F Ford Motor Options Ahead of EarningsFord follows Tesla’s example and cuts price on Mustang Mach-E from as little as $600 to as large as $6,000. Most notable are the cuts to the Premium eAWD Standard range model, which takes it to $53,999 from $57,676.

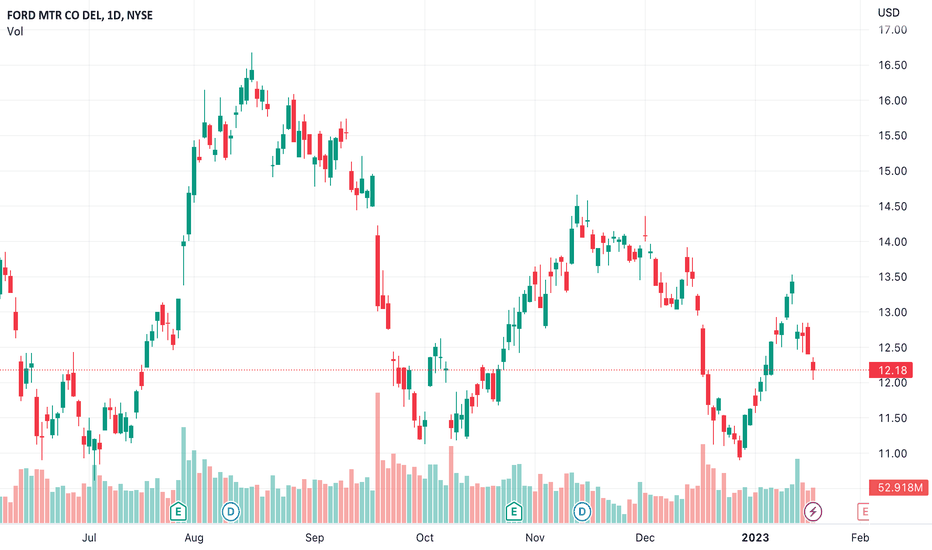

Looking at the F Ford Motor options chain ahead of earnings , I would buy the $13.5 strike price Calls with

2023-2-3 expiration date for about

$0.21 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

F trade ideas

$F: Bullish trendI'm not particularly fond of $F's CEO as of late, but he is the one doing a less worse job when it comes from transitioning from ICE to EV among legacy firms, so I give Jim that. Setup here is good and there is a gigantic YEARLY scale uptrend signal in the stock, so as long as it holds over yearly support, it could catapult the stock WAY up over time. Setup here is decent, and offers a nice swing trade op for us.

Best of luck!

Cheers,

Ivan Labrie.

Ford levels below 11 continue to attract.Ford - 30d expiry - We look to Buy at 11.21 (stop at 10.55)

Levels below 11 continue to attract buyers.

A lower correction is expected.

We look to buy dips.

We are trading at oversold extremes.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

Our profit targets will be 12.77 and 13.07

Resistance: 13.50 / 14.00 / 14.60

Support: 12.50 / 12.00 / 11.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Ford shares and trucks are getting traction in 2023In just two weeks, Ford shares (F) soared from $10.86 (USD) to $13.42. Traders are wondering what’s causing the surge and whether it will continue throughout 2023.

Ford’s EV truck is racing ahead of competitors

Among investors and traders, there are two things everyone understands about the automotive industry: trucks drive massive profits for manufacturers, and electric vehicles are the future. Ford's electric vehicle sales are surging, but the brand's future success may depend on one car.

Electric and hybrid cars are growing in popularity the world over, but would the working utility driver see the benefits over the cost? The Basic F-150 starts at $33,695, so when the price of the Ford F-150 Lightning was revealed to be only $8000 more, truck drivers took notice.

If Ford Motor Company's F-150 Lightning’s current sales are an indication, electric trucks are set to become the future of utility vehicles, and Ford is leading the way.

Is Lightning optimism just hype?

Maybe not! The F-150 Lightning electric pickup added to its trophy shelf the 2023 MotorTrend Truck of the Year award, and it was the first electric truck to win by a unanimous vote from the judges. In a MotorTrend vote, electric vehicles have only been unanimously voted twice before, and nobody expected that with a truck.

In the eyes of its supporters, the F-150 Lightning is Ford's best truck ever and a historic achievement in the history of American transportation. Time will tell if the truck is worthy of such high praise, but for now it’s checking all the boxes, and the stock has been reacting bullish since the beginning of the year.

Sales say everything about the F-150 Lightning

Since its launch, Ford's F-150 Lightning has been the best-selling electric truck in America throughout November and December, and its sales are growing twice as fast as the industry as a whole.

As a result, Ford's electric vehicle sales jumped 126% in 2022 compared to the previous year, and production soared 223% in December. Ford's F-150 Lightning is off to a great start, but it may hit speed bumps in the near future, and that might have a weighty effect on stocks, and not many traders are aware of it.

Production pushes the breaks on expansion

When a product trends, producers often find themselves shorthanded and under-equipped to handle the order volume. Clearly, Ford underestimated the global interest in the F-150 Lightning, and they are struggling to keep in step.

Ford is building Lightnings around the clock, but it wants to boost production capacity to 150,000 units by the end of Q2. A tall order that seems unrealistic, given what’s happening in the world.

Ford hasn’t exactly placed all its eggs in one basket, but it is somewhat dependent on one truck type for healthy shareholder reports and revenue. This might sound strange, given that Ford produces 40+ types of vehicles worldwide, but keep in mind, the “OG” F-150 has consistently generated around 90% of Ford's global profits for years.

We saw it with Tesla. An overworked production line led to late orders and quality issues. Is Ford about to make the same mistake? If that’s true, the bullish trend will be short-lived, and a correction is on the horizon.

Conclusion

Ford has made an electric version of its best selling vehicle and truck drivers love it. The world is ready to adopt hybrid and EV alternatives. The Lightning hype helped rocket F prices from a 12-year low to $13.43. And then, on January 12, somebody dumped a large volume of stock in a single day, pushing prices back to $12.64, creating a buyer opportunity.

Both fundamentally and technically, Ford stocks are trending in a buyers market with both long-term and short-term possibilities, but supply and demand in 2023 will be the deciding factor for the company’s success. If recession fears diminish sales, right after Ford sets up an infrastructure for increased production, F charts will get stormy, so trade under the assumption that a trend change could happen any time.

Keep up with the latest news surrounding Ford's F-150 Lightning. Vehicle recalls and sales drops could create negative sentiment, and any gains could be erased within a day.

Ford(F) - Double Bottom - BullishOn the chart of Ford, we can see a forming double bottom pattern on a daily timeframe.

A double bottom pattern may suggest a bullish reversal. When the price reaches and breaks out of the neckline a long position can be taken. But first we have to be patience and wait for the price to reach and test the neckline.

All further details are shown on the chart.

Goodluck!

F 13.5C 1/27Ford has touched the bottom support area 3 times and has shown to be a pretty strong area. The top trendline has had 2 touches so far, so the bottom is a more reliable play for the time being. Should it respect the top trend line . We should be looking to sell at $13. I've loaded up and plan to take half at $12, and the rest at $13.

2023 Ford Targets - $10.72, 9.6, 8.01Ford Motors has pulled back more than 50% from 2022 highs. It has been testing the major support trend line (WHITE) running from Mar 2020 lows.

This is a weekly chart and you can notice it's breaking the major support trend line and 200 EMA weekly.

I see Ford to test the $10.72 support levels and have a technical bounce testing the white trendline around $12-$13.. and eventually test the other support levels $9.6 (Orange) and $8.01 (Green).

Each support line will give a good technical bounce. One can buy at these technical support levels and swing trade for quick profits.

Let me know your thoughts in comments

Ford: Strong Possibility for a Bounce!Here we are looking at Ford on the daily TF.

As shown on the chart, we are analyzing two supports (which have confluence with one another) which both connect to our downwards sloping resistance (yellow).

It’s important to note that both support lines were previously resistance, but have both served as strong support since Fords breakout (to the upside) in January of 2021.

Currently, Ford finds itself testing support (blue circle). We expect for these two support lines to act as strong support, though we’re ready for a breakdown if it can’t hold.

We will continue to monitor price action, and will follow up on this post when there’s either a bounce or breakdown.

Do you think Ford will hold its supports?

Cheers!

Ford BounceI missed some profits on my last trade on Ford but that is why we don't go all in every trade. I trimmed a little more after my last post and now I am glad I did. Ford had a sharp selloff but looks like it found some support yesterday. I am looking for a bounce back to 13. Adding here but saving some powder in case we do get more weakness in first half of 2023. Looking to add full position below 11 or above 14.50. I believe if we get another wave of selling it will be our last until the credit bubble pops.

I like the 5% dividend on this into an uncertain 2023. Debt ratios are a bit high and ROA/ROE leave you wanting more so I am underweight.