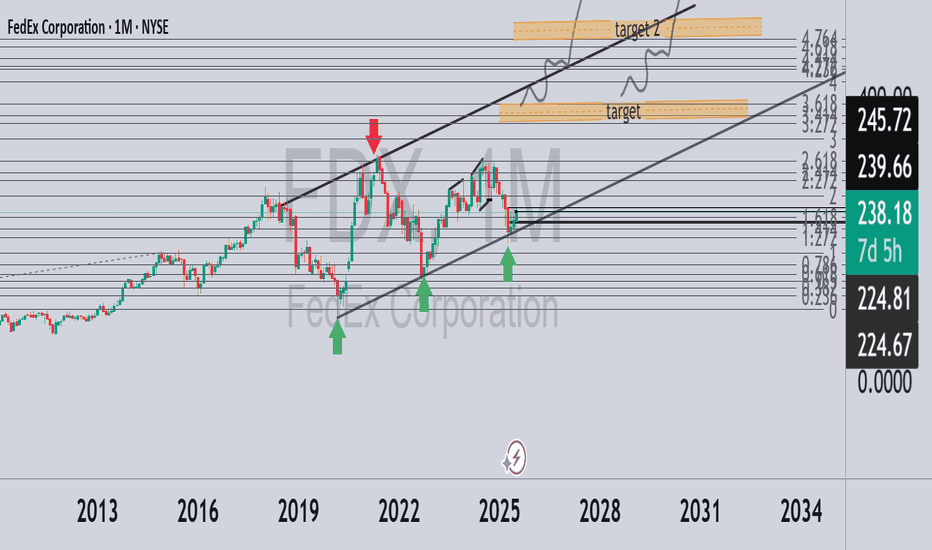

FedEx - Is the recovery process here yet? FDX The monthly chart of FedEx (symbol: FDX) shows a classic ascending channel pattern, with the price touching the bottom of the channel several times and finding support (green arrows), and on the other hand stopping several times at the upper resistance line (red arrow).

In July, we received a stron

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.958 CHF

3.36 B CHF

72.37 B CHF

215.76 M

About FedEx Corporation

Sector

Industry

CEO

Rajesh Subramaniam

Website

Headquarters

Memphis

Founded

1971

FIGI

BBG006TLPW64

FedEx Corp. is a holding company, which engages in the provision of transportation, e-commerce, business services, and business solutions. It operates through the following segments: FedEx Express, FedEx Ground, FedEx Freight, FedEx Services, and Corporate, Other and Eliminations. The FedEx Express segment offers transportation and delivery services. The FedEx Ground segment provides small-package ground delivery services. The FedEx Freight segment refers to freight transportation services to business and residences. The FedEx Services segment includes sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and certain back-office functions that support the company's operating segments. The Corporate, Other, and Eliminations segment is involved in the corporate headquarters costs for executive officers and certain legal and finance functions, as well as certain other costs and credits not attributed to the firm's core business. The company was founded by Frederick Wallace Smith on June 18, 1971, and is headquartered in Memphis, TN.

Related stocks

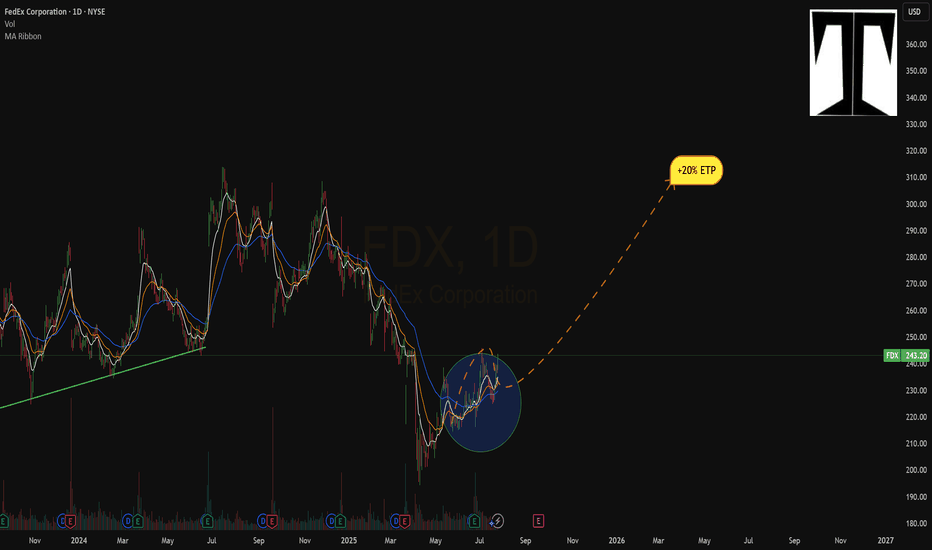

FedEx (FDX) – Cautious Bullish SetupNYSE:FDX Price is testing the upper Bollinger Band, while Stochastic shows overbought conditions (78–82), which may trigger a pullback or sideways move.

✅ RSI remains strong above 50, showing momentum is still positive.

🎯 Idea: Wait for earnings or a breakout above $230–$231 zone for confirmation

Will FedEx See a Big Swing Following Next Week’s Earnings?Shares of FedEx NYSE:FDX have often swung quite violently following release of the delivery-service giant's quarterly earnings. What does FDX’s chart and fundamental analysis say might happen after the firm reports results next Tuesday (June 24)?

Let’s check:

A History of Big Swings

Looking a

FedEx: Balancing Act or Precarious Gamble?Recent market activity highlights significant pressure on FedEx, as the logistics giant grapples with prevailing economic uncertainty. A notable drop in its stock price followed the company's decision to lower its revenue and profit outlook for fiscal year 2025. Management attributes this revision t

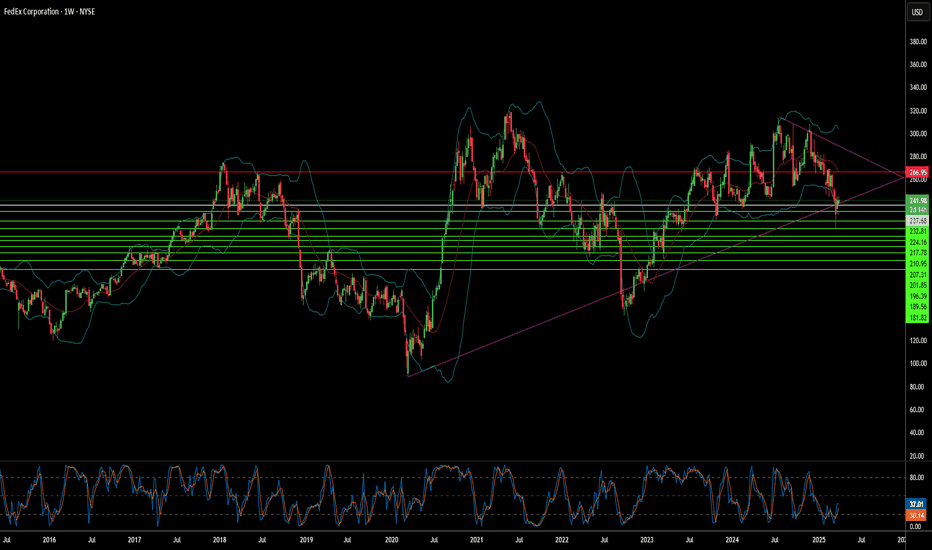

FDX watch $244.36: SemiMajor Covid fib giving furious resistanceFDX dumped upon last earnings but has been trying to recover.

Currently struggling against a semi-major covid fib at $244.26

It seems likely it will reject to green support zone $231 -233

======================================================

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximate

The #1 Power Of A Chart Patterns Analysis Am feeling low on courage and energy because of this i decided to do some yard maintenance work 😊

Just to remove my negative thoughts even as we trade mental health is very important.

Am following this awesome newsletter watchlist recommend to me by Tim Sykes.

This i where I got the idea of how

FDX 267.5 PUT Exp 2/21/25 (Win)Saw multiple confluences on higher timeframes. Broke a weekly uptrend to the downside, came back to retest the consolidation box it made, retested the weekly trend line break, Hit the 61.8% fibonacci retracement level, and formed a gap on a smaller timeframe.

Broke a structure level and broke a mi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US31428XBD7

FEDEX CORP. 2065Yield to maturity

8.24%

Maturity date

Feb 1, 2065

US31428XBQ8

FEDEX CORP. 2048Yield to maturity

7.53%

Maturity date

Feb 15, 2048

FDX3881474

FedEx Corporation 3.875% 01-AUG-2042Yield to maturity

7.33%

Maturity date

Aug 1, 2042

FDXD

FEDEX CORP. 2045Yield to maturity

7.29%

Maturity date

Feb 1, 2045

US31428XCE4

FEDEX 21/41Yield to maturity

7.23%

Maturity date

May 15, 2041

US31428XBN5

FEDEX CORP. 2047Yield to maturity

7.23%

Maturity date

Jan 15, 2047

USU31520AX4

FEDEX 25/48 REGSYield to maturity

7.20%

Maturity date

Feb 15, 2048

USU31520AT3

FEDEX 25/45 REGSYield to maturity

7.14%

Maturity date

Feb 1, 2045

US31428XBG0

FEDEX CORP. 2046Yield to maturity

7.11%

Maturity date

Apr 1, 2046

USU31520AP1

FEDEX 25/41 REGSYield to maturity

7.09%

Maturity date

May 15, 2041

FDX3992903

FedEx Corporation 4.1% 15-APR-2043Yield to maturity

7.06%

Maturity date

Apr 15, 2043

See all FDX bonds

Curated watchlists where FDX is featured.

Frequently Asked Questions

The current price of FDX is 190.309 CHF — it has increased by 1.23% in the past 24 hours. Watch FEDEX CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange FEDEX CORP stocks are traded under the ticker FDX.

We've gathered analysts' opinions on FEDEX CORP future price: according to them, FDX price has a max estimate of 258.41 CHF and a min estimate of 161.51 CHF. Watch FDX chart and read a more detailed FEDEX CORP stock forecast: see what analysts think of FEDEX CORP and suggest that you do with its stocks.

FDX stock is 1.22% volatile and has beta coefficient of 0.88. Track FEDEX CORP stock price on the chart and check out the list of the most volatile stocks — is FEDEX CORP there?

Today FEDEX CORP has the market capitalization of 41.75 B, it has decreased by −0.46% over the last week.

Yes, you can track FEDEX CORP financials in yearly and quarterly reports right on TradingView.

FEDEX CORP is going to release the next earnings report on Sep 18, 2025. Keep track of upcoming events with our Earnings Calendar.

FDX earnings for the last quarter are 5.00 CHF per share, whereas the estimation was 4.79 CHF resulting in a 4.24% surprise. The estimated earnings for the next quarter are 3.04 CHF per share. See more details about FEDEX CORP earnings.

FEDEX CORP revenue for the last quarter amounts to 18.27 B CHF, despite the estimated figure of 17.89 B CHF. In the next quarter, revenue is expected to reach 17.72 B CHF.

FDX net income for the last quarter is 1.35 B CHF, while the quarter before that showed 820.26 M CHF of net income which accounts for 65.16% change. Track more FEDEX CORP financial stats to get the full picture.

Yes, FDX dividends are paid quarterly. The last dividend per share was 1.18 CHF. As of today, Dividend Yield (TTM)% is 2.57%. Tracking FEDEX CORP dividends might help you take more informed decisions.

FEDEX CORP dividend yield was 2.53% in 2024, and payout ratio reached 32.82%. The year before the numbers were 1.98% and 29.25% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 300 K employees. See our rating of the largest employees — is FEDEX CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FEDEX CORP EBITDA is 8.48 B CHF, and current EBITDA margin is 11.77%. See more stats in FEDEX CORP financial statements.

Like other stocks, FDX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FEDEX CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FEDEX CORP technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FEDEX CORP stock shows the sell signal. See more of FEDEX CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.