DBK trade ideas

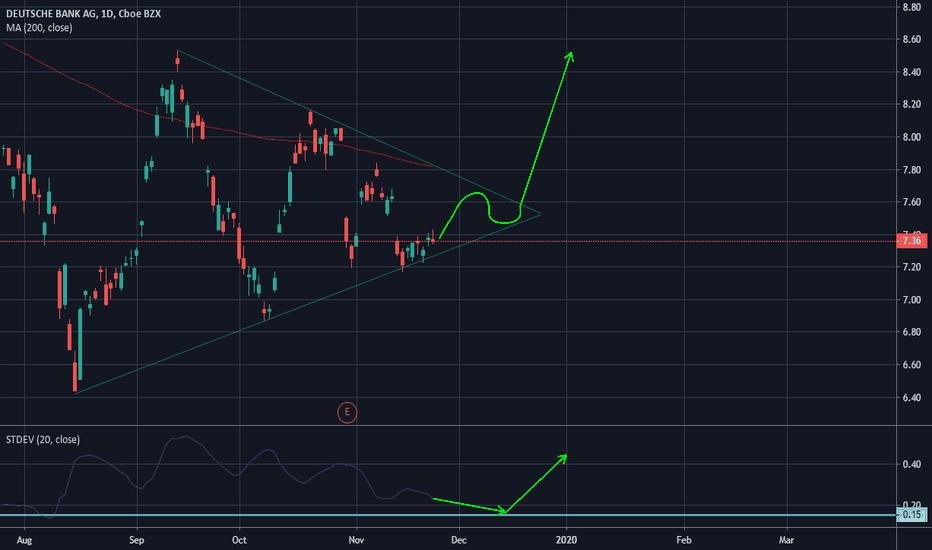

Is DB Possibly Bullish?Hmm, I am interested to see how this idea is received. I do think there is a possibility it moves back down, but what I know for sure is that there is going to a decent move as volatility is low. It has spent an extensive time below the 200-day avg, but the fundamentals aren't completely in its favor so that is for good reason. If it does move Long, I think that it would be purely based on sentiments of the new vision that the bank has for itself.

Deutsche Bank LongNYSE:DB

Entry - $7.60

Target 1 - $8.30

Target 2 - $9.65

Target 3 - $12

Stop loss - $6.79

DB is at an important Fib level as well as showing Bullish Divergence.

Be aware that this is a contrarian play and a countertrend trade. However, this area has a good chance of being a medium term bottom and we might be catching a trend reversal here which can be very powerful.

I plan on taking a 100 share position and selling calls against it on the way up as we hit important fib levels/moving averages.

Trade at your own risk and remember, this is not financial advice and I am not a financial advisor. Do your own research and due diligence.

What kind of pump & dump is this ? Hello everyone,

Today I would love to point that not only altcoins are loosing big.

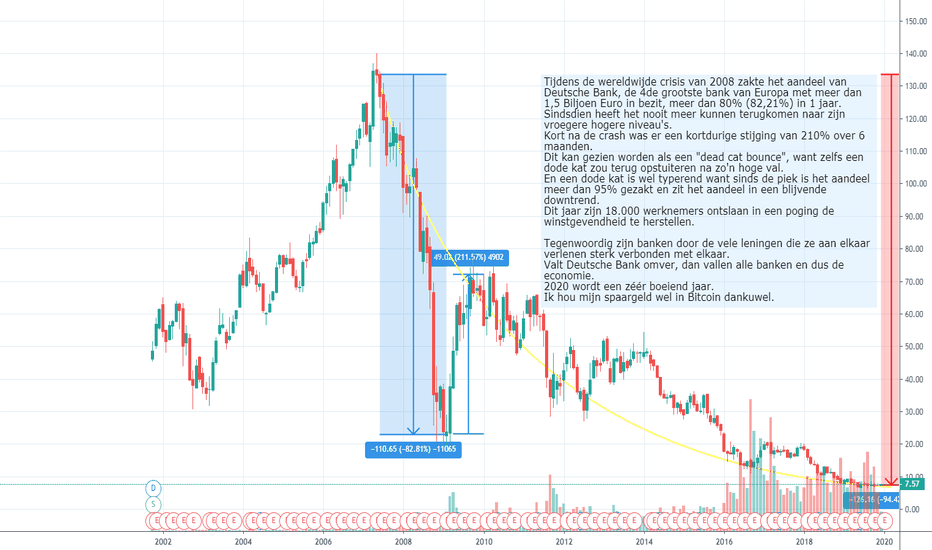

Shares of Deutsche Bank (NYSE:DB), Germany´s largest bank closed above $7 which is more than 95% down from the stock´s all-time high over $139 in the summer of 2007.

The bank is operational in 58 countries with a large presence in Europe, the Americas and Asia. Deutsche Bank is the 17th largest bank in the world by total assets. As the largest German banking institution, it is a component of the DAX stock market index.

DB investors waiting patiently for over twelve years for a recovery !!

While some of you calling cryptocurrencies fraud, others see the truth as the opposite.

In my opinion BIG CHANGES COMING to the financial industry.

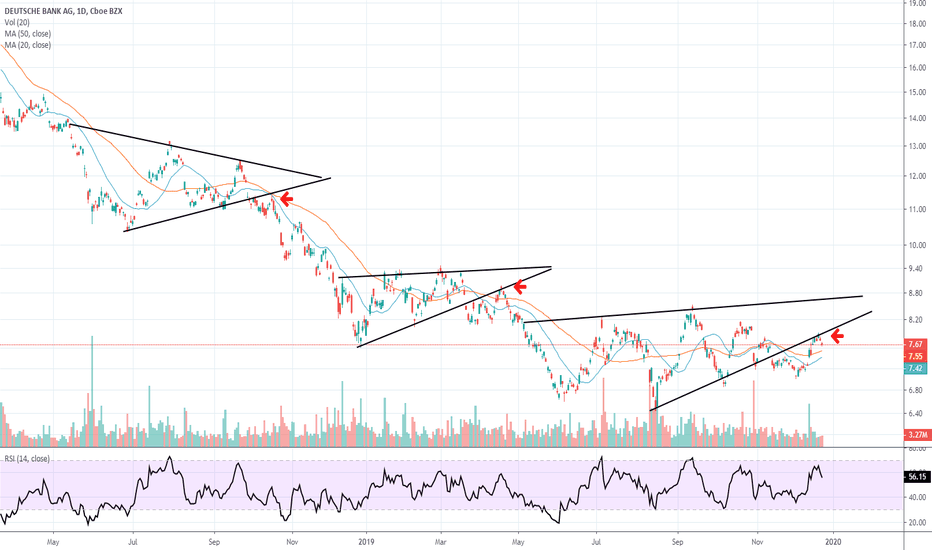

Deutsche Bank updateThe longs still running from the uptrend line. Now wave count suggests continuation up. Adding another long on the break of the 200SMA and then waiting for the test of the downtrend line for next setup.

As DBK trading open in the morning in Europe, could wait for the break and retest before adding for more confirmation and better stop placement.

Good Luck!

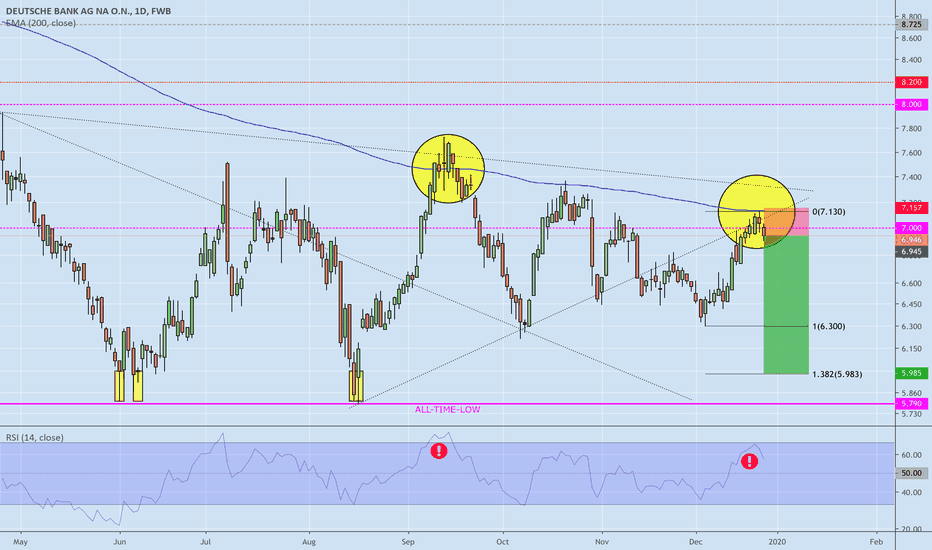

Deutsche Bank - Next Target € 8,50 or 24 PercentOnly the chart counts and without the following fundamental things in mind: feelings, financial crisis 2.0, zero or negative interest rates, margin erosion, Dr. Markus Krall, Zombibanken, personell overcapacities, Overbanking - too many branches, target 2 balances, Google Pay, Paypal, Alipay, Payoneer, Skrill, WePay, Wirecard, Adyen, FinTecs, IoT, Blockchain, RTP, BS PayOne, .....

If shareprice hit € 7.00 again, target of € 8.50 will be activated. However, shareprice should not fall below € 6.44 any more. At a current entry price of € 6.82, the chance/risk ratio CRR would be 4.2 to 1.