Nightly $SPY / $SPX Scenarios for March 26, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📉 Consumer Confidence Hits Four-Year Low: The Conference Board reported that the Consumer Confidence Index fell to 92.9 in March, marking the fourth consecutive monthly decline and reaching its lowest level since January 2021. Rising concerns over tariffs and inflation are major contributors to this decline.

🇺🇸🏠 New Home Sales Rebound: New home sales increased by 1.8% in February to a seasonally adjusted annual rate of 676,000 units, slightly below the forecasted 679,000. The median sales price decreased by 1.5% to $414,500 from a year earlier, indicating potential affordability improvements in the housing market.

📊 Key Data Releases 📊

📅 Wednesday, March 26:

🛠️ Durable Goods Orders (8:30 AM ET):

Forecast: -1.0%

Previous: 3.2%

Reflects new orders placed with domestic manufacturers for long-lasting goods, indicating manufacturing activity.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY trade ideas

SPY Technical Outlook - Will Buyers Step In?AMEX:SPY is experiencing a corrective move after rejecting the upper boundary of the ascending channel. This rejection led to increased selling pressure, bringing price back to the lower boundary of the channel, where buyers may step in to defend the trendline support.

If the price holds at this dynamic support level, a bullish reaction could send AMEX:SPY toward the midline of the channel, with the next target around 607.00. Holding above this level would reinforce the bullish trend structure and increase the probability of continuation toward the upper boundary of the channel.

However, a breakdown below the trendline support would weaken the bullish outlook and open the door for further downside. Monitoring price action, volume, and confirmation signals will be crucial in determining the next move.

SPY Free Signal! Sell!

Hello,Traders!

SPY made a nice bullish

Move and will soon hit a

Horizontal support of 577.19$

From where we can enter

A short trade with the

Take Profit of 566.48$

And the Stop Loss of 583.38$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

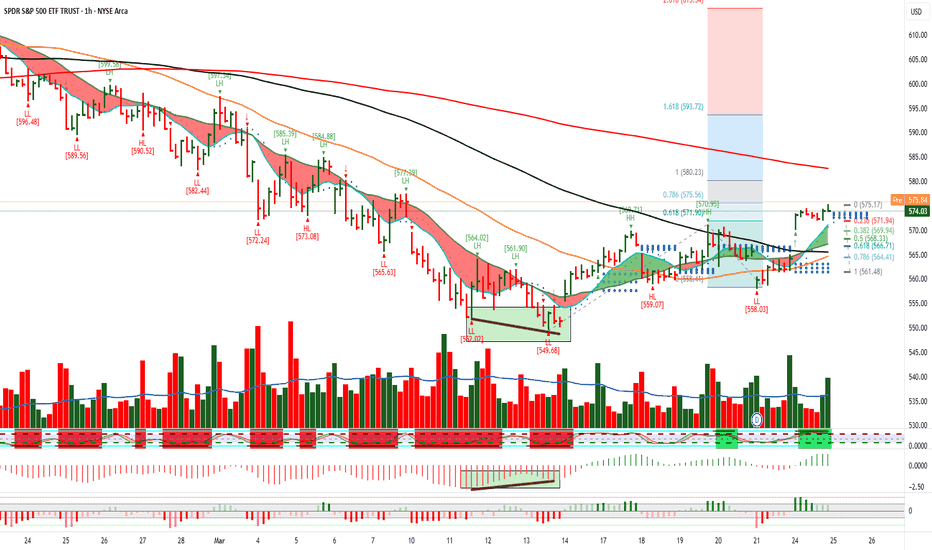

$SPY Marcg 25, 2025AMEX:SPY Marcg 25, 2025

15 Minutes.

No trade for me yesterday as gap up and had no chance to enter.

For the rise 561.48 to 575.17 i am expecting a retrace to 566-568 levels as too far away from movoing averages.

On 60-minute time frame for the fall 597.37 to 549.68 4SPY has retraced between .5 to .618 levels.

So, at the moment I expect upside to be capped at 579-580 levels being .618 levels.

So, I will short around that levels or buy around 569 levels for the day.

SPY had a very bulish close to the week!boost and follow for more ❤️🔥

SPY had bullish break of trend resistance to finish the week after a big gap down, bulls continue to buy the dip and now we are gapping up in the futures market. push into 572.47 is likely, from there we either reject and head to lower to trend support or break the resistance and start heading higher to 578.31-584.92 🎯

SPY/QQQ Plan Your Trade For 3-25-25 : Top PatternToday's Top Pattern suggests the SPY/QQQ will find resistance slightly above yesterday's closing price level and attempt to roll over into a bearish price trend.

Watch today's video to see which levels I believe will be the top for the SPY & QQQ.

I do expect metals to rally over the next 3+ weeks and I'm watching for this morning's bounce to carry onward and upward.

Bitcoin should be rolling downward off that FWB:88K top level I predicted months ago.

We are moving into a topping phase - so get ready for the markets to attempt to ROLL DOWNWARD over the next 5+ trading days into a deeper low price level.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

ETFs vs Mutual Funds: Differences and Advantages ETFs vs Mutual Funds: Differences and Advantages

Exchange-traded funds (ETFs) and mutual funds are two of the most popular investment options, each offering unique features and advantages. While both provide access to diversified portfolios, their differences in structure, management, and trading make them suitable for different strategies. This article breaks down the key distinctions between exchange-traded funds vs mutual funds and how to choose between them.

What Are ETFs?

Exchange-traded funds, or ETFs, are investment vehicles that allow traders to access a diverse range of assets through a single product. An ETF is essentially a basket of investments—such as stocks, bonds, or commodities—that typically tracks the performance of an index, sector, or specific theme. For example, SPDR S&P 500 ETF Trust (SPY) follows the S&P 500 index, providing exposure to the largest companies listed on US stock exchanges.

What sets ETFs apart is how they’re traded. Unlike mutual funds, which are only bought or sold at the end of the trading day, ETFs trade on stock exchanges throughout the day, just like individual shares. This means their prices fluctuate as demand and supply change, giving traders the flexibility to enter or exit positions at market prices.

ETFs are known for their cost-effectiveness, as most are passively managed to mirror the performance of an index rather than exceed it. This passive structure usually leads to lower management fees compared to actively managed funds. Additionally, ETFs are often transparent, with their holdings disclosed daily, so investors know exactly what they’re buying.

ETFs come in various types, from those focused on specific sectors, like technology or healthcare, to broader options covering entire economies or bond markets. This variety makes them a popular choice for traders and investors looking to diversify or target specific market opportunities.

What Are Mutual Funds?

Mutual funds are investment products that pool money from multiple investors to create a diversified portfolio, typically managed by a professional fund manager. These funds invest in a wide range of assets, including stocks, bonds, and other securities, depending on the fund’s objective. For instance, an equity mutual fund focuses on stocks, while a bond fund invests primarily in fixed-income securities.

One defining feature of mutual funds is their pricing. Unlike ETFs, mutual funds aren’t traded on stock exchanges. Instead, they are bought and sold at the fund’s net asset value (NAV), which is calculated at the end of each trading day. This makes them more suited to long-term investment strategies.

Mutual funds often appeal to investors looking for a hands-off approach. The fund manager handles the selection and management of assets, aiming to achieve the fund’s stated goals—whether that’s generating income, preserving capital, or achieving long-term growth.

However, this active management comes with higher fees compared to ETFs. These costs include management fees and sometimes additional charges like entry or exit loads, which can eat into returns over time.

Mutual funds also often require a minimum investment, making them less accessible for some investors. That said, they offer a wide variety of options, from sector-specific funds to diversified portfolios, providing flexibility for different investment goals and risk preferences.

Are There Differences Between an ETF and a Mutual Fund?

ETFs and mutual funds share similarities—they both allow investors to pool money into diversified portfolios. However, the differences between ETFs and mutual funds can significantly impact which one is better suited to an investor’s goals.

Trading and Pricing

ETFs are traded on stock exchanges continuously during market hours, similar to individual shares. Price fluctuations are based on market demand and supply. In contrast, mutual funds are priced only once per day after the market closes, based on the fund’s net asset value (NAV). This makes ETFs more appealing for those seeking flexibility and the ability to react to market movements, while mutual funds cater to long-term investors less concerned with intraday price changes.

Management Style

ETFs are mostly passively managed, designed to track the performance of a specific index, sector, or asset class. Mutual funds, on the other hand, often feature active management. This involves fund managers selecting assets to outperform the market, which can offer potential opportunities for higher returns but also comes with increased costs.

Fees and Costs

ETFs typically come with a lower expense ratio compared to mutual funds, making them more cost-efficient. This is due to their passive management approach and lower operational costs. Mutual funds may charge higher fees to cover active management and administrative expenses. Additionally, mutual funds may have extra costs like sales charges or redemption fees, whereas ETFs incur standard brokerage commissions.

Liquidity

When considering mutual funds versus ETFs, liquidity becomes a critical factor, as ETF prices change intraday, while mutual funds are limited to end-of-day pricing. This difference can influence how quickly you can access your funds.

Tax Efficiency

ETFs tend to be more tax-efficient because of their structure. When investors sell ETF shares, transactions occur directly between buyers and sellers on the exchange, limiting taxable events. In mutual funds, redemptions often require the fund manager to sell securities, which can result in capital gains distributed to all investors in the fund.

Minimum Investment

Mutual funds often require a minimum initial investment, which can range from a few hundred to thousands of dollars. ETFs, however, don’t have such requirements—traders can purchase as little as a single share, making them more accessible for those with smaller starting capital.

ETF CFD Trading

ETF CFD trading offers a flexible way for traders to speculate on the price movements of exchange-traded funds without the need to buy them on stock exchanges. CFDs, or Contracts for Difference, are derivative products that track the price of an ETF, allowing traders to take positions on whether the price will rise or fall. This approach is particularly appealing for short-term speculation, making it a useful complement to traditional long-term ETF or mutual fund investing.

Flexibility

One of the standout features of ETF CFDs is their flexibility. Unlike investing directly in ETFs, CFD trading enables you to capitalise on price fluctuations without owning ETF shares. Traders can go long if they anticipate a rise in the ETF’s value or short if they expect a decline. This ability to trade in both directions can potentially create opportunities in both bullish and bearish markets. Moreover, CFDs allow for trading over shorter timeframes like 1-minute or 5-minute charts, providing potential opportunities for scalpers and day traders.

Leverage

Leverage is another significant feature of ETF CFDs. With leverage, traders can gain larger exposure to an ETF’s price movements with smaller initial capital. For example, using 5:1 leverage, a $1,000 position would control $5,000 worth of ETF exposure. However, you should remember that while this magnifies potential returns, losses are also amplified, making risk management a critical component of trading CFD products.

Costs

Actively managed ETFs can charge expense ratios to cover management and operational costs. CFDs eliminate these fees, as traders don’t directly invest in the ETF’s assets. However, both ETF investing and ETF CFD trading include brokerage fees or spreads.

Wider Range of Markets

With CFDs, traders can access a variety of global ETF markets through a single platform. This reduces the need to open accounts in different jurisdictions, saving on administrative and currency conversion costs.

CFD trading is popular among traders who want to take advantage of short-term price movements, diversify their strategies, or access ETF markets straightforwardly. While traditional ETFs are often favoured for long-term growth, ETF CFDs provide an active, fast-paced alternative for traders looking to react quickly to market changes.

Use Cases for ETFs and Mutual Funds

In comparing ETFs vs mutual funds, it’s important to recognise their use cases based on an investor’s goals, strategies, and time horizons.

ETFs

ETFs are used by investors seeking flexibility and real-time market engagement. They are attractive for those who want to take advantage of price movements or actively manage their portfolios. For example, an investor might focus on sector-specific ETFs, like technology or energy, to capitalise on industry trends. ETFs also offer a lower-cost option for diversification, making them useful for those building broad exposure across markets without significant capital.

Additionally, ETFs may be effective for hedging. An investor with exposure to a specific market segment can use an ETF to potentially offset risks, especially in volatile markets. For instance, during an anticipated downturn in equities, an inverse ETF could be used to possibly mitigate losses.

Mutual Funds

Mutual funds are popular among long-term investors prioritising professional management. Their hands-off approach makes them appealing to individuals who prefer not to monitor markets daily. For instance, someone saving for retirement might opt for a diversified mutual fund that balances risk and growth over time.

Mutual funds are also advantageous for accessing specialised strategies, such as actively managed funds focusing on niche markets or themes. While they typically involve higher fees, the tailored management can align with specific financial objectives.

Factors for Choosing Between ETFs and Mutual Funds

Selecting between mutual funds vs ETF options depends on an investor’s financial goals, trading style, and the level of involvement they are comfortable with in managing their investments.

- Time Horizon: ETFs are popular among short- to medium-term investors and traders who prefer flexibility and the ability to follow intraday price movement. Mutual funds, on the other hand, are mostly used by long-term investors focused on gradual growth or income over time.

- Cost Sensitivity: ETFs generally have lower expense ratios and no minimum investment requirements, making them cost-efficient. Mutual funds often involve higher management fees and, in some cases, additional charges like entry or exit fees, which can add up over time.

- Active vs Passive Management: If you’re looking for a hands-off approach with professional oversight, actively managed mutual funds might be more appealing. However, if you prefer to track indices or specific sectors at a lower cost, ETFs might be more suitable.

- Liquidity Needs: Investors who need quick access to their capital often prefer ETFs because they can be traded throughout the day. Mutual funds lack this intraday liquidity, as transactions are only processed at the trading day’s end.

The Bottom Line

Understanding the differences between mutual funds vs exchange-traded funds is crucial for selecting the right investment approach. ETFs offer flexibility and cost-efficiency, while mutual funds are popular among long-term investors seeking professional management. For those interested in ETF CFD trading, which allows traders trade in rising and falling markets, opening an FXOpen account provides access to a diverse range of ETF markets alongside competitive trading conditions.

FAQ

What Is an ETF vs Mutual Fund?

An ETF is a fund traded on stock exchanges, offering intraday liquidity and lower fees, typically tracking an index or sector. A mutual fund pools investor money for professional management, priced once at the end of a trading day at its net asset value per share.

Mutual Funds and ETFs: Differences

ETFs trade like stocks, are generally more cost-efficient, and offer intraday liquidity. Mutual funds are actively managed, have higher fees, and are designed for long-term investing with end-of-day pricing.

Is the S&P 500 an ETF or a Mutual Fund?

The S&P 500 itself is an index, not a fund. However, it can be tracked by both ETFs (like SPDR S&P 500 ETF) and mutual funds, offering similar exposure but with differing management styles and fee structures.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nightly $SPY / $SPX Scenarios for March 25, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸🛍️ Amazon Spring Sale Impact 🛍️: Amazon’s Big Spring Sale is underway, and increased consumer activity could lift retail sector sentiment this week. Watch for broader impacts on e-commerce competitors and discretionary stocks.

🇬🇧📉 UK Growth Outlook Cut 📉: Ahead of the UK's Spring Statement, the Office for Budget Responsibility is expected to revise growth forecasts downward. While not U.S.-centric, weaker UK economic momentum may influence broader global risk sentiment.

📊 Key Data Releases 📊:

📅 Tuesday, March 25:

🏠 S&P Case-Shiller Home Price Index (9:00 AM ET):

Forecast: +4.4% YoY

Previous: +4.5% YoY

A gauge of housing market strength based on home price changes in 20 U.S. metro areas.

🛒 Consumer Confidence Index (10:00 AM ET):

Forecast: 95.0

Previous: 98.3

Measures consumers’ outlook on business and labor conditions. A key sentiment driver.

🏘️ New Home Sales (10:00 AM ET):

Forecast: 679K annualized

Previous: 657K

Tracks the number of newly constructed homes sold. Sensitive to rates and affordability.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY at Critical Levels! Decision Point for Bulls and BearsHere’s a clear breakdown for SPY based on the 1-hour chart and Options GEX:

📈 Technical Analysis (TA):

* SPY recently broke structure bullishly (BOS) at ~$573, confirming bullish momentum.

* Immediate Support identified around $570–$573, marking a potential bullish reversal zone (green zone).

* Strong bearish reversal zone detected at $550–$560 (red zone), critical if the market pulls back significantly.

* MACD and Stoch RSI are indicating potential weakening momentum; watch closely for consolidation or slight retracement.

📊 GEX & Options Insights:

* Highest negative NETGEX / PUT support at $560 level. This area is crucial to watch for downside protection.

* Immediate strong CALL resistance at the $575–$580 area, acting as a ceiling for bullish momentum.

* IV Rank moderate at 23.2%, indicating balanced option premium pricing.

* PUT/CALL ratio balanced (PUT$ 50.7%), indicating mixed market sentiment.

💡 Trade Recommendations:

* Bullish Scenario: Confirm a hold above the green reversal zone ($573) and target CALL resistance near $580 initially, with a potential extension to $585–$590 if bullish momentum continues. Keep tight stops around $570.

* Bearish Scenario: Consider bearish positions if SPY breaks below $570 decisively, targeting the significant bearish reversal zone at $560.

* Neutral Strategy: Iron Condors or credit spreads between the $560–$580 range, benefiting from current balanced IV environment.

🛑 Risk Management:

Given current volatility at critical decision points, manage your risks carefully, and consider tighter stops and smaller position sizing.

Trade smart and safe!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

SPY Trend Analysis

SPY has been in a long-term uptrend , with two major corrections (2022 & 2023) that touched the primary trend line before recovering.

The most recent bullish channel (late 2023 - early 2024) has broken downward , indicating a short-term pullback .

SPY remains bullish in the long-term as long as it stays above the primary trend line (~$500).

Short-term correction might continue toward $550 before resuming the uptrend.

⚠️ Disclaimer : This is not financial advice. Always conduct your own research before making investment decisions.

* SPY/SPX Update 3/24*Hello degenerates,

I am going to try and post daily updates on SPY/SPX to help me with my analysis and preparation for next day trades.

If you follow my analysis, you are aware that we have 2 possible scenarios being played out but I'll be using the bullish scenario for this analysis. This doesn't mean that the bearish scenario is invalidated.

As we all know, price is now moving towards our W3 target at $580. If you haven't gotten in a play yet, I might have some good news: We might be able to have an opportunity to buy in the move tomorrow. I do have to let you know that it will be EXTREMELY RISKY.

BUY IN OPPORTUNITY:

- As you can see in the image, the close we have today kinda imitates the close we had on March 14th.

- If you zoom in, you can see that price closed with a strong rejection and is trailing back under the previous high of the day. You can also see the volume peak that happened in both days which means that sellers stepped in when price hit that level.

- I can see price opening around the $572 range and possibly even testing the 570 breakout since it is now a Whale Target(WT).

- After that, I do believe we will continue with a strong impulse to finish W3.

- On the 1Month Volume profile, you can see that we are in the range of a Volume peak, so I do want to see this level hold support for a continuation towards $580.

- You can also see RSI giving us Lower Highs while price is on Higher highs, and MACD histogram below zero. This means that the SPY/SPX is oversold and needs a little breather. An RSI dip towards 60 will be a good level for a bounce to continue to uptrend.

- In the 5D Volume Profile, you can see that we hit a volume peak and got rejected, and if we can't hold the 572 level, a dip to 570 is where we will find support.

I DO HAVE TO REMIND YOU , during strong trends dips and corrections can just be disregarded (shoutout to my mentor for passing down the knowledge.) This is just a possible scenario that might happen tomorrow due to how we closed today. Buyers are really aggressive and we like it that way, so if you can't find a buy opportunity, don't sweat it. Save your capital and wait for another opportunity.

This is my analysis for today, the main purpose was to find a trade opportunity for tomorrow and share the insight with you. Let me know what you think about it, and how I can make it better!

$SPY Bullish Next WeekHere we are in a red market, a market correction some might say. We all know AMEX:SPY is about as trendy as it gets, despite all the macroeconomic headwinds that we currently are enduring, I am seeing a green week ahead. Follow that trend line of the past year, in the twos it has retreated, an average of 7.5% increase occurred in the following 15 trading day. It seems that investor confidence has increased this past week especially with the strong push to end the week. Also, volume of this 15 day segment is 24% ahead of the pace of those previous 15 dat segments - Could we see major green next week?

SPY/QQQ Plan Your Trade for 3-24-25 : Bozu Trending PatternToday's Bozu Trending pattern suggests a very aggressive price move is likely. I believe this move will be to the upside after my weekend research suggested we are moving into a "blow-off" topping pattern that will act as a Bull Trap.

Overall, I belive the SPY/QQQ have about 2-3 days up upward price trending early this week, then the markets will suddenly roll into a topping pattern and start to aggressively move downward.

The next base/bottom of the continued downward price trend sets up in early/mid April. The March 21-24 base/bottom is likely the minor base/bottom we have seen over the past 3-5+ days.

I believe the breakdown in the SPY/QQQ late this week and into next week will result in a new lower low - causing the Consolidation phase of this downturn to extend down to the 520-525 level on the SPY.

Bitcoin is very close to my $88,000 upper target level (only about $250 off that level). Get ready, BTCUSD should make an aggressive move downward after stalling near the FWB:88K level peak.

Gold and Silver are moving into a trending mode. I believe both Gold and Silver will rally this week and into the next few weeks as we expand into the Expansion phase.

Buckle up. If my research is correct, we are going to see a BIG ROLLOVER this week.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Week of March 24 Earnings Plenty of earnings this week from major companies this week including:

Monday

NASDAQ:LUCD

NASDAQ:OCX

NASDAQ:SKYX

NYSE:EPAC

NASDAQ:DFLI

Tuesday

NASDAQ:CSIQ

NYSE:GME ( get your 1DTE calls ready )

NASDAQ:RUM

NASDAQ:PAVM

AMEX:ACCS

Wednesday

NASDAQ:DLTR

NYSE:CHWY

NASDAQ:CAN

NASDAQ:IVA

NASDAQ:MVIS

Thursday

NASDAQ:BITF

NYSE:SNX

NASDAQ:LULU

NYSE:OXM

NASDAQ:PDSB

Friday

NASDAQ:IPA

NASDAQ:KPLT

NASDAQ:SLE

NASDAQ:ZSPC

NASDAQ:SBC

Follow for weekly earnings reports!

SPY Primary Trend is still UP

The recent breakdown from the steeper uptrend could lead to a pullback to $550-$530.

If SPY holds above $550, it may recover towards $580-$600.

A break below $530 could signal a deeper correction.

As long as SPY holds the primary trend line (~$520), the bullish uptrend remains intact.

If it reclaims $600+, it could aim for new all-time highs above $620+.

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Weekly $SPY / $SPX Scenarios for March 24–28, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 Anticipated U.S. Inflation Data 📈: The Bureau of Economic Analysis will release the Personal Consumption Expenditures (PCE) Price Index for February on Friday, March 28. This index, closely monitored by the Federal Reserve, is expected to show a 0.3% month-over-month increase, maintaining a 2.5% year-over-year growth. These figures will provide insights into inflation trends and potential monetary policy adjustments.

🇬🇧💼 UK's Spring Statement and Economic Outlook 💼: Chancellor Rachel Reeves is set to deliver the UK's Spring Statement to Parliament this week, addressing revised growth forecasts and fiscal policies. The Office for Budget Responsibility is expected to lower growth estimates, potentially impacting global markets, including the U.S., due to economic interlinkages.

🇨🇳📊 China's Manufacturing and Services PMIs 📊: China will release its official Manufacturing and Services Purchasing Managers' Indexes (PMIs) for March on March 28. These indicators will provide insights into the health of China's economy, with potential implications for global trade and U.S. markets.

📊 Key Data Releases 📊:

📅 Monday, March 24:

🏭 S&P Global U.S. Manufacturing PMI (9:45 AM ET) 🏭:

Forecast: 51.5

Previous: 52.7

This index measures the performance of the manufacturing sector, with a reading above 50 indicating expansion.

📅 Tuesday, March 25:

🛒 Consumer Confidence Index (10:00 AM ET) 🛒:

Forecast: 95.0

Previous: 98.3

This index measures consumer sentiment regarding economic conditions, with higher readings indicating greater confidence.

🏘️ New Home Sales (10:00 AM ET) 🏘️:

Forecast: 679,000 annualized units

Previous: 657,000

This report indicates the number of newly constructed homes sold in the previous month, reflecting the health of the housing market.

📅 Wednesday, March 26:

🛠️ Durable Goods Orders (8:30 AM ET) 🛠️:

Forecast: -1.0%

Previous: 3.2%

This data reflects new orders placed with domestic manufacturers for delivery of long-lasting goods, indicating manufacturing activity.

📅 Thursday, March 27:

📉 Initial Jobless Claims (8:30 AM ET) 📉:

Forecast: 226,000

Previous: 223,000

This report provides the number of individuals filing for unemployment benefits for the first time during the past week, offering insight into the labor market.

📈 Gross Domestic Product (GDP) – Second Estimate (8:30 AM ET) 📈:

Forecast: 2.3% annualized growth

Previous: 2.3%

This release provides a second estimate of the nation's economic growth for the fourth quarter of 2024.

🏠 Pending Home Sales Index (10:00 AM ET) 🏠:

Forecast: 1.0%

Previous: -4.6%

This index measures housing contract activity for existing single-family homes, offering insights into future home sales.

📅 Friday, March 28:

💵 Personal Income and Outlays (8:30 AM ET) 💵:

Forecast for Personal Income: 0.4%

Previous: 0.9%

Forecast for Personal Spending: 0.6%

Previous: -0.2%

This report indicates changes in personal income and spending, providing insights into consumer behavior.

💹 PCE Price Index (8:30 AM ET) 💹:

Forecast: 0.3% month-over-month; 2.5% year-over-year

Previous: 0.3% month-over-month; 2.5% year-over-year

This index measures changes in the price of goods and services purchased by consumers, serving as the Federal Reserve's preferred inflation gauge.

🛢️ Baker Hughes Rig Count (1:00 PM ET) 🛢️:

Previous: 592 rigs

This report provides the number of active drilling rigs in the U.S., offering insights into the oil and gas industry's activity.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

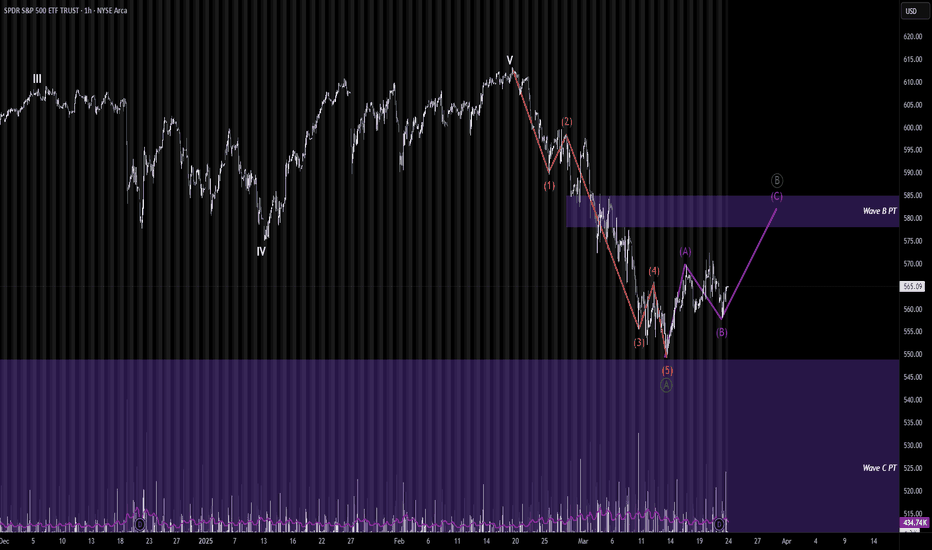

* SPY: ELLIOT WAVES BEARISH BIAS *As promised, I am now sharing you what I can see happening on SPY/SPX on the bearish point of view. I do recommend for you to check out my Bullish analysis post that I did on Friday in case you get confused: ( )

As you can see in the main image of this post, in the bearish bias I am considering this dip from last month to be Wave A of an ABC correction(Green). In this correction, Wave A has 5 sub-waves(Orange), Wave B has 3 sub-waves(Pink), and Wave C have 5 sub-waves as well.

- We are now in Wave B of this correction, which retraces to 38-50% or more.

As you can see in the picture above, we have completed sub-waves A and B and are now beginning sub-wave C of Wave B.

Weekly Chart EMAs:

- In the picture above you can see how price was able to keep itself above the 50EMA(Yellow) and is now turning to a little pump that will target the area where the 20EMA(Orange). If price gets rejected by the 20EMA, it will continue down to complete Wave C of the pattern, which confirms the bearish scenario.

- Once that rejection happens, if price breaks through the 50EMA line, our next support level will be at the 100EMA(Red), which is right in between the bottom of Wave A and or Wave C target(161.8% of Wave A).

I do believe that having a correction is the intent of the current government. Their intention might be to cool down from the growth that was happening during the last years of the last administration. By doing that, the markets would be set for at least 4 more years of healthy growth, institutions and new participants will have another chance at accumulating in order to participate in this next economic boom, and Trump will have a chance at showing the real results of his policies.

At the end of the day, I do have to remind you all that I am just an observer of the market. My analysis is not a prediction of the future, they are just my attempt to be prepare to the different scenarios my money losing journey will take me while I learn the wisdom of the waves.