SPXL trade ideas

Stock Trade Plan - 07 November 2018

The trade idea for today is an ETF with ticker symbol SPXL that trades the S&P 500 3x, it is a leverage S&P 500 a 3x version of SPY. It can be compared to SPY.

This is a straight bullish trade;

Entry is at $48

Stop is at $46

Target is at $55

The risk reward is a ratio of 7:2, which is a great reward risk ratio. You can trade options for December 2018 in the money with open interest at $45 (4.60/$5).

Let me know what you think about it in the comment box below

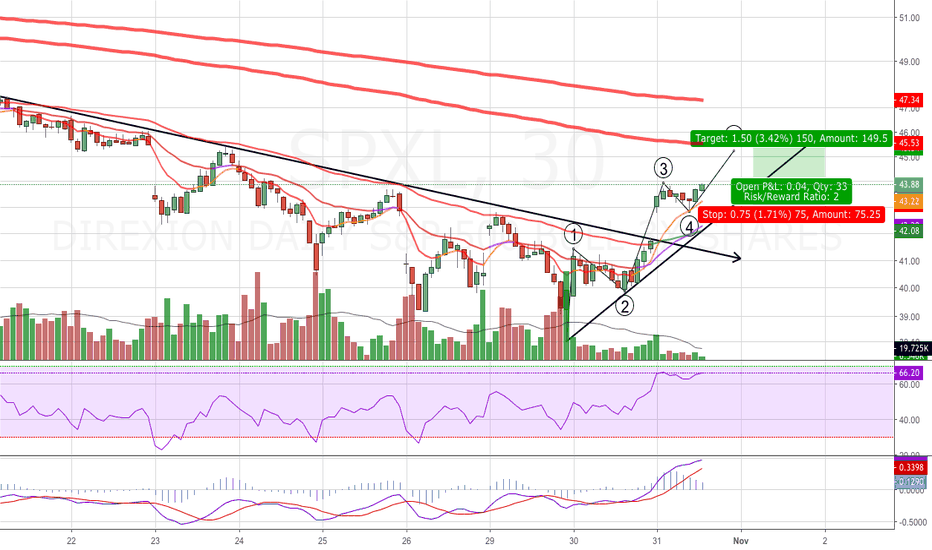

Big movement ahead on SPXLBull flag vs RSI correction

RSI suggests market correection for tomorrow and next week camdlesticks based on oct 03,09,117 situations. Purple vertical lines shows historic path itself.

Bull Flag

Background: 12 d 5h for -16.23% down

Stick: 20h for +8% up

Flag: 1d 6h +3.39% up

However, there is a huge resistance at 45 price level, so we can expectate another selling wing/breath to break through 50 level

SPXL - Let's see how big this bounce or V-shape recovery isWe are at a market crossroads testing 200 DMA support across a number of big names that makes up the SPX. I'm long here with a stop loss and the stop loss will be more than just this short term SPXL trade...

Long Short term - will decide longer term depending on bounce (or not)

SPXL - Go long, fears overblown. Trade wars fears, inflation, flat yield curve, slower global growth, the Fed hawkishness, etc. are all overblown.

Here's the facts:

"From 1933 to 2016, the average return for the S&P 500 Index when Republicans held the presidency, House and Senate for the one year after midterms was 15.1%. When Democrats have been in complete control, the increase averaged 9.3%."

Many analysts (including myself) believe that Trump is going to scale back tariff talks before mid-terms in November. This will allow markets to reach new highs. Despite what I hear from many analyst here, it's Trump keeping this market from hitting new highs, and it will be his policy stance that will allow us to break through this consolidation period.

Don't get me wrong, the Fed, inflation, the yield curve, etc. will be concerns, just not much in 2018 (likely 2019 as well).

Proprietary models that I follow suggest that S&P 500 will reach ATHs this year - see red line.

SPXL or UPRO (3x leveraged index funds) are one of the best ways to play this rally.

I'd be a buyer on dips.

Cheers!

Earning season has come and that will lead to a huge rallySPXL has had some problems the last few months but I think that will change. The market has begun to level off and with earning seasons I feel a run will start. Hopefully Apple will also begin to buy back in force and also push the market higher.