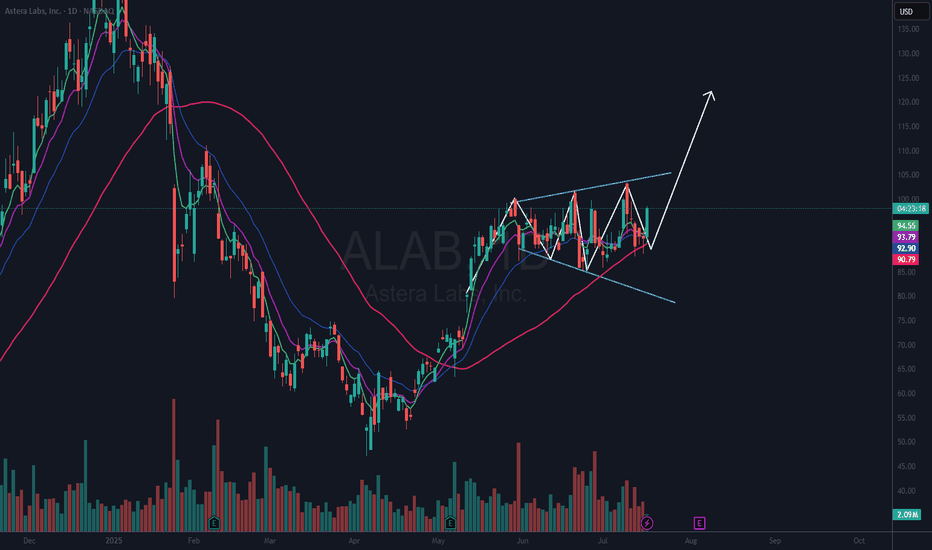

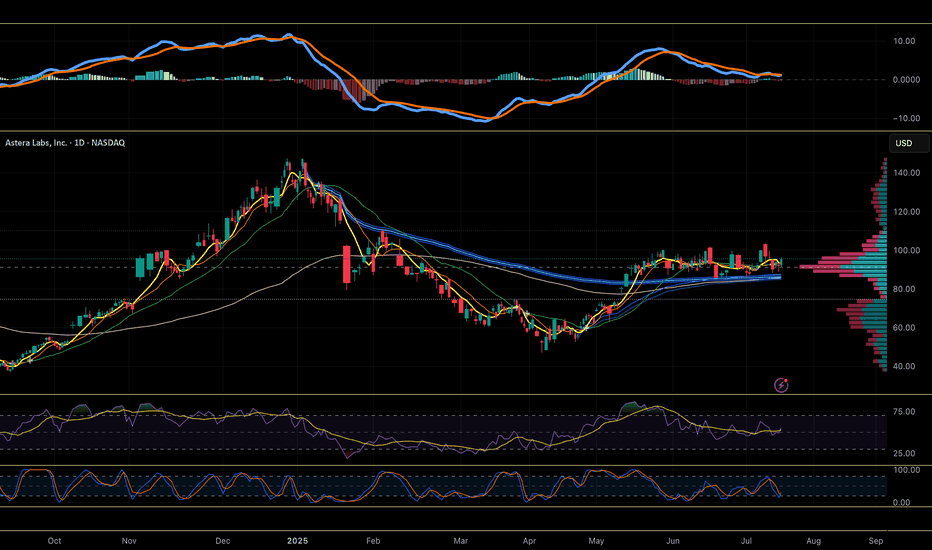

ALAB: High-Quality Breakout With Strong Structure and 3.2 R/RAstera Labs ( NASDAQ:ALAB ) just delivered a clean technical breakout above multi-week resistance, paired with bullish confirmation from momentum and Ichimoku structure. This isn’t a hype trade — this is what a textbook continuation breakout looks like.

📊 Key Technical Breakdown

Base Breakout

Afte

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.222 CHF

−75.76 M CHF

359.91 M CHF

125.99 M

About Astera Labs, Inc.

Sector

Industry

CEO

Jitendra Mohan

Website

Headquarters

San Jose

Founded

2017

FIGI

BBG01TNYQVX2

Astera Labs, Inc. is a global semiconductor company, which engages in the provision of hardware and software solutions for AI and cloud infrastructure applications to solve data, memory, and networking bottlenecks. It operates through the following geographical segments: Taiwan, China, United States, and Other. The company was founded by Jitendra Mohan, Casey Morrison, and Sanjay Gajendra in October 2017 and headquartered in San Jose, CA.

Related stocks

ALAB | Smart Money Compression → Breakout Threat🔭 ALAB | Smart Money Compression → Breakout Threat

Posted by: VolanX Quant Systems | July 10, 2025

We're at a critical inflection point on $ALAB.

The previous supply zone (highlighted in red) is under pressure — one more CHoCH + BOS and it may flip to DEMAND. If that happens, we don’t trickle...

W

$ALAB Forming a Megaphone PatternNASDAQ:ALAB has seen a lot of volatility as of late. I took a position in it and was stopped out for a loss due to that volatility.

I may be too fixated on this name, but I want to get involved as I think it has a chance to run to previous highs. I thought it had formed a cup with handle pattern,

$ALAB coiled over AVWAP pinchNASDAQ:ALAB has been coiling in a tight range since May, when it vaulted over the AVWAP from the January high. Now above the AVWAP pinch from that Jan high and April low, consolidating above key moving averages, the stock looks ready to launch soon of the volume shelf at ~$90-92

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

The current price of ALAB is 73.356 CHF — it has decreased by −7.58% in the past 24 hours. Watch ASTERA LABS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange ASTERA LABS INC stocks are traded under the ticker ALAB.

ALAB stock has fallen by −7.58% compared to the previous week, the month change is a 3.30% rise, over the last year ASTERA LABS INC has showed a 3.30% increase.

We've gathered analysts' opinions on ASTERA LABS INC future price: according to them, ALAB price has a max estimate of 95.76 CHF and a min estimate of 59.85 CHF. Watch ALAB chart and read a more detailed ASTERA LABS INC stock forecast: see what analysts think of ASTERA LABS INC and suggest that you do with its stocks.

ALAB reached its all-time high on Jul 10, 2025 with the price of 79.372 CHF, and its all-time low was 70.961 CHF and was reached on Jul 4, 2025. View more price dynamics on ALAB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ALAB stock is 8.20% volatile and has beta coefficient of 2.39. Track ASTERA LABS INC stock price on the chart and check out the list of the most volatile stocks — is ASTERA LABS INC there?

Today ASTERA LABS INC has the market capitalization of 12.15 B, it has decreased by −6.60% over the last week.

Yes, you can track ASTERA LABS INC financials in yearly and quarterly reports right on TradingView.

ASTERA LABS INC is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

ALAB earnings for the last quarter are 0.29 CHF per share, whereas the estimation was 0.25 CHF resulting in a 16.22% surprise. The estimated earnings for the next quarter are 0.26 CHF per share. See more details about ASTERA LABS INC earnings.

ASTERA LABS INC revenue for the last quarter amounts to 141.15 M CHF, despite the estimated figure of 135.53 M CHF. In the next quarter, revenue is expected to reach 136.85 M CHF.

ALAB net income for the last quarter is 28.17 M CHF, while the quarter before that showed 22.44 M CHF of net income which accounts for 25.50% change. Track more ASTERA LABS INC financial stats to get the full picture.

No, ALAB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 17, 2025, the company has 440 employees. See our rating of the largest employees — is ASTERA LABS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ASTERA LABS INC EBITDA is −16.12 M CHF, and current EBITDA margin is −28.49%. See more stats in ASTERA LABS INC financial statements.

Like other stocks, ALAB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ASTERA LABS INC stock right from TradingView charts — choose your broker and connect to your account.