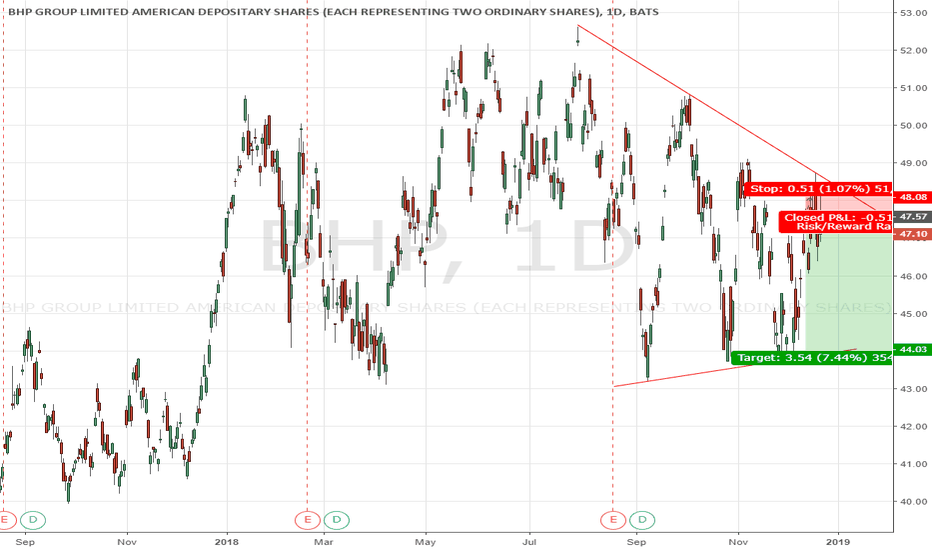

BHP with too tight stopWrite sometning about your psyhology thinking before trade? Very sleepy and not in the mood for thinking

Describe the trade. What you see? there will be the bounce from resistance and price will fall to the support level between wedge

What have I done well for this trade? recognizing the triangel and try to play within the support and resistance level

What can I take away to help with later trades? that you sould be more focus on major swings.

How many shares: 20

Where will I enter the market? 47,36

Price in 47,58

Profit taker 44,1

Stop loss (na most recent higher low) SAR(0,2;0,02;0,2) 48,08

BHP1 trade ideas

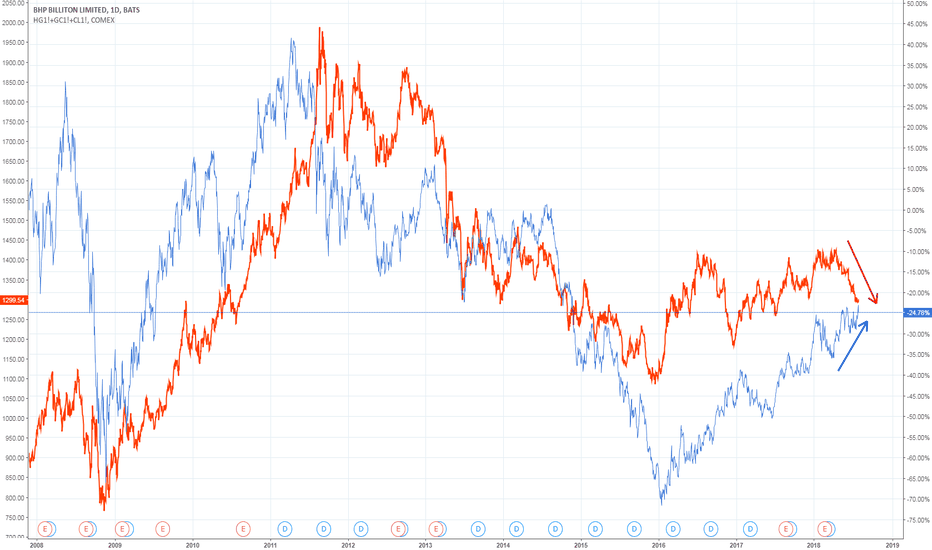

BHP BILLITON | Heading Towards 16.00 ???BHP for the last two years has been quite the bullish pick of the ASX , after it's bear run from late 2014 it was an obvious investment for the long haul trader.

-

Now into late 2018 , we can see that price is currently retesting structure at the range of DEC 201 3 and JUL 2014 . Currently ranging in the structure zone as displayed, accompanied by an RSI divergence, we have a strong reason to believe that price has completed its pullback and is headed on back down to the low of JAN 2016 .

-

A break and close over the trend-line would place us in an ideal position to short the stock.

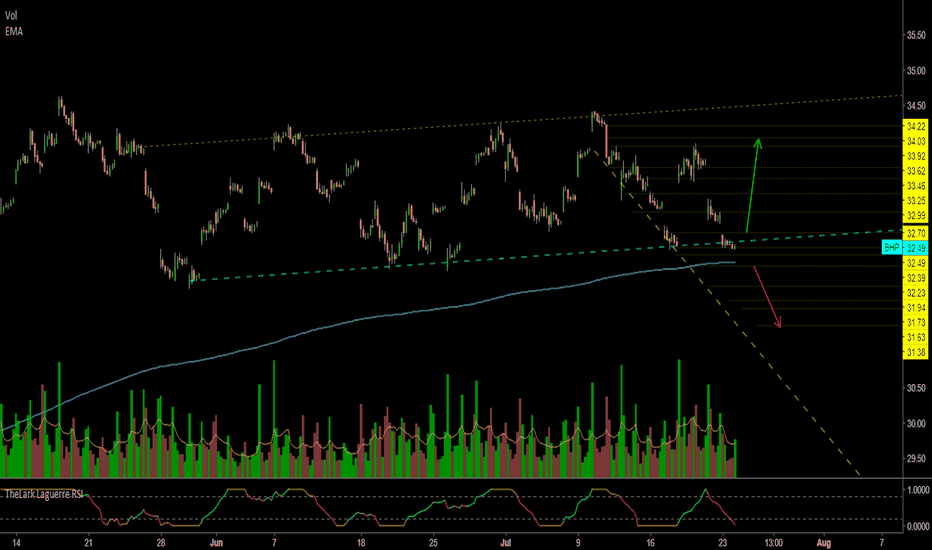

Renko Manual Back Test with BHPTesting basic Renko system.

Enter Long when:

- 2 green bricks (top of 2nd brick + 5% brick size)

- Top of 2nd brick is above 10EMA

Stop:

- bottom of 1st full brick under 10EMA -5% brick size

Exit:

- 2 red bricks (bottom of 2nd brick - 5% brick size)

- close under 10EMA

Enter Stop Exit R Profit R Mulitple

19.05 15.95 28.95 3.1 9.9 3.1935483871

27.05 24.95 35.95 2.1 8.9 4.2380952381

36.05 33.95 43.95 2.1 7.9 3.7619047619

37.05 33.95 45.95 3.1 8.9 2.8709677419

39.05 36.95 37.95 2.1 -1.1 -0.5238095238

38.05 35.95 35.95 2.1 -2.1 -1

28.05 25.95 25.95 2.1 -2.1 -1

28.05 25.95 27.95 2.1 -0.1 -0.0476190476

So far so good.