrace to the blue zone (support) before continuing upward.

2️⃣ If it holds, 🚀 potential rally towards 87,050.22 🎯

3️⃣ If it breaks below support, ⚠️ possible downside risk.

✅ Conclusion:

A bullish setup with a 7.45% profit target 📊

Risk managed with a stop loss below support ⚠️

BTCUSD Daily View Based on your 15-minute BTC/USD chart, here’s a structured technical analysis for **April 10, 2025**:

---

### 🧠 **Chart Breakdown**

- **Break of Structure (BOS)**: Bullish BOS occurred earlier, indicating short-term upward momentum.

- **Strong High**: Marked at **$83,568** — this is a **liquidity point** that could act as a magnet if bullish momentum resumes.

- **Weak Low Zone**: Around **$81,451** — a key liquidity area that might be swept before any significant move up.

- **Current Price**: **$81,814**, sitting just above the weak low zone and in a minor consolidation phase.

---

### 🔍 **Market Context**

- After a strong impulsive move up, BTC started pulling back with lower highs and lower lows, indicating **retracement** or **distribution**.

- The price is holding slightly above the weak low, meaning:

- Smart money may be trying to **trap shorts or induce longs** before a deeper sweep or reversal.

- There's potential for **liquidity sweep below $81,451** before heading back up to test the strong high ($83,568).

---

### 🔮 **Today's Bias: Neutral-to-Bullish (Scalp or Swing)**

#### 🎯 **Bullish Scenario (Preferred if $81,451 holds)**

- Price holds above or sweeps $81,451 and **reclaims the zone quickly**.

- Expect a bounce toward:

- **$82,500** (intermediate resistance)

- **$83,568** (strong high / liquidity target)

#### 🛑 **Bearish Scenario (Only if clean break below $81,451)**

- Price breaks and holds below **$81,451** → retest failure = bearish.

- Target downside levels:

- **$80,500**

- Potentially **$79,500** if momentum is strong.

---

### 🧭 **Action Plan for Today**

| Type | Strategy |

|-------------|----------------------------------------------------------|

| Intraday Long | Buy near $81,451 zone with tight SL below $81,200 |

| Confirmation Entry | Wait for 15m bullish engulfing / BOS above GETTEX:82K |

| Short Setup | Only valid on clear 15m breakdown + retest below $81,451 |

---

Thu 10th Apr 2025 BTC/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Buy. Enjoy the day all. Cheers. Jim

Add-on to the 4h TF analysis.On the 1 hr Timeframe I have drawn the .283 ORANGE Fib retrace level (which may be the reversal back to bullish ALREADY ,as bullish momentum is STRONG here)

Below the Orange line is the Green long 0.5 level which i think may be the maximum retracement in this appearantly strong bullish momentum .

But as i write it, know that MM may be watching and reading this too !.. :)

BTCUSD – 30-Min Long Trade Setup!📈 🟢

🔹 Asset: Bitcoin / U.S. Dollar (BTCUSD)

🔹 Timeframe: 30-Min Chart (Bitstamp)

🔹 Setup Type: Bullish breakout with retest confirmation

📊 Trade Plan (Long Position)

✅ Entry Zone: $82,879 (post-breakout consolidation)

✅ Stop-Loss (SL): $81,452 (below breakout + key demand zone)

🎯 Take Profit Targets:

📌 TP1: $85,434 – resistance level

📌 TP2: $87,875 – previous high & major zone

📐 Risk-Reward Ratio:

🟥 Risk: $82,879 - $81,452 = $1,427

🟩 Reward to TP2: $87,875 - $82,879 = $4,996

📊 R/R Ratio: 1 : 3.5+ – solid reward potential

🔍 Technical Breakdown

📌 Clean trendline breakout with retest ✔

📌 Price holding above previous structure ✔

📌 Volume confirms bullish breakout momentum ✔

📌 Tight consolidation = potential launchpad setup 🚀

📉 Risk Management Strategy

🔁 Move SL to breakeven at TP1

💰 Partial profits at TP1

🎯 Let rest run to TP2

📏 Stay disciplined – follow plan

🚨 Setup Invalidation

❌ Break below $81,452 with strong volume

❌ Fakeout candle with rejection & close below trendline

⚡️ Final Thoughts

✔ Strong breakout setup backed by structure & momentum

✔ Excellent R/R for swing traders

✔ Follow the levels, not emotions

🔗 #BTCUSD #Bitcoin #CryptoTrading #BreakoutSetup #TechnicalAnalysis #ProfittoPath #TradeSmart #ChartAnalysis #MomentumTrade #RiskManagement

BEARISH RETRACEMENT for a BULLISH CONTINUATION? Thick long blue Line 1.618 TP level

Thick RED long Line 2.618 fib level

But btc has (as you can see on small green horizontal lines) Already hit a ( Perfect ) Fib retrace level of .786 ( Thicker line is perfect retracement from the highest point before the low) , the thinner green line is the later "high" shortly after it.

THUS ==> I think retracement is now in the make, for how much? I dont know, we can count on 0.5 to .618 move I think , before it continues bullish momentum.

OFCOURSE, its BRYPTO, its BITCOIN, it may also fall the hell back down again. Maybe to around the 76k level! But I THINK the first will play out!

So keep the other scenarios in mind as well.

I expect you can be calmly expecting a further bullish momentum , not taking news into consideration , but i think "A lot of bears have been SHOT on the way"! - Thus, having seen A LOT of BEARISH movements, It may be finally time to become BULLISH again, and CONTINUE!! :rocket:

BTCUSD:You need to refer to this strategyPresident Trump of the United States suddenly announced the suspension of tariffs, which led to a significant change in market sentiment.

Since tariffs play a crucial role in global economic relations and market expectations, this unexpected move has caused investors to adjust their investment portfolios.

As the new tariff suspension policy has reduced market uncertainties to a certain extent, gold, which is usually regarded as a safe-haven asset, has been sold off.

Conversely, the price of BTC has soared, reflecting the market's rapid response to this major policy change.

If you're at a loss right now, don't face it alone. Please get in touch with me. We are always ready to fight side by side with you.

Fade The News You have to fade the news because it's all technical. As you can see we have a strong hidden divergence on the 1hr TF. The bears did not succeed in trying to wipe out the low of 74,483. Instead price found it's ground at 74,588. The news articles/billionaires who control the news are trying to convince traders to sell but HODL or you will regret the biggest profit potential in history.

Bullish setup for Bitcoin for coming 6 monthsIf we look at pure technicals. Basic technicals, things couldn't be more bullish. The sentiment is at extreme fear, but look at this beautiful chart.

Maybe we chop here for a bit, but once the MACD flips in momentum weakness, then I suspect massive upwards move for Bitcoin.

CHECK BTCUSD ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINTrade Type: Long (Buy)

Entry Zone:

Around $76,100, as indicated by the horizontal entry box (blue zone).

Take Profit Levels:

1. TP1: Around $77,000

2. TP2: Slightly above $77,000 (approx. $77,400

3. Last Target: $77,900

Stop Loss

Placed at $75,300

FALLOW RISK MANAGEMENT ✅

BTC Double Tops Trap or Trump BreakoutAs noted on the charts BTC has reached a critical point in its journey. Altcoins are already hammered into the weekend, is this an early indication of a rug pull?

BTC on the 8H time frame is showing rejection of higher prices into previous all time high with most indicators sounding a warning. I am only sharing my thoughts on whether this is a market maker's trap or Trump Breakout Trade.

Personally, I have a bias that even if US congress and White house would designate BTC as a Reserve asset (That's a Big iF), my question is would the US government with it's mountain of debt and DOGE (Department of Government Efficiency) buy BTC at over $100,000 per coin? Where is the taxpayer money to accumulate BTC at this price. I suspect the insiders will pull the rug before such an event.

Let the chart print!!!

These are just my thoughts I am sharing with the world. Cheers to profitable trades!

2024-? Deathcross Goldencross Pattern for BTCDeathcross then Goldencross then Deathcross creating a zone indicates a bearish move.

The time to sell before bigger dump ahead

Goldencross then Deathcross then Goldencross creating a zone indicates a bullish move.

The time to buy before bigger pump ahead

2021-2024 Deathcross Goldencross Pattern for BTCDeathcross then Goldencross then Deathcross creating a zone indicates a bearish move.

The time to sell before bigger dump ahead

Goldencross then Deathcross then Goldencross creating a zone indicates a bullish move.

The time to buy before bigger pump ahead

2017-2021 Deathcross Goldencross Pattern for BTCDeathcross then Goldencross then Deathcross creating a zone indicates a bearish move.

The time to sell before bigger dump ahead

Goldencross then Deathcross then Goldencross creating a zone indicates a bullish move.

The time to buy before bigger pump ahead

2012-2017 Deathcross Goldencross Pattern for BTC Deathcross then Goldencross then Deathcross creating a zone indicates a bearish move.

The time to sell before bigger dump ahead

Goldencross then Deathcross then Goldencross creating a zone indicates a bullish move.

The time to buy before bigger pump ahead

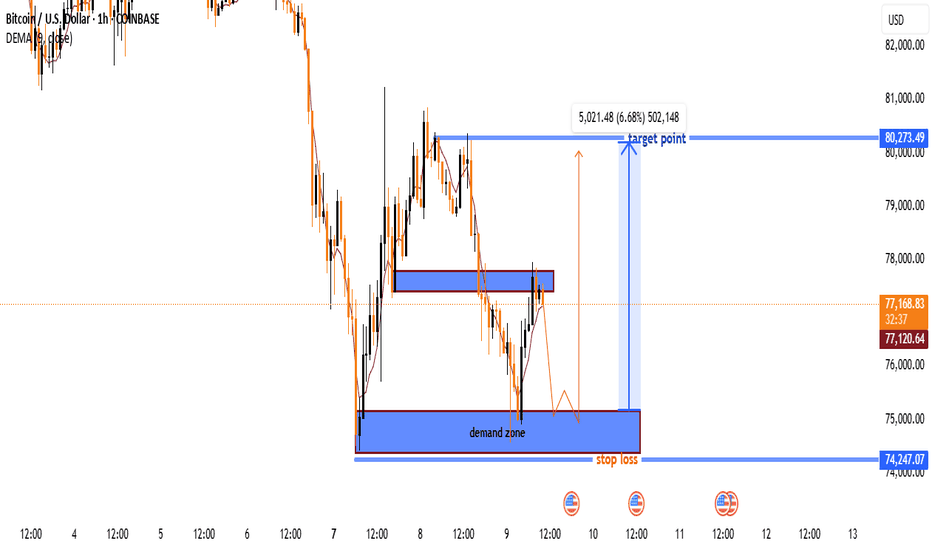

BTC/USD Long Setup – Bounce from Demand Zone Towards $80K TargetKey Zones

Demand Zone (Buy Zone)

🔵 $74,250 – $75,000

Strong support area

Buyers previously stepped in here

Marked for potential entry

Resistance Zone

🟣 $77,300 – $77,600

Mid-level resistance

Could cause a short pullback

Watch for breakout or rejection

Target Point

🎯 $80,273.49

Potential upside: +6.68% gain

Previous supply/structure zone

Take Profit (TP) zone

Stop Loss

⛔ $74,247.07

Just below the demand zone

Protects against invalid setup

Trade Idea

1. 🔽 Price expected to drop into demand zone

2. 🔄 Wait for bullish confirmation (e.g. bounce or engulfing candle)

3. 📈 Enter long position near $75,000

4. ⬆️ Ride it up through resistance

5. ✅ Target = $80,273 | ❌ Stop = $74,247