IBB trade ideas

IBB: The time is now...tight risk, huge reward potentialI think @timwest's idea that #TSLA and #IBB both represent innovation and disruption, and so, #IBB should correlate #TSLA (which has been the case so far), gives us a good opportunity as a less evident catch up play, to follow #TSLA's violent climb.

Perhaps some company in the portfolio manages to find a vaccine that resolves the Coronavirus crisis, as a possible catalyst to boost the ETF higher.

The technical chart is absolutely perfect now, we have a daily and weekly explosion pattern setup, where most of the recent highs align near the same zone, and price breaking out above them.

I will add some more detail as updates, lower timeframe and higher timeframe charts, as well as other interesting tidbits supporting this idea.

For full disclosure: I'm long #IBB and #BTC currently, sold #TSLA for now, not in a rush to buy it back. My clients receive timely updates to benefit from my derivatives trading and my position shifts in my stock, crypto and FX portfolios.

If interested in being part of this community, message me for more details.

Cheers,

Ivan Labrie.

IBB - Biotech BounceWhats up Traders -

Stealing a CNBC idea, but i like it and agree with it. Biotech has bounced back to its past highs. IN all liklihood we will bounce around here for a bit -

Entering a Call Credit Spread

1 x 123.5 Call Sell

Jan 31

1 x 125.00 Call Buy

Jan 31

Have a look and see if you. Best of luck.

- Nix

A trend Channel in a downtrend in the ETF of IBBA descending channel is formed with two parallel bearish lines, which indicates a downward trend in price.

Within the channel, the operations are opened by betting that the price remains within it, so when the price is touching the bottom line, the operation can be opened long, even when the price touches the top line, these operations open after rebound confirmed

IBB - Struggling to return to Long Term ChannelIBB broke it primary trend a while back, and since has been struggling to re-enter it. If it fails to re-enter again here, it looks like it will drop significantly. If it re-enters, then we're back to Longing it. Just waiting to see.

I'M NOT A PROFESSIONAL, THIS IS NOT TRADING ADVICE.

IBB Breakdown After Back TestIBB is showing weakness, having broken through a key support area and then failed to recover in day 1 of the back test. Expect to see re-test of 98'ish support, with failure leading to a re-test of December 2018 lows, and perhaps much lower. Bang for buck isn't great here, so we aren't taking the trade, but risk/reward is very good on this move.

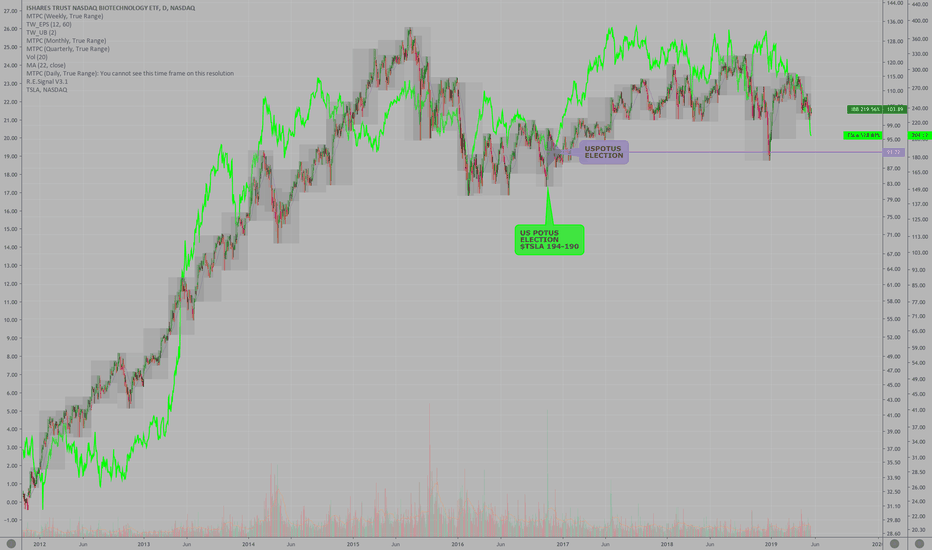

$TSLA Tesla vs $IBB Biotech over 7 years The pioneers in medicine ($IBB Biotech) vs the pioneer in automobile, battery and automated driving ($TSLA, Tesla).

Notice the wave of investor recognition of the future of biotech from 2011 to 2015 matches quite well to the wave of investor recognition of the future of energy storage and EV vehicles in the stock price of Tesla.

Biotechs returned to the US Presidential Election level and Tesla has also pulled back to the level this week in the low 190's (chart to follow of the exact level). The US President supported faster drug approvals if lower drug pricing was on the table.

The President of the US hasn't done anything to support the efforts of EV's and in fact hasn't been a believer of solar and alternative energy.

It's curious that $TSLA is pulling back to the Presidential election price level in the low 190's were we have seen the lows this week on the various Wall Street downgrades. Oddly, Wall Street was upgrading $TSLA at the highs near $370-$380 last year . If you want to make money in stocks long term, be aware that Wall Street tends to get it wrong more than most people think. If you follow Wall Street recommendations, realize that analysts are typically reacting to old news and not regarding or weighting the potential for positive future news which will weigh more in the minds of investors. Wall Street is more concerned about having another Enron (fraud) and melt-down on their hands, so any company having short term difficulties is sold out of fear.

Full disclosure: I follow Tesla on an intraday basis and have for many years. I have positions in $TSLA and will trade in and out of shares as I see opportunities to enter on bad news and exit on good news.

We discuss Tesla quite often in the Key Hidden Levels chat room where we discuss "EARNINGS LEVELS", "NEWS LEVELS", "TIME@MODE TREND" and assorted sentiment and liquidity indicators like $SKEW and $VIX to pinpoint entry/exit levels for stocks and the market overall.

Tim West

12:04PM EST, May 21, 2019