Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, there is a chance that we will see new all time highs soon.

📝Levels to watch:

$200

🙏🏻#LONGTERMVISION

Philip - Swing Trader

GOOGL trade ideas

GOOG Wave B

Bullish price action from the last couple of months has been unconvincing, and this looks more like a wave B correction.

A break of the black ascending channel would be a trigger for wave C.

It would be interesting to see a reversal pattern in smaller timeframes if price touches the gray supply zone.

Google: Upcoming TopWe locate Google in turquoise wave 2 (of a downward impulse). In more detail, we see the stock developing a complex - - - pattern and expect turquoise wave 2 to conclude imminently with wave . All the while, the price should maintain a safe distance from resistance at $209.28. Looking ahead to turquoise wave 3, we anticipate sell-offs down into our magenta Target Zone between $123.92 and $98, before wave 4 likely triggers a temporary rebound up to the $138.35 level. Ultimately, the entire turquoise downward impulse should bottom out again in the magenta zone, which would also mark the completion of waves (C) in magenta and in green. Since a new larger upward phase should begin afterward, the magenta zone presents an opportunity to establish long positions. However, if Google were to break above the $209.28 resistance next, we would have to expect a new high for magenta wave alt.(B) —which would only temporarily postpone the anticipated sell-off though (probability: 24%).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

GOOGL – Sitting on the Edge! What’s Next After This Break? 📊 GEX Analysis – Options Sentiment Insight:

* Call Resistance Wall: Strongest resistance at 180–182.5 area (High GEX%, Gamma Wall, 2nd & 3rd CALL Wall). A breakout above this may trigger a gamma squeeze.

* Support Zone: HVL @ 174.39 — aligned with PUT support and GEX10 (-6.92%) at 167.5, forming a key downside guardrail.

* Gamma Exposure (GEX): Green double-dot 🟢🟢 = supportive for bullish bias but nearing exhaustion.

* IVR/IVx: IVR 40, IVx avg 37.2 — Neutral to slightly bullish. Options aren't overly expensive, risk-reward still good for directional plays.

* Call Participation: 16.4% CALLS = Moderate bullish activity but not extreme greed.

🔥 Options Strategy Idea:

* Bullish case: If price holds above 174–175, consider 7/12 or 7/19 180C debit spread (e.g., Buy 175C / Sell 180C).

* Bearish case: Break below 173.5 and you can play PUT debit spread down to 170 or 167.5.

📉 1-Hour Chart Analysis (Intraday/Swing):

* Structure: Bearish CHoCH confirmed. Price has pulled back after rejecting from red OB zone (~179.5–180).

* Current Action: Price hovering below trendline and sitting above demand zone (173.5–174.4). Break and close below this could lead to continuation down toward 170.5 / 167.5.

* Bias:

* Bearish under 177.06.

* Neutral chop zone between 174–176.6.

* Bullish recovery only above 177.5–179.5 reclaim.

🎯 Scenarios & Trade Setups:

* Scalp BUY Setup:

* Entry: Hold above 175

* Target: 177 / 179.5

* Stop: Below 173.5

* Scalp SELL Setup:

* Entry: Break and retest below 173.5

* Target: 171 → 167.5

* Stop: Back above 175

📌 Thoughts & Suggestions:

* GOOGL’s options positioning suggests a potential bounce, but the bearish CHoCH and rejection at resistance urges caution.

* If bulls reclaim 177.5, we may see a push to test the heavy CALL walls at 180–182.5.

* Trade defensively inside chop zone, don’t force full directional plays unless you see clean BOS or demand failure.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

Momentum Watch: GOOG Entry ZoneNASDAQ:GOOG – Trend Continuation Setup

The price has been trending within a clean ascending channel since April 2025.

After a pullback toward the midline and Bollinger basis, price is showing potential support.

Setup:

• Entry: $175 (conceptual)

• Stop: $165.5 (below channel)

• Target: $208 (upper boundary)

• Risk/Reward: 3.51

Stochastic is retracing but remains above key support zone.

As long as the channel holds, expecting continuation toward $200–208 by late September.

⚠️ Market remains under pressure following July 9th events, which could increase short-term volatility across tech.

GOOGL Looks Ready to Reclaim the Channel for July 10GOOGL Looks Ready to Reclaim the Channel – Watch These Key Zones! 📈

🧠 GEX-Based Options Sentiment Insight (20 DTE):

GOOGL shows a strong bullish options bias going into this week, with CALLs comprising 20.3% of flow and a positive Gamma Exposure (GEX) reading. Here's the breakdown:

* Gamma Wall (Resistance): $180–$182.50

* 2nd CALL Wall: $177.50 (69.5%) – key magnet

* Highest Positive NET GEX: $180 – breakout level for upside continuation

* Support Zone: $172.5 (Put Wall -31%)

* PUT Pressure Floor: $170–$167 range (3rd/4th PUT wall cluster)

🔧 Option Strategy Suggestion:

🎯 Bullish setup

* Consider 177.5c or 180c contracts (0DTE or 7/12 expiry) for quick moves if price holds above $175 and breaks $177.50.

* Scalp the range to $179–$180, trail stops near $174.80.

* Aggressive breakout players can aim for $182.50 if volume confirms.

🛑 Bearish hedge

* If price breaks $172.50 with strong volume, consider 170p or 167.5p targeting the lower PUT Wall zone.

* Keep stops tight above $174.96.

📊 1-Hour Chart – Price Action Breakdown

GOOGL recently flipped bullish with a BOS and a solid CHoCH confirmation. Price reclaimed a critical trendline and retested a fair value gap inside the green demand zone.

* Current Price: $176.45

* Key Demand Zone: $172.8–$174.9 (multiple FVG and liquidity sweep confluence)

* CHoCH + BOS combo: Indicates momentum shift

* Supply Zone (Resistance): $177.9–$179.7

* Trendline Breakout Retest Confirmed

🧭 If buyers defend above $174.9–$175, we could see a move toward $179.67 and possibly challenge the $181.96 high. A failure below $173.5 risks a full reversion to the prior range near $170.

🎯 Trading Plan Summary:

* Bullish Scenario:

* Entry: Above $177.50

* Target: $179.67 → $182

* Stop Loss: Below $174.96

* Bearish Scenario:

* Entry: Below $172.50

* Target: $170 → $167.5

* Stop Loss: Above $175.10

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

GOOGL Eyeing a Gamma Launch Above $182. for July 14🔹 GEX Options Sentiment Analysis

* Gamma Resistance Zone:

The $180 level marks the highest positive Net GEX / Call Wall, making it a magnet and potential resistance for GOOGL.

Above that:

* $182.5 = 2nd Call Wall

* $185 = 3rd Call Wall

* $186.43 is the extreme call zone from GEX

* Put Walls (Support):

* $172.5 = 2nd Put Wall

* $167.5 = HVL

* $165 = 3rd Put Wall

* IVR & Call/Put Sentiment:

* IVR = 38.4 → moderate implied volatility ranking

* IVX avg = 42

* GEX Score = 🟢🟢🟢 (bullish bias)

* CALLs flow = 26.5% net positive

🔸 Implication:

With price above $180 gamma wall and still pushing into $182.5–$185 range, GOOGL is positioned for a potential gamma squeeze, especially if volume supports a move over $182.5.

💡 Options Trade Suggestion Based on GEX

Bullish Scenario:

* 📈 GOOGL 182.5C 07/19 or 07/26

* Entry: On break and hold above $181.50

* Target: $185–$186.5

* Stop: Below $179.50

* Reason: Riding gamma squeeze above the GEX resistance wall with strong call flow and IV breakout potential.

Bearish Rejection Scenario (if false breakout):

* 📉 GOOGL 175P 07/26

* Entry: If price rejects $182.5 and breaks below $179

* Target: $174 → $172.5

* Stop: Above $181.20

📊 1H Chart Analysis (SMC Price Action)

* Market Structure:

* Clean Break of Structure (BOS) confirmed above previous highs.

* Price is currently consolidating inside a bearish OB between $180–$181.40.

* Key Levels:

* Support: $178.8 / $177.6

* Demand Zone: $174.65 → $172.79

* Resistance: $182.5 → $185 zone

* Bias: Bullish (as long as price holds above $177.6)

* Trendline: Still being respected, with CHoCH flip bullish.

📍 Trade Setup Based on 1H Chart

Scalping Intraday Long Setup:

* Long above $181.40 (breakout from OB)

* Target: $182.5 → $185

* Stop: Below $179.80

Intraday Short Setup (if rejected):

* Short below $179

* Target: $177.6 → $174.6

* Stop: Above $181.25

🧠 Final Thoughts

GOOGL looks ripe for continuation as long as price remains above the $180 GEX wall. However, failure to clear $182.5 could invite profit-taking. Watch volume into open and how it behaves near the order block range.

Disclaimer: This analysis is for educational purposes only and not financial advice. Trade your plan, manage your risk, and stay adaptive to market conditions.

GOOG - Possible Break OutHello Everyone,

Happy Sunday to All.

I would like to make a quick Analyse on GOOG. When i was scanning the stocks,i reliazed that this could be a possible breakout and could be a opportunity to buy.

This looks like a breakout and i am expecting to Re-test trend line which price level 175 $.

Then first target is 190-192 which is approx %8 - 10 above from 175.

If it will restest and hit the 175 , this could be good entry point.

If not then first target is 190-192 which is approx %5 above current price level.

Long Term , of course Google is Google no doubt to jump in every price points :)

For me, short term i would wait 175 and put my order to that price , then wait for next moves.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday and good start a Week

GOOGLE Count changed, Bullish outlook.I have adjusted NASDAQ:GOOG NASDAQ:GOOGL Elliot wave count with a wave 1 completing a leading diagonal backed up by a deep wave 2 correction into High Volume Node support (HVN). We potentially have another 1-2 with fast drop and recovery to the S1 daily pivot which would make long term outlook extra bullish by extending target.

Wave 3 is underway with a target of the all time hime high HVN for wave 5. The next resistance HVN is $191.

Price above the daily pivot and is continuing upwards after testing as support.

Analysis is invalidated below $162 swing low.

Safe trading

GOOGL Breaking Out of Downtrend? July 7🔍 GEX-Based Options Insight (Chart 1)

* Current Price: $179.53

* Highest Positive Gamma Level: $180 — this is the key gamma wall. Price is magnetized toward it and may experience hesitation or consolidation here.

* Call Walls Above:

* $182.5 → 2nd Call Wall

* $185 → 3rd Call Wall (possible extended target if momentum remains bullish)

* Put Walls Below:

* $170, $165 → Both levels suggest downside is well-defended by PUT buyers

* Options Sentiment:

* IVR: 36.2 (fairly elevated)

* IVX > IVR (IV expansion potential)

* Call Bias: 22.9% Call$, GEX bullish (green circles)

* 🔋 Interpretation: Bullish GEX + elevated IV suggests strong upward pressure. Consider buying CALL options near $179–$180, targeting a breakout continuation toward $182.5–$185.

🧠 1-Hour Technical Analysis (Chart 2)

* Structure: GOOGL just broke a local CHoCH → BOS, reclaiming short-term EMA support.

* Trendline Breakout: Clean break above descending trendline + break of BOS = bullish confirmation.

* Support Zones:

* $178.85 (minor support)

* $175.70 and $173.50 (stronger demand)

* Next Resistance Levels:

* $181.61 → matches GEX wall

* $185.0 → next key area to watch if breakout sustains

* Volume: Bullish breakout accompanied by rising volume = healthy momentum

* Bias: Leaning bullish, but needs to hold $178.85 zone to stay valid.

✅ Trade Plan Suggestion

Call Entry Idea:

* 📍 Entry: $179–$180 (on pullback or breakout)

* 🎯 Target: $182.5 → $185

* ⛔️ Stop-loss: Below $178.50

* 📆 Contract: 1–2 weeks out (due to IV and potential expansion)

Note: If it fails to hold $178.50–$175.70 zone, re-evaluate for PUTs or wait for new structure confirmation.

This analysis is for educational purposes only and does not constitute financial advice. Always manage risk and trade with a plan.

$GOOGL $GOOG AI Signals a Volatile Expansion 🔍 Technical Overview (Daily TF)

GOOGL is currently trading at $180.19, breaking upward inside a well-defined bullish channel, hugging equilibrium levels after consolidating just below the $184 resistance zone. This setup reflects classic Smart Money reaccumulation behavior:

🟩 Current Structure: CHoCH → BOS confirmed on higher lows

📊 Equilibrium: Mid-channel value alignment; strong price efficiency with low imbalance

🟧 Premium Zone: $202.81–208 marked for liquidity sweep (target zone)

🔴 Strong Highs: Not yet swept; draw on liquidity to the upside likely

Key price levels:

Resistance zone: $184.00–208.00

Support cluster: $172.00–168.00

Discount Block (Demand): $144.00–132.00

🤖 VolanX AI Models Forecast (as of July 12)

📌 Model 1 – Smart Money AI Trading Suite

LSTM Forecast: +9.0% gain expected over next 14 days

Target: $196.34

Market Condition: Overbought (No order blocks currently)

Volatility: 26.4%

Volume Shift: -15.5% (suggesting short-term supply exhaustion)

📌 Model 2 – WaverVanir DSS Platform

Sentiment Score: 78 (bullish bias)

15-Day Prediction: $182.34 (+1.2%)

30-Day Prediction: $184.36 (+2.3%)

📈 Note: The DSS is projecting slower upside in comparison to the Smart Money AI suite. This divergence suggests that while short-term price may rise, the major move could depend on external catalysts.

🌍 Macro & Catalyst Outlook

NASDAQ Tech Momentum: Q2 earnings in July will be a key macro driver

Yields & Dollar Index: Softening DXY supports tech; watch 10Y real yield inversion

AI Sector Beta: GOOGL is lagging NVDA/MSFT but may play catch-up into August

CPI/Inflation Watch: If inflation readings cool, it may trigger flows into mega-cap tech

Fed Policy Risk: September dot-plot shift could trigger volatility (Fed pivot vs sticky inflation)

🧠 WaverVanir DSS Conclusion:

📌 Bias: Bullish-to-Neutral

📌 Trade Zone: Watching for breakout above $184 to trigger sweep toward $196–202

📌 Invalidation: Break below $168 invalidates bullish structure; targets $144 liquidity pool

📌 Strategy: Standby mode; entry requires confirmation of volume breakout above range high.

📢 WaverVanir Insight:

"Smart Money has shown its hand — compression is a prelude to expansion. We're monitoring confluence between AI signal alignment and SMC structures. $196 target remains valid unless CHoCH flips bearish with volume."

#WaverVanir #VolanX #SmartMoneyConcepts #GOOGL #AITrading #InstitutionalFlow #LSTM #VolumeProfile #TradingView #MacroAnalysis #StockForecast #Alphabet #MarketForecast

Open AI building it's own Browser- Open AI building it's own Browser. They have the talent to build it.

- Apple buying Perplexity AI

- MARKETSCOM:GOOGLE chrome isn't the best. I find Firefox better than Chrome but that's subjective. There's no stickiness in web browsers honestly. It's just that there are no good options.

- Recently, Google chrome added some weird looking AI summarizer on top which must be reducing number of organic hits to the website.

- I'm bullish long term but bearish short term. Open AI is really disruptor and has strong talent density better than Google in my opinion.

This Looks So Bullish (I See A Cup And Handle. What do you see?)Pattern Identified: Cup and Handle

From the chart of Alphabet Inc. (GOOGL), the most prominent and likely bullish pattern is a Cup and Handle formation:

Cup Formation:

The price declines sharply around February–April 2025.

It then forms a rounded bottom.

Recovers back to the previous resistance near $180 in June–July.

Handle Formation:

A short pullback (forming a small downward-sloping consolidation).

Followed by a breakout around $180.55 (current price).

Price Target Calculation:

Formula:

Target Price = Breakout Level+(Cup Height)

Breakout Level: ~$180

Cup Bottom: ~$145

Cup Height: 180 - 145 = $35

Target Price = 180+35 = 215

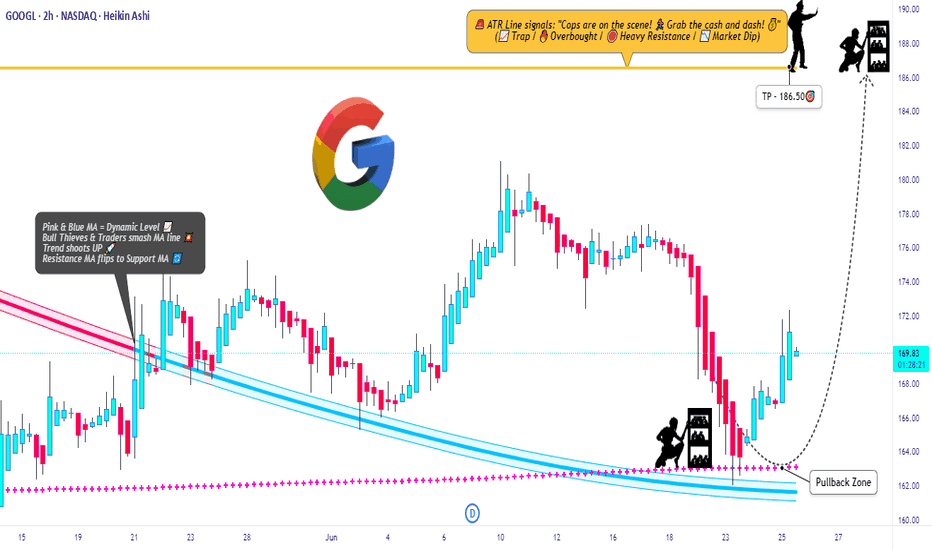

GOOGL Raid Plan: Bulls Set to Hijack the Chart!💎🚨**Operation GOOGL Grab: Robbery in Progress! Swing & Run!**🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Robbers, 🤑💰💸✈️

Get ready for another high-stakes market heist – this time, we’re raiding the vaults of GOOGL (Alphabet Inc.) using the Thief Trading Strategy™. Based on sharp technical intel and subtle fundamental whispers, the setup is clear: the bulls have cracked the code, and it’s time to grab our loot.

🟢 🎯 ENTRY POINT - THE LOOT ZONE

"The vault is wide open!"

Snatch your bullish entry anywhere on the chart, but the pros will place limit buys on recent pullbacks (15m/30m zones), either on swing lows or highs. The pullback is your door in — don’t miss it!

🛑 STOP LOSS - ESCAPE ROUTE

Set the Thief SL at the recent 2H swing low (162.00).

But remember, each robber’s risk appetite is unique — adjust your SL based on your size, cash, and courage.

🎯 TARGET - GETAWAY MONEY

💼 Main Target: 186.50

Or if heat rises early, vanish with your gains before the full score hits. Disappear like a ghost — profit first, questions later!

🧲 FOR SCALPERS – THE QUICK GRAB

Only ride the long wave — shorting is off-limits in this mission.

If your wallet is loaded, dive in. If not, join the swing crew.

Use trailing SL to protect your cash stack 💰.

📈 THE SETUP – WHY THIS RAID WORKS

The GOOGL Market is bursting with bullish energy — a classic Red Zone robbery moment.

Overbought tension, fakeouts, trend shifts — exactly where we love to strike! Consolidation and reversals = opportunity for the brave.

📣 TRADING ALERT - NEWS AHEAD!

🚨 Avoid entries during news releases – they trigger alarms!

Use trailing SL to lock in your stash, especially during high-volatility windows.

🔍 TIPS FROM THE THIEF’S DESK

Stay updated with the latest whispers — from fundamentals to geopolitical noise, COT positioning to sentiment swings. The market changes faster than a thief on the run — so adapt fast!

💖 Show some love: 💥Hit that Boost Button💥

Let’s fuel this robbery plan with more power and precision.

Every day in the market is a new heist — let’s win like thieves, not sheep. 🏆💪🤝❤️🚀

I'll be back soon with another masterplan...

📡 Stay sharp, stay hidden — and always aim for the vault. 🤑🐱👤🎯

GOOG LongMarket Structure Breakdown

Initial Break of Structure (BOS) – Bearish Phase

A significant bearish BOS occurred after a liquidity sweep above the prior high. This marked the temporary dominance of sellers, driving price downward.

Change of Character (ChoCh) – Sentiment Shift

Following the bearish leg, price printed a sharp recovery and broke above internal lower highs, signaling a Change of Character. This is the first indication of buyers regaining control.

Bullish BOS – Confirmation of Uptrend

The bullish BOS validated the upward structural transition, establishing new higher highs and higher lows. This confirms that institutional order flow has shifted bullishly.

🔹 Liquidity Dynamics

The liquidity sweep at the recent low (marked with a red dot) is a critical manipulation event, removing weak longs before institutions accumulate.

The current price action is printing a re-accumulation range, where price is likely to dip into key zones to trap breakout sellers.

Multiple liquidity pockets (green shaded regions) below serve as potential inducement zones. These areas may be revisited to gather liquidity before the next leg higher.

Final target is projected near the higher time frame sell zone around the $186–188 level, where substantial resting liquidity likely exists from previous swing highs.

🔹 Risk Management Considerations

Entry Zones: Look for confirmation-based entries within the liquidity trap zones, avoiding premature positioning at highs.

Stop-Loss: Place invalidation levels below engineered sweep zones to prevent getting caught in liquidity grabs.

Scaling Strategy: A tiered entry model can be effective here — initiating partial entries at the first trap and scaling in on deeper retracements.

Targeting: Conservative traders can aim for the internal high; aggressive positioning could seek full mitigation of the higher time frame zone.

GOOGL Option Flow Suggests Opportunity Ahead 🧠 GEX Sentiment Breakdown (Options Insights):

From the GEX data:

* GEX is green with 3 bullish signals ✅

* Call flow dominance at 21.3%, showing stronger bullish participation

* IVR: 37.1 — implying slightly elevated premium conditions, which benefits directional plays

* Key Levels:

* $180 → Major Call Wall (profit-taking & resistance)

* $177.5 → 3rd Call Wall (possible stall zone)

* $175 → 2nd Call Wall, currently being tested

* $172.5 → HVL + GEX Support, critical for bulls to defend

* $170 → Next GEX flip zone

💡 Trade Bias from GEX:

→ BUY CALLS if price reclaims and holds above $175 with momentum

→ Avoid CALLS if it rejects $175 and drops under $172.5 — at that point, PUTs become viable

📉 1H Price Action (Intraday Game Plan):

Based on the second chart:

* GOOGL is consolidating just below a recent CHoCH zone (change of character), forming a tight range under a bearish breaker block at $176–$178

* Trendline from June breakout was broken and is now acting as dynamic resistance

* If $175.80–176.20 gets rejected again, we may see a move down to test $172.50 or deeper into demand zone near $170–$168

📊 Intraday Setup Ideas:

🔼 Bullish Setup (CALLS):

* Entry: Above $176.20 with strong volume

* Target: $178 → $180 (Gamma Wall & resistance)

* Stop: Below $174.80

* Best if IV stays stable and GEX remains bullish

🔽 Bearish Setup (PUTS):

* Entry: Rejection at $176 → enter short or PUTs below $174.50

* Target: $172.35 → $170

* Stop: Above $176.50

* Confirmation if GEX flips or if IV spikes and GEX green dots disappear

🎯 My Thoughts:

This is a tricky zone. GOOGL is sandwiched between resistance at $176 and support at $172.5. GEX flow supports buying CALLs on strength, but price needs to break above $176 to make that valid. Watch for any gap open or strong push with volume for confirmation. If the market stays weak, don’t chase CALLs blindly — the safer play is fading into $170.

Disclaimer:

This breakdown is for educational use only — not financial advice. Trade at your own risk, manage position sizing, and stay disciplined.