ARKK: when a breakout isn’t just a breakout-it’s a runway to $91On the weekly chart, ARKK has broken out of a long-standing ascending channel, ending a year-long consolidation phase. The breakout above $71.40, with a confident close and rising volume, signals a transition from accumulation to expansion. The move came right after a golden cross (MA50 crossing MA2

Key stats

About ARK ETF TRUST

Home page

Inception date

Oct 31, 2014

Structure

Open-Ended Fund

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

ARK Investment Management LLC

Distributor

Foreside Fund Services LLC

ARKK is full of cutting-edge firms, selected to represent the advisers highest-conviction investment ideas in this space. The adviser defines disruptive innovation as a technologically enabled new product or service that has the potential to change the way the world works. ARKK's portfolio focuses on companies involved in genomics, automation, transportation, energy, artificial intelligence and materials, shared technology, infrastructure and services , and technologies that make financial services more efficient . ARKK's proprietary macroeconomic and fundamental research, aimed at assessing company potential,drives security selection and weighting. ARKK's research integrates ESG considerations as a secondary assessment.

Related funds

Classification

What's in the fund

Exposure type

Technology Services

Health Technology

Finance

Electronic Technology

Stock breakdown by region

Top 10 holdings

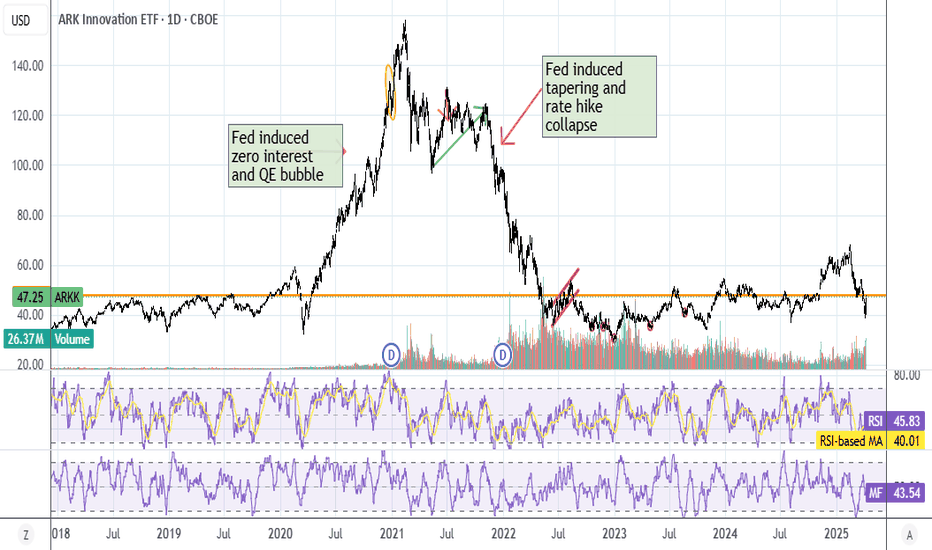

Cathie Wood Sucks ARKKI always like to mock Cathie, so just throwing up a plot for fun. Orange line is today's close after a 10% market day. If you invested in ARKK in 2018, congrats, you broke even today, lol.

She got a reputation from picking a bunch of speculative stocks during the COVID days, you can see the perfo

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

ARKK trades at 70.70 USD today, its price has risen 1.00% in the past 24 hours. Track more dynamics on ARKK price chart.

ARKK net asset value is 71.18 today — it's risen 21.74% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

ARKK assets under management is 6.73 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

ARKK price has risen by 23.49% over the last month, and its yearly performance shows a 55.38% increase. See more dynamics on ARKK price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 21.74% over the last month, showed a 43.62% increase in three-month performance and has increased by 58.68% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 21.74% over the last month, showed a 43.62% increase in three-month performance and has increased by 58.68% in a year.

ARKK fund flows account for −7.48 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

ARKK invests in stocks. See more details in our Analysis section.

ARKK expense ratio is 0.75%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, ARKK isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, ARKK technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating ARKK shows the buy signal. See more of ARKK technicals for a more comprehensive analysis.

Today, ARKK technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating ARKK shows the buy signal. See more of ARKK technicals for a more comprehensive analysis.

ARKK trades at a premium (0.26%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

ARKK shares are issued by ARK Invest LLC

ARKK follows the No Underlying Index. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Oct 31, 2014.

The fund's management style is active, aiming to outperform its benchmark index by actively selecting and adjusting assets. The goal is to achieve returns that exceed those of the index the fund tracks.