DBK trade ideas

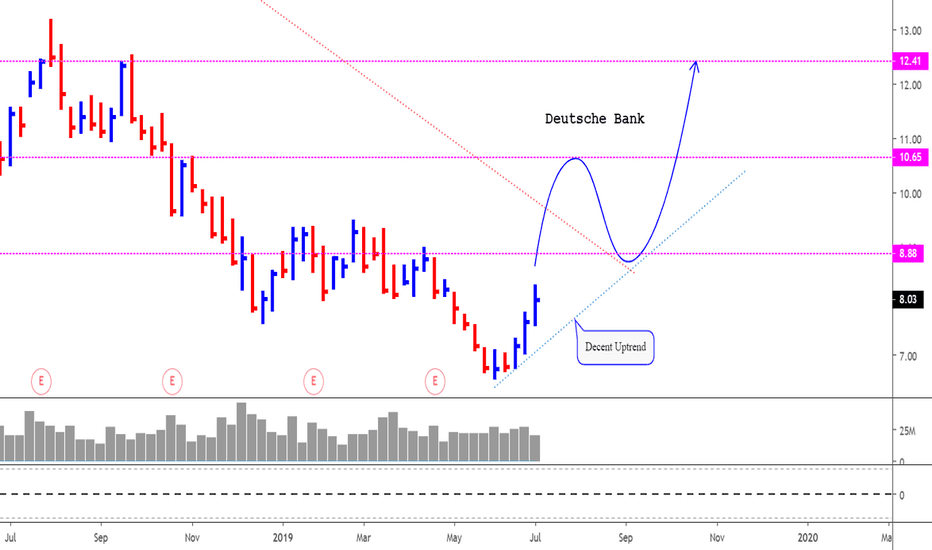

Deutsche Bank (DB) (The swing back UP is here to stay)View On Deutsche Bank (8 July 2019)

Apparently, the market seems to love the news of retrenchment.

Deutsche Bank (DB) is in the healthy midterm UPtrend for the recent weeks. I expect it will go to 8.88 regions easily soon.

So, it is better to stand on the LONG side now.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice.

We may (or) We may not take the trade. The risk of trading in securities markets can be substantial.

You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Free Telegram FX/Stock analysis at your fingertip @ t.me/sonictraders

Follow our Trading View, @ bit.ly

Visit our Webby @ bit.ly

Like our FB @ bit.ly

Looking for a good broker? Go to cmc.mk

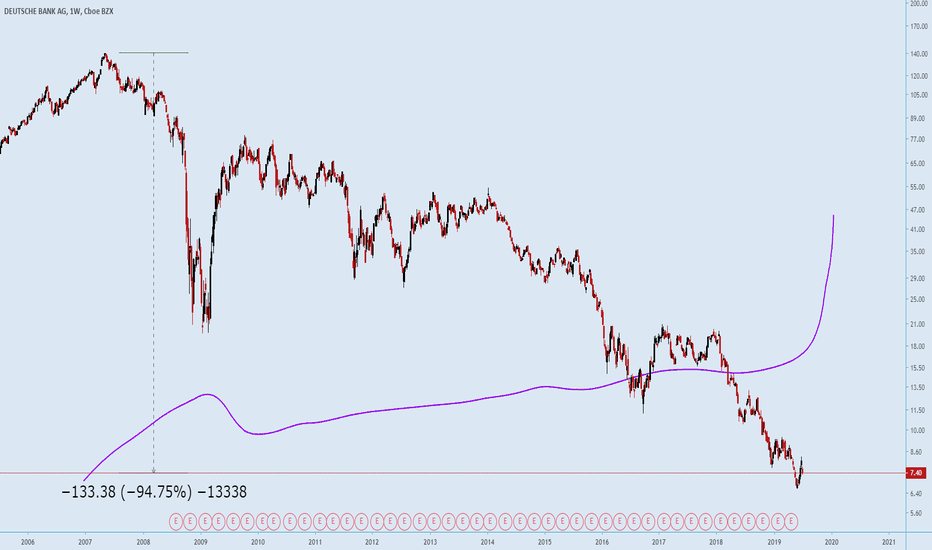

Interesting: Deutsche Bank Robinhood baghodlers went parabolicAnother fun story :D

By the way, the number of baghodlers on Tesla is down now that the price went up. Got their chance to break even on idiotic buys.

DB baggies spiked during the whole day of the 08 July. Did some guru tell his gullible paid group to buy the "bottom"? Or whale uses Baginhood?

DB baggies have been following the usual baggy path: exact opposite to what price does.

After being down 90% I guess baggies that lucked out and bought closest to the bottom, when it eventually goes back up, will get their shot at breaking even, and others will just ride it to zero.

Not making any speculation on this. Just watching and laughing.

Not even a good counter indicator as they just opposite-shadow the price just like alot of funds simply shadow the price.

Does not tell us anything we do not already know.

I have to finish my series...

Trading styles. Part 1/5. The 4 different kinds of bottoms.

Trading styles. Part 2/5. Buying pullbacks.

Trading styles. Part 3/5. Trend continuation breaks.

4/5 countertrend

5/5 other (ranging or exotic strats)

The count is wrong 1/5 is an intruder. I want to throw that and restart.

But I don't really know... I guess there are not that many type of strategies it's either pullbacks continuation countertrend or trading ranges?

With all the hate I got for shorting BTC as it was going up this makes zero sense. The peons all want to go against the trend.

The difference is they only go against the trend when it goes down I guess... "Buy cheap". How dumb. Just flip the chart then...

Noobs will buy absolutely anything when they see something down 95%. I bet there are some "educator" that teaches idiots to scan for poop and buy it.

Probably alot of those in penny stocks. Maybe they imagine other people than them are buying and they are not just scamming each other?

(With Tim making most of the dumping, on his followers).

Tim is a name I made up for the example. It is a totally made up character, let's call him Tim S. and he does not represent anyone existing in real life.

DANGER: Global financial chaos looms, next week (educational). This is a brief educational post, that is meant as a heads up for sensible traders. They would wish to be aware of systemic risks approaching if Deutsche Bank collapses finally. This is likened to the Lehman Brothers fiasco of a few years ago, but it could be much bigger. I'm sharing this information based on reliable hard data available freely on the internet. DYOR.

It's better to be prepared - and nothing happens, than not prepared and your world turns into chaos.

The financial world is far more hooked up globally than around 2008 with the advent since, of superfast internet connections. The speed at which shockwaves may travel, would likely be hundreds of times faster than in 2008. So a 'flap of a butterfly's wings' in one financial corner of the planet could cause 'hurricanes' thousands of miles away in other corners of the world - like you never imagined before (concepts applied from Chaos Theory).

Nothing here is predictive. I never do predictions. I deal only in probabilities.

Appropriate seeding non-promotional references:

1. Lehman Brothers story

2. Deutsche Bank - recent events

Disclaimer : This is not financial advice, even if so construed. Should you come to be influenced by this brief screencast, know that your losses are your own. In simple terms no liabilities accepted by me. You'd just have to sue yourself.

I am bullish on Deutsche Bank..I am bullish on Deutsche Bank and will start a Bullish Position Trade.

Deutsche Bank AG on Thursday passed an annual health check by the Federal Reserve, clearing a second hurdle at a critical time for the German lender in tests administered by the U.S. central bank that measure banks' ability to weather a major economic downturn.

Global Stop Loss(GSL) @$6.30

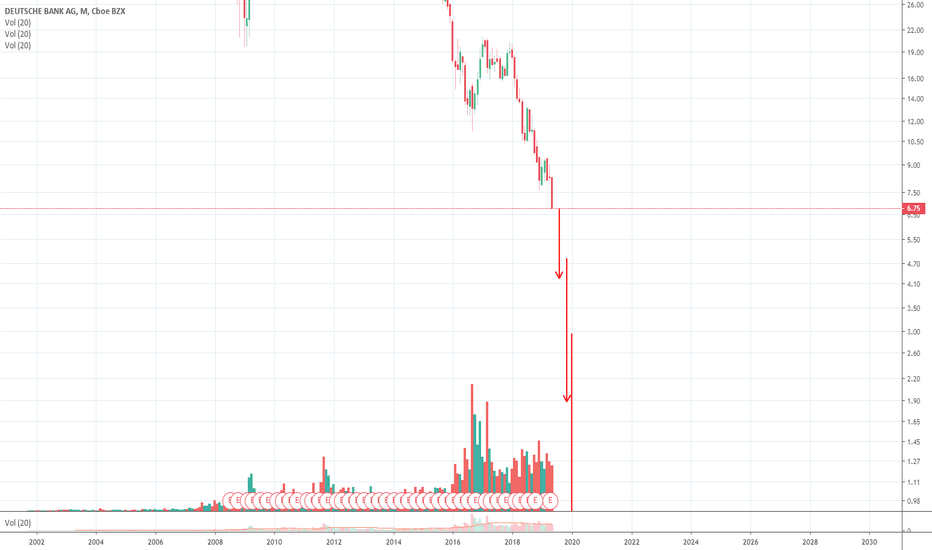

DEUTSCHE BOMB - Sorry I meant 'BANK'Some may not have heard of Deutsche Bank. Some may not know what 'systematic risk' is. Well, whether you heard of any of this before listen up. DB has been in serious trouble for years and in recent weeks there is more trouble.

As the rules do not allow me to reference what I say here, people will need to Google some of this.

Deutsche Bank has been over leveraged to the tune of Trillions. Then recently there has leveraging of the leveraging, to put that in a nutshell.

Read up on level 3 assets in relation to Deutsche Bank. Germany's domestic economy relies heavily on Deutsche Bank. DB is totally wired into major banks globally.

Share holder confidence in DB has been galloping south in recent weeks. Would you buy shares in DB? Some say when there's blood on the streets that's the best time to jump in. Sorry - some can go right ahead. I like my money in my pocket.

Looking into the derivatives fiasco looming on DB the whole world is at risk! If DB falls watch out for shockwaves globally.

Disclaimer: This educational post is not intended for trading or investing decision-making. No liabilities accepted.

DB collapse is looming, the rest should followThe structures developed in the market across all instruments are unchanged: all currencies need to trace another major low vs the Dollar, the indices should slide further, losing 20-25%, the bonds are due for another high, and metals should explode.

I think a valid scenario for DB is to trace an extended wave 5, since wave 1 and 3 are likely completed.

HODL TO ZERO - THIS BANK IS TULIP MANIAWASSA WASSA WASSSUUUPPPP DEUTSCHE CONNNECCCCTTTTTT!

The merger(fake news?) failed.

"UBS downgrades stock to sell

-CNBC

You can't taper a ponzi scheme(think derivatives).

A new economic structure world wide is coming eventually...but DB(probably) won't survive that long, why should they?

HODL to ZERO, or to 17 cents?