Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.283 CHF

−633.79 M CHF

4.87 B CHF

1.07 B

About Snap Inc.

Sector

Industry

CEO

Evan Thomas Spiegel

Website

Headquarters

Santa Monica

Founded

2010

FIGI

BBG00G4XH035

Snap, Inc. operates as a technology company, which engages in the provision of a visual messaging application that was created to help people communicate through short videos and images. The company was founded by Frank Reginald Brown IV, Evan Thomas Spiegel, and Robert C. Murphy in 2010 and is headquartered in Santa Monica, CA.

Related stocks

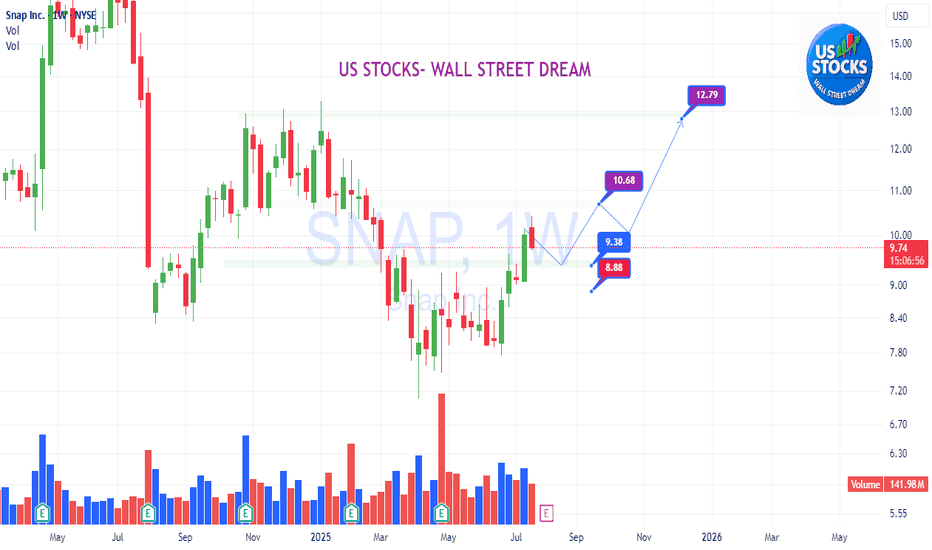

SNAP is in the Wyckoff Accumulation phaseThis Week (July 8 - 12):

Support: The 20-week moving average around $9.00 is now the immediate floor. Below that, the recent support shelf is at $8.00.

Resistance: The first hurdle is the recent high around $10.40. Above that, the path opens up towards $12.00.

Next Month (July/August):

Support:

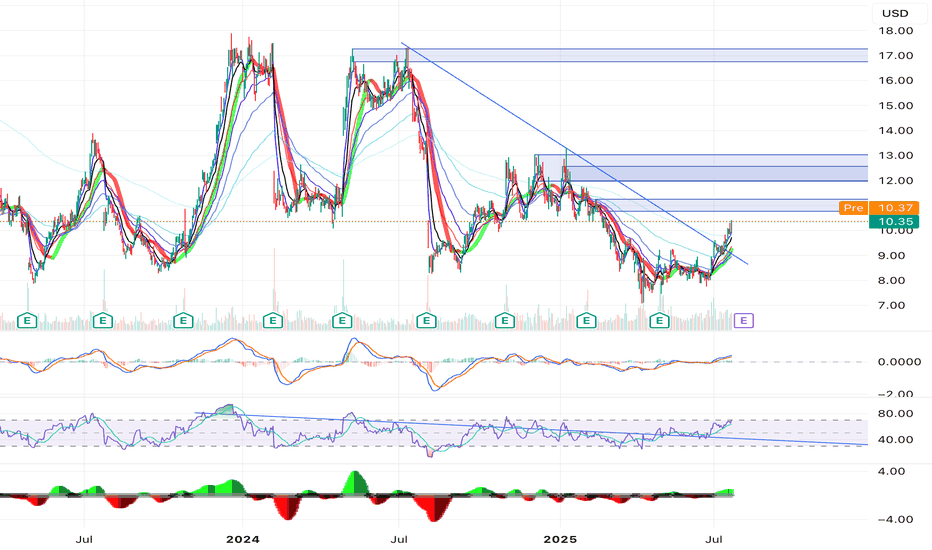

$SNAP -- accumulation $8 into $9. big move brewing into earningsHello, extensive chart here: Daily and Weekly. Looking at this name I like the setup here. The Daily and Weekly chart shows strength in this area, $8 to $9 with heavy accumulation and support. The Weekly chart shows about 13 weeks of this bottoming area with tons of buying from previous years as wel

SNAP - Bullish Reversal in Playhi traders,

* Reclaimed Support Zone

Price has successfully reclaimed a key historical support around the $8.06–$8.72 range, which previously acted as a base before major rallies. This suggests growing buyer interest at this level.

* RSI Breakout

On the RSI, we’ve seen a clean breakout from a long

A BULLISH SNAPCHAT ANALYSIS SNAPCHAT has a neat chart setup long term. Here is a bullish look. I use a metric called NJT which analyzes total user hours available.

From a technical standpoint, there are gaps up to $70, and it could soar much higher. Think longer term investment, with short term jump potential.

Here is my su

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

USU83274AA5

SNAP 25/33 REGSYield to maturity

6.60%

Maturity date

Mar 1, 2033

SNAP5541575

Snap Inc. 0.125% 01-MAR-2028Yield to maturity

5.57%

Maturity date

Mar 1, 2028

SNAP5409062

Snap Inc. 0.0% 01-MAY-2027Yield to maturity

5.44%

Maturity date

May 1, 2027

SNAP5029110

Snap Inc. 0.75% 01-AUG-2026Yield to maturity

4.74%

Maturity date

Aug 1, 2026

SNAP6077259

Snap Inc. 0.5% 01-MAY-2030Yield to maturity

3.75%

Maturity date

May 1, 2030

See all 1SI bonds

Curated watchlists where 1SI is featured.

Frequently Asked Questions

The current price of 1SI is 7.762 CHF — it has increased by 2.66% in the past 24 hours. Watch SNAP INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange SNAP INC stocks are traded under the ticker 1SI.

1SI stock has fallen by −3.37% compared to the previous week, the month change is a 12.43% rise, over the last year SNAP INC has showed a −31.80% decrease.

We've gathered analysts' opinions on SNAP INC future price: according to them, 1SI price has a max estimate of 12.07 CHF and a min estimate of 5.63 CHF. Watch 1SI chart and read a more detailed SNAP INC stock forecast: see what analysts think of SNAP INC and suggest that you do with its stocks.

1SI stock is 2.89% volatile and has beta coefficient of 1.17. Track SNAP INC stock price on the chart and check out the list of the most volatile stocks — is SNAP INC there?

Today SNAP INC has the market capitalization of 12.33 B, it has increased by 3.78% over the last week.

Yes, you can track SNAP INC financials in yearly and quarterly reports right on TradingView.

SNAP INC is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

1SI earnings for the last quarter are −0.07 CHF per share, whereas the estimation was −0.12 CHF resulting in a 39.93% surprise. The estimated earnings for the next quarter are −0.12 CHF per share. See more details about SNAP INC earnings.

SNAP INC revenue for the last quarter amounts to 1.21 B CHF, despite the estimated figure of 1.19 B CHF. In the next quarter, revenue is expected to reach 1.07 B CHF.

1SI net income for the last quarter is −123.57 M CHF, while the quarter before that showed 8.27 M CHF of net income which accounts for −1.59 K% change. Track more SNAP INC financial stats to get the full picture.

No, 1SI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 3, 2025, the company has 4.91 K employees. See our rating of the largest employees — is SNAP INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SNAP INC EBITDA is −437.16 M CHF, and current EBITDA margin is −11.74%. See more stats in SNAP INC financial statements.

Like other stocks, 1SI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SNAP INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SNAP INC technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SNAP INC stock shows the sell signal. See more of SNAP INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.