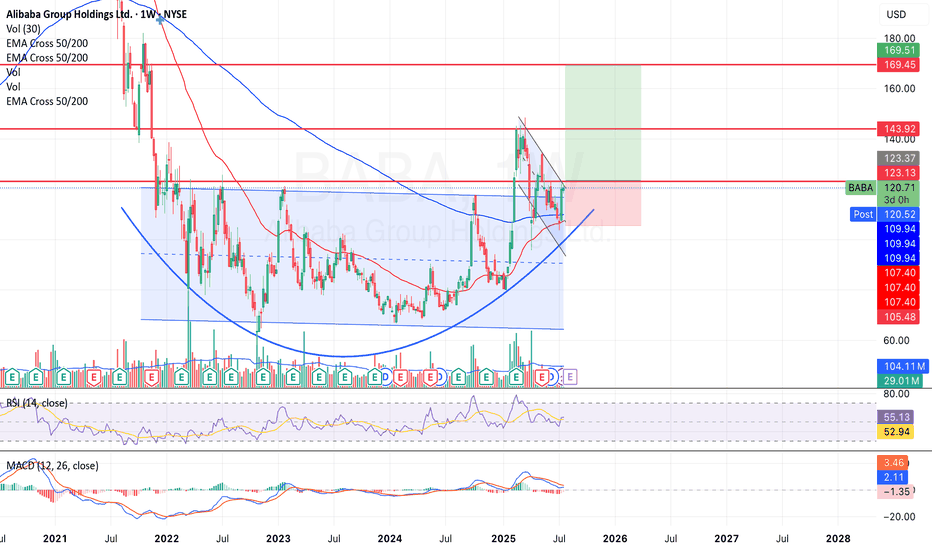

Alibaba - A remarkable reversal!🛒Alibaba ( NYSE:BABA ) reversed exactly here:

🔎Analysis summary:

Recently Alibaba has perfectly been respecting market structure. With the current bullish break and retest playing out, there is a very high chance that Alibaba will rally at least another +20%. But all of this chart behaviour j

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.784 CHF

15.88 B CHF

122.19 B CHF

2.23 B

About Alibaba Group Holdings Ltd.

Sector

Industry

CEO

Yong Ming Eddie Wu

Website

Headquarters

Hangzhou

Founded

1999

FIGI

BBG007FJLZG8

Alibaba Group Holding Ltd. engages in providing technology infrastructure and marketing reach. It operates through the following business segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others segments. The Core Commerce segment consists of platforms operating in retail and wholesale. The China Commerce segment includes China commerce retail and wholesale businesses. The International Commerce segment focuses on international commerce retail and wholesale businesses. The Local Consumer Services segment is involved in To-Home businesses, which include Ele.me, local services and delivery platform, and Taoxianda, and To-Destination segment businesses which include Amap, the provider of mobile digital map, navigation and real-time traffic information, and restaurant and local services guide platform. The Cainiao segment has Cainiao Network and offers domestic and international one-stop-shop logistics services and supply chain management solution. The Cloud segment includes Alibaba Cloud and DingTalk. The company was founded by Chung Tsai and Yun Ma on June 28, 1999 and is headquartered in Hangzhou, China.

Related stocks

Much needed break for $BABA on the horizonI took a much needed break but not as long as NYSE:BABA has taken since 2021; swinging between ~$70 and ~$120 over the past six years.

I strongly suspect that this might have something to do with Jack Ma's speech in late 2024 that made him go 'missing' from public view

- www.wired.com .

The s

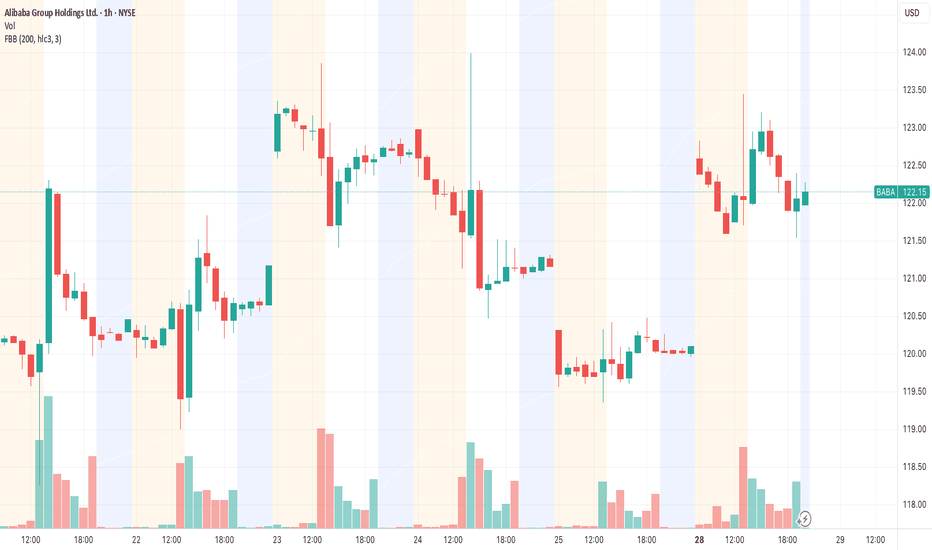

BABA looks ready to drop.It’s been hitting the $125 wall since May and just can’t break it. This last bounce? Weak volume. No real buyers stepping in. RSI is already stretched and there’s no accumulation from big players.

If it loses $120 with conviction, we might see $110 or lower.

And let’s be real — China’s still strug

BABA | Long | Strong AI & Seasonality Tailwinds (July 2025)BABA | Long | Strong AI & Seasonality Tailwinds (Aug 2025)

1️⃣ Quick Insight: Alibaba is showing strong AI-driven momentum, healthy fundamentals, and positive seasonality patterns. August–December tends to be bullish, and the stock is already holding up well despite recent dips.

2️⃣ Trade Paramete

Long $BABA - NYSE:BABA is testing 200 SMA

- NYSE:BABA moves are explodes higher then cools then retest support then explodes higher than the last high. It's called trading with higher wavelength

-> Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $9

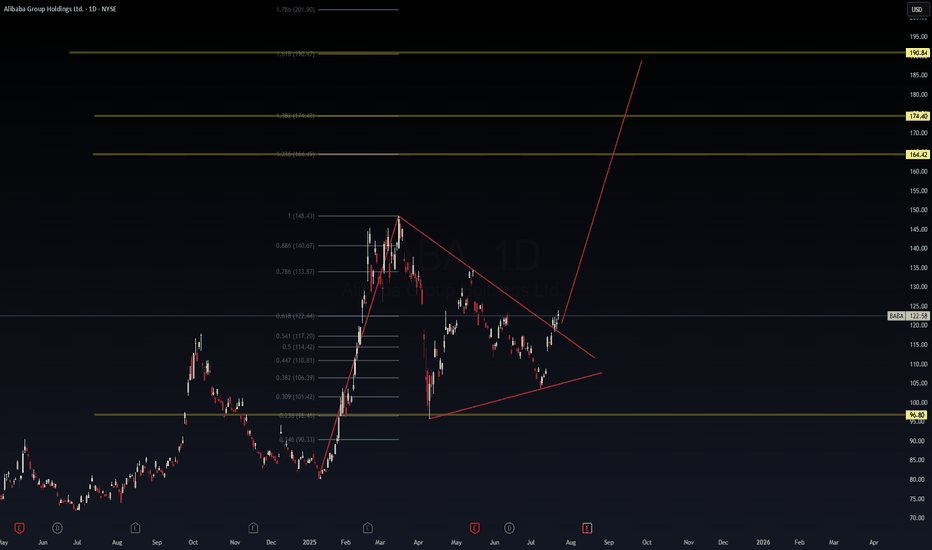

$BABA Breakout Imminent – Triangle Compression Ending, Fib .....📈 NYSE:BABA Breakout Imminent – Triangle Compression Ending, Fib Confluence Targets Set

After weeks of coiling inside a converging triangle, Alibaba ( NYSE:BABA ) just broke above the downtrend line with conviction. The structure and Fibonacci extensions point toward an explosive leg up—possibly

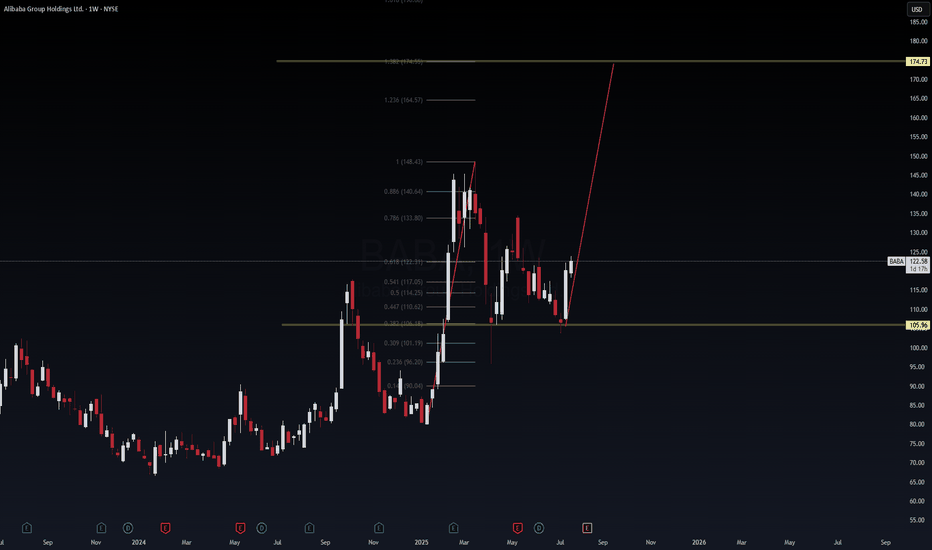

BABA | Weekly VolanX Setup📈 BABA | Weekly VolanX Setup

WaverVanir International LLC | July 24, 2025

Alibaba is bouncing off a key institutional demand zone at 105.96, reclaiming the .382 Fibonacci level with strong bullish conviction. This weekly structure sets the stage for a macro Fibonacci extension run toward 174.73 — a

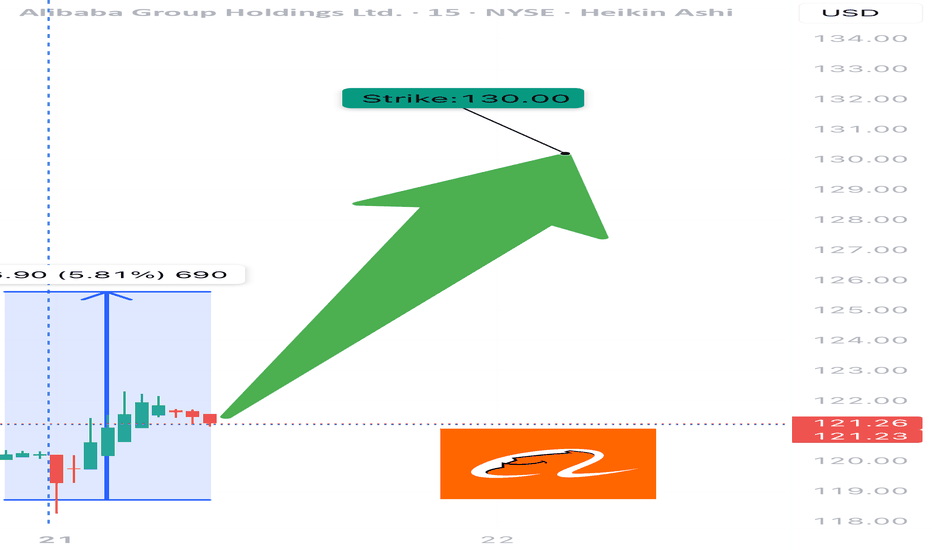

BABA WEEKLY TRADE IDEA – JULY 21, 2025

🐉 NYSE:BABA WEEKLY TRADE IDEA – JULY 21, 2025 🐉

📈 Strong RSI. Institutional Accumulation. Gamma-juiced upside.

Momentum is building — timing is key.

⸻

📊 Trade Setup

🔹 Type: Long Call

🎯 Strike: $130.00

📆 Expiry: July 25, 2025 (4 DTE)

💰 Entry Price: $0.52

🎯 Profit Target: $0.74 (📈 +42%)

🛑 Stop Lo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AHLA is featured.