OptionsMastery: Looks like a good buy on GOOGLE!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

GOOGL trade ideas

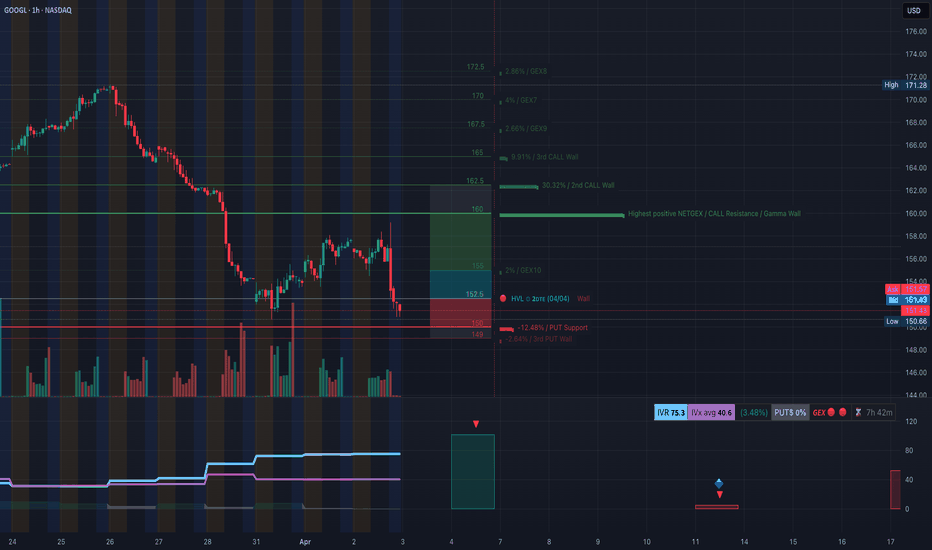

Alphabet ($GOOGL) Nearing Completion of 5-Wave DeclineIn our latest Elliott Wave analysis of Alphabet ( NASDAQ:GOOGL ) on the 30 minute chart, we observe a clear 5-wave impulse structure unfolding to the downside, originating from the February 5, 2025 peak. This decline aligns with the broader corrective pattern, and we believe NASDAQ:GOOGL is now in the final stages of this bearish move before a larger recovery takes shape. Let’s break down the structure and what to expect next.

Wave Structure Breakdown

The chart below illustrates that NASDAQ:GOOGL reached a significant high on February 5, 2025, at 209.51.

From this peak, the stock initiated a 5-wave impulse decline:

- Wave ((1)): The first leg down concluded at 156.72, marking a sharp initial decline from the February 5 high.

- Wave ((2)): A corrective rally followed, retracing part of the decline and peaking at 171.28, completing wave ((2)) as the 30 minute chart below shows.

- Wave ((3)): The decline resumed with wave ((3)), which extended lower to 150.66.

- Wave ((4)): A counter-trend rally unfolded in a 3-wave structure, labeled (W)-(X)-(Y) on the chart, reaching a high of 159.23 on April 3, 2025, as indicated on the chart. This peak marked the completion of wave ((4)).

- Wave ((5)): The current leg lower began after the April 3 peak at 159.23. As of the latest data on April 3, 2025, NASDAQ:GOOGL has reached 152.76, as shown on the chart, and appears to be in the final stages of wave ((5)).

Current Position and Invalidation Level

The chart highlights an invalidation level at 171.34 (the “RIGHT SIDE+” line in red). As long as NASDAQ:GOOGL remains below this level, the bearish outlook for wave ((5)) remains valid. With the current price at 152.76, wave ((5)) is likely approaching its conclusion soon. It should not go below 138.7, otherwise wave ((3)) will be the shortest wave. Alphabet (GOOGL) 30 Minutes Elliott Wave Chart

What’s Next: A Larger 3-Wave Rally

Upon the completion of wave ((5)), we expect NASDAQ:GOOGL to initiate a larger 3-wave corrective rally. This should be end a higher-degree wave b. The rally should unfold in a 3-wave pattern (A-B-C) and could target a retracement toward the 170.6 area, where prior wave ((2)) levels may act as resistance.

GOOGL Testing Key Support: Breakdown or Bounce from $150?

🧠 Macro Context:

In the wake of the Trump tariff announcement, market-wide risk aversion hit big tech hard. GOOGL is now sitting on a crucial $150 gamma support zone, where both technical and options flow converge. The market is indecisive: is this a base or a trap?

📊 Technical Analysis (1H Chart)

Market Structure:

* GOOGL has been in a consistent downtrend, rejecting lower highs.

* Attempted recovery stalled at the HVL around $152.50, and now price is back down to support near $150.66.

* The short-term trendline from the late March breakdown has held, acting as dynamic resistance.

Key Levels:

* Support:

* 🔻 $150.66 = Recent session low

* 🔻 $149 = PUT wall / breakdown risk zone

* Resistance:

* 🔺 $152.50 = HVL rejection zone

* 🔺 $155 = First GEX resistance area

* 🔺 $160 = Massive Gamma Wall / Call Resistance

Indicators:

* Selling volume continues to be elevated.

* No real sign of divergence or bottoming pattern yet, but price is coiling near a gamma pivot.

🧨 GEX & Options Flow Analysis

GEX Map (Options GEX ):

* GEX: 🔴🔴🔴 — heavy short gamma positioning means dealers are sellers into strength, adding fuel to downside momentum if $150 breaks.

* Highest Net Positive GEX / Call Wall sits around:

* $160–162.5 = Gamma resistance cluster

* Put Support:

* $150–149 = Highest PUT density. A break below could trigger dealer hedging flows, accelerating losses.

Options Oscillator:

* IVR 75.3 → Elevated risk expectations.

* IVx 40.6 avg vs 3.48% daily → Volatility is rising but hasn't spiked.

* PUT$ 0% → Either the data is delayed or retail isn't hedging — could mean more downside is possible.

🧭 Trade Scenarios

🐻 Bearish Breakdown Setup:

* Trigger: Clean break below $150.60 with volume

* Target: $149 → $147.50

* Stop: Above $152.50 (tight control)

* Edge: GEX confirms no real support below $149

🐂 Gamma Bounce Setup:

* Trigger: $150 holds and price reclaims $152.50

* Target: $155 → $160 (scalp to swing)

* Stop: $149 breakdown

🔥 Summary:

GOOGL is coiled at the gamma pivot zone ($150). If it breaks, the lack of strong PUT interest and dealer short gamma could trigger a fast move down to $147 or lower. On the flip side, a strong bounce and reclaim of $152.50 can open up a path toward $155–$160.

⚔️ Suggested Plays:

🔻 Buy $150P 0DTE/2DTE on breakdown — ride momentum

🔺 Buy $155C 1-week expiry only if $152.50 is reclaimed with strength

Stay nimble — we’re in a gamma battlefield.

Disclaimer: This is not financial advice. Trade your own plan, manage your risk, and stay objective.

GOOGL - bears taking controlhi traders,

GOOGL ready for more downside.

The monthly time frame is pretty straightforward here.

Huge bearish engulfing is almost confirmed.

STOCH RSI with a bearish cross.

It's a time to retest the 50 simple moving average.

Bears will drag the price towards 135$ where we should see some bounce.

Lower prices are coming.

Check out our SPX analysis:

The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

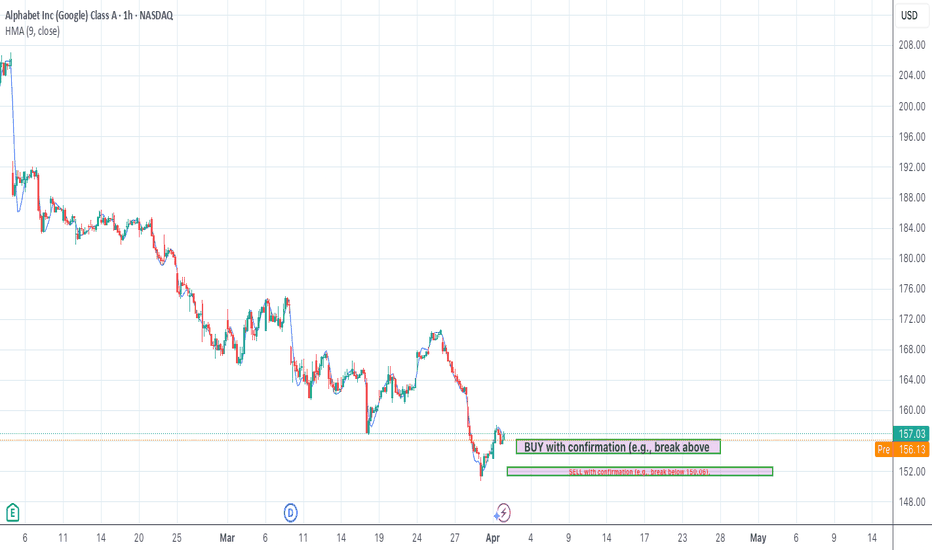

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

If Price Holds Support (152.48-154.34):

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).

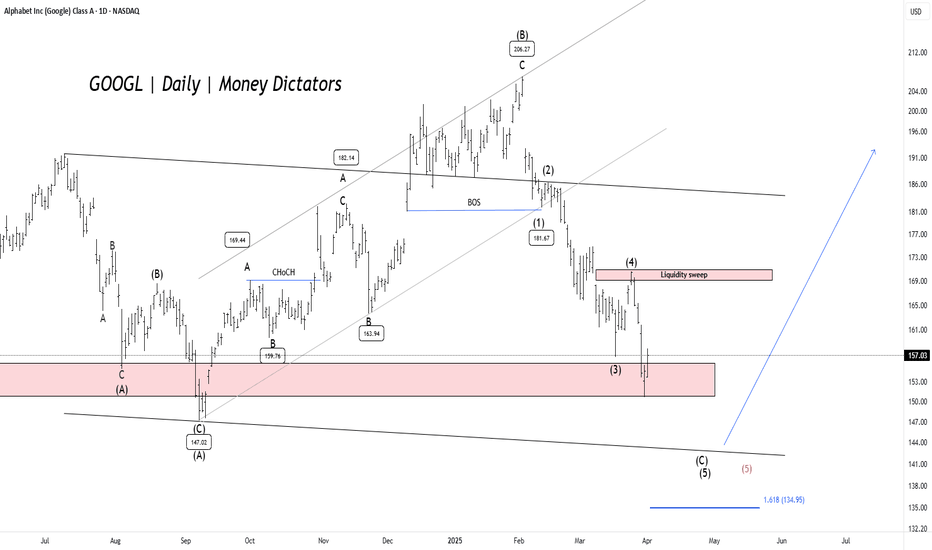

GOOGL - Elliott Wave Final ShowdownGOOGL has dropped over 27.28% , reaching a minor profit-booking zone. The $150 level serves as a key demand zone, where a potential price reversal could occur. The formation is either expanded flat or a running flat on the daily timeframe chart.

Confirmation is best observed near the lower trendline of the parallel channel. If bearish momentum persists, prices may decline further to the $142-$140 range before a strong rebound. Once the correction ends, the upside targets are $168, $180, and $195.

A new low will form if the previous low is breached. Further research will be uploaded soon.

Alphabet (GOOGL) Stock Hits 2025 LowAlphabet (GOOGL) Stock Hits 2025 Low

As seen on the Alphabet (GOOGL) stock chart, the price has dropped close to $156—a level not seen since September 2024.

Since the start of 2025, the stock has fallen by more than 18%.

Why Is GOOGL Falling?

As mentioned earlier today, overall market sentiment remains bearish due to the White House’s tariff policies.

For Alphabet (GOOGL), the situation has worsened today due to the following developments (as reported by the media):

➝ Google has admitted liability and agreed to pay $100 million in cash to settle a US class-action lawsuit accusing the company of overcharging advertisers, according to Reuters. Alphabet shares dropped 4.4%.

➝ Google’s division was found guilty of anti-competitive behaviour in India related to its app store billing system.

Technical Analysis of Alphabet (GOOGL)

In February, we noted investors’ negative reaction to the company’s earnings report, which led to a bearish gap (marked by a red arrow).

Since then, bears have maintained control, pushing the price below the lower boundary of the ascending channel that had been valid since 2023. Key signals include:

➝ The $170 level (near the bearish gap on 10 March) acted as resistance on 25 March.

➝ Bears showed little reaction to bulls at the $160 level and have kept the price contained between two downward-sloping red lines.

Bears may now be targeting the psychological level of $150. If bulls want to maintain control over GOOGL’s long-term uptrend, they need to take action soon.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

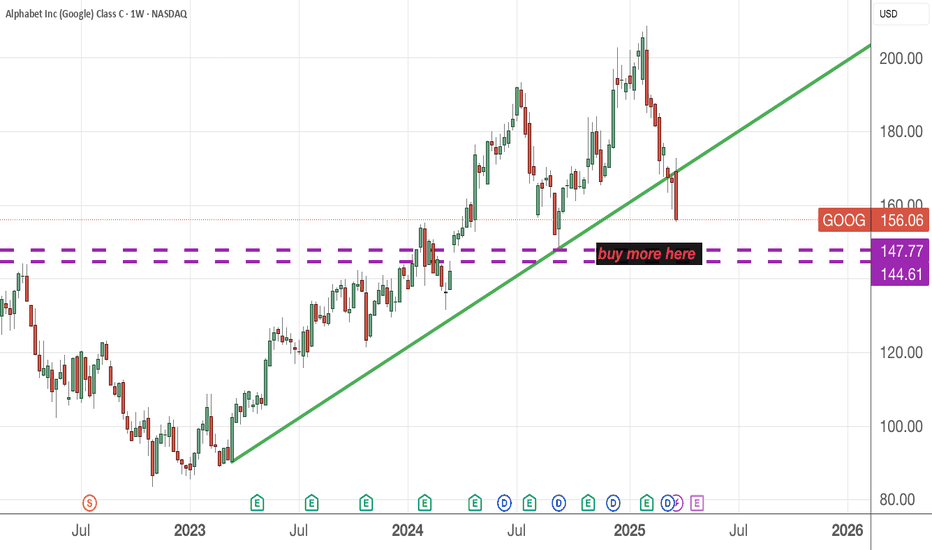

Googl.. where we standMy last post on googl (See below)

I showed you the rising wedge on googl at 200.. 25% later here we are..

This is a long term view. This the great reset back to the primary trendline..

This is logarithmic, logarithmic or log scale comes in handy to chart stocks or indexes that have made a parabolic move .

Here's the monthly trend

As you can see , with exception of the covid pump googl has respected this trend.. Now we are heading back to support.

Since 2009 googl has never broken it's monthly 50 SMA. The monthly 50 SMA + the long term trendline is around 128-135.00

Throw in a Fibonacci level from ATH and 2020 lows and you get a 50% retracement

That's my long term by zone for googl.. I wouldn't buy this stock until the 130's

I will update this later today with some actual tradeable analysis, this was just a long term view

Google Wave Analysis – 28 March 2025

- Google broke key support level 160.00

- Likely to fall to support level 147.30

Google recently broke the key support level 160.00 (which has been reversing the price from September, as can be seen from the daily Google chart below).

The breakout of the support level 160.00 accelerated the active impulse waves iii and 1 – both of which belong to the extended downward impulse wave (1) from last month.

Google can be expected to fall to the next support level 147.30 (a former multi-month low from last September).

GOOGLE Bottom confirmed. Laying eyes on $220.Alphabet Inc. (GOOG) has been trading within a Channel Up since the July 10 2024 High. Last week, the Bearish Leg touched the pattern's bottom, completing a -23.92% decline from the top, which is almost symmetrical to the previous Bearish Leg (-23.32%).

At the same time the 1D RSI got oversold (<30.00) and recovered on a Bullish Divergence, while the 1D MA50 (blue trend-line) crossed below the 1D MA100 (green trend-line), forming a Bearish Cross. Last time we had this formation was September 06 2024 and 1 day later, the bottom (Higher Low of the Channel Up) was formed.

Among all this, the 1W MA100 (red trend-line) is holding, which is the market's long-term Support since July 12 2023. As a result, we expect the new Bullish Leg to start and as the previous one did, target the 1.236 Fibonacci extension at $220.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOOGL Facing Major Reversal Zone! Decision Time Approaching!Here's a straightforward breakdown of GOOGL based on the 1-hour chart and GEX insights:

📈 Technical Analysis (TA):

* GOOGL currently hovering within a critical green reversal zone around $167–$168, showing possible bullish exhaustion.

* Recent Break of Structure (BOS) indicates bullish sentiment, but price action within this green reversal zone is critical.

* A strong red reversal zone at $157–$160 indicates robust support below, confirmed by a significant Change of Character (CHoCh).

* Watch closely how GOOGL behaves in the current zone. Any rejection could quickly see a retracement.

📊 GEX & Options Insights:

* Highest positive NET GEX and critical CALL resistance clearly marked at the $170 level, a significant gamma magnet.

* Strong PUT support positioned firmly at $160, aligning closely with the red reversal zone. Essential for downside protection.

* IV Rank moderate at 31.4%, suitable for either debit or credit spread strategies.

* CALL sentiment low at 9.8%, indicating cautiously optimistic sentiment but alertness at reversal zones.

💡 Trade Recommendations:

* Bullish Scenario: On a solid breakout above $168, target the $170 gamma resistance using calls. Maintain tight stops around $165.

* Bearish Scenario: Monitor for rejection signs in the green reversal zone; consider puts targeting lower support at $160.

* Neutral Approach: Given moderate IV, consider balanced credit spreads or Iron Condors between clear support/resistance ($160–$170).

🛑 Risk Management: Always adhere to disciplined risk management, especially near pivotal reversal zones.

Stay alert and trade wisely!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

GOOGL: Bullish Bounce Before a Bigger Drop? Here's My RoadmapGoogle NASDAQ:GOOG NASDAQ:GOOGL is shaping up to look bullish in the short term, and I believe that in the next few weeks to months, we could see a solid upside move - before things could turn ugly again later on. Let me explain why.

Big picture: we’re currently in a Wave (2) corrective structure, which is playing out as a complex WXY correction (marked in orange). This type of correction follows a 3-3-3 wave pattern, and everything we’ve seen so far fits that structure. Since the top in February, NASDAQ:GOOGL has dropped around 24% , which is significant - but also not unexpected within this context.

What’s interesting now is that we’ve just printed a bullish divergence on the RSI for the first time in this move down. That’s the first green flag. The second? The lower wick, which I currently mark as sub-wave ((a)) has been very well respected so far. That’s the second sign that this could be the turning point - at least temporarily.

I’m expecting a move up in the coming weeks toward the 2024 VAH, around $178, where we could see a first rejection. From there, the price should continue higher in a 3-wave structure toward Wave ((b)), likely reaching between $187.80 and $196.30 (the 61.8% to 78.6% retracement zone).

But let’s be clear: this is not the start of a new bullish trend. After Wave ((b)), I expect a 5-wave move to the downside, completing Wave ((c)) - and that means lower prices ahead , potentially in Q3, Q4 2025 or even into 2026.

Until then, I’m keeping a close eye on this structure. As long as the current Wave ((a)) low holds, this short-term bullish scenario remains valid. If we get a strong breakout in the coming days / weeks, I’ll be looking to enter on a retest, targeting that $187.80–$196.28 zone.

Let’s see if the market plays it my way.

Make sure to follow me for future updates on this scenario and other setups !

Alphabet Inc. (GOOGL) has declined by 21% since peaking at 207With its long-term bullish structure compromised, Alphabet could repeat its previous 45% correction. Although closing at 163.99, slightly above the critical 156-160 support zone, any rebound might be capped at 167.35, 174.00, 185.58, and 192.70. A break below support could see shares fall toward 144-137 or even 126-119, marking a 42% correction

GOOGL – Potential Reset Structure Similar to March 2024 | Price This chart outlines a potential reaccumulation and continuation setup on GOOGL, mirroring the March 2024 price reset structure that preceded a strong rally into late 2024.

After a healthy correction from recent highs, price has now retraced into a key equilibrium zone, sitting just above the 200-day moving average and reclaiming the long-term ascending trendline.

We could be witnessing the formation of a higher low, potentially setting the stage for another strong leg up — projecting a ~35% move from the current structure lows, aligning with previous historical expansions over similar time frames (notably 119 days from low to high).

🔍 Smart Money Insights:

•Discount zone tapped, showing buyer interest and possible accumulation.

•Price is recovering above trendline + EMA confluence.

•Premium zone around $215 may act as the next major target/liquidity area.

🧠 Thesis:

If this monthly candle closes strong and confirms support around the $160–165 range, we may see a March-like reset that kicks off a Q2-Q3 continuation, targeting the $215 level.

Google Wave Analysis – 21 March 2025

- Google reversed from key support level 160.00

- Likely to rise to resistance level 167.00

Google recently reversed up from the key support level 160.00 (which has been reversing the price from October) intersecting with the lower daily Bollinger Band.

The upward reversal from the support level 160.00 created the daily Japanese candlesticks reversal pattern Hammer – which stopped the previous impulse wave C.

Given the strength of the support level 160.00 and the bullish divergence on the daily Stochastic, Google can be expected to rise to the next resistance level 167.00.