Stocks SPOT ACCOUNT: APPLE stocks Buy Trade with Take ProfitStocks SPOT ACCOUNT:

MARKETSCOM:APPLE stocks my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

AAPL trade ideas

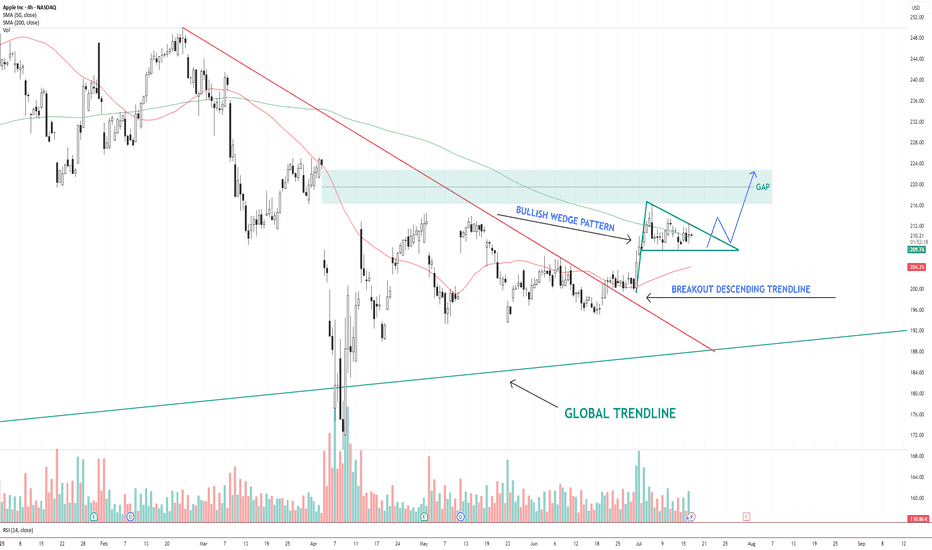

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting as the next upside target.

Key levels:

Support: $206 (wedge base / 50 SMA)

Resistance: $216–$224 (gap zone)

Trend structure: Bullish consolidation after breakout

A clean breakout from the wedge with volume could trigger a continuation move toward the gap zone.

📌 Watching for confirmation and potential entry on a breakout + retest.

This is not financial advice. Always do your own research.

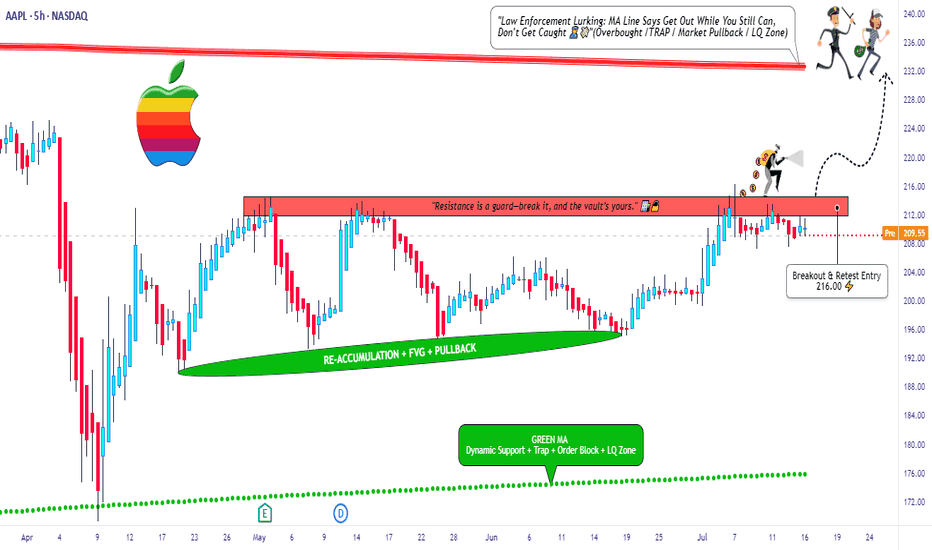

Apple Inc Long Setup – Break, Ride, Exit Like a Pro🕵️♂️💼 “The Apple Heist: Thief Trader's Masterplan for a Clean Escape” 💸🚀

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers & Market Thieves! 🤑💰💸✈️

This ain’t your average stock analysis — this is a high-level blueprint for the Apple Inc. (AAPL) market heist, built using the Thief Trading Style 🔥📊.

We've scouted the field using a mix of technical patterns, market sentiment, and fundamental fuel, and we’re ready to make our move. The plan is set: go long once the resistance wall cracks, and aim for a clean getaway just before the danger zone hits.

🎯 THE PLAN: INFILTRATE, ESCAPE, PROFIT

Entry Point:

💥 “The vault’s cracking – the breakout begins at 216.00!”

Place Buy Stop orders just above the resistance wall or wait for a pullback to recent swing zones (15M–30M charts work best).

📌 Set your alerts early – you don’t want to miss the opening.

🛑 STOP LOSS - YOUR BACKUP PLAN

🔊 “Listen up, crew: No stop loss until the breakout confirms! Once you’re in, place SL wisely – use the 4H swing low (200.00). Your risk, your rules. Don't get caught slippin’.”

📍 Adjust SL based on lot size, entry volume, and trade size. Protect your stash.

🏁 TARGET ZONE:

🎯 Heist Target = 232.00

(Or bail early if the heat's on – you know the drill.)

⚠️ SCALPERS & SWINGERS

💸 Long side only – don’t fight the wave.

🧲 Scalpers: Get in, grab the cash, trail the stop.

📈 Swing Traders: Hold firm. This setup has legs.

🔎 WHY WE’RE ROBBING THIS CHART:

Apple’s bullish momentum is fueled by:

📌 Strong institutional sentiment

📌 Earnings strength

📌 Index rotation and positioning

📌 COT data & macro tailwinds

Get the full scope: fundamentals, macro outlook, positioning data, sentiment, and intermarket dynamics 🔗📊.

Stay sharp – stay informed.

📰 NEWS ALERTS & POSITION MANAGEMENT

🚨 Avoid new entries during high-impact news releases.

🏃 Use trailing SLs to lock profits and exit clean.

💖 BOOST THE CREW — STRENGTH IN NUMBERS

🚀 Hit that BOOST button if this helped you steal a profitable trade. Your support powers our heist team.

Let’s keep making money the Thief Way – with style, planning, and confidence. 🎉💪🏆

📌 NOTE FROM HQ:

This analysis is for educational purposes. It’s not personalized financial advice. Manage your trades responsibly. Conditions can shift quickly — stay updated and flexible. Stay in the shadows and move smart. 🐱👤

💬 Drop a comment, hit like, share with your gang – the market's a vault, and we’re the codebreakers.

See you on the next heist, Thief Fam. 🤑🔥🕶️💼

Time to buy? Too much negative press. Buy in Fear- Updated 13/7Apple has faced prolonged downward pressure from bearish investors. Despite its best efforts and some dips, the stock has steadily maintained a baseline price of 200 USD. The flag pattern required some adjustments along its path to break out, primarily due to geopolitical issues and economic variables. Ultimately, Apple broke out to the upside in the week of June 30th, as predicted in my earlier posts. This breakout resulted from end-of-Q2/H1 sell pressure, delivering a 7.56% gain or 15 USD. This is a very bullish sign for Apple, and with the tailwinds forming for September product releases, we can expect further gains as traders return and volume increases.

If Apple follows its historical profit trajectory (see pink line), we could see a new all-time high (ATH) in the region of 270 USD in September. The green resistance and support levels are highlighted, and I may use these to adjust my position, considering whether to short or go long once confirmation is established on the daily timeframe.

Apple has significantly underperformed compared to the other Magnificent 7 stocks, but I don’t believe it’s a company you should bet against in the current climate. With a slow rollout of AI and recent statements from Apple, they may not always be first to market, but they generally execute well. The remarks regarding Sony, Samsung, and Netflix by Apple were very revealing and demonstrate a solid long-term strategy. However, there may be some bumps along the way as they work toward their goals, potentially involving acquisitions.

The fear spread in the media is similar to the FUD (fear, uncertainty, doubt) often associated with Bitcoin, and this is typically a good time to buy. Remember the saying: if retail investors miss the boat, it’s gone, but if institutions miss it, they often bring the boat back.

While this is not financial advice, based on the green weekly candle, it's hard not to pay attention, and Apple may now have a very positive year ahead! Especially with the weakening dollar and reports stating that this will benefit them greatly.

Apple has continued to trend along its predicted trajectory, and with the exception of economic headwinds driving the price down, this trend is expected to continue. Strong support has been observed at 210 USD, with further support at $208.50, providing solid technical support for potential upside while reducing the risk of a downturn below $208. However, a short correction could occur if overall market confidence is shaken due to new policies. Nevertheless, Apple has demonstrated resilience to new tariffs, and its underperformance compared to other tech giants indicates plenty of upside potential. The target price remains set at over $260.

My large long position is still intact, and my target price will depend on how we manage supports and resistances. I am looking to take profits at over 260 USD.

AAPL PREPARING FOR A LARGER MOVEAAPL clearly shows a descending channel pattern, marked by two parallel downward-sloping yellow trendlines. Within that broader structure, the price is currently consolidating in a narrow range between two horizontal yellow lines:

Resistance around $210.98

Support around $207.46

🔍 Current Technical Setup

Consolidation Range

AAPL is moving sideways in a tight range between $207.46 and $210.98. This narrow trading zone within a broader descending channel is typical of compression before a breakout.

Descending Channel Context

The channel suggests a longer-term downtrend bias, but the compression at these levels can lead to a breakout in either direction, especially when volume starts to increase.

Support Zone ($207.46)

This level has been tested and held, making it a key line to watch. A breakdown below this support would likely trigger a sharper selloff toward the lower channel boundary, near $203–$204.

Resistance Zone ($210.98)

This level lines up with the upper boundary of the current consolidation and the midline of the descending channel. A breakout above would invalidate the local downtrend and could send price to test the top of the channel (~$214+).

Volume Clues

Volume is relatively low during this sideways movement, which often precedes a high-volume breakout as indecision resolves.

📈 Scenarios to Watch

Bullish Breakout

Above $210.98 and the descending trendline.

Likely target: $214–$216

Confirmation: Volume spike + strong bullish candle

Bearish Breakdown

Below $207.46 support.

Target: $203 or lower, testing channel support.

Confirmation: Increasing red volume + bearish momentum

🧠 Summary

AAPL is in a compressed state, with a tight horizontal range forming inside a broader downward-sloping channel. This often sets the stage for a powerful directional move. Traders should closely monitor breaks of $210.98 or $207.46 to catch the next leg — either a reversal toward higher levels or continuation of the downtrend.

APPLE Set To Fall! SELL!

My dear friends,

APPLE looks like it will make a good move, and here are the details:

The market is trading on 211.08 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 206.69

Recommended Stop Loss - 213.91

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

$AAPL | Smart Money Concepts Weekly DSS Update Apple ( NASDAQ:AAPL ) is approaching a critical decision zone on the weekly SMC structure, where liquidity, volume, and macro pressure converge.

🔎 Key Observations (WaverVanir DSS):

🔺 Premium Zone (240–260) acting as a weak high with multiple CHoCH & BOS confirmations

🔻 Major equilibrium level at ~$181 aligns with EMA 200 & potential downside sweep

📈 Projected upside target: $301.52, contingent on reclaiming premium zone

📉 Breakdown watch: If $211 fails, next liquidity pockets sit between $181 and $120

⚙️ Volume Profile shows divergence—price rally on declining volume = possible distribution pattern.

🌐 Catalysts to Monitor:

Q3 earnings (E icon on chart)

China iPhone demand

US macro (Fed policy, CPI, yield curve shifts)

🧠 DSS Probability Bias:

Neutral to Slight Bullish (17/25 score)

→ Expect volatility with directional bias forming post-premium test.

📊 Trade Management:

Wait for confirmation above $260 for continuation

Or short-term bearish setups if price stalls below EMA cluster (~$213)

🧠 Posted by WaverVanir DSS | Quant x Macro x Liquidity Driven

#AAPL #SmartMoney #TradingView #MarketStructure #VolumeProfile #LiquidityZones #QuantAnalysis #WaverVanir #AppleStock #MacroTrading #OptionsFlow #TradingSignals #RiskManagement

AAPL at a Pivotal Zone! TA for July 14AAPL at a Pivotal Zone! GEX & Price Action Align for Major Move 📉📈

🧠 GEX Sentiment (Options-Based Insight)

* Current Price: $210.53

* GEX Zone Traps:

* Below Price:

* 🟥 Put Support at $205 (-11.48%)

* 🔻 PUT Wall at $200 (-9.06%) — strong floor

* Above Price:

* 🟩 CALL Walls at:

* $212.5 → 29.79% GEX7

* $215 → 38.62% GEX6 (3rd largest resistance)

* $217.5 → 11.45% GEX9

* $220 → 39.78% GEX2 (heavy resistance zone)

* 🟩 Max GEX Cluster: $215–$220

* 🔺GEX10 spike at $230 → unlikely unless squeeze

* IVR/IVX:

* IVR: 24 (low volatility environment)

* IVX: 34.2 → Soft volatility bounce

* Call/Put Flow:

* Calls: 3.1% favored

* GEX trend: 🌕🌕🌕 (Neutral-to-Bullish if over $212.5)

📦 Interpretation:

Gamma compression is strong near $212.5–$215. If AAPL stays above $210.5 and reclaims $212.5, options market opens up space toward $217.5–$220. Below $207.5 = risk of drop toward $205 then $200 PUT wall.

🕹️ Option Trade Ideas Based on GEX

Bullish Strategy (IF Breaks $212.5):

* Trade: Buy AAPL 215c or 217.5c (Jul 19 or 26 expiry)

* Trigger: Hold above $212.5

* Target: $217.5–$220

* Stop: Break below $209.8

Bearish Strategy (IF Breaks $207.5):

* Trade: Buy AAPL 205p or 200p (Jul 19 or 26 expiry)

* Trigger: Loss of $207.5 with momentum

* Target: $205 → $200

* Stop: Reclaim of $210.5

🔍 1-Hour Chart Analysis (Price Action)

* Structure: Sideways consolidation between $207.5–$213.5

* Key Levels:

* Demand: $205–$207.5 (Buyers defended)

* CHoCH (Change of Character) confirmed near $209.8

* Resistance: $213.48 (rejected multiple times)

* Trendline: Rising wedge forming under liquidity sweep zone

* Liquidity Pools: Resting above $215 and below $205

* FVG/OB Zones: Thin FVG at $209.8–210.5 and mid OB around $207

📈 Scenario 1 (Bullish):

* If price bounces off $210 again and breaks $212.5 with volume, watch for sweep of $215–$217.5

* Watch for re-entry above CHoCH/BOS confluence near $211.5

📉 Scenario 2 (Bearish):

* If we break $207.5 and fail to reclaim $210.5 → liquidity vacuum opens toward $205 and $200

✅ My Thoughts & Suggestions

* Direction Bias: Neutral > Bullish if $212.5 is claimed, otherwise range-bound.

* Best Risk/Reward: Wait for $212.5 breakout confirmation OR $207.5 breakdown.

* Scalpers: Use $210.5–212.5 as chop zone — fade edges.

* Swing Traders: Only enter on clear breakouts with stop discipline.

🔒 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

Crypto in July 2025: A Financial Reset from Macromics GroupThe world of cryptocurrencies in July 2025 is experiencing more than just another growth cycle — it’s undergoing a fundamental transformation of the global financial system. Amid geopolitical instability, tighter control over digital assets, and growing interest from institutional investors, digital currencies are once again in the spotlight. Macromics Group shares its latest analytical insights on the key events and trends.

A New Bull Run: Ethereum 3.0 and Bitcoin Network Upgrade

Since the start of summer 2025, Ethereum has shown strong growth, largely due to the launch of Ethereum 3.0, which reduced transaction fees and made the network more scalable. Bitcoin, in turn, has undergone another major security upgrade, attracting new institutional investors, including funds from Japan and Saudi Arabia.

CBDCs and Regulation: Governments Shift Approach

Central banks are actively rolling out central bank digital currencies (CBDCs). China, India, Brazil, and the EU have expanded pilot programs for their national digital currencies. This has led to increased interest in stablecoins backed by fiat currencies and greater demands for transparency on DeFi platforms.

Macromics Group helps clients navigate these new dynamics, offering up-to-date analytical resources and capital protection strategies across both regulated and unregulated sectors of the crypto market.

NFTs Make a Comeback — In the Corporate World

A new wave of interest in NFTs is emerging, not from artists, but from the corporate sector. Companies are using tokens for intellectual property, document verification, and digital rights management. Macromics Group is investing in startups building infrastructure for business-focused NFTs — a clear sign of the technology’s long-term potential.

AI + Blockchain: A Union of Future Technologies

In 2025, two mega-trends are converging: artificial intelligence and blockchain. AI-powered protocols are automating trading, cybersecurity, and even smart contract audits. Macromics Group is already implementing these technologies into its analytical tools and services.

What’s Next? Macromics Group Forecast

According to our data, the crypto market has entered a phase of "conscious growth" — where technology, regulation, and real-world utility are evolving in harmony. In the coming months, we anticipate increased attention toward:

DePIN projects (decentralized physical infrastructure)

Tokenized real-world assets (real estate, gold)

ESG-focused cryptocurrencies

Conclusion: Don’t Just Invest — Understand

Macromics Group urges investors to go beyond participation — to become informed decision-makers. We provide deep analytics, access to unique tools, and expert support at every stage of crypto investing. July 2025 is the perfect time to rethink your strategy and take a step into the future.

Macromics Group — your expert in the world of digital assets.

AAPL - Another Possible BreakoutsHello Everyone,

Apple AAPL is the another possible breakouts in my list.

Good entry point could be 205-206 , Re-test point.

228-230 is target price for me , which is approx %10 above from 205-206.

I tried to draw possible price action on Graphs.

Same as I mentioned in GOOG , Apple is Apple and you can get it in every price point for long term.

But short term you can watch the these price points that i mentioned to get some gain.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday and good start a Week

AAPL - Weekly HV/IV PerspectiveGood evening —

I wanted to do one more write up with that being on NASDAQ:AAPL as we enter the week with futures just opening.

HV10 (16.58%) is trending -11.56% below IV (28.14%) showing a weekly price gap differential of -$2.89 on the stated implied move to what trending markets are doing. This current IV value entering the week sits 69% within the sliding year spectrum.

Now, with Apple consolidating in range for almost eight weeks after selling off when it reached its 4T milestone in December of 2024, has now begun advancing back upwards in price. The strength here is obvious and the quality of company is well, Apple.

My price targets on the week is first the upper band of stated IV ($220.58) then moving on towards the upper implied range of HV63 ($225.87). I believe the markets are going to push apple higher while balancing the indices out selling off in other areas. This would start to accelerate HV10, as it is now 91.23% coiled to its yearly lows and needs to unwind. Hopefully with a few short-term trending days increasing we find our regression.

Please come back next week and see how our position and volatility progressed forward.

Ethereum Empowers Its Future Zero-Knowledge TechnologyThe Ethereum $2,969 Foundation has unveiled a new roadmap that aims to expand zero-knowledge (ZK) technologies across the network shortly after the ETH price surpassed the $3,000 threshold. This announcement aims to enhance scalability while concurrently reducing transaction fees and bolstering both security and privacy. The foundation has emphasized integrating ZK-based solutions into the primary layer to accelerate the user experience. This development marks a critical period that may prompt Layer 2 projects and entrepreneurs within the ecosystem to reconsider their competitive strategies.

Key Objectives of the Announced Zero-Knowledge Roadmap

Today, the Ethereum Foundation announced through its official channels that the primary goal is to institutionalize the “ZK-based verification” model at every network point. The plan envisions directing energy from intensive smart contracts towards more efficient cryptographic proofs to reduce transaction congestion. This approach aims to make the network accessible to larger audiences with lower-cost and faster approval processes.

The second focal point is to deepen the security layer. A foundation executive stated, “By integrating ZK technology into our network, we are not only enhancing privacy and security but also achieving significant improvements in transaction efficiency.” The objective is to establish a privacy standard rather than just performance. Within this framework, new technical collaborations and developer grants will be highlighted, with the priority being to develop toolsets and training programs that accelerate integration.

Potential Impacts of the Roadmap on the Layer-2 Ecosystem

The new roadmap closely concerns Layer 2 projects, which have long provided scalability with ZK Rollup solutions. Experts emphasize that local ZK integration could narrow the competition advantage of these projects but also lay the groundwork for stronger collaborations. Initiatives may need to update their architectural plans to reinforce compatibility with the main network.

As relevant actors seek different models to cover compliance costs, an environment is emerging that will open doors to new partnerships and grants. This process, paralleling Ethereum’s scalability goal, may direct the developer community within the network towards ZK-centered innovation. On the market side, the interest in ETH seems to be supported by expectations of increased security and privacy.

AAPL: The Rally Might Not Be OverWhile many tech giants have already reached new all-time highs, Apple is still lagging behind — NASDAQ:AAPL hasn’t yet broken out. This may represent both a risk and an opportunity for latecomers.

Investor caution remains due to potential tariffs on Apple products from China, with the decision now postponed until August.

This uncertainty may be holding the price back, but could also lead to a strong accumulation phase if no negative headlines emerge in the near term.

Technicals:

• A breakout above $215 could open the way toward $249 (previous high).

• Support at $197 remains strong.

• Stochastic is in overbought, but MACD confirms bullish momentum.

NASDAQ:AAPL may start catching up with the broader market — especially if tariff fears subside. Watch closely for a confirmed breakout above $215.

Apple in 2025: Why the Bulls Are Losing SteamApple’s stock has clearly lost its bullish momentum this year, and the chart you shared sums it up perfectly.

Let’s break down what’s happening and why investors are shifting focus to companies like Nvidia and Microsoft.

Chart Says :

Weak Rebounds (green), Bearish Pressure (blue channels are now more agresive)

Downtrend Channels: The chart shows Apple forming lower highs and lower lows, bouncing inside downward channels (not real channels, but are very ilustrative of how the price is moving trendy or not in each direction).

Each recovery (green) is weaker than the last, and the most recent upward move is still capped by resistance.

Bearish Patterns : The price action is dominated by failed breakouts and new descending channels, signaling that sellers are in control.

Volume & Participation: There’s no strong buying volume to support a real reversal. This makes any rally fragile and prone to quick pullbacks.

Why Is the Market Doubting Apple?

Slowing Growth : Apple’s revenue growth has stalled, especially in China, where sales dropped 13% year-over-year. The latest iPhone launch was underwhelming, and services aren't growing fast enough to offset weak hardware sales.

Falling Behind in AI: While Nvidia and Microsoft are leading the AI revolution, Apple is seen as late to the party. Their recent AI announcements disappointed investors looking for bold innovation.

External Pressures: New tariffs and global tensions are hitting Apple harder than its peers, since more than 60% of its sales are international.

Analyst Downgrades: Several analysts have lowered their price targets and ratings, reflecting concerns about Apple’s future growth. We've recently seen someanalyst showing prices under $200.

Key Takeaway

Apple is struggling to regain its former strength. The chart shows persistent bearishness, and the fundamentals back it up: slow growth, weak innovation, and external risks. Meanwhile, Nvidia and Microsoft are capturing investor attention with explosive growth and leadership in AI.

Until Apple delivers a real catalyst, the path of least resistance remains down or sideways, not up.

Do you think apple can surprise with some new AI innovation unexpected for all of us?

Apple Stock Is Surging! Here’s What Most People MissWhen it comes to trading, we don’t care about the latest news headlines or whether some analyst has upgraded or downgraded Apple stock. We focus on one thing and one thing only: the undeniable forces of supply and demand imbalances on higher timeframes.

Right now, Apple’s monthly chart is a textbook example of how waiting for a strong demand imbalance pays off. That $178 monthly level is no random number. It’s the exact origin of a massive bullish impulse that happened in June 2024 — the kind of move that only happens when smart money and big institutions step in, creating an imbalance that pushes the price away rapidly.

📈 It’s Not About Fundamentals. It’s About Imbalances.

Most retail traders waste time chasing news, earnings, or rumours about iPhone sales. But if you think about it, all those factors are already priced in once a strong imbalance is formed. Institutions don’t wait for tomorrow’s news — they plan their positions weeks or months ahead, and those footprints are visible right on your chart.

The $178 level indicates a significant drop in supply and a surge in demand large enough to propel Apple higher, marked by consecutive large bullish candlesticks. That’s our signal — nothing more, nothing less.

AAPL – Long Bias SetupWhy I’m Watching the Long Side:

✅ Clean Bounce from $190 Zone

That \$190–195 level has held multiple times since April. Last two dips got scooped with solid demand = solid base forming.

✅ Break of Recent Lower Highs

Stock finally pushed through prior resistance around $205–208. Structure shift. Possible start of a trend reversal.

✅ Buy Signal Triggered (Green "4")

Chart printed a buy signal near lows with follow-through = momentum may be shifting.

✅ Holding Above Short-Term Moving Level

Price is now holding above the short-term EMA (teal line), showing trend momentum flipping bullish.

✅ Vol Picking Up

Volume on the green days has increased, signaling interest from bigger players.

---

Trade Plan:

• Entry Zone: \$208–211

• TP1: $220 (near previous supply)

• TP2: $230 (gap fill zone)

• TP3: $250

• SL: Just below $204 = exit

---

⚠️ Caution:

Still under red resistance band ($220). Needs real strength to reclaim it.

Watch how price reacts there – could stall or squeeze.

📅 Next earnings 3 weeks out. Could build up into it.

---

💬 Setup looks constructive. Playing the reversal with tight risk. Not chasing, just reacting. Trade your plan.

AAPL needs to break above 213 to start an upward moveAAPL needs to break above 213 to start an upward move

From our previous analysis, the price increased by almost +8% from 200 to 216.

The resistance zone, which was also our first target, stopped the price near 213.50, but again the bullish volume seems to be high and there is a good chance that AAPL will continue to rise further.

A clear move above 212.5 should push AAPL higher to 224.50; 240 and 257.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Previous analysis: