AAPL trade ideas

AAPL About to CRACK!Without Question, AAPL is the best company in the world and the most valuable. However, it means little in this economic landscape.

AAPL is about to start cracking here. I usually do not post them ahead like this, but in this situation, I will break my own rules.

Take your money and RUN!!!

WARNING!! GTFO!

Why this strategy works so well (Ticker Pulse Meter + Fear EKG) Disclaimer: This is for educational purposes only. I am not a financial advisor, and this is not financial advice. Consult a professional before investing real money. I strongly encourage paper trading to test any strategy.

The Ticker Pulse + Fear EKG Strategy is a long-term, dip-buying investment approach that balances market momentum with emotional sentiment. It integrates two key components:

Ticker Pulse: Tracks momentum using dual-range metrics to pinpoint precise entry and exit points.

Fear EKG: Identifies spikes in market fear to highlight potential reversal opportunities.

Optimized for the daily timeframe, this strategy also performs well on weekly or monthly charts, making it ideal for dollar-cost averaging or trend-following with confidence. Visual cues—such as green and orange dots, heatmap backgrounds, and SMA/Bollinger Bands—provide clear signals and context. The strategy’s default settings are user-friendly, requiring minimal adjustments.

Green dots indicate high-confidence entry signals and do not repaint.

Orange dots (Fear EKG entries), paired with a red “fear” heatmap background, signal opportunities to accumulate shares during peak fear and market sell-offs.

Now on the the educational part that is most fascinating.

Load XLK on your chart and add a secondary line by plotting the following on a secondary axis:

INDEX:SKFI + INDEX:SKTH / 2

Now, you should see something like this:

Focus on the INDEX:SKFI + INDEX:SKTH / 2 line, noting its dips and spikes. Compare these movements to XLK’s price action and the corresponding dot signals:

Green and Orange Dots: Opportunities to scale into long positions.

Red Dots: Opportunities to start scaling out of positions.

This concept applies not only to XLK but also to major stocks within a sector, such as AAPL, a significant component of XLK. Chart AAPL against INDEX:SKFI + INDEX:SKTH / 2 to observe how stock and sector indices influence each other.

Now, you should see something like this:

Long-Term Investing Considerations

By default, the strategy suggests exiting 50% of open positions at each red dot. However, as long-term investors, there’s no need to follow this rule strictly. Instead, consider holding positions until they are profitable, especially when dollar-cost averaging for future retirement.

In prolonged bear markets, such as 2022, stocks like META experienced significant declines. Selling 50% of positions on early red dots may have locked in losses. For disciplined long-term investors, holding all open positions through market recoveries can lead to profitable outcomes.

The Importance of Context

Successful trading hinges on context. For example, using a long-term Linear Regression Channel (LRC) and buying green or orange dots below the channel’s point-of-control (red line) significantly improves the likelihood of success. Compare this to buying dots above the point-of-control, where outcomes are less favorable.

Why This Strategy Works

The Ticker Pulse + Fear EKG Strategy excels at identifying market dips and tops by combining momentum and sentiment analysis. I hope this explanation clarifies its value and empowers you to explore its potential through paper trading.

Anyway, I thought I would make a post to help explain why the strategy is so good at identifying the dips and the tops. Hope you found this write up as educational.

The strategy:

The Companion Indicator:

Dollar-Yen Compression Coil: A Breakout is Brewing🧠 Why This Matters Right Now

USD/JPY has been tightly range-bound for the past 7 sessions, hugging the underside of 154.50, a historically significant resistance level. With U.S. inflation coming in hotter than expected and the Bank of Japan stepping back from policy tightening, this tug-of-war has compressed price action into a tight coil. A volatility eruption is right around the corner.

🔍 Breakdown of the Strategy

This is a volatility compression breakout setup based on the logic that low volatility precedes expansion. The ingredients:

Bollinger Bands (20, 2) for detecting squeeze zones

ADX (14) under 15 to confirm low trend strength

Price range compressing within 0.5%

Entry Logic:

📈 Long: Close above upper Bollinger Band + ADX > 20

📉 Short: Close below lower Bollinger Band + ADX > 20

Stops & Targets:

Stop Loss: Just inside the opposite Bollinger Band

Take Profit: 2× ATR(14)

🚀 Why This Works in Today’s Market

The policy divergence between the U.S. and Japan is creating a classic fundamental standoff, but the price can't stay neutral for long. Volatility is compressed to its limits. When the breakout comes, it's likely to run fast and clean in the direction of the imbalance.

🤖 Automate It with PineScriptAI

With PineScriptAI, you can instantly:

Detect when Bollinger Band width narrows

Monitor ADX thresholds

Set up conditional breakout logic with smart alerts and backtests

Create a dual-trigger script that catches either direction — no need to guess the breakout side.

⚡ From Trend to Code — Instantly

This isn’t just a chart pattern — it’s a recurring market phenomenon. With PineScriptAI, you can adapt this same logic to GBP/JPY, EUR/JPY, or even gold compressions with zero manual tweaking.

🧭 Final Insight FX:USDJPY

When price coils, energy builds. Don’t just watch it break — code it, trade it, and scale it across markets with PineScriptAI.

AAPL Weekly Options Trade Plan 2025-04-16AAPL Weekly Analysis Summary (2025-04-16)

Below is a synthesized analysis of the AAPL data and the five model reports:

──────────────────────────────

SUMMARY OF EACH MODEL’S KEY POINTS

• Grok/xAI Report – Observes a slightly recovered 5‐minute bounce but a generally volatile, declining daily trend. – Notes bearish technicals (price below EMAs, RSI recovering from oversold levels but MACD still below signal) and mixed sentiment (max pain at $202.50 with heavy put volume). – Recommends a trade on the $190 PUT given its attractive liquidity and proximity (–2.60% from current price).

• Claude/Anthropic Report – Highlights AAPL trading below key EMAs with persistent bearish momentum on both short and daily timeframes and a downtrend of –17% over 30 days. – Points out oversold conditions on the 5‑minute chart with continuing bearish pressure on the daily charts, alongside caution from negative news. – Chooses the $190 PUT as the best blend of risk and reward given its liquidity and technical setup.

• Gemini/Google Report – Emphasizes AAPL’s price below intraday and daily EMAs, with the short-term bounce near the lower Bollinger Band offering a minor contradiction. – Underlines strong bearish sentiment supported by high VIX and negative news, while noting resistance at the call side. – Recommends a bearish pick – the $187.50 PUT – though with a similar rationale as the others (i.e. trading just out‐of‐the‐money to capture a move).

• Llama/Meta Report – Notes bearish indicators including price under moving averages, low RSI, and MACD below the signal line. – Recognizes key support and resistance levels (supports near $194 and resistance near $197) and the opposing pressure suggested by max pain. – Ends up favoring a moderately bearish setup with the $190 PUT given its attractive liquidity and risk profile.

• DeepSeek Report – Reviews the technical and sentiment picture and concludes a moderately bearish position, underscored by negative news and broad put interest. – Emphasizes that a break from near-term support (around $194) could steer the price toward the $190 area. – Also recommends the $190 PUT, noting that its setup offers a reasonable risk/reward profile.

────────────────────────────── 2. AREAS OF AGREEMENT AND DISAGREEMENT

• Agreement: – All reports agree that AAPL is trading in a bearish environment overall, with price below key moving averages and a downtrend on daily charts. – There is a common focus on the options chain, where puts at or below $190 are highly liquid and carry significant open interest. – Every model, despite minor nuances, leans toward buying a naked PUT as the trade idea for this weekly options expiry. – All analysts recommend an entry at market open.

• Disagreement: – One model (Gemini/Google) slightly deviates by suggesting a $187.50 PUT as an alternative to $190, while the majority favor the $190 strike. – The exact profit target and stop‐loss levels differ somewhat between models, but all align on the general risk controls and short-term nature due to weekly expiration.

────────────────────────────── 3. CONCLUSION AND RECOMMENDED TRADE

Overall Market Direction: • Consensus is moderately bearish. Despite a brief short-term bounce noted on the intraday charts, the dominant trend and negative news sentiment favor further downside.

Recommended Trade: • Trade: Buy a single-leg, naked PUT option on AAPL • Expiration: Weekly (April 17, 2025) • Strike and Price: The $190 PUT (with an Ask around $0.83; it is about 2.60% below the current price) • Strategy Rationale: – This strike is liquid (high volume and open interest) and is supported by the bearish bias from momentum indicators and negative sentiment. – Although the premium of ~$0.83 is a bit above the preferred $0.30–$0.60 band, it is justified by the sharper risk/reward setup in this environment. • Entry Timing: At market open • Proposed Risk/Reward: – Profit Target: Approximately a 50% gain on the premium (target near $1.25) – Stop-Loss: Approximately a 50% loss on the premium (stop-loss near $0.42) • Confidence Level: 70% • Key Risks and Considerations: – A brief intraday bounce (short-term oversold recovery) could push prices above support, triggering the stop-loss. – Any unexpected news or a reversal in overall market sentiment may rapidly alter the risk profile given the short-dated expiration. – Monitor price action closely at open, as weekly options are particularly sensitive to early volatility.

────────────────────────────── 4. TRADE_DETAILS (JSON Format) { "instrument": "AAPL", "direction": "put", "strike": 190.0, "expiry": "2025-04-17", "confidence": 0.70, "profit_target": 1.25, "stop_loss": 0.42, "size": 1, "entry_price": 0.83, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Apple Wave Analysis – 16 April 2025

- Apple reversed from resistance level 210.00

- Likely to fall to support level 190.00

Apple earlier reversed down from the resistance zone between the resistance level 210.00 (former support from the start of March), 20-day moving average and the 50% Fibonacci correction of the impulse wave (1) from February.

The downward reversal from this resistance zone stopped the previous medium-term correction (2) from the start of April.

Apple can be expected to fall to the next support level 190.00 – the breakout of which can lead to further losses toward the next support level 170.00.

SPX and AAPL. A breakdown of key levels and potential trades.If this is a repeat of 2020, then I am going with the bulls on this. In this video I walk through what I am seeing in the overall market and how I chart my stocks. I have personally been in and out of trades and it was chipping away at my profits, so it was time to reset! The best way for me to do that is to to walk through my charts, update my levels as needed, and remember that my plan is my plan bc it works!

Apple – More Pain to come? Apple’s NASDAQ:AAPL chart right now? Honestly, it’s a mess. It’s one of those setups where you can’t confidently say much with conviction , but one thing feels clear to me: it should go lower before it gets better.

Zooming out to the 3-day timeframe , you can spot something interesting: the downtrend from 2022 to 2023 looks almost identical to the one we’ve seen from July 2023 to April 2024 — same structure, same slow bleed, and almost the exact same duration. That kind of symmetry doesn’t happen by accident.

After that, we had a massive rally from April/May 2024 , but now we’re already seeing a sharp retracement — down over 35%. My take? We probably need one more leg lower to really shake things out before Apple makes a meaningful move higher, maybe toward $250–$260 .

To get there, I think we still need to retest the $160–$150 zone. If we break below that and head toward $120, then we’re in real trouble structurally — that would shift the whole outlook.

Yes, the recent bounce from the VWAP level was clean , and it looked strong — but I wouldn’t rule out one more flush before we get the real recovery. Apple is in no-man’s-land right now, and until we hit key levels or reclaim broken structure, it’s caution over confidence.

AAPL should you wait out the chop? Still overall downtrendWhen in doubt, leave it out < I remember being in a training class for my first job out of college and my teacher said that. She was talking about dress codes, and that if we had a doubt like...is this work appropriate, then the answer was no. This quote has stayed with me and even proven useful in trading. Right now we are in indecision on a lot of names. No clear uptrends, and still most stocks remain in overall downtrends.

Most of us are impatient, we want to catch the bottom, even though we know when we wait for a clear direction the profits flow effortlessly.

It's ok to put on a small position, but just know where we are at in the trend and range.

What's your position on AAPL for the next few days or weeks?

For me, I am really leaning sideways, but am testing small positions. It is important to wait after the morning noise dies down before committing. In fact, yesterday I broke my 11am rule of no decisions or trades til after 11am, and closed a put on another name. Then within the hour, the position flipped. Talk about regret. What was worse was that I had hedged it the day before with a call, and closed the call at a loss too. Amateur moves, but hey, new day and fresh eyes will make a killing.

AAPL moves in steps of 20% and sometimes 30% Many stocks move in steps thats why trendlines work. But in some stock the steps are not very clear, But Apple the steps are very clear.

Here the price rejected by trendline and could be great time to short and also completes 20%

The steps are caused because stock holders expect that return before they sell off

Apple ($AAPL): Shares Jump After Tariff Exemption on ElectronicsApple Inc. (AAPL) experienced a significant rally on Monday, climbing as high as $212.94 before settling around $206.05 as of writing, reflecting a 4.5% intraday gain. The spike followed the U.S. government's decision over the weekend to exclude smartphones and other electronics from the latest round of tariffs on Chinese imports. This move provided relief for tech companies like Apple that rely on global supply chains.

As of 3:38 PM EDT, Apple shares Volume reached 258.63 million shares, indicating heightened investor interest. The favorable news also triggered substantial profits for derivatives traders. One bullish options trade worth $5 million, opened on Friday, was reportedly valued at around $14 million by Monday morning—a 180% gain as per Reuters.

According to Capital Market Laboratories CEO Ophir Gottlieb, the trade may have been a calculated bet anticipating favorable policy moves affecting Apple or broader China-related tariffs.

Technical Analysis

The 2-day chart shows a strong bullish reaction from a major support zone near $172, where the price rebounded sharply following the news. The current price at $206 is trading slightly below key moving averages, including the 50-day at $231.81, 100-day MA at $228.36, and 200-day MA at $205.91

Price action also broke above a previous resistance area of $196, turning that level into new support. If momentum holds, Apple could aim for a move toward the $260.10 recent high. However, technical structure suggests a possible pullback before further upside continuation. Overall, the rebound and volume surge indicate strong buyer interest in the wake of the tariff announcement.

AAPL Technical Analysis (Trading Perspective)Price Structure:

AAPL has bounced from the recent low around $168 and is now climbing within an upward price channel. Price is attempting to reclaim the psychological $200 level, now acting as short-term resistance.

Trendline Channel:

A bullish channel has formed from the April 9th reversal, and the current price is near the midline. Price is showing consolidation just below a previous resistance level at ~$200.32, which aligns with the upper gamma levels.

Key Support/Resistance Levels:

* Resistance: $200.32 → key gamma and technical resistance

* Support: $185.29 (confluence of HVL + breakout area)

* Critical Support: $168.13 → the base of recent bounce

Volume & RSI:

* RSI is trending upward but starting to curve slightly at the 60 zone, showing bullish but cautious strength.

* Volume during the bounce shows aggressive buying but has tapered off recently — signaling a possible pause or retest before continuation.

Bias: Neutral-Bullish (watch for $200 breakout confirmation)

💡 Options GEX Analysis (For Option Trading)

Gamma Exposure (GEX) Levels:

* Highest Positive GEX / Gamma Wall: $200

→ A breakout above this may lead to a gamma squeeze toward $205–$220.

* Resistance Levels:

* $205 (12.8% GEX8)

* $220 (35.5% / 2nd Call Wall)

* Put Walls / Support:

* $185.29 = HVL (04/17 expiry)

* $180 and $170 have layered PUT GEX walls acting as support (–22% to –25%)

IV & Sentiment:

* IV Rank (IVR): 73.1 (elevated — premiums are rich)

* IVx avg: 68.5

* Put/Call Skew: Puts at 33.2% dominance, indicating hedge pressure, but not panic.

* Sentiment Flags: 🟢🔴🟢 → mixed signals: volatility + hedging pressure but potential support at $185+

🔁 Trading & Option Strategy Suggestions

📊 For Stock Traders:

* Bullish Play: Watch for breakout and retest above $200 → Target $205, $220

* Bearish Play: Rejection at $200 + breakdown below $185 = possible fade toward $175–$168

* Neutral Range Play: Between $185 – $200, consider scalping intraday using EMA/VWAP confluence

🧠 For Option Traders:

* Bullish Strategy:

* Debit Call Spread: Buy 200C / Sell 210C (cheap gamma play on breakout)

* Short Put Spread (Cash-secured): Sell 185P / Buy 175P if price consolidates above 190

* Bearish Strategy:

* Put Debit Spread if price rejects $200: Buy 195P / Sell 185P

* Avoid naked calls — IV is high, and premiums are inflated

🧭 Final Thought:

AAPL is at a decision zone with significant option market activity clustered around $200. A breakout here could trigger a squeeze toward $220, but failure may bring a retest of the $185–$180 range. The GEX layout shows dealer positioning supports upward movement above $200 but is still hedged underneath. Be nimble — wait for confirmation, and don't chase unless the breakout holds.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

Apple - no useful dataThis now is just speculation, since we do not have any data to work with. The market is confused, big boys are confused, everybody is confuse. But atm we have a slightly news leaded more bullish sentiment, after China gave their first living signs friday and yesterday saying they are not fans of the tarrifs from every side. Which I coun`t as slightly more bullish than what a Trump related person said the Tech tarrif excemption was only temporary. Which means most of the world and China do not like tarrifs and I do think China will drop or at least sink their tarrifs to a minimum, if the US will drop their tarrifs. And in my opinion Trump´s brain is still working because the only rational decision is to completely drop the tarrifs. Of course not immediatly to first get deals done.

What Trump did not expect is that people not only don´t want to buy stocks, but they also dont want to buy bonds from the US. Which makes the Tarrifs a lot worse.

APPLE: Long Trade with Entry/SL/TP

APPLE

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy APPLE

Entry - 198.05

Stop - 191.79

Take - 216.53

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

$AAPL This is going to burst... $220 target.NASDAQ:AAPL : Expecting a move to $210 easy off the $200 zone then to the target of $220. Lots of testing in that area. I think $210 is a clear "gimme." Not even close to overbought, with the volatility this can ramp up. Technically look great to me. Push up to 200EMA/SMA located above $220 zone ($221 and $228).

wsl.

APPLE On The Rise! BUY!

My dear friends,

Please, find my technical outlook for APPLE below:

The instrument tests an important psychological level 198.05

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 214.26

Recommended Stop Loss - 187.76

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Apple gap fill potential - Grok Ai sees option activity Grok ai analyzed the option chain for me:

Call Volume Strike Price Put Volume

---------------------------------------------------------------------------------------

* 155.00 *

* 160.00 *

* 165.00 ****

* 170.00 ******

* 175.00 *****

** 180.00 *******

* 185.00 ****

* 190.00 *****

***** 195.00 ***

********* 200.00 ***

****** 205.00 *

********* 210.00 *

***** 215.00 *

*********** 220.00 *

****** 225.00 *

******************** 230.00 *

** 235.00 *

*** 240.00 ***

* 245.00 *

***** 250.00 *

Ai found lots of in interest upward call strikes.

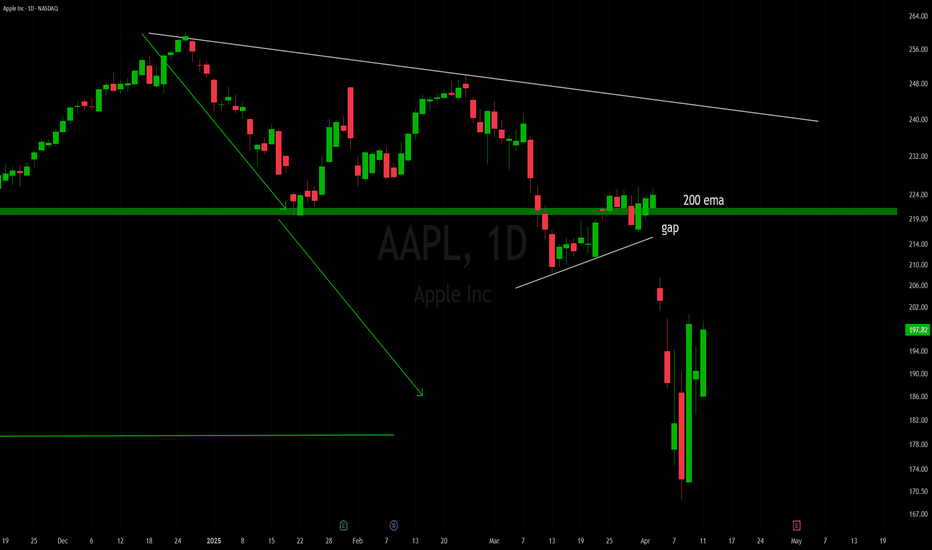

Gap, on the chart may be the thesis.

Get apple right, and youll understand qqq , spy, dia, its so big.

Fundamentally, Im not a long term fan of apple, but cant ignore the mag seven large caps giants.